Saudi Arabia Smart LED Lighting Market

Saudi Arabia Smart LED Lighting Market By Products (Wireless and Wired), By Technology (WIFI, Hybrid, Dali, Bluetooth and Zigbee), By Distribution (Online and Offline), By Region, Competition, Forecast and Opportunities, 2019-2029

Published Date: May - 2025 | Publisher: MIR | No of Pages: 320 | Industry: Power | Format: Report available in PDF / Excel Format

View Details Buy Now 2890 Download Free Sample Ask for Discount Request Customization| Forecast Period | 2025-2029 |

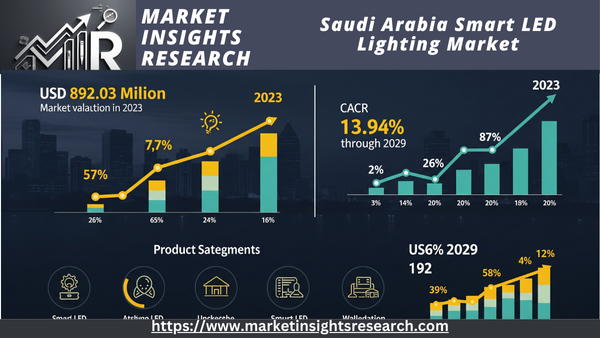

| Market Size (2023) | USD 892.03 Million |

| Market Size (2029) | USD 1969.37 Million |

| CAGR (2024-2029) | 13.94% |

| Fastest Growing Segment | Online |

| Largest Market | Riyadh |

Market Overview

The Saudi Arabia Smart LED Lighting Market was valued at USD 892.03 million in 2023 and is anticipated to project robust growth in the forecast period with a CAGR of 13.94% through 2029.

Download Free Sample Ask for Discount Request Customization

Key Market Drivers

Energy Efficiency and Sustainability

A significant force driving the Saudi Arabia Smart LED Lighting market is the increasing emphasis on energy efficiency and sustainability. With growing awareness of environmental concerns and the need to lower carbon emissions, governments, businesses, and consumers are actively seeking innovative solutions to minimize energy consumption. Smart LED lighting presents a sustainable alternative to conventional lighting systems, notably reducing energy consumption and, consequently, lowering electricity costs.

A primary factor fueling the adoption of smart LED lighting in Saudi Arabia is its energy-saving potential. LED technology is inherently more energy-efficient compared to traditional incandescent or fluorescent lighting. LEDs require considerably less electricity to produce the same amount of light, which translates to reduced energy expenses. When combined with smart lighting controls, such as motion sensors, daylight harvesting, and automated dimming, the energy savings become even more substantial. These intelligent features allow the lighting to adapt to environmental conditions, ensuring lights are only active when necessary, which conserves energy and further supports sustainability efforts.

Sustainability is also a key driver, as Saudi Arabia works toward reducing its carbon footprint and energy consumption. Smart LED lighting can aid the nation in achieving its environmental goals by lowering greenhouse gas emissions. LED technology consumes less energy and has a longer lifespan, decreasing the frequency of replacements and minimizing waste. Moreover, the ability to control lighting remotely and monitor energy usage through smart systems ensures efficient resource utilization and minimized wastage.

Initiatives like Saudi Arabia's Vision 2030, which focuses on diversifying the economy and reducing reliance on oil, have accelerated the adoption of energy-efficient technologies like smart LED lighting. Government incentives and regulations promoting energy efficiency have further bolstered the market. Companies and individuals are motivated to invest in smart LED lighting solutions to meet sustainability targets, comply with regulations, and benefit from potential cost savings. This synergy of energy efficiency and sustainability is a powerful driver propelling the Saudi Arabia Smart LED Lighting market forward.

Download Free Sample Ask for Discount Request Customization

Technological Advancements and Connectivity

Another significant driver for the Smart LED Lighting market in Saudi Arabia is the rapid advancement of technology and the increasing connectivity of devices and systems. The integration of LED lighting with smart technology has unlocked numerous opportunities for enhancing lighting control, efficiency, and user experience.

Smart LED lighting systems can now be effortlessly controlled and managed through smartphones, tablets, or voice-activated devices such as Amazon Alexa or Google Assistant. This level of convenience and accessibility is transforming how individuals interact with their lighting, making it more intuitive and user-friendly. Residents, businesses, and public institutions in Saudi Arabia are increasingly adopting these advancements to improve their lighting environments.

The interconnectivity of smart LED lighting with other smart home or building automation systems is another crucial driver. In Saudi Arabia, where the adoption of smart home technology is on the rise, people are integrating lighting with other devices like thermostats, security systems, and entertainment setups. This integration allows for more seamless and efficient control over various aspects of the environment, enhancing comfort, security, and energy management.

The growth of the Internet of Things (IoT) is playing a pivotal role in enabling this connectivity. Sensors, communication protocols, and data-sharing capabilities equip smart LED lighting systems to facilitate communication with other IoT devices and platforms. These advancements enable data-driven decisions, real-time monitoring, and enhanced automation, which can lead to more efficient energy consumption and an improved overall quality of life.

Download Free Sample Ask for Discount Request Customization

Cost Savings and Long-Term Benefits

Cost savings and long-term benefits are compelling drivers for the Smart LED Lighting market in Saudi Arabia. While the initial investment in smart LED lighting systems might be higher compared to traditional lighting, the long-term economic advantages are substantial.

A primary driver is the energy-saving potential of LED lighting. LEDs are significantly more energy-efficient than incandescent or fluorescent bulbs, consuming up to 80% less energy while providing the same or even better illumination. This translates to considerable energy cost savings for businesses and households in Saudi Arabia. The reduced energy consumption of LED bulbs, which can last 25,000 hours or more, can lead to significant reductions in electricity bills.

Smart LED lighting enhances these savings by incorporating features like motion sensors, automated dimming, and scheduling, which optimize energy use. For businesses and organizations, these features are particularly valuable as they can lead to considerable operational cost reductions. In Saudi Arabia's hot climate, where air conditioning is a significant energy expense, smart lighting can be integrated with HVAC systems to further enhance energy efficiency.

The longer lifespan of LED bulbs compared to traditional lighting sources translates to less frequent replacement and lower maintenance expenses. Reduced maintenance saves money and minimizes the disruption caused by frequent bulb replacements. The durability and robustness of LED bulbs are particularly important in Saudi Arabia, where extreme weather conditions, such as sandstorms and high temperatures, can impact traditional lighting systems.

Beyond direct cost savings, the long-term benefits of smart LED lighting extend to improved productivity, safety, and overall well-being. Smart lighting systems can be customized to create the ideal lighting environment for specific tasks, whether in homes, offices, or public spaces. This tailored lighting not only enhances comfort and ambiance but can also boost productivity and enhance security. The combination of reduced energy costs, decreased maintenance, and enhanced well-being makes smart LED lighting an attractive investment with substantial long-term benefits in Saudi Arabia.

Key Market Challenges

Initial Cost and Return on Investment

The comparatively high starting cost of smart LED lighting systems is one of the main issues facing the Saudi Arabian smart LED lighting market. Despite the long lifespan and energy efficiency of LED technology, the initial cost of buying and installing smart LED lighting fixtures and related control systems can be a major deterrent to adoption, particularly for people, companies, and government organizations with limited resources.

Smart LED lighting solutions are more costly than traditional lighting technologies because they are more sophisticated and include sensors, connection features, and control systems. Furthermore, adding smart LED technology to an existing lighting system might be expensive. Potential customers might not be able to see these technologies' return on investment (ROI) right away, which could discourage adoption.

Long-term benefits of smart LED lighting include lower maintenance expenses, higher overall illumination quality, and significant energy cost reductions. But it takes time to experience these advantages. Convincing Saudi Arabian consumers and businesses to consider the possible return on investment and long-term advantages above the initial expense is a difficult task. Such an effort calls for clear communication of the financial benefits and possible energy savings of smart LED lighting, which can be a challenging task.

Offering financial incentives, rebates, or financing options to make the upfront cost more bearable is one way to deal with this issue. By offering financial assistance or enabling low-interest loans, government programs and utilities can significantly contribute to the adoption of smart LED lighting. To change the attention from the initial investment to the possible returns, it is also crucial to increase awareness of the long-term savings and environmental advantages.

Technical Complexity and Integration

The intricacy of intelligent LED lighting solutions is an additional obstacle for the Saudi Arabian industry. For these systems to function at their best, various sensors, communication protocols, and control mechanisms must cooperate harmoniously. Even though the technology is strong, managing and integrating these parts can be difficult, particularly for people and organizations without technical expertise.

When combining smart LED lighting with other building automation or smart home technologies, incompatibilities may occur. Devices of different brands or generations may have compatibility issues, which can result in annoying user experiences and increased expenses for resolving technical problems. Programming and setting up lighting systems to suit certain requirements and tastes is another sophisticated aspect that can present a challenging learning curve for consumers.

Smart LED lighting systems are internet-connected and vulnerable to hacking and cyberattacks, making cybersecurity a major problem. Ensuring data and network connection security requires a level of technical expertise that end users may lack.

Manufacturers and service providers must concentrate on developing smart LED lighting solutions that are secure, interoperable, and easy to use to overcome these obstacles. Essential actions include making the installation and setup procedure simpler, offering customer support, and providing thorough user guides. Cooperation between standardization organizations and manufacturers can facilitate the establishment of common protocols and guarantee compatibility across various brands and devices. To increase trust and confidence in smart LED lighting systems in Saudi Arabia, it should also be a top goal to educate users on cybersecurity and privacy best practices.

Download Free Sample Ask for Discount Request Customization

Limited Infrastructure and Regulatory Framework

The lack of a thorough legal framework to enable its expansion and inadequate infrastructure provide challenges for the Saudi Arabian smart LED lighting market. In other places, especially in rural or underdeveloped portions of the nation, creating the infrastructure required for the broad adoption of smart LED lighting systems—such as a strong and dependable internet connection—may be a challenge.

Installing smart LED lighting systems frequently requires a reliable, fast internet connection in addition to auxiliary equipment like cloud-based platforms and data centers. Poor connectivity may jeopardize the usefulness and advantages of smart lighting systems. This situation makes it difficult to reach a large audience nationwide, as not all locations have equal access to the necessary infrastructure.

To guarantee safety, quality, and interoperability, a thorough regulatory framework that establishes standards, certifications, and guidelines for the implementation of smart LED lighting systems is necessary. Clear regulations can boost industry expansion and consumers' trust in the technology. Saudi Arabia is now working on creating and enforcing these rules for the market for smart LED lighting.

To overcome these obstacles and guarantee that smart LED lighting solutions are widely available and operational, it is imperative that stakeholders from the public and commercial sectors make investments in infrastructure development, especially in rural and underserved areas. To level the playing field and foster market trust, it is also necessary to create a transparent and encouraging regulatory framework. Cooperation between governmental organizations, trade groups, and technology suppliers is essential to overcome these obstacles and promote the expansion of the Saudi Arabian market for smart LED lighting.

Key Market Trends

IoT Integration and Smart City Initiatives

A significant trend in the Saudi Arabia Smart LED Lighting market is the growing integration of Internet of Things (IoT) technology alongside the nation's active participation in smart city initiatives. Cities within Saudi Arabia, such as Riyadh and Jeddah, are adopting the smart city model with the goals of elevating urban living standards, improving energy efficiency, and fostering sustainability. Smart LED lighting systems are proving to be crucial in realizing these ambitions.

The integration of IoT allows smart LED lighting systems to connect with various sensors, data analytics platforms, and other smart city elements. These systems can monitor environmental conditions, traffic patterns, and pedestrian movement, subsequently adjusting lighting levels as needed. For instance, streets can be illuminated optimally only when required, thereby reducing energy consumption during periods of low activity. This trend aligns with Saudi Arabia's wider aims to minimize energy use and decrease carbon emissions.

Furthermore, IoT integration extends to incorporating sensors and cameras for enhanced security and surveillance. Smart LED lighting fixtures can be outfitted with cameras and sensors to monitor public areas, identify unusual activities, and provide real-time alerts to authorities. This integration bolsters safety and improves emergency response capabilities within Saudi cities.

As Saudi Arabia persists in its investment in smart city infrastructure, the trend of IoT integration within the Smart LED Lighting market is anticipated to gain further traction. The development of interconnected, data-driven lighting solutions will optimize energy consumption and enhance the overall quality of urban life. These initiatives demonstrate a commitment to leveraging technology for the benefit of its residents, businesses, and the environment.

Human-Centric Lighting and Wellness

The use of human-centric lighting (HCL) principles is another noteworthy trend in the Saudi Arabian smart LED lighting market. HCL focuses on how lighting affects people's health, productivity, and well-being. This development reflects a growing understanding of the significance of lighting quality beyond simple illumination.

By modifying color temperature and intensity throughout the day, smart LED lighting systems can be configured to replicate natural light patterns. This circadian lighting aids the body's internal clock by helping people maintain a regular sleep-wake cycle and reducing disruptions to their natural rhythms. Maintaining a connection to natural light through thoughtfully planned indoor lighting is essential for general wellness in a nation where intense heat can restrict outside activities during the day.

In Saudi Arabia, the use of HCL principles is expanding in various contexts, such as homes, workplaces, medical facilities, and educational establishments. HCL, for instance, can be utilized in the medical field to establish restorative settings that aid in patients' recuperation. It can improve pupils' focus and cognitive abilities in the classroom.

The COVID-19 epidemic has made wellness-centric lighting even more crucial since it may enhance remote work and learning environments and help with mental health issues. The need for smart LED lighting systems with HCL characteristics is anticipated to increase as more Saudi Arabian individuals and businesses become aware of the positive effects that lighting has on well-being.

This pattern is in line with a worldwide movement to raise awareness about indoor environmental quality and its effects on productivity and health. The adoption of lighting solutions that put human-centric principles first is therefore anticipated to soar in the Saudi Arabian smart LED lighting market, fostering energy efficiency and well-being in various contexts.

Download Free Sample Ask for Discount Request Customization

Segmental Insights

Products

In 2023, the wireless category became the most dominant. The growing need for energy-efficient lighting solutions has been the main driver of the smart LED lighting market's notable expansion in Saudi Arabia. This development is largely due to the wireless segment, which provides automation, flexibility, and convenience.

Many networking technologies in the wireless category enable smart LED lighting solutions. Wi-Fi, Bluetooth, Zigbee, and even newer technologies like Li-Fi are among them. Because of its high bandwidth and extensive application in smart home settings, Wi-Fi is especially well-liked. In Saudi Arabia, smart home technology use is increasing. Consequently, many customers are incorporating smart LED lighting into their smart home networks.

Lighting can be easily controlled with smartphones and voice assistants like Google Assistant and Amazon Alexa thanks to wireless connectivity. Sustainability and energy efficiency are becoming more and more important in Saudi Arabia. Energy consumption can be decreased by precisely controlling lighting using smart LED lighting that has wireless controls. This approach is in line with the nation's objectives to lower electricity prices and conserve energy resources.

Regional Insights

Riyadh dominated the Saudi Arabia Smart LED Lighting market.

In Riyadh, the residential sector represents a significant market for smart LED lighting. Homeowners are increasingly embracing smart lighting solutions for their energy efficiency, convenience, and aesthetic appeal. Government institutions and public infrastructure projects within Riyadh are also adopting smart LED lighting to decrease energy consumption and enhance public spaces. This process includes the installation of intelligent street lighting systems. Wireless technologies such as Wi-Fi, Bluetooth, and Zigbee are commonly employed in smart LED lighting systems in Riyadh, facilitating remote control via smartphones and other devices.

Voice-controlled smart lighting systems, compatible with platforms like Amazon Alexa and Google Assistant, have gained traction in Riyadh, enhancing user experience and convenience. Consumers in Riyadh frequently seek customizable lighting solutions that allow them to tailor the mood and ambiance to their preferences, contributing to the demand for smart LED lighting.

The Smart LED Lighting Market in Riyadh is anticipated to maintain its growth trajectory, driven by urbanization, sustainability initiatives, and the increasing awareness of the advantages of smart lighting. As technology progresses and consumer preferences evolve, the market is likely to witness further innovation and expansion.

Recent Developments

- In June 2023, URC introduced its latest integrated lighting solution, the URC Lighting LT-3300. This innovative product offers a versatile all-in-one design that allows installers to choose between dimmer and switch configurations. It enables straightforward programming to customize lighting settings, catering to various occasions with ease, such as social gatherings or peaceful family gatherings.

- In February 2024, Signify launched a new accessory for Philips Hue smart lighting in the UK and the EU. This accessory enhances the ability to create imaginative lighting arrangements on ceilings or walls. Currently, customers can purchase the product exclusively through the brand's online store.

- In July 2024, Lumary, known for its extensive lineup of smart lighting solutions, introduced the new Smart UFO LED High Bay Light. This product features a remarkable efficiency of 160 lumens per watt (LM/W) and incorporates advanced motion-sensing technology, making it a standout choice for users seeking exceptional lighting solutions.

- In October 2023, Halonix Technologies, a rapidly expanding electrical company in India, unveiled the country's inaugural 'UP-DOWN GLOW' LED Bulb. This innovation underscores the company's dedication to enhancing everyday living through cutting-edge technology. The bulb's unique feature involves dual illumination—both the upper dome and lower stem glow in distinct colors, offering consumers the ability to create diverse lighting atmospheres with three switch-enabled modes.

Download Free Sample Ask for Discount Request Customization

Key Market Players

- Signify N.V. (Signify Netherlands B.V.)

- ams-OSRAM AG

- Schneider Electric SE

- Legrand Group

- Leviton Manufacturing Co., Inc.

- Acuity Brands, Inc.

- Eaton Corporation plc

- Feilo Sylvania Group

|

Byproducts |

By Technology |

By Distribution |

By Region |

|

|

|

|

Related Reports

- North America Residential Boiler Market Size - By Fuel (Natural Gas, Oil, Electric), By Technology (Condensing {Natural ...

- U.S. Commercial Boiler Market – By Product (Hot Water, Steam), Application (Offices, Healthcare Facilities, Educationa...

- North America Commercial Boiler Market Size - By Fuel (Natural Gas, Oil, Coal, Electric), By Capacity, By Technology (Co...

- Water Tube Industrial Boiler Market Size By Capacity, By Application (Food Processing, Pulp & Paper, Chemical, Refinery,...

- U.S. Industrial Boiler Market Size By Fuel (Natural Gas, Oil, Coal), By Capacity, By Technology (Condensing, Non-Condens...

- Fire Tube Industrial Boiler Market - By Capacity (<10 MMBtu/hr, 10-25 MMBtu/hr, 25-50 MMBtu/hr, 50-75 MMBtu/hr, >75 MMBt...

Table of Content

-

Executive Summary

-

1.1 Market Snapshot

-

1.2 Key Trends and Insights

-

1.3 Strategic Recommendations

-

-

Introduction

-

2.1 Report Objectives and Scope

-

2.2 Research Methodology

-

2.3 Definitions and Assumptions

-

-

Market Overview

-

3.1 Overview of Smart LED Lighting Systems

-

3.2 Importance in Smart Cities and Vision 2030

-

3.3 Industry Ecosystem and Stakeholders

-

-

Market Dynamics

-

4.1 Market Drivers

-

4.1.1 Urbanization and Smart Infrastructure Projects

-

4.1.2 Government Energy Efficiency Mandates

-

-

4.2 Market Restraints

-

4.2.1 High Initial Investment Costs

-

4.2.2 Technical Compatibility and Retrofitting Issues

-

-

4.3 Market Opportunities

-

4.3.1 Integration with IoT and AI Systems

-

4.3.2 Increasing Commercial and Industrial Adoption

-

-

4.4 Challenges

-

4.5 Porter’s Five Forces Analysis

-

-

Technology Overview

-

5.1 Smart LED Control Systems (Dimming, Sensors, Automation)

-

5.2 Communication Protocols (Zigbee, Bluetooth, Wi-Fi, LoRa)

-

5.3 Energy Monitoring and Scheduling Capabilities

-

5.4 Cloud Connectivity and App-Based Management

-

-

Market Segmentation by Product Type

-

6.1 Smart Bulbs

-

6.2 Smart Tubes

-

6.3 Smart Downlights and Spotlights

-

6.4 Smart Street Lights

-

6.5 Smart Panel and Ceiling Lights

-

6.6 Others (Strip Lights, Decorative LEDs)

-

-

End-Use Application Segmentation

-

7.1 Residential

-

7.2 Commercial

-

7.3 Industrial

-

7.4 Municipal and Outdoor

-

-

Regional and City-Level Analysis

-

8.1 Riyadh

-

8.2 Jeddah

-

8.3 Dammam

-

8.4 Mecca and Medina

-

8.5 Other Regions

-

-

Market Size and Forecast (2020–2030)

-

9.1 Revenue Forecast by Product

-

9.2 Volume Forecast by End-Use

-

9.3 Regional Growth Projections

-

-

Competitive Landscape

-

10.1 Market Share of Major Players

-

10.2 Company Profiles

-

10.2.1 Philips Signify

-

10.2.2 OSRAM (ams OSRAM)

-

10.2.3 GE Lighting

-

10.2.4 Eaton

-

10.2.5 Local Distributors and System Integrators

-

-

10.3 Recent Partnerships, Launches, and Initiatives

-

Regulatory and Policy Environment

-

11.1 Government Energy Efficiency Standards

-

11.2 Public Procurement Policies for Smart Lighting

-

11.3 Compliance with Sustainability Mandates

-

-

Innovation and Future Outlook

-

12.1 AI-Driven Adaptive Lighting

-

12.2 Integration with Building Management Systems (BMS)

-

12.3 Role in Carbon Reduction and ESG Goals

-

-

Conclusion and Strategic Recommendations

-

Appendices

-

14.1 Glossary

-

14.2 Research Methodology

-

14.3 Sources and References

-

To get a detailed Table of contents/Table of figures/Methodology Please contact our salesperson at chris@marketinsightsresearch.com.

To get a detailed Table of contents/Table of figures/Methodology Please contact our salesperson at chris@marketinsightsresearch.com.

FAQ'S

For a single, multi and corporate client license, the report will be available in PDF format. Sample report would be given you in excel format. For more questions please contact:

Within 24 to 48 hrs.

You can contact Sales team (sales@marketinsightsresearch.com) and they will direct you on email

You can order a report by selecting payment methods, which is bank wire or online payment through any Debit/Credit card, Razor pay or PayPal.

Discounts are available.

Hard Copy