Germany Battery Energy Storage System Market

Germany Battery Energy Storage System Market, By Battery Type (Lithium-Ion Batteries, Advanced Lead-Acid Batteries, Flow Batteries, Others), By Connection Type (On-grid and Off-grid), By Energy Capacity (Above 500 MWh, Between 100 to 500 MWh, Below 100 MWh), By Application (Utility, Commercial, Residential), By Country, Competition, Forecast and Opportunities, 2028

Published Date: May - 2025 | Publisher: MIR | No of Pages: 320 | Industry: Power | Format: Report available in PDF / Excel Format

View Details Buy Now 2890 Download Free Sample Ask for Discount Request Customization| Forecast Period | 2024-2028 |

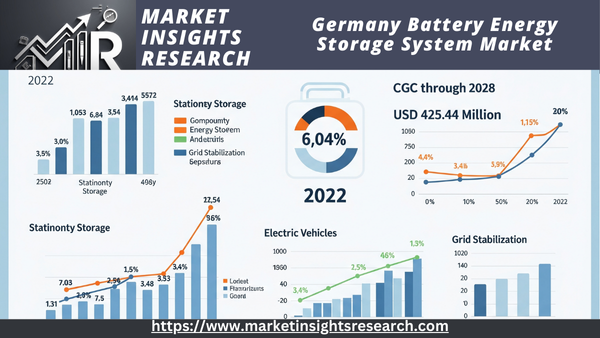

| Market Size (2022) | USD 425.44 Million |

| CAGR (2023-2028) | 6.04% |

| Fastest Growing Segment | Advanced Lead-Acid Batteries |

| Largest Market | Noth-West Germany |

Market Overview

The German market for battery energy storage systems was estimated to be worth USD 425.44 million in 2022 and is expected to develop at a strong rate during the forecast period, with a compound annual growth rate (CAGR) of 6.04% through 2028. Advanced technological configurations known as Battery Energy Storage Systems (BESS) store electrical energy in rechargeable batteries for future use.

Download Free Sample Ask for Discount Request Customization

By storing extra electricity produced at times of low demand, as when it comes from renewable sources like solar or wind, and releasing it during times of high demand or when renewable generation is low, these systems are essential to contemporary energy management. By responding quickly to changes in supply and demand, BESS helps power grids become more reliable and stable. They aid in frequency regulation, load balancing, and the reduction of voltage anomalies. Because of its versatility, BESS can be used at several settings, ranging from huge utility-scale installations to household setups. The increased demand for grid resilience, intermittent renewable resource integration, and sustainable energy solutions is driving their growing use.

Key Market Drivers

Germany’s Battery Energy Storage Systems (BESS) MarketCatalysts for Transformation by 2025 and Vision for 2035

Germany remains at the forefront of Battery Energy Storage Systems (BESS) deployment, with a host of transformative drivers shaping the sector’s trajectory. These foundational elements reflect Germany’s broader ambition to lead the clean energy revolution and achieve a resilient, low-carbon future.

Energiewende 2.0 and Accelerated Renewable Adoption

At the core of Germany’s clean energy mission lies the continued evolution of Energiewende. This renewed phase, targeting significant renewable integration by 2035, prioritizes smart energy storage. BESS solutions are critical enablers—bridging the gap between inconsistent generation from solar and wind and the grid's need for stable, controllable energy flows. By 2025, Germany is expected to have increased renewable capacity by over 30%, prompting urgent expansion of storage capacity to match this growth.

Enhancing Grid Flexibility and Reliability

As Germany transitions away from fossil fuel reliance, grid resilience becomes paramount. BESS systems offer real-time balancing—smoothing frequency fluctuations, managing voltage shifts, and providing immediate load response. This technical agility enables the grid to accommodate the intermittency of renewables and avoid blackouts, especially as traditional baseload plants are phased out by 2035.

Next-Generation Market Participation and Ancillary Services

The modern energy landscape demands agility—and BESS delivers. By participating in balancing markets, providing frequency containment reserves, and contributing to demand-side response initiatives, these systems allow operators to monetize flexibility while supporting overall grid health. From 2025 onwards, energy arbitrage and real-time grid support will form a multi-billion-euro segment of the BESS market.

Accelerating Climate Targets and COâ‚‚ Reduction Goals

Germany’s climate strategy envisions a 65% reduction in emissions by 2035 compared to 1990 levels. Battery storage is essential to this roadmap, enabling full utilization of clean energy sources and reducing dependence on fossil fuel peaker plants. By efficiently storing excess energy and minimizing curtailment, BESS directly contribute to lowering grid-based emissions.

Technological Innovation and Digital Integration

Germany’s leadership in engineering and automation feeds directly into BESS development. Advances in lithium-ion and solid-state battery technology, AI-driven energy management systems, and blockchain-enabled energy trading will dominate the sector between 2025 and 2035. These innovations will increase storage duration, safety, and efficiency, making BESS more commercially viable across all scales.

Supportive Policies and Robust Regulation

Government policy remains a cornerstone of BESS growth. Germany’s Federal Network Agency (BNetzA) continues to roll out incentives, funding schemes, and streamlined permitting processes. Key regulatory reforms in 2025 are expected to eliminate double-charging for storage, making the economics of BESS even more attractive to investors and utilities alike.

Energy Sovereignty and Disaster Resilience

The geopolitical landscape of the 2020s has underscored the need for national energy resilience. BESS is now viewed not just as an enabler of decarbonization, but as a shield against energy crises. Systems deployed in critical infrastructure—from hospitals to data centers—ensure continuity during grid failures. By 2035, decentralized storage will be a standard feature in Germany’s energy security blueprint.

Innovation Hubs and Industry Growth

Germany’s prowess in clean-tech R&D has positioned it as a global hub for energy storage breakthroughs. The growth of local manufacturing clusters, supported by EU battery alliances, ensures supply chain resilience and job creation. Between 2025 and 2035, the BESS sector is projected to create over 60,000 jobs, spanning production, installation, software development, and maintenance.

Download Free Sample Ask for Discount Request Customization

Key Market Challenges

Germany is leading the energy revolution, but the road to full-scale adoption of Battery Energy Storage Systems (BESS) isn’t without its hurdles. While the potential is vast, several complex challenges need addressing to turn that potential into reality.

Evolving and Fragmented Regulations

One of the major roadblocks is regulatory inconsistency. Germany’s energy laws are still catching up with the fast-paced evolution of storage technologies. With differing policies across regions and ongoing legislative changes, developers often face uncertainty, making long-term planning and cross-border projects more difficult to execute confidently.

Lack of Industry-Wide Standards

Without universal technical and safety standards, integration becomes complicated. Manufacturers use varied designs and protocols, which can create compatibility issues. This lack of standardization makes it harder for BESS to scale seamlessly across the grid and delays the broader rollout of energy storage infrastructure.

Complex Permitting and Location Issues

Getting the green light to install a BESS isn't easy. Navigating the maze of permits and approvals can slow projects down. Local opposition, environmental considerations, and overlapping jurisdictions all contribute to delays and rising costs, especially in urban or protected zones.

High Upfront Costs and Financing Challenges

Even though BESS promises long-term savings, the initial capital outlay can be a major deterrent. Securing investment is tough—particularly for larger projects—because of unclear revenue models and unpredictable returns. Investors want certainty, and without stable incentives or market clarity, many hesitate to commit.

Grid Integration Limitations

Connecting BESS to Germany’s legacy grid infrastructure isn’t always straightforward. Many systems need upgrades to handle two-way electricity flows, frequency management, and reactive power. Without modernization, the full benefit of storage—like peak shaving and renewable smoothing—remains underutilized.

Keeping Up with Technological Shifts

Battery technology is evolving rapidly. While progress brings better performance and lower prices, it also introduces the risk of choosing solutions that could soon become outdated. Developers face a tough balancing actinvest in proven tech or bet on emerging innovations that may offer long-term gains but higher short-term risk.

Material Scarcity and Supply Chain Issues

Critical minerals like lithium, cobalt, and nickel are essential for battery production—but sourcing them ethically and sustainably is a growing concern. Volatile markets, geopolitical tensions, and environmental impact all influence supply chain stability, affecting both pricing and project scalability.

Sizing and System Optimization

Finding the right scale and configuration for each BESS project is a technical puzzle. Overbuild and you risk wasted investment; underbuild and you may not meet grid demands. Accurate forecasting, grid analysis, and understanding market dynamics are vital but challenging tasks.

Public Perception and Local Resistance

BESS installations, especially near residential areas, can face public pushback. Safety concerns, misinformation, and a lack of awareness about the system’s benefits can lead to resistance. Engaging communities early and building trust through education is crucial for smooth project rollouts.

Navigating Market Participation

BESS operates in a complex economic environment. From capacity markets to frequency regulation and energy arbitrage, navigating the layers of compensation is no easy feat. Ensuring fair and reliable revenue streams for storage services requires more robust and transparent market structures.

Segmental Insights

Battery Type

In the market for battery energy storage systems, the Lithium-Ion Battery sector took the lead in 2022 and is expected to stay there for the duration of the forecast. Developments in Li-ion battery technology are supported by Germany's research and innovation environment. The total value proposition of Li-ion-based BESS is improved by advancements in energy density, cycle life, and safety brought about by partnerships between research institutes, academia, and industry.

Application Insights

Regional Insights

The most advanced BESS market in Germany is found in the North-East region. This is because of how densely populated and industrialized this area is. Because of the increasing need for grid balancing and the growing demand for renewable energy, the Central German region is also an established market for BESS. The growing investment in renewable energy in the South German region has made it a developing market for BESS. Because there is no need for BESS in East Germany, this region has the least developed BESS market in Germany.

Download Free Sample Ask for Discount Request Customization

Recent Developments

- In November 2022RWE announced its plans to install 220 MW of battery storage capacity at two decommissioned lignite-fired and coal-fired power plants in North Rhine-Westphalia, Germany, for around USD 147 million. The construction of this project is scheduled to start in 2023, and commissioning is planned for 2024.

- In October 2022Fluence Energy GmbH and TransnetBW GmbH announced the deployment of the world’s largest battery-based energy storage-as-transmission project. Fluence Energy GmbH is a leading company in energy storage products and services, and TransnetBW GmbH is Germany's leading transmission system operator. With this project, both companies aim to improve energy security and significantly support Germany’s energy transition pathway by increasing the efficiency of the existing grid infrastructure.

Key Market Players

-

Siemens AG

-

LG Chem

-

BYD Co. Ltd

-

Samsung SDI

-

Enpal

-

Sonnen GmbH

-

Fraunhofer-Gesellschaft

-

Redt Energy PLC

|

By Battery Type

|

By Energy Capacity

|

By Application

|

By Connection Type |

By Region |

|

|

|

|

|

Related Reports

- U.S. Boiler Market Size By Fuel (Natural Gas, Oil, Coal), Capacity, By Technology (Condensing, Non-Condensing), By Produ...

- Commercial Hot Water Boiler Market Size - By Fuel (Natural Gas, Oil, Coal, Electric), By Technology (Condensing, Non-Con...

- UK Commercial Boiler Market Size By Fuel (Natural Gas, Oil, Coal, Electric), By Capacity, By Technology (Condensing, Non...

- Residential Electric Boiler Market Size - By Voltage Rating (Low Voltage, Medium Voltage), Industry Analysis Report, Reg...

- Europe Steam Boiler Market - By Capacity, By Fuel (Natural Gas, Oil, Coal), By Technology (Condensing, Non-Condensing), ...

- Electric Boiler Market Size By Voltage Rating (Low, Medium), By Application (Residential, Commercial, Industrial, Food P...

Table of Content

-

Executive Summary

-

1.1 Market Overview

-

1.2 Key Insights and Developments

-

1.3 Strategic Recommendations

-

-

Introduction

-

2.1 Report Objectives and Scope

-

2.2 Methodology and Data Sources

-

2.3 Definitions and Market Segmentation

-

-

Market Overview

-

3.1 Role of BESS in Germany’s Energiewende

-

3.2 Integration with Solar, Wind, and Distributed Generation

-

3.3 Market Evolution: From Pilot Projects to Commercial Scale

-

3.4 Ecosystem and Value Chain Overview

-

-

Market Dynamics

-

4.1 Market Drivers

-

4.1.1 High Penetration of Rooftop Solar PV

-

4.1.2 Feed-in Tariff Expiry and Rise of Self-Consumption

-

4.1.3 Growth of EVs and Residential Energy Independence

-

-

4.2 Restraints

-

4.2.1 Complex Permitting and Regional Policy Variations

-

4.2.2 CAPEX Sensitivity and Subsidy Reliance

-

-

4.3 Opportunities

-

4.3.1 Second-Life Battery Utilization

-

4.3.2 BESS Integration into Virtual Power Plants (VPPs)

-

-

4.4 Challenges

-

4.5 Porter’s Five Forces Analysis

-

-

Technology Landscape

-

5.1 Lithium-Ion Dominance and Chemistries (LFP, NMC)

-

5.2 Growth of Flow and Other Long-Duration Storage

-

5.3 Inverter Technologies, EMS, and Grid Integration

-

5.4 Safety and Fire Protection Measures

-

-

Market Segmentation

-

6.1 By Application

-

6.1.1 Residential

-

6.1.2 Commercial & Industrial (C&I)

-

6.1.3 Utility-Scale

-

-

6.2 By Energy Capacity

-

6.2.1 <5 kWh

-

6.2.2 5–100 kWh

-

6.2.3 100 kWh–1 MWh

-

6.2.4 >1 MWh

-

-

6.3 By Deployment Model

-

6.3.1 Front-of-the-Meter (FTM)

-

6.3.2 Behind-the-Meter (BTM)

-

-

-

Regional Analysis (Germany)

-

7.1 Bavaria

-

7.2 Baden-Württemberg

-

7.3 North Rhine-Westphalia

-

7.4 Saxony & Eastern States

-

7.5 Others

-

-

Market Size and Forecast (2020–2030)

-

8.1 Installed Capacity and Revenue Forecast

-

8.2 Segment-Wise Demand Outlook

-

8.3 Key Infrastructure Investments and Trends

-

-

Competitive Landscape

-

9.1 Market Share Analysis

-

9.2 Key Company Profiles

-

9.2.1 Sonnen (Shell Group)

-

9.2.2 SENEC (EnBW)

-

9.2.3 Varta AG

-

9.2.4 TESVOLT

-

9.2.5 Others

-

-

9.3 Strategic Collaborations, R&D, and Emerging Entrants

-

-

Policy and Regulatory Framework

-

10.1 Germany’s Renewable Energy Act (EEG) and Storage Incentives

-

10.2 Grid Fee Exemptions, VAT Reductions, and KfW Subsidies

-

10.3 Technical Standards and Safety Regulations

-

-

Innovation and Future Outlook

-

11.1 AI-Based Optimization and Predictive Grid Balancing

-

11.2 Energy Communities and Peer-to-Peer Trading

-

11.3 Circular Economy and Battery Recycling Initiatives

-

-

Conclusion and Strategic Outlook

-

Appendices

-

13.1 Glossary

-

13.2 Research Methodology

-

13.3 References and Data Sources

To get a detailed Table of content/ Table of Figures/ Methodology Please contact our sales person at ( chris@marketinsightsresearch.com )

FAQ'S

For a single, multi and corporate client license, the report will be available in PDF format. Sample report would be given you in excel format. For more questions please contact:

Within 24 to 48 hrs.

You can contact Sales team (sales@marketinsightsresearch.com) and they will direct you on email

You can order a report by selecting payment methods, which is bank wire or online payment through any Debit/Credit card, Razor pay or PayPal.

Discounts are available.

Hard Copy