Anti-corrosion Coatings Market Size, Segment Forecast 2024–2032

Anti-corrosion Coatings Market - By Product (Epoxy, Polyurethane, Acrylic, Alkyd, Zinc, Chlorinated Rubber), By Mode of Application (Solvent-based, Water-based, Powder), By End-use & Forecast, 2024– 2032

Published Date: May - 2025 | Publisher: MRA | No of Pages: 240 | Industry: Chemical | Format: Report available in PDF / Excel Format

View Details Buy Now 2890 Download Free Sample Ask for Discount Request CustomizationAnti-corrosion Coatings Market Size

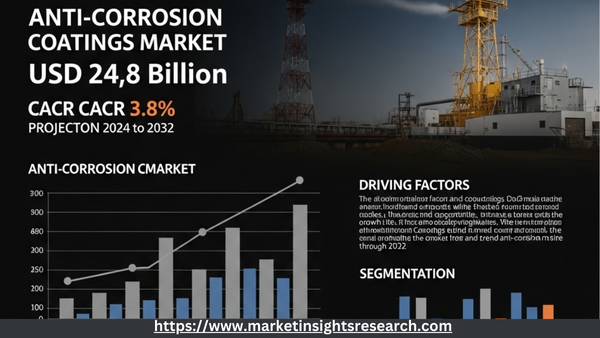

Anti-corrosive coatings The market was valued at over USD 24.8 billion and is expected to grow at a CAGR of more than 3.8% between 2024 and 2032, led by increased demand from industries such as oil and gas, marine, automotive, and construction.

Download Free Sample

The demand for protective coatings is increasing because of the difficult working conditions in the oil and gas industry, which can exacerbate infrastructure deterioration. For example, in September 2022, Extreme Coatings debuted a new internal diameter high-velocity oxygen fuel coating system for oil and gas and industrial components. Furthermore, corrosion-resistant coatings extend the life and safety of pipelines, shorelines, and storage tanks, resulting in significant cost savings for maintenance and replacement.

| Report Attribute | Details |

|---|---|

| Base Year | 2023 |

| Anti-corrosion Coatings Market Size in 2023 | USD 24.58 billion |

| Forecast Period | 2024 - 2032 |

| Forecast Period 2024 - 2032 CAGR | 3.8% |

| 2032 Value Projection | USD 35.38 billion |

| Historical Data for | 2021–2023 |

| No. of Pages | 374 |

| Tables, Charts & Figures | 268 |

| Segments covered | Product, End-user, Mode of Application |

| Growth Drivers |

|

| Pitfalls & Challenges |

|

What are the growth opportunities in this market?

Technological developments and the development of high-performance coating materials will have an impact on market growth. Innovative materials such as epoxies, polyurethanes, and fluoropolymer coatings offer greater protection and lifespan even in hostile environments. Stringent environmental regulations and industry standards are driving manufacturers to create ecologically friendly, VOC-free coatings that meet safety standards while providing excellent performance. The growing awareness of the economic and safety benefits of corrosion protection is encouraging more companies to invest in high-quality corrosion-resistant coatings, hence boosting market growth.

On the other hand, the increased cost of sophisticated coating materials and the complex application methods required may limit product adoption to some extent. Strict environmental rules governing VOC emissions and the use of hazardous chemicals in coatings provide compliance issues for producers. Alternative corrosion protection approaches, such as anticorrosive chemicals and composites, are also vying for market share, with the latter potentially offering more cost-effective alternatives.

Anti-Corrosion Coatings Market Trends

The development and application of nanotechnology and smart coatings to provide improved protection and self-healing qualities will help the industry grow. The growing emphasis on sustainability is accelerating the development of ecologically friendly, low-VOC materials and corrosion-resistant water coatings that meet environmental laws. High-performance coatings will be in great demand in renewable energy industries, such as wind and solar, where various pieces of equipment need to withstand harsh environmental conditions.

For example, in February 2024, Covestro developed high-performance aqueous resins for industrial coatings such as wood furniture and building materials, resulting in a significant industry revolution. Rising manufacturing investments, particularly in emerging nations, are driving up demand for durable coatings.

Download Free Sample

Anti-Corrosion Coatings Market Analysis

Learn more about the important segments that shape this industry.

Based on the product, the epoxy segment's market value is predicted to exceed USD 13.9 billion by 2032 due to its superior protective characteristics and adaptability across multiple applications. Epoxy coatings have the capacity to establish a strong waterproof barrier that resists moisture and corrosion, providing long-term protection for metal surfaces while dramatically lowering maintenance expenses and increasing the life of structures and equipment. Epoxy formulation advancements, such as the proliferation of eco-friendly low-VOC fittings, are enhancing their appearance. Epoxy coatings will continue to fuel market expansion due to their low cost and dependability.

Learn more about the important segments that shape this industry.

If you own or utilize ships or other ocean-based constructions, you are well aware of the harsh circumstances they confront on a daily basis. Saltwater, moisture, and severe temperatures can all cause corrosion, weakening or even destroying your vessels. This is where anti-corrosion coatings come in. In 2023, the shipbuilding industry spent over $4.6 billion on these coatings, a figure that is anticipated to rise in the coming years. Why? Anti-corrosion coatings are necessary to preserve the strength and safety of ships and offshore buildings. These coatings protect your vessels from the ocean's harmful impacts, decreasing the need for maintenance and costly downtime. And as global trade and maritime activities expand, the demand for new and well-maintained ships will only rise, propelling the anti-corrosion coatings market even higher.

Are you looking for region-specific information?

The North American anti-corrosion coatings market will be worth more than USD 5 billion by 2032, owing to the strong industrial foundation and the growing need to protect vital infrastructure and industrial equipment from corrosion. The region's oil and gas industry relies heavily on pipelines, drilling rigs, and storage tanks coated with high-performance corrosion-resistant polymers to maintain operating efficiency and safety. Manufacturing upgrades and investments in the automotive, aerospace, and aerospace industries all contribute to the region's high demand for protective coatings.

Download Free Sample

Anti-Corrosion Coatings Market Share

Leading anti-corrosion coating firms are investing in R&D activities to create innovative, high-performance coatings with enhanced durability and eco-friendly properties for addressing the growing demand for sustainable solutions. Acquisitions and strategic partnerships are helping these companies expand their product portfolios. These companies are also focusing on improving their manufacturing capabilities and adopting advanced technologies to enhance production efficiency and cost-effectiveness.

Anti-Corrosion Coatings Market Companies

Major players operating in the market include

- AICA Kogyo

- Akzonobel

- AnCatt

- Ashland

- Axalta Coating

- BASF

- Chugoku Marine Paints

- Hempel

- Jötun

- Kansai Paints

- Nippon Paints

- PPG Industries

- RPM International

- Sokema

- The Sherwin-Williams Company

- Tnemec

- Valspar

AntiCorrosion Coatings Industry News

- In October 2023, PPG introduced the GLADIATOR XC Matte Extreme coating, which provides high-quality, low-gloss urethane protection for various applications across different industries.

- In May 2024, Axalta Coating Systems introduced the Alesta BioCore range of powder coatings made from non-food organic waste, reducing COâ‚‚ emissions by up to 25% without compromising performance.

The anti-corrosion coatings market report includes in-depth coverage of the industry, with estimates & forecasts in terms of revenue and volume (USD Million) (Tons) from 2024 to 2032, for the following segments

Click here to Buy Section of this Report

By Product

- Epoxy

- Polyurethane

- Acrylic

- Alkyd

- Zinc

- Chlorinated rubber

- Others

By Mode of Application

- Solvent-based

- Water-based

- Powder

By End-user

- Oil & gas

- Shipbuilding

- Infrastructure

- Industrial markets

- Energy

- Transport

- Others

By Region

- North America

- U.S.

- Canada

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Asia Pacific

- China

- India

- Japan

- South Korea

- Indonesia

- Malaysia

- Thailand

- Latin America

- Brazil

- Argentina

- Middle East & Africa

- South Africa

- GCC

Related Reports

- Glycerol Market Size - By Product Type (Crude, Refined), By Source (Biodiesel, Fatty Acids, Fatty Alcohols, Soap Industr...

- Flat Glass Market - By Product (Basic Float, Laminated, Insulating, Tempered), By Application (Automotive [OEM, Aftermar...

- Electrical Steel Market - By Product (Grain Oriented, Non-Grain-Oriented), By Application (Large Power Transformers, Dis...

- Lithium Cobalt Oxide Market - By Grade (Industrial, Battery), Application (Consumer electronic, Electric vehicle, Medica...

- Conductive Polymers Market – By Conduction Mechanism (Composites Inherently Conductive Polymers, Conducting Polymer), ...

- Dimethyl Terephthalate Market - By Form (Solid, Liquid), Grade (Technical, Reagent, Pure, Synthesis), Application, End u...

Table of Content

Table of Content

Report Content

Chapter 1 Methodology & Scope

1.1 Market scope & definition

1.2 Base estimates & calculations

1.3 Forecast calculation

1.4 Data sources

1.4.1 Primary

1.4.2 Secondary

1.4.2.1 Paid sources

1.4.2.2 Public sources

Chapter 2: Executive Summary

2.1 Industry 3600 synopsis

Chapter 3: Industry Insights

3.1 Industry ecosystem analysis

3.1.1 Key manufacturers

3.1.2 Distributors

3.1.3 Profit margins across the industry

3.2 Industry impact forces

3.2.1 Growth drivers

3.2.2 Market challenges

3.2.3 Market opportunity

3.2.3.1 New opportunities

3.2.3.2 Growth potential analysis

3.3 Raw material landscape

3.3.1 Manufacturing trends

3.3.2 Technology evolution

3.3.2.1 Sustainable manufacturing

3.3.2.1.1 Green practices

3.3.2.1.2 Decarbonization

3.3.3 Sustainability in raw materials

3.3.4 Pricing trends (USD/Ton)

3.3.4.1 North America

3.3.4.2 Europe

3.3.4.3 Asia Pacific

3.3.4.4 Latin America

3.3.4.5 Middle East & Africa

3.4 Regulations & market impact

3.5 Porter’s analysis

3.6 PESTEL analysis

Chapter 4: Competitive Landscape, 2023

4.1 Company market share analysis

4.2 Competitive positioning matrix

4.3 Strategic outlook matrix

Chapter 5: Market Size and Forecast, By Product, 2021-2032 (USD Million, Kilo Tons)

5.1 Key trends

5.2 Epoxy

5.3 Polyurethane

5.4 Acrylic

5.5 Alkyd

5.6 Zinc

5.7 Chlorinated rubber

5.8 Others

Chapter 6: Market Size and Forecast, By End User, 2021-2032 (USD Million, Kilo Tons)

6.1 Key trends

6.2 Oil & gas

6.3 Shipbuilding

6.4 Infrastructure

6.5 Industrial markets (tanks, pipes, etc.)

6.6 Energy

6.7 Transport

6.8 Others

Chapter 7: Market Size and Forecast, By Mode of Application, 2021-2032 (USD Million, Kilo Tons)

7.1 Key trends

7.2 Solvent-based

7.3 Water-based

7.4 Powder

7.5 Others

Chapter 8: Market Size and Forecast, By Region, 2021-2032 (USD Million, Kilo Tons)

8.1 Key trends

8.2 North America

8.2.1 U.S.

8.2.2 Canada

8.3 Europe

8.3.1 Germany

8.3.2 UK

8.3.3 France

8.3.4 Italy

8.3.5 Spain

8.3.6 Rest of Europe

8.4 Asia Pacific

8.4.1 China

8.4.2 India

8.4.3 Japan

8.4.4 South Korea

8.4.5 Australia

8.4.6 Rest of Asia Pacific

8.5 Latin America

8.5.1 Brazil

8.5.2 Mexico

8.5.3 Argentina

8.5.4 Rest of Latin America

8.6 MEA

8.6.1 Saudi Arabia

8.6.2 UAE

8.6.3 South Africa

8.6.4 Rest of MEA

Chapter 9: Company Profiles

9.1 Valspar

9.2 VanCatt

9.3 Sokema

9.4 Tnemec

9.5 Nippon Paints

9.6 Chugoku Marine Paints

9.7 The Sherwin-Williams Company

9.8 PPG Industries

9.9 Kansai Paints

9.10 RPM International

9.11 Jotun

9.12 Hempel

9.13 BASF

9.14 Axalta Coating

9.15 Ashland9.16 AkzoNobel

- AICA Kogyo

- Akzonobel

- AnCatt

- Ashland

- Axalta Coating

- BASF

- Chugoku Marine Paints

- Hempel

- Jotun

- Kansai Paints

- Nippon Paints

- PPG Industries

- RPM International

- Sokema

- The Sherwin-Williams Company

- Tnemec

- Valspar

FAQ'S

For a single, multi and corporate client license, the report will be available in PDF format. Sample report would be given you in excel format. For more questions please contact:

Within 24 to 48 hrs.

You can contact Sales team (sales@marketinsightsresearch.com) and they will direct you on email

You can order a report by selecting payment methods, which is bank wire or online payment through any Debit/Credit card, Razor pay or PayPal.

Discounts are available.

Hard Copy