Distributed Energy Storage System Market

Distributed Energy Storage System Market - Global Industry Size, Share, Trends, Opportunity, and Forecast, Segmented By Capacity Type (Single Phase Type, Three Phase Type, Double Phase Fire Line), By Battery (Nickel-Cadmium, Lead Acid, Lithium-Ion), By Application (Transportation, Grid Storage, Renewable Energy Storage), By End User (Commercial, Residential), By Region, By Competition Forecast, 2022-2028

Published Date: May - 2025 | Publisher: MIR | No of Pages: 320 | Industry: Power | Format: Report available in PDF / Excel Format

View Details Buy Now 2890 Download Free Sample Ask for Discount Request Customization| Forecast Period | 2024-2028 |

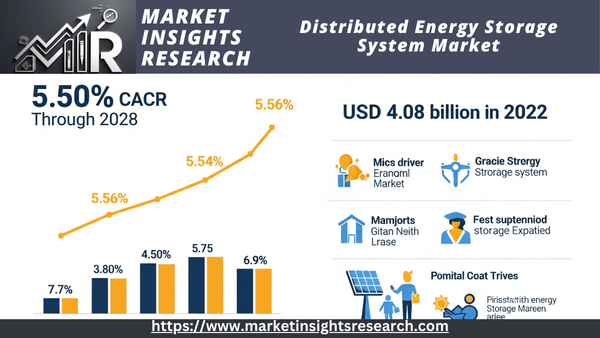

| Market Size (2022) | USD 4.08 billion |

| CAGR (2023-2028) | 5.50% |

| Fastest Growing Segment | Grid Storage |

| Largest Market | Asia Pacific |

Market Overview

The global market for distributed energy storage is valued at USD 4.08 billion in 2022 and is anticipated to experience robust growth in the forecast period with a CAGR of 5.50% through 2028. The Distributed Energy Storage System (DESS) market refers to the industry involved in the development, manufacturing, deployment, and operation of energy storage solutions that are distributed across various locations within an electrical grid.

Download Free Sample Ask for Discount Request Customization

DESS technologies encompass a wide range of energy storage systems, such as batteries, flywheels, and pumped hydro, strategically placed at decentralized points within the grid infrastructure, including homes, commercial buildings, industrial facilities, and utility substations. The primary purpose of DESS is to store excess electrical energy generated during periods of low demand or high renewable energy output and release it when demand is high or generation is low. This process aids in balancing the electricity grid, improving its reliability, and enhancing its resilience to fluctuations in supply and demand. The DESS market plays a pivotal role in supporting the integration of renewable energy sources, such as solar and wind, into the grid by mitigating their intermittency and ensuring a stable and continuous energy supply. Furthermore, DESS systems offer a wide array of benefits, including reduced energy costs, optimized grid operations, and the ability to provide backup power during outages, making them a critical component of modern energy infrastructure.

Key Market Drivers

Renewable Energy Integration Accelerates Distributed Energy Storage System Market Growth

The global transition towards renewable energy sources, such as solar and wind power, is a primary driver propelling the Distributed Energy Storage System (DESS) market. Renewable energy generation can be intermittent, depending on weather conditions and time of day. DESS technologies, including batteries and other energy storage solutions, play a vital role in mitigating this intermittency by storing excess energy during periods of high generation and releasing it when demand is high or renewable generation is low.

As nations and regions worldwide set ambitious targets for reducing greenhouse gas emissions and increasing renewable energy capacity, DESS becomes an essential enabler of a more sustainable and reliable energy grid. It not only helps balance supply and demand but also enhances the stability and resilience of power systems.

Furthermore, DESS offers the flexibility to integrate distributed renewable energy resources, like rooftop solar panels, into the grid seamlessly. This enhances the economic viability of renewable energy installations and encourages their adoption, driving further growth in the DESS market.

Grid Modernization Initiatives Foster DESS Adoption

Many countries are investing heavily in grid modernization initiatives to improve the reliability and efficiency of their electrical grids. These initiatives often involve the deployment of advanced technologies, including DESS. As aging grid infrastructure faces increasing challenges due to higher energy demand and the integration of renewables, DESS systems are being deployed to address these issues.

DESS technologies provide grid operators with tools for voltage regulation, peak shaving, and load balancing. They can also help reduce transmission and distribution losses. As a result, utilities and grid operators are increasingly incorporating DESS solutions into their grid modernization plans to enhance grid stability and optimize its performance.

The advent of smart grids, which rely on real-time data and communication networks, further synergizes with DESS deployments. Smart grids enable more precise control of distributed energy resources, including DESS systems, making them even more valuable in optimizing grid operations and reducing downtime.

Download Free Sample Ask for Discount Request Customization

Decentralization of Power Generation Spurs DESS Market Expansion

The trend towards decentralization of power generation is reshaping the energy landscape and boosting the DESS market. Traditional centralized power plants are being complemented and, in some cases, replaced by distributed energy resources (DERs), such as rooftop solar panels, small-scale wind turbines, and microgrids. These DERs generate power closer to the point of consumption, reducing transmission and distribution losses and enhancing energy security.

DESS technologies are integral to the effective integration of DERs into the grid. They provide the necessary flexibility to store excess energy generated locally and release it when needed, ensuring a reliable power supply. Moreover, DESS systems can serve as backup power sources during grid outages, enhancing energy resilience in decentralized energy systems.

In regions where energy access is limited or unreliable, DESS can play a transformative role by providing off-grid and remote communities with a stable and sustainable source of electricity. This application of DESS contributes to greater energy access and serves as a powerful driver for market growth.

Electric Vehicle Proliferation Boosts DESS Demand

The rapid growth of the electric vehicle (EV) market is driving up the demand for DESS solutions. Electric vehicles rely on lithium-ion batteries, which are a type of DESS, for energy storage. As the EV market expands, the demand for high-capacity, high-performance batteries grows in tandem.

In addition to providing energy storage for EVs, these batteries can also be used in stationary DESS applications, such as home energy storage systems and grid-scale installations. This dual-use capability makes DESS more cost-effective and incentivizes further investment in battery technology research and development.

Furthermore, bidirectional charging capabilities in EVs, known as vehicle-to-grid (V2G) technology, enable EVs to discharge stored energy back into the grid during peak demand periods. This capability not only benefits EV owners by offsetting charging costs but also supports grid stability and reduces the need for additional power generation capacity.

As governments and automakers continue to promote EV adoption through incentives and regulations, the DESS market is expected to experience significant growth due to the increased demand for batteries and related energy storage solutions.

Increasing Energy Storage in Commercial and Industrial Sectors

The commercial and industrial (C&I) sectors are increasingly recognizing the value of DESS solutions to reduce electricity costs and enhance energy reliability. Many C&I facilities experience high electricity demand charges, which can make up a substantial portion of their energy bills. DESS systems can help mitigate these charges by storing energy during periods of low demand and discharging it during peak hours.

Moreover, DESS technologies provide backup power to critical C&I operations, ensuring uninterrupted production processes and data center operations. This reliability is crucial for industries where downtime can result in significant financial losses.

DESS solutions also support the integration of renewable energy systems within C&I facilities, allowing businesses to reduce their carbon footprint and achieve sustainability goals. As organizations continue to prioritize sustainability and cost savings, the adoption of DESS in the C&I sectors is set to increase, driving market growth.

Falling Battery Prices and Technological Advancements

One of the most influential drivers of the DESS market is the continuous decline in battery prices and ongoing technological advancements. Over the past decade, the cost of lithium-ion batteries, the most common type used in DESS applications, has plummeted. This cost reduction has made DESS systems more economically viable, spurring their adoption across various sectors.

Simultaneously, ongoing research and development efforts have led to improvements in battery performance, energy density, and cycle life. These advancements have translated into longer-lasting, more efficient DESS systems that can better meet the requirements of diverse applications.

Innovations in materials science and battery chemistry are also paving the way for next-generation DESS technologies, such as solid-state batteries and flow batteries, which promise even higher performance and safety standards. As these technologies mature and become commercially found at, they are expected to further expand the DESS market.

In conclusion, the global Distributed Energy Storage System (DESS) market is being driven by the integration of renewable energy sources, grid modernization initiatives, the decentralization of power generation, the proliferation of electric vehicles, the adoption of DESS in the commercial and industrial sectors, and falling battery prices coupled with technological advancements. These drivers collectively contribute to the rapid growth and evolution of the DESS market, positioning it as a critical component of the future energy landscape.

Download Free Sample Ask for Discount Request Customization

Government Policies are Likely to Propel the Market

Renewable Energy Integration Incentives

To accelerate the adoption of Distributed Energy Storage Systems (DESS) and promote the integration of renewable energy sources into the energy mix, governments worldwide are implementing policies that provide incentives and subsidies. These policies aim to reduce the financial barriers associated with DESS installations and encourage individuals, businesses, and utilities to invest in energy storage technologies.

One common incentive is the provision of tax credits or rebates for DESS installations, which can significantly reduce the upfront costs. These financial incentives make DESS more accessible to a broader range of consumers, from homeowners looking to install residential energy storage systems to commercial and industrial entities seeking to implement grid-scale solutions.

In addition to financial incentives, governments may establish net metering or feed-in tariff programs that allow DESS owners to sell excess stored energy back to the grid or receive credits for their contributions. Such policies not only encourage DESS adoption but also facilitate the integration of intermittent renewable sources like solar and wind by providing a reliable means of storing surplus energy for later use.

Furthermore, some governments set ambitious renewable energy targets, which indirectly drive the demand for DESS as a means to enhance the reliability and flexibility of renewable energy systems. These targets can stimulate investments in DESS infrastructure and research and development, further advancing the technology.

Grid Modernization and Resilience Initiatives

As electrical grids face increasing challenges from factors like climate change and the growing use of distributed energy resources, governments are implementing policies to modernize and enhance the resilience of their grids. These initiatives often include provisions for the deployment of DESS as a critical component of grid infrastructure.

Grid modernization policies may require utilities to invest in DESS systems to improve grid stability, reduce transmission and distribution losses, and enhance the integration of renewable energy sources. Such policies can lead to increased DESS installations at the distribution level, allowing utilities to better manage energy flows, maintain voltage stability, and ensure grid reliability.

Moreover, in regions susceptible to natural disasters and grid outages, governments may incentivize the deployment of DESS systems for emergency backup power. DESS can provide essential services during blackouts, ensuring critical facilities like hospitals, emergency response centers, and communication networks remain operational.

Resilience-focused policies often include funding opportunities, grants, or low-interest loans to support DESS installations in vulnerable areas. These initiatives not only bolster energy resilience but also contribute to community safety and disaster preparedness.

Capacity Market Participation

Certain governments have started initiatives allowing DESS owners to engage in capacity markets, which are systems meant to guarantee grid stability by motivating the availability of enough electricity output and storage capacity during periods of peak demand.

DESS owners can make money in capacity markets by providing the grid with their stored energy capacity either in response to grid operator requests or during peak demand hours. DESS deployment generates a financial incentive for owners since it lets them profit from their storage capacity outside standard energy arbitrage and backup power solutions.

Regulatory systems that set guidelines, market processes, and remuneration systems for DESS providers help to often enable participation in capacity markets. These laws encourage further investment in DESS infrastructure since they generate a consistent income source that can balance installation and running expenses.

Moreover, participation in capacity markets corresponds with more general objectives of energy policy by promoting the building of a dependable and strong energy infrastructure fit for the needs of a modern, digital society.

Grid Access and Interconnection Standards

Governments are putting rules and standards addressing grid access and interconnection needs to help the distributed energy storage systems be widely adopted. These rules seek to guarantee that, following safety and performance criteria, DESS installations can link easily to the grid.

Establishing explicit interconnection criteria is one important policy area since it determines the technical requirements and methods for tying DESS devices to the grid. By guaranteeing compatibility between DESS systems and the current grid infrastructure, these criteria help to lower technical obstacles to adoption.

Often including simplified permission and approval procedures for DESS installations, grid access policies help to lower administrative costs and hasten project deadlines. Simplifying these procedures helps governments promote more quick acceptance of DESS technology, which can be rather important for grid stability and resilience.

Moreover, governments should demand utilities to give open information on grid conditions and capacity to possible DESS owners, thereby facilitating informed decisions on system size and grid support capacities. These rules support effective grid use and assist in supply- and demand-balancing.

Environmental and Safety Regulations

To guarantee the environmental sustainability and safety of distributed energy storage systems, governments all over are imposing rules and requirements. Protecting public health and the environment, these rules handle DESS technology manufacture, installation, operation, and disposal.

Environmental rules could specify the materials DESS components utilize, therefore promoting the adoption of recyclable and environmentally friendly products. These rules might also set standards for the disposal and recycling of DESS components, therefore reducing the environmental impact of end-of- life systems.

Safety rules cover several facets of DESS including chemical safety, electrical safety, and fire safety. These rules specify safety criteria for DESS installations, therefore guaranteeing that they neither endanger people or property. Safety elements—such as heat control systems or fire suppression systems—may be mandated by laws into DESS designs.

To guarantee that these systems are implemented and maintained properly, governments may sometimes demand training and certification programs for DESS installers and operators. Building confidence in DESS technologies and advancing their general acceptance depend on following environmental and safety standards.

Research and Development Funding

Governments may set money for research and development (R&D) projects since they understand the need of encouraging creativity in the DESS industry. With an eye toward cost reduction, performance enhancement, and application expansion, these rules help DESS technologies to advance.

Universities, research facilities, and businesses engaged in DESS-related projects could all be recipients of R&D money. Advanced battery chemistries, energy management systems, and grid integration solutions—among other next-generation DESS technologies—are encouraged by these programs.

Apart from direct financing, governments might create cooperative research initiatives combining industry players, academics, and legislators to find problems and create answers for the DESS market. Such cooperative projects guarantee that DESS technologies complement more general energy policy objectives and speed the rate of innovation.

Moreover, R&D money may help with pilot projects and demonstration projects so that fresh DESS innovations could be tried in actual surroundings. These initiatives boost confidence among possible consumers and investors, therefore supporting the validity of DESS solutions.

Ultimately, the worldwide Distributed Energy Storage System (DESS) industry is shaped in great part by government policy. Policies that support grid modernization, capacity market participation, renewable energy integration incentives, grid access and interconnection standards, environmental and safety regulations, and funding for research and development taken together help the DESS sector to grow and be sustainable. These rules not only support more robust and efficient energy environment but also coincide with more general energy and sustainability goals, thereby advancing technical innovation.

Key Market Challenges

Cost Barriers and Return on Investment Uncertainty

Adoption of these technologies poses one of the main obstacles confronting the worldwide Distributed Energy Storage System (DESS) marketcost barrier. Although Dess systems have many advantages—energy savings, grid stability, and improved resilience—their initial outlay can be high. These expenses cover the buy-in, installation, control system, inverter, storage equipment, and required electrical infrastructure.

Potential adopters—including homes, companies, and utilities—often find great discouragement from the hefty initial capital outlay for DESS systems. Since the return on investment (ROI) depends on several elements including energy costs, the availability of financial incentives, and the particular use case for the DESS system, uncertainty regarding it can be a major challenge.

Furthermore, the location and the energy market structure will greatly affect the payback time for Dess installations. The lengthier ROI for DESS systems in places with low electricity rates or limited financial incentives may discourage investment. Moreover, the absence of consistent measures for computing and evaluating DESS system ROI makes it difficult for companies and consumers to fairly evaluate the financial feasibility of these expenditures.

Widespread application of DESS technologies depends on addressing the cost barrier and ROI uncertainty. Working together, governments, industry players, and financial institutions may create more easily available financing choices, incentives, and standardized measures that enable possible adopters make wise decisions about DESS investments. Moreover, constant decreases in DESS component costs resulting from technological developments and economies of scale will be very helpful in reducing this difficulty.

Regulatory and Policy Hurdles

For the worldwide Distributed Energy Storage System (DESS) market, the regulatory and policy scene might provide major obstacles. Dess producers, developers, and consumers find a difficult environment created by the complexity and variation of rules and policies across many areas and jurisdictions.

The absence of consistency in laws and regulations controlling DESS installations and grid interconnections presents one of the main regulatory difficulties. Different locations can have very different regulations and grid codes, which makes developing, manufacturing, and implementing DESS systems that fit local criteria difficult. This fluctuation might raise expenses and impede the DESS solution expansion.

Sometimes the benefit that DESS can offer the energy system may not be enough acknowledged by regulatory systems. DESS systems can offer, for instance, grid services including voltage support, frequency control, and peak demand shaving. Lack of market systems, however, that pay DESS providers for these services can restrict the financial incentives for using such technologies.

Furthermore lacking clear, simplified permission procedures for DESS installations could cause delays and higher expenses. Complicated or long approval procedures could discourage possible adopters, therefore slowing down the expansion of the DESS industry.

Governments and regulatory authorities must cooperate with industry stakeholders to create common rules for DESS installations, grid integration, and market participation in order to remove these legislative and legal obstacles. Realizing the value of DESS and simplifying the permission and approval procedures will help to create a supportive regulatory climate that fully uses distributed energy storage systems. Moreover, worldwide coordination and harmonization of rules and standards would help DESS producers and consumers both, hence fostering a more scalable and efficient market.

Segmental Insights

Lithium-Ion Insights

With the highest market share in 2022 and likely to keep it during the projection period is the Lithium-Ion sector. High energy density of lithium-ion batteries allows them to store a lot of energy in a rather small and light weight packaging. For uses like residential and commercial installations where space and weight restrictions are crucial, they are therefore perfect. Long cycle life of lithium-ion batteries makes them well-known for allowing a great number of charge and discharge cycles before notable degradation. DESS applications depend on this lifespan since it guarantees a consistent and dependable energy storage method over a long time. Rapid charging and discharge of lithium-ion batteries make them ideal for uses requiring quick reactions to changing energy needs. Peak shaving and frequency control among grid support services depend on this capacity especially. High charge and discharge efficiency of lithium-ion batteries enable them to little lose converted stored energy back into electricity. Cost reductions and better general system performance follow from this efficiency. Low self-discharge rates of lithium-ion batteries ensure that their stored energy is kept for more prolonged durations free from major losses. Applications needing occasional or emergency backup power will find this function useful. Unlike some other battery technologies, such as lead-acid, lithium-ion batteries require quite little maintenance. Their absence of regular watering or equalizing charging helps to lower running expenses and effort. Constant developments in lithium-ion battery technology brought about by ongoing research and development have driven reduced costs, longer cycle life, and higher energy density. For DES uses, these developments have made lithium-ion batteries even more appealing. Because they are so widely used in consumer gadgets, electric cars, and renewable energy projects, lithium-ion batteries gain from economies of scale and easily located production infrastructure. This has helped to drive general acceptance and cost cuts. Advanced safety elements including thermal management systems and protection circuitry help modern lithium-ion batteries reduce the risk of overheating, fires, or explosions. These safety precautions improve its fit for both home and business uses. Their dependability and proven performance have won consumers, companies, and utilities trust as well as market acceptance of lithium-ion batteries. Their established reputation confirms even more their supremacy in the DESS sector. With the highest market share in 2022, the segment on Grid Storage is expected to grow fast over the next years. Ensuring the stability and dependability of electrical systems depends critically on grid storage technology. Crucially for preserving grid integrity, they offer frequency management, voltage support, and grid balancing. These services assist to lessen the difficulties presented by changing demand for electricity and intermittent renewable energy sources. Managing peak power demand is quite effectively accomplished with grid storage technologies. Grid storage systems discharge stored energy to the grid during times of great demand, including as summer afternoons when air conditioning consumption rises. This helps to avoid grid congestion and blackouts and lessens the load on power producing plants. Grid storage systems help to stabilize the grid by lowering peak demand and thereby lessening the necessity for costly peaker plants. The intermittent character of renewable energy sources such as solar and wind creates difficulties for their increasing penetration. Excess energy created during times of high renewable output is stored in grid storage systems and released when either low or absent renewable generation is present. By allowing renewable energy fluctuations to be seamlessly integrated into the grid, this smoothing of them helps to improve grid dependability and lessen the need for backup coal burning. Through backup power during grid disruptions, grid storage increases grid resilience. Dess systems can provide a continuous power supply to important facilities as hospitals, emergency response centers, and data centers when unanticipated events or natural disasters throw off the grid. Maintaining public safety and basic services depends much on this skill. By lowering transmission and distribution losses, grid storage systems help the grid to be more generally efficient. Dess systems help to create a more affordable and efficient grid infrastructure by storing extra electricity nearer where it is needed and minimising energy losses during long-distance transmission. Grid storage is becoming more and more important for many governments and regulatory agencies in improving grid dependability and enabling integration of renewable energy sources. Their dominance in the market has been further enhanced by policies and incentives meant to promote the application of grid storage technologies. Particularly lithium-ion batteries, the cost of grid storage devices has been constantly declining as technology develops and economies of scale take front stage. Reduced cost has made grid storage more financially feasible, so encouraging its use. Utility and grid operator adoption of grid storage systems is rather broad. Rising investment and implementation follow from their demonstrated ability to improve grid performance and resilience.

Grid Storage Insights

With the biggest market share in 2022, the Grid Storage segment is expected to grow rapidly over the course of the forecast period. In order to maintain the stability and dependability of electrical grids, grid storage solutions are essential. In order to preserve grid integrity, they offer vital services like grid balancing, voltage support, and frequency regulation. These services assist in reducing the difficulties brought on by sporadic renewable energy sources and variations in the demand for electricity. Systems for grid storage are very good at controlling the demand for electricity during peak hours. Grid storage systems release stored energy to the grid during times of high demand, like hot summer afternoons when air conditioning use peaks. This lessens the burden on power plants and avoids blackouts and grid congestion. Grid storage solutions help to stabilize the grid and lessen the need for costly peaker plants by reducing peak demand. Due to their sporadic nature, renewable energy sources like wind and solar are becoming more and more popular. When renewable energy production is low or nonexistent, grid storage systems release the excess energy they have stored during times of high renewable output. By reducing the need for backup fossil fuel generation and improving grid reliability, this smoothing of renewable energy fluctuations makes it easier for them to integrate seamlessly into the grid. By supplying backup power during grid outages, grid storage improves grid resilience. DESS systems can guarantee a steady power supply to vital facilities like hospitals, emergency response centers, and data centers in the event of natural disasters or unanticipated events that disrupt the grid. Public safety and the preservation of vital services depend heavily on this capability. By lowering transmission and distribution losses, grid storage solutions can increase the grid's overall efficiency. DESS systems make grid infrastructure more economical and efficient by storing excess electricity closer to where it's needed and reducing energy losses during long-distance transmission. Grid storage is crucial for improving grid reliability and facilitating the integration of renewable energy sources, as acknowledged by numerous governments and regulatory agencies. Their market dominance has been further enhanced by the policies and incentives they have put in place to promote the deployment of grid storage solutions. The cost of grid storage systems, especially lithium-ion batteries, has been falling steadily as the technology advances and economies of scale take effect. Grid storage is now more economically feasible as a result of this cost reduction, which encourages its use even more. Utilities and grid operators now widely accept and use grid storage solutions. Increased investment and deployment have resulted from their demonstrated ability to improve grid performance and resilience.

Regional Insights

Asia Pacific

The Asia Pacific region has the largest and fastest-growing DESS market in the world. This is due to a number of factors, including

Rapid economic growth

Increasing urbanization

Ambitious renewable energy targets

Government support for DESS deployment

China is the largest DESS market in the Asia Pacific region, followed by India, Japan, South Korea, and Australia.

North America

North America is another major DESS market, with the United States being the largest market in the region. The US government is supportive of the DESS industry and has implemented a number of policies to promote its deployment.

Europe

Europe is also a significant DESS market, with Germany being the largest market in the region. The European Commission has set ambitious targets for renewable energy deployment and is supporting the development of DESS to help achieve these targets.

Download Free Sample Ask for Discount Request Customization

Recent Developments

- In August 2023, Fluence Energy, a leading provider of energy storage technology and services, announced that it raised USD1.6 billion in new funding. The company plans to use the funds to accelerate its growth and expand its global reach.

- In July 2023, Form Energy, a developer of long-duration energy storage systems, announced that it closed a USD450 million Series E funding round. The company plans to use the funds to scale up its manufacturing and commercialize its energy storage technology.

- In June 2023, Heliogen, a company that develops and manufactures renewable energy storage technologies, announced that it raised USD560 million in new funding. The company plans to use the funds to accelerate the commercialization of its solar-powered hydrogen production and energy storage technology.

- In May 2023, Ameresco, a leading energy services company, announced that it acquired YSI, a developer and manufacturer of energy storage systems. The acquisition will enable Ameresco to expand its energy storage offerings and provide its customers with more comprehensive solutions.

- In April 2023, Tesla, the world's leading electric vehicle manufacturer, announced that it is building a USD1.2 billion lithium-ion battery factory in Texas. The factory will produce batteries for Tesla's electric vehicles, as well as for its energy storage products.

Key Market Players

- Tesla Inc

- BYD Co. Ltd

- LG Chem

- Samsung SDI Co., Ltd.

- Panasonic Holdings Corporation

- ABB Ltd

- Siemens AG

- General Electric Company

- Eaton Corporation plc

- Sonnen GmbH

|

By Capacity Type |

By Battery |

By Application |

By End User |

By Region |

|

Related Reports

- U.S. Industrial Boiler Market Size By Fuel (Natural Gas, Oil, Coal), By Capacity, By Technology (Condensing, Non-Condens...

- Fire Tube Industrial Boiler Market - By Capacity (<10 MMBtu/hr, 10-25 MMBtu/hr, 25-50 MMBtu/hr, 50-75 MMBtu/hr, >75 MMBt...

- Gas Fired Boiler Market Size - By Capacity (≤ 10 MMBtu/hr, > 10 - 50 MMBtu/hr, > 50 - 100 MMBtu/hr, > 100 - 250 MMBtu/...

- Europe Residential Boiler Market Size - By Technology (Condensing {Natural Gas, Oil, Electric}, Non-Condensing {Natural ...

- U.S. Boiler Market Size By Fuel (Natural Gas, Oil, Coal), Capacity, By Technology (Condensing, Non-Condensing), By Produ...

- Commercial Hot Water Boiler Market Size - By Fuel (Natural Gas, Oil, Coal, Electric), By Technology (Condensing, Non-Con...

Table of Content

- 1. Executive Summary

- 1.1. Key Findings

- 1.2. Market Snapshot (2025)

- 1.3. Future Outlook and Growth Opportunities

- 2. Introduction to the Distributed Energy Storage System (DESS) Market

- 2.1. Defining Distributed Energy Storage Systems (DESS)

- 2.2. How DESS Works and its Role in the Energy Landscape

- 2.3. Key Benefits of DESS

- 2.3.1. Grid Stability and Resilience (Backup Power, Frequency Regulation)

- 2.3.2. Integration of Renewable Energy Sources (Solar, Wind)

- 2.3.3. Peak Shaving and Demand Charge Reduction

- 2.3.4. Enhanced Energy Efficiency and Reduced Transmission Losses

- 2.3.5. Energy Independence and Security

- 2.4. Limitations and Challenges of DESS

- 2.5. Scope of the Report

- 3. Market Overview

- 3.1. Current Market Size and Valuation (2025)

- 3.2. Market Dynamics

- 3.2.1. Drivers of Market Growth

- 3.2.1.1. Rapid Increase in Renewable Energy Deployment

- 3.2.1.2. Growing Demand for Grid Modernization and Resilience

- 3.2.1.3. Declining Costs of Energy Storage Technologies (Especially Li-ion)

- 3.2.1.4. Supportive Government Policies, Incentives, and Regulations

- 3.2.1.5. Rising Adoption of Electric Vehicles (EVs) and Associated Charging Infrastructure

- 3.2.1.6. Increasing Focus on Energy Independence and Sustainability

- 3.2.2. Challenges and Restraints

- 3.2.2.1. High Initial Capital Expenditure

- 3.2.2.2. Grid Integration Complexities and Interconnection Issues

- 3.2.2.3. Lack of Standardization Across Technologies

- 3.2.2.4. Supply Chain Volatility for Key Materials

- 3.2.1. Drivers of Market Growth

- 4. Market Segmentation

- 4.1. By Technology

- 4.1.1. Electrochemical Storage

- 4.1.1.1. Lithium-Ion Batteries (LiFePO4, NMC, etc.)

- 4.1.1.2. Lead-Acid Batteries (VRLA, Flooded)

- 4.1.1.3. Flow Batteries (Vanadium Redox, Zinc-Bromine, Organic)

- 4.1.1.4. Sodium-Ion Batteries (Emerging)

- 4.1.1.5. Others (Nickel-Cadmium, etc.)

- 4.1.2. Mechanical Storage

- 4.1.2.1. Flywheel Energy Storage

- 4.1.2.2. Compressed Air Energy Storage (CAES - Distributed Scale)

- 4.1.3. Thermal Storage (Distributed Applications)

- 4.1.4. Other Technologies (Supercapacitors, Hydrogen Storage/Fuel Cells at Distributed Scale)

- 4.1.1. Electrochemical Storage

- 4.2. By Application

- 4.2.1. Residential (Rooftop Solar Integration, Backup Power)

- 4.2.2. Commercial (Peak Shaving, Demand Response, EV Charging Infrastructure)

- 4.2.3. Industrial (Load Shifting, Power Quality, Backup)

- 4.2.4. Utility-Scale (Grid Support at Distributed Points, Microgrids)

- 4.2.5. Off-Grid Systems

- 4.3. By Connectivity

- 4.3.1. On-Grid

- 4.3.2. Off-Grid

- 4.3.3. Hybrid

- 4.1. By Technology

- 5. Regional Analysis

- 5.1. North America (U.S., Canada, Mexico)

- 5.1.1. Policy Landscape and Incentives

- 5.1.2. Key Projects and Deployments

- 5.2. Europe (Germany, UK, France, Italy, Spain, etc.)

- 5.2.1. Renewable Energy Targets and Decarbonization Efforts

- 5.2.2. Focus on Decentralized Grids

- 5.3. Asia Pacific (China, India, Japan, Australia, South Korea, Southeast Asia)

- 5.3.1. Rapid Growth in Renewable Energy Installations

- 5.3.2. Government Support and Electrification Initiatives

- 5.3.3. Emerging Markets and Rural Electrification

- 5.4. Latin America (Brazil, Chile, etc.)

- 5.5. Middle East & Africa (Saudi Arabia, UAE, South Africa, etc.)

- 5.1. North America (U.S., Canada, Mexico)

- 6. Competitive Landscape

- 6.1. Market Share Analysis of Key Players

- 6.2. Profiles of Major Companies Operating in the DESS Market

- 6.2.1. Tesla Inc.

- 6.2.2. LG Energy Solution

- 6.2.3. Samsung SDI Co., Ltd.

- 6.2.4. Panasonic Corporation

- 6.2.5. BYD Company Ltd.

- 6.2.6. Fluence (Siemens AG & AES Corporation Joint Venture)

- 6.2.7. General Electric (GE)

- 6.2.8. Schneider Electric SE

- 6.2.9. Hitachi Energy Ltd.

- 6.2.10. Huawei Technologies Co., Ltd.

- 6.2.11. Sonnen GmbH

- 6.2.12. Enphase Energy Inc.

- 6.2.13. Other Prominent Players (e.g., Invinity Energy Systems, Redflow, SimpliPhi Power)

- 6.3. Recent Developments, Mergers, Acquisitions, and Strategic Partnerships

- 7. Technological Trends and Innovations

- 7.1. Advancements in Battery Chemistries (LFP, Solid-State, Sodium-Ion)

- 7.1. Integration of Smart Grid Technologies (IoT, AI, Machine Learning)

- 7.2. Enhanced Battery Management Systems (BMS)

- 7.3. Virtual Power Plants (VPPs) and Aggregation of DESS

- 7.4. Development of Hybrid DESS Solutions

- 7.5. Focus on Safety and Longevity of DESS

- 7.6. Progress in Battery Recycling and Second-Life Applications

- 8. Future Outlook and Projections (up to 2035)

- 8.1. Forecasted Market Size and CAGR (Global and Regional)

- 8.2. Emerging Opportunities in Specific Applications and Geographies

- 8.3. Impact of Regulatory Evolution and Decarbonization Goals

- 8.3. Evolution of Business Models (e.g., Storage-as-a-Service)

- 9. Conclusion

Major Key Players & Manufacturers in the Distributed Energy Storage System Market:

- Fluence

- Schneider Electric

- Tesla

- Toshiba Corporation

- General Electric Company

- Hitachi Energy Ltd.

- Panasonic Corporation

- Jabil Inc.

- Johnson Controls

- NextEra Energy Resources, LLC

- Samsung SDI Co., Ltd.

- BYD Company Ltd.

- LG Energy Solution

- Siemens AG

- ABB Ltd.

- Delta Electronics, Inc.

- Huawei Technologies Co., Ltd.

- GoodWe

- Growatt New Energy Co.,Ltd.

- Chilicon Power, LLC

- Darfon Electronics Corp.

- Fronius International GmbH

- Sungrow Power Supply Co., Ltd.

- FIMER Group

- Ginlong Technologies (Solis)

- Northern Electric Power Technology Inc.

- Sparq Systems Inc.

- Deye Inverter

- AEconversion GmbH & Co. KG

- Envertech

- Yotta Energy

- AES Corporation

- Enphase Energy

- Exide Technologies

- Luminous Power Technologies

- CATL

- Engie

- Enel X

- Honeywell International Inc.

- EDF

- Greensmith Energy

- AutoGrid Systems Inc.

- Sunverge Energy Inc.

- NGK Insulators Ltd.

- Nippon Chemi-Con Corporation

- Bloom Energy

- Sonnen

- Saft

- Albemarle

FAQ'S

For a single, multi and corporate client license, the report will be available in PDF format. Sample report would be given you in excel format. For more questions please contact:

Within 24 to 48 hrs.

You can contact Sales team (sales@marketinsightsresearch.com) and they will direct you on email

You can order a report by selecting payment methods, which is bank wire or online payment through any Debit/Credit card, Razor pay or PayPal.

Discounts are available.

Hard Copy