India CNG Market

India CNG Market By Source (Associated Gas, Non-Associated Gas, Unconventional Sources), By Application (Light Duty Vehicles, Medium/Heavy Duty Buses, Medium/Heavy Duty Trucks, Others), By Region, Competition, Forecast and Opportunities, 2020-2030

Published Date: June - 2025 | Publisher: MIR | No of Pages: 320 | Industry: Power | Format: Report available in PDF / Excel Format

View Details Buy Now 2890 Download Free Sample Ask for Discount Request Customization| Forecast Period | 2026-2030 |

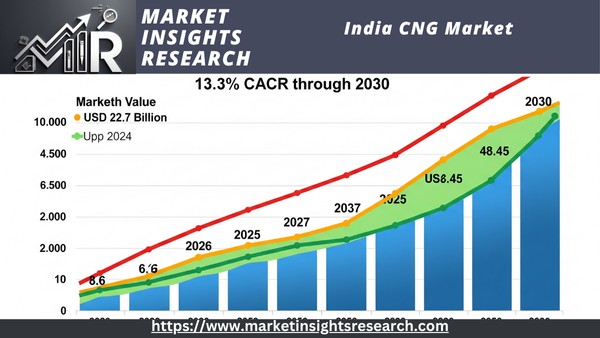

| Market Size (2024) | USD 22.7 Billion |

| Market Size (2030) | USD 48.45 Billion |

| CAGR (2025-2030) | 13.3% |

| Fastest Growing Segment | Associated Gas |

| Largest Market | North India |

Market Overview

India CNG Market was valued at USD 22.7 billion in 2024 and is expected to reach at USD 48.45 Billion in 2030 and project robust growth in the forecast period with a CAGR of 13.3% through 2030. The India CNG (Compressed Natural Gas) market is experiencing significant growth driven by its advantages over conventional fuels.

Download Free Sample Ask for Discount Request Customization

Because of its lower emissions and cost-effectiveness, CNG has become a popular substitute as India struggles with growing air pollution and environmental issues. The market's growth is being further accelerated by government initiatives and subsidies that support cleaner energy alternatives. This growth is being aided by the expansion of CNG refueling infrastructure and the increase in vehicle uptake, particularly in public transit networks. The CNG industry has also been strengthened by the movement to lessen the country's dependency on imported crude oil and promote energy security through indigenous natural gas sources. Technological developments in CNG engine systems and rising infrastructure development investments are also contributing to the market's expansion. The India CNG market is expected to grow rapidly in the upcoming years, establishing itself as a major participant in the nation's energy transition plan as a result of metropolitan regions' increased adoption of CNG for commercial fleets and public transportation as well as rising awareness of the advantages it offers the environment.

Key Market Drivers

Government Policies and Regulations

In order to solve environmental issues and lower pollution, the Indian government has been a steadfast supporter of greener energy options. The National Clean Air Programme (NCAP) and other policies that encourage the use of compressed natural gas (CNG) through tax breaks and subsidies have been major factors in the expansion of the CNG market. A favorable climate for CNG adoption has been established by the government's dedication to developing CNG infrastructure, which includes building new pipelines and filling stations. Further supporting market expansion are laws aimed at reducing vehicle emissions and improving air quality, which force businesses and consumers to convert to cleaner fuels like CNG. Initiatives from the federal and state governments, including as funding and supportive legislation for the construction of CNG infrastructure, highlight their strategic emphasis on improving air quality and lowering greenhouse gas emissions.

Environmental Benefits

When compared to conventional fossil fuels, CNG is known for its advantages for the environment. It contributes to less air pollution and better public health by producing lower amounts of carbon dioxide (CO2), nitrogen oxides (NOx), and particle matter. The demand for CNG as a cleaner fuel option has increased as a result of the serious air quality problems in cities like Delhi and Mumbai. CNG's lower emissions profile is consistent with India's climate pledges and larger environmental objectives. In order to improve urban air quality and meet strict emission standards, this change is essential. CNG is becoming more and more popular because to its environmental benefits, which make it a popular option for both individual automobiles and public transportation systems.

Download Free Sample Ask for Discount Request Customization

Infrastructure Development

One of the main factors propelling market expansion is the development of CNG infrastructure. The construction of CNG pipelines and refill stations is being heavily funded by the Indian government and private sector, improving consumer access to and convenience with CNG. The widespread use of CNG cars is supported by efforts to create CNG networks in urban and semi-urban regions as well as developments in CNG distribution technology. Improved infrastructure increases consumer confidence in switching to CNG-powered vehicles while also making refilling simpler. The market can accommodate the increasing demand and encourage the use of sustainable fuels thanks to the strategic regional expansion of CNG infrastructure.

Rising Vehicle Conversion

Due to the availability of affordable and dependable CNG conversion technologies, government incentives for adopting cleaner fuels, and the growing number of CNG conversion workshops and service centers, the trend of converting traditional internal combustion engine (ICE) vehicles to CNG-powered engines is on the rise, which is driving the growth of the CNG market in India. As more vehicle owners move to CNG, the demand for CNG infrastructure and fuel keeps increasing, supporting the market's expansion.

Key Market Challenges

Infrastructure Limitations

The inadequate infrastructure for CNG distribution and recharging is one of the main issues facing the Indian CNG business. The network of CNG filling stations is still insufficient despite large investments made recently, especially in rural and semi-urban areas. This restriction may impede market expansion by affecting consumers' access to and convenience with CNG. Infrastructure expansion may be slowed down by the significant financial expenditure and regulatory permits needed to build CNG stations. Infrastructure issues are also exacerbated by the logistical difficulties in setting up a broad pipeline network to move CNG from producing sites to distribution hubs. To expand the market's reach and entice additional customers to convert to CNG, these infrastructure deficiencies must be filled.

High Initial Costs for Conversion

For many buyers, the upfront expense of switching to a CNG-powered car might be a major deterrent. Although CNG is inexpensive in and of itself, installing CNG conversion kits and making other adjustments might cost a significant amount of money up front. This covers the price of buying and installing CNG tanks, regulators, and other necessary parts. Car owners may be discouraged from switching to CNG because to the hefty upfront costs, especially in a nation where consumers are price conscious like India. Government subsidies and incentives are available to help offset these costs, but they might not be sufficient to cover all of the costs for all customers. This cost barrier hinders market expansion and prevents CNG vehicles from being widely used.

Regulatory and Policy Challenges

Another difficulty facing the Indian CNG sector is navigating the regulatory and policy environment. Numerous laws and guidelines pertaining to safety, pollution, and fuel quality apply to the industry. Constant updates and adherence to evolving policies are necessary to ensure compliance with these regulations, which can be difficult and resource-intensive. Furthermore, there may be differences in how state and municipal governments implement legislation, which could result in irregularities in the supply and use of CNG. Regulatory obstacles may cause delays in the installation of CNG infrastructure and have an impact on the market's overall effectiveness. Promoting market expansion requires streamlining regulatory procedures and guaranteeing uniform policy application across geographical boundaries.

Competition from Alternative Fuels

Alternative fuels like hydrogen and electric cars (EVs) compete with the CNG market in India. With the help of growing government incentives and technological developments, alternative fuels are becoming more popular as the global car industry moves toward more environmentally friendly energy sources. Because of their low emissions and expanding infrastructure for charging, electric vehicles in particular are gaining popularity. Hydrogen fuel cells are also showing promise as a clean transportation solution. Because businesses and consumers may choose these more modern technologies over CNG, the emergence of these alternative fuels poses a competitive threat to the CNG sector. The CNG market needs to highlight its unique advantages and keep coming up with new ideas for fuel efficiency and environmental benefits if it wants to stay competitive.

Key Market Trends

Expansion of CNG Infrastructure

One of the main factors propelling the growth of the CNG market in India is the construction of CNG infrastructure. To increase consumer accessibility and convenience, the Indian government and corporate sector are making large investments in the construction of a strong CNG fuelling network. For effective CNG distribution, this entails building new CNG stations, growing current networks, and creating a thorough pipeline infrastructure. Infrastructure projects have received more permissions and support as a result of the government's emphasis on promoting CNG as a cleaner substitute for gasoline and diesel. In order to address air quality concerns, cities with high pollution levels are also giving priority to CNG infrastructure. The market's reach and adoption rates are anticipated to rise as a result of continued investments meant to cover more urban and rural areas.

Government Incentives and Policies

The CNG market in India is significantly shaped by government regulations and incentives. To promote the use of CNG vehicles, the Indian government has introduced a number of subsidies and incentives, such as tax breaks, lowered registration costs, and funding for conversion kits. The emphasis on cleaner fuels is in line with the more general goals of lowering vehicle emissions and enhancing air quality. Stricter car pollution regulations are another recent policy that is fueling demand for CNG as a competitive substitute. Furthermore, measures that encourage the development of CNG infrastructure and make it a priority fuel for urban transportation are anticipated to accelerate market expansion. Market dynamics and adoption rates will be significantly influenced by these policies' ongoing development.

Technological Advancements in CNG Vehicles

The market is changing as a result of technological developments in CNG vehicles that improve performance, customer appeal, and fuel efficiency. increased CNG engine technologies, sophisticated fuel management systems, and increased safety measures for CNG tanks and parts are examples of recent improvements. In order to solve earlier issues with performance and maintenance, automakers are spending money on research and development to create more dependable and efficient CNG vehicles. Hybrid technology integration, which combines CNG with electricity, is also becoming more popular. These developments not only enhance the entire driving experience but also help the market expand by increasing consumer interest in CNG vehicles. Further acceptance and integration of CNG into the Indian automotive sector is anticipated as technology advances.

Increasing Environmental Awareness

The Indian CNG business is being greatly impacted by growing environmental consciousness among consumers and authorities. Cleaner fuel alternatives are becoming more popular as a result of growing worries about climate change, air pollution, and environmental sustainability. CNG is thought to be a more environmentally friendly choice because it emits fewer emissions than gasoline and diesel. The advantages of CNG in lowering greenhouse gas emissions and enhancing air quality are also being highlighted by public awareness campaigns and educational programs. The demand for CNG infrastructure and automobiles is being driven by this change in consumer behavior as well as the government's dedication to environmental sustainability. It is anticipated that the trend toward environmentally friendly solutions would continue, influencing consumer preferences and legislative frameworks to support CNG.

Growth in CNG-Powered Public Transport

One significant development in the CNG market in India is the growth of public transportation powered by CNG. To combat urban air pollution and enhance air quality, numerous Indian cities are switching to compressed natural gas (CNG) for their public transportation fleets. In order to provide cleaner alternatives to traditional fuels, public transportation networks are incorporating CNG buses, autorickshaws, and taxis. This transformation is being aided by government programs and regulations that invest in the required infrastructure and offer incentives to fleet operators. In addition to lowering emissions, the expansion of CNG-powered public transportation also increases demand for CNG fuel in general. The market for CNG is anticipated to grow as additional cities adopt comparable policies, helped by rising use of urban transportation systems and ongoing government assistance.

Segmental Insights

Application Insights

The Light Duty Vehicles segment was the primary driver of the India CNG market and is anticipated to maintain its leadership position over the course of the forecast period. Because of their substantial portion of the total vehicle population and the growing demand for cleaner fuels, light duty vehicles—which include passenger cars and small commercial vehicles—have become the most popular application sector. The adoption of CNG-powered light-duty cars has been supported by government incentives and subsidies for CNG vehicles as well as an increase in environmental consciousness. Cost effectiveness, reduced emissions, and advantageous regulations meant to lessen urban air pollution all work in this segment's favor. The growth of this market has been further stimulated by the Indian government's emphasis on developing CNG infrastructure and providing tax breaks for CNG vehicles. Furthermore, improvements in CNG technology have increased vehicle performance and fuel economy, which has made CNG a more alluring choice for light-duty vehicles. The Light Duty Vehicles sector dominates the market because of its higher volume and wider customer base, even if Medium/Heavy Duty Buses and Medium/Heavy Duty Trucks also play a part. India's overarching goals of lowering vehicle emissions and advancing environmentally friendly transportation options are in line with the growing use of CNG in the light-duty vehicle market. This segment's continued growth and domination are supported by the ongoing infrastructure and filling station expansion, which guarantees its crucial position in the Indian CNG industry. As a result, during the forecast period, the Light Duty Vehicles sector is anticipated to continue to drive the market's trajectory and hold its dominant position.

Regional Insights

Throughout the forecast period, the Northern region of India is expected to continue to hold its dominant position in the CNG market. Due to several important characteristics, this region—which includes important states like Delhi, Uttar Pradesh, Haryana, and Punjab—has a sizable market share. The substantial construction of CNG infrastructure, including a strong network of refill stations, has greatly aided the widespread acceptance of CNG vehicles. With strict air quality laws and government programs encouraging the use of CNG as a cleaner substitute for traditional fuels, Delhi, the capital of India, has been a significant motivator. Furthermore, the Northern region enjoys the advantages of a sizable metropolitan population and a high vehicle ownership density, which increases the need for affordable and sustainable transportation options. The market in this area is additionally supported by government initiatives like CNG car subsidies and incentives. Furthermore, the Northern region's advantageous geographic position makes it easier for CNG to be distributed and made available, which adds to its dominance. It is anticipated that the Northern region's current infrastructure and enabling policies will maintain its dominant position as long as the Indian government continues to place a high priority on sustainable transportation and air quality improvements. The region's crucial position in the market is highlighted by its continuous investments in growing the CNG refueling network and encouraging the usage of CNG across different vehicle categories. The Northern area is well-positioned to maintain its leadership in the Indian CNG industry due to its sophisticated infrastructure, favorable policies, and strong demand for greener modes of transportation.

Download Free Sample Ask for Discount Request Customization

Recent Developments

- In June 2024, TotalEnergies reached an agreement with EIG, a prominent global energy investor, to acquire all shares of West Burton Energy for €450 million. This strategic acquisition aligns with TotalEnergies' transformation into a comprehensive electricity provider.

- In May 2024, Gazprom's Management Committee reviewed the progress of its gas supply and infrastructure expansion initiatives across Russia. The expansion program, set for completion between 2021 and 2025, aims to enhance gas coverage in 72 regions throughout the Russian Federation.

- In April 2024, Gujarat Gas and Indian Oil Corporation Limited (IOCL) have signed a strategic memorandum of understanding (MoU) to jointly expand their CNG infrastructure. This partnership aims to enhance the network of CNG outlets and improve customer accessibility. Following the announcement, both companies saw a significant rise in their share prices on the Bombay Stock Exchange (BSE) and National Stock Exchange (NSE). We expect the collaboration to increase the availability of CNG fueling stations and bolster their market positions in the energy sector.

Key Market Players

- Indian Oil Corporation Limited

- Bharat Petroleum Corporation Limited

- Hindustan Petroleum Corporation Limited

- GAIL (India) Limited

- Tata Power Company Limited

- Reliance Industries Limited

- Mahanagar Gas Limited

- Indraprastha Gas Limited

- Sabarmati Gas Limited

- Gujarat Gas Limited

|

By Source |

By Application |

By Region |

|

|

|

Related Reports

- North America Commercial Boiler Market Size - By Fuel (Natural Gas, Oil, Coal, Electric), By Capacity, By Technology (Co...

- Water Tube Industrial Boiler Market Size By Capacity, By Application (Food Processing, Pulp & Paper, Chemical, Refinery,...

- U.S. Industrial Boiler Market Size By Fuel (Natural Gas, Oil, Coal), By Capacity, By Technology (Condensing, Non-Condens...

- Fire Tube Industrial Boiler Market - By Capacity (<10 MMBtu/hr, 10-25 MMBtu/hr, 25-50 MMBtu/hr, 50-75 MMBtu/hr, >75 MMBt...

- Gas Fired Boiler Market Size - By Capacity (≤ 10 MMBtu/hr, > 10 - 50 MMBtu/hr, > 50 - 100 MMBtu/hr, > 100 - 250 MMBtu/...

- Europe Residential Boiler Market Size - By Technology (Condensing {Natural Gas, Oil, Electric}, Non-Condensing {Natural ...

Table of Content

- 1. Executive Summary

- 1.1. Key Findings

- 1.2. Market Overview

- 1.3. Future Outlook

- 2. Introduction to the India CNG Market

- 2.1. What is Compressed Natural Gas (CNG)?

- 2.2. Role of CNG in India's Energy Mix

- 2.3. Advantages of CNG as a Fuel in India

- 2.3.1. Cost-Effectiveness Compared to Petrol and Diesel

- 2.3.2. Environmental Benefits (Lower Emissions)

- 2.3.3. Safety Aspects

- 2.4. Scope of the Report

- 3. Market Overview and Dynamics

- 3.1. Current Market Size and Valuation (2025)

- 3.2. Historical Market Performance (2018-2024)

- 3.3. Market Dynamics

- 3.3.1. Drivers of Market Growth

- 3.3.1.1. Government Incentives and Policies (e.g., Vision 2030 targets for CNG stations)

- 3.3.1.2. Rising Petrol and Diesel Prices

- 3.3.1.3. Increasing Environmental Awareness and Pollution Concerns

- 3.3.1.4. Expanding CNG Station Infrastructure

- 3.3.1.5. Growing Automotive Industry and CNG Vehicle Variants

- 3.3.1.6. Focus on Cleaner Energy Alternatives

- 3.3.2. Challenges and Restraints

- 3.3.2.1. Price Volatility of Natural Gas

- 3.3.2.2. Supply Bottlenecks and Dependence on Imports

- 3.3.2.3. Competition from Electric Vehicles (EVs)

- 3.3.2.4. Limited Availability of CNG Stations in certain regions

- 3.3.2.5. Higher Initial Cost of CNG Vehicles (compared to petrol equivalents)

- 3.3.3. Opportunities

- 3.3.3.1. Further Expansion of CGD Networks

- 3.3.3.2. Development of Domestic Gas Production

- 3.3.3.3. Policy Support for Natural Gas under GST

- 3.3.1. Drivers of Market Growth

- 4. Market Segmentation

- 4.1. By Vehicle Type

- 4.1.1. Passenger Vehicles (Cars, SUVs, MPVs)

- 4.1.2. Commercial Vehicles (Buses, Trucks, LCVs)

- 4.1.3. Three-Wheelers (Auto-rickshaws)

- 4.1.4. Other Vehicles (e.g., Two-wheelers - emerging)

- 4.2. By Kit Type

- 4.2.1. OEM Fitted

- 4.2.2. Aftermarket/Retrofitment

- 4.3. By End-Use Application

- 4.3.1. Transportation

- 4.3.2. Industrial

- 4.3.3. Commercial

- 4.1. By Vehicle Type

- 5. Regional Analysis

- 5.1. North India (Dominant Region Analysis)

- 5.2. West India

- 5.3. South India

- 5.4. East India

- 6. Competitive Landscape

- 6.1. Market Share Analysis of Key Players

- 6.2. Profiles of Major City Gas Distribution (CGD) Companies

- 6.2.1. Indraprastha Gas Limited (IGL)

- 6.2.2. Mahanagar Gas Limited (MGL)

- 6.2.3. Gujarat Gas Limited (GGL)

- 6.2.4. GAIL (India) Limited (and its subsidiaries like GAIL Gas)

- 6.2.5. Adani Total Gas Limited

- 6.2.6. Bharat Petroleum Corporation Limited (BPCL)

- 6.2.7. Hindustan Petroleum Corporation Limited (HPCL)

- 6.2.8. Other Key Players (e.g., AG&P, THINK Gas, Central U.P. Gas Limited)

- 6.3. Profiles of Major OEM Manufacturers Offering CNG Vehicles

- 6.3.1. Maruti Suzuki India Limited (Dominant Player)

- 6.3.2. Tata Motors Limited

- 6.3.3. Hyundai Motor India Limited

- 6.3.4. Mahindra & Mahindra Limited

- 6.3.5. Other OEMs

- 6.4. Recent Developments, Joint Ventures, and Strategic Initiatives

- 7. Regulatory Landscape and Policy Analysis

- 7.1. Role of Petroleum and Natural Gas Regulatory Board (PNGRB)

- 7.2. Government Initiatives and Schemes (e.g., City Gas Distribution bidding rounds)

- 7.3. Impact of Administered Pricing Mechanism (APM) Gas Allocation Changes

- 7.4. Potential Inclusion of Natural Gas under GST

- 8. Future Outlook and Projections (up to 2030/2034)

- 8.1. Forecasted Market Size and CAGR

- 8.2. Emerging Trends

- 8.2.1. Further Expansion of CNG Infrastructure (Target: 10,000 stations by 2030)

- 8.2.2. Innovations in CNG Vehicle Technology (e.g., twin-cylinder technology)

- 8.2.3. Growing Adoption in Commercial Fleets and Public Transport

- 8.2.4. Potential for CNG in Two-Wheelers

- 8.3. Impact of Policy Changes and Economic Factors

- 9. Conclusion and Key Recommendations

Major Key Players

- Gujarat Gas Ltd. (India)

- Indraprastha Gas Limited (IGL) (India)

- Mahanagar Gas Ltd (MGL) (India)

- GAIL (India) Limited (India)

- Adani Total Gas Ltd. (India)

- Bharat Petroleum Corporation Limited (BPCL) (India)

- Hindustan Petroleum Corporation Limited (HPCL) (India)

- AG&P Pratham (India)

- Think Gas Distribution Pvt. Ltd. (India)

- Maruti Suzuki India Limited (India - as a leading CNG vehicle seller)

Manufacturers Key Players

- Maruti Suzuki India Limited (India)

- Tata Motors Limited (India)

- Hyundai Motor India Limited (India)

- Ashok Leyland Limited (India)

- Mahindra & Mahindra Limited (India)

- Bajaj Auto Limited (India - for 3-wheelers and now 2-wheelers)

- VE Commercial Vehicles Limited (Eicher & Volvo JV) (India)

- SML Isuzu Limited (India)

- JBM Auto Limited (India)

- Everest Kanto Cylinders Ltd. (India - for CNG cylinders)

- Time Technoplast Ltd. (India - for CNG cylinders)

- Faber Industries S.p.A. (Italy - with presence in India for cylinders)

- Worthington Enterprises (USA - with presence in India for cylinders)

- Luxfer Holdings PLC (UK - with presence in India for cylinders)

FAQ'S

For a single, multi and corporate client license, the report will be available in PDF format. Sample report would be given you in excel format. For more questions please contact:

Within 24 to 48 hrs.

You can contact Sales team (sales@marketinsightsresearch.com) and they will direct you on email

You can order a report by selecting payment methods, which is bank wire or online payment through any Debit/Credit card, Razor pay or PayPal.

Discounts are available.

Hard Copy