Residential Lead Acid Battery Market

Residential Lead Acid Battery Market – Global Industry Size, Share, Trends, Opportunity, and Forecast, Segmented By Product (Stationary, Motive, and Start Light & Ignition Batteries (SLI)), By Construction Method (Flooded and Valve Regulated Lead Acid (VRLA) Batteries), By Sales Channel (Original Equipment Market (OEM) & Aftermarket) By Region, Competition, 2018-2028

Published Date: May - 2025 | Publisher: MIR | No of Pages: 320 | Industry: Power | Format: Report available in PDF / Excel Format

View Details Buy Now 2890 Download Free Sample Ask for Discount Request Customization| Forecast Period | 2024-2028 |

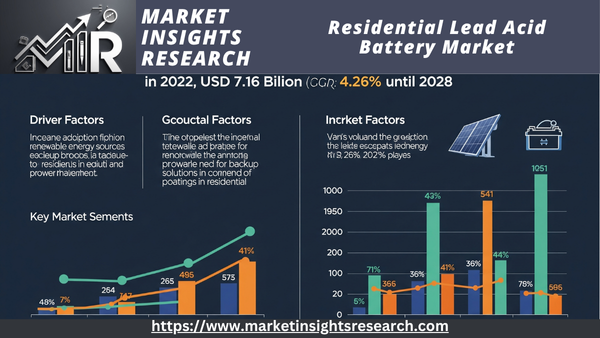

| Market Size (2022) | USD 7.16 Billion |

| CAGR (2023-2028) | 4.26% |

| Fastest Growing Segment | Start Light & Ignition Batteries (SLI) |

| Largest Market | Asia-Pacific |

Market Overview

The global residential lead acid battery market is valued at USD 7.16 billion in 2022 and is anticipated to experience robust growth in the forecast period with a CAGR of 4.26% through 2028.

Download Free Sample Ask for Discount Request Customization

A rechargeable energy storage device that stores electrical energy as chemical energy is a lead-acid battery. It is renowned for its dependability and cost, making it one of the most traditional and extensively used battery kinds. A sulfuric acid electrolyte, two lead-based electrodes, and a separator to stop electrical short circuits are the essential parts of a lead-acid battery. As sponge lead forms on the negative electrode and lead dioxide forms on the positive electrode, electrical energy is transformed into chemical energy during charging. For subsequent usage, this chemical energy is stored. The chemical energy that has been saved is transformed back into electrical energy when the battery discharges, supplying power to any systems or devices that are attached. Automotive starting batteries, backup power systems, uninterruptible power supply (UPS), and household machines are just a few of the many typical uses for lead-acid batteries. They are strong and have a high current output, but because they contain lead, a dangerous substance, they need to be maintained occasionally and disposed of carefully.

Key Market Drivers

Growing Demand for Home Energy Storage Solutions

The market for residential lead-acid batteries is expanding rapidly as a result of rising demand for energy storage products for homes. Several elements are the main sources of fuel for this driver

a. Energy IndependenceHomeowners are looking for methods to become more independent from the grid and less dependent on it. On bright days, excess energy produced by renewable sources, such as solar panels, can be stored thanks to lead-acid batteries. When the grid is disrupted or throughout the night, this stored energy might be used.

b. Grid ResilienceIn areas vulnerable to severe weather and power disruptions, the necessity of grid resilience is becoming increasingly clear. Lead-acid batteries guarantee that homes stay operational during blackouts by offering a dependable backup power source for essential appliances and systems.

c. Cost SavingsHomeowners are encouraged to purchase domestic lead-acid batteries as the price of solar panels and battery storage systems keeps falling. By storing and utilizing their own generated energy instead of depending entirely on grid power, these systems enable them to lower their electricity expenses.

Expansion of Solar Photovoltaic (PV) Installations

The growth of solar PV installations on residential rooftops is directly related to the market for lead-acid batteries for homes. This driver helps the market grow in the following ways

a. Growing Solar AdoptionHomeowners are investing in solar PV systems as a result of their desire to lessen their carbon footprints and their increased awareness of climate change. These installations are enhanced by lead-acid batteries, which make it possible to store extra solar energy for later use.

b. Energy ShiftingSolar photovoltaic systems frequently produce more energy than is required right away. Lead-acid batteries maximize self-consumption and minimize reliance on grid electricity by enabling households to transfer excess solar energy from the day to the evening or overcast days.

Download Free Sample Ask for Discount Request Customization

Government Incentives and Policies

The market for residential lead-acid batteries is significantly stimulated by government programs and incentives

a. Tax Credits and SubsidiesMany countries offer tax credits, rebates, or subsidies to households that purchase renewable energy equipment, such as solar panels and energy storage systems. Residential lead-acid battery systems are now more appealing and reasonably priced thanks to these financial advantages.

b. Net MeteringHomeowners can sell extra energy from their solar PV systems back to the grid through net metering regulations. By storing extra energy for later use, lead-acid batteries can increase these advantages and guarantee that homeowners get the most money for the energy they produce.

Advancements in Battery Technology

The market is expanding due to ongoing developments in lead-acid battery technology

Enhanced PerformanceHigher energy density, quicker charging, and longer cycle life are just a few of the enhanced performance features built into contemporary lead-acid batteries. Residential lead-acid battery systems are now more dependable and efficient thanks to these developments.

b. Smart Battery ManagementBy integrating smart battery management systems, leads-acid battery systems may be monitored and their performance optimized. This guarantees effective energy use and improves the user experience.

Environmental Considerations and Recycling Efforts

The market for residential lead-acid batteries is being influenced by homeowners' attention to the environment and their emphasis on proper waste management

a. Recycling InitiativesTo reduce the negative effects on the environment, lead-acid battery recycling is receiving more attention. Homeowners are being reassured about the environmentally friendly nature of lead-acid battery systems by industry initiatives and regulatory obligations to recycle these batteries securely.

b. Sustainable Energy PracticesBecause lead-acid batteries are recyclable and have a lower environmental impact than certain other battery technologies, many homes are embracing sustainable energy practices and are motivated to employ them for energy storage.

In conclusion, the growing need for home energy storage options, the growth of solar PV installations, encouraging government incentives, technological improvements, and a growing focus on environmental responsibility are all driving the residential lead-acid battery market. As more homes look to reduce their energy use and become energy independent, these factors work together to propel the market's expansion.

Government Policies are Likely to Propel the Market

Download Free Sample Ask for Discount Request Customization

Renewable Energy Incentives and Subsidies

Offering incentives and subsidies for the adoption of renewable energy is one of the most important government initiatives propelling the residential lead-acid battery market. The installation of solar photovoltaic (PV) systems and related energy storage devices, such as lead-acid batteries, is usually encouraged by these policies. Let's examine these incentives in more detail

Homeowners that invest in renewable energy solutions, such solar panels and energy storage, can receive tax credits from a number of governments. Residential users can now afford lead-acid battery systems because of these tax incentives, which directly lower the initial cost of installation.

Rebate ProgramsIn certain areas, homeowners who install solar and storage systems might get financial advantages through rebate programs. The cost of buying and setting up lead-acid battery systems for homes can be considerably reduced by these discounts.

Homeowners who install solar and battery systems in areas with feed-in tariffs (FiTs) may be compensated for any extra energy they feed back into the grid. Lead-acid batteries are essential for maximizing this process since they store excess energy for later usage and grid feed-in, which can benefit homeowners monetarily.

Net MeteringUnder net metering regulations, homeowners can get credits or other payment for the extra energy that their solar PV systems produce. Lead-acid batteries help homeowners get the most out of net metering by allowing them to store extra energy during the day for usage at night.

In addition to lowering the cost of household lead-acid battery systems, these renewable energy subsidies and incentives encourage homeowners to switch to greener, more sustainable energy sources.

Environmental Regulations and Recycling Mandates

The market for residential lead-acid batteries is significantly impacted by government regulations pertaining to battery recycling and environmental protection. These regulations aim to reduce the negative effects of lead-acid batteries on the environment and guarantee their proper recycling and disposal. Important elements consist of

Recycling RequirementsA number of nations mandate that producers of lead-acid batteries set up and finance recycling initiatives. With an emphasis on recovering valuable elements like lead and plastic, these initiatives make sure that spent batteries are gathered, transported, and recycled in an environmentally friendly manner.

Pollution ControlTo safeguard the quality of the air and water, regulations restrict the amount of lead and sulfuric acid released by battery production facilities. Tight emissions regulations and monitoring systems aid in preventing pollution and the harm it does to the environment and public health.

Labeling and Disposal of BatteriesGovernments frequently require lead-acid batteries to have clear labels and instructions for handling and disposal. To avoid contaminating the environment, this includes guidelines for recycling and proper disposal techniques.

Energy Efficiency Standards

The market for residential lead-acid batteries is also impacted by government regulations centered on energy efficiency requirements. These regulations seek to increase the energy efficiency of a range of domestic systems and appliances, including lead-acid batteries and other energy storage devices. Important elements consist of

Residential lead-acid battery systems are among the energy-efficient items certified by the Energy Star program, which is supported by numerous countries. Customers who want to lower their energy use and carbon footprint are more inclined to choose products that adhere to Energy Star standards.

Minimum Efficiency RequirementsIn order for goods like lead-acid batteries to be sold in the market, governments may set minimum energy efficiency requirements. Manufacturers are compelled by these standards to create battery systems that use less energy.

Consumer Protection and Safety Regulations

Regulations pertaining to consumer protection and safety are essential to guaranteeing the dependability and safety of residential lead-acid battery systems for homeowners. These regulations cover a number of topics, such as

Product Safety StandardsTo make sure that residential battery systems fulfill particular safety and performance requirements, governments frequently establish safety standards. Products must meet these requirements in order to be sold lawfully.

Guidelines for Installation and MaintenanceRules may lay forth requirements for the correct installation and upkeep of lead-acid battery systems in homes. These rules aid in preventing mishaps, fires, and other safety risks brought on by inappropriate handling.

Requirements for Consumer InformationGovernments may mandate that manufacturers give customers thorough information and paperwork, such as warranty terms, maintenance instructions, and safety rules. This guarantees that homeowners are knowledgeable about how to maintain and use their battery systems safely.

Grid Integration and Demand Response Programs

In order to enhance demand response initiatives and grid stability, several governments encourage the integration of household battery systems, especially lead-acid batteries, into the electrical grid. These regulations improve the grid's resilience and assist balance the supply and demand for energy. Important elements consist of

Incentives for Grid IntegrationBy permitting their battery systems to supply grid services at times of high demand, governments can provide incentives to households who take part in grid integration schemes. This can involve lower electricity prices or financial incentives.

Grid Compatibility StandardsRules may set rules and standards to ensure that home battery systems integrate seamlessly with the power grid. By adhering to these guidelines, battery systems can support grid operations in a safe and efficient manner.

Emergency Backup SupportIn order to supply vital infrastructure with emergency backup power in the event of grid outages or natural disasters, several areas encourage homeowners to install domestic battery systems, including lead-acid batteries. To encourage these installations, tax breaks or incentives might be provided.

In conclusion, government regulations have a significant impact on affordability, safety, environmental responsibility, and grid integration, all of which shape the residential lead-acid battery industry. These regulations are necessary to guarantee the long-term expansion of the residential energy storage market and to motivate homeowners to use more robust and clean energy sources.

Key Market Challenges

Technological Advancements and Competition from Alternative Technologies

Keeping up with technological improvements and the competition from alternative energy storage technologies, especially lithium-ion batteries and other advanced energy storage solutions, is a significant problem for the residential lead-acid battery market. Here's a closer look at this problem

Developments in Lithium-Ion BatteriesBy outperforming conventional lead-acid batteries in terms of energy density, cycle life, and charging speed, lithium-ion batteries have drawn a lot of interest and adoption. Lithium-ion batteries are very appealing for household energy storage applications because of these benefits.

Energy Density and Space RestrictionsCompared to lithium-ion batteries with comparable energy storage capacity, lead-acid batteries are heavier and bulkier. This restricts its applicability in settings with restricted space, including dwellings with limited installation spaces.

Limited Depth of DischargeThe lifespan of lead-acid batteries may be adversely affected by their sensitivity to deep discharges. This restriction is especially important in home situations where deep and regular cycling may be necessary.

Emerging TechnologiesIn terms of scalability, safety, and efficiency, emerging energy storage technologies including flow batteries, solid-state batteries, and alternative chemistries provide special benefits. These technologies are developing quickly and may provide conventional lead-acid batteries more competition.

Environmental and Safety Concerns

Another major issue facing the residential lead-acid battery market is safety and environmental issues. These issues center on the possible hazards connected to the use of lead-acid batteries as well as their effects on the environment over the course of their lifetime. Let's examine this challenge in more detail

Lead Pollution and RecyclingLead, a hazardous heavy metal found in lead-acid batteries, can endanger both human and environmental health if improperly handled and recycled. Lead pollution of land and water bodies can occur from the inappropriate disposal or recycling of lead-acid batteries, even with recycling efforts.

Limited Environmental FriendlinessWhen compared to certain other battery technologies, lead-acid batteries have a lower environmental impact. Their ecological impact is questioned due to the usage of sulfuric acid and lead in their production and recycling operations.

Safety precautionsLead-acid batteries need to be installed and used with adequate ventilation and safety precautions since they release explosive gasses when they charge and discharge. These batteries can cause mishaps, fires, or even explosions if used improperly.

Public Perception and acceptabilityThe public's perception and acceptability of lead-acid batteries may be impacted by their link to lead contamination and possible safety hazards. This may influence homeowners' inclination to install lead-acid battery systems, especially in places with strict environmental laws.

Regulatory ComplianceTo address safety and environmental issues, governments enforce stringent laws governing the manufacture, recycling, and disposal of lead-acid batteries. Manufacturers must make investments in recycling facilities and sustainable production methods in order to comply with these rules.

The residential lead-acid battery industry must make research and development investments to provide safer and cleaner battery technologies in order to meet the challenges posed by environmental and safety issues. Industry participants must also make appropriate recycling procedures a top priority and endeavor to inform the public about the advantages of recycling and disposing of batteries responsibly.

In summary, the market for residential lead-acid batteries faces difficulties with safety concerns, competition from alternative technologies, technological improvements, and the environment. To ensure the sustained expansion of domestic energy storage systems, overcoming these obstacles calls for a combination of innovation, regulatory compliance, and public awareness campaigns.

Segmental Insights

Start Light & Ignition Insights

With the biggest market share in 2022, the Start Light & Ignition category is anticipated to hold a dominant position throughout the projected period. The main purpose of light and ignition batteries is to supply the initial power boost needed to start internal combustion engine-powered vehicles, such as trucks, motorbikes, passenger automobiles, and other vehicles used in residential settings. They play a vital part in making sure cars start consistently. Light and ignition batteries are essential for meeting homeowners' automobile needs in residential settings. They are usually mounted in private automobiles, giving locals dependable mobility for everyday commutes, errands, and crises. Powering not only passenger cars but also motorbikes, recreational vehicles (RVs), and other motorized equipment used for both practical and recreational purposes, these batteries are an essential part of residential garages. Light and ignition batteries are renowned for their capacity to efficiently turn over the engine's starter motor by delivering a large amount of cranking power in a brief burst. This feature is essential, particularly in cold climates where starting engines takes more energy. They are perfect for the urgent needs of engine starting because of their ability to deliver a strong and quick electrical energy discharge.

Seasonal changes, such frigid winters, can have a big effect on how well Light & Ignition Batteries work in homes. Vehicle starting might be more difficult in colder climates because of decreased battery efficiency. To guarantee dependable car starting in the winter, many homeowners purchase cold-cranking amps (CCA) ratings for their light and ignition batteries.

Valve Regulated Led Acid (VRLA) Batteries Insights

With the biggest market share in 2022, the Valve Regulated Led Acid (VRLA) Batteries sector is anticipated to hold a dominant position throughout the projected period. Because of their adaptability, VRLA Batteries have been widely used in residential settings. They are used in a variety of ways to satisfy households' demands for energy storage and backup power. Backup power solutions are one of the main uses for VRLA Batteries in residential settings. In order to keep vital appliances and systems running during blackouts, homeowners depend on these batteries to supply constant electricity. Uninterruptible power supply (UPS) systems, which automatically transition to battery power in the event of a grid power outage, frequently incorporate VRLA Batteries. During blackouts, this is essential for protecting delicate devices and sustaining productivity. VRLA Batteries are essential for storing surplus energy produced by home solar photovoltaic (PV) systems, which are becoming more and more popular. During the day, homeowners can store excess solar energy to use at night or in situations without grid electricity. By enabling homeowners to maximize their own use of clean, renewable energy and lessen their need on the grid, VRLA Batteries promote energy independence.

Residential security systems and emergency lighting systems frequently incorporate VRLA Batteries. During power outages, they make sure that security equipment like cameras and alarms and emergency lights continue to work. This is crucial for preserving residential homes' safety and security and giving homeowners peace of mind.

Regional Insights

With more than 40% of the residential lead acid battery market in 2022, Asia Pacific is the largest market. The rising demand for lead acid batteries in China and India is responsible for the market's expansion in the Asia Pacific region. In Asia Pacific, China is the biggest market for lead acid batteries used in homes.

With more than 25% of the residential lead acid battery market in 2022, North America is the second-largest market. The rising demand for lead acid batteries in the US and Canada is responsible for the market's expansion in North America. North America's biggest market for household lead acid batteries is the US.

With more than 20% of the residential lead acid battery market in 2022, Europe is the third-largest market. The rising demand for lead acid batteries in Germany, France, and the UK is responsible for the market's expansion in Europe. In Europe, Germany is the biggest market for lead acid batteries used in homes.

Download Free Sample Ask for Discount Request Customization

Recent Developments

- In March 2022, Amara Raja Batteries Ltd., a leading manufacturer of lead acid batteries in India, announced an investment of USD127 million to expand its manufacturing capacity in Tamil Nadu, India. The investment will be used to build a new manufacturing plant and to upgrade the existing facilities. The expansion is expected to create over 1,000 new jobs.

- In April 2022, East Penn Manufacturing Co., a leading manufacturer of lead acid batteries in the United States, announced an investment of USD100 million to expand its manufacturing capacity in Pennsylvania, United States. The investment will be used to build a new manufacturing plant and to upgrade the existing facilities. The expansion is expected to create over 200 new jobs.

- In May 2022, Johnson Controls International PLC, a leading manufacturer of lead acid batteries in the world, announced an investment of USD 52 million to expand its manufacturing capacity in Europe. The investment will be used to build a new manufacturing plant in Germany. The expansion is expected to create over 100 new jobs.

- In June 2022, GS Yuasa International Ltd., a leading manufacturer of lead acid batteries in Japan, announced an investment of USD 87 million to expand its manufacturing capacity in Japan. The investment will be used to build a new manufacturing plant in Japan. The expansion is expected to create over 500 new jobs.

- In July 2022, EnerSys, a leading manufacturer of lead acid batteries in the world, announced an investment of USD 50 million to expand its manufacturing capacity in the United States. The investment will be used to build a new manufacturing plant in the United States. The expansion is expected to create over 100 new jobs.

Key Market Players

- EnerSys

- Stryten Energy LLC

- GS Yuasa Corporation

- East Penn Manufacturing Co. (US)

- Johnson Controls International PLC

- C&D Technologies Inc

- Crown Battery Manufacturing Co.

- Hoppecke AG

- NorthStar Battery Company

- Saft Groupe

|

By Product |

By Construction Method |

By Sales Channel |

By Region |

|

|

|

|

Related Reports

- U.S. Industrial Boiler Market Size By Fuel (Natural Gas, Oil, Coal), By Capacity, By Technology (Condensing, Non-Condens...

- Fire Tube Industrial Boiler Market - By Capacity (<10 MMBtu/hr, 10-25 MMBtu/hr, 25-50 MMBtu/hr, 50-75 MMBtu/hr, >75 MMBt...

- Gas Fired Boiler Market Size - By Capacity (≤ 10 MMBtu/hr, > 10 - 50 MMBtu/hr, > 50 - 100 MMBtu/hr, > 100 - 250 MMBtu/...

- Europe Residential Boiler Market Size - By Technology (Condensing {Natural Gas, Oil, Electric}, Non-Condensing {Natural ...

- U.S. Boiler Market Size By Fuel (Natural Gas, Oil, Coal), Capacity, By Technology (Condensing, Non-Condensing), By Produ...

- Commercial Hot Water Boiler Market Size - By Fuel (Natural Gas, Oil, Coal, Electric), By Technology (Condensing, Non-Con...

Table of Content

-

Executive Summary

-

1.1 Market Overview

-

1.2 Key Trends and Forecast Highlights

-

1.3 Strategic Recommendations

-

-

Introduction

-

2.1 Report Scope and Objectives

-

2.2 Research Methodology

-

2.3 Definitions and Market Classification

-

-

Market Overview

-

3.1 What Are Residential Lead Acid Batteries?

-

3.2 Historical Use in Backup and Off-Grid Power Systems

-

3.3 Role in Solar + Storage Solutions

-

3.4 Lead Acid vs. Lithium-Ion: Comparative Analysis

-

-

Market Dynamics

-

4.1 Market Drivers

-

4.1.1 Low Cost and Proven Reliability for Residential Backup

-

4.1.2 Widespread Use in Emerging Markets for Solar Homes

-

4.1.3 Supportive Off-Grid Energy Access Programs

-

-

4.2 Market Restraints

-

4.2.1 Lower Energy Density and Shorter Lifespan

-

4.2.2 Environmental and Safety Concerns

-

-

4.3 Market Opportunities

-

4.3.1 Hybrid System Deployment (Lead + Solar or Inverters)

-

4.3.2 Lead Recycling Economy and Circular Business Models

-

-

4.4 Market Challenges

-

4.5 Porter’s Five Forces Analysis

-

-

Technology Landscape

-

5.1 Flooded Lead Acid Batteries

-

5.2 Valve-Regulated Lead Acid (VRLA)

-

5.2.1 AGM (Absorbed Glass Mat)

-

5.2.2 Gel Cells

-

-

5.3 Charge Efficiency, Maintenance, and Cycle Life

-

5.4 BMS Integration and Hybrid Storage Configurations

-

-

Market Segmentation

-

6.1 By Product Type

-

6.1.1 Flooded

-

6.1.2 AGM

-

6.1.3 Gel

-

-

6.2 By Application

-

6.2.1 Off-Grid Homes

-

6.2.2 Solar + Battery Storage Systems

-

6.2.3 Backup Power for Critical Loads

-

6.2.4 Rural Electrification

-

-

6.3 By Voltage Rating

-

6.3.1 Below 12V

-

6.3.2 12V–48V

-

6.3.3 Above 48V

-

-

-

Regional Analysis

-

7.1 North America

-

7.2 Europe

-

7.3 Asia-Pacific

-

7.4 Latin America

-

7.5 Middle East & Africa

-

-

Market Size and Forecast (2020–2030)

-

8.1 Revenue and Volume Forecast

-

8.2 Regional Demand Outlook

-

8.3 Price Trends and Battery Replacement Cycles

-

-

Competitive Landscape

-

9.1 Market Share of Key Vendors

-

9.2 Key Company Profiles

-

9.2.1 Exide Technologies

-

9.2.2 Amara Raja Batteries

-

9.2.3 GS Yuasa

-

9.2.4 East Penn Manufacturing

-

9.2.5 Luminous Power Technologies

-

9.2.6 Others

-

-

9.3 Local Manufacturing, Distribution, and Recycling Strategies

-

-

Regulatory and Environmental Framework

-

10.1 Battery Safety, Labeling, and Transport

-

10.2 Lead Disposal and Recycling Mandates

-

10.3 Energy Access and Rural Electrification Policies

-

-

Innovation and Future Outlook

-

11.1 Smart Monitoring and IoT-Enabled Lead Acid Systems

-

11.2 Hybrid Models Combining Lead Acid with Solar and Lithium

-

11.3 Future Role in Low-Cost Residential Microgrids

-

-

Conclusion and Strategic Outlook

-

Appendices

-

13.1 Glossary

-

13.2 Research Methodology

-

13.3 References and Sources

To get a detailed Table of content/ Table of Figures/ Methodology Please contact our sales person at ( chris@marketinsightsresearch.com )

FAQ'S

For a single, multi and corporate client license, the report will be available in PDF format. Sample report would be given you in excel format. For more questions please contact:

Within 24 to 48 hrs.

You can contact Sales team (sales@marketinsightsresearch.com) and they will direct you on email

You can order a report by selecting payment methods, which is bank wire or online payment through any Debit/Credit card, Razor pay or PayPal.

Discounts are available.

Hard Copy