Saudi Arabia HVDC Transmission Market

Saudi Arabia HVDC Transmission Market By Technology (Line Commutated Converter (LCC), Voltage Source Converter (VSC)), By Component (Converter Stations, Transmission Cables, Transformers, Switchgear), By End-User (Utility, Industrial, Commercial, Residential), By Region, Competition, Forecast and Opportunities, 2019-2029F

Published Date: December - 2024 | Publisher: MIR | No of Pages: 320 | Industry: Power | Format: Report available in PDF / Excel Format

View Details Buy Now 2890 Download Free Sample Ask for Discount Request Customization| Forecast Period | 2025-2029 |

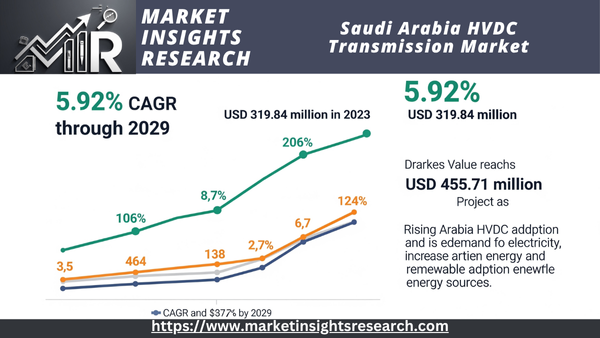

| Market Size (2023) | USD 319.84 million |

| Market Size (2029) | USD 455.71 million |

| CAGR (2024-2029) | 5.92% |

| Fastest Growing Segment | Transmission Cables |

| Largest Market | Eastern Province |

Market Overview

Saudi Arabia HVDC Transmission Market was valued at USD 319.84 million in 2023 and is expected to reach USD 455.71 million by 2029 with a CAGR of 5.92% during the forecast period.

Download Free Sample Ask for Discount Request Customization

Key Market Drivers

Integration of Renewable Energy Sources

The Saudi Arabia High Voltage Direct Current Transmission Market is growing because it is becoming easier to use renewable energy sources. As Saudi Arabia works to diversify its energy sources, a big part of that is bringing in a lot of renewable energy, such solar and wind power. Many renewable energy projects are built in places that are far away from big cities, where there are lots of natural resources but not many people who use them. It is hard for traditional alternating current transmission systems to send power over long distances because of large transmission losses and problems with stability. High Voltage Direct Current technology solves the problem by letting electricity travel vast distances with few losses in a safe and effective way. This feature is very important for linking renewable energy sources that are far away with cities and factories that need the power. HVDC systems also provide you more control over how electricity flows and how different energy sources work together, which is important for keeping the grid stable and reliable as more and more renewable energy sources come online. The Saudi Vision 2030 plan stresses the need for sustainable energy development and wants to raise the percentage of renewable energy in the country's energy mix. Using HVDC technology helps the country move toward a cleaner and more sustainable energy infrastructure by making it easier to send renewable energy efficiently. The market will develop as the need for HVDC transmission networks rises along with the growth of renewable energy projects.

Enhancement of Grid Reliability and Stability

Another important reason for the growth of the Saudi Arabia High Voltage Direct Current Transmission Market is the need for more reliable and stable grids. As the country's energy infrastructure grows and changes, it becomes more and more necessary to keep the grid stable and reliable. High Voltage Direct Current technology has a number of benefits in this area, such as better control over the flow of electricity and better handling of electrical problems. HVDC systems can keep the grid stable by separating problems and stopping them from spreading to the whole network. This capacity is especially useful in big, complicated grids where it might be hard to keep supply and demand in balance. In addition, HVDC systems make it possible to connect asynchronous electricity grids, which lets different areas or nations with differing grid characteristics work together smoothly. This connection can make the grid more stable and reliable by giving it more flexibility and backup. As the demand for electricity grows and the energy infrastructure expands in Saudi Arabia, innovative technologies are needed to make sure that power is always available and reliable. HVDC technology meets these demands by providing better performance in controlling electricity flows and reducing grid problems. The necessity to service a developing and changing energy market and advances in technology that make the grid more reliable and stable are both likely to drive up the demand for HVDC transmission systems in the area.

Download Free Sample Ask for Discount Request Customization

Support for Economic and Industrial Growth

The Saudi Arabia High Voltage Direct Current Transmission Market is driven by support for economic and industrial expansion. As Saudi Arabia's economy diversifies and its industries grow, there is a rising demand for strong and efficient energy infrastructure to support this growth. High Voltage Direct Current technology is a dependable way to send a lot of electricity over long distances. This is necessary to power factories, businesses, and homes. To address the growing need for power, new industrial zones, economic hubs, and metropolitan centers need a reliable and high-capacity energy transmission system. In this case, HVDC systems have a number of advantages, such as more transmission capacity, lower energy losses, and better grid stability. These benefits are very important for running large-scale businesses and making sure that the energy supply can keep up with the needs of a rising economy. Also, adding HVDC technology fits with Saudi Arabia's Vision 2030 goals, which are to promote economic growth and development by modernizing infrastructure and encouraging the use of renewable energy sources. HVDC technology is very important for the country's economic goals and market expansion since it makes it easier to send power to important industrial and economic sectors quickly and efficiently.

Key Market Challenges

High Initial Capital Investment

The Saudi Arabia High Voltage Direct Current Transmission Market has a big problem with the high initial capital investment needed to set up HVDC systems. Building High Voltage Direct Current infrastructure requires a lot of money up front, such as the expenditures of building converter stations, putting in transmission cables, and buying particular tools. When compared to standard Alternating Current systems, which usually have lower initial capital needs, these prices can be a problem for many stakeholders. The expenses go rise even further since HVDC technology is so complicated. For example, it needs modern converter stations that can change direct current to alternating current and back again. Also, putting in the subterranean or underwater connections that some HVDC projects need can add a lot to the cost. The high cost of HVDC technology is a financial problem for Saudi Arabia, which is putting a lot of money into expanding and modernizing its energy infrastructure. To solve this problem, stakeholders need to look into new ways to fund projects, such public-private partnerships, and weigh the long-term benefits of HVDC technology, like lower transmission losses and more reliable grids, to make the initial investment worth it. To get more people to use HVDC systems, it's important to make sure that the long-term economic benefits are greater than the initial expenses.

Technical Complexity and Integration Challenges

Another big problem for the Saudi Arabia HVDC Transmission Market is that High Voltage Direct Current systems are difficult to work with and difficult to connect to other systems. HVDC technology has several complicated and advanced parts, including as high-voltage converter stations, control systems, and advanced protective systems. Integrating these systems into existing Alternating Current grids requires specialized knowledge and skills because HVDC systems operate differently from other methods of power transmission. It can be technically difficult to link HVDC systems to existing grid infrastructure. This requires complicated engineering solutions to make sure everything works together and runs well. Additionally, maintaining and operating HVDC systems requires specialized skills and training, which could pose a challenge in regions with a limited number of qualified personnel. To successfully use HVDC technology in Saudi Arabia, certain technical problems must be solved. These problems include ensuring that systems can work together, maintaining grid stability, and optimizing operational efficiency. To deal with these problems well, you need to build up local expertise, put money into training programs, and encourage cooperation with international technology companies. The Saudi Arabia HVDC Transmission Market can move forward and reach the full potential of this technology by dealing with the technical challenges and making sure it works well with the current infrastructure.

Key Market Trends

Increased Adoption of Voltage Source Converter Technology

The Saudi Arabia High Voltage Direct Current Transmission Market is seeing a lot of growth in the use of Voltage Source Converter technology. Voltage Source Converters are a big step forward for HVDC technology since they make power transmission more flexible and efficient. Voltage Source Converters are different from regular Line Commutated Converters because they use semiconductor devices to change direct current to alternating current and back again. This gives you more control over power flows and makes it easier to combine renewable energy sources. This technology makes it possible to connect asynchronous power grids, which makes it easier to combine different energy sources and makes the grid more stable overall. Voltage Source Converter technology is becoming more and more appealing in Saudi Arabia, where there is a rising focus on adding renewable energy to the national grid. It makes it easier to send power from remote renewable energy projects to major consumption areas, which helps the country reach its goals of diversifying its energy mix and using less fossil fuels. The grid's stability and adaptability are also improved by this new technology, which is important for keeping up with the changing energy landscape. Voltage Source Converter technology is projected to be a big part of the future of the HVDC transmission business in the region as Saudi Arabia keeps spending money on updating its energy infrastructure.

Expansion of Cross-Border HVDC Interconnections

Another important trend in the Saudi Arabia High Voltage Direct Current Transmission Market is the growth of cross-border High Voltage Direct Current interconnections. As Saudi Arabia works to improve its energy security and better connect with its neighbors, building HVDC linkages across borders is becoming more and more crucial. Cross-border HVDC links make it easier to move power between different national grids. This lets areas share resources and balance supply and demand. The need to make the most of energy resources, cut down on dependence on localized generation, and make the grid more stable and reliable are all driving this development. For Saudi Arabia, cross-border HVDC connections make it possible to send extra electricity made from renewable sources to adjacent nations. This helps with regional energy cooperation and economic integration. These connections can also supply backup power in case of an emergency and help make the regional grid stronger and more connected. The growth of cross-border HVDC projects fits with Saudi Arabia's Vision 2030 goals of improving the efficiency of energy infrastructure and encouraging cooperation between countries in the area. As the government works toward these goals, the rise of cross-border HVDC interconnections is likely to be a major trend in the changing HVDC transmission industry.

Focus on Technological Innovations and Efficiency

One important trend in the Saudi Arabia High Voltage Direct Current Transmission Market is that people are paying more attention to new technologies and ways to make things work better. As the need for more dependable and efficient ways to transmit power grows, stakeholders are putting money into research and development to improve HVDC technology. New semiconductor materials, power electronics, and control systems are making HVDC systems work better and use less energy. The goal of these technological advances is to lower transmission losses, raise capacity, and make HVDC infrastructure more reliable overall. The focus on new technologies in Saudi Arabia fits with the country's larger goals of making its energy industry more modern and more sustainable. The development of modern HVDC technologies, like high-efficiency converters and cutting-edge monitoring and control systems, makes it easier to use renewable energy sources and improves the national grid's capabilities. Furthermore, the focus on efficiency includes making current HVDC systems work better and cost less to run. Saudi Arabia is still making the renovation of its energy infrastructure a top priority. The trend toward technological innovation and better efficiency in HVDC transmission is likely to have a big impact on the future of the market.

Segmental Insights

Technology

The Line Commutated Converter category was the most popular in the Saudi Arabia High Voltage Direct Current Transmission Market in 2023 and is likely to stay that way for the rest of the forecast period. Line Commutated Converters have been the standard choice for high-capacity direct current transmission because they have been shown to be reliable and efficient in moving huge amounts of power over long distances. This technology, which uses thyristor-based systems to change direct current to alternating current and the other way around, is well-known and frequently employed in high-voltage direct current projects all over the world, even in Saudi Arabia. Line Commutated Converters are strong and cost-effective for high-capacity systems and good at handling big energy transfers. Saudi Arabia has a lot of energy infrastructure and is still putting money into extending and modernizing its grid. Line Commutated Converters are still the most popular choice since they are cost-effective and can handle large-scale power transmission needs. Voltage Source Converters have more advanced capabilities, like more flexibility and better integration with renewable energy sources. However, Line Commutated Converters will continue to be the most popular choice in Saudi Arabia since they have a proven track record and are more cost-effective. The Line Commutated Converter segment is expected to stay the most popular technology choice because it is reliable, cost-effective, and able to fulfill the needs of the national energy grid. This is because the country is working on improving its energy infrastructure and meeting rising power demands.

Regional Insights

In 2023, the Eastern Province had the most power in the Saudi Arabia High Voltage Direct Current Transmission Market, and it is expected to stay in that position for the rest of the forecast period. The Eastern Province is an important place for building energy infrastructure because it is home to significant oil and gas producing facilities and important industrial hubs. This region is the most important because it is home to many of the country's energy companies, including huge power generation and processing plants. Saudi Arabia is still putting money into building and updating its energy infrastructure. The Eastern Province is a key part of these efforts since it is strategically important for meeting both local and national energy needs. This area needs to build high-voltage direct current transmission networks so that power can be moved quickly and easily from far generation sites to large consumption centers, such as cities and industrial districts. The Eastern Province's continuous expenditures in new energy projects and infrastructure renovations also increase the need for modern transmission technologies, such as high voltage direct current networks. The region's long-standing significance as an energy hub, along with its ongoing focus on building and modernizing infrastructure, guarantees that it will continue to be the biggest market segment in the Saudi Arabian high-voltage direct current transmission industry. The Eastern Province will continue to be at the forefront of high voltage direct current market activity as the government works to improve its energy transmission capacity and meet rising energy needs.

Download Free Sample Ask for Discount Request Customization

Recent Developments

- In June 2024, ABB introduced ABB Ability™ OPTIMAX® 6.4, the latest iteration of its leading digital energy management and optimization system. This advanced system offers enhanced coordination for controlling multiple industrial assets and processes, aimed at improving energy efficiency, reducing emissions, and supporting decarbonization efforts. The upgraded OPTIMAX system features a new artificial intelligence module designed to enhance load demand forecasting, energy generation, and pricing, eliminating the need for manual intervention. These improvements significantly decrease the occurrence of day-ahead and intraday nomination errors when supplying energy to the grid, thereby helping operators avoid potential penalty payments.

- In November 2023, Siemens AG undertook strategic actions to enhance the stability of Siemens Energy AG and accelerate its separation process in India. The German multinational corporation Siemens Aktiengesellschaft (Siemens AG) will acquire an additional 18 percent stake in its Indian subsidiary, Siemens Limited, for USD 2.28 billion. This acquisition will raise Siemens AG’s ownership in Siemens Limited from 51 percent to 69 percent. As a result, Siemens Energy’s stake in Siemens Limited will decrease from 24 percent to 6 percent, according to an official announcement.

- In November 2023, Schneider Electric, a global leader in digital transformation for energy management and next-generation automation, announced the introduction of the EcoCare service membership in India. This new offering provides exclusive access to industry-specific and critical facility services, enhancing system expertise and enabling Indian businesses to achieve superior performance, resilience, safety, and environmental sustainability throughout the entire lifecycle of their equipment.

Key Market Players

- ABB Ltd

- Siemens Energy AG

- General Electric Company

- Schneider Electric SE

- Mitsubishi Electric Corporation

- Hitachi Energy Ltd

- NR Electric Co., Ltd

- Toshiba Energy Systems & Solutions Corporation

- Sungrow Power Supply Co., Ltd

- AESC Group Ltd

|

By Technology |

By Component |

By End-user |

By Region |

|

|

|

|

Related Reports

- North America Commercial Boiler Market Size - By Fuel (Natural Gas, Oil, Coal, Electric), By Capacity, By Technology (Co...

- Water Tube Industrial Boiler Market Size By Capacity, By Application (Food Processing, Pulp & Paper, Chemical, Refinery,...

- U.S. Industrial Boiler Market Size By Fuel (Natural Gas, Oil, Coal), By Capacity, By Technology (Condensing, Non-Condens...

- Fire Tube Industrial Boiler Market - By Capacity (<10 MMBtu/hr, 10-25 MMBtu/hr, 25-50 MMBtu/hr, 50-75 MMBtu/hr, >75 MMBt...

- Gas Fired Boiler Market Size - By Capacity (≤ 10 MMBtu/hr, > 10 - 50 MMBtu/hr, > 50 - 100 MMBtu/hr, > 100 - 250 MMBtu/...

- Europe Residential Boiler Market Size - By Technology (Condensing {Natural Gas, Oil, Electric}, Non-Condensing {Natural ...

Table of Content

- 1. Executive Summary

- 1.1. Key Findings

- 1.2. Market Overview

- 1.3. Future Outlook

- 2. Introduction to the Saudi Arabia HVDC Transmission Market

- 2.1. What is HVDC Transmission?

- 2.2. Advantages of HVDC over HVAC in Saudi Arabia's Context

- 2.2.1. Long-Distance Bulk Power Transmission

- 2.2.2. Integration of Remote Renewable Energy Sources

- 2.2.3. Grid Interconnection and Stability

- 2.2.4. Reduced Transmission Losses

- 2.3. Scope of the Report

- 3. Market Overview

- 3.1. Current Market Size and Valuation (2024-2025)

- 3.1.1. Market Value (USD Million)

- 3.1.2. CAGR (2024-2029/2030/2032)

- 3.2. Market Dynamics

- 3.2.1. Drivers of Market Growth

- 3.2.1.1. Saudi Vision 2030 and Economic Diversification

- 3.2.1.1.1. Mega-Projects (NEOM, Red Sea Project, Qiddiya, New Murabba)

- 3.2.1.1.2. Urbanization and Industrial Expansion

- 3.2.1.2. Ambitious Renewable Energy Targets (50% by 2030)

- 3.2.1.3. Increasing Electricity Demand from Population and Industry

- 3.2.1.4. Need for Grid Stability and Reliability

- 3.2.1.5. Cross-Border Interconnections and Energy Exchange (Egypt, GCC, Jordan, Iraq, India)

- 3.2.1.6. Investments in Smart Grid Infrastructure

- 3.2.1.1. Saudi Vision 2030 and Economic Diversification

- 3.2.2. Challenges and Restraints

- 3.2.2.1. High Initial Investment Costs of HVDC Projects

- 3.2.2.2. Technical Complexities and Skill Requirements

- 3.2.2.3. Competition from Traditional AC Transmission in Shorter Distances

- 3.2.3. Opportunities

- 3.2.3.1. Development of Advanced HVDC Technologies

- 3.2.3.2. Local Manufacturing and Supply Chain Development

- 3.2.3.3. Increased Private Sector Investment

- 3.2.1. Drivers of Market Growth

- 3.1. Current Market Size and Valuation (2024-2025)

- 4. Market Segmentation

- 4.1. By Technology

- 4.1.1. Line Commutated Converter (LCC)

- 4.1.1.1. Dominance and Reasons

- 4.1.2. Voltage Source Converter (VSC)

- 4.1.2.1. Growing Adoption and Advantages

- 4.1.3. Capacitor Commutated Converter (CCC)

- 4.1.1. Line Commutated Converter (LCC)

- 4.2. By Component

- 4.2.1. Converter Stations

- 4.2.2. Transmission Cables (Overhead, Underground, Submarine)

- 4.2.3. Transformers

- 4.2.4. Switchgear

- 4.2.5. Other Components

- 4.3. By Application

- 4.3.1. Bulk Power Transmission (Long Distance)

- 4.3.2. Interconnecting Grids (Asynchronous AC Systems)

- 4.3.3. Renewable Energy Integration (Solar, Wind)

- 4.3.4. Infeed to Urban Areas / Remote Loads

- 4.3.5. Grid Stabilization

- 4.4. By End-User

- 4.4.1. Utility

- 4.4.2. Industrial

- 4.4.3. Commercial

- 4.4.4. Residential (Indirect Impact)

- 4.1. By Technology

- 5. Regional Analysis (within Saudi Arabia)

- 5.1. Eastern Province (Dominance and Drivers)

- 5.2. Al-Riyadh Province (Fastest Growing, Major Projects)

- 5.3. Makkah Province

- 5.4. Madinah Province

- 5.5. Tabuk Province (NEOM Influence)

- 5.6. Rest of Saudi Arabia

- 6. Competitive Landscape

- 6.1. Market Concentration Analysis (Consolidated Nature)

- 6.2. Market Share Analysis of Key Players

- 6.3. Profiles of Major Global and Local Companies

- 6.3.1. Hitachi Energy Ltd. (formerly Hitachi ABB Power Grids)

- 6.3.2. Siemens AG

- 6.3.3. ABB Ltd.

- 6.3.4. General Electric Company

- 6.3.5. Prysmian Group

- 6.3.6. Hyundai Engineering & Construction (E&C) Co. Ltd.

- 6.3.7. Larsen & Toubro (L&T) Saudi Arabia

- 6.3.8. Saudi Electricity Company (SEC) - Key Client and Developer

- 6.3.9. ENOWA (NEOM's Utility Subsidiary)

- 6.3.10. Saudi Services for Electro Mechanic Works (SSEM)

- 6.3.11. Other Local and International Players (e.g., Al Sharif Group Holding, Nesma Infrastructure & Technology)

- 6.4. Recent Developments, Strategic Partnerships, and Project Awards

- 7. Major HVDC Projects in Saudi Arabia (Current & Upcoming)

- 7.1. Saudi Arabia – Egypt HVDC Interconnection (Madinah-Tabuk-Aqaba, Badr)

- 7.2. NEOM-Yanbu HVDC Transmission System (Oxagon, Yanbu-NIC)

- 7.3. Riyadh-Kudmi 500kV HVDC Transmission Line

- 7.4. HVDC EOA-COA Link 1 (Nariyah IPP to Zulff BSP)

- 7.5. HVDC EOA-COA Link 2 (Qurayyah-4 BSP/Hajer-2 IPP to Khari Industrial City BSP)

- 7.6. Al-Fadhili HVDC Converter Station Upgrade

- 7.7. Future Interconnections (Oman, Iraq, Jordan, India)

- 8. Future Outlook and Projections (up to 2030/2032/2033)

- 8.1. Forecasted Market Size and Growth Trajectory

- 8.2. Emerging Trends and Opportunities

- 8.3. Impact of Policy and Regulatory Frameworks

- 9. Conclusion

Major Key Players

- Hitachi Energy (Japan/Switzerland)

- Siemens Energy AG (Germany)

- ABB Ltd. (Switzerland)

- General Electric Company (GE Vernova) (USA)

- Hyundai Engineering & Construction Co. Ltd. (Hyundai E&C) (South Korea)

- Larsen & Toubro (L&T) (India)

- Saudi Electricity Company (SEC) (Saudi Arabia)

- ENOWA (NEOM's utility company) (Saudi Arabia)

- Mitsubishi Electric Corporation (Japan)

- Alstom Grid (now part of GE Grid Solutions) (France/USA)

Manufacturers Key Players

- Hitachi Energy (Japan/Switzerland)

- Siemens Energy AG (Germany)

- ABB Ltd. (Switzerland)

- General Electric Company (GE Vernova) (USA)

- Mitsubishi Electric Corporation (Japan)

- Toshiba Corporation (Japan)

- Hyundai Electric Co., Ltd. (South Korea)

- Prysmian Group (Italy)

- Nexans S.A. (France)

- Sumitomo Electric Industries, Ltd. (Japan)

- NKT A/S (Denmark)

- LS Cable & System Ltd. (South Korea)

- Aksa Power Generation (Turkey)

- Saudi Services for Electro Mechanic Works (SSEM) (Saudi Arabia)

- Arabian Electrical Transmission Line Construction Company (AETCON) (Saudi Arabia)

FAQ'S

For a single, multi and corporate client license, the report will be available in PDF format. Sample report would be given you in excel format. For more questions please contact:

Within 24 to 48 hrs.

You can contact Sales team (sales@marketinsightsresearch.com) and they will direct you on email

You can order a report by selecting payment methods, which is bank wire or online payment through any Debit/Credit card, Razor pay or PayPal.

Discounts are available.

Hard Copy