Commercial Energy Storage Market

Commercial Energy Storage Market – Global Industry Size, Share, Trends, Opportunity, and Forecast Segmented By Technology Type (Lithium-ion Batteries, Lead-acid Batteries, and Other Technology Types), By Power Rating (3-6 kW, 6-10 kW, 10-20 kW), By Connectivity (On-Grid, Off-Grid), By Operation (Standalone, Solar), By Region, Competition 2018-2028

Published Date: May - 2025 | Publisher: MIR | No of Pages: 320 | Industry: Power | Format: Report available in PDF / Excel Format

View Details Buy Now 2890 Download Free Sample Ask for Discount Request Customization| Forecast Period | 2024-2028 |

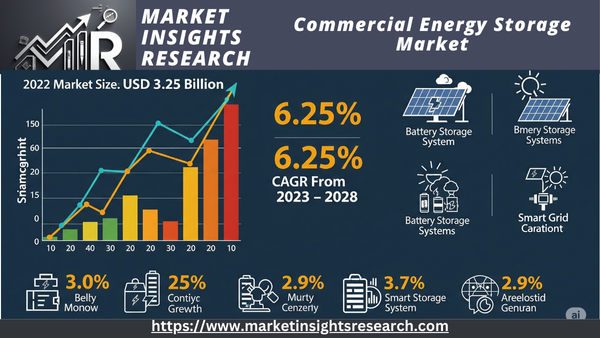

| Market Size (2022) | USD 3.25 Billion |

| CAGR (2023-2028) | 6.25% |

| Fastest Growing Segment | Solar |

| Largest Market | Europe |

Market Overview

The global Commercial Energy Storage Market was valued at USD 522.16 Million in 2022 and is anticipated to project robust growth in the forecast period with a CAGR of 18.51% through 2028.

Download Free Sample Ask for Discount Request Customization

In essence, the global Commercial energy storage market encompasses the range of products and services aimed at empowering homeowners to harness, store, and manage energy at the household level. This market is driven by the increasing adoption of renewable energy sources, the desire for energy cost savings, grid stability enhancements, and the growing interest in achieving sustainability and resilience in Commercial energy consumption. As the world transitions toward cleaner and more sustainable energy solutions, Commercial energy storage systems play a crucial role in facilitating the integration of renewable energy into everyday life while providing homeowners with greater control over their energy usage.

Key Market Drivers

Battery Energy Storage Systems Regulate Voltage and Frequency Help in Market Growth

One of the most important technologies in the shift to a sustainable energy system is battery energy storage. The battery energy storage systems combine renewable energy sources, control voltage and frequency, lower peak demand costs, and offer a backup power source. Energy storage systems rely heavily on batteries, which account for about 60% of the system's overall cost. Nevertheless, it is anticipated that batteries will only make up a minor percentage of the installed storage capacity. Lithium-ion, lead-acid, nickel-metal hydride (NiMH), nickel-cadmium (NiCD), nickel-zinc (NiZn), and flow batteries are among the different kinds of batteries utilized in energy storage systems. The market for battery energy storage is seeing a huge surge in demand for lithium-ion batteries as a result of their falling costs. Lithium-ion battery prices are predicted to drop to as low as USD 73/kWh by 2030, with the US Department of Energy (DOE) announcing an interim pricing target of USD 123/kWh by 2022.

The market for battery energy storage is likewise anticipated to be dominated by lithium-ion batteries. They are lightweight, have a dependable cycle life, a high energy density relative to volume, a high charge/discharge efficiency, and minimum maintenance. Lead-acid batteries make up the majority of the energy storage market, but other battery chemistries like lithium-ion (Li-ion), sodium, and flow batteries are anticipated to offer extra advantages like greater durability or higher energy capacity for longer-term storage or other specialized uses. Additionally, the battery energy storage devices lower energy costs by using utility grids to provide customers with electricity. Additionally, utilities' battery energy storage systems are a more affordable option than traditional infrastructure, particularly when it comes to assisting substations and transmission and distribution (T&D) lines in meeting the growing demand. These elements are supporting the market expansion for battery energy storage systems.

Utilities currently dominate the market for battery energy storage. During the projection period, there will be more opportunities for battery energy storage systems as more utilities include storage in their solar project solicitations. Furthermore, combining large batteries with renewable energy projects increases reliability without generating greenhouse gas (GHG) emissions. As a result, companies and homes are putting more emphasis on using batteries for backup power and harvesting extra energy from rooftop systems when needed. Only a few industrialized economies in Europe, Central Asia, East Asia-Pacific, and North America have so far focused on adopting battery storage. The main causes of the expanding use of battery energy storage in these areas are the rising percentages of renewable energy sources and the deteriorating grid infrastructure.

India wants to have 275 GW of wind and solar power overall by 2027, along with 15 GW of nuclear and 72 GW of hydropower. By 2027, it is anticipated that 43% of installed capacity will come from renewable sources. The need for energy storage devices to solve the issues associated with intermittency in renewable power generation is anticipated to increase as the renewable energy sector expands. Furthermore, the South Korean government's 2017 8th Basic Plan for Electricity Supply and Demand states that the country's electricity demand will only increase by 1% annually until 2030. By employing ESS and other energy-saving measures, as well as cleaner electricity from renewable sources, the government hopes to reduce its greenhouse gas emissions and fine dust pollution. Together with recent implementations of time-of-use power tariffs that increase the range between peak and off-peak power prices, China's 2021 announcement of plans to increase cumulatively installed non-pumped hydro energy storage to approximately 30 GW by 2025 and 100 GW by 2030 is also fueling a surge in battery storage activity.

The market under study may be significantly influenced by India's aspirations to diversify its energy sources and build a significant amount of renewable energy production capacity to supply electricity to everyone every day of the week. The increasing demand for electricity, the increase in disposable income, and the requirement for a dependable power source are all anticipated to support the market under study throughout the projection period. All Chinese residences and commercial buildings must have solar photovoltaic systems mounted on their roofs by 2023. A specific number of buildings must have solar PV systems installed in accordance with a government regulation. In roughly 676 counties, solar PV rooftop systems will be required for government buildings (at least 50%), public buildings (40%), commercial buildings (30%), and rural buildings (20%).

Key Market Challenges

- Costs and ROIThe initial investment required for commercial energy storage systems, which includes both batteries and installation, can be relatively high. While long-term cost savings are possible, achieving a reasonable return on investment (ROI) remains a challenge for some homeowners.

- Battery Lifespan and DegradationThe lifespan and degradation of battery systems are critical factors. Over time, battery performance may decline, affecting the overall efficiency and storage capacity of the system. Ensuring durable and long-lasting batteries is essential.

- Regulatory BarriersRegulations and policies around energy storage, including incentives, tariffs, and grid connection rules, vary from region to region. Complex regulations can hinder market growth and slow adoption.

- Technical ChallengesIntegrating energy storage systems with existing solar installations and electrical systems requires technical expertise. Compatibility, installation, and maintenance can be challenging for some homeowners.

- Environmental ConcernsThe production, disposal, and recycling of battery systems raise environmental concerns. Ensuring the sustainable lifecycle of these systems is crucial to minimizing their ecological impact.

- Perception and AwarenessMany homeowners are still unaware of the benefits of Commercial energy storage and may perceive it as complex or unaffordable. Increasing awareness and educating consumers about the advantages can drive market growth.

- Competition and Market FragmentationThe growing interest in commercial energy storage has led to heightened competition, which has resulted in a fragmented market characterized by various technologies and vendors. Finding the right solution among the multitude of options can be overwhelming for consumers.

- In conclusion, the global Commercial energy storage market presents a promising landscape filled with opportunities to revolutionize energy consumption, reduce costs, and enhance energy sustainability. However, challenges such as initial costs, battery longevity, regulatory hurdles, and technical complexities must be addressed for the market to reach its full potential. As technology advances and stakeholders collaborate to overcome these challenges, Commercial energy storage systems could contribute significantly to determining the future of sustainable energy consumption at the household level.

Download Free Sample Ask for Discount Request Customization

Key Market Trends

Battery Advancements In the Market

Batteries are a critical component of energy storage systems; they represent a significant portion of the total system cost, especially in Commercial energy storage systems. The total installed capacity of renewable energy sources is increasing substantially worldwide, as is the installation of solar rooftops on Commercial buildings. This increase in solar rooftop capacity is likely to drive higher demand for battery energy storage. Consequently, we expect the emergence of new energy storage systems (ESS) for commercial applications to boost the demand for lithium-ion batteries during the forecast period.

The properties of lithium-ion batteries, such as their lighter weight, shorter charging times, higher number of charging cycles, and decreasing cost, make them preferable for this application. Recently, due to their falling prices, lithium-ion batteries have become a popular choice for battery storage systems in Commercial solar and home inverters. In 2021, the price of lithium-ion batteries was USD 123/kWh, marking an 81.58% decrease from USD 668/KWh in 2013. The policies for commercial energy storage are still relatively new. However, countries like the United States and Germany are creating opportunities in their local energy storage markets through state and regulatory policy actions. For example, in June 2021, the United States Department of Energy (D.O.E.) announced an immediate policy to scale up the domestic manufacturing supply chain for advanced battery materials and technologies.

Segmental Insights

Technology Type Insights

Lithium-ion (Li-ion) batteries allow the same ampere-hours to enter and exit, making them virtually 100% efficient during charging and discharging. Compared to other technologies, such as lead-acid batteries, these batteries have several technical advantages. Unlike lead-acid batteries, which have an average lifespan of 400–500 cycles, rechargeable Li-ion batteries have an average lifespan of over 5,000 cycles. Li-ion batteries are more stable and can be recharged many times. Additionally, compared to other rechargeable batteries, they often have a better energy density, a higher voltage capacity, and a lower rate of self-discharge. Because a single cell retains charge longer than other battery types, this increases power efficiency. Furthermore, compared to lead-acid batteries, Li-ion batteries require less upkeep and replacement. While the voltage of lead-acid batteries steadily decreases during the discharge cycle, Li-ion batteries sustain their voltage throughout, enabling higher and longer-lasting electrical component efficiency. Li-ion batteries are more expensive initially, but when longevity and performance are taken into account, the real cost is significantly lower than that of lead-acid batteries. Lithium-ion battery technology is therefore anticipated to dominate the global market for commercial energy storage systems over the projected period, based on the previously mentioned criteria.

Regional Insights

That's intriguing! Based on the information I have, Europe did hold an important position in the Global Commercial Energy Storage Market in 2022, but it might not have been the outright leader in terms of revenue share.

Multiple sources indicate that Asia Pacific held the largest share of the overall energy storage market in 2022. For example, one source noted that Asia Pacific accounted for over 46% of the global market share for energy storage systems in 2022.

However, Europe is definitely a strong player and a leader in certain aspects, particularly in the adoption of residential and commercial battery storage systems, driven by factors like high adoption rates of rooftop solar and supportive policies in countries like Germany.

Download Free Sample Ask for Discount Request Customization

Recent Developments

- February 2022The partnership between FIMER and Vega Solar supplied 14 PVS-100 inverters, a three-phase string solution, to Albania. The PVS-100/120-TL is a cloud-connected three-phase string inverter by FIMER designed for cost-effective decentralized solar systems on both ground and rooftops.

- May 2022Salient Energy, a company developing proprietary zinc-ion batteries as an alternative to lithium-ion batteries in Commercial energy storage, announced that it had formalized a partnership with Horton World Solutions (HWS), a sustainable homebuilder whose proprietary composite framing system enables best-in-class energy efficiency and construction time.

- In May 2022, Mango Power launched the Mango Power M Series at Intersolar Munich 2022. You can use the system with a 10-20 kWh solar PV battery for both daily and emergency use. The system supports single- and triple-phase connections with an output capability of 8–14 kW. The system can be used in various applications, including a built-in inverter, backup gateway, and EV charger. The company launched different versions for the United States and European markets.

- In June 2022, Toyota entered the energy storage market with the launch of the O'Uchi Kyuden System, a Commercial battery product. Toyota launched a battery storage system with a rated output of 5.5 kWh and a rated capacity of 8.7 kWh, which uses the company’s electric vehicle battery technology. When connected to a photovoltaic rooftop system, the system can power a home day and night. Initially, the company aims to sell the storage system in Japan.

Key Market Players

- Tesla, Inc.

- LG Chem Ltd.

- Sonnen GmbH.

- Enphase Energy, Inc.

- Sunrun Inc.

- Panasonic Corporation.

- Orison.

- Eguana Technologies Inc.

- Pika Energy.

- BYD Company Limited.

|

By Technology Type |

By Power Rating |

By Connectivity |

By Operation |

By Region |

|

|

|

|

|

Related Reports

- Asia Pacific Electric Boiler Market Size - By Capacity (≤ 10 MMBtu/hr, > 10 - 50 MMBtu/hr, > 50 - 100 MMBtu/hr, > 100 ...

- North America & Europe Electric Boiler Market Size - By Voltage Rating (Low Voltage, Medium Voltage), By Application (Re...

- North America Residential Boiler Market Size - By Fuel (Natural Gas, Oil, Electric), By Technology (Condensing {Natural ...

- U.S. Commercial Boiler Market – By Product (Hot Water, Steam), Application (Offices, Healthcare Facilities, Educationa...

- North America Commercial Boiler Market Size - By Fuel (Natural Gas, Oil, Coal, Electric), By Capacity, By Technology (Co...

- Water Tube Industrial Boiler Market Size By Capacity, By Application (Food Processing, Pulp & Paper, Chemical, Refinery,...

Table of Content

-

Executive Summary

-

1.1 Market Snapshot

-

1.2 Key Developments and Highlights

-

1.3 Strategic Recommendations

-

-

Introduction

-

2.1 Report Objectives and Scope

-

2.2 Research Methodology

-

2.3 Definitions and Assumptions

-

-

Market Overview

-

3.1 What is Commercial Energy Storage?

-

3.2 Role in Grid Resilience and Cost Optimization

-

3.3 Components of a Commercial Energy Storage System (ESS)

-

3.4 Energy Storage Business Models for C&I Users

-

-

Market Dynamics

-

4.1 Market Drivers

-

4.1.1 Rising Electricity Demand Charges for Businesses

-

4.1.2 Grid Modernization and Demand Response Programs

-

4.1.3 Corporate Sustainability and Renewable Integration

-

-

4.2 Market Restraints

-

4.2.1 High Upfront Capital Expenditures

-

4.2.2 Complex Interconnection and Regulatory Hurdles

-

-

4.3 Market Opportunities

-

4.3.1 Time-of-Use (ToU) Optimization and Peak Shaving

-

4.3.2 Backup Power and Microgrid Integration

-

-

4.4 Market Challenges

-

4.5 Porter’s Five Forces Analysis

-

-

Technology Landscape

-

5.1 Battery Energy Storage Systems (BESS)

-

5.1.1 Lithium-Ion (LFP, NMC)

-

5.1.2 Lead-Acid

-

5.1.3 Flow Batteries

-

5.1.4 Sodium-Based Batteries

-

-

5.2 Hybrid Systems (Solar + Storage, Wind + Storage)

-

5.3 Energy Management Software (EMS, AI Optimization)

-

5.4 Safety Systems and UL/IEC Standards

-

-

Market Segmentation

-

6.1 By Technology

-

6.1.1 Lithium-Ion

-

6.1.2 Lead-Based

-

6.1.3 Flow

-

6.1.4 Others

-

-

6.2 By Application

-

6.2.1 Peak Shaving

-

6.2.2 Load Shifting

-

6.2.3 Renewable Energy Integration

-

6.2.4 Emergency Backup

-

6.2.5 Frequency Regulation

-

-

6.3 By Industry

-

6.3.1 Retail and Commercial Buildings

-

6.3.2 Data Centers

-

6.3.3 Manufacturing and Industrial Facilities

-

6.3.4 Warehouses and Logistics

-

-

-

Regional Analysis

-

7.1 North America

-

7.2 Europe

-

7.3 Asia-Pacific

-

7.4 Latin America

-

7.5 Middle East & Africa

-

-

Market Size and Forecast (2020–2030)

-

8.1 Global Revenue and Installed Capacity Forecast

-

8.2 Segment-Wise Outlook by Technology and Application

-

8.3 Regional and Country-Level Forecasts

-

-

Competitive Landscape

-

9.1 Market Share of Key Players

-

9.2 Company Profiles

-

9.2.1 Tesla (Megapack)

-

9.2.2 Fluence

-

9.2.3 LG Energy Solution

-

9.2.4 Enphase Energy

-

9.2.5 Others

-

-

9.3 Recent Deployments, Strategic Partnerships, and M&A

-

-

Policy and Regulatory Environment

-

10.1 Incentives and Tax Credits (e.g., ITC, subsidies)

-

10.2 Net Metering and Interconnection Rules

-

10.3 Safety and Grid Compliance Standards

-

-

Innovation and Future Outlook

-

11.1 Virtual Power Plants (VPPs) and Aggregated Storage

-

11.2 Role of AI and Machine Learning in Energy Optimization

-

11.3 Modular and Scalable Storage Architectures

-

-

Conclusion and Strategic Outlook

-

Appendices

-

13.1 Glossary

-

13.2 Research Methodology

-

13.3 References and Sources

-

To get a detailed Table of content/ Table of Figures/ Methodology Please contact our sales person at ( chris@marketinsightsresearch.com )

FAQ'S

For a single, multi and corporate client license, the report will be available in PDF format. Sample report would be given you in excel format. For more questions please contact:

Within 24 to 48 hrs.

You can contact Sales team (sales@marketinsightsresearch.com) and they will direct you on email

You can order a report by selecting payment methods, which is bank wire or online payment through any Debit/Credit card, Razor pay or PayPal.

Discounts are available.

Hard Copy