PV Inverter Market

PV Invertor Market – Global Industry Size, Share, Trends, Opportunity, and Forecast, Segmented by Type of Inverter (Central Inverters, String Inverters, Microinverters, Hybrid Inverters, Battery Inverters), By Technology (Grid-Tied Inverters, Off-Grid Inverters, Hybrid (Grid-Tied with Battery Backup) Inverters) By Application (Residential, Commercial, Industrial, Utility-Scale), By Region, By Company, Forecast 2025 - 2035

Published Date: May - 2025 | Publisher: MIR | No of Pages: 320 | Industry: Power | Format: Report available in PDF / Excel Format

View Details Buy Now 2890 Download Free Sample Ask for Discount Request Customization| Forecast Period | 2024-2028 |

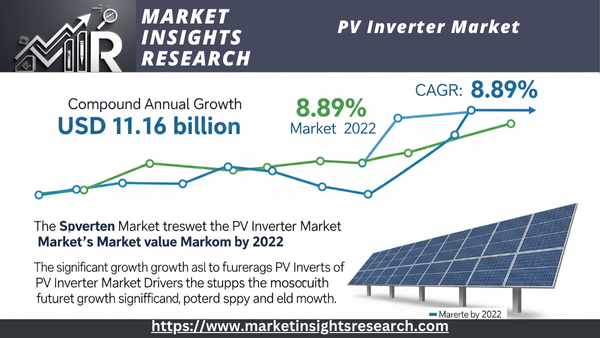

| Market Size (2022) | USD 11.16 billion |

| CAGR (2023-2028) | 8.89% |

| Fastest Growing Segment | Microinverters |

| Largest Market | Asia Pacific |

Market Overview

The global PV Inverter market has seen significant expansion in recent years and is expected to continue its strong growth trajectory through 2028. The market was valued at USD 11.16 billion in 2022 and is projected to achieve a compound annual growth rate (CAGR) of 8.89% during the forecast period.

Download Free Sample Ask for Discount Request Customization

The increasing energy demand has been a key driver for this market growth. Independent Power Producers (IPPs) are increasingly collaborating with inverter providers to develop customized, large-scale solar + storage projects designed to meet specific client requirements. Furthermore, emerging applications in electric vehicles and desalination are also creating new opportunities within the market.

Key Market Drivers

Rapid Growth in Solar Energy Installations

A major factor fueling the PV Inverter market is the rapid growth of solar energy installations globally. As countries increasingly adopt renewable energy sources to address environmental concerns and lower their carbon footprint, solar power has become a leader in the global energy transition. This increase in solar energy deployment requires efficient and reliable PV inverters, which are essential for converting DC (direct current) generated by solar panels into usable AC (alternating current) electricity for homes, businesses, and the grid.

Governments and utilities are encouraging solar adoption through subsidies, feed-in tariffs, and net metering programs, further increasing the demand for PV inverters. Moreover, advancements in solar technology, decreasing solar panel costs, and improved energy storage solutions have made solar energy more accessible and economically feasible. This continuous growth in solar installations is a key driver for the PV Inverter market, with manufacturers innovating to meet the rising demand for high-performance, grid-compliant inverters.

Integration of Energy Storage Solutions

The market for PV inverters is also being driven by the incorporation of energy storage options into solar PV systems. The capacity of energy storage devices, like lithium-ion batteries, to store extra solar-generated electricity during the day for use at night or during times of high energy demand has made them popular. PV inverters are changing to support hybrid systems, which combine energy storage and solar panels to optimize grid independence and energy self-sufficiency.

Grid stability, energy resilience, and the capacity to control energy expenses with energy storage technologies are becoming more and more desirable to consumers and enterprises. This tendency is especially noticeable in areas that frequently experience power outages, where there is a considerable demand for hybrid PV systems with inverters that can control both solar energy and battery storage. In response, producers are creating complex hybrid inverters with cutting-edge features like bidirectional power flow and grid-forming capabilities, which increase the systems' dependability and adaptability.

Download Free Sample Ask for Discount Request Customization

Favorable Regulatory Policies and Net Metering

Positive regulations and net metering programs are now major factors propelling the PV inverter market. Globally, governments and regulatory agencies are putting laws into place that promote the use of renewable energy sources and aid in the expansion of distributed solar photovoltaic systems. Solar investments are financially appealing because net metering, in particular, enables customers to send excess solar energy back into the grid and offset their electricity bills.

In addition to encouraging the installation of solar panels, these policies also increase demand for PV inverters that can integrate seamlessly with the grid. Businesses and homeowners are encouraged to invest in larger solar installations in areas that offer feed-in tariffs and other financial incentives, which raises the need for high-capacity inverters. industry participants are encouraged to create cutting-edge PV inverters that comply with grid codes and regulatory requirements by the existence of such supportive policies, which promotes additional industry expansion.

Key Market Challenges

Grid Integration Challenges and Grid Stability

The intricate problem of grid integration and maintaining grid stability in the face of variable solar power generation is one of the major obstacles confronting the PV inverter business. Although the rise in solar installations is praiseworthy, grid operators have difficulties as a result, necessitating the use of complex solutions like advanced PV inverters.

Voltage and frequency fluctuations in the grid may result from the sporadic nature of solar energy generation, which is impacted by variables such as the time of day and the weather. Both residential and commercial users may be impacted by this potential disruption in the stability and dependability of the electrical supply. Maintaining grid stability and ensuring smooth solar power integration are top priorities.

The task of creating grid-friendly inverters that can lessen these difficulties falls to PV inverter manufacturers. By independently regulating voltage and frequency, grid-forming inverters, for example, are a viable technology that can aid in grid stabilization. It is a challenging task to standardize and deploy such technologies across various grid infrastructures. Furthermore, grid regulations and regulatory frameworks could need to change to adapt to PV inverters' growing capabilities, which would be a constant issue for market participants.

Cost Pressures and Price Volatility

Navigating cost pressures and pricing volatility is another urgent issue facing the PV inverter market. Over time, the cost of solar panels and other balance-of-system components has significantly decreased, which has increased the economic appeal of solar energy. However, because PV inverters need cutting-edge technology to guarantee efficiency, dependability, and grid compliance, they constitute a crucial component with limited opportunity for cost reduction.

Due to price sensitivity brought on by market competition, PV inverter manufacturers are under pressure to provide affordable solutions without sacrificing quality. In this market, it's always difficult to strike a balance between cost and performance because consumers are looking for inverters that can provide high yields and long-term dependability while remaining within their means.

Additionally, the market for PV inverters is vulnerable to fluctuations in the cost of essential raw materials, including rare-earth metals and semiconductor components used in power electronics. Disruptions in the supply chain and worldwide economic conditions may affect the cost of materials, which may have an effect on PV inverter prices overall.

To stay competitive, manufacturers must devise plans to control cost variations, streamline production procedures, and investigate cutting-edge materials and manufacturing methods. Another persistent issue in the PV inverter market is striking a balance between cost-effectiveness and adhering to changing industry standards.

Download Free Sample Ask for Discount Request Customization

Key Market Trends

Advanced Grid Support and Smart InvertersEnhancing Grid Resilience

The growing use of smart inverters and improved grid support features is one significant trend affecting the PV inverter industry. Electrical grid stability and resilience have become critical as the use of renewable energy sources, especially solar power, increases. When renewable energy penetration is high, grid operators are looking for solutions that can actively support and manage the grid.

With their sophisticated grid support functions, smart inverters are becoming important contributors to improving grid stability. In order to assist avoid grid disruptions, these inverters can provide reactive power, independently control voltage and frequency, and even cut off from the grid during disruptions. The larger objectives of moving toward a more adaptable and durable grid architecture are in line with this trend.

Additionally, the integration of smart inverter features is being driven by the adoption of standards like IEEE 1547-2018 and regulations like California Rule 21. The market for PV inverters is seeing a major move toward smart, grid-responsive inverters as utilities and grid operators want grid support capabilities.

Energy Storage IntegrationThe Rise of Hybrid Systems

Energy storage integration is a game-changing trend in the PV Inverter market, leading to the increasing popularity of hybrid PV systems. These systems pair solar panels with energy storage solutions, often lithium-ion batteries, to enhance energy self-sufficiency and grid independence. PV inverters are crucial in managing the two-way flow of electricity between solar panels, batteries, and the grid.

Hybrid PV systems offer several benefits, including the ability to store surplus solar energy produced during the day for use at night or during times of high electricity demand. This trend aligns with consumers' growing interest in energy resilience, cost management, and reduced reliance on traditional grid electricity.

Manufacturers are innovating with hybrid inverters that can efficiently manage both solar generation and energy storage. These inverters feature advanced energy management algorithms, enabling optimal energy utilization and grid interaction. As energy storage technologies continue to advance and become more cost-effective, the PV Inverter market is poised for continued growth in the adoption of hybrid systems.

Digitalization and Monitoring SolutionsMaximizing Performance

Data-driven performance optimization made possible by digitalization and monitoring solution integration is changing the PV inverter market. PV inverters are evolving from passive equipment to data hubs that gather operational data in real time and offer insights for system maintenance and monitoring.

A number of variables are driving the development toward data-driven PV inverters. First, system operators and owners aim to optimize their solar installations' effectiveness and performance. They may watch energy generation, identify system irregularities, and maximize energy output with digital monitoring technologies, which guarantees a high return on investment.

Second, the value of predictive maintenance skills is growing. By anticipating and identifying possible problems, data analytics and machine learning algorithms included into PV inverters allow for proactive maintenance and minimize downtime. The industry's overarching objective of reducing operating and maintenance expenses is in line with this trend.

Third, PV systems can be remotely monitored and controlled thanks to the incorporation of IoT (Internet of Things) technology and networking characteristics. Rapid reaction to system events or failures is made possible by this remote accessibility, which also improves convenience for system owners.

Digitalization and monitoring solutions will continue to lead the PV inverter market's evolution, giving system owners, installers, and operators the means to get the most out of their solar installations' longevity and performance.

Segmental Insights

Type of Inverter Insights

The PV Inverter Market's "String Inverters" segment became the market leader in 2022 and is expected to stay so for the duration of the forecast. Because string inverters are adaptable, affordable, and suitable for a variety of solar PV setups, they have become increasingly popular. These inverters are a great option for both residential and commercial applications since they can control several solar panels that are connected in a string configuration. Due to their reputation for simplicity, scalability, and convenience of installation, string inverters are available to a wide range of consumers. Their appeal has also been strengthened by developments in string inverter technology, such as increased efficiency and monitoring capabilities. String inverters, which provide a dependable and affordable way to transform solar energy into usable electricity, are well-positioned to hold onto their supremacy as solar installations continue to rise globally due to residential and small-to medium-sized business projects.

Technology Insights

The PV Inverter Market's "Grid-Tied Inverters" segment became the market leader in 2022 and is expected to stay that way for the duration of the forecast. Due to their crucial function in linking solar PV systems to the electrical grid, grid-tied inverters—also referred to as grid-connected or on-grid inverters—have become more well-known. By facilitating the smooth integration of surplus solar power into the grid, these inverters provide grid stability while enabling customers to take advantage of feed-in tariff and net metering schemes. Grid-tied inverters are now the preferred option for utility-scale, commercial, and residential solar systems due to the growing emphasis on clean energy integration and the reduction of reliance on fossil fuels worldwide. They are the recommended technology for capturing solar energy while staying connected to the grid because of their effective grid synchronization, real-time monitoring capabilities, and adherence to grid standards and laws. Grid-tied inverters are anticipated to continue to hold their leading position as a crucial part of the PV inverter market as the shift to sustainable energy sources continues and electrical networks change to handle increased penetrations of renewable energy.

Regional Insights

That's accurate. In 2022, the Asia-Pacific region established itself as the leader in the PV Inverter Market, and it is projected to maintain this leading position throughout the forecast period.

This dominance can be attributed to several key factors

- The region is home to some of the world's largest solar markets, notably China and India, which have seen significant solar energy installations driven by government incentives, ambitious renewable energy targets, and increasing environmental awareness.

- Asia-Pacific has a strong manufacturing ecosystem for PV inverters, with many leading manufacturers based in countries like China, Taiwan, and South Korea. This local production helps in achieving competitive pricing and ensuring product availability, further boosting market growth.

- The region's varied energy landscape, ranging from densely populated urban areas to remote off-grid locations, drives demand for a wide spectrum of PV inverter types, including grid-tied, off-grid, and hybrid inverters.

As Asia-Pacific continues to prioritize the adoption of renewable energy and expand its solar capacity, the demand for PV inverters is expected to remain strong, solidifying the region's leadership in the global PV Inverter Market.

Download Free Sample Ask for Discount Request Customization

Recent Developments

-

In September 2023, Huawei launched its next-generation string inverter, the SUN2000-165KTL-H0, which offers up to 165 kW of maximum input power. This addition expands Huawei's product range for large commercial and utility-scale projects.

- In August 2023, SolarEdge acquired the EV charging business of Enphase Energy. This acquisition aims to strengthen SolarEdge's integrated solar+storage+EV charging solutions.

- In July 2023, Sungrow released its new 1500V string inverter series, claiming an industry-leading efficiency of 98.7%. This launch broadens Sungrow's portfolio of high-voltage products.

- In June 2023, FIMER introduced its String Inverter Technology (SIT) platform, featuring a modular design and integrated safety functions. This platform is well-suited for large commercial rooftops.

- In May 2023, KACO new energy acquired the string inverter business of German manufacturer Kostal. This acquisition enhances KACO's global production capacity and service network.

Key Market Players

- Huawei Technologies Co., Ltd

- Sungrow Power Supply Co., Ltd

- Delta Electronics, Inc

- Sineng Electric Co., Ltd

- KACO new energy GmbH

- Power Electronics

- FIMER SpA

- Zhejiang Jinzhou Energy Technology Co., Ltd.

- Chint Power Systems Co., Ltd.

- SolarEdge Technologies

|

By Type of Inverter |

By Technology |

By Application |

By Region |

|

|

|

|

Related Reports

- North America Commercial Boiler Market Size - By Fuel (Natural Gas, Oil, Coal, Electric), By Capacity, By Technology (Co...

- Water Tube Industrial Boiler Market Size By Capacity, By Application (Food Processing, Pulp & Paper, Chemical, Refinery,...

- U.S. Industrial Boiler Market Size By Fuel (Natural Gas, Oil, Coal), By Capacity, By Technology (Condensing, Non-Condens...

- Fire Tube Industrial Boiler Market - By Capacity (<10 MMBtu/hr, 10-25 MMBtu/hr, 25-50 MMBtu/hr, 50-75 MMBtu/hr, >75 MMBt...

- Gas Fired Boiler Market Size - By Capacity (≤ 10 MMBtu/hr, > 10 - 50 MMBtu/hr, > 50 - 100 MMBtu/hr, > 100 - 250 MMBtu/...

- Europe Residential Boiler Market Size - By Technology (Condensing {Natural Gas, Oil, Electric}, Non-Condensing {Natural ...

Table of Content

- 1. Executive Summary

- 1.1. Key Findings

- 1.2. Market Overview

- 1.3. Future Outlook

- 2. Introduction to the PV Inverter Market

- 2.1. What is a PV Inverter?

- 2.2. Types of PV Inverters

- 2.2.1. String Inverters

- 2.2.2. Central Inverters

- 2.2.3. Microinverters

- 2.2.4. Hybrid Inverters

- 2.3. Importance of PV Inverters in Solar Energy Systems

- 2.4. Scope of the Report

- 3. Market Overview

- 3.1. Current Market Size and Valuation (2025)

- 3.2. Market Dynamics

- 3.2.1. Drivers of Market Growth

- 3.2.1.1. Increasing Solar PV Installations Globally

- 3.2.1.2. Government Incentives and Policies Supporting Solar

- 3.2.1.3. Technological Advancements in Inverter Technology

- 3.2.1.4. Declining Costs of Solar Components

- 3.2.1.5. Rise in Energy Storage Solutions

- 3.2.2. Challenges and Restraints

- 3.2.2.1. High Initial Costs

- 3.2.2.2. Grid Integration Issues

- 3.2.2.3. Cybersecurity Risks for Smart Inverters

- 3.2.1. Drivers of Market Growth

- 4. Market Segmentation

- 4.1. By Product Type

- 4.1.1. String Inverters

- 4.1.2. Central Inverters

- 4.1.3. Microinverters

- 4.1.4. Hybrid Inverters

- 4.2. By Phase

- 4.2.1. Single-Phase

- 4.2.2. Three-Phase

- 4.3. By System Type

- 4.3.1. On-Grid

- 4.3.2. Off-Grid

- 4.4. By Application

- 4.4.1. Residential

- 4.4.2. Commercial

- 4.4.3. Utilities

- 4.5. By Power Output

- 4.1. By Product Type

- 5. Regional Analysis

- 5.1. North America

- 5.2. Europe

- 5.3. Asia Pacific

- 5.4. Latin America

- 5.5. Middle East & Africa

- 6. Competitive Landscape

- 6.1. Market Share Analysis of Key Players

- 6.2. Profiles of Major Companies

- 6.2.1. Huawei Technologies Co., Ltd.

- 6.2.2. Sungrow Power Supply Co., Ltd.

- 6.2.3. SMA Solar Technology AG

- 6.2.4. Power Electronics S.L.

- 6.2.5. SolarEdge Technologies Inc.

- 6.2.6. FIMER Group

- 6.2.7. Fronius International GmbH

- 6.2.8. Delta Electronics Inc.

- 6.2.9. Enphase Energy

- 6.2.10. Schneider Electric SE

- 6.2.11. ABB Ltd.

- 6.2.12. Other Prominent Players

- 6.3. Recent Developments and Agreements

- 7. Technological Trends and Innovations

- 7.1. Smart Inverters with Grid Support Functions

- 7.2. Hybrid Inverters Integrating Battery Storage

- 7.3. Module-Level Power Electronics (MLPE)

- 7.4. AI and IoT Integration for Monitoring and Optimization

- 7.5. Increased Efficiency and Reliability

- 8. Future Outlook and Projections (up to 2030/2034)

- 8.1. Forecasted Market Size and CAGR

- 8.2. Emerging Trends and Opportunities

- 8.3. Impact of Policy and Technological Advancements

- 9. Conclusion

To get a detailed Table of content/ Table of Figures/ Methodology Please contact our sales person at ( chris@marketinsightsresearch.com )

Major Key Players in the PV Inverter Market:

Based on the provided market research data, some of the major key players in the global PV Inverter Market include:

- Huawei Technologies Co., Ltd. (China): Holds a significant global market share and is known for its smart solar inverters and integration of AI and IoT technologies.

- Sungrow Power Supply Co., Ltd. (China): A prominent global supplier offering a broad range of PV inverter solutions, including string, central, and hybrid inverters.

- SMA Solar Technology AG (Germany): A key player involved in the production of solar inverters and AC converters for various photovoltaic systems.

- Fimer Group (Italy): Specializes in a wide range of PV solutions, including central and string inverters, and acquired ABB's solar inverter business.

- Delta Electronics Inc. (Taiwan): Offers various power and energy management products, including solar inverters.

- Schneider Electric SE (France): Provides a range of energy solutions, including solar and energy storage.

- Siemens AG (Germany): Operates in various sectors, including energy, and offers solar inverters.

- Mitsubishi Electric Corporation (Japan): A diversified company with a presence in the PV inverter market.

- Ginlong Technologies (Solis) (China): Provides cost-effective solar PV inverter solutions across different scales.

- Power Electronics S.L. (Spain): Specializes in utility-scale solar and energy storage inverters.

- SolarEdge Technologies Inc. (Israel): Known for its intelligent inverter solutions and DC-optimized inverter systems.

- Growatt New Energy Co., Ltd. (China)

- GoodWe (China)

- TMEIC (Toshiba Mitsubishi-Electric Industrial Systems Corporation) (Japan/US)

- ABB Ltd (Switzerland)

- Omron Corporation (Japan)

- Eaton (Ireland/US)

- Emerson Electric Co. (US)

- Yaskawa Solectria Solar (US)

- Canadian Solar (Canada)

- SunPower Corporation (US)

- Sineng Electric Co., Ltd. (China)

- First Solar (US)

- Fronius International GmbH (Austria)

- Hitachi Hi-Rel Power Electronics Private Limited (India)

- Kehua Technology Pvt Ltd (China)

- TBEA Energy (India) Pvt. Ltd. (China/India)

- Medha Servo Drives Pvt. Ltd. (India)

- Altenergy Power System Inc.

- Enphase Energy (US)

- Darfon Electronics Corp.

- General Electric Company (US)

- Exide Industries Ltd. (India)

- KACO New Energy (Germany)

- SHENZHEN SOFARSOLAR (China)

- Tabuchi Electric (Japan)

- Panasonic Corporation (Japan)

Manufacturers Key Players in the PV Inverter Market:

Many of the "Major Key Players" listed above are also manufacturers of PV inverters. To reiterate and highlight some of the key manufacturing companies:

- Huawei Technologies Co., Ltd.

- SUNGROW

- SMA Solar Technology AG

- Fimer Group

- Delta Electronics Inc.

- Power Electronics S.L.

- Ginlong Technologies (Solis)

- Schneider Electric SE

- Siemens AG

- Mitsubishi Electric Corporation

FAQ'S

For a single, multi and corporate client license, the report will be available in PDF format. Sample report would be given you in excel format. For more questions please contact:

Within 24 to 48 hrs.

You can contact Sales team (sales@marketinsightsresearch.com) and they will direct you on email

You can order a report by selecting payment methods, which is bank wire or online payment through any Debit/Credit card, Razor pay or PayPal.

Discounts are available.

Hard Copy