Oil & Gas Ultrasonic Flowmeter Market

Oil & Gas Ultrasonic Flowmeter Market – Global Industry Size, Share, Trends, Opportunity, and Forecast Segmented by Transducer Type (Spool piece, Inline, Clamp-on and Others), By Technology (Transit-time, Doppler and Hybrid), By Region, Competition Forecast 2018-2028

Published Date: June - 2025 | Publisher: MIR | No of Pages: 320 | Industry: Power | Format: Report available in PDF / Excel Format

View Details Buy Now 2890 Download Free Sample Ask for Discount Request Customization| Forecast Period | 2024-2028 |

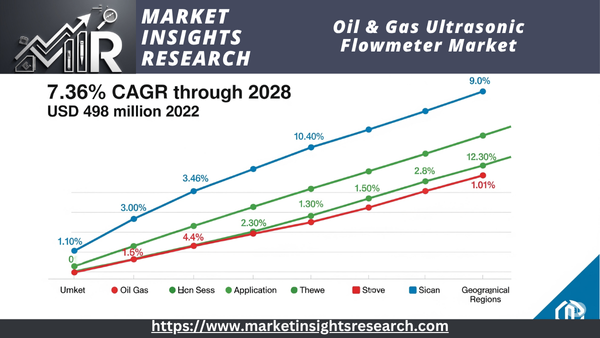

| Market Size (2022) | USD 498 Million |

| CAGR (2023-2028) | 7.36% |

| Fastest Growing Segment | Spool piece |

| Largest Market | Asia Pacific |

Market Overview

The global oil and gas ultrasonic flowmeter market is valued at USD 498 million in 2022 and is anticipated to experience robust growth in the forecast period with a CAGR of 7.36% through 2028. The global Oil & Gas ultrasonic flowmeter market is primarily driven by the demand for ultrasonic flowmeters in the oil and gas sector, specifically for custody transfer applications. Accurate measurement is crucial in determining the quantity of product being transferred, and even the slightest inaccuracy can result in significant costs.

Download Free Sample Ask for Discount Request Customization

Some models boast an accuracy as high as 0.1 percent; ultrasonic flowmeters provide remarkable accuracy. It is a widely used technology in the oil and gas sector because of its accurate metering capability, which boosts confidence in business dealings and reduces custody transfer disputes. Furthermore, because non-invasive measurement tools are needed, the use of ultrasonic flowmeters has spread to other industries like chemical, power, and wastewater management.

Key Market Drivers

Advancements in Ultrasonic Flowmeter Technology

The ongoing development of ultrasonic flowmeter technology is one of the main factors propelling the global ultrasonic flowmeter market. In order to create flowmeter solutions that are more precise, dependable, and adaptable, manufacturers constantly innovate.

Even under difficult flow conditions, contemporary ultrasonic flowmeters perform exceptionally well in providing extremely accurate readings. The accuracy of measurements is greatly increased by improved signal processing algorithms and ultrasonic sensor designs.

Oil and gas, chemical, water and wastewater, and energy are just a few of the industries that use the more recent ultrasonic flowmeters. They are capable of handling a wide range of fluids, including abrasive, corrosive, and clean liquids. You can also use them to measure the flow rates of gases. They are very appealing because of their versatility.

Some ultrasonic flowmeters do not require insertion into the flow stream; instead, they provide non-contact and non-invasive measurement techniques. This feature lowers the chance of contamination or leakage and minimizes maintenance needs.

Many contemporary ultrasonic flowmeters incorporate advanced communication protocols, simplifying their integration with existing control and monitoring systems. This connectivity improves operational efficiency by enabling effective data analysis and remote monitoring.

Growing Demand for Non-Invasive Flow Measurement

Due to the industry's increasing need for non-invasive flow measurement solutions, the global market for oil and gas ultrasonic flowmeters is expanding significantly. Due to their many benefits that meet the unique requirements of the oil and gas industry, ultrasonic flowmeters are leading this market evolution. Several important factors are responsible for the growing demand for non-invasive flow measurement. Above all, the oil and gas sector works in settings where safety and process integrity are critical. Conventional intrusive flow measurement techniques, like turbine flowmeters or mechanical meters, frequently call for close proximity to the flowing medium. This can be dangerous, particularly when working with dangerous materials like natural gas or crude oil. However, ultrasonic flowmeters are a safer option for fluid measurement in these crucial applications because they are non-invasive and do not require penetration into vessels or pipelines.

Additionally, ultrasonic flowmeters' non-invasive design reduces interference with ongoing operations. Downtime can be costly in the oil and gas sector. Production disruptions brought on by invasive meter installation or maintenance may result in significant financial losses. Because they can be installed externally or clamped on, ultrasonic flowmeters make maintenance and retrofitting simple and eliminate the need to stop operations.

Additionally, ultrasonic flowmeters' adaptability makes them perfect for various oil and gas industry applications. Without changing the fluid's composition or characteristics, they can precisely measure the flow rates of a variety of fluids, including hydrocarbons. For the various operations involved in oil exploration, production, transportation, and refining, this flexibility is crucial. The need for non-invasive flow measurement solutions, especially ultrasonic flowmeters, is anticipated to continue growing as the oil and gas industry places a greater emphasis on environmental responsibility, efficiency, and safety. These cutting-edge tools are essential to the industry's transition to a more technologically sophisticated and sustainable future because they not only improve safety and operational effectiveness but also lower costs and help comply with strict regulations.

Download Free Sample Ask for Discount Request Customization

Increasing Focus on Energy Efficiency and Conservation

We expect the oil and gas sector's growing emphasis on energy conservation and efficiency to propel the global market for ultrasonic flowmeters. With their many advantages that perfectly match the industry's sustainability objectives, ultrasonic flowmeters have become a crucial technology in this field. The oil and gas industry's unrelenting quest for energy efficiency is one of the main factors propelling this market's expansion. Energy conservation has emerged as a major concern as the globe struggles with the effects of climate change and the depletion of fossil fuel resources. In this pursuit, ultrasonic flowmeters are essential because they offer extremely precise fluid flow measurements, allowing operators to streamline their operations and cut down on energy waste. This efficiency minimizes the environmental impact of oil and gas production and extraction while also lowering operating expenses.

Furthermore, stricter regulations on energy use and emissions in the oil and gas sector are being enforced by regulatory agencies around the world. By guaranteeing that businesses can accurately measure and report their energy consumption, ultrasonic flowmeters provide a way to comply with these regulations. In today's environmentally conscious business environment, this helps organizations meet their compliance requirements and improves their sustainability credentials. Ultrasonic flowmeters are very adaptable and ideal for the demanding conditions of the oil and gas sector, in addition to their advantages in energy efficiency. They can precisely measure the flow rates of various fluids, such as natural gas, crude oil, and different petroleum products. For applications where maintenance expenses and downtime are major concerns, their non-intrusive, maintenance-free design is especially beneficial.

In conclusion, the global oil and gas ultrasonic flowmeter market is expected to grow as the industry places a greater emphasis on energy conservation and efficiency. In addition to lowering energy use and operating expenses, these cutting-edge tools for flow measurement help oil and gas companies comply with strict regulations and support their sustainability initiatives. Ultrasonic flowmeters will be essential in promoting efficiency and conscientious resource management in the oil and gas industry as the globe moves toward a more sustainable energy future.

Key Market Challenges

Sensitivity to Fluid Properties and Environmental Factors

The sensitivity of ultrasonic flowmeters to fluid characteristics and environmental factors is one of the main issues facing the global ultrasonic flowmeter market. In order to calculate the flow rate, ultrasonic flowmeters measure the speed of sound in a fluid. Variations in a fluid's temperature and viscosity can affect the speed of sound, potentially leading to measurement errors. It might be necessary to use compensation algorithms to take these variations in ultrasonic flowmeters into consideration.

Additionally, handling gas-liquid mixtures can present challenges for ultrasonic flowmeters. Accurate flow measurements can be difficult when there are gas bubbles in a liquid because they can scatter ultrasonic waves.

Furthermore, well-developed flow profiles are frequently necessary to obtain accurate readings with ultrasonic flowmeters. Measurement uncertainties may be introduced by complex piping configurations or irregular flow patterns.

The pipe's material and internal coatings should also be taken into account because they may have an impact on how ultrasonic waves propagate. The precision of the flow measurements may be impacted by corrosion or scale accumulation on pipe walls, which can interfere with ultrasonic signals.

High Initial Costs and Complex Installation

The high initial cost of ultrasonic flowmeter systems is a significant obstacle in the global ultrasonic flowmeter market. These costs include purchasing the flowmeter itself, paying for installation, and possibly incurring extra costs for maintenance and data integration.

Ultrasonic flowmeters can be expensive to buy, especially the more sophisticated models with many features. These expenses may deter potential users, especially small and medium-sized businesses (SMEs).

Ultrasonic flowmeter installation can be difficult and time-consuming, particularly for in-line applications. It might call for specific expertise, which would raise the cost of installation. It can be difficult to integrate data from ultrasonic flowmeters with current control and monitoring systems. It might be necessary to address compatibility problems, differences in data formats, and various communication protocols, which would add to the expenses.

Download Free Sample Ask for Discount Request Customization

Competition from Alternative Flow Measurement Technologies

Alternative flow measurement technologies like differential pressure, vortex, and electromagnetic flowmeters compete with the global ultrasonic flowmeter market. Certain applications are better suited for different flow measurement technologies. For example, vortex flowmeters work well for measuring gases, while electromagnetic flowmeters are best suited for measuring liquid conductance.

Alternative flow measurement technologies might occasionally provide more affordable options, especially for applications that are straightforward and simple. Instead of using ultrasonic flowmeters, customers may choose these alternatives to save money. Conventional flow measurement techniques have a long history in some industries and geographical areas. Convincing users to switch to ultrasonic flowmeters can be difficult.

In conclusion, the main obstacles facing the global ultrasonic flowmeter market are high initial costs, competition from alternative flow measurement technologies, and fluid and environmental factors. Continuous research and development is required to overcome these obstacles to improve measurement accuracy, lower costs, and satisfy particular industry demands. Furthermore, successful marketing and educational campaigns emphasizing the benefits of ultrasonic flowmeters can encourage broader use of these devices in a range of applications.

Key Market Trends

Adoption of Clamp-On and Portable Ultrasonic Flowmeters

The growing use of clamp-on and portable ultrasonic flowmeters is one noteworthy trend in the global ultrasonic flowmeter market. Without requiring pipeline cutting or flow interruption, these devices provide flexible and non-intrusive flow measurement solutions. Clamp-on ultrasonic flowmeters, mounted externally on the pipe's exterior, eliminate the need to enter the pipe's interior. This non-invasive method minimizes installation downtime and simplifies the installation process.

Users can move portable ultrasonic flowmeters to various measurement locations as needed, giving them flexibility. Applications with fluctuating flow patterns or short-term measurement requirements benefit most from this flexibility. Because there are usually fewer parts exposed to the process fluid, both clamp-on and portable ultrasonic flowmeters require less maintenance and are less likely to leak or become contaminated. These ultrasonic flowmeters are easy for users to install and begin using, which lowers labor costs and increases operational efficiency.

Integration of Digital and Wireless Connectivity

The industry's adoption of digital and wireless connectivity solutions is largely responsible for the significant growth that the global oil and gas ultrasonic flowmeter market is expected to experience. Ultrasonic flowmeters are becoming more and more popular as a result of this technological advancement because they provide several advantages that meet the changing demands of the oil and gas industry. The oil and gas sector is changing as a result of the incorporation of digital and wireless connectivity. These features make ultrasonic flowmeters an essential tool for streamlining processes and increasing productivity. This integration is driving market expansion in the following waysMonitoring in real time and access to dataReal-time flow measurement monitoring from distant locations is made possible by digital and wireless connectivity. Critical data, including temperature, pressure, and flow rates, are instantly and remotely accessible to oil and gas companies. This feature facilitates proactive maintenance and troubleshooting, improves decision-making, and speeds up issue response times.

Analytics and Data IntegrationAnalyzing and integrating data is made easy by integration with digital platforms. Businesses can combine data from flow measurements with other pertinent data streams, like environmental factors and production rates. Then, advanced analytics can offer insightful information for enhancing energy efficiency, reducing downtime, and optimizing operations. Cost-effectivenessOn-site inspections and manual data collection are less necessary when there is digital connectivity. This leads to a reduction in labor, travel, and potential operational disruption costs. Furthermore, real-time data-driven predictive maintenance can increase equipment longevity and lower unforeseen repair costs.

Environmental ComplianceThe oil and gas sector is facing stricter environmental regulations. Accurate and ongoing monitoring of emissions and fluid flow is made possible by digital connectivity, which guarantees adherence to environmental regulations. By doing this, businesses can avoid expensive fines and harm to their reputation. Safety ImprovementsIn dangerous situations, wireless connectivity enables remote equipment operation and monitoring. This improves general safety procedures and lessens the exposure of employees to potentially hazardous circumstances.

ScalabilityBusinesses can more easily adjust and grow their operations thanks to the high scalability of digital and wireless solutions. Ultrasonic flowmeters with these features provide flexibility in expanding into remote areas, integrating with current systems, and adding new measuring points. To sum up, the combination of digital and wireless connectivity is propelling the global market for ultrasonic flowmeters for oil and gas by giving businesses the means to maximize efficiency, guarantee security, and satisfy strict regulations. Ultrasonic flowmeters with digital and wireless capabilities are positioned as crucial resources for improving productivity, cutting expenses, and advancing sustainability in the oil and gas industry as the industry continues to adopt these technologies.

Segmental Insights

Technology Insights

The transit-time segment dominates the global ultrasonic flowmeter market. Due to their accuracy, flexibility, and ability to measure various types of liquid flow, transit-time ultrasonic flowmeters—also known as time-of-flight or time-difference flowmeters—are commonly used in many industries. In the oil and gas sector, distribution networks, and municipal water and wastewater treatment plants, transit-time flowmeters precisely measure flow rates. They are typically outfitted with two ultrasonic sensors, one upstream and one downstream. Even in difficult flow conditions, these flowmeters can measure a wide range of fluids with high accuracy, including natural gas, crude oil, and refined products.

The integration of transit-time flowmeters with digital communication protocols and data analysis tools also enables real-time monitoring, diagnostics, and remote access. Industries are implementing them to guarantee adherence to environmental standards concerning water use and wastewater release.

Regional Insights

The Asia-Pacific region is anticipated to dominate the market during the forecast period. Rapid urbanization, industrialization, and significant investments in infrastructure development across multiple sectors have made the Asia-Pacific region a key player in the global ultrasonic flowmeter market.

The demand for ultrasonic flowmeters in various applications, such as oil and gas production and water and wastewater management, is fueled by the region's diverse economies and industries. The demand for flow measurement solutions across a range of industries is rising as a result of ongoing industrial expansion, especially in nations in Southeast Asia, China, India, Japan, and South Korea.

Additionally, the need for ultrasonic flowmeters to monitor water flow in treatment facilities and distribution networks has increased due to the rapid urbanization and population growth in many Asian nations.

Ultrasonic flowmeters are also essential for custody transfer applications pipeline monitoring, and production processes because Asia-Pacific nations—including China and India—are significant producers and consumers of natural gas and oil. In line with Industry 4.0 concepts, ultrasonic flowmeters are also increasingly being used with digital technologies and the Internet of Things (IoT), which enable real-time monitoring, maintenance need prediction, and remote data access.

In conclusion, the Asia-Pacific region significantly drives the global ultrasonic flowmeter market. The demand for ultrasonic flowmeters in various applications is being driven by factors such as rapid industrialization, infrastructure development, environmental concerns, and an emphasis on digitization. We anticipate that the Asia-Pacific ultrasonic flowmeter market will continue to grow and evolve as industries increasingly prioritize sustainability, efficiency, and compliance.

Recent Developments

- In July 2020, the KROHNE Group introduced the OPTISONIC 6300 V2 ultrasonic flowmeter with a stationary, clamp-on design, which is well-suited for various system applications. This flowmeter enables users to measure flow at any desired location while ensuring uninterrupted processes. Notable enhancements include an expanded viscosity range of up to 200 cSt and an advanced signal converter, facilitating a wider range of applications.

- In February 2020, Endress+Hauser unveiled the Proline Prosonic Flow G 300/500 flow meter, specifically designed for demanding applications. With its exceptional precision of ±0.5% and reliable performance in fluctuating processes and ambient conditions, this meter is capable of accurately measuring both dry and wet gases. Developed in compliance with IEC 61508 (SIL), the Prosonic Flow G measuring system is suitable for multiple safety-critical applications.

Key Market Players

- Baker Hughes Company (GE)

- Endress+Hauser Group Services AG

- Fuji Electric Co. Ltd

- Honeywell International Inc.

- Emerson Electric Co.

- Badger Meter Inc.

- Omega Engineering Inc (Spectris plc)

- KROHNE Group

- Teledyne Technologies Incorporated

- Bronkhorst High-Tech BV

|

By Transducer Type |

By Technology |

By Region |

|

|

|

|

|

Related Reports

- North America & Europe Electric Boiler Market Size - By Voltage Rating (Low Voltage, Medium Voltage), By Application (Re...

- North America Residential Boiler Market Size - By Fuel (Natural Gas, Oil, Electric), By Technology (Condensing {Natural ...

- U.S. Commercial Boiler Market – By Product (Hot Water, Steam), Application (Offices, Healthcare Facilities, Educationa...

- North America Commercial Boiler Market Size - By Fuel (Natural Gas, Oil, Coal, Electric), By Capacity, By Technology (Co...

- Water Tube Industrial Boiler Market Size By Capacity, By Application (Food Processing, Pulp & Paper, Chemical, Refinery,...

- U.S. Industrial Boiler Market Size By Fuel (Natural Gas, Oil, Coal), By Capacity, By Technology (Condensing, Non-Condens...

Table of Content

- 1. Executive Summary

- 1.1. Key Findings

- 1.2. Market Snapshot (2025)

- 1.3. Future Outlook and Growth Opportunities

- 2. Introduction to the Oil & Gas Ultrasonic Flowmeter Market

- 2.1. Defining Ultrasonic Flowmeters in Oil & Gas

- 2.2. Principles of Ultrasonic Flow Measurement (Transit-Time, Doppler, Hybrid)

- 2.3. Advantages of Ultrasonic Flowmeters in Oil & Gas Applications

- 2.3.1. High Accuracy and Reliability

- 2.3.2. Non-Intrusive Measurement (Clamp-on options)

- 2.3.3. Low Maintenance and No Moving Parts

- 2.3.4. Wide Turn-down Ratio

- 2.3.5. Bi-directional Flow Measurement Capability

- 2.3.6. Suitability for Harsh Environments and High Pressures

- 2.4. Limitations of Ultrasonic Flowmeters

- 2.5. Scope of the Report

- 3. Market Overview

- 3.1. Current Market Size and Valuation (2025)

- 3.1.1. Overall Ultrasonic Flowmeter Market Size (USD Million)

- 3.1.2. Share of Oil & Gas Sector within the Ultrasonic Flowmeter Market

- 3.2. Market Dynamics

- 3.2.1. Drivers of Market Growth

- 3.2.1.1. Increasing Need for Accurate Custody Transfer Applications

- 3.2.1.2. Growing Demand for Operational Efficiency and Process Optimization

- 3.2.1.3. Stringent Environmental Regulations and Emissions Monitoring

- 3.2.1.4. Expansion of Oil & Gas Exploration, Production, and Transportation Infrastructure

- 3.2.1.5. Rising Adoption of Smart Flowmeters with IoT and Data Analytics Integration

- 3.2.1.6. Focus on Predictive Maintenance and Real-time Monitoring

- 3.2.2. Challenges and Restraints

- 3.2.2.1. High Initial Investment Costs of Advanced Ultrasonic Flowmeters

- 3.2.2.2. Technical Limitations in Harsh Environments or with Specific Fluid Properties (e.g., highly aerated fluids, slurries)

- 3.2.2.3. Competition from Traditional Flowmeter Technologies (Coriolis, Turbine, Differential Pressure)

- 3.2.2.4. Need for Skilled Technicians for Installation and Maintenance

- 3.2.1. Drivers of Market Growth

- 3.1. Current Market Size and Valuation (2025)

- 4. Market Segmentation

- 4.1. By Transducer Type / Implementation

- 4.1.1. Spool Piece (In-line)

- 4.1.2. Clamp-on

- 4.1.3. Insertion / Plug-in

- 4.1.4. Others

- 4.2. By Technology

- 4.2.1. Transit-Time (Single/Dual Path, Multi-Path: 3-path, 4-path, 5-path, 6+ paths)

- 4.2.2. Doppler

- 4.2.3. Hybrid

- 4.3. By Fluid Type

- 4.3.1. Natural Gas

- 4.3.2. Petroleum Liquids (Crude Oil, Refined Products, Liquid Hydrocarbons)

- 4.3.3. Non-Petroleum Liquids (Water, Produced Water, Chemicals)

- 4.3.4. Steam

- 4.4. By Application

- 4.4.1. Upstream (Wellhead Monitoring, Production Optimization, EOR, Well Testing)

- 4.4.2. Midstream (Pipeline Monitoring, Custody Transfer, Storage Terminal Operations)

- 4.4.3. Downstream (Refineries, Petrochemical Plants, Distribution Networks)

- 4.4.4. Leak Detection

- 4.4.5. Process Control and Optimization

- 4.4.6. Other Applications

- 4.1. By Transducer Type / Implementation

- 5. Regional Analysis

- 5.1. North America (U.S., Canada, Mexico)

- 5.1.1. Shale Gas Development and Infrastructure

- 5.1.2. Regulatory Environment

- 5.2. Europe (Germany, UK, Russia, Norway, etc.)

- 5.2.1. Energy Security and Infrastructure Projects

- 5.2.2. Environmental Regulations

- 5.3. Asia Pacific (China, India, Australia, Indonesia, Japan, South Korea, etc.)

- 5.3.1. Rapid Industrialization and Energy Demand

- 5.3.2. Investment in New Oil & Gas Projects

- 5.4. Middle East & Africa (Saudi Arabia, UAE, Qatar, Nigeria, etc.)

- 5.4.1. Major Oil & Gas Producing Region

- 5.4.2. Investment in Upstream and Midstream Projects

- 5.5. South America (Brazil, Argentina, etc.)

- 5.1. North America (U.S., Canada, Mexico)

- 6. Competitive Landscape

- 6.1. Market Share Analysis of Key Players

- 6.2. Profiles of Major Companies Operating in the Oil & Gas Ultrasonic Flowmeter Market

- 6.2.1. Emerson Electric Co.

- 6.2.2. Endress+Hauser Group Services AG

- 6.2.3. KROHNE Group

- 6.2.4. Siemens AG (including Siemens Energy)

- 6.2.5. Baker Hughes Company (GE)

- 6.2.6. Honeywell International Inc.

- 6.2.7. Fuji Electric Co. Ltd.

- 6.2.8. Badger Meter Inc.

- 6.2.9. ABB Ltd.

- 6.2.10. Yokogawa Electric Corporation

- 6.2.11. Faure Herman

- 6.2.12. Teledyne Technologies Incorporated

- 6.2.13. Bronkhorst High-Tech BV

- 6.2.14. Other Prominent Players

- 6.3. Recent Developments, Mergers, Acquisitions, and Strategic Partnerships

- 7. Technological Trends and Innovations

- 7.1. Integration of Digital and Wireless Connectivity (IoT, IIoT, Industry 4.0)

- 7.2. Enhanced Signal Processing Algorithms for Improved Accuracy in Challenging Conditions

- 7.3. Development of Advanced Multi-Path Designs

- 7.4. Focus on Real-time Diagnostics and Predictive Maintenance

- 7.5. Portable and Smart Ultrasonic Flowmeters for Temporary Monitoring

- 7.6. Use of Advanced Materials for Transducers (e.g., Titanium for harsh environments)

- 7.7. Cybersecurity in Integrated Flow Measurement Systems

- 8. Future Outlook and Projections (up to 2033)

- 8.1. Forecasted Market Size and CAGR (Overall and Oil & Gas Specific)

- 8.2. Emerging Opportunities in Specific Oil & Gas Segments (e.g., LNG, Hydrogen Blending)

- 8.3. Impact of Global Energy Transition and Decarbonization Efforts

- 8.4. Growth in Emerging Markets (Asia Pacific, Middle East & Africa)

- 9. Conclusion

Major Key Players & Manufacturers in the Oil & Gas Ultrasonic Flowmeter Market:

- Emerson Electric Co.

- Siemens AG

- Endress+Hauser Management AG

- Baker Hughes Company (Panametrics)

- Fuji Electric Co. Ltd.

- Honeywell International Inc.

- KROHNE Messtechnik GmbH

- ABB Ltd.

- Yokogawa Electric Corporation

- Badger Meter, Inc.

- Azbil Corporation

- Schneider Electric SE

- General Electric Company

- Danfoss A/S

- SICK AG

- Teledyne FLIR LLC

- Spire Metering Technology

- ONICON Incorporated

- Katronic AG & Co. KG

- MITSUBISHI ELECTRIC CORPORATION

- Sierra Instruments

- Aalborg Instruments & Controls, Inc.

- Manas Microsystems

- Sensia (joint venture of Rockwell Automation and Schlumberger)

- Aichi Tokei Denki Co., Ltd.

- Titan Enterprises

- ATO Flow Meter

FAQ'S

For a single, multi and corporate client license, the report will be available in PDF format. Sample report would be given you in excel format. For more questions please contact:

Within 24 to 48 hrs.

You can contact Sales team (sales@marketinsightsresearch.com) and they will direct you on email

You can order a report by selecting payment methods, which is bank wire or online payment through any Debit/Credit card, Razor pay or PayPal.

Discounts are available.

Hard Copy