Residential Lithium-Ion Battery Energy Storage Systems Market

Residential Lithium-Ion Battery Energy Storage Systems Market – Global Industry Size, Share, Trends, Opportunity, and Forecast, Segmented By Power Rating (Under 3kW, 3kW - 5kW, Others), By Connectivity (On-Grid, Off-Grid), By Region, By Competition, 2018-2028

Published Date: May - 2025 | Publisher: MIR | No of Pages: 320 | Industry: Power | Format: Report available in PDF / Excel Format

View Details Buy Now 2890 Download Free Sample Ask for Discount Request Customization| Forecast Period | 2024-2028 |

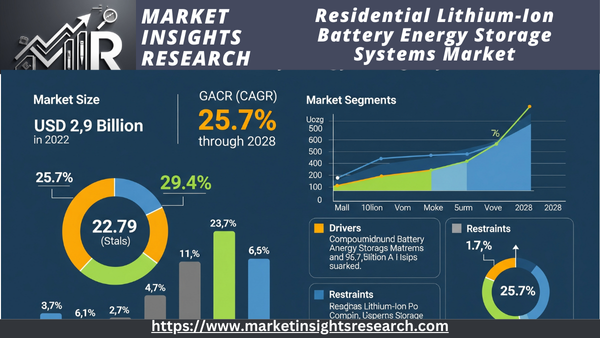

| Market Size (2022) | USD 2.9 Billion |

| CAGR (2023-2028) | 25.7% |

| Fastest Growing Segment | Off-Grid |

| Largest Market | Asia Pacific |

Market Overview

The Global Residential Lithium-Ion Battery Energy Storage Systems Market was valued at USD 2.9 Billion in 2022 and is anticipated to project robust growth in the forecast period with a CAGR of 25.7% through 2028.

Download Free Sample Ask for Discount Request Customization

This market is experiencing robust growth, fueled by the rising demand for sustainable energy solutions and the increasing adoption of renewable energy sources in residential spaces. Lithium-ion battery systems for energy storage have become crucial in the transition toward clean energy, offering efficient storage and management of electricity generated from renewable sources like solar panels or wind turbines. The technology's compact size, high energy density, and rapid charging capabilities make it particularly suitable for residential applications.

Homeowners are increasingly investing in these systems to store surplus energy generated during peak production hours, ensuring a stable power supply during periods of high demand or when renewable sources are unavailable. Moreover, factors such as energy cost savings, grid independence, and growing environmental awareness are driving the market forward. Government incentives and favorable policies further bolster market expansion.

As residential spaces continue to embrace sustainable energy practices, the Residential Lithium-Ion Battery Energy Storage Systems Market is poised for continuous growth, offering consumers reliable energy storage solutions while contributing significantly to the global efforts for a greener and more sustainable future.

Key Market Drivers

Rising Demand for Sustainable Energy Solutions

Demand for sustainable energy solutions is driving significant expansion in the worldwide residential lithium-ion battery energy storage systems market. Residential users are using lithium-ion battery systems for energy storage to save extra energy produced from renewable sources like solar panels as they pay more attention to environmental preservation and the need for dependable power sources. These devices greatly contribute to grid independence and less dependency on conventional power sources by letting homes capture solar energy during peak sunlight hours and use it during times of high energy demand or when solar generation is low.

Growing Embrace of Renewable Energy

The increased popularity of renewable energy sources—especially solar and wind power—among household users is driving a rise in industry development. Promoting the use of renewable energy, governments and environmental organizations all around are providing incentives and subsidies for household users to set up solar panels and other renewable energy systems. Maximizing the use of renewable energy depends much on the energy storage systems of lithium-ion batteries. They guarantee a constant power supply even when renewable sources are not actively producing electricity, therefore supporting sustainable energy practices and lowering carbon emissions. They store extra energy produced under favorable conditions.

Download Free Sample Ask for Discount Request Customization

Energy Independence and Grid Resilience

The growing need for energy independence and grid resilience is a significant driver for the adoption of lithium-ion battery systems for residential energy storage. Homeowners are investing in these systems to ensure a reliable power supply during grid outages or emergencies. These energy storage solutions provide backup power, allowing essential appliances and devices to function seamlessly even when the grid is down. This aspect of energy resilience is becoming increasingly vital, particularly in regions susceptible to natural disasters. Lithium-ion battery systems for energy storage empower homeowners with control over their energy usage, enabling them to manage energy fluctuations effectively and ensure uninterrupted power for critical applications, thereby enhancing grid resilience and energy security at the residential level.

Technological Advancements and Cost Efficiency

Government Initiatives and Incentives

Government projects and incentives, such as tax credits, subsidies, and favorable laws, are driving the residential lithium-ion battery energy storage systems market. Different countries are enacting laws meant to encourage household adoption of renewable energy and energy storage technologies. Homeowners' initial investment expenses are much lowered by financial incentives, including tax benefits and rebates, therefore rendering the installation of lithium-ion battery energy storage systems financially feasible. These encouraging regulations not only make sustainable energy solutions more reasonably priced for customers but also provide a favorable climate for market expansion, therefore motivating more homes to switch toward renewable energy and energy storage technology.

Integration with Smart Home Systems

Key driver of market expansion is the integration of smart home systems with residential lithium-ion battery storage. Smart home technology lets homeowners easily monitor and regulate their energy use. These systems let consumers schedule energy use, maximize usage during low power tariff periods, and remotely control energy flow, therefore enabling effective management of stored energy. Combining smart home systems with energy storage devices improves the user experience by giving homeowners real-time awareness of their energy consumption trends, which helps them make educated decisions to maximize energy use and lower expenses. The demand for residential lithium-ion battery energy storage systems coupled with these platforms is predicted to expand as the acceptance of smart home technologies keeps increasing, therefore promoting market development.

Download Free Sample Ask for Discount Request Customization

Key Market Challenges

Compatibility and Standardization Struggles

Compatibility and standardization provide major difficulties for the Global Residential Lithium-Ion Battery Energy Storage Systems Market. Different kinds of lithium-ion battery technology and storage systems have surfaced as the market develops, creating a patchy scene. Homeowners running new energy storage systems alongside current solar panels or renewable energy configurations have compatibility problems. This fragmentation creates uncertainty and challenges, requiring customers to purchase specific parts or systems that are compatible with their existing configuration. The lack of consistent procedures aggravates this difficulty by limiting customer options and hence affecting flawless integration. Consistent efforts are required to standardize lithium-ion battery energy storage systems, which will provide compatibility across many technologies and brands, thereby improving user experience and promoting broad adoption.

Quality Assurance Amidst Counterfeits

The market faces a significant issue with counterfeit and substandard lithium-ion battery energy storage systems, which pose risks to user safety and property. These fake products often lack crucial safety features, potentially leading to hazards like overheating, electrical failures, or even fires. Tackling this challenge requires strict quality control measures throughout the supply chain. Manufacturers need to implement strong authentication mechanisms so consumers can verify the authenticity of products, thereby reducing the risk of buying counterfeit or low-quality energy storage systems. Additionally, awareness campaigns are vital to educate consumers on how to identify genuine products and make informed purchasing decisions, ensuring their safety and promoting the reliability of lithium-ion battery energy storage solutions.

Environmental Impact and Recycling Challenges

The general acceptance of lithium-ion batteries for energy storage has sparked environmental sustainability questions. Given their limited lifetime, disposal and recycling of spent batteries provide a major difficulty for these systems. Inappropriate disposal techniques contribute to electronic waste, potentially harming the environment. To solve this problem, the sector has to create thorough recycling schemes that inspire households to properly dispose of their outdated battery systems. These initiatives should facilitate the recycling or proper disposal of spent batteries, thereby mitigating their environmental impact. Manufacturers must also give environmentally friendly materials and designs a priority in battery manufacture, therefore encouraging recyclability and lowering the total environmental impact of lithium-ion battery energy storage systems. The market may reduce its environmental effect and open the path for a better future by adopting sustainable practices and increasing knowledge about appropriate disposal.

Regulatory Compliance and Safety Standards

Maintaining home lithium-ion battery energy storage systems' safety and conformity with international standards presents continuous difficulty. Manufacturers must negotiate changing rules about environmental effects, electromagnetic compatibility, and electrical safety. Ignoring these guidelines could result in consumer safety being jeopardized, legal obligations, and product recalls. Rigid testing, certification, and industry standards adherence are absolutely necessary if we are to solve this problem. Clear norms and standards must be established by manufacturers, regulators, and stakeholders working together to guarantee the dependability and safety of home energy storage solutions. Maintaining compliance and preserving customer confidence in the market depend on ongoing observation of legislative changes and proactive modification of manufacturing techniques and product designs.

Key Market Trends

Rapid Adoption of Portable Electronic Devices

Driven by the increased acceptance of portable electronic devices, including smartphones, tablets, and laptops, the Global Residential Lithium-Ion Battery Energy Storage Systems Market is seeing a notable rise. These devices have evolved into essential instruments for entertainment, business, and communication, therefore generating a huge demand for dependable energy storage options. As homeowners include lithium-ion battery energy storage systems with their solar panels, they guarantee a continuous power supply for their equipment. As consumers search for energy storage options that can easily run their portable electronics, the market is seeing a paradigm change, and lithium-ion battery systems are becoming an increasingly important part of contemporary homes.

Technological Innovations and Enhanced Efficiency

The Residential Lithium-Ion Battery Energy Storage Systems Market is marked by rapid technological advancements focused on enhancing efficiency and energy storage capabilities. Manufacturers are investing in research and development to create energy storage systems with greater storage capacity, faster charging times, and more efficient discharge rates. Advanced battery management systems and innovative materials are being utilized to improve the overall performance of lithium-ion battery systems. Furthermore, the integration of smart technologies, such as IoT-enabled energy management systems, allows homeowners to monitor and optimize their energy usage, further driving the demand for energy storage solutions using lithium-ion batteries.

Transition to Renewable Energy Sources

The Residential Lithium-Ion Battery Energy Storage Systems Market is advancing under the worldwide attention on sustainable energy sources. Homeowners are making investments in energy storage systems to save on extra solar panels and other renewable energy production as the globe shifts toward them. Effective energy storage made possible by lithium-ion battery systems guarantees a constant power supply even in cases of non-active generation from renewable energy sources. This shift to renewable energy fits the expanding environmental awareness, so lithium-ion battery energy storage devices are becoming increasingly important in the worldwide green energy movement.

Government Incentives and Subsidies

Government initiatives and incentives are playing a pivotal role in the growth of the Residential Lithium-Ion Battery Energy Storage Systems Market. Many countries are offering subsidies, tax credits, and incentives to homeowners and businesses adopting renewable energy systems, including energy storage solutions. These financial benefits encourage consumers to invest in lithium-ion battery energy storage systems, making them more accessible and affordable. The support from governmental bodies not only reduces the initial investment for consumers but also fosters a favorable environment for the market's expansion, driving increased adoption of residential energy storage solutions.

Integration of Smart Home Technologies

The integration of smart home technologies is a key trend shaping the Residential Lithium-Ion Battery Energy Storage Systems Market. Home automation systems and smart energy management solutions are becoming increasingly popular among consumers. Lithium-ion battery energy storage systems are being designed to seamlessly integrate with these smart technologies, allowing homeowners to control and monitor their energy usage remotely. This integration enhances the overall efficiency of energy storage solutions and provides consumers with greater control over their energy consumption patterns. As smart home adoption continues to rise, the demand for energy storage systems using lithium-ion batteries that are compatible with these technologies is expected to grow, driving market expansion.

Segmental Insights

Power Rating Insights

The 3 kW–5 kW segment dominated the global residential lithium-ion battery energy storage systems market in the power rating segment and accounted for more than 54.0% of overall revenue share in 2022. Residential lithium-ion battery energy storage systems with a capacity of between 3 kW and 5 kW are capable of storing sufficient energy to power a household for several hours, even during periods of peak energy demand. This type of system can help reduce energy bills and provide greater control to consumers over energy consumption. Another advantage of these battery storage systems is their scalability. Residential buildings with multiple apartments and larger homes can easily install these battery storage systems. Furthermore, the household's energy needs determine the scaling of these systems. Battery energy storage systems with a capacity between 3 kW and 5 kW are generally more expensive owing to their higher capacity, leading to higher production and installation costs.

Connectivity

Comprising more than 56.0% of total revenue share in 2022, the off-grid sector dominated the worldwide residential lithium-ion battery energy storage systems market in the connection segment. Residential lithium-ion battery energy storage systems for on-grid uses are becoming more and more sought after since they give homes consistent access to electricity even in far-off areas.

These systems are made to store extra energy produced by solar panels or wind turbines, which may then be used to run homes either during low energy output or while energy generation is offline. For homeowners living in distant locations, these systems offer one of the main advantagesmore energy independence and security. Homeowners can guarantee consistent access to electricity by storing extra energy from solar panels or wind turbines. Depending on the household's energy consumption, these systems can be scaled up or down and readily deployed in a range of domestic environments.

For homes seeking a dependable and sustainable source of energy in far-off areas, residential lithium-ion battery systems for off-grid use present a good answer. Generally speaking, off-grid battery energy storage systems are somewhat less expensive than on-grid alternatives since they usually run at lower power ratings and are not linked to the national grid.

Regional Insights

The Asia-Pacific region has emerged as the dominant force in the Global Residential Lithium-Ion Battery Energy Storage Systems Market, demonstrating significant growth and innovation. This leadership is driven by several factors, including the region's growing population, rapid urbanization, and increasing focus on renewable energy solutions. Countries such as China, Japan, South Korea, and Australia have played crucial roles, fostering a strong market ecosystem through extensive research and development initiatives, supportive government policies, and substantial investments in renewable energy infrastructure. China, in particular, has been a major contributor, with its strong emphasis on clean energy adoption and ambitious renewable energy targets. The region's dominance is further amplified by the presence of established lithium-ion battery manufacturers and technological advancements in energy storage systems. Moreover, increasing concerns about energy security, coupled with the need to address environmental challenges, have led to a surge in demand for residential lithium-ion battery ESS across households in the Asia-Pacific. The proactive approach of governments in promoting energy storage solutions, along with the increasing affordability and efficiency of lithium-ion batteries, has positioned the Asia-Pacific region as a frontrunner in the global market.

Looking ahead, the Asia-Pacific region is expected to maintain its dominance during the forecast period. Continued investments in renewable energy projects, supportive policies promoting clean energy adoption, and a growing awareness of the benefits of residential lithium-ion battery ESS are anticipated to fuel the market's expansion. Additionally, the region's manufacturing capabilities, coupled with a focus on technological innovation, are likely to contribute significantly to the ongoing advancements in energy storage systems. As the demand for sustainable and reliable energy solutions continues to rise, the Asia-Pacific region is poised to lead the way, shaping the future of the Residential Lithium-Ion Battery Energy Storage Systems Market globally.

Download Free Sample Ask for Discount Request Customization

Recent Developments

- January 2022 - Tesla Unveils Advanced Home Energy Storage Solutions - In a groundbreaking move, Tesla announced its latest lineup of residential lithium-ion battery energy storage systems, revolutionizing home energy management. These cutting-edge solutions integrate advanced energy storage technologies with enhanced safety features. Tesla's systems are designed to efficiently store excess energy generated from solar panels, ensuring a reliable and continuous power supply for households. With sleek designs and compact form factors, these energy storage systems provide homeowners with convenient and portable options for managing their energy needs. Tesla's commitment to innovation is reflected in these solutions, addressing the growing demand for sustainable and efficient home energy storage.

- September 2021 - LG Chem Introduces Intelligent Home Battery Systems - LG Chem, a leading player in the energy storage industry, introduced its latest line of intelligent home battery systems in September 2021. These systems incorporate fast charging capabilities and intelligent power management, optimizing energy usage for homeowners. Equipped with advanced circuitry, LG Chem's home battery solutions automatically adapt to varying energy demands, ensuring optimal charging and discharging speeds. The technology safeguards devices from overcharging and overheating, enhancing the overall safety and longevity of the energy storage systems. LG Chem's commitment to eco-friendly practices is evident in these offerings, catering to environmentally conscious consumers seeking reliable and sustainable energy storage solutions.

- April 2021 - Panasonic Unveils High-Capacity Residential Energy Storage Solutions - Panasonic, a renowned name in electronics, unveiled its new line of high-capacity residential lithium-ion battery energy storage solutions in April 2021. These systems feature high-power output and multiple charging ports, allowing homeowners to efficiently charge multiple devices simultaneously. Designed to meet the increasing power demands of modern households, Panasonic's energy storage solutions provide robust build quality and reliable performance. The integration of smart technology enables seamless monitoring and control, empowering homeowners to manage their energy consumption effectively. Panasonic's focus on durability and efficiency ensures a dependable and long-lasting energy storage solution for residential applications.

Key Market Players

- HAIKU

- Enphase Energy

- E3/DC

- Panasonic

- sonnen Holding GmbH

- Tesla

- Pylon Technologies Co., Ltd.

- LG Chem

- AlphaESS

- Generac Power Systems

- Hitachi Energy

- GOODWE

|

By Power Rating |

By Connectivity |

By Region |

|

|

|

Related Reports

- Water Tube Industrial Boiler Market Size By Capacity, By Application (Food Processing, Pulp & Paper, Chemical, Refinery,...

- U.S. Industrial Boiler Market Size By Fuel (Natural Gas, Oil, Coal), By Capacity, By Technology (Condensing, Non-Condens...

- Fire Tube Industrial Boiler Market - By Capacity (<10 MMBtu/hr, 10-25 MMBtu/hr, 25-50 MMBtu/hr, 50-75 MMBtu/hr, >75 MMBt...

- Gas Fired Boiler Market Size - By Capacity (≤ 10 MMBtu/hr, > 10 - 50 MMBtu/hr, > 50 - 100 MMBtu/hr, > 100 - 250 MMBtu/...

- Europe Residential Boiler Market Size - By Technology (Condensing {Natural Gas, Oil, Electric}, Non-Condensing {Natural ...

- U.S. Boiler Market Size By Fuel (Natural Gas, Oil, Coal), Capacity, By Technology (Condensing, Non-Condensing), By Produ...

Table of Content

Table of Contents

-

Executive Summary

-

1.1 Market Snapshot

-

1.2 Key Highlights and Trends

-

1.3 Strategic Recommendations

-

-

Introduction

-

2.1 Scope and Objectives of the Report

-

2.2 Research Methodology

-

2.3 Assumptions and Definitions

-

-

Market Overview

-

3.1 What are Residential Lithium-Ion ESS?

-

3.2 System Components and Architecture

-

3.3 Benefits for Homeowners and the Grid

-

3.4 Value Chain and Business Model Insights

-

-

Market Dynamics

-

4.1 Drivers

-

4.1.1 Rising Residential Electricity Prices and Demand Charges

-

4.1.2 Growth in Rooftop Solar and Net Metering Programs

-

4.1.3 Advancements in Battery Safety, Lifespan, and Energy Density

-

-

4.2 Restraints

-

4.2.1 High Initial Cost of Purchase and Installation

-

4.2.2 Regulatory Barriers and Grid Compatibility Issues

-

-

4.3 Opportunities

-

4.3.1 Smart Home Integration and Energy Independence

-

4.3.2 Aggregation in Virtual Power Plants (VPPs)

-

-

4.4 Market Challenges

-

4.5 Porter’s Five Forces Analysis

-

-

Technology Landscape

-

5.1 Lithium-Ion Chemistries (LFP, NMC, LCO)

-

5.2 Battery Management Systems (BMS) and Safety Mechanisms

-

5.3 Inverter and EMS Integration

-

5.4 Fire Safety, Thermal Management, and Lifespan Optimization

-

5.5 AC-Coupled vs. DC-Coupled Configurations

-

-

Market Segmentation

-

6.1 By Battery Chemistry

-

6.1.1 Lithium Iron Phosphate (LFP)

-

6.1.2 Lithium Nickel Manganese Cobalt Oxide (NMC)

-

6.1.3 Others

-

-

6.2 By System Size

-

6.2.1 Below 5 kWh

-

6.2.2 5–10 kWh

-

6.2.3 Above 10 kWh

-

-

6.3 By Application

-

6.3.1 Solar Self-Consumption

-

6.3.2 Backup Power

-

6.3.3 Time-of-Use Optimization

-

6.3.4 Energy Trading and VPP Participation

-

-

-

Regional Analysis

-

7.1 North America

-

7.2 Europe

-

7.3 Asia-Pacific

-

7.4 Latin America

-

7.5 Middle East & Africa

-

-

Market Size and Forecast (2020–2030)

-

8.1 Global Revenue and Installed Capacity Forecast

-

8.2 Regional and Country-Level Forecasts

-

8.3 Segment-Wise Demand Outlook

-

-

Competitive Landscape

-

9.1 Market Share Analysis

-

9.2 Key Player Profiles

-

9.2.1 Tesla (Powerwall)

-

9.2.2 LG Energy Solution

-

9.2.3 Sonnen (Shell Group)

-

9.2.4 BYD

-

9.2.5 Panasonic

-

9.2.6 Others

-

-

9.3 Product Portfolio Comparison and Strategic Initiatives

-

-

Regulatory and Policy Framework

-

10.1 Solar and Storage Incentives (e.g., ITC, Feed-in Tariffs)

-

10.2 Safety Standards and Certifications (UL 9540, IEC)

-

10.3 Net Metering and Grid Services Participation Rules

-

-

Innovation and Future Outlook

-

11.1 AI and Smart Energy Management Integration

-

11.2 Solid-State and Next-Gen Lithium Batteries for Residential Use

-

11.3 Grid-Interactive and Peer-to-Peer Energy Trading Models

-

-

Conclusion and Strategic Outlook

-

Appendices

-

13.1 Glossary

-

13.2 Research Methodology

-

13.3 References and Sources

-

To get a detailed Table of content/ Table of Figures/ Methodology Please contact our sales person at ( chris@marketinsightsresearch.com )

FAQ'S

For a single, multi and corporate client license, the report will be available in PDF format. Sample report would be given you in excel format. For more questions please contact:

Within 24 to 48 hrs.

You can contact Sales team (sales@marketinsightsresearch.com) and they will direct you on email

You can order a report by selecting payment methods, which is bank wire or online payment through any Debit/Credit card, Razor pay or PayPal.

Discounts are available.

Hard Copy