Butylated Hydroxytoluene (BHT) Market Size, share & Forecast, 2024-2032

Butylated Hydroxytoluene (BHT) Market - By Application (Food, Animal Feed, Lubricating & Specialty Oils, Rubber, Personal Care & Cosmetics, Industrial Fats, Oils, & Fatty Acids, Printing Inks & Coatings, Food Packaging) & Forecast, 2024-2032

Published Date: May - 2025 | Publisher: MRA | No of Pages: 240 | Industry: Chemical | Format: Report available in PDF / Excel Format

View Details Buy Now 2890 Download Free Sample Ask for Discount Request CustomizationButylated Hydroxytoluene Market Size

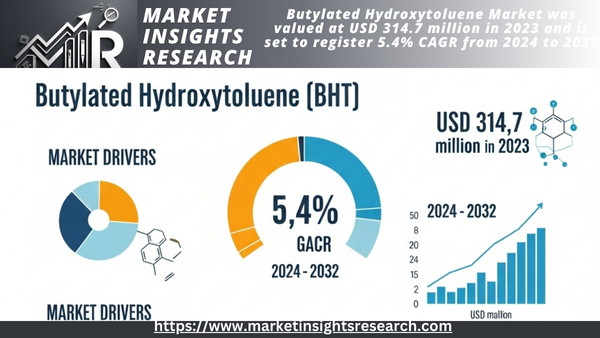

The Butylated Hydroxytoluene Market was estimated at USD 314.7 million in 2023 and is expected to grow at a 5.4% CAGR between 2024 and 2032. Increasing laws and guidance from respected organizations to ensure safe BHT use are boosting demand. BHT is a popular antioxidant found in foods, medicines, cosmetics, and pharmaceuticals, and it has recently come under criticism. The market demand for BHT has been heavily influenced by its potential health hazards.

Download Free Sample Ask for Discount Request Customization

Regulatory authorities, such as the FDA and EFSA, have created criteria for permitted dose levels, thereby promoting market growth. For example, in November 2023, the United Kingdom Scientific Advisory Group on the Safety of Chemicals for Non-Food and Chemical Consumption (SAG-CS) released an important opinion on the use of butyl hydroxytoluene (BHT) and kojic acid in cosmetic preparations. The SAG-CS proposed maximum BHT doses to assure its safe use. This proposed regulation seeks to establish safe amounts of BHT in cosmetic products as a requirement for consumer health protection and to ensure tension-free chemical use.

| Report Attribute | Details |

|---|---|

| Base Year | 2023 |

| Butylated Hydroxytoluene Market Size in 2023 | USD 314.7 Million |

| Forecast Period | 2024 - 2032 |

| Forecast Period 2024 - 2032 CAGR | 5.4% |

| 2032 Value Projection | USD 512.1 Million |

| Historical Data for | 2021 - 2023 |

| No. of Pages | 120 |

| Tables, Charts & Figures | 172 |

| Segments covered | Application |

| Growth Drivers |

|

| Pitfalls & Challenges |

|

Download Free Sample Ask for Discount Request Customization

What are the growth opportunities in this market?

Advanced regulatory control ensures that producers follow safety requirements, which boosts consumer confidence and demand for compliant products. Furthermore, organizations such as the WHO do scientific research that informs the legal system and public opinion. As safety standards improve, corporations engage in R&D to satisfy them, resulting in innovation in BHT applications. As a result, the BHT market is primed for expansion, aided by tough laws that prioritize consumer safety and stimulate the manufacture of high-quality, safe goods.

The demand for BHT, a common antioxidant, has declined recently. This is mostly because people are concerned about the health and environmental consequences. Food regulatory bodies, the FDA and EFSA, have imposed restrictions on the use of BHT. As a result, manufacturers have begun to seek alternative antioxidants. People are also beginning to see BHT negatively, as several studies have indicated that it may be harmful to their health. This shift has resulted in fewer individuals wanting to buy products containing BHT. Furthermore, an increasing number of individuals are opting for organic and natural products, which frequently lack BHT and other artificial ingredients. Environmentalists are especially concerned about BHT since it can persist in the environment and accumulate in animals over time. All of these factors make it more difficult for businesses to market items containing BHT; therefore, they are transitioning to safer and more environmentally friendly alternatives.

Download Free Sample Ask for Discount Request Customization

Butylated Hydroxytoluene Market Trends

As more research focuses on determining safe additive levels and improving testing capabilities, the BHT industry is expanding. Butylated hydroxytoluene (BHT), a common antioxidant found in foods, cosmetics, and pharmaceuticals, is now well understood thanks to scientific discoveries. Researchers want to address health issues and regulatory criteria that will be utilized to define safe levels. This continuous study is leading to the development of advanced testing procedures for accurately measuring BHT levels in products.

Advanced testing allows producers to comply with severe requirements imposed by organizations such as the FDA and EFSA, resulting in increased consumer confidence and market growth. Furthermore, collaboration among academic institutions, law enforcement agencies, and industry partners fosters innovation in safety research. These efforts improve safety guidelines and promote transparency and accountability in the BHT business. As a result, the industry is experiencing expansion.

As an example, in February 2024, a study offered a simple spectrofluorometric approach for determining BHT and BHA using native fluorescence and synchronous scanning. This simple and inexpensive approach was designed to detect BHT and BHA in bulk powders and pharmaceutical formulations. It appears to be precise, selective, and sensitive, making it appropriate for routine quality assessment and monitoring of BHT and BHA residues in foods.

Butylated Hydroxytoluene Market Analysis

Learn more about the important segments that shape this industry.

The BHT market is segmented by application into food, animal feed, lubricating and specialty oils, rubber, personal care and cosmetics, industrial fats, oils, and fatty acids, printing inks and coatings, food packaging, and others. The food segment held the majority of the market share and is expected to grow at a 5.9% CAGR between 2024 and 2032. Cereals, snacks, and baked products often use BHT to maintain freshness and flavor stability.

As customer demand for high-quality, long-lasting foods grows, so does the need for potent agents like BHT. Regulatory approvals from bodies like the FDA and EFSA, which set allowed limits on BHT use, help to promote market demand. Despite some health concerns, continued research and rigorous restrictions assure safe use, preserving BHT's critical role in the food sector and fueling its market expansion.

Learn more about the important segments that shape this industry.

Consider your favorite processed foods and beauty items that stay fresher for longer. What is the secret to their extended shelf life? Butylated hydroxytoluene (BHT), an antioxidant and preservative, is extensively employed in these goods. In 2023, Asia Pacific became the undisputed ruler of the BHT market, earning a massive $109.36 million. And get thisby 2032, researchers believe the figure will have risen to more than $184.68 million. So, what is driving this extraordinary growth? Well, when more individuals relocate to cities and their purchasing power grows, they consume more processed foods and personal care goods. This increases the demand for BHT to prevent these products from rotting and preserve their quality. China, India, and Japan are all playing an important role, thanks to strong rules ensuring the safe use of chemicals such as BHT. The situation has established a favorable atmosphere in which the BHT market can develop. Furthermore, Asia-Pacific serves as a hub for manufacturing and research and development. Asia-Pacific is a manufacturing and R&D hub. As a result, the region is not only a large consumer of BHT but also a significant producer. The combination creates a perfect storm for continued expansion in the BHT market in the years ahead.

Butylated Hydroxytoluene Market Share

Are you looking for region-specific data?

Companies are working hard to supply the increased demand for BHT, which is an important element in many products. They are investing much in research to improve BHT and safer, while also ensuring that it complies with tight government regulations. These companies are also developing new ways to blend BHT and incorporating it into additional goods, which is helping to increase its popularity. Furthermore, firms are being transparent and honest about what ingredients are in their products, as well as informing consumers about the benefits of BHT, to alleviate concerns and establish confidence. Working with law enforcement and adhering to international safety guidelines, they ensure BHT meets the highest standards. So, by focusing on making BHT better and safer, these corporations increase demand for it and ensure that it is utilized in everything from food and makeup to medicine.

Download Free Sample Ask for Discount Request Customization

Butylated Hydroxytoluene Market Companies

Major companies operating in the butylated hydroxytoluene industry competitive landscape include

- AB Enterprises

- Akrochem Corporation

- Anmol Chemicals

- Cayman Chemical Company

- Eastman Chemical Company

- Kemin Industries

- KH Chemicals BV

- Lanxess AG

- Oxiris Chemicals SA

- Ratnagiri Chemicals Pvt Ltd

- Sasol Ltd

- SI Group

- Spectrum Chemical Manufacturing Corporation

- Twinkle Chemilab Pvt Ltd

Butylated Hydroxytoluene Industry News

In April 2024, LANXESS planned to showcase cosmetic preservatives, multifunctions, flavor, and fragrance solutions at the global cosmetics exhibition in Paris. Within its consumer protection segment, this specialty chemical company offers a wide range of products.

In March 2024, Specialty chemicals company LANXESS will showcase its range of additive solutions for the tire industry at the Tire Technology Expo 2024 in Hannover, Germany. The company will demonstrate how tire manufacturers can reduce the environmental footprint of their manufacturing processes and end products.

For the following segments, the butylated hydroxytoluene market research report provides comprehensive industry coverage along with estimates and forecasts for revenue and volume (USD million) (tons) from 2021 to 2032.

Click here to purchase this report's section.

Market, By application

- Food

- Animal Feed

- Lubricating and Speciality Oils

- Rubber

- Personal Care & Cosmetics

- Industrial Fats, Oils and Fatty Acids

- Printing Inks and Coatings

- Food Packaging

- Others (Pharmaceutical, Corrosion Inhibitors)

The following regions and countries have access to the information above

- North America

- U.S.

- Canada

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- India

- Japan

- South Korea

- Australia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Argentina

- Rest of Latin America

- MEA

- Saudi Arabia

- UAE

- South Africa

- Rest of MEA

Related Reports

- Dimethyl Terephthalate Market - By Form (Solid, Liquid), Grade (Technical, Reagent, Pure, Synthesis), Application, End u...

- Bromine Derivatives Market - By Derivative Type (Organobromines, Clear Brine Fluids, Hydrogen Bromide, Brominated Flame ...

- Nano Coating Market - By Type (Anti-Fingerprint Coatings, Anti-Microbial Coatings, Self-Cleaning Coatings, Anti-Corrosio...

- Anti-corrosion Coatings Market - By Product (Epoxy, Polyurethane, Acrylic, Alkyd, Zinc, Chlorinated Rubber), By Mode of ...

- Coil Coatings Market - By Product (Polyester, Silicone Modified Polyester, Polyvinylidene Fluorides, Polyurethane, Plast...

Table of Content

Table of Content

Report Content

Chapter 1 Methodology & Scope

1.1 Market scope & definition

1.2 Base estimates & calculations

1.3 Forecast calculation

1.4 Data sources

1.4.1 Primary

1.4.2 Data mining sources

1.4.2.1 Paid sources

1.4.2.2 Public sources

Chapter 2: Executive Summary

2.1 Market 3600 synopsis, 2021-2032

Chapter 3: Market Industry Insights

3.1 Industry ecosystem analysis

3.1.1 Key manufacturers

3.1.2 Distributors

3.1.3 Profit margins across the industry

3.1.4 Supply disruptions (If applicable)

3.2 Industry impact forces

3.2.1 Growth drivers

3.2.2 Market challenges

3.2.3 Market opportunity

3.2.3.1 New opportunities

3.2.3.2 Growth potential analysis

3.3 Raw material landscape

3.3.1 Manufacturing trends

3.3.2 Technology evolution

3.3.2.1 Sustainable manufacturing

3.3.2.1.1 Green practices

3.3.2.1.2 Decarbonization

3.4 Sustainability in raw materials

3.5 Pricing trends (USD/Ton)

3.5.1 North America

3.5.2 Europe

3.5.3 Asia Pacific

3.5.4 Latin America

3.5.5 MEA

3.6 Regulations & market impact

3.7 Porter’s analysis

3.8 PESTEL analysis

Chapter 4: Competitive Landscape, 2023

4.1 Introduction

4.2 Company market share, 2023

4.2.1 Company market share, by region, 2023

4.2.1.1 North America

4.2.1.2 Europe

4.2.1.3 Asia Pacific

4.2.1.4 Latin America

4.2.1.5 Middle East & Africa

4.3 Competitive analysis of major market players

4.4 Competitive positioning matrix

4.5 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Application, 2021-2032 (USD Million) (Kilo Tons)

5.1 Key trends

5.2 Food

5.3 Animal feed

5.3.1 Poul

5.3.2 Swine

5.3.3 Fish feed

5.3.4 Cattle

5.4 Lubricating & specialty oils

5.5 Rubber

5.6 Personal care & cosmetics

5.7 Industrial fats, oils & fatty acids

5.8 Printing inks and coatings

5.9 Food packaging

5.10 Others (pharmaceutical, corrosion inhibitors)

Chapter 6: Market Estimates & Forecast, By Region, 2021-2032 (USD Million) (Kilo Tons)

6.1 Key trends, by region

6.2 North America

6.2.1 U.S.

6.2.2 Canada

6.3 Europe

6.3.1 Germany

6.3.2 UK

6.3.3 France

6.3.4 Spain

6.3.5 Italy

6.4 Asia Pacific

6.4.1 China

6.4.2 India

6.4.3 Japan

6.4.4 South Korea

6.4.5 Indonesia

6.4.6 Australia

6.4.7 Malaysia

6.5 Latin America

6.5.1 Brazil

6.5.2 Mexico

6.5.3 Argentina

6.6 MEA

6.6.1 South Africa

6.6.2 Saudi Arabia

6.6.3 UAE

Chapter 7: Company Profiles

7.1 Lanxess AG

7.2 Eastman Chemical Company

7.3 Oxiris Chemicals SA

7.4 KH Chemicals B.V

7.5 Spectrum Chemical Manufacturing Corporation

7.6 Akrochem Corporation

7.7 Twinkle Chemilab Pvt Ltd

7.8 Kemin Industries

7.9 Ratnagiri Chemicals Pvt Ltd

7.10 Cayman Chemical Company

7.11 Anmol Chemicals

7.12 AB Enterprises

7.13 Sasol Ltd

7.14 SI Group

- AB Enterprises

- Akrochem Corporation

- Anmol Chemicals

- Cayman Chemical Company

- Eastman Chemical Company

- Kemin Industries

- KH Chemicals BV

- Lanxess AG

- Oxiris Chemicals SA

- Ratnagiri Chemicals Pvt Ltd

- Sasol Ltd

- SI Group

- Spectrum Chemical Manufacturing Corporation

- Twinkle Chemilab Pvt Ltd

FAQ'S

For a single, multi and corporate client license, the report will be available in PDF format. Sample report would be given you in excel format. For more questions please contact:

Within 24 to 48 hrs.

You can contact Sales team (sales@marketinsightsresearch.com) and they will direct you on email

You can order a report by selecting payment methods, which is bank wire or online payment through any Debit/Credit card, Razor pay or PayPal.

Discounts are available.

Hard Copy