Self-Priming Centrifugal Pump Market

Self-Priming Centrifugal Pump Market – Global Industry Size, Share, Trends, Opportunity, and Forecast, Segmented By Product Type (Multistage, Single Stage), By Drive Type (Electric, Diesel), By Application (Agriculture, Mining, Household, Oil & Gas, Waste Water Management), By Region & Competition, 2019-2029

Published Date: June - 2025 | Publisher: MIR | No of Pages: 320 | Industry: Power | Format: Report available in PDF / Excel Format

View Details Buy Now 2890 Download Free Sample Ask for Discount Request Customization| Forecast Period | 2025-2029 |

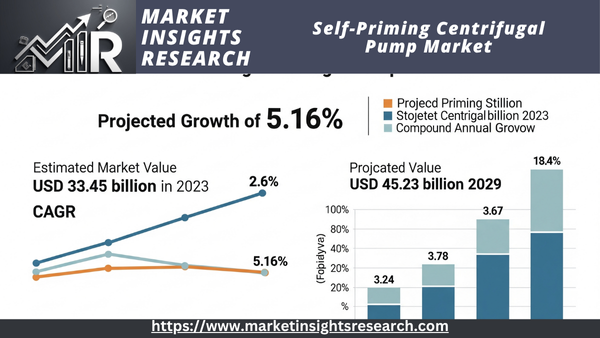

| Market Size (2023) | USD 33.45 Billion |

| Market Size (2029) | USD 45.23 Billion |

| CAGR (2024-2029) | 5.16% |

| Fastest Growing Segment | Electric |

| Largest Market | North America |

Market Overview

Self-Priming Centrifugal Pump Market was valued at USD 33.45 Billion in 2023 and is expected to reach at USD 45.23 Billion in 2029 and project robust growth in the forecast period with a CAGR of 5.16% through 2029.

Download Free Sample Ask for Discount Request Customization

In applications where the liquid source may be below the pump's level, a self-priming centrifugal pump is especially useful because it is a specialized kind of pump made to handle liquids without needing to be manually primed before operating. Without first filling the pump casing with liquid, this pump can begin pumping effectively by creating a vacuum that pulls the liquid into the pump casing. Self-priming centrifugal pumps are becoming more and more popular in a variety of industries, such as municipal water systems, construction, agriculture, and chemical processing, due to their efficiency and adaptability. Self-priming pumps provide a dependable way to move fluids when the pump is positioned above the liquid source, as in drainage applications or when fluid levels fluctuate, as industries work to increase operational efficiency and decrease downtime. The need for sophisticated pumping solutions is being driven by the continuous trend toward automation and modernization of industrial processes. The demand for efficient fluid management systems in industries like oil and gas, food and beverage, and wastewater treatment is driving market expansion even more. Self-priming centrifugal pumps are becoming more attractive to end users due to improvements in their performance and longevity brought about by advancements in pump design, materials, and technology. As industries look to cut back on energy use and their carbon footprint, the emphasis on ecologically friendly and energy-efficient pumping solutions is also having an impact on market dynamics. The need for self-priming centrifugal pumps is anticipated to increase as a result of growing investments in water and wastewater management projects as well as the development of infrastructure in developing nations. Businesses are more inclined to invest in self-priming solutions as they become more aware of the operational cost savings and dependability provided by these pumps. Self-priming pumps' capabilities are anticipated to be improved by the growth of industrial automation and the Internet of Things, allowing for remote monitoring and predictive maintenance, which will further fuel the market's expansion. Overall, the market for self-priming centrifugal pumps is expected to grow significantly as a result of its versatility in a range of applications, technological developments, and the increasing demand for effective fluid handling solutions across industries. Self-priming centrifugal pumps are expected to be essential in satisfying industry demands for efficiency and sustainability, setting the market up for success in the years to come.

Key Market Drivers

Increasing Demand for Efficient Fluid Management Solutions

One major factor propelling the self-priming centrifugal pump market is the increasing demand for effective fluid management solutions across a range of industries. There is an increase in operational activities in sectors like manufacturing, construction, and agriculture that call for dependable and effective pumping systems. Self-priming centrifugal pumps, which can operate efficiently without the need for manual priming, are becoming more and more popular as businesses look to streamline their processes. These pumps are a desirable choice for fluid transfer applications because of their efficiency, which lowers downtime and increases productivity. The ability of self-priming pumps to manage different fluid levels without requiring a lot of setup is becoming a crucial component in their adoption as industries seek to reduce waste and enhance sustainability. This trend increases the need for self-priming centrifugal pumps in the market by highlighting the significance of fluid management systems that can adjust to changing operational requirements.

Rising Infrastructure Development in Emerging Economies

One important factor driving the expansion of the self-priming centrifugal pump market is the increase in infrastructure development in emerging economies. Reliable pumping solutions are becoming more and more necessary as nations in Asia, Africa, and South America concentrate on constructing and improving their infrastructure, including roads, bridges, water supply systems, and wastewater treatment facilities. Because they can handle different fluid levels and are simple to install, self-priming centrifugal pumps are especially well-suited for these applications. The need for these pumps in municipal water management projects is also being increased by government initiatives to increase access to sanitary facilities and clean water. As self-priming pumps become essential parts of newly constructed facilities, this infrastructure boom not only creates an immediate demand for these systems but also establishes a long-term market presence.

Download Free Sample Ask for Discount Request Customization

Emphasis on Energy Efficiency and Sustainability

The market for self-priming centrifugal pumps is being greatly impacted by the global emphasis on sustainability and energy efficiency. Energy-efficient pumping solutions are now of utmost importance as industries concentrate more on lowering their operational expenses and carbon footprints. Self-priming centrifugal pumps are made to transfer fluids reliably while using less energy. Because of this feature, they are a desirable option for businesses looking to satisfy strict legal requirements and environmental objectives. Self-priming pump adoption is anticipated to increase as businesses realize the financial advantages of lowering energy usage. The market is expanding as a result of numerous manufacturers spending money on R&D to produce pumps that not only fulfill but also surpass current energy efficiency standards. In an environment where environmental responsibility is becoming more and more important, the Self-Priming Centrifugal Pump Market is well-positioned thanks to its alignment with global sustainability initiatives.

Growth of Industrial Automation and Smart Technologies

The market for self-priming centrifugal pumps is being driven by several important factors, including the expansion of industrial automation and the incorporation of smart technologies into manufacturing processes. The need for dependable, high-performance pumps is growing as more industries implement automated systems for handling and processing fluids. With the help of sophisticated sensors and control systems, self-priming centrifugal pumps can be easily integrated into automated settings, providing improved operational efficiency and monitoring. By enabling real-time data collection and analytics, these features help operators optimize pump performance and make well-informed decisions. Pumping system longevity and dependability are increased by the trend toward predictive maintenance, which identifies possible problems before they become failures. The market will expand and self-priming centrifugal pumps will become indispensable parts of contemporary industrial systems as a result of the growing demand for these pumps due to the increasing automation of industrial facilities.

Key Market Challenges

Technical Limitations and Performance Constraints

The intrinsic performance and technical limitations of these systems are one of the main issues confronting the self-priming centrifugal pump market. Self-priming pumps have certain operating parameters that must be followed in order for them to work effectively, even though they are made to run without manual priming. For example, self-priming centrifugal pumps are typically less effective than conventional centrifugal pumps when handling liquids that are heavy in solids or have a high viscosity. This restriction may make it more difficult to use them in sectors like heavy industry or wastewater treatment, where the properties of the fluid being pumped might not match those of the pump's design. Over time, self-priming pumps' efficiency may deteriorate, especially if they are exposed to circumstances outside of their advised operating range. Potential customers searching for economical solutions may be turned off by this inefficiency since it can result in higher energy usage and operating expenses. The shortcomings of self-priming centrifugal pumps may impede market expansion as industries look for higher-performance machinery to satisfy demanding operational requirements. To improve these pumps' performance capabilities and make sure they can satisfy the varied demands of different industries, manufacturers must consistently invest in research and development.

Competitive Pressure from Alternative Pump Technologies

The fierce competition from alternative pump technologies is another major obstacle facing the self-priming centrifugal pump market. A wide range of fluid transfer options, such as submersible pumps, diaphragm pumps, and positive displacement pumps, are available to industries as they develop and diversify. The advantages of self-priming centrifugal pumps may be overshadowed by the special advantages of these alternative technologies. Positive displacement pumps, for example, are well-known for their capacity to manage viscous fluids and deliver steady flow rates, which makes them appropriate for uses where self-priming pumps might find it difficult. Likewise, diaphragm pumps are perfect for moving dangerous liquids and have outstanding chemical compatibility. Self-priming centrifugal pumps may lose market share as a result of the increasing use of these substitute technologies, particularly in applications that call for particular performance attributes. New players in the market are probably going to present creative solutions that go against the self-priming pumps' established advantages as pump technology continues to advance. Manufacturers of self-priming centrifugal pumps must constantly innovate and distinguish their goods, emphasizing special features and performance improvements that meet changing market demands, in order to stay competitive.

Regulatory Compliance and Environmental Considerations

Environmental concerns and regulatory compliance present additional difficulties for the self-priming centrifugal pump market. Regulatory agencies are placing more stringent requirements on equipment used in a variety of industries, including fluid handling, as environmental concerns gain more attention on a global scale. These rules, which frequently deal with waste management, emissions, and energy efficiency, force producers to make sure their goods meet changing requirements. This compliance may require a large investment in research and development for self-priming centrifugal pumps in order to change designs, increase energy efficiency, and lessen the production and operating environmental impact. End users are choosing products that support their corporate social responsibility objectives as a result of their growing emphasis on sustainability in their procurement processes. This change may put pressure on producers of self-priming centrifugal pumps to use eco-friendly materials and production techniques, which could raise operating costs and make the process more difficult. Penalties, product recalls, and reputational harm from noncompliance with regulations can have a long-term impact on a company's ability to compete in the market. Thus, companies in the self-priming centrifugal pump market face a great challenge in navigating the complex landscape of regulatory compliance while simultaneously addressing environmental concerns. This calls for a proactive and strategic approach to product development and market positioning.

Key Market Trends

Increasing Adoption of Smart Pump Technologies

The market for self-priming centrifugal pumps is seeing a notable shift in favor of smart pump technologies. Pumps with sophisticated monitoring and control systems are becoming more and more in demand as industries embrace automation and the Internet of Things. Operators can keep an eye on performance indicators like flow rate, pressure, and energy usage thanks to these smart pumps' real-time data collection and analysis capabilities. These features improve operational effectiveness and make predictive maintenance easier, which lowers operating expenses and downtime. Making more intelligent decisions about maintenance plans and operational modifications is made possible by the incorporation of artificial intelligence and machine learning algorithms into pump systems. Self-priming centrifugal pumps with smart technologies are expected to become more and more in demand as businesses look to streamline their operations and boost output, making them essential parts of contemporary industrial systems.

Growth in Water and Wastewater Treatment Applications

One important trend influencing the self-priming centrifugal pump market is the expansion of water and wastewater treatment applications. Municipalities are making significant investments in infrastructure to upgrade water supply and treatment facilities as urban populations grow and the need for clean water rises. These applications are especially well-suited for self-priming centrifugal pumps, which can manage fluctuating liquid levels and flow rates without the need for manual priming. The need for dependable pumping solutions is being driven by the requirement for effective wastewater management systems in order to meet regulatory standards. Self-priming centrifugal pumps are gaining recognition for their capacity to maximize fluid transfer processes while reducing energy consumption, which is in line with the growing emphasis on sustainable water management techniques. The market for self-priming centrifugal pumps is expected to grow significantly in this industry as investments in water and wastewater treatment infrastructure keep rising.

Expansion in Emerging Markets

There is a noticeable upward trend in the self-priming centrifugal pump market in emerging markets. The need for dependable pumping solutions is being driven by the rapid industrialization, urbanization, and infrastructure development occurring in regions like Asia-Pacific, Latin America, and Africa. The need for effective fluid management systems is growing as these economies make investments in industries like manufacturing, construction, and agriculture. Self-priming centrifugal pumps are a popular option in these expanding markets because they provide the adaptability and dependability needed for a variety of applications. The need for pumping solutions in developing areas is being further supported by government initiatives to improve sanitation and water supply. We anticipate steady growth in the Self-Priming Centrifugal Pump Market as businesses in these markets strive to enhance operational effectiveness and meet regulatory requirements. The market will provide manufacturers wishing to increase their global presence with a number of opportunities.

Segmental Insights

Product Type Insights

The self-priming centrifugal pump market was dominated by the single stage segment in 2023 and is anticipated to continue to hold this position throughout the forecast period. This dominance can be ascribed to the single-stage pump's affordability, simplicity, and ease of use, which make it a popular option for a range of applications in sectors like municipal water supply, construction, and agriculture. Single-stage pumps are especially well-suited for applications that require moderate flow rates because they can effectively handle a variety of fluids at lower pressures, avoiding the complications associated with multistage pumps. The popularity of single-stage self-priming centrifugal pumps is further supported by the growing emphasis on effective fluid management and the rising need for dependable pumping solutions in smaller-scale operations. The performance and durability of pumps have been improved by design and material advancements, making them more appealing to end users. The simplicity of single-stage pumps continues to appeal to stakeholders as industries look to streamline their processes and cut expenses. The versatility and affordability of single-stage pumps guarantee their continued dominance in the market, meeting a wide range of needs across various sectors, even though the multistage segment offers advantages in high-pressure applications. As a result, throughout the forecast period, the single-stage self-priming centrifugal pump segment is anticipated to maintain its growth momentum and continue to be the end-users' preferred option.

Regional Insights

North America dominated the Self-Priming Centrifugal Pump Market in 2023 and it is expected to maintain its dominance throughout the forecast period. This region benefits from a robust industrial infrastructure, a well-established manufacturing sector, and significant investments in water and wastewater management systems. The increasing emphasis on energy efficiency and sustainability in North America is driving demand for advanced pumping solutions that can meet stringent regulatory standards. The presence of key players and manufacturers in the region enhances innovation and technological advancements, further solidifying North America's leadership in the market. Industries such as agriculture, chemical processing, and oil and gas are leveraging self-priming centrifugal pumps for their operational efficiency and reliability, contributing to their widespread adoption. The ongoing trend of automation and smart technologies in industrial applications is fostering the integration of self-priming pumps equipped with advanced monitoring and control features. As North America continues to prioritize infrastructure development and modernization initiatives, particularly in water treatment and environmental sustainability, the demand for self-priming centrifugal pumps is anticipated to grow steadily. This combination of industrial demand, technological innovation, and commitment to sustainable practices positions North America as a key player in the Self-Priming Centrifugal Pump Market, ensuring its continued dominance in the coming years.

Download Free Sample Ask for Discount Request Customization

Recent Developments

- In June 2024, Holland Pump Company, a prominent independent provider of specialty pump rental and dewatering solutions, announced the successful acquisition of C&R Distribution, Inc. (doing business as Florida Dewatering) located in Tampa, Florida. This strategic acquisition enhances Holland Pump’s fleet, capabilities, and customer base throughout Florida's Gulf Coast and marks the company's seventh acquisition since partnering with XPV Water Partners in 2019. Tom Vossman, CEO of Holland Pump Company, emphasized commitment to growth and superior customer service, expressing enthusiasm for expanding the product line and serving new customers effectively.

- In February 2023, Atlas Copco introduced a versatile range of electric self-priming dewatering pumps designed for various applications, including sewage bypass, quarry/mine dewatering, and urban construction. The E-Pumps, comprising PAC High Head and High Flow models, provide an environmentally friendly alternative to diesel pumps, reducing CO2 emissions and operating costs. These easy-to-install pumps feature a patented hinge door for maintenance access, extended pump life, and lower servicing costs, while meeting recent environmental regulations for noise-sensitive and low emission areas.

Key Market Players

- Grundfos Holding A/S

- Xylem Inc.

- KSB SE & Co. KGaA

- Flowserve Corporation

- Pentair plc

- EBARA CORPORATION

- WILO SE

- Tsurumi Manufacturing Co., Ltd.

- SPX FLOW, Inc.

- ITT Inc.

|

By Product Type |

By Drive Type |

By Application |

By Region |

|

|

|

|

Related Reports

- North America Commercial Boiler Market Size - By Fuel (Natural Gas, Oil, Coal, Electric), By Capacity, By Technology (Co...

- Water Tube Industrial Boiler Market Size By Capacity, By Application (Food Processing, Pulp & Paper, Chemical, Refinery,...

- U.S. Industrial Boiler Market Size By Fuel (Natural Gas, Oil, Coal), By Capacity, By Technology (Condensing, Non-Condens...

- Fire Tube Industrial Boiler Market - By Capacity (<10 MMBtu/hr, 10-25 MMBtu/hr, 25-50 MMBtu/hr, 50-75 MMBtu/hr, >75 MMBt...

- Gas Fired Boiler Market Size - By Capacity (≤ 10 MMBtu/hr, > 10 - 50 MMBtu/hr, > 50 - 100 MMBtu/hr, > 100 - 250 MMBtu/...

- Europe Residential Boiler Market Size - By Technology (Condensing {Natural Gas, Oil, Electric}, Non-Condensing {Natural ...

Table of Content

- 1. Executive Summary

- 1.1. Key Findings

- 1.2. Market Overview

- 1.3. Future Outlook

- 2. Introduction to the Self-Priming Centrifugal Pump Market

- 2.1. What are Self-Priming Centrifugal Pumps?

- 2.2. How Self-Priming Centrifugal Pumps Work

- 2.3. Advantages of Self-Priming Centrifugal Pumps

- 2.3.1. Ease of Installation and Reduced Downtime

- 2.3.2. Ability to Handle Air and Vapor Entrainment

- 2.3.3. Reduced Maintenance Requirements

- 2.3.4. Versatility in Various Applications

- 2.4. Limitations of Self-Priming Centrifugal Pumps

- 2.5. Scope of the Report

- 3. Market Overview

- 3.1. Current Market Size and Valuation (2025)

- 3.2. Market Dynamics

- 3.2.1. Drivers of Market Growth

- 3.2.1.1. Increasing Demand for Efficient Fluid Management Solutions Across Industries

- 3.2.1.2. Rising Infrastructure Development and Urbanization in Emerging Economies

- 3.2.1.3. Growing Investments in Water and Wastewater Treatment Facilities

- 3.2.1.4. Increasing Demand in Agriculture for Irrigation and Dewatering

- 3.2.1.5. Focus on Energy Efficiency and Sustainability

- 3.2.1.6. Adoption of Automation and Smart Technologies (IoT Integration)

- 3.2.2. Challenges and Restraints

- 3.2.2.1. Higher Initial Acquisition Costs Compared to Standard Centrifugal Pumps

- 3.2.2.2. Competition from Alternative Pump Technologies (e.g., Submersible Pumps)

- 3.2.2.3. Maintenance Complexity of Air Management Systems

- 3.2.2.4. Volatility in Raw Material Prices

- 3.2.1. Drivers of Market Growth

- 4. Market Segmentation

- 4.1. By Operation Type

- 4.1.1. Electric

- 4.1.2. Diesel

- 4.1.3. Others

- 4.2. By Design Type

- 4.2.1. Single Stage

- 4.2.2. Multi-stage

- 4.3. By Material Type

- 4.3.1. Cast Iron

- 4.3.2. Stainless Steel

- 4.3.3. Steel

- 4.3.4. Alloy Steel

- 4.3.5. Bronze

- 4.3.6. Others

- 4.4. By Head Size

- 4.4.1. Below 30 m

- 4.4.2. 30 to 50 m

- 4.4.3. 50 to 100 m

- 4.4.4. 100 to 150 m

- 4.4.5. Above 150 m

- 4.5. By Horsepower

- 4.5.1. Below 1 HP

- 4.5.2. 1 HP to 10 HP

- 4.5.3. 10 HP to 50 HP

- 4.5.4. Above 50 HP

- 4.6. By Application/End-Use Industry

- 4.6.1. Water Supply and Treatment

- 4.6.2. Wastewater Management (including Sewage and Effluent)

- 4.6.3. Agriculture (Irrigation, Dewatering)

- 4.6.4. Construction (Dewatering, Flood Control)

- 4.6.5. Oil & Gas

- 4.6.6. Mining

- 4.6.7. Chemical & Petrochemical

- 4.6.8. Food and Beverages

- 4.6.9. Household/Residential

- 4.6.10. Other Industrial (e.g., Manufacturing, Pharmaceuticals)

- 4.1. By Operation Type

- 5. Regional Analysis

- 5.1. North America (U.S., Canada, Mexico)

- 5.2. Europe (Germany, UK, France, Italy, Spain, Rest of Europe)

- 5.3. Asia Pacific (China, India, Japan, Australia, South Korea, Southeast Asia, Rest of Asia Pacific)

- 5.4. Latin America (Brazil, Argentina, Rest of Latin America)

- 5.5. Middle East & Africa (Saudi Arabia, UAE, South Africa, Rest of MEA)

- 6. Competitive Landscape

- 6.1. Market Share Analysis of Key Players

- 6.2. Profiles of Major Companies

- 6.2.1. Xylem Inc.

- 6.2.2. Grundfos Holding A/S

- 6.2.3. KSB Aktiengesellschaft

- 6.2.4. Flowserve Corporation

- 6.2.5. Weir Group Plc

- 6.2.6. Franklin Electric Co., Inc.

- 6.2.7. Kirloskar Brothers Limited

- 6.2.8. Sulzer Ltd.

- 6.2.9. BBA Pumps

- 6.2.10. EDUR Pumpenfabrik Eduard Redlien GmbH & Co. KG

- 6.2.11. ANDRITZ AG

- 6.2.12. Wilo SE

- 6.2.13. Ebara Corporation

- 6.2.14. Crane Pumps & Systems

- 6.2.15. Other Prominent Players

- 6.3. Recent Developments, Strategic Initiatives, and Collaborations

- 7. Technological Trends and Innovations

- 7.1. Integration with IoT and Smart Monitoring Systems

- 7.2. Development of Energy-Efficient and Sustainable Designs

- 7.3. Advancements in Materials for Enhanced Durability and Corrosion Resistance

- 7.4. Focus on Compact and Portable Designs

- 7.5. Remote Monitoring and Predictive Maintenance Capabilities

- 8. Future Outlook and Projections (up to 2032/2033)

- 8.1. Forecasted Market Size and CAGR (Ranges from 4.5% to 5.9% by various sources, with market size projections varying from USD 34 billion to USD 53 billion by 2032/2033)

- 8.2. Emerging Opportunities and Growth Pockets

- 8.3. Impact of Government Regulations and Environmental Policies

- 9. Conclusion

Major Key Players

- Grundfos Holding A/S (Denmark)

- Xylem Inc. (USA)

- Flowserve Corporation (USA)

- KSB SE & Co. KGaA (Germany)

- Weir Group plc (UK)

- ANDRITZ AG (Austria)

- Ebara Corporation (Japan)

- Wilo SE (Germany)

- Kirloskar Brothers Limited (KBL) (India)

- Gorman-Rupp Company (USA)

Manufacturers Key Players

- Grundfos Holding A/S (Denmark)

- Xylem Inc. (USA)

- Flowserve Corporation (USA)

- KSB SE & Co. KGaA (Germany)

- Weir Group plc (UK)

- ANDRITZ AG (Austria)

- Ebara Corporation (Japan)

- Wilo SE (Germany)

- Kirloskar Brothers Limited (KBL) (India)

- Gorman-Rupp Company (USA)

- Delta Electronics Inc. (Taiwan)

- Franklin Electric Co., Inc. (USA)

- BBA Pumps B.V. (Netherlands)

- Azcue Pumps S.A. (Spain)

- Calpeda S.p.A. (Italy)

- Crane Pumps & Systems (USA)

- DAB PUMPS S.p.A. (Italy)

- EDUR-Pumpenfabrik Eduard Redlien GmbH & Co. KG (Germany)

- Vikas Pump (India)

- Sujal Engineering (India)

FAQ'S

For a single, multi and corporate client license, the report will be available in PDF format. Sample report would be given you in excel format. For more questions please contact:

Within 24 to 48 hrs.

You can contact Sales team (sales@marketinsightsresearch.com) and they will direct you on email

You can order a report by selecting payment methods, which is bank wire or online payment through any Debit/Credit card, Razor pay or PayPal.

Discounts are available.

Hard Copy