Madagascar Diesel Genset Market

Madagascar Diesel Genset Market By Capacity (0-100 kVA, 101-350 kVA, 351-1000 kVA, Above 1000 kVA), By Application (Standby Power, Prime Power, Peak Shaving, Cogeneration), By End-User (Residential, Commercial, Industrial, Government), By Fuel Type (Biodiesel, Hybrid), By Region, Competition, Forecast and Opportunities, 2019-2029

Published Date: June - 2025 | Publisher: MIR | No of Pages: 320 | Industry: Power | Format: Report available in PDF / Excel Format

View Details Buy Now 2890 Download Free Sample Ask for Discount Request Customization| Forecast Period | 2025-2029 |

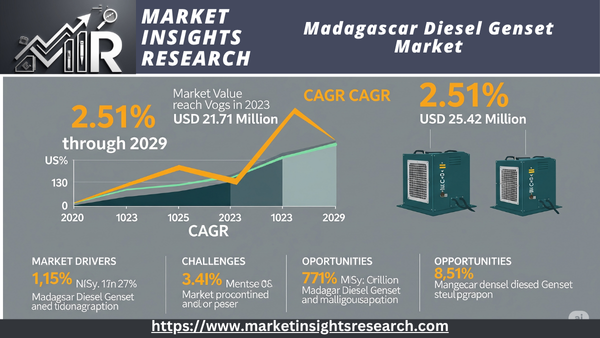

| Market Size (2023) | USD 21.71 Million |

| Market Size (2029) | USD 25.42 Million |

| CAGR (2024-2029) | 2.51% |

| Fastest Growing Segment | Hybrid |

| Largest Market | Antananarivo Province |

Market Overview

The Madagascar Diesel Genset Market was valued at USD 21.71 million in 2023 and is expected to reach USD 25.42 million by 2029, with a CAGR of 2.51% during the forecast period.

Download Free Sample Ask for Discount Request Customization

The Madagascar diesel genset market is growing quickly because the country's industries are growing, its infrastructure is improving, and people are looking for more reliable power sources. Diesel generators are very important in Madagascar because they provide backup power in a country where the electrical supply is typically unpredictable and blackouts occur frequently.

The rapid rise of infrastructure projects is one of the main reasons why the diesel genset market in Madagascar is growing. The government's efforts to improve transportation networks, build new commercial and residential structures, and expand industrial facilities have created a significant need for reliable power sources. In these situations, diesel gensets are preferred because they are strong, dependable, and can provide electricity without interruption in places where the grid supply is unreliable. The mining and agricultural sectors in Madagascar also play a big role in the demand for diesel gensets. Mining, which includes getting nickel, cobalt, and graphite out of the ground, needs power all the time and in a consistent way to run machines and keep production going. In the same way, the agriculture sector uses diesel generators to power cold storage facilities, processing equipment, and irrigation systems, which keeps productivity and efficiency high.

The need for diesel generators is much higher in Madagascar because power goes out a lot and the grid supply is not stable in many areas. Diesel gensets are a backup power source for many businesses, hospitals, and schools that need to keep running when the grid goes down. The need for emergency power solutions is expanding, which is driving market growth, especially in areas where the power grid isn't very stable. Technological improvements in diesel generators, like better fuel efficiency, reduced emissions, and longer life, are also driving market expansion. Modern gensets work better and are better for the environment, which is in line with worldwide trends toward efficiency and sustainability. As Madagascar builds up its energy infrastructure and makes its rules more flexible, more advanced diesel gensets are likely to be used. This will help the country meet its energy needs and boost its economy.

Key Market Drivers

Infrastructure Development

The diesel genset industry in Madagascar is experiencing significant growth due to ongoing infrastructure development. To help the economy flourish and improve people's quality of life, the country has been working on building more roads, bridges, and buildings. Diesel generators are essential for these projects since they are reliable and can provide a lot of power. This is especially true in places where the electrical grid is faulty or doesn't exist. Diesel generators give the power that machines, lights, and temporary buildings need during the building period. Madagascar is putting a lot of money into building ports, transportation networks, and urban areas, which will increase the need for diesel gensets. This expansion is driven by the requirement for reliable and steady sources of electricity to make sure that projects are finished on time and within budget.

Industrial and Mining Activities

The diesel genset market is mostly made up of Madagascar's mining and industrial sectors. Nickel, cobalt, and graphite are just a few of the abundant minerals found in Madagascar. Large gear and a constant power supply are required for the collection and processing of these minerals. In mining, diesel gensets are essential because they provide reliable power to run equipment, control systems, and support activities in remote areas where the grid is not easily accessible. The growth of the industrial sector, which includes manufacturing and processing units, also increases the need for strong and dependable power solutions. As Madagascar's mining and industrial activities grow, so will the need for diesel generators to help these industries run smoothly and efficiently.

Download Free Sample Ask for Discount Request Customization

Power Grid Instability

Madagascar's unstable electricity supply is a major reason for the high demand for diesel gensets. Power outages happen often and the electrical supply is not always reliable. This condition affects businesses, hospitals, schools, and homes all around the country. Diesel generators are an important backup power source because they keep electricity flowing even when the grid goes down. This makes sure that essential services and processes stay running. The demand for diesel generators during emergencies has created a robust market for these systems. People are still worried about how reliable the electricity system is, thus the need for diesel generators as a reliable backup keeps growing.

Agricultural Sector Needs

The agriculture sector in Madagascar also drives the diesel genset market. To keep farming productive and efficient, diesel generators are necessary to power irrigation systems, processing plants, and cold storage units. A large part of Madagascar's economy depends on farming, so it's very important to have reliable electricity sources to support farming operations. Diesel generators give the power needed to run machines in places where the grid isn't forceful and make sure that farming activities don't stop. The need for diesel gensets to help with farming will stay high as the industry grows and changes.

Key Market Challenges

Power Supply and Infrastructure Challenges

The diesel genset market in Madagascar has a lot of problems because the country's power supply is unreliable and its infrastructure is not well developed. Because power goes out often and the electricity supply is unreliable, diesel generators are needed for backup power. But there are big problems with the national grid's variable quality and the costly cost of keeping gensets running in rural or underserved locations. The lack of proper infrastructure for fuel distribution and maintenance services makes it even harder to run and manage diesel gensets well. This lack of infrastructure leads to more downtime, higher operating expenses, and less reliable power solutions, which affects both businesses and homes.

High Fuel Costs and Supply Chain Issues

The cost of fuel is a big problem for the diesel genset market in Madagascar. The country depends a lot on imported petroleum, which makes prices go up and down a lot. This problem gets worse because of changes in the worldwide oil markets and problems in getting fuel to where it has to go. Also, infrastructure and logistics problems often get in the way of the diesel fuel supply chain, which affects the availability and price stability of fuel. These factors increase the operating costs for diesel genset users, reducing their overall cost-effectiveness and making them less likely to invest in new genset installations.

Environmental Regulations and Sustainability Concerns

Madagascar's diesel generator business is under more and more pressure from rules about the environment and sustainability. As worldwide rules about emissions and environmental damage are stronger, diesel generators have to follow rules that are getting stricter all the time. This change requires investment in cleaner and more efficient technologies, which may be costly. In a developing country, where rules may not always be followed and the expense of switching to eco-friendly gensets can be too high, the problem is even worse. It is still very hard for people in the market to find a balance between the demand for reliable power and the need to protect the environment.

Limited Technological Advancements and Expertise

The Madagascar diesel genset market has a hard time because it doesn't have easy access to new technologies and experts. Diesel genset technology is getting better around the world, which means they work better and produce less pollution. However, Madagascar is hesitant to adopt new technologies since they are expensive and there isn't much local experience. The lack of technical support and maintenance services makes it much harder to operate and accept contemporary gensets. This gap in technology makes it hard for the market to flourish and stops users from getting the most out of the newest diesel power options.

Key Market Trends

Growing Demand in Infrastructure Development

There is a lot of demand for diesel gensets in Madagascar because of all the infrastructure construction going on. This trend is being driven by the government's promise to improve transit networks, build new cities, and open new businesses. Diesel generators are necessary to power construction sites, temporary buildings, and new infrastructure, especially in areas where the electricity supply isn't very stable. Diesel generators are great at providing a steady and reliable power supply, which is needed for more road building, bridge building, and real estate development. Madagascar is putting a lot of money into its infrastructure to enhance economic growth and raise living standards, so this trend is likely to continue.

Rising Adoption in Mining and Agriculture

Another big development in the Madagascar diesel genset market is that more and more mining and farming companies are using generators. Mining activities in Madagascar need strong power sources to support their work because the country has a lot of minerals, such as nickel, cobalt, and graphite. People like diesel gensets because they can provide a lot of power in places where the power grid isn't very strong. Diesel generators are also used in farming to power irrigation systems, processing equipment, and storage facilities. This makes sure that agricultural items are produced and stored in the most efficient way possible. The growth of these businesses is making people want diesel generators that are reliable and long-lasting.

Increasing Focus on Fuel Efficiency and Emissions

There is a rising focus on emissions and fuel economy in the Madagascar diesel genset industry as environmental rules become stricter around the world. Engineers are using new technology to make modern diesel generators more fuel-efficient and less hazardous to the environment. This trend is happening because of rules that have to be followed and because more people are becoming conscious of how it affects the environment. Manufacturers are putting money into research and development to make gensets that are cheaper to run and meet international standards for emissions. The market is likely to change because of this move toward greener technology, which will make more people want to buy diesel gensets that are better for the environment.

Expanding Market for Backup Power Solutions

One big development in Madagascar's diesel genset industry is the demand for backup power sources that people can trust. Businesses, hospitals, and schools around the country are buying diesel generators because power outages and an insecure grid supply happen often. These gensets are important backup power sources that keep key services running even when the power goes out. The need for reliable backup solutions is growing because power outages are happening more often because of old infrastructure and natural disasters. The market for diesel generators as a backup power source is likely to rise as the country's energy system continues to have problems.

Segmental Insights

Capacity

351-1000 kVA segment

One main reason this category is so popular is that there is a growing need for dependable power solutions in big businesses and factories. Madagascar's growing infrastructure projects, such as building new facilities, mining operations, and transportation networks, need diesel generators with a lot of power. The 351–1000 kVA gensets can easily meet the power needs of major industries by delivering enough power to run heavy machinery, big commercial buildings, and processes that need to run all the time.

Also, the fact that power outages happen more often and the energy grid in Madagascar is unstable makes the need for strong diesel generators in this power range even greater. Manufacturing plants, hospitals, and big businesses all need reliable backup power to keep running smoothly. For these important uses, the 351-1000 kVA gensets are a reliable choice. They keep businesses running and efficient even when the electricity goes out. The 351–1000 kVA category is also the most popular because of new technologies. Modern gensets in this category have better fuel efficiency, lower emissions, and more complex control systems. This makes them more appealing to those who want power solutions that are both cost-effective and good for the environment. These new ideas fit with the global trend toward cleaner technologies and make the 351–1000 kVA category more appealing overall. Also, the 351–1000 kVA gensets can be employed in many different places, such as as temporary power sources at building sites or as permanent backup power sources for important infrastructure. This capacity to change makes them even more popular in Madagascar's diesel genset industry.

Regional Insights

In 2023, Antananarivo Province was the biggest player in the Madagascar Diesel Genset market. Antananarivo Province is where the capital of Madagascar, Antananarivo, is located. It is also the economic and administrative hub of the country. The province is the center of politics, business, and culture, thus there are a lot of industrial, commercial, and government operations there. Antananarivo has a lot of enterprises, government offices, and institutions, which creates a lot of need for diesel generators to keep the power on all the time. Diesel gensets are very important for keeping operations going in many industries that have to deal with frequent power outages and an inconsistent grid supply.

The province's continued growth in cities and infrastructure makes it even more powerful in the diesel genset market. Antananarivo is seeing a lot of expansion in building and real estate development, including developments for homes, businesses, and mixed-use spaces. Diesel generators are in high demand since building sites and freshly built commercial properties need temporary and backup power. These generators are necessary to run the tools, lights, and other equipment needed for big construction projects.

Antananarivo's increasing industrial base is one reason why diesel generators are in high demand. Manufacturing, telecommunications, and healthcare are just a few of the industries that need strong and dependable power solutions to keep running. The 351–1000 kVA genset range is perfect for these industries since it offers enough power for medium- to large-scale applications. Also, the province's role in getting ready for and responding to disasters shows how much it depends on diesel gensets. Antananarivo is a major population center that needs reliable backup power solutions to keep emergency services, hospitals, and important infrastructure running during power outages caused by natural catastrophes or system failures.

Download Free Sample Ask for Discount Request Customization

Recent Developments

- In October 2023, MTN Group's South African division unveiled a substantial investment in network infrastructure to address the persistent power crisis impacting the country. This strategic move has enhanced network reliability by 15%, achieved through the deployment of over 20,000 batteries, 5,000 rectifiers, and nearly 900 diesel generators across its operational sites. This initiative underscores MTN Group's commitment to ensuring uninterrupted service amid frequent power disruptions, significantly bolstering operational resilience and improving connectivity for its customers. The extensive investment reflects a proactive approach to mitigating the effects of South Africa's power challenges on telecommunications services.

- In May 2024, Trime announced the upcoming launch of a new line of diesel generators. This new range is designed to enhance performance and efficiency, addressing the growing demand for reliable power solutions in various industries. The launch reflects Trime’s commitment to innovation and its focus on providing advanced, high-quality products to meet the evolving needs of its customers in the power generation sector.

- In May 2024, Aggreko introduced the market’s first three-engine generator as part of its new POWERMX range. This innovative generator is designed to deliver superior performance and reliability, setting a new benchmark in power generation. The launch of the POWERMX range underscores Aggreko’s commitment to advancing technology and meeting the evolving demands of the industry with cutting-edge solutions for diverse power needs.

Key Market Players

- Caterpillar Inc.

- Cummins Inc.

- Rolls-Royce plc

- Generac Holdings Inc.

- Kohler Co.

- Mitsubishi Heavy Industries, Ltd.

- Perkins Engines Company Limited

- Yanmar Holdings Co., Ltd.

- Kirloskar Oil Engines Limited

- Wärtsilä Corporation

- Doosan Corporation

- Deere & Company

|

By Capacity |

By Application |

By End-User |

By Fuel Type |

By Region |

|

|

|

|

|

Related Reports

- U.S. Commercial Boiler Market – By Product (Hot Water, Steam), Application (Offices, Healthcare Facilities, Educationa...

- North America Commercial Boiler Market Size - By Fuel (Natural Gas, Oil, Coal, Electric), By Capacity, By Technology (Co...

- Water Tube Industrial Boiler Market Size By Capacity, By Application (Food Processing, Pulp & Paper, Chemical, Refinery,...

- U.S. Industrial Boiler Market Size By Fuel (Natural Gas, Oil, Coal), By Capacity, By Technology (Condensing, Non-Condens...

- Fire Tube Industrial Boiler Market - By Capacity (<10 MMBtu/hr, 10-25 MMBtu/hr, 25-50 MMBtu/hr, 50-75 MMBtu/hr, >75 MMBt...

- Gas Fired Boiler Market Size - By Capacity (≤ 10 MMBtu/hr, > 10 - 50 MMBtu/hr, > 50 - 100 MMBtu/hr, > 100 - 250 MMBtu/...

Table of Content

- 1. Executive Summary

- 1.1. Key Findings

- 1.2. Market Overview

- 1.3. Future Outlook

- 2. Introduction to the Madagascar Diesel Genset Market

- 2.1. What are Diesel Gensets?

- 2.2. Role of Diesel Gensets in Madagascar's Energy Landscape

- 2.3. Advantages of Diesel Gensets in Madagascar

- 2.3.1. Reliability in Unstable Grid Conditions

- 2.3.2. Suitability for Remote Locations

- 2.3.3. Quick Deployment and Scalability

- 2.4. Limitations of Diesel Gensets in Madagascar

- 2.5. Scope of the Report

- 3. Market Overview

- 3.1. Current Market Size and Valuation (2025)

- 3.2. Market Dynamics

- 3.2.1. Drivers of Market Growth

- 3.2.1.1. Unstable and Insufficient National Power Grid

- 3.2.1.2. Rapid Infrastructure Development (Roads, Buildings, Ports)

- 3.2.1.3. Growth in Industrial and Mining Activities

- 3.2.1.4. Expanding Telecommunications Sector (e.g., 5G rollout)

- 3.2.1.5. Increasing Demand for Backup Power in Commercial & Residential Sectors

- 3.2.2. Challenges and Restraints

- 3.2.2.1. High Initial Investment Costs

- 3.2.2.2. Fluctuating Fuel Prices and Import Dependence

- 3.2.2.3. Environmental Concerns (Emissions)

- 3.2.2.4. Competition from Emerging Renewable and Hybrid Solutions

- 3.2.2.5. Logistical Challenges in Remote Areas

- 3.2.1. Drivers of Market Growth

- 4. Market Segmentation

- 4.1. By Power Rating

- 4.1.1. 15-75 kVA

- 4.1.2. 76-375 kVA

- 4.1.3. 376-750 kVA

- 4.1.4. Above 750 kVA

- 4.2. By Application

- 4.2.1. Commercial (Hotels, Hospitals, Telecom Towers, Retail, Offices)

- 4.2.2. Industrial (Mining, Manufacturing, Oil & Gas, Construction, Energy & Power)

- 4.2.3. Residential

- 4.2.4. Others (Agriculture, Governmental, Marine)

- 4.3. By End-User

- 4.3.1. Utilities

- 4.3.2. Commercial & Industrial

- 4.3.3. Residential

- 4.1. By Power Rating

- 5. Competitive Landscape

- 5.1. Market Share Analysis of Key Players

- 5.2. Profiles of Major Companies Operating in Madagascar

- 5.2.1. Aksa Power Generation SA (Pty) Ltd.

- 5.2.2. Jubaili Bros

- 5.2.3. Atlas Copco AB

- 5.2.4. Kohler Co.

- 5.2.5. Cummins Inc.

- 5.2.6. Caterpillar Inc.

- 5.2.7. Aggreko Ltd.

- 5.2.8. Local Distributors and Service Providers

- 5.3. Recent Strategic Developments (Partnerships, Product Launches, etc.)

- 6. Technological Trends and Innovations

- 6.1. Development of More Fuel-Efficient Gensets

- 6.2. Lower Emission Technologies

- 6.2. Hybrid Genset Solutions (Diesel-Solar)

- 6.3. Remote Monitoring and Control Systems

- 7. Regulatory Landscape and Government Initiatives

- 7.1. Overview of Energy Policies in Madagascar (e.g., Vision 2030 Electrification Goals)

- 7.2. Import Regulations and Tariffs

- 7.3. Environmental Regulations for Diesel Emissions

- 8. Future Outlook and Projections (up to 2030)

- 8.1. Forecasted Market Size and CAGR

- 8.2. Emerging Opportunities in the Market

- 8.3. Impact of Renewable Energy Expansion on Diesel Genset Demand

- 9. Conclusion

Major Key Players

- Caterpillar Inc. (USA)

- Cummins Inc. (USA)

- Aksa Power Generation SA (Pty) Ltd. (Turkey/South Africa)

- Atlas Copco AB (Sweden)

- KOHLER Co. (USA)

- Jubaili Bros (UAE/Lebanon - significant regional presence)

- Aggreko Ltd. (UK)

- Yanmar Holdings Co. Ltd. (Japan)

- Mitsubishi Heavy Industries Ltd. (Japan)

- Generac Power Systems Inc. (USA)

Manufacturers Key Players

- Caterpillar Inc. (USA)

- Cummins Inc. (USA)

- Aksa Power Generation SA (Pty) Ltd. (Turkey/South Africa)

- KOHLER Co. (USA)

- Perkins Engines Company Limited (UK - part of Caterpillar)

- Yanmar Holdings Co. Ltd. (Japan)

- Mitsubishi Heavy Industries Ltd. (Japan)

- Denyo Co., Ltd. (Japan)

- Generac Power Systems Inc. (USA)

- Rolls-Royce Power Systems AG (MTU) (Germany)

- Jubaili Bros (Acts as an OEM/assembler for various brands)

- Welland Power (UK - supplies to Madagascar)

- Guangxi Dingbo Generator Set Manufacturing Co.,Ltd (China - exports to Madagascar)

- Kirloskar Oil Engines Limited (India - global presence, also supplies to African markets)

FAQ'S

For a single, multi and corporate client license, the report will be available in PDF format. Sample report would be given you in excel format. For more questions please contact:

Within 24 to 48 hrs.

You can contact Sales team (sales@marketinsightsresearch.com) and they will direct you on email

You can order a report by selecting payment methods, which is bank wire or online payment through any Debit/Credit card, Razor pay or PayPal.

Discounts are available.

Hard Copy