Lithium-Ion Battery Market

Lithium-Ion Battery Market – Global Industry Size, Share, Trends, Opportunity, and Forecast, Segmented By Component (Cathode, Anode and Others), By Product (Lithium Cobalt Oxide, Lithium Iron Phosphate, Lithium Iron Phosphate and Others), By Capacity (0–3,000 mAh, 3,000–10,000 mAh, 10,000–60,000 mAh, 60,000 mAh and Above), By Application (Consumer Electronics, Automotive, Industrial, Energy Storage Forecast & Opportunities, 2018-2028

Published Date: May - 2025 | Publisher: MIR | No of Pages: 320 | Industry: Power | Format: Report available in PDF / Excel Format

View Details Buy Now 2890 Download Free Sample Ask for Discount Request Customization| Forecast Period | 2024-2028 |

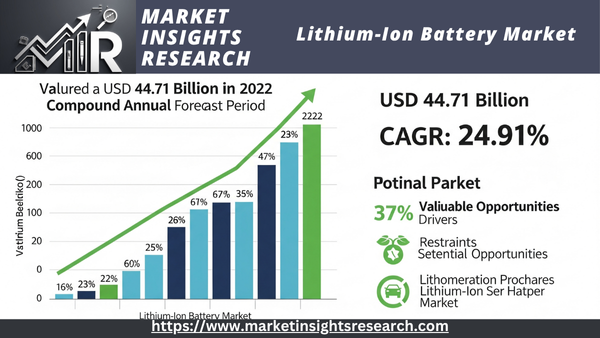

| Market Size (2022) | USD 44.71 billion |

| CAGR (2023-2028) | 24.91% |

| Largest Market | Asia Pacific |

| Fastest Growing Segment | Cathode |

Market Overview

The global lithium-ion battery market was estimated to be worth USD 44.71 billion in 2022 and is anticipated to expand at a compound annual growth rate (CAGR) of 24.91% over the course of the forecast period.

Download Free Sample Ask for Discount Request Customization

Because of its high energy density and extended shelf life, the lithium-ion battery can be used in cars and other vehicles. Growing consumer expenditure on consumer electronics is a major factor behind the growth of the worldwide lithium-ion battery industry. The high price of gasoline and fossil fuels is also contributing to the widespread adoption of electric vehicles, which is bolstering the expansion of the worldwide lithium-ion battery industry. The market for lithium-ion batteries is also expanding as a result of the expanding renewable energy industry. The market for lithium-ion batteries is expanding as a result of governments' steady investments in infrastructure and energy development initiatives. To support the growth of the lithium-ion battery business, major industry participants are also working with governmental organizations.

Key Market Drivers

Electric Vehicle (EV) Revolution

The global market for lithium-ion batteries is being significantly accelerated by the electric vehicle revolution. Much emphasis has been paid to the global movement toward ecologically friendly and sustainable transportation. Electric vehicles are becoming more and more accepted by governments, automakers, and customers as a practical way to improve energy efficiency, lower greenhouse gas emissions, and fight air pollution.

The automobile industry's shift from internal combustion engine (ICE) to electric vehicle (EV) vehicles has resulted in an unparalleled increase in demand for high-performance lithium-ion batteries. The recommended option for EVs is lithium-ion batteries, which are well-known for their high energy density, extended cycle life, and lightweight design.

The launch of new EV models, improvements in battery technology, and the growth of charging infrastructure all contribute to the acceleration of the trend towards electric transportation. The market for lithium-ion batteries is expanding due to the significant expenditures being made in EV production by well-known automakers like Tesla, Nissan, and Volkswagen.

Renewable Energy Integration

One major factor propelling the expansion of the lithium-ion battery industry is the incorporation of renewable energy sources, like wind and solar, into the global energy landscape.

Renewable energy generation's intermittent nature frequently presents a problem because it doesn't match energy demand. Energy storage systems, mostly in the form of lithium-ion batteries, are essential in addressing this issue since they stabilize the grid and provide a consistent supply of energy from renewable sources by holding extra energy during times of abundance and releasing it when needed.

Large-scale battery energy storage projects are becoming more and more common, servicing both remote locations with little access to traditional power grids and grid support applications. A sizable market for lithium-ion batteries is developing as a result of the integration of energy storage technologies with renewable energy installations. The use of renewable energy sources in conjunction with batteries is expected to rise exponentially as long as technological developments keep lowering costs and improving energy storage efficiency.

Download Free Sample Ask for Discount Request Customization

Consumer Electronics Proliferation

The proliferation of consumer electronics devices has long been a key driver of the lithium-ion battery market. Smartphones, laptops, tablets, wearable devices, and other portable electronics heavily rely on lithium-ion batteries due to their high energy density, lightweight design, and rechargeable nature.

The consumer electronics segment continues to be a significant contributor to the revenue of the lithium-ion battery market. As consumers demand devices with longer battery life, faster charging capabilities, and improved energy efficiency, manufacturers must innovate and produce advanced lithium-ion battery solutions. The trend of continuous innovation in consumer electronics stimulates the demand for lithium-ion batteries with enhanced performance characteristics.

Manufacturers are investing in research and development to create batteries that meet the growing power requirements of modern electronic devices. In conclusion, the global lithium-ion battery market is driven by the electric vehicle revolution, integration of renewable energy, and the proliferation of consumer electronics. These drivers are interconnected and collectively propel the industry's growth. As technological advancements continue to enhance lithium-ion battery performance, energy density, and cost-effectiveness, the market's expansion is expected to accelerate, providing sustainable and efficient energy solutions for various applications.

Download Free Sample Report

Key Market Challenges

Raw Material Supply Chain Vulnerability

The supply chain's sensitivity to raw materials is one of the biggest issues facing the lithium-ion battery industry. A number of essential components, including as lithium, cobalt, nickel, and graphite, are vital to lithium-ion batteries. Environmental problems, price volatility, and geopolitical tensions can all have an impact on the availability, extraction, and processing of these commodities.

The manufacturing of batteries may be significantly impacted by any interruption in the supply chain for these vital components, which could result in higher prices and possible shortages. Particularly, cobalt has drawn attention because of worries about unethical mining methods and possible supply shortages.

There is a rising movement to investigate substitute materials and reduce or eliminate cobalt from lithium-ion batteries in order to address this issue. Furthermore, initiatives to broaden the sources of supply and boost the rates of recovery and recycling of these resources are gaining momentum.

Safety and Thermal Management

One of the biggest challenges is making sure lithium-ion batteries are safe. Thermal runaway events can cause overheating, fires, and even explosions with these batteries.

Safety issues are especially pertinent to energy storage and electric car applications. Safety problems can harm manufacturers' reputations in addition to posing a risk to users. Battery designs need to include strong heat management and safety measures as safety standards and regulations get stricter.

An increasing number of advanced thermal management systems are being developed to address safety concerns. These systems include better cooling methods and the use of advanced materials to improve thermal stability. Furthermore, solid-state batteries are becoming more and more popular as a possible remedy due to their inherent increased safety.

Download Free Sample Ask for Discount Request Customization

Key Market Trends

Transition to High-Nickel Cathode Chemistries

The move toward high-nickel cathode chemistries, particularly nickel-cobalt-manganese (NCM) and nickel-cobalt-aluminum (NCA) formulations, is a notable trend in the lithium-ion battery market. Comparing high-nickel cathodes to conventional lithium-cobalt oxide (LiCoO2) cathodes reveals a number of benefits, such as increased energy density, higher thermal stability, and longer cycle life. The electric vehicle (EV) industry's increasing demand for batteries with greater energy capacity and range is the main factor driving the switch to high-nickel cathodes. Automakers can now produce EVs with longer driving ranges and quicker charging thanks to high-nickel chemistries, which successfully allays a major worry of prospective EV purchasers.

In an effort to attain even greater energy densities, battery manufacturers are aggressively raising the amount of nickel in cathode formulations. As researchers continue to enhance the balance between energy density and other performance factors, this trend is anticipated to continue.

There is a discernible trend toward lowering the cobalt percentage in cathode materials while maintaining performance and safety in order to address supply chain issues and lower cobalt-related expenses.

Gigafactories and Capacity Expansion

The building of gigafactories and the significant increase in manufacturing capacity are two noteworthy trends in the lithium-ion battery business. To accommodate the increasing demand for lithium-ion batteries across a range of applications, major investments in large-scale manufacturing facilities are being made by leading battery manufacturers and IT businesses. The market is greatly impacted by the construction of gigafactories since it increases total production capacity, reduces manufacturing costs, and permits economies of scale.

As a result, this makes lithium-ion batteries more accessible and affordable for both individuals and companies. Prominent corporations like Tesla, CATL, and LG Chem are aggressively growing their manufacturing plants worldwide, encompassing strategic areas like the US, Europe, and Asia. The markets for energy storage and electric vehicles are supported by this trend. In order to secure access to raw materials, improve operational efficiency, and lower production costs, battery manufacturers are now rapidly integrating their supply chains.

Segmental Insights

Product

The global market for lithium-ion batteries is dominated by the lithium cobalt oxide category. An important part of the global lithium-ion battery market is the lithium cobalt oxide (LiCoO2) segment. Due to its remarkable energy density, LiCoO2 is a commonly utilized cathode material in lithium-ion batteries. Because of its high energy density, it is widely used in portable electronics and consumer electronics. The continuous attempt to lower the amount of cobalt in batteries, motivated by its expense and related ethical and environmental issues, is one noteworthy development in the LiCoO2 market.

Manufacturers of batteries are constantly looking for ways to use less cobalt while maintaining peak performance. Because consumer electronics safety is still of the utmost importance, producers have developed LiCoO2 batteries with cutting-edge safety features including protection circuits and thermal management systems, which successfully reduce the hazards of overcharging and overheating.

LiCoO2 batteries with improved energy density and longer cycle life are required due to the ongoing spike in demand for smartphones, laptops, and other portable electronic devices worldwide. In order to improve the performance of LiCoO2 batteries, battery makers continuously pursue innovation, concentrating on important aspects including energy density, charging speed, and total lifespan.

Capacity Insights

3,000–10,000 mAh segment

Consumer gadgets like smartphones, tablets, e-readers, digital cameras, and portable gaming consoles are the main uses for batteries in this market. Innovation in this market is driven by growing consumer demand for faster charging times and longer battery life. The energy density of lithium-ion batteries in this range is constantly being improved by battery makers, enabling smaller, lighter devices with longer runtimes.

The need for batteries in the 3,000–10,000 mAh range is further fueled by the growing global market for smartphones, tablets, and portable gadgets. Furthermore, small-scale energy storage systems that use batteries with this capacity range are becoming more and more common. These systems allow households to store extra energy produced by renewable sources, such as solar panels, for their future use.

Download Free Sample Report

Regional Insights

Over the course of the forecast period, the Asia Pacific region is anticipated to lead the market. The global revolution in electric vehicles is being spearheaded by the Asia-Pacific area. Electric vehicles and two-wheelers are becoming more and more popular in nations like China, Japan, South Korea, and India. The demand for lithium-ion batteries has increased as a result of governments enacting strict emission regulations and providing incentives for electric vehicles.

Manufacturers of lithium-ion batteries have benefited greatly from the shift to electric mobility in metropolitan areas. The use of electric vehicles is anticipated to increase as a result of continuous technological developments that increase battery energy density and lower costs. Renewable energy generation, such as solar and wind power, has also gained more attention in the Asia-Pacific area.

Lithium-ion batteries are essential components of energy storage systems that allow the grid to efficiently manage sporadic renewable energy sources. Lithium-ion battery energy storage systems combined with solar and wind installations increase the stability and dependability of renewable energy grids. The Asia-Pacific market for lithium-ion batteries is expected to grow significantly as a result of this trend.

Additionally, Asia-Pacific is a major global center for the production of consumer electronics. Lithium-ion batteries are essential to the manufacturing of smartphones, laptops, tablets, and other portable electronics. High-quality batteries are becoming more and more necessary as the demand for these devices keeps growing. The demand for sophisticated lithium-ion batteries with increased energy density and longer cycle life is fueled by the ongoing innovation in consumer devices, such as smartphones with longer battery lives and lighter, more compact computers.

Numerous nations in the Asia-Pacific area have put in place incentives and laws that encourage the use of lithium-ion batteries in a range of applications. These initiatives include renewable energy objectives, tax breaks, and electric car subsidies. It is anticipated that government policies will continue to be in line with sustainability objectives, which will support the lithium-ion battery industry in the Asia-Pacific area even more.

Download Free Sample Ask for Discount Request Customization

Recent Developments

- In February 2022, Panasonic Holdings Corporation is set to establish a production facility at its Wakayama Factory in western Japan. The purpose is to manufacture new "4680" lithium-ion batteries for electric vehicles, as part of the company's global business expansion strategy. Productivity verification and mass production are expected to commence by the end of fiscal year 2024.

- In October 2021, LG Energy Solution, a subsidiary of LG Chem, signed a memorandum of understanding with Stellantis N.V. to establish a joint venture for the production of battery cells and modules in North America. This collaboration aligns with Stellantis N.V.'s goal of capturing a 40% market share in the United States with electrified vehicles by 2030. The batteries manufactured in this plant will be supplied to Stellantis N.V.'s assembly plants in the United States, Canada, and Mexico for integration into next-generation electric vehicles.

- In January 2021, BYD Company Ltd. formed a partnership with Chinese lithium-ion recycling startup, Pandpower Co., Ltd., and Japanese trading house, Itochu, for the conversion of old batteries into energy storage systems. Used battery packs from buses, taxis, and other vehicles are collected from BYD Company Ltd. dealerships across China and transformed into ship-container-sized power units for renewable energy applications and industrial use.

Key Market Players

- BYD Company Limited

- Contemporary Amperex Technology Co. Limited

- LG Chem Ltd

- Panasonic Corporation

- Samsung SDI

- Sony Corporation

- Tesla Inc.

- Tianjin Lishen Battery Joint-Stock Co. Ltd

- Toshiba Corporation

- Hitachi Chemical Co. Ltd.

|

By Component |

By Product |

By Capacity |

By Application |

By Region |

|

|

|

|

|

|

|

Related Reports

- U.S. Industrial Boiler Market Size By Fuel (Natural Gas, Oil, Coal), By Capacity, By Technology (Condensing, Non-Condens...

- Fire Tube Industrial Boiler Market - By Capacity (<10 MMBtu/hr, 10-25 MMBtu/hr, 25-50 MMBtu/hr, 50-75 MMBtu/hr, >75 MMBt...

- Gas Fired Boiler Market Size - By Capacity (≤ 10 MMBtu/hr, > 10 - 50 MMBtu/hr, > 50 - 100 MMBtu/hr, > 100 - 250 MMBtu/...

- Europe Residential Boiler Market Size - By Technology (Condensing {Natural Gas, Oil, Electric}, Non-Condensing {Natural ...

- U.S. Boiler Market Size By Fuel (Natural Gas, Oil, Coal), Capacity, By Technology (Condensing, Non-Condensing), By Produ...

- Commercial Hot Water Boiler Market Size - By Fuel (Natural Gas, Oil, Coal, Electric), By Technology (Condensing, Non-Con...

Table of Content

-

Executive Summary

-

1.1 Market Overview

-

1.2 Key Trends and Forecast Insights

-

1.3 Strategic Recommendations

-

-

Introduction

-

2.1 Report Scope and Objectives

-

2.2 Research Methodology

-

2.3 Definitions and Assumptions

-

-

Market Overview

-

3.1 What Are Lithium-Ion Batteries?

-

3.2 Evolution and Technological Milestones

-

3.3 Value Chain Analysis and Ecosystem Overview

-

3.4 Key Advantages Over Other Chemistries

-

-

Market Dynamics

-

4.1 Market Drivers

-

4.1.1 Surge in Electric Vehicle (EV) Production

-

4.1.2 Rapid Expansion of Renewable Energy Storage Needs

-

4.1.3 Rising Demand for Consumer Electronics and Mobile Devices

-

-

4.2 Market Restraints

-

4.2.1 Supply Chain Constraints for Lithium and Cobalt

-

4.2.2 Fire Risk and Thermal Runaway Concerns

-

-

4.3 Market Opportunities

-

4.3.1 Growth of Grid-Scale and Residential Storage Markets

-

4.3.2 Recycling and Second-Life Battery Programs

-

-

4.4 Challenges

-

4.5 Porter’s Five Forces Analysis

-

-

Technology Landscape

-

5.1 Lithium-Iron Phosphate (LFP)

-

5.2 Nickel Manganese Cobalt (NMC)

-

5.3 Nickel Cobalt Aluminum (NCA)

-

5.4 Lithium Titanate (LTO)

-

5.5 Innovations: Solid-State, Silicon Anodes, and Fast Charging

-

-

Market Segmentation

-

6.1 By Product Type

-

6.1.1 Cells

-

6.1.2 Battery Packs

-

-

6.2 By Form Factor

-

6.2.1 Cylindrical

-

6.2.2 Prismatic

-

6.2.3 Pouch

-

-

6.3 By Application

-

6.3.1 Electric Vehicles (BEVs, PHEVs, HEVs)

-

6.3.2 Consumer Electronics

-

6.3.3 Energy Storage Systems (Residential, Commercial, Utility)

-

6.3.4 Industrial Equipment

-

6.3.5 Others

-

-

-

Regional Market Analysis

-

7.1 Asia-Pacific (China, Japan, South Korea, India)

-

7.2 North America (U.S., Canada)

-

7.3 Europe (Germany, France, UK, Nordic Countries)

-

7.4 Latin America

-

7.5 Middle East & Africa

-

-

Market Size and Forecast (2020–2030)

-

8.1 Revenue and Volume Forecast by Region and Segment

-

8.2 Battery Production Capacity and Cost Trends

-

8.3 EV Battery Gigafactory Pipeline and Investments

-

-

Competitive Landscape

-

9.1 Market Share Analysis

-

9.2 Key Company Profiles

-

9.2.1 Contemporary Amperex Technology Co. Ltd. (CATL)

-

9.2.2 LG Energy Solution

-

9.2.3 Panasonic Corporation

-

9.2.4 BYD Company Ltd.

-

9.2.5 Samsung SDI

-

9.2.6 Others

-

-

9.3 M&A Activity, Strategic Alliances, and Joint Ventures

-

-

Regulatory and Policy Framework

-

10.1 Battery Safety Standards (UN38.3, IEC62133)

-

10.2 Incentives and EV Battery Mandates

-

10.3 Environmental Policies and Recycling Legislation

-

-

Innovation and Future Outlook

-

11.1 Solid-State Batteries and Energy Density Breakthroughs

-

11.2 AI in Battery Health Monitoring and Predictive Maintenance

-

11.3 ESG Reporting and Circular Economy in Battery Supply Chains

-

-

Conclusion and Strategic Outlook

-

Appendices

-

13.1 Glossary

-

13.2 Research Methodology

-

13.3 References and Sources

To get a detailed Table of content/ Table of Figures/ Methodology Please contact our sales person at ( chris@marketinsightsresearch.com )

FAQ'S

For a single, multi and corporate client license, the report will be available in PDF format. Sample report would be given you in excel format. For more questions please contact:

Within 24 to 48 hrs.

You can contact Sales team (sales@marketinsightsresearch.com) and they will direct you on email

You can order a report by selecting payment methods, which is bank wire or online payment through any Debit/Credit card, Razor pay or PayPal.

Discounts are available.

Hard Copy