Bromine Derivatives Market Size

Bromine Derivatives Market - By Derivative Type (Organobromines, Clear Brine Fluids, Hydrogen Bromide, Brominated Flame Retardants), By Application (Flame Retardants, Biocides, Drilling Fluids, Chemical Intermediates), By End Use & Forecast, 2024 – 2032

Published Date: May - 2025 | Publisher: MRA | No of Pages: 240 | Industry: Chemical | Format: Report available in PDF / Excel Format

View Details Buy Now 2890 Download Free Sample Ask for Discount Request CustomizationBromine Derivatives Market Size

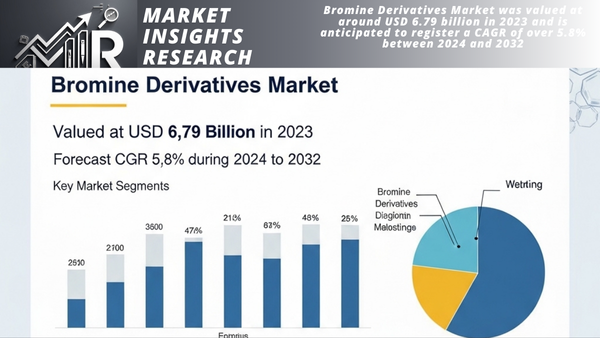

The market for bromine derivatives was estimated to be worth USD 6.79 billion in 2023, and it is projected to grow at a compound annual growth rate (CAGR) of more than 5.8% from 2024 to 2032. The demand for bromine derivatives is largely driven by the flame-retardant industry because of its crucial function. The need for efficient fire prevention materials has increased due to stricter safety regulations and standards, particularly in the electronics, automotive, and construction industries.

To obtain important market trends

Download Free Sample Ask for Discount Request Customization

The effectiveness of brominated flame retardants in decreasing flammability and improving the fire resistance of materials makes them especially prized. The market for these derivatives is further supported by the growth of the electronics sector, which is being driven by consumer demand and quick technological advancements. The construction industry is becoming more and more dependent on global urbanization and industrialization. Therefore, by 2032, the market is anticipated to reach a market value of more than USD 11.46 billion.

| Report Attribute | Details |

|---|---|

| Base Year | 2023 |

| Bromine Derivatives Market Size in 2023 | USD 6.79 billion |

| Forecast Period | 2024 to 2032 |

| Forecast Period 2024 to 2032 CAGR | 5.8% |

| 2032 Value Projection | USD 11.46 billion |

| Historical Data for | 2021 - 2023 |

| No. of Pages | 320 |

| Tables, Charts & Figures | 210 |

| Segments covered | Derivative Type, Application, End Use |

| Growth Drivers |

|

| Pitfalls & Challenges |

|

What are the growth opportunities in this market?

Download Free Sample Ask for Discount Request Customization

One significant pitfall for the bromine derivatives industry is the environmental and health concerns associated with their production and use. Brominated compounds can be toxic and persistent in the environment, leading to regulatory restrictions and a push for alternatives. Stringent environmental regulations and increasing awareness about the potential health risks posed by these chemicals can limit market growth and lead to increased costs for compliance and the development of safer alternatives.

Bromine Derivatives Market Trends

Several noteworthy phenomena are influencing the growth and development of the bromine derivatives market. One significant trend is the growing emphasis on environmental effects and sustainability, which has prompted the creation and uptake of environmentally friendly bromine compounds. To create derivatives that satisfy strict environmental laws and lessen ecological footprints, businesses are investing in research and innovation.

Furthermore, the market is moving toward advanced brominated compounds due to the increased demand for high-performance flame retardants brought on by stricter safety regulations in the electronics, automotive, and construction sectors. The growth of the pharmaceutical industry, where bromine derivatives are essential for medication production, is another noteworthy trend. Continuous improvements and the launch of new pharmaceutical products are driving demand.

Bromine derivatives Market Analysis

Learn more about the key segments shaping this market

Based on derivative type, the market is divided into organobromines, clear brine fluids, hydrogen bromide, brominated flame retardants, and others. Organobromines held the dominant market share of USD 3.11 billion in 2023 and is expected to reach USD 5.29 billion by 2032. Organobromines are the most dominant derivative type in the bromine derivatives industry due to their extensive use as flame retardants, particularly in the electronics and automotive industries. Their effectiveness in enhancing fire resistance and meeting stringent safety standards makes them indispensable in manufacturing various consumer and industrial products.

Additionally, organobromines are widely utilized in pharmaceuticals and agrochemicals, where they play a crucial role in the synthesis of active ingredients and pesticides. The growing emphasis on safety and the continuous expansion of these end-use industries drive the demand for organobromines, solidifying their leading position in the market.

Learn more about the key segments shaping this market

Download Free Sample Ask for Discount Request Customization

There is one thing you would rather not burn down, whether it's your house, workplace, or vehicle. Bromine derivatives are ready to put out a fire in this situation! Their ability to act as fire retardants is one of these substances' main purposes. They are experts in electronics, building, and automobiles, ensuring that temperatures don't rise too high. These substances, which are based on bromine, effectively put out smoke and flames by acting as tiny fire extinguishers. And you know what else? They can withstand the heat in any circumstance because they are resilient and efficient. Because of this, many people rely on them for their fire safety requirements. They are excellent at keeping us safe from fire threats and are always ready to act.

Consider the following scenarioBromine derivatives are utilized across various industries. And you know what? The biggest consumer of bromine derivatives is the chemical sector. "We love bromine derivatives!" they exclaim. The chemical industry used $1.91 billion worth of bromine derivatives in 2023. The industry expects to need an additional 3.29 billion dollars' worth of bromine derivatives by 2032! There are so many bromine derivatives! Why are bromine derivatives so popular among chemists? These substances serve as the building blocks for a wide variety of other substances. These compounds are used in everything from pesticides to medications. They can even strengthen plastics, slow down fires, and clean your water. Derivatives of bromine are so crucial to the chemical industry. They serve as the foundation of the entire enterprise. For this reason, the world's largest consumer of bromine derivatives is the chemical sector.

Are you looking for region-specific data?

Download Free Sample Ask for Discount Request Customization

Asia Pacific dominated the global market for bromine derivatives in 2023. It brought in a staggering $2.49 billion, and by 2032, it is expected to reach $4.14 billion. What, therefore, is causing Asia Pacific to dominate? The supremacy of Asia Pacific is fueled by a few important elements. First off, manufacturing is flourishing in the Asia-Pacific area, particularly in China and India. Derivatives of bromine are essential to many industrial operations. Next, these nations are developing and growing their infrastructure and cities at a quick pace. There will be a giant need for flame retardants based on bromine as a result of the numerous new buildings and electronics that will be built. Another factor is that those crowded cities must adhere to stringent fire safety regulations. This requirement has led to a significant demand for flame retardants that use bromine compounds.

China is the most powerful country in the Asia-Pacific area when it comes to the bromine derivatives market. China is the world's largest producer of bromine and a key hub for downstream sectors like electronics, chemicals, and textiles that heavily rely on bromine derivatives. The nation's extensive chemical manufacturing industry and large infrastructure developments sustain the high demand for bromine derivatives. Additionally, China's competitive market environment and the existence of reputable producers of bromine derivatives reinforce its position as the market leader in the Asia-Pacific region.

Bromine derivatives Market Share

The competitive landscape of the bromine derivatives industry is characterized by a diverse mix of global conglomerates and regional players, each contributing to the market's dynamism and innovation. Albemarle Corporation, a key global player, commands a significant presence in the bromine derivatives sector with its broad portfolio of flame retardants, drilling fluids, and specialty chemicals. Similarly, LANXESS, another major player, leverages its expertise in specialty chemicals to offer a wide range of bromine derivatives catering to various industries, including automotive and electronics.

Regionally, companies like BRB Chemicals and Dhruv Chem Industries play pivotal roles in the bromine derivatives market, particularly in Asia-Pacific. These companies specialize in supplying bromine-based chemicals to diverse industries, capitalizing on the region's burgeoning manufacturing sector and stringent fire safety regulations. Additionally, smaller players such as Krishna Solvachem Ltd and PACIFIC ORGANICS PVT. LTD contribute to the market's competitiveness by offering niche products and fostering innovation in bromine derivatives. Overall, the competitive landscape of the market reflects a blend of established global leaders and agile regional players, driving continuous advancements and market expansion.

Bromine derivatives Market Companies

Major players operating in the bromine derivatives industry include

- Albemarle Corporation

- BRB Chemicals

- Dhruv Chem Industries

- Gulf Resources

- Jordan Bromine Company

- Krishna Solvachem Ltd

- LANXESS

- Merck KGaA

- Mody Chemi Pharma Ltd

- PACIFIC ORGANICS PVT. LTD

Bromine Derivatives Industry News

- In March 2024, Archean Chemical Industries started a production facility of bromine derivative products. The company commissioned phase 1 of the production facility for bromine derivative products.

- In August 2021, the Environmental Protection Agency (EPA) released revised guidelines on the usage of methyl bromide as a quarantine and pre-shipment fumigant for logs stored in a ship's hold, effective from 1st January 2023.

The bromine derivatives market research report includes in-depth coverage of the industry, with estimates & forecasts in terms of revenue and volume (USD Million) (Kilo Tons) from 2018 to 2032, for the following segments

Click here to Buy Section of this Report

Market, By Derivative Type

- Organobrom

- Clear brine fluids

- Hydrogen bromide

- Brominated flame retardants

- Other (potassium bromide, sodium bromide)

Market, By Application

- Flame Retardants

- Biocides

- Drilling Fluids

- Chemical Intermediates

- Others (dyes, fumigants)

Market, By End Use

- Chemical industry

- Construction industry

- Oil & gas industry

- Pharmaceuticals

- Electronics industry

- Others (textiles, transportation)

The following regions and countries have access to the information above

- North America

- U.S.

- Canada

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- India

- Japan

- South Korea

- Australia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Argentina

- Rest of Latin America

- MEA

- Saudi Arabia

- UAE

- South Africa

- Rest of MEA

Related Reports

- Urea Formaldehyde Market - By Form (Powder, Liquid), By Application (Particleboard and Plywood, Medium Density Fiberboar...

- Iron Powder Market - By Type (Reduced iron powder, Atomised iron powder, Electrolytic iron powder), By Purity (High puri...

- Thermal Transfer Ribbon Market – By Printing Head Type (Flat Type, Near Head), By Product (Wax Resin Ribbon, Wax Ribbo...

- Iron & Steel Casting Market - By Material (Iron, Steel), By Process (Sand Casting, Die Casting), By Application (Automot...

- Sodium Carbonate Market - By Type (Natural, Synthetic), By End-Use (Flat Glass, Container Glass, Other Glass, Soaps & De...

- Hybrid Polymer Market Size - By Product (Coating, Sealant & Adhesive, Concrete Additive, Electrode Material, Cleaning So...

Table of Content

Report Content

Chapter 1 Methodology & Scope

1.1 Market scope & definition

1.2 Base estimates & calculations

1.3 Forecast calculation

1.4 Data sources

1.4.1 Primary

1.4.2 Secondary

1.4.2.1 Paid sources

1.4.2.2 Public sources

Chapter 2: Executive Summary

2.1 Industry 3600 synopsis

Chapter 3: Industry Insights

3.1 Industry ecosystem analysis

3.1.1 Key manufacturers

3.1.2 Distributors

3.1.3 Profit margins across the industry

3.2 Industry impact forces

3.2.1 Growth drivers

3.2.2 Market challenges

3.2.3 Market opportunity

3.2.3.1 New opportunities

3.2.3.2 Growth potential analysis

3.3 Raw material landscape

3.3.1 Manufacturing trends

3.3.2 Technology evolution

3.3.2.1 Sustainable manufacturing

3.3.2.1.1 Green practices

3.3.2.1.2 Decarbonization

3.3.3 Sustainability in raw materials

3.3.4 Raw material pricing trends (USD/Ton)

3.3.4.1 U.S.

3.3.4.2 European Union

3.3.4.3 UK

3.3.4.4 China

3.3.4.5 Southeast Asia

3.3.4.6 GCC

3.4 Regulations & market impact

3.5 Porter’s analysis

3.6 PESTEL analysis

Chapter 4: Competitive Landscape, 2023

4.1 Company market share analysis

4.2 Competitive positioning matrix

4.3 Strategic outlook matrix

Chapter 5 Market Size and Forecast, By Derivative Type, 2018-2032 (USD Million, Kilo Tons)

5.1 Key trends

5.2 Organobrom

5.3 Clear brine fluids

5.4 Hydrogen bromide

5.5 Brominated flame retardants

5.6 Other (potassium bromide, sodium bromide)

Chapter 6: Market Size and Forecast, By Application, 2018-2032 (USD Million, Kilo Tons)

6.1 Key trends

6.2 Flame retardants

6.3 Biocides

6.4 Drilling fluids

6.5 Chemical intermediates

6.6 Others (dyes, fumigants)

Chapter 7 Market Size and Forecast, By End Use, 2018-2032 (USD Million, Kilo Tons)

7.1 Key trends

7.2 Chemical industry

7.3 Construction industry

7.4 Oil & gas industry

7.5 Pharmaceuticals

7.6 Electronics industry

7.7 Others (textiles, transportation)

Chapter 8: Market Size and Forecast, By Region, 2018-2032 (USD Million, Kilo Tons)

8.1 Key trends

8.2 North America

8.2.1 U.S.

8.2.2 Canada

8.3 Europe

8.3.1 Germany

8.3.2 UK

8.3.3 France

8.3.4 Italy

8.3.5 Spain

8.3.6 Rest of Europe

8.4 Asia Pacific

8.4.1 China

8.4.2 India

8.4.3 Japan

8.4.4 South Korea

8.4.5 Australia

8.4.6 Rest of Asia Pacific

8.5 Latin America

8.5.1 Brazil

8.5.2 Mexico

8.5.3 Argentina

8.5.4 Rest of Latin America

8.6 MEA

8.6.1 Saudi Arabia

8.6.2 UAE

8.6.3 South Africa

8.6.4 Rest of MEA

Chapter 9: Company Profiles

9.1 Albemarle Corporation

9.2 BRB Chemicals

9.3 Dhruv Chem Industries

9.4 Gulf Resources

9.5 Jordon Bromine Company

9.6 Krishna Solvachem Ltd

9.7 LANXESS

9.8 Merck KGaA

9.9 Mody Chemi Pharma Ltd

9.10 PACIFIC ORGANICS PVT. LTD.

9.11 Shandong Hengalin Chemical Co. Ltd.

9.12 Shanghai Wescco Chemical Co. Ltd.

9.13 Tata Chemicals Ltd.

9.14 Thermo Fisher

9.15 Tokyo Chemical Industry Co. Ltd.

- Albemarle Corporation

- BRB Chemicals

- Dhruv Chem Industries

- Gulf Resources

- Jordan Bromine Company

- Krishna Solvachem Ltd

- LANXESS

- Merck KGaA

- Mody Chemi Pharma Ltd

- PACIFIC ORGANICS PVT. LTD

FAQ'S

For a single, multi and corporate client license, the report will be available in PDF format. Sample report would be given you in excel format. For more questions please contact:

Within 24 to 48 hrs.

You can contact Sales team (sales@marketinsightsresearch.com) and they will direct you on email

You can order a report by selecting payment methods, which is bank wire or online payment through any Debit/Credit card, Razor pay or PayPal.

Discounts are available.

Hard Copy