Sodium-Nickel Chloride Battery Market

Sodium-Nickel Chloride Battery Market - Global Industry Size, Share, Trends, Opportunity, and Forecast, Segmented By End User (Residential, Commercial, Electric Vehicles, Industrial, Others), By Product Type (Less Than 300 kW, 300-600 kW, 600-900 kW, More Than 900 kW), By Region, By Competition 2019-2029

Published Date: May - 2025 | Publisher: MIR | No of Pages: 320 | Industry: Power | Format: Report available in PDF / Excel Format

View Details Buy Now 2890 Download Free Sample Ask for Discount Request Customization| Forecast Period | 2025-2029 |

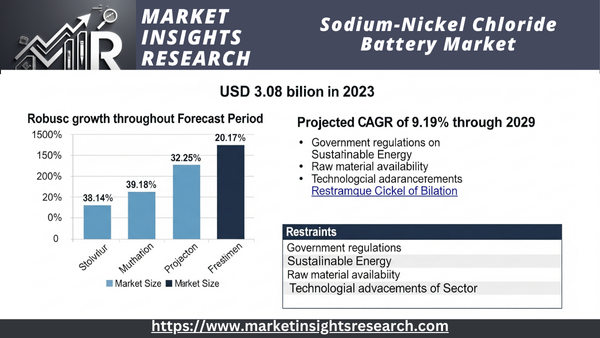

| Market Size (2023) | USD 3.08 Billion |

| Market Size (2029) | USD 5.27 Billion |

| CAGR (2024-2029) | 9.19% |

| Fastest Growing Segment | Less Than 300 kW |

| Largest Market | North America |

Market Overview

The Global Sodium-Nickel Chloride Battery Market was valued at USD 3.08 billion in 2023 and is projected to experience strong growth in the forecast period, with an anticipated Compound Annual Growth Rate (CAGR) of 9.19% through 2029.

The Sodium-Nickel Chloride (NaNiCl) Battery market is a specific area within the global energy storage industry focused on the production, distribution, and application of NaNiCl batteries. These batteries, also referred to as molten salt batteries, represent an advanced energy storage technology engineered for the efficient storage and release of electrical energy. Their operation is based on the reversible electrochemical reactions between sodium and nickel chloride, utilizing molten salt as the electrolyte.

Download Free Sample Ask for Discount Request Customization

The market includes a diverse range of participants, such as battery manufacturers, research institutions, project developers, and end-users, all actively engaged in the development, deployment, and commercialization of NaNiCl battery technology. NaNiCl batteries are well-known for their high energy density, long cycle life, and suitability for various applications, including large-scale grid energy storage, integration of renewable energy sources, and industrial backup power systems.

As the global shift toward cleaner and more sustainable energy sources gains momentum, the NaNiCl Battery market plays a crucial role in offering dependable and efficient energy storage solutions. This market is driven by the increasing need to integrate renewable energy, the demand for grid stability, and the search for environmentally sound alternatives to conventional energy storage technologies. It encounters challenges like technological obstacles, market competition, and regulatory complexities, which require continuous innovation and collaboration to fully realize the potential of NaNiCl batteries within the broader energy storage sector.

Key Market Drivers

Growing Demand for Energy Storage Solutions

The growing demand for dependable energy storage solutions is driving a notable upswing in the global sodium-nickel chloride (Na-NiClâ‚‚) battery market. The globe's shift toward renewable energy sources like solar and wind is increasing the need to store excess energy for use when renewable energy supply is low. Sodium-Nickel Chloride batteries' high energy density and extended cycle life have made them a viable choice for large-scale energy storage. One of the main factors propelling the worldwide Na-NiClâ‚‚ battery market is the rising need for energy storage solutions.

Integrating renewable energy sources into the grid has become a primary priority as a result of the global push for decarbonization and the reduction of greenhouse gas emissions. However, maintaining a steady and dependable energy source is difficult due to the sporadic nature of solar and wind power output. By storing extra energy during times of high generation and releasing it when needed, sodium-nickel chloride batteries can improve grid stability and lessen the demand for fossil fuels to generate electricity.

Advancements in Battery Technology

The global market for sodium-nickel chloride batteries has grown significantly due in large part to advancements in battery technology. The performance and efficiency of Na-NiClâ‚‚ batteries have been continuously improved by manufacturers and researchers. Innovations like improved electrolytes, improved electrode materials, and improved heat management systems are the outcome of these efforts.

The creation of high-temperature versions of Na-NiClâ‚‚ batteries, which function at higher temperatures and increase their overall efficiency and energy density, is one of the noteworthy developments in this technology. Longer cycle life and higher energy storage capacities have also resulted from research into novel materials and manufacturing techniques, increasing the appeal of sodium nickel chloride batteries for a range of uses, such as grid-scale energy storage and electric vehicles.

Download Free Sample Ask for Discount Request Customization

Expansion of Renewable Energy Installations

Another major factor propelling the global market for sodium-nickel chloride batteries is the growth of renewable energy projects, especially wind and solar farms. Countries are investing in large-scale renewable energy projects as they work to reach their renewable energy targets and lessen their reliance on fossil fuels. To balance the supply and demand for energy, these projects frequently call for dependable and effective energy storage technologies.

For large-scale energy storage, sodium-nickel chloride batteries work effectively because they can store excess energy produced during times of high renewable energy production and release it during times of low renewable energy generation or high demand. This feature further encourages the use of sodium-nickel chloride batteries by making them a useful tool for improving the stability and dependability of renewable energy systems.

Government Policies are Likely to Propel the Market

Renewable Energy Integration and Storage Mandates

Governments worldwide are increasingly acknowledging the importance of incorporating renewable energy sources into their energy portfolios to lower greenhouse gas emissions and combat climate change. To facilitate this shift, many governments have put in place policies that mandate the deployment of energy storage solutions like Sodium-Nickel Chloride (Na-NiClâ‚‚) batteries.

These policies require utilities and grid operators to invest in energy storage infrastructure to store surplus renewable energy generated during periods of high production, such as sunny or windy days, and release it when demand is high or during times of low renewable energy generation. By doing so, governments aim to enhance grid stability, reduce reliance on fossil fuels, and achieve their renewable energy targets.

For example, California's Renewable Portfolio Standard (RPS) necessitates that utilities procure a specific percentage of their electricity from renewable sources and mandates the deployment of energy storage systems to help balance the intermittent nature of renewable energy.

Energy Storage Incentives and Subsidies

Governments across the globe have introduced various financial incentives and subsidies to encourage the adoption of energy storage technologies, including Sodium-Nickel Chloride batteries. These incentives aim to lower the initial costs of installing energy storage systems, making them more accessible to businesses, utilities, and residential consumers.

These incentives can include tax credits, grants, or rebates. They encourage investment in energy storage infrastructure, stimulate economic growth, and contribute to the development of a strong energy storage industry. In the United States, for instance, the Investment Tax Credit (ITC) and the Energy Storage Tax Credit (ESTC) provide financial incentives for deploying energy storage technologies, including Na-NiClâ‚‚ batteries.

Download Free Sample Ask for Discount Request Customization

Research and Development Funding

Governments are instrumental in supporting research and development (R&D) efforts aimed at advancing energy storage technologies. Funding allocated to R&D initiatives can lead to significant advancements in battery chemistry, materials science, and manufacturing techniques, ultimately enhancing the performance, efficiency, and cost-effectiveness of Sodium-Nickel Chloride batteries.

Governments may collaborate with research institutions, universities, and private companies to finance projects focused on developing and improving energy storage technologies. These initiatives accelerate the commercialization of innovative battery solutions and contribute to the expansion of the global Na-NiClâ‚‚ battery market.

For example, the U.S. Department of Energy's (DOE) Advanced Research Projects Agency-Energy (ARPA-E) has provided funding for numerous research projects focused on enhancing energy storage technologies, including those involving Sodium-Nickel Chloride batteries.

Key Market Challenges

Technological Hurdles in Sodium-Nickel Chloride Battery Development

The global Sodium-Nickel Chloride (NaNiCl) battery market encounters several challenges, with technological hurdles in battery development being a major one. While NaNiCl batteries offer compelling benefits like high energy density, long cycle life, and suitability for large-scale grid storage, they also have limitations.

A key technological challenge is the high operating temperature of NaNiCl batteries. Typically operating above 300°C (572°F), this process presents several issues. Firstly, maintaining these high temperatures requires extra energy input, which can lower the overall energy efficiency of the system. Secondly, high operating temperatures can accelerate wear and tear on battery components, potentially shortening their lifespan and increasing maintenance expenses. Moreover, these high temperatures make it difficult to integrate NaNiCl batteries into existing energy storage infrastructure, as well as residential and commercial applications, where safety concerns related to high temperatures need careful consideration.

Another technological obstacle is the development of advanced materials for NaNiCl batteries. The quality and stability of the electrodes and electrolyte materials greatly affect these batteries' performance and efficiency. Finding materials that can endure the demanding operating conditions of NaNiCl batteries while remaining cost-effective is an ongoing challenge for researchers and manufacturers. Additionally, the scarcity or environmental impact of certain materials used in NaNiCl batteries, like nickel and rare earth elements, raises sustainability concerns and could limit the scalability of this technology.

The challenge of scaling up production while preserving the quality and consistency of NaNiCl batteries is also significant. As the demand for energy storage solutions grows, manufacturers must overcome issues related to economies of scale, production efficiency, and quality control. Achieving cost-competitive pricing and ensuring a reliable supply chain for materials are crucial for the widespread adoption of NaNiCl batteries.

Addressing these technological hurdles will necessitate substantial research and development efforts, collaboration among industry players and research institutions, and investment in innovative manufacturing processes. Overcoming these challenges will be critical to realizing the full potential of NaNiCl batteries for grid-scale energy storage and other applications.

Market Competition and Regulatory Frameworks

Another big challenge facing the global Sodium-Nickel Chloride (NaNiCl) battery market is the growing competition in the energy storage industry and the complicated rules that control how energy storage systems are used.

The energy storage market has experienced rapid expansion recently, with various battery technologies competing for market share. While NaNiCl batteries offer unique benefits, such as high energy density and a long lifespan, they face strong competition from other technologies like lithium-ion batteries, which have dominated the energy storage sector for decades. This competition not only presents a challenge for market penetration but also necessitates continuous innovation and cost reduction efforts to remain competitive.

Furthermore, the regulatory landscape surrounding energy storage systems can be a significant hurdle. Different regions and countries have varying regulations and standards governing the deployment of energy storage technologies. These regulations may pertain to safety standards, environmental impact assessments, permitting processes, and grid integration requirements. Navigating these complex regulatory frameworks can be time-consuming and costly, particularly for new and emerging technologies like NaNiCl batteries. Achieving compliance and obtaining the necessary approvals can significantly affect project timelines and budgets.

The lack of uniform standards and guidelines for NaNiCl battery technology can also impede its global adoption. Industry organizations and governments need to collaborate to establish clear and consistent standards for the design, manufacturing, installation, and operation of NaNiCl batteries. Without standardized protocols, it becomes challenging for manufacturers to scale up production and for project developers to ensure interoperability and safety.

Finally, the environmental and sustainability aspects of NaNiCl batteries are also under scrutiny. The production and disposal of certain materials used in these batteries, such as nickel and chlorine, can have environmental implications. Meeting sustainability goals and addressing concerns related to resource availability and recycling will be essential for the long-term viability of NaNiCl battery technology.

Key Market Trends

Growing Demand for Renewable Energy Storage Solutions

An important development in the worldwide market for sodium-nickel chloride batteries is the rise in demand for renewable energy storage options. Effective energy storage systems are becoming more and more important as the globe moves toward greener and more sustainable energy sources like solar and wind. In renewable energy applications, sodium-nickel chloride (NaNiCl) batteries, sometimes referred to as ZEBRA (Zero Emission Batteries Research Activity) batteries, have shown enormous promise as an energy storage solution.

Because of their high energy density and extended cycle life, sodium-nickel chloride batteries are in high demand for renewable energy storage. These batteries are ideal for storing energy produced by sporadic renewable sources like solar and wind because of their long-term capacity to store huge amounts of energy. Additionally, their reliable performance and sturdy design make them appealing for projects including the integration of renewable energy.

Compared to other energy storage technologies like lithium-ion batteries, sodium-nickel chloride batteries have several advantages. Since they don't include any of the hazardous or combustible substances that are frequently found in lithium-ion batteries, they are by nature safer and more environmentally friendly. For large-scale energy storage systems where dependability and safety are crucial factors, this feature is very alluring.

The growing emphasis on grid stability and dependability is another factor fueling the need for sodium-nickel chloride batteries in renewable energy storage. Because of variables like weather, energy produced by renewable sources frequently varies, making grid stability difficult to maintain. Grid managers can help balance supply and demand on the grid by utilizing sodium-nickel chloride batteries to efficiently store extra energy during times of high generation and release it during times of high demand.

Growing awareness of sodium-nickel chloride batteries' potential to solve the problems involved in integrating renewable energy into the power grid is reflected in the trend of rising demand for these batteries in renewable energy storage. The market for sodium-nickel chloride batteries is anticipated to increase steadily over the coming years as governments and energy stakeholders throughout the world continue to place a high priority on the switch to clean energy.

Segmental Insights

Product Type Insights

In 2023, the segment with the largest market share will be less than 300 kW. Small commercial and residential applications are ideal for sodium-nickel chloride batteries with a capacity under 300 kW. By moving energy use to off-peak hours, these batteries can lower electricity bills, store energy from renewable sources like solar panels, and supply backup power during grid failures. This capacity range is appropriate for small enterprises and residential users, who frequently have lower energy consumption. By producing and storing their electricity, many small business owners and homeowners want to become energy independent. The "Less Than 300 kW" class of sodium-nickel chloride batteries can provide an affordable way to achieve partial or total energy self-sufficiency. Users can begin with a smaller capacity and grow their energy storage system as needed thanks to the scalability provided by the "Less Than 300 kW" category. Because it fits with their changing energy needs and budgets, this flexibility appeals to small enterprises and residential customers. Smaller-scale sodium-nickel chloride batteries can serve as a dependable backup power source in areas with unstable grid infrastructure or frequent power outages, guaranteeing that necessary appliances and equipment continue to function during interruptions. Solar panels are a popular investment for small businesses and homeowners looking to produce renewable energy. By combining these solar arrays with a "Less Than 300 kW" NaNiCl battery, customers can optimize their use of renewable energy sources and lessen their reliance on the grid.

Regional Insights

In 2023, North America's market share was the greatest. For several important reasons, North America leads the world market for sodium-nickel chloride batteries and has impressive supremacy in this industry. Gaining insight into the reasons for this dominance helps one understand the market dynamics and strategic advantages of the area.

Download Free Sample Ask for Discount Request Customization

First and foremost, North America's dominance in the worldwide market for sodium-nickel chloride batteries can be attributed to its robust market leadership. The region boasts a sophisticated infrastructure for research and development, fostering innovation and technological advancement in battery technology. Major players in the industry, including both established corporations and startups, are headquartered or have significant operations in North America. This concentration of expertise and resources positions the region as a leader in the manufacturing of sodium-nickel chloride batteries, research, and deployment.

North America benefits from substantial investments in renewable energy and sustainable technologies, including battery storage solutions. Government support and favorable policies further bolster the growth of the market for sodium-nickel chloride batteries in the region. Incentives such as tax credits, grants, and regulatory frameworks that promote energy storage encourage investment and adoption of advanced battery technologies. This supportive ecosystem creates a conducive environment for businesses to thrive and expand their presence in the market.

North America's dominance in the worldwide market for sodium-nickel chloride batteries is also driven by its focus on technological innovation. The region is home to leading research institutions, universities, and technology hubs dedicated to advancing energy storage technologies. Collaborations between academia, industry, and government facilitate knowledge exchange and drive breakthroughs in battery performance, efficiency, and cost-effectiveness. As a result, North American companies gain a competitive edge by offering advanced sodium-nickel chloride batteries that meet the evolving needs of various applications, from grid-scale energy storage to electric vehicles.

North American companies leverage strategic partnerships and alliances to expand their market reach and accelerate growth. Collaborations with utilities, energy developers, and OEMs enable them to tap into diverse markets and applications, driving the widespread adoption of sodium-nickel chloride batteries. By establishing strong networks and distribution channels, North American firms strengthen their position as preferred suppliers of advanced energy storage solutions globally

Recent Developments

- In 2022, LiNa Energy, a company specializing in solid-state sodium-ion batteries, successfully concluded a late seed funding round, securing USD 3.4 million, primarily from its existing investor base. This funding helped the company move faster towards selling its products by working on important projects like improving a new type of electrolyte, making the assembly process easier to boost battery production, and starting early design studies to get ready for future investments in larger manufacturing plants.

Key Market Players

- Aquion Energy

- NGK Insulators Ltd

- SAFT Groupe SAS

- General Electric Company

- Hangzhou Eumo Technology Co. Ltd

- HiNa Battery Technology Co., Ltd.

- Natron Energy, Inc.

- Faradion Ltd.

- Altris AB

- FZ Sonick SA

|

By Product Type |

By End User |

By Region |

|

|

|

Related Reports

- Water Tube Industrial Boiler Market Size By Capacity, By Application (Food Processing, Pulp & Paper, Chemical, Refinery,...

- U.S. Industrial Boiler Market Size By Fuel (Natural Gas, Oil, Coal), By Capacity, By Technology (Condensing, Non-Condens...

- Fire Tube Industrial Boiler Market - By Capacity (<10 MMBtu/hr, 10-25 MMBtu/hr, 25-50 MMBtu/hr, 50-75 MMBtu/hr, >75 MMBt...

- Gas Fired Boiler Market Size - By Capacity (≤ 10 MMBtu/hr, > 10 - 50 MMBtu/hr, > 50 - 100 MMBtu/hr, > 100 - 250 MMBtu/...

- Europe Residential Boiler Market Size - By Technology (Condensing {Natural Gas, Oil, Electric}, Non-Condensing {Natural ...

- U.S. Boiler Market Size By Fuel (Natural Gas, Oil, Coal), Capacity, By Technology (Condensing, Non-Condensing), By Produ...

Table of Content

-

Executive Summary

-

1.1 Market Overview

-

1.2 Key Trends and Insights

-

1.3 Strategic Recommendations

-

-

Introduction

-

2.1 Report Objectives and Scope

-

2.2 Methodology and Data Sources

-

2.3 Definitions and Assumptions

-

-

Market Overview

-

3.1 What Are Sodium-Nickel Chloride Batteries?

-

3.2 Evolution and Technology Status

-

3.3 Comparison with Other Battery Chemistries (Li-ion, Na-ion, Flow Batteries)

-

3.4 Value Chain and Industry Ecosystem

-

-

Market Dynamics

-

4.1 Drivers

-

4.1.1 High Safety and Thermal Stability

-

4.1.2 Longer Lifecycle for Grid and Stationary Applications

-

4.1.3 Abundance of Raw Materials

-

-

4.2 Restraints

-

4.2.1 High Operating Temperature Requirements

-

4.2.2 Limited Commercial Availability

-

-

4.3 Opportunities

-

4.3.1 Integration into Long-Duration Energy Storage Systems

-

4.3.2 Demand in Harsh and Remote Environments

-

-

4.4 Challenges

-

4.5 Porter’s Five Forces Analysis

-

-

Technology Landscape

-

5.1 Operating Principle and Chemistry

-

5.2 System Components (Cathode, Anode, Electrolyte, Separator)

-

5.3 Performance Metrics (Cycle Life, Energy Density, Temperature Range)

-

5.4 Innovations in Material Science and Packaging

-

-

Market Segmentation

-

6.1 By Battery Type

-

6.1.1 Single-Module

-

6.1.2 Multi-Module Systems

-

-

6.2 By Application

-

6.2.1 Grid Storage

-

6.2.2 Commercial and Industrial Storage

-

6.2.3 Backup and Remote Power Supply

-

6.2.4 Transportation and Rail

-

-

6.3 By End-User

-

6.3.1 Utilities

-

6.3.2 Commercial Enterprises

-

6.3.3 Government and Defense

-

6.3.4 Mining and Oil & Gas

-

-

-

Regional Market Analysis

-

7.1 North America

-

7.2 Europe

-

7.3 Asia-Pacific

-

7.4 Latin America

-

7.5 Middle East & Africa

-

-

Market Size and Forecast (2020–2030)

-

8.1 Global Market Revenue and Volume Forecast

-

8.2 Segment-Wise Forecast

-

8.3 Regional Growth Opportunities

-

-

Competitive Landscape

-

9.1 Market Share Analysis

-

9.2 Company Profiles

-

9.2.1 FZSoNick (Swiss-based)

-

9.2.2 General Electric (GE Energy Storage)

-

9.2.3 Others Active in Sodium-Based Chemistries

-

-

9.3 Strategic Collaborations and R&D Investments

-

-

Regulatory and Standards Framework

-

10.1 Battery Safety and Environmental Regulations

-

10.2 Energy Storage Policy Inclusion

-

10.3 Regional Standards and Certifications

-

-

Trends and Innovation Outlook

-

11.1 Hybrid Battery Systems

-

11.2 Cost Reduction Strategies

-

11.3 Role in Future Decarbonized Energy Grids

-

-

Conclusion and Strategic Outlook

-

Appendices

-

13.1 Glossary of Technical Terms

-

13.2 Research Methodology

-

13.3 References and Sources

-

To get a detailed Table of contents/Table of figures/Methodology Please contact our salesperson at chris@marketinsightsresearch.com.

To get a detailed Table of contents/Table of figures/Methodology Please contact our salesperson at chris@marketinsightsresearch.com.

FAQ'S

For a single, multi and corporate client license, the report will be available in PDF format. Sample report would be given you in excel format. For more questions please contact:

Within 24 to 48 hrs.

You can contact Sales team (sales@marketinsightsresearch.com) and they will direct you on email

You can order a report by selecting payment methods, which is bank wire or online payment through any Debit/Credit card, Razor pay or PayPal.

Discounts are available.

Hard Copy