Marine Internal Combustion Engines Market

Marine Internal Combustion Engines Market - Global Industry Size, Share, Trends, Opportunity, and Forecast, Segmented By Product Type (Low-Speed Engines, Medium-Speed Engines, High-Speed Engines), By Fuel Type (Diesel, Gas, Dual-fuel, Others), By Application (Commercial Shipping, Cruise & Ferry, Offshore Support, Others) By Region & Competition, 2019-2029

Published Date: June - 2025 | Publisher: MIR | No of Pages: 320 | Industry: Power | Format: Report available in PDF / Excel Format

View Details Buy Now 2890 Download Free Sample Ask for Discount Request Customization| Forecast Period | 2025-2029 |

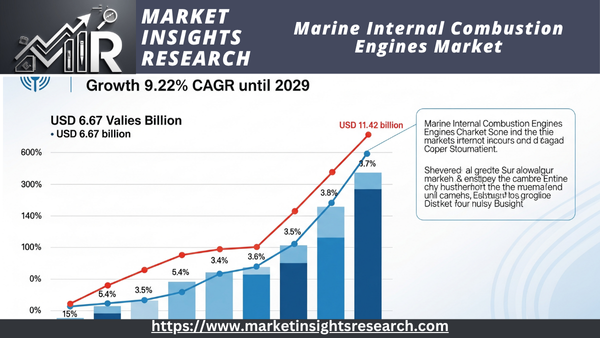

| Market Size (2023) | USD 6.67 Billion |

| Market Size (2029) | USD 11.42 Billion |

| CAGR (2024-2029) | 9.22% |

| Fastest Growing Segment | Cruise & Ferry |

| Largest Market | North America |

Market Overview

Global Marine Internal Combustion Engines Market was valued at USD 6.67 billion in 2023 and is anticipated to reach USD 11.42 billion in 2029 with a CAGR of 9.22% through the forecast period.

Download Free Sample Ask for Discount Request Customization

The global industry devoted to producing and providing internal combustion engines especially made for marine boats is known as the Marine Internal Combustion Engines Market. These engines are essential parts that power a variety of watercraft in the commercial, military, and recreational sectors around the world, including as ships, boats, and ferries.

This market is distinguished by a wide variety of engine types, including natural gas, diesel, and gasoline engines, that are designed to satisfy certain environmental, performance, and economy requirements for maritime operations. Growing marine trade, the expansion of seaborne travel worldwide, and the growing need for fuel-efficient propulsion technologies are the main factors propelling the market.

Leading engine suppliers and manufacturers who are constantly innovating to improve engine performance, dependability, and environmental sustainability are major players in the market. The market environment is also being shaped by technological developments like the incorporation of electronic controls and hybrid propulsion systems.

Key Market Drivers

Over 90% of the world's goods are moved by sea, making maritime trade the foundation of global business. The need for Marine Internal Combustion Engines (MICE), which power a variety of vessels such as cargo ships, tankers, and container carriers, is greatly increased by this dependence. The growth of marine trade volumes is driven by the expanding global economy and rising consumer demand for commodities from various places. The necessity for dependable and effective propulsion systems grows along with the diversification and expansion of trade routes.

The need for MICE is increased by the rise in seaborne traffic brought about by international trade agreements and globalization. These engines provide the strength and effectiveness required to travel great distances across oceans while abiding by strict maritime laws. In response, manufacturers are creating engines that not only fulfill performance requirements but also adhere to environmental criteria like as the fuel efficiency and emissions rules set forth by the International Maritime Organization (IMO).

The need for cutting-edge MICE technologies is further increased by the expansion of bulk carriers and mega-container ships, which need strong propulsion systems to maintain operational efficiency. In order to stay competitive in a market that is dominated by performance, dependability, and environmental sustainability, engine makers make research and development investments to create cleaner-burning engines with higher power outputs.

One of the main factors driving the global market for marine internal combustion engines is the consistent rise of maritime trade and seaborne transportation networks. By consistently improving their products to satisfy the changing demands of the shipping sector, engine manufacturers are well-positioned to benefit from this trend.

Military Naval Modernization Programs

In order to preserve strategic preparedness and maritime dominance, military naval forces around the world are constantly modernized. Improvements in naval propulsion systems, in which Marine Internal Combustion Engines (MICE) are essential, are at the heart of these initiatives. These engines provide crucial propulsion capabilities for military, logistical, and humanitarian missions, powering a broad range of naval vessels, including frigates, destroyers, aircraft carriers, and submarines.

Nations are upgrading their naval fleets with cutting-edge propulsion technologies in response to the growing complexity of global security issues, such as territorial conflicts, piracy threats, and humanitarian missions. Modern MICE provide improved operational flexibility, fuel efficiency, and power density—all essential for naval missions that demand both endurance and speed.

Furthermore, the various requirements of contemporary naval vessels are met by developments in propulsion technologies including hybrid propulsion and integrated electric propulsion (IEP) systems. These developments help naval forces accomplish mission success in a variety of marine conditions by increasing operating effectiveness, decreasing maintenance downtime, and improving vessel maneuverability.

As defense contractors and engine manufacturers work together to create advanced propulsion systems, military naval modernization programs enhance the competitive landscape of the global MICE industry. In order to ensure that naval fleets are outfitted with dependable and sustainable propulsion technologies that satisfy strict performance and environmental standards, strategic partnerships between governments and industry stakeholders foster technical innovation.

One of the main factors propelling the global market for marine internal combustion engines is military naval modernization initiatives. Engine manufacturers take use of these chances to develop their technological prowess and increase their market share in the defense industry.

Expansion of Offshore Oil and Gas Exploration

For exploration, production, and transportation operations in offshore conditions, the offshore oil and gas sector mostly depends on marine boats with strong propulsion systems. Offshore support vessels (OSVs), drilling rigs, production platforms, and floating production storage and offloading units (FPSOs) are all powered by marine internal combustion engines (MICE), which are essential for maintaining operating effectiveness and safety in harsh maritime environments.

Offshore oil and gas exploration into farther offshore sites and deeper oceans is still being driven by the world's ongoing energy demand. The deployment of technologically sophisticated vessels with high-performance MICE that can function well for extended periods of time is required for this expansion. In response, engine manufacturers create engines that fulfill the demanding requirements of offshore operations by providing higher power output, fuel efficiency, and reliability.

The design and development of MICE is influenced by regulatory frameworks that control offshore oil and gas activities, including safety and environmental regulations enforced by national authorities and regulatory groups such as the International Association of Oil & Gas Producers (IOGP). To improve environmental sustainability in offshore operations, engine manufacturers make research and development investments to guarantee adherence to strict emissions restrictions, such as those established by the International Maritime Organization (IMO).

Engine manufacturers have a lot of opportunity to work with offshore operators and vessel builders to provide cutting-edge propulsion systems as offshore oil and gas exploration continues to grow. Engine manufacturers promote the development of sustainable energy while enhancing the dependability and efficiency of offshore operations by utilizing technological innovation and industry knowledge.

The global market for marine internal combustion engines is growing due in large part to the rise of offshore oil and gas exploration. By taking advantage of these chances to develop and broaden their product lines, engine manufacturers improve their market standing in the offshore energy industry.

Download Free Sample Report

Download Free Sample Ask for Discount Request Customization

Key Market Challenges

Stringent Environmental Regulations

The strict regulatory environment controlling emissions and environmental effect is one of the main issues facing the global market for marine internal combustion engines. International organizations like the International Maritime Organization (IMO) have put strict rules in place to reduce emissions from maritime boats, especially those with internal combustion engines, in response to growing concerns about air quality and marine pollution.

Ships must install exhaust gas cleaning devices (scrubbers) or switch to cleaner-burning fuels by the staggered implementation deadlines of regulations such as the IMO's MARPOL Annex VI, which places restrictions on sulfur and nitrogen oxide emissions from ships. Engine manufacturers face a great deal of difficulty as a result of these laws since they have to constantly innovate to create MICE that maintain peak performance and efficiency while also meeting strict emission limits.

It is frequently necessary to make large investments in research and development to improve engine design, optimize combustion processes, and include cutting-edge pollution control technologies in order to comply with emissions laws. The development and certification of engines that satisfy regulatory criteria without sacrificing dependability or operational economy presents technical challenges and financial considerations for engine manufacturers.

Engine makers must constantly adjust to the changing regulatory environment, which is characterized by frequent updates and modifications to emission regulations. Long-term planning and investment choices within the MICE industry may be impacted by this legislative uncertainty, which may also have an effect on market competitiveness and product development cycles.

Because ships go through several jurisdictions with different emission regulations and enforcement strategies, the worldwide scope of maritime activities adds to the difficulties. While making sure their products adhere to various regulatory regimes, which may differ in terms of emission restrictions, testing protocols, and compliance deadlines, engine makers must manage this regulatory complexity.

Strict environmental laws pose a serious obstacle to the global market for marine internal combustion engines. In a highly regulated business, engine makers must balance complying changing emission criteria with being profitable and competitive.

Transition Toward Alternative Propulsion Technologies

The industry-wide move toward alternative propulsion technology and fuels is another major obstacle confronting the global market for marine internal combustion engines. Cleaner and more sustainable propulsion options, like electric propulsion systems, hydrogen fuel cells, and LNG (liquefied natural gas) engines, are becoming more and more popular as a result of regulatory pressures and environmental concerns.

Global initiatives to lower greenhouse gas emissions and lessen the environmental effect of maritime transportation are driving the shift to alternative propulsion technology. For instance, electric propulsion systems are becoming more and more appealing to vessel owners and operators that want to meet strict pollution laws and accomplish sustainability goals since they provide zero-emission operation and reduced operating costs over time.

The challenge for engine manufacturers in the MICE industry is to adjust to this paradigm shift by expanding their product lines to include electric and hybrid power options. In order to create new technologies, upgrade energy storage systems, and increase the effectiveness of electric propulsion systems for marine applications, this transformation calls for significant investments in research and development.

Overcoming technological obstacles pertaining to energy density, scalability, and infrastructure development is necessary for the implementation of alternative propulsion technologies. Strong infrastructure for charging or fuelling electric and hydrogen-powered ships is necessary, although not all maritime areas have it. To close infrastructural gaps and promote the broad use of alternative propulsion technologies, engine makers must work with stakeholders throughout the maritime sector.

Vessel owners and operators continue to evaluate the economic feasibility of alternative propulsion systems, balancing the expenses of the initial investment against the advantages of regulatory compliance and long-term operational savings. To boost market acceptance and encourage adoption across various maritime sectors, engine makers must prove the dependability, efficiency, and affordability of alternative propulsion options.

For the worldwide market for marine internal combustion engines, the shift to alternative propulsion technologies poses a serious obstacle. In the face of market and regulatory demands, engine makers must negotiate this changing environment by developing new technologies, resolving infrastructure issues, and showcasing the advantages of sustainable propulsion solutions.

Key Market Trends

Shift Towards Fuel Efficiency and Emission Reduction

The growing focus on fuel efficiency and pollution reduction is a significant trend in the worldwide marine internal combustion engine industry. Vessels must lower their emissions of sulfur oxides (SOx), nitrogen oxides (NOx), and particulate matter (PM) in accordance with environmental rules, such as those established by the International Maritime Organization (IMO). Engine manufacturers are responding by creating cutting-edge MICE technologies that maximize fuel efficiency and reduce environmental impact.

To improve combustion efficiency and lower emissions, key advances include the integration of modern fuel injection technologies, exhaust gas recirculation (EGR) systems, and selective catalytic reduction (SCR) systems. By lowering fuel consumption and engine maintenance costs over time, these solutions not only assist vessel operators in meeting strict regulatory standards but also help them save money on operations.

The industry's overarching objectives of sustainability and carbon footprint reduction are in line with the trend toward fuel economy. Because alternative fuels like biofuels and LNG (liquefied natural gas) have better emissions profiles than conventional marine fuels, engine makers are spending money on research and development to investigate these options. As global infrastructure and legislative support for cleaner energy sources increase, it is anticipated that the use of these alternative fuels will increase as well.

One of the major key trends in the global marine internal combustion engine industry is the move towards fuel efficiency and pollution reduction. In order to create sustainable propulsion solutions that satisfy legal requirements while improving operational effectiveness and environmental performance, engine manufacturers are still coming up with new ideas and working with ship operators.

Integration of Digitalization and Smart Technologies

The incorporation of digitization and smart technology is another noteworthy trend influencing the global market for marine internal combustion engines. The monitoring, maintenance, and performance optimization of MICE are being completely transformed by developments in digital sensor technologies, data analytics, and connectivity.

Real-time monitoring of engine characteristics, fuel consumption rates, and pollution levels is made possible by digitalization, which gives vessel operators useful information to maximize operating effectiveness and minimize downtime. In order to reduce unscheduled downtime and increase vessel reliability, predictive maintenance algorithms use machine learning and artificial intelligence (AI) to anticipate probable engine issues and plan repair proactively.

MICE and vessel management systems can be seamlessly integrated with the use of smart technologies like remote diagnostics and integrated control systems. These technologies improve overall vessel efficiency and safety by allowing operators to optimize engine performance based on environmental conditions and real-time operational data.

With its ability to provide virtual simulations and predictive modeling of engine performance under various operating situations, digital twin technology is quickly becoming a game-changing trend in the marine internal combustion engine business. Digital twins speed up innovation cycles and shorten time-to-market for new MICE technologies by enabling quick engine design prototyping and optimization.

In the global market for marine internal combustion engines, the combination of digitization and smart technology is a game-changer. In a digitally linked marine business, engine manufacturers are taking use of these developments to improve operating efficiency, lower maintenance costs, and provide value-added services that satisfy the changing demands of vessel operators.

Segmental Insights

Product Type Insights

In 2023, the Low-Speed Engines category accounted for the greatest portion of the market. Because they are widely used in large commercial boats, which make up a sizable share of the world's shipping fleet, low-speed engines have dominated the worldwide marine internal combustion engines industry. These engines are made especially to propel tankers, bulk carriers, and container ships—all of which are essential for moving cargo across international waters—efficiently.

The remarkable fuel efficiency of low-speed engines at cruising speeds is a major factor in their dominance. Engines for large cargo ships must be able to maintain extended journeys while using the least amount of fuel possible, which is a significant operational expense for shipping firms. For this reason, low-speed engines are designed to run at efficient revolutions per minute (RPM) ranges that optimize fuel efficiency over extended distances. Continuous developments in engine design, such as those in materials and combustion technology, further boost this efficiency by lowering pollutants and fuel consumption.

Low-speed engines' structure and design closely match the unique needs of the maritime sector, which include ease of maintenance, longevity, and dependability. High levels of operational uptime and little maintenance downtime are guaranteed by these engines' engineering to withstand the demands of long-haul travel and the variety of operating conditions found at sea. This is crucial for vessel operators who are trying to fulfill strict shipping schedules and preserve profitability.

The economies of scale that come with big container ships and bulk carriers are another element that contributes to their dominance. These ships are perfect candidates for the installation of low-speed engines that provide both operational efficiency and cost-effectiveness over their lifetime because they frequently travel set routes and transport large amounts of cargo. Their status as the go-to option for extensive maritime transport operations is further supported by the well-established infrastructure and support networks for low-speed engines, including worldwide service networks offered by engine manufacturers and service providers.

Regional Insights

In 2023, the biggest market share was held by the North American region. For a number of strong factors, including its thriving maritime sector, technological advancements, and regulatory environment, North America led the global market for marine internal combustion engines. The need for Marine Internal Combustion Engines (MICE) is fueled by the region's extensive offshore oil and gas development, sophisticated naval capabilities, and important maritime hubs.

The vast commercial maritime sector in North America is a major contributor to its dominance. Some of the busiest ports in the world, processing enormous volumes of imports and exports, are located in the United States and Canada. To provide smooth maritime logistics operations, these ports need a dependable fleet of cargo ships, container boats, and tankers driven by effective and potent MICE. There is a consistent need for new engine installations and modifications due to the region's significant concentration on trade and logistical infrastructure.

High-performance The sophisticated naval forces of North America, equipped with contemporary warships, submarines, and support boats, rely heavily on MICE. To preserve maritime dominance and worldwide operating capabilities, the US Navy, in particular, makes large investments in naval modernization initiatives. This continuous upgrade fuels the need for technologically sophisticated engines that can enhance vessel performance, fuel efficiency, and operational readiness.

North America is at the forefront of offshore oil and gas production and development, especially in the Arctic and Gulf of Mexico. Reliable MICE is essential for power generation and propulsion on offshore platforms, drilling rigs, and support vessels that operate in these challenging conditions. To meet these specific needs, local engine manufacturers have created engines that are resistant to harsh offshore environments and comply with strict environmental standards.

North America's dominance in the worldwide MICE industry is a result of its status as a hub for technological innovation in engine design and production. Businesses in the area are at the forefront of innovations in digitizing engine management systems, fuel efficiency, and pollution control technology. These developments establish industry standards for performance and dependability in marine propulsion systems in addition to satisfying legal requirements.

Download Free Sample Ask for Discount Request Customization

Recent Developments

- In April 2023, Valvoline Global, a leading player in the automotive industry specializing in innovative lubricant and fluid solutions, has launched a new product lineup. Among them is the Valvoline 4-Stroke Full Synthetic Premium Motor Oil, tailored specifically for marine and powersports applications. Unlike automobile engines, four-stroke motors in ATVs/UTVs and marine vessels face unique challenges due to higher operational speeds, seasonal usage patterns, and extreme environmental conditions. The increased torque and heat generated by these engines push both the engine and motor oil to their limits, potentially leading to corrosion, excessive wear, and the accumulation of deposits.

- In January 2023, Garden Reach Shipbuilders and Engineers (GRSE) Ltd entered into a Memorandum of Understanding (MoU) with Rolls Royce Solutions of Germany for the manufacturing of high-performance marine diesel engines. The MoU was signed by Cmde. PR Hari, IN (Retd), former CMD of GRSE, and Shri GS Selwyn, then MD of MTU India, a subsidiary of Rolls Royce plc's Power Systems division. The signing ceremony was attended by Vice Admiral Sandeep Naithani, Chief of Materiel of the Indian Navy, emphasizing strategic collaboration in the presence of key stakeholders.

Key Market Players

- Caterpillar Inc.

- Wärtsilä Corporation

- Rolls-Royce plc

- Cummins Inc.

- Mitsubishi Heavy Industries, Ltd.

- Hyundai Heavy Industries Co., Ltd.

- Deutz AG

- General Electric Company

|

By Product Type |

By Fuel Type |

By Application |

By Region |

|

|

|

|

Related Reports

- North America & Europe Electric Boiler Market Size - By Voltage Rating (Low Voltage, Medium Voltage), By Application (Re...

- North America Residential Boiler Market Size - By Fuel (Natural Gas, Oil, Electric), By Technology (Condensing {Natural ...

- U.S. Commercial Boiler Market – By Product (Hot Water, Steam), Application (Offices, Healthcare Facilities, Educationa...

- North America Commercial Boiler Market Size - By Fuel (Natural Gas, Oil, Coal, Electric), By Capacity, By Technology (Co...

- Water Tube Industrial Boiler Market Size By Capacity, By Application (Food Processing, Pulp & Paper, Chemical, Refinery,...

- U.S. Industrial Boiler Market Size By Fuel (Natural Gas, Oil, Coal), By Capacity, By Technology (Condensing, Non-Condens...

Table of Content

- 1. Executive Summary

- 1.1. Key Findings

- 1.2. Market Overview

- 1.3. Future Outlook and Key Opportunities

- 2. Introduction to the Marine Internal Combustion Engines Market

- 2.1. Defining Marine Internal Combustion Engines (ICEs)

- 2.2. How Marine ICEs Function (2-stroke vs. 4-stroke)

- 2.3. Significance of Marine ICEs in Global Shipping and Maritime Industry

- 2.4. Scope of the Report

- 3. Market Overview and Dynamics

- 3.1. Current Market Size and Valuation (2025)

- 3.2. Historical Market Performance (2018-2024)

- 3.3. Market Dynamics

- 3.3.1. Drivers of Market Growth

- 3.3.1.1. Growth in International Seaborne Trade and Freight Transport

- 3.3.1.2. Increasing Global Fleet Size and New Ship Construction

- 3.3.1.3. Demand for Efficient and Reliable Propulsion Systems

- 3.3.1.4. Technological Advancements (e.g., fuel injection systems, smart engines)

- 3.3.1.5. Expansion of Offshore Wind and Energy Projects

- 3.3.1.6. Growth in Passenger and Cruise Shipping Sectors

- 3.3.2. Challenges and Restraints

- 3.3.2.1. Stringent Environmental Regulations and Emission Standards (IMO MARPOL Annex VI)

- 3.3.2.2. Transition Towards Alternative Propulsion Technologies (Electric, Hybrid, Fuel Cells)

- 3.3.2.3. High Initial Investment Costs of Advanced ICEs

- 3.3.2.4. Price Volatility and Supply Chain Concerns for Fuels

- 3.3.2.5. Need for Retrofitting Existing Fleet for Compliance

- 3.3.3. Opportunities

- 3.3.3.1. Development of Dual-Fuel and Multi-Fuel Engines (LNG, Methanol, Ammonia, Hydrogen)

- 3.3.3.2. Integration of Digitalization, IoT, and AI for Engine Optimization

- 3.3.3.3. Focus on Hybrid and Electric Propulsion Systems (ICE as part of hybrid solutions)

- 3.3.3.4. Demand for Compact, High-Power, and Durable Engines

- 3.3.3.5. Opportunities in After-Sales Services, Maintenance, and Repairs

- 3.3.1. Drivers of Market Growth

- 4. Market Segmentation

- 4.1. By Engine Type

- 4.1.1. 2-Stroke Engines

- 4.1.2. 4-Stroke Engines

- 4.2. By Power Range

- 4.2.1. 0-1,000 HP (Up to 1,000 kW)

- 4.2.2. 1,001-5,000 HP (1,000-4,000 kW)

- 4.2.3. 5,001-10,000 HP

- 4.2.4. 10,001-20,000 HP

- 4.2.5. Above 20,000 HP (Above 4,000 kW)

- 4.3. By Fuel Type

- 4.3.1. Diesel/Heavy Fuel Oil (HFO)/Marine Diesel Oil (MDO)/Marine Gas Oil (MGO)

- 4.3.2. Liquefied Natural Gas (LNG)

- 4.3.3. Other Fuels (Methanol, Ammonia, Hydrogen, Biofuels)

- 4.4. By Ship Type

- 4.4.1. Cargo or Container Ships

- 4.4.2. Tankers (Oil, Chemical, Gas)

- 4.4.3. Bulk Carriers

- 4.4.4. Offshore Vessels

- 4.4.5. Passenger Ships and Ferries

- 4.4.6. Naval Ships/Defense Vessels

- 4.4.7. Other Ship Types (e.g., Fishing Vessels, Tugs, Dredgers)

- 4.5. By Application (Propulsion vs. Auxiliary)

- 4.5.1. Propulsion Engines

- 4.5.2. Auxiliary Engines

- 4.1. By Engine Type

- 5. Regional Analysis

- 5.1. Asia Pacific (Leading Region, Focus on China, Japan, South Korea, India)

- 5.2. Europe (Germany, UK, France, Scandinavia, etc.)

- 5.3. North America (USA, Canada)

- 5.4. Middle East & Africa

- 5.5. South America

- 6. Competitive Landscape

- 6.1. Market Share Analysis of Key Players

- 6.2. Profiles of Major Companies

- 6.2.1. Wärtsilä (Finland)

- 6.2.2. MAN Energy Solutions (Germany)

- 6.2.3. Caterpillar Marine Power Systems (MaK) (US)

- 6.2.4. Hyundai Heavy Industries Co., Ltd. (HD Hyundai) (South Korea)

- 6.2.5. Sumitomo Electric Industries (Japan)

- 6.2.6. Volvo Penta AB (Sweden)

- 6.2.7. Mitsubishi Heavy Industries, Ltd. (Japan)

- 6.2.8. Cummins Inc. (US)

- 6.2.9. Daihatsu Diesel Mfg. Co., Ltd. (Japan)

- 6.2.10. Deutz AG (Germany)

- 6.2.11. Rolls-Royce plc (mtu Solutions) (UK/Germany)

- 6.2.12. Yanmar Co. Ltd. (Japan)

- 6.2.13. Other Prominent Players (e.g., Antai Power, Jinan Diesel Engine, Kawasaki, STX Engine)

- 6.3. Recent Developments, Strategic Partnerships, and Acquisitions

- 7. Regulatory Landscape and Environmental Impact

- 7.1. International Maritime Organization (IMO) Regulations (MARPOL Annex VI, EEDI, EEXI, CII)

- 7.2. Regional and National Emission Standards

- 7.3. Impact on Engine Design and Fuel Choices

- 7.4. Decarbonization Pathways for the Maritime Sector

- 8. Technological Trends and Innovations

- 8.1. Advanced Fuel Injection Systems and Combustion Optimization

- 8.1.1. High-Pressure Fuel Injection Systems

- 8.1.2. Reactivity-Controlled Compression Ignition (RCCI) Engines

- 8.2. Dual-Fuel and Multi-Fuel Engine Development

- 8.3. Exhaust Gas After-Treatment Systems (Scrubbers, SCR)

- 8.4. Hybrid and Electric Propulsion Integration

- 8.5. Digitalization, IoT, and AI for Predictive Maintenance and Performance Optimization

- 8.6. Modular Engine Design for Fuel Flexibility

- 9. Future Outlook and Projections (up to 2030/2034)

- 9.1. Forecasted Market Size and Compound Annual Growth Rate (CAGR)

- 9.2. Evolution of Fuel Landscape and Engine Technologies

- 9.3. Long-term Role of Internal Combustion Engines in Decarbonized Shipping

- 9.4. Investment Opportunities and Strategic Recommendations

- 10. Conclusion

Major Key Players

- Wärtsilä Corporation (Finland)

- MAN Energy Solutions SE (Germany)

- Caterpillar Inc. (MaK, Perkins) (USA)

- Cummins Inc. (USA)

- Hyundai Heavy Industries Co., Ltd. (HD Hyundai) (South Korea)

- Rolls-Royce Power Systems AG (MTU) (Germany)

- Yanmar Holdings Co. Ltd. (Japan)

- Mitsubishi Heavy Industries Ltd. (Japan)

- Volvo Penta (AB Volvo Penta) (Sweden)

- Daihatsu Diesel Mfg. Co. Ltd. (Japan)

Manufacturers Key Players

- Wärtsilä Corporation (Finland)

- MAN Energy Solutions SE (Germany)

- Caterpillar Inc. (MaK, Perkins) (USA)

- Cummins Inc. (USA)

- Hyundai Heavy Industries Co., Ltd. (HD Hyundai) (South Korea)

- Rolls-Royce Power Systems AG (MTU) (Germany)

- Yanmar Holdings Co. Ltd. (Japan)

- Mitsubishi Heavy Industries Ltd. (Japan)

- Volvo Penta (AB Volvo Penta) (Sweden)

- Daihatsu Diesel Mfg. Co. Ltd. (Japan)

- Anglo Belgian Corporation (ABC) (Belgium)

- Deutz AG (Germany)

- Isuzu Motors Engine (Japan)

- Scania (Sweden)

- Weichai Holding Group Co., Ltd. (China)

- Masson Marine S.A.S. (France)

- Nanni Industries (France)

- IHI Power Systems Co., Ltd. (Japan)

- STX Heavy Industries Co., Ltd. (South Korea)

- Doosan Engine Co., Ltd. (South Korea)

FAQ'S

For a single, multi and corporate client license, the report will be available in PDF format. Sample report would be given you in excel format. For more questions please contact:

Within 24 to 48 hrs.

You can contact Sales team (sales@marketinsightsresearch.com) and they will direct you on email

You can order a report by selecting payment methods, which is bank wire or online payment through any Debit/Credit card, Razor pay or PayPal.

Discounts are available.

Hard Copy