Marine Propulsion Engine Market

Marine Propulsion Engine Market - Global Industry Size, Share, Trends, Opportunity, and Forecast, Segmented By Engine Type (Diesel, Gas Turbine, Natural Engine, Others), By Application (Passenger, Commercial, Defense), By Ship Type (Container Ship, Tanker, Bulk Carrier, Offshore Vessel, Naval Ship, Passenger Ship), By Region & Competition, 2019-2029

Published Date: June - 2025 | Publisher: MIR | No of Pages: 320 | Industry: Power | Format: Report available in PDF / Excel Format

View Details Buy Now 2890 Download Free Sample Ask for Discount Request Customization| Forecast Period | 2025-2029 |

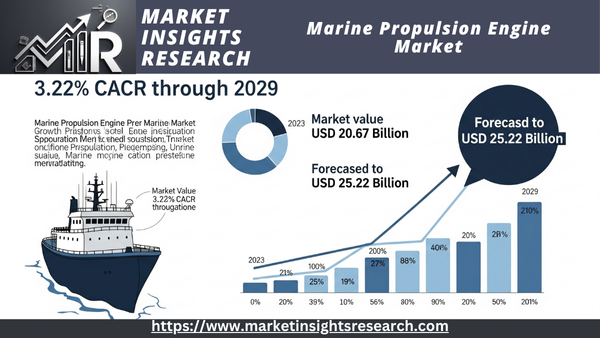

| Market Size (2023) | USD 20.67 Billion |

| Market Size (2029) | USD 25.22 Billion |

| CAGR (2024-2029) | 3.22% |

| Fastest Growing Segment | Passenger Ship |

| Largest Market | Asia-Pacific |

Market Overview

Global Marine Propulsion Engine Market was valued at USD 20.67 billion in 2023 and is expected to reach USD 25.22 billion by 2029 with a CAGR of 3.22% during the forecast period.

Download Free Sample Ask for Discount Request Customization

The Marine Propulsion Engine market includes the business that makes and sells engines that power different kinds of ships, such as cargo ships, tankers, passenger ships, and navy ships. These engines are essential for ships to work because they turn energy into mechanical force that moves ships over water. There are different types of engines on the market, such as diesel, gas turbine, steam turbine, and dual-fuel engines. Each type has its own pros and cons, and the best one for a vessel depends on its needs and the environment in which it will be used.

The Marine Propulsion Engine market is growing because there is increased need for maritime trade, engine technology is getting better, and strict environmental rules require cleaner and more efficient propulsion systems. Some important trends are the creation of hybrid and electric propulsion systems that use less fuel and produce fewer emissions, as well as the use of digital technologies to improve engine efficiency and maintenance.

To satisfy the changing needs of the marine industry, major companies in this market are focusing on innovation, strategic collaborations, and adding new products to their portfolios. The Marine Propulsion Engine market is likely to see a lot of growth and change as international trade grows and environmental issues become more important.

Key Market Drivers

Increasing Maritime Trade and Globalization

The rapid rise of maritime trade and globalization is one of the main things driving the worldwide Marine Propulsion Engine market. As trade between countries develops, so does the need for marine propulsion systems that work well and are dependable. Ships are the most important part of global trade since they move goods and raw materials across continents. As maritime traffic grows, we need to create better propulsion engines that will let ships work well over long distances and in a variety of conditions.

As economies have become more global, long supply chains have formed. These chains move items from one place to another to be used. This needs a strong and dependable maritime transport system. Marine propulsion engines are very important to this system since they power the ships that move these items. As a result, shipping companies and vessel operators are always looking for propulsion engines that are more efficient, more reliable, and cost less to run in order to keep up with the demands of this global commerce climate.

The move toward bigger ships, including giant container ships and bulk carriers, which can carry more cargo in one trip, has made the need for more powerful and efficient propulsion systems even greater. These engines have to give these huge ships enough power to move them while also being fuel-efficient and following strict environmental rules.

Technological Advancements in Engine Design

The global Marine Propulsion Engine market is being driven by big changes in engine design and materials. The goal of new propulsion technologies is to make marine engines work better, use less fuel, and be better for the environment. Engine makers are putting a lot of money into research and development to make better propulsion systems since there is more pressure to cut greenhouse gas emissions and follow international maritime rules.

The development of dual-fuel engines, which can run on both regular maritime fuels and cleaner options like liquefied natural gas (LNG), is one important area of technological progress. These engines can switch between fuels according on how much they cost and how easy they are to find, and they also cut down on pollution. Also, improvements in turbocharging and fuel injection systems have made combustion processes more efficient, which means less fuel is used and less pollution is released.

Another big trend is the use of digital technology like sensors and data analytics together. These technologies make it possible to monitor things in real time and do predictive maintenance, which makes marine propulsion engines more reliable and better at what they do. Digitalization also lets you optimize how engines work, which makes them use less fuel and costs less to run.

Download Free Sample Ask for Discount Request Customization

Stringent Environmental Regulations

International maritime organizations and governments have strict rules on the environment that are a big reason why the Marine Propulsion Engine industry is so big. The shipping industry is a major source of greenhouse gas emissions around the world, so organizations like the International Maritime Organization (IMO) have set tough rules to lessen the harm that ships do to the environment.

The IMO's sulfur cap is one of the most important rules. It says that the amount of sulfur in marine fuels must be cut from 3.5% to 0.5%. Because of this rule, ship operators have had to either switch to low-sulfur fuels or buy exhaust gas cleaning devices (scrubbers). The IMO also wants to cut carbon dioxide emissions per transport work by at least 40% by 2030 and overall yearly greenhouse gas emissions by at least 50% by 2050 compared to 2008 levels.

Engine makers are working on propulsion technologies that are better for the environment in response to these rules. This includes switching to cleaner fuels like LNG, biofuels, and hydrogen, as well as making hybrid and electric propulsion systems. These innovations not only assist the maritime industry follow environmental rules, but they also make it more sustainable as a whole.

Key Market Challenges

Regulatory Compliance and Environmental Challenges

One of the biggest problems for the global Marine Propulsion Engine market is following the rules and protecting the environment. The shipping sector is being watched very closely to see how it can have less of an effect on the environment. Following stricter international rules can be hard and expensive for both shipowners and engine makers. The International Maritime Organization (IMO) has set high goals to cut greenhouse gas emissions and restrict sulfur and nitrogen oxide emissions from ships. To reach these goals, ships will need to make big changes to how they are powered and how they consume fuel.

The IMO's 2020 sulfur cap, which limits the amount of sulfur in marine fuel to 0.5%, has made ship operators switch to low-sulfur fuels, put in exhaust gas cleaning systems (scrubbers), or buy new engines that run on LNG. All of these options require a lot of money and changes to how things work. For example, fuels with low sulfur are more expensive and can affect how well an engine works and how much maintenance it needs. Scrubber systems need to be paid for up front and maintained regularly, and their performance can change depending on how they are used.

The attempt to cut carbon emissions adds another level of difficulty. The IMO wants to cut the amount of carbon dioxide released each transport work by at least 40% by 2030 and the overall amount of greenhouse gases released each year by at least 50% by 2050, compared to 2008 levels. To reach these goals, we need to create and use new propulsion technologies like hybrid systems, electric propulsion, and hydrogen fuel cells. These technologies are still developing, though, and their widespread use is limited by expensive costs, a lack of infrastructure, and doubts about how well they will work.

Engine makers and ship owners have to deal with a lot of rules and regulations while also making sure that their businesses are still profitable and good for the environment. If you don't follow the rules, you could face big fines and damage to your reputation, which makes the market even harder to understand. Regional differences in rules also make things more complicated, since corporations have to make solutions that work for certain areas. To get over these regulatory and environmental problems, the industry needs to spend a lot of money on research and development, strategic planning, and working together to come up with new propulsion solutions that follow the rules.

Technological and Infrastructure Barriers

Another big problem in the global Marine Propulsion Engine market is technological and infrastructure constraints. To meet regulatory requirements and protect the environment, it is important to develop and use sophisticated propulsion technologies such LNG engines, hydrogen fuel cells, and electric propulsion systems. But there are a number of problems with these technologies that make it hard for them to be used by a lot of people.

First, the exorbitant expense of creating and using new propulsion technology is a big problem. It often costs a lot of money to do research and development, construct, and test advanced engines and alternative fuel systems. For example, LNG engines and hydrogen fuel cells need complicated systems for storing and handling, which raises the total cost. These hefty upfront expenditures can be too much for smaller shipping companies with minimal capital.

The infrastructure needed to handle different types of propulsion systems is not yet fully in place. For instance, the global network of LNG bunkering facilities is still in its early stages, and there aren't many of them in important shipping areas. Hydrogen and electric propulsion systems also need particular refueling and charging infrastructure, which is currently hard to find and not uniformly spread out. Ship operators can't use these technologies on a big scale since there isn't enough infrastructure in place. This limits their operating flexibility and raises the danger of fuel supply disruptions.

The speed of innovation and the unknowns in technology are both problems. There has been a lot of development in creating alternative propulsion systems, but many of these technologies are still in the early phases of being sold to the public. Shipowners and operators are hesitant to put a lot of money into new technologies that haven't been proven yet since they aren't sure how well they will work, how reliable they will be, or how long they will last. Because technology is moving so quickly, today's cutting-edge solutions could be out of date in a few years. This makes long-term investments even more risky and unclear.

It is hard to add new propulsion technology to established ship designs and fleets because of engineering and logistical issues. Adding new propulsion systems to old ships can be technically difficult and expensive, and it generally means making big changes to the ship's structure and systems. This process might cause operating downtime and extra costs, making it further harder to use sophisticated propulsion systems.

To get rid of these technological and infrastructure problems, everyone in the sector, including engine makers, shipowners, port authorities, and governments, needs to work together. Investing in research and development, building infrastructure, and running pilot projects can help solve these problems and make the marine propulsion industry more efficient and sustainable.

Key Market Trends

Adoption of LNG and Dual-Fuel Engines

The use of liquefied natural gas (LNG) and dual-fuel engines is becoming more common in the global Marine Propulsion Engine market. LNG has become a cleaner option to traditional marine fuels as the shipping sector confronts more and more pressure to cut greenhouse gas emissions and follow strict environmental rules. LNG engines make a lot less sulfur oxides (SOx), nitrogen oxides (NOx), and particle matter, which helps to greatly minimize air pollution.

Dual-fuel engines can run on both LNG and regular marine fuels, which gives ship operators the freedom to choose between fuels based on availability and cost. Shipowners that want to protect their ships against changing rules and market situations in the future might consider dual-fuel engines because they can use both types of fuel. Using LNG also helps the world reach its objective of reducing carbon emissions, since LNG produces less carbon dioxide than heavy fuel oil and diesel.

The infrastructure for LNG bunkering is growing, with new facilities being built at important ports across the world. This makes it easier for ships to run on LNG. Governments and international organizations are also giving money and incentives to promote greener shipping, which supports this trend even further. Because of this, the need for LNG and dual-fuel engines is likely to expand steadily, which will lead to new ideas and competition among engine makers.

Development of Hybrid and Electric Propulsion Systems

The growth and use of hybrid and electric propulsion systems is another big trend in the Marine Propulsion Engine industry. Hybrid propulsion systems use both traditional internal combustion engines and electric motors with battery storage. They are more fuel-efficient, produce less emissions, and give you more operating flexibility. These systems can make the best use of energy by switching between power sources dependent on what has to be done. For example, they might use electric power when moving slowly in ports and regular engines when cruising in wide water.

Electric propulsion systems are becoming more popular, especially for short-sea transport, ferries, and coastal vessels. These systems use electric motors that are fueled by batteries or fuel cells. Improvements in battery technology and energy storage systems are making electric propulsion more practical. These improvements include longer battery life, faster charging periods, and higher energy density. Also, adding renewable energy sources like solar and wind power to electric propulsion systems makes them even better for the environment.

Hybrid and electric propulsion systems are in line with the world's aspirations to make shipping completely emissions-free and follow strict environmental rules. The maritime industry wants to use less carbon and switch to renewable energy sources, thus the need for hybrid and electric propulsion systems is likely to expand. Engine makers are putting money into research and development to make these systems work better, be more reliable, and cost less. This is pushing the market to come up with new ideas and technologies.

Digitalization and Smart Engine Technologies

The Marine Propulsion Engine market is changing because of digitalization and the use of smart engine technology. Using powerful digital tools and data analytics lets you monitor things in real time, plan maintenance ahead of time, and improve engine performance. This makes things safer, more efficient, and less expensive to run.

Smart engine technologies use sensors, IoT (Internet of Things) devices, and smart software to gather and analyze information from different parts and systems of the engine. This data-driven method lets you find possible problems before they happen, so you can execute maintenance on time and lower the chance of unexpected breakdowns. Machine learning and artificial intelligence power predictive maintenance tactics that assist estimate how much wear and tear an engine will experience, make maintenance plans more efficient, and cut down on downtime.

Digital twins, which are virtual copies of real engines, are becoming more and more useful for modeling and improving how engines work in diverse situations. These computer models help people make better choices by showing how engines will work in different situations. This lets people make changes to make engines more fuel-efficient and less polluting.

Using digital technology together makes training crews and running operations more efficient. Crew members can learn how to operate engines and fix problems with advanced simulation and training tools. This makes them more skilled and confident. Ship operators can keep an eye on engine performance across their fleet, spot patterns, and put best practices into action by using digital tools for fleet management and performance monitoring.

As the maritime industry goes digital, the need for smart engine technologies is likely to rise. Engine makers are putting more and more effort into making digital solutions that improve performance, dependability, and cost savings. This is what is driving the growth of the Marine Propulsion Engine market.

Segmental Insights

Engine Type Insights

In 2023, the Diesel sector had the biggest share of the market. People know that diesel engines are quite powerful and efficient. They have a better power-to-weight ratio, which lets them make a lot of thrust. This is what lets them move big ships like cargo ships, tankers, and passenger ships. This great efficiency means that the vehicle uses less gasoline, which is very important in an industry where fuel prices make up a large part of operational costs.

Diesel engines are very reliable and have been used successfully in the maritime industry for a long time. They have been improved throughout the years in terms of design and how they work, making them quite strong and able to handle the tough sea climate. This dependability cuts down on downtime and maintenance expenses, making sure that things run smoothly and dependably, which is important for getting people and goods where they need to go on time and safely.

There is a lot of infrastructure around the world for diesel engines and gasoline. Diesel fuel is easy to find at almost all ports, which makes it easy to refill and makes diesel engines a good choice for international shipping routes. The wide range of service and maintenance centers for diesel engines makes them even more popular because they give ship operators the help and knowledge they need to keep their engines running smoothly.

Diesel engines are flexible and may be changed to fit different needs. They can be employed on boats of many sizes and sorts, from little fishing boats to big ships that go to sea. Because they are so flexible, they are a good choice for a wide range of maritime uses.

Even if more people are interested in alternative propulsion systems like LNG, gas turbines, and hybrid technologies, the cost-effectiveness of diesel engines is still the most important aspect. Diesel engines are a good choice for many shipowners and operators since they cost less to buy and run than new technology.

Regional Insights

In 2023, the Asia-Pacific region had the biggest market share. Shanghai, Singapore, and Hong Kong are three of the biggest and busiest ports in the world, and they are all in the Asia-Pacific area. These big ports are very important for international trade, which makes marine propulsion systems very popular. The region's large marine infrastructure supports a large number of commercial ships, which in turn drives the need for more modern propulsion technologies.

The maritime sector in the Asia-Pacific area is robust and rising quickly. China, Japan, and South Korea are some of the best shipbuilders in the world. They spend a lot of money on both building new ships and upgrading old ones. The maritime fleet is growing because trade is increasing and the economy is growing. This means that marine propulsion engines need to be available all the time. These countries are also key players in the development and supply of marine engines, which helps them stay on top of the market.

The region's economy is growing and its industries are becoming more modern, which is increasing the need for propulsion systems that are good for the environment and use less energy. As countries in the Asia-Pacific region come under increased pressure to follow international environmental rules, there is a rising focus on switching to cleaner and more efficient propulsion technology, such LNG and hybrid engines. This change is leading to new ideas and more money being put into the marine propulsion industry in the area.

In many nations in the Asia-Pacific region, the government offers incentives and legislation that help the development and use of sophisticated marine propulsion technologies. These rules include tax breaks for using greener technologies, money for research and development, and money for building up maritime infrastructure.

Download Free Sample Ask for Discount Request Customization

Recent Developments

- In March 2024, With the launch of Hanwha Engine, Hanwha, a leading South Korean shipbuilder, has enhanced its portfolio to deliver a full spectrum of shipbuilding solutions, now including engine production with advanced in-house manufacturing and technology capabilities. Hanwha officially unveiled its new subsidiary, Hanwha Engine, following the successful acquisition of HSD Engine, which ranks as the world's second-largest marine engine manufacturer by market share. Hanwha Engine will leverage its extensive expertise in marine engine production and the strategic synergy among Hanwha affiliates to advance the development and commercialization of eco-friendly propulsion technologies, including engines designed to operate on ammonia.

- The 2024 Asia Pacific Maritime (APM 2024), a key event for the maritime industry, took place at Marina Bay Sands in Singapore from March 13-15. As the premier maritime exhibition in the Asia-Pacific, it attracted over 1,500 exhibitors from 60 countries. Weichai showcased its cutting-edge marine propulsion innovations, drawing significant interest from an international audience, particularly from the Asia-Pacific region.

- In June 2023, Wärtsilä Automation, Navigation and Control Systems (ANCS), a division of Wärtsilä Group, introduced a groundbreaking retrofit solution for its marine engine governor system. This new offering, developed in partnership with Swedish green tech company Qtagg, aims to prolong the lifespan of a ship’s propulsion control system while boosting the vessel's overall efficiency.

Key Market Players

- ABB Limited

- Siemens AG

- Cummins Inc.

- Rolls-Royce plc

- Hyundai Heavy Industries Co., Ltd.

- Caterpillar Inc.

- General Electric Company

- Wartsila Corporation

- Mitsubishi Heavy Industries, Ltd.

- Yanmar Holdings Co., Ltd.

|

By Engine Type |

By Application |

By Ship Type |

By Region |

|

|

|

|

Related Reports

- North America Commercial Boiler Market Size - By Fuel (Natural Gas, Oil, Coal, Electric), By Capacity, By Technology (Co...

- Water Tube Industrial Boiler Market Size By Capacity, By Application (Food Processing, Pulp & Paper, Chemical, Refinery,...

- U.S. Industrial Boiler Market Size By Fuel (Natural Gas, Oil, Coal), By Capacity, By Technology (Condensing, Non-Condens...

- Fire Tube Industrial Boiler Market - By Capacity (<10 MMBtu/hr, 10-25 MMBtu/hr, 25-50 MMBtu/hr, 50-75 MMBtu/hr, >75 MMBt...

- Gas Fired Boiler Market Size - By Capacity (≤ 10 MMBtu/hr, > 10 - 50 MMBtu/hr, > 50 - 100 MMBtu/hr, > 100 - 250 MMBtu/...

- Europe Residential Boiler Market Size - By Technology (Condensing {Natural Gas, Oil, Electric}, Non-Condensing {Natural ...

Table of Content

- 1. Executive Summary

- 1.1. Key Findings

- 1.2. Market Overview

- 1.3. Future Outlook

- 2. Introduction to the Marine Propulsion Engine Market

- 2.1. What are Marine Propulsion Engines?

- 2.2. Role of Propulsion Engines in the Maritime Industry

- 2.3. Evolution of Marine Propulsion Technologies

- 2.4. Scope of the Report

- 3. Market Overview

- 3.1. Current Market Size and Valuation (2024-2025)

- 3.1.1. Market Value (USD Billion)

- 3.1.2. CAGR (2025-2030/2034)

- 3.2. Market Dynamics

- 3.2.1. Drivers of Market Growth

- 3.2.1.1. Growth in Global Seaborne Trade and Maritime Industry

- 3.2.1.2. Increasing Demand for Fuel-Efficient and Environmentally Friendly Engines

- 3.2.1.3. Stringent Environmental Regulations (IMO 2020 Sulfur Cap, MARPOL Annex VI)

- 3.2.1.4. Expanding Naval Presence and Defense Spending

- 3.2.1.5. Technological Advancements in Engine Design and Propulsion Systems

- 3.2.1.6. Rise in Demand for Offshore Wind Support Vessels

- 3.2.2. Challenges and Restraints

- 3.2.2.1. High Initial Costs of Advanced Propulsion Technologies (Hybrid, Electric, LNG)

- 3.2.2.2. Limited Infrastructure for Alternative Fuels (LNG, Hydrogen, Ammonia)

- 3.2.2.3. Volatility in Raw Material Prices (Metals)

- 3.2.2.4. Technical Complexities and Compliance Challenges with Evolving Regulations

- 3.2.2.5. Safety Concerns Related to New Fuel Types

- 3.2.2.6. Skill Gap for Operating and Maintaining New Technologies

- 3.2.3. Opportunities

- 3.2.3.1. Growing Demand for Eco-Friendly and Sustainable Propulsion Solutions

- 3.2.3.2. Development of Dual-Fuel and Multi-Fuel Engines

- 3.2.3.3. Retrofit and Repowering Opportunities for Existing Vessels

- 3.2.3.4. Digitalization and AI Integration for Optimization and Predictive Maintenance

- 3.2.1. Drivers of Market Growth

- 3.1. Current Market Size and Valuation (2024-2025)

- 4. Market Segmentation

- 4.1. By Fuel Type

- 4.1.1. Diesel (Dominant Share)

- 4.1.2. Heavy Fuel Oil (HFO)

- 4.1.3. Natural Gas (LNG, CNG)

- 4.1.4. Other Fuels (Methanol, Ammonia, Hydrogen, Biofuels)

- 4.2. By Propulsion Type / Engine Type

- 4.2.1. Diesel Engines (2-Stroke, 4-Stroke)

- 4.2.2. Gas Turbines

- 4.2.3. Electric Motors

- 4.2.4. Hybrid Systems (Diesel-Electric, Battery-Electric)

- 4.2.5. Steam Turbine

- 4.2.6. Fuel Cell Propulsion

- 4.2.7. Wind & Solar Assisted Propulsion

- 4.3. By Power Range

- 4.3.1. Upto 1,000 kW (0-1,000 HP)

- 4.3.2. 1,000-4,000 kW (1,001-5,000 HP)

- 4.3.3. Above 4,000 kW (5,001-10,000 HP, 10,001-20,000 HP, Above 20,000 HP)

- 4.4. By Application / Vessel Type

- 4.4.1. Commercial Ships (Container Ships, Tankers, Bulk Carriers, Offshore Vessels, Cargo Ships)

- 4.4.2. Passenger Ships (Cruise Liners, Ferries)

- 4.4.3. Naval Ships / Defense Vessels

- 4.4.4. Yachts and Leisure Boats

- 4.4.5. Fishing Vessels

- 4.4.6. Other Vessel Types

- 4.5. By Component (Gearbox, Engine, Shaft, Propeller, etc.)

- 4.6. By Control System (Manual, Remote, Autonomous)

- 4.1. By Fuel Type

- 5. Regional Analysis

- 5.1. Asia Pacific (Largest Market Share, Driven by Shipbuilding in China, Japan, South Korea)

- 5.1.1. China

- 5.1.2. Japan

- 5.1.3. India

- 5.1.4. South Korea

- 5.1.5. Rest of Asia Pacific

- 5.2. Europe (Strong Focus on Decarbonization and Alternative Fuels)

- 5.2.1. Germany

- 5.2.2. UK

- 5.2.3. France

- 5.2.4. Scandinavia (Norway, Finland, Sweden)

- 5.2.5. Rest of Europe

- 5.3. North America (Growing Adoption of Hybrid/Electric, Stricter Emission Regulations)

- 5.3.1. U.S.

- 5.3.2. Canada

- 5.4. Latin America

- 5.5. Middle East & Africa

- 5.1. Asia Pacific (Largest Market Share, Driven by Shipbuilding in China, Japan, South Korea)

- 6. Competitive Landscape

- 6.1. Market Concentration Analysis (Moderately Consolidated)

- 6.2. Market Share Analysis of Key Players

- 6.3. Profiles of Major Companies

- 6.3.1. Wärtsilä Corporation (Finland)

- 6.3.2. MAN Energy Solutions SE (Germany, Volkswagen Group)

- 6.3.3. Caterpillar Marine (MaK) (US)

- 6.3.4. Hyundai Heavy Industries Co. Ltd. (South Korea)

- 6.3.5. Yanmar Holdings Co. Ltd. (Japan)

- 6.3.6. Mitsubishi Heavy Industries Ltd. (Japan)

- 6.3.7. Rolls-Royce Plc (UK)

- 6.3.8. Cummins Inc. (US)

- 6.3.9. Daihatsu Diesel MFG. Co. Ltd. (Japan)

- 6.3.10. General Electric Company (US)

- 6.3.11. ABB Ltd. (Switzerland)

- 6.3.12. Volvo Penta (Sweden)

- 6.3.13. Deutz AG (Germany)

- 6.3.14. Scania (Sweden)

- 6.3.15. John Deere (US)

- 6.3.16. Other Prominent Players

- 6.4. Recent Developments, Strategic Partnerships, and Acquisitions

- 6.5. Competitive Strategies of Leading Players (e.g., focus on dual-fuel, digitalization, emissions compliance)

- 7. Technological Trends and Innovations

- 7.1. Hybrid Diesel-Electric Propulsion Systems

- 7.2. LNG (Liquefied Natural Gas) Propulsion and Dual-Fuel Engines

- 7.3. Battery-Electric Propulsion Systems (for short-sea, harbor craft)

- 7.4. Hydrogen Fuel Cells and Hydrogen-Fueled Engines

- 7.5. Ammonia-Fueled Engines

- 7.6. Wind-Assisted Propulsion Technologies (Rotor Sails, Rigid Sails, Kites)

- 7.7. Digitalization, AI, and IoT Integration (Predictive Maintenance, Fuel Optimization)

- 7.8. Advanced Propeller Designs (Contra-rotating, Ducted)

- 7.9. Air Lubrication Systems for Hull Drag Reduction

- 7.10. Onboard Carbon Capture Technologies

- 7.11. Development of Small Modular Nuclear Reactors (SMRs) for specialized vessels

- 8. Regulatory Landscape and Environmental Impact

- 8.1. International Maritime Organization (IMO) Regulations (IMO 2020, EEXI, CII)

- 8.2. Regional Emission Control Areas (ECAs)

- 8.3. Green Shipping Initiatives and Decarbonization Targets

- 8.4. Government Subsidies and Incentives for Cleaner Technologies

- 9. Future Outlook and Projections (up to 2030-2034)

- 9.1. Forecasted Market Size and CAGR

- 9.2. Emerging Opportunities and Growth Areas

- 9.3. Impact of Decarbonization and Alternative Fuels on Market Evolution

- 9.4. Investment Trends in R&D and Sustainable Solutions

- 10. Conclusion

Major Key Players

- Wärtsilä Corporation (Finland)

- Caterpillar Inc. (MaK) (USA)

- MAN Energy Solutions SE (Germany)

- Cummins Inc. (USA)

- Hyundai Heavy Industries Co., Ltd. (HD Hyundai) (South Korea)

- Rolls-Royce Power Systems AG (MTU) (Germany)

- Yanmar Holdings Co. Ltd. (Japan)

- Mitsubishi Heavy Industries Ltd. (Japan)

- ABB Ltd. (Switzerland)

- Volvo Penta (AB Volvo Penta) (Sweden)

Manufacturers Key Players

- Wärtsilä Corporation (Finland)

- Caterpillar Inc. (MaK) (USA)

- MAN Energy Solutions SE (Germany)

- Cummins Inc. (USA)

- Hyundai Heavy Industries Co., Ltd. (HD Hyundai) (South Korea)

- Rolls-Royce Power Systems AG (MTU) (Germany)

- Yanmar Holdings Co. Ltd. (Japan)

- Mitsubishi Heavy Industries Ltd. (Japan)

- ABB Ltd. (Switzerland)

- Volvo Penta (AB Volvo Penta) (Sweden)

- Daihatsu Diesel Mfg. Co. Ltd. (Japan)

- Anglo Belgian Corporation (ABC) (Belgium)

- Deutz AG (Germany)

- Isuzu Motors Engine (Japan)

- Scania (Sweden)

- Weichai Holding Group Co., Ltd. (China)

- Masson Marine S.A.S. (France)

- Nanni Industries (France)

- Perkins Engines Company Limited (UK)

- IHI Power Systems Co., Ltd. (Japan)

FAQ'S

For a single, multi and corporate client license, the report will be available in PDF format. Sample report would be given you in excel format. For more questions please contact:

Within 24 to 48 hrs.

You can contact Sales team (sales@marketinsightsresearch.com) and they will direct you on email

You can order a report by selecting payment methods, which is bank wire or online payment through any Debit/Credit card, Razor pay or PayPal.

Discounts are available.

Hard Copy