South Africa Battery Market

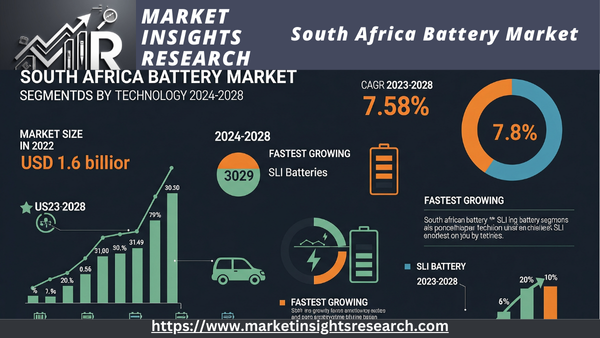

South Africa Battery Market Segmented By Technology (Lithium-ion Battery, Lead-acid Battery and Others), By Product Type (SLI Batteries, Industrial Batteries and Others), By End User (Telecom, Energy Storage Systems, Consumer Electronics, Automotive and Others), By Region, Competition Forecast & Opportunities, 2024-2028

Published Date: May - 2025 | Publisher: MIR | No of Pages: 320 | Industry: Power | Format: Report available in PDF / Excel Format

View Details Buy Now 2890 Download Free Sample Ask for Discount Request Customization| Forecast Period | 2024-2028 |

| Market Size (2022) | USD 1.6 Billion |

| Fastest Growing Segment | SLI Batteries |

| CAGR (2023 | 7.58% |

| Largest Market | Gauteng |

Market Overview

The South Africa Battery Market was valued at USD 1.6 Billion in 2022 and is anticipated to project robust growth in the forecast period with a CAGR of 7.58% through 2028. This growth is primarily driven by the high demand for portable gadgets such as fitness bands, tablets, LCDs, smartphones, and wearables. Experts predict significant growth in the industry due to technological advancements in cost-effectiveness, increased efficiency, and product innovation. Furthermore, the demand for batteries is likely being propelled by strict pollution standards set by governments of wealthy nations and the growing concern over fuel efficiency.

A battery is essentially an electrochemical device, composed of one or more electrochemical cells, that can be charged with an electric current and discharged as needed. Typically, batteries are constructed from multiple electrochemical cells connected to external inputs and outputs. They commonly power small electric devices like remote controls, torches, and mobile phones. Batteries are broadly classified into two main categoriesprimary batteries and secondary batteries. Primary batteries are designed for single use only and must be discarded once fully discharged. Secondary batteries, in contrast, can be recharged and used repeatedly; hence, they are also known as rechargeable batteries.

Increasing Domestic Demand Thriving the South Africa Battery Market Growth

South Africa has a major influence on the worldwide battery value chain given a predicted domestic need for 10–15 GWh of battery energy storage by 2030. The nation's battery storage market could need between 9,700 MWh and 10,400 MWh by 2030. Demand for South Africa can be as great as 15,000 MWh. This figure is a notable increase over the few hundred MWh projected for 2020. Almost 99% of the demand for battery storage in South Africa in 2020 came from behind-the-meter energy storage systems (ESS), which comprise commercial and industrial (C&I), residential, and mobile applications. The country boasts several early-stage businesses in the lithium-ion battery value chain, along with a "diverse automotive industry" that must migrate to EVs to maintain its commanding presence in the African market. Furthermore, EVs are expected to be the main driver of development in the country's battery ecosystem. By 2030, South Africa might localize 5 GWh of lithium-ion battery cells' production. Growing domestic manufacturing is likely to drive the South African battery market.

Growth of Electric Vehicles in Propelling the South Africa Battery Market

With a 0.62% market share according to the International Trade Administration (IEA), South Africa ranked 21st in the world for car manufacture in May 2023. Rising foreign direct investment and trade have driven the South African automotive sector's expansion plan to be mostly focused on excellent integration into the worldwide automotive scene. Furthermore, the South African Automotive Masterplan (SAAM) 2021–2035 seeks to generate 1% of global car manufacturing, or 1.4 million vehicles annually, in South Africa by 2035, greatly enhancing the nation's position worldwide. For example, German automobile company Audi introduced six much-awaited e-tron models to the South African market early in 2022, comprising a range of all-electric cars with zero direct COâ‚‚ emissions when driving. Offering a range of 369km to 440km, Audi's e-tron 55 Sport Utility Vehicle (SUV) is the least expensive model in the lineup. The battery market in South Africa is predicted to be driven by the spread of electric cars in the nation.

Rising Demand from Telecommunication Sector is Driving the Growth of the South Africa Battery Market

One of the few sectors that is still seeing wonderful technical innovation and progress even during the COVID-19 epidemic is telecommunications applications for stationary batteries, whether it's for constant power needs or emergency situations. For the telecom sector, lead-acid batteries thus present a practical solution. As a result of telecom operators building more telecom towers to accommodate growing consumers, the need for lead-acid batteries for backup purposes has dramatically grown. Data centers will eventually require a central power backup facility, so it is expected that the use of this battery will greatly increase as the number of data centers rises. Rising demand for telecommunication and data center applications indicates that, based on the above-mentioned factors, the battery market in South Africa is expected to expand throughout the projected period.

High Price and Lack of Government Regulations are Hindering the Growth of the South African Battery Market

The decreasing cost of lithium-ion batteries has led to a substantial surge in the demand for both the batteries themselves and the necessary minerals for their production. This situation is driving up the prices of these minerals and, in some cases, creating a scarcity in the material supply.

Presently, the market also lacks standardization in fast-charging infrastructure, which has limited the practical use of the available charging points and the wider adoption of compatible vehicles. This underdeveloped EV support infrastructure is hindering the market's growth.

Moreover, the presence of a comprehensive charging infrastructure is vital for the acceptance of electric and plug-in hybrid vehicles. The current inadequacies in this area increase the risk—both actually and in perception—for end-users of being stranded without access to a charging station. We project that these combined elements will impede the expansion of the South African battery market.

Latest Investments Driving the South Africa Battery Market Growth

- The City of Cape Town declared its intent to move forward with the Paardevlei Ground-mounted Solar Photovoltaic and Battery Energy Storage System project in April 2023. The city would The USD 65 million project would safeguard the city against a full-scale load shedding phase. could create 60 megawatts of renewable energy and be developed with technical support from the C40 Cities Finance Facility. The city set aside USD 22.61 million from its USD 65 million budget, or half of the USD 65 million needed for the project, to halt load shedding over a three-year period.

- Eskom, the energy provider in South Africa, released information in 2022 about its impending large-scale battery storage deployments, including project locations and volumes. By December 2024, the utility and electrical grid operator hope to have the first 343 MW of a 500 MW nationwide rollout online. In a competitive request procedure, Eskom chose two battery energy storage system (BESS) suppliersHyosung Heavy Industries of South Korea and Pinggao Group of China. The BESS's 343 MW is expected to have a four-hour runtime, for a total capacity of 1,440 MWh. We would construct the systems in two stages. Phase 1 would involve the construction of 199 MW/833 MWh of battery storage coupled with 2 MW of solar PV, and Phase 2 would involve the installation of 144 MW/616 MWh of BESS combined with 58 MW of solar PV. The battery storage devices would help manage peak load on the power network in addition to providing other applications, including ancillary services. The Eskom lettHyosung made public the Eskom letter of acceptance for a different 48MW/192MWh project close to the city of Durban.

Market player

Major market players in the South African battery market are Duracell Inc., Eveready (Pty) Ltd., Probe Corporation, First National Battery, Exide Industries Ltd., and Potensa (Pty) Ltd., among others.

|

Attribute |

Details |

|

Base Year |

2022 |

|

Historical Data |

2018–2022 |

|

Estimated Year |

2023 |

|

Forecast Period |

2024–2028 |

|

Quantitative Units |

Revenue in USD Million and CAGR for 2018-2022 and 2023-2028 |

|

Report coverage |

Revenue forecast, company share, growth factors, and trends |

|

Segments covered |

Technology Product Type End User Region |

|

Regional scope |

Gauteng, KwaZulu-Natal, Western Cape, Eastern Cape, Mpumalanga, Limpopo, North West, Free State and Northern Cape |

|

Key companies profiled |

Duracell Inc., Eveready (Pty) Ltd., Probe Corporation, First National Battery, Exide Industries ltd, Potensa (Pty) Ltd. |

|

Customization scope |

10% free report customization with purchase. Addition or all You can add or alter the scope of the country, region, and segment. |

|

purchase options |

Avail yourself of customized purchase options to meet your exact research needs. Explore purchase options |

|

Delivery Format |

PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request.) |

South Africa Battery Market Scope

The battery market is segmented based on the battery type, sales channel, voltage range, components, and application. The growth amongst these segments will help you analyze meager growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

Battery Type

- Lead-acid Battery

- Lithium-ion Battery

- Nickel-cadmium Battery

- Nickel Metal Hydride Battery

- Nickel-zinc Battery

- Flow Battery

- Sodium-sulfur Battery

- Zinc-manganese Dioxide Battery

- Small Sealed Lead-acid Battery

- Other Batteries

Type

- Secondary

- Primary

Sales Channel

- Direct

- Indirect

Voltage Range

- Less than 50 volts

- 51 volts to 100 Volt

- More than 100 volts

Components

- Anode

- Cathode

- Separator Outer Body/Container

Application

- Automotive

- Commercial

- Mobile Phone

- Electronic Devices

- Industrial

- Others

Related Reports

- U.S. Commercial Boiler Market – By Product (Hot Water, Steam), Application (Offices, Healthcare Facilities, Educationa...

- North America Commercial Boiler Market Size - By Fuel (Natural Gas, Oil, Coal, Electric), By Capacity, By Technology (Co...

- Water Tube Industrial Boiler Market Size By Capacity, By Application (Food Processing, Pulp & Paper, Chemical, Refinery,...

- U.S. Industrial Boiler Market Size By Fuel (Natural Gas, Oil, Coal), By Capacity, By Technology (Condensing, Non-Condens...

- Fire Tube Industrial Boiler Market - By Capacity (<10 MMBtu/hr, 10-25 MMBtu/hr, 25-50 MMBtu/hr, 50-75 MMBtu/hr, >75 MMBt...

- Gas Fired Boiler Market Size - By Capacity (≤ 10 MMBtu/hr, > 10 - 50 MMBtu/hr, > 50 - 100 MMBtu/hr, > 100 - 250 MMBtu/...

Table of Content

-

Executive Summary

-

1.1 Market Highlights

-

1.2 Key Trends and Developments

-

1.3 Strategic Recommendations

-

-

Introduction

-

2.1 Objectives and Scope of the Report

-

2.2 Methodology Overview

-

2.3 Assumptions and Definitions

-

-

Market Overview

-

3.1 Overview of the Battery Industry in South Africa

-

3.2 Importance of Batteries in Power Backup and Mobility

-

3.3 Market Structure: Manufacturers, Importers, and Distributors

-

3.4 Trends in Load Shedding, Renewable Integration, and Electrification

-

-

Market Dynamics

-

4.1 Drivers

-

4.1.1 Growing Demand for Energy Storage Due to Power Instability

-

4.1.2 Increasing Adoption of Solar PV and Inverter Systems

-

4.1.3 Growth in Electric Vehicles and Telecom Infrastructure

-

-

4.2 Restraints

-

4.2.1 High Import Dependence and Currency Volatility

-

4.2.2 Regulatory Uncertainty for Distributed Energy Systems

-

-

4.3 Opportunities

-

4.3.1 Localization and Battery Assembly Investment

-

4.3.2 Second-Life Battery Solutions and Recycling Initiatives

-

-

4.4 Challenges

-

4.5 Porter’s Five Forces Analysis

-

-

Technology Landscape

-

5.1 Lead-Acid Batteries (Flooded, VRLA, AGM)

-

5.2 Lithium-Ion Batteries (LFP, NMC)

-

5.3 Emerging Technologies (Sodium-Ion, Flow Batteries)

-

5.4 Battery Management Systems and Inverter Integration

-

-

Market Segmentation

-

6.1 By Battery Type

-

6.1.1 Lead-Based

-

6.1.2 Lithium

-

6.1.3 Others

-

-

6.2 By Application

-

6.2.1 Residential Backup and Solar Storage

-

6.2.2 Telecom and Commercial UPS

-

6.2.3 Industrial and Utility Storage

-

6.2.4 Electric Vehicles and Mobility

-

-

6.3 By Distribution Channel

-

6.3.1 Direct OEM Sales

-

6.3.2 Retail Distributors

-

6.3.3 Online Platforms

-

-

-

Regional Market Analysis

-

7.1 Gauteng

-

7.2 Western Cape

-

7.3 KwaZulu-N

-

7.4 Eastern Cape and Others

-

-

Market Size and Forecast (2020–2030)

-

8.1 Revenue and Volume Outlook

-

8.2 Segment-Wise and Regional Demand Projections

-

8.3 Import vs. Local Manufacturing Trends

-

-

Competitive Landscape

-

9.1 Market Share Analysis

-

9.2 Key Company Profiles

-

9.2.1 First National Battery

-

9.2.2 Freedom Won

-

9.2.3 Solar MD

-

9.2.4 Blue Nova

-

9.2.5 Others (including global brands like Huawei, BYD)

-

-

9.3 Strategic Developments and Investment Plans

-

-

Regulatory and Policy Environment

-

10.1 SSEG (Small-Scale Embedded Generation) Regulations

-

10.2 Import Duties, Incentives, and Local Content Rules

-

10.3 Energy Security and Just Transition Framework

-

-

Innovation and Future Outlook

-

11.1 Second-Life and Circular Battery Economy

-

11.2 Off-Grid and Mini-Grid Storage Deployment

-

11.3 Battery-as-a-Service and Subscription Models

-

-

Conclusion and Strategic Outlook

-

Appendices

-

13.1 Glossary

-

13.2 Methodology and Sources

-

13.3 Data Tables

-

|

Duracell Inc., Eveready (Pty) Ltd., Probe Corporation, First National Battery, Exide Industries ltd, Potensa (Pty) Ltd. |

FAQ'S

For a single, multi and corporate client license, the report will be available in PDF format. Sample report would be given you in excel format. For more questions please contact:

Within 24 to 48 hrs.

You can contact Sales team (sales@marketinsightsresearch.com) and they will direct you on email

You can order a report by selecting payment methods, which is bank wire or online payment through any Debit/Credit card, Razor pay or PayPal.

Discounts are available.

Hard Copy