Advanced Lead Acid Battery Market

Advanced Lead Acid Battery Market - Global Industry Size, Share, Trends, Opportunity, and Forecast, Segmented By Type (Stationary, Motive), By Construction Method (Flooded, VRLA, Others), By End User (Automotive & Transportation, Energy & Power, Industrial, Commercial), By Region & Competition, 2019-2029

Published Date: May - 2025 | Publisher: MIR | No of Pages: 320 | Industry: Power | Format: Report available in PDF / Excel Format

View Details Buy Now 2890 Download Free Sample Ask for Discount Request Customization| Forecast Period | 2025-2029 |

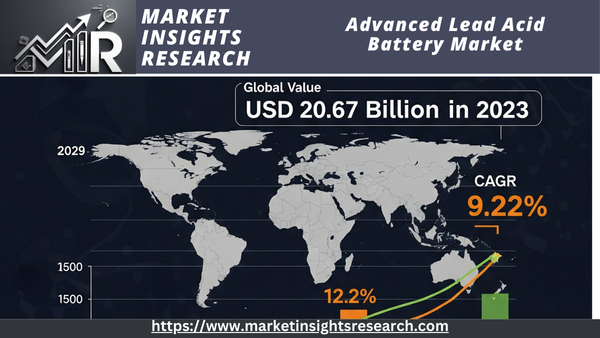

| Market Size (2023) | USD 20.67 Billion |

| Market Size (2029) | USD 35.94 Billion |

| CAGR (2024-2029) | 9.22% |

| Fastest Growing Segment | Industrial |

| Largest Market | Asia-Pacific |

Market Overview

The market for advanced lead acid batteries was estimated to be worth USD 20.67 billion in 2023 and is expected to grow at a strong rate during the forecast period, with a compound annual growth rate (CAGR) of 9.22% through 2029.

The creation, manufacturing, and distribution of improved lead acid batteries that perform better than conventional lead acid batteries are all included in the advanced lead acid battery market. These batteries use cutting-edge technologies, including better materials, better designs, and creative manufacturing techniques, to provide greater dependability, longer life cycles, faster recharge times, and higher energy densities. They are extensively utilized in many different applications, such as uninterruptible power supplies (UPS), automotive, industrial, and renewable energy storage.

Download Free Sample Ask for Discount Request Customization

The drawbacks of traditional lead acid batteries, like their short cycle life and poor charge acceptance, are intended to be addressed by advanced lead acid batteries. Advanced grid structures, improved active materials, and improved electrolyte compositions are some of the innovations in this market that increase the batteries' overall durability and efficiency. These batteries also frequently have maintenance-free designs, which lessens the need for routine maintenance.

The increasing need for economical and ecologically friendly energy storage solutions is propelling the market for advanced lead acid batteries. The market for advanced lead acid batteries is anticipated to grow significantly over the next several years due to the growing demand for dependable backup power and the growing adoption of renewable energy systems.

Key Market Drivers

Increasing Demand for Renewable Energy Storage

The need for effective and dependable energy storage solutions has grown dramatically as a result of the world's transition to renewable energy sources like solar and wind. Modern lead acid batteries are essential to this shift because they offer long-lasting and reasonably priced energy storage solutions. Renewable energy sources, in contrast to conventional energy sources, produce power sporadically, so reliable storage systems are required to guarantee a steady and uninterrupted power supply. Modern lead acid batteries are ideal for storing excess energy produced during periods of high production and releasing it during times of low generation or high demand because of their longer cycle life and increased efficiency.

Lead acid batteries have become more competitive with other battery types, like lithium-ion, thanks to advancements in battery technology that have produced batteries with higher energy densities and quicker recharge rates. These enhancements are especially crucial for microgrids and off-grid renewable energy systems in isolated locations where dependable energy storage is essential. Advanced lead acid batteries' affordability and scalability make them a desirable choice for extensive renewable energy projects, which fuels the market's expansion.

Rising Automotive Industry Adoption

The market for advanced lead acid batteries is largely driven by the automotive sector. Because of their dependability, affordability, and capacity to provide high surge currents—which are necessary for engine starting—lead acid batteries have long been the go-to option for automotive applications. But the introduction of start-stop systems in contemporary automobiles has raised the need for batteries that can withstand partial state-of-charge and frequent cycling. Absorbent glass mat (AGM) and enhanced flooded batteries (EFB) are examples of advanced lead acid batteries that are specifically made to satisfy these specifications.

Start-stop systems lower emissions and fuel consumption by automatically turning off the engine when the car is idling and starting it again when the driver lets go of the brake pedal. Because these systems put a lot of strain on the battery, advanced lead acid batteries with better cycling performance and charge acceptance are required. The adoption of these advanced batteries is being driven by the automotive industry's increasing emphasis on fuel efficiency and emission reduction. Furthermore, it is anticipated that the growing demand for advanced lead acid batteries for energy storage and auxiliary power applications will be further increased by the growing electrification of vehicles, including the rise of hybrid and electric vehicles.

Industrial Applications and Backup Power Solutions

Uninterrupted power supplies (UPS) are essential for industrial applications like data centers, telecommunications, and manufacturing in order to guarantee continuous operation and shield delicate equipment from power fluctuations. Modern lead acid batteries are a common option for UPS systems because of their affordability, dependability, and minimal maintenance needs. For industries where even a short power outage can cause large operational and financial losses, these batteries offer a reliable and steady power source.

Advanced lead acid batteries, which provide strong performance and durability, are extensively utilized in industrial machinery, forklifts, and other heavy equipment, including UPS systems. They are perfect for such demanding applications because of their resilience to severe operating conditions and reliable power output. The demand for advanced lead acid batteries in the industrial sector is being driven by the growth of industrial infrastructure and the increasing need for dependable backup power solutions in emerging economies.

Key Market Challenges

Competition from Alternative Battery Technologies

The fierce competition from alternative battery technologies, especially lithium-ion batteries, is one of the major issues facing the global market for advanced lead acid batteries. Because they are lighter, have a higher energy density, and have a longer cycle life than lead acid batteries, lithium-ion batteries have become increasingly popular in a variety of applications. These benefits increase the appeal of lithium-ion batteries for use in renewable energy storage systems, portable electronics, and electric vehicles (EVs).

The market for advanced lead acid batteries faces a significant challenge from the expanding use of lithium-ion batteries in the automotive sector, particularly with the rise of EVs. Because of their superior performance characteristics, lithium-ion batteries are becoming more and more popular among automakers for their new models. The need for increased driving range, quicker charging times, and general improved efficiency—all of which lithium-ion technology can offer—is what is causing this change. Consequently, there is a lot of pressure on the market share of advanced lead acid batteries in the automotive industry.

The problem is made worse by the falling cost of lithium-ion batteries as a result of production technology advancements and economies of scale. Lithium-ion batteries are being used more frequently in applications like industrial equipment and uninterruptible power supplies (UPS) that have historically relied on lead acid batteries due to their lower cost. A significant barrier to the expansion of the advanced lead acid battery market is the belief that lithium-ion batteries are a more contemporary and high-performing option, which also affects consumer preferences and market trends.

Download Free Sample Ask for Discount Request Customization

Environmental and Regulatory Concerns

Another major obstacle facing the market for advanced lead acid batteries is environmental and regulatory concerns. One of the main ingredients in lead acid batteries, lead is a hazardous heavy metal that can have detrimental effects on the environment and human health. Lead acid battery recycling and disposal done incorrectly can contaminate water and soil, harming ecosystems and human health. If not handled correctly, the recycling process itself can result in dangerous emissions and put employees in danger.

Because of this, many areas have strict environmental laws controlling the use, disposal, and recycling of lead acid batteries. Manufacturers frequently incur significant costs in order to comply with these regulations, including expenditures for environmentally friendly production methods and safe recycling techniques. When compared to other battery technologies that are not subject to the same regulatory burdens, these extra expenses may have an effect on the manufacturers of advanced lead acid batteries' overall profitability and competitiveness.

Governmental and public pressure to promote greener alternatives and lessen the use of hazardous materials is increasing. The operating environment for lead acid battery manufacturers may become even more complex as a result of this pressure, which may result in more stringent regulations in the future. For the market for advanced lead acid batteries, striking a balance between environmental sustainability and performance is a difficult task.

The industry must keep innovating in areas like lead recycling efficiency, lead content reduction, and safer battery chemistries in order to address these environmental concerns. These initiatives, however, necessitate large investments in research and development, which might not pay off right away. The market for advanced lead acid batteries must overcome the difficulty of meeting strict environmental regulations while preserving economic viability in order to guarantee long-term growth.

Key Market Trends

Advancements in Battery Technology

The market for advanced lead acid batteries is still evolving due to technological advancements. Battery performance, durability, and efficiency are significantly improving as a result of innovations in materials, design, and manufacturing techniques. The creation of improved grid alloys and cutting-edge active materials that raise the energy density and cycle life of batteries is one of the noteworthy trends.

For instance, it has been demonstrated that adding carbon additives to the negative plates of lead acid batteries enhances charge acceptance and lowers sulfation, a frequent reason for battery failure. As a result, batteries can charge more quickly and operate more reliably for the duration of their lives. Furthermore, improvements in separator technology are improving battery efficiency by lowering internal resistance.

The incorporation of intelligent battery management systems (BMS), which track and improve battery performance in real-time, is another technological trend. These mechanisms prolong the battery's useful life and enhance safety by preventing overcharging, overdischarging, and overheating. Advanced lead acid batteries' dependability and affordability are further increased by the integration of Internet of Things (IoT) capabilities into BMS, which enables remote monitoring and predictive maintenance.

Increasing Focus on Sustainability and Recycling

Recycling and sustainability are becoming more and more important in the market for advanced lead acid batteries. Manufacturers are making investments in environmentally friendly production techniques and effective recycling procedures to reduce the environmental impact of lead acid batteries as regulatory pressures and environmental concerns increase. Both consumer demand for greener products and regulatory requirements are driving this trend.

The advancement of battery recycling technologies is one noteworthy development in this field. With more than 95% of their lead, plastic, and acid components recoverable, advanced lead acid batteries are extremely recyclable. Recycling process innovations are lowering emissions, cutting waste, and improving the safety and efficiency of lead recovery. As a result of these developments, lead acid batteries are now among the most recycled goods in the world, supporting the circular economy.

Manufacturers are looking into ways to use less hazardous materials in batteries in place of lead. New battery chemistries that provide comparable performance with less of an impact on the environment are being researched. In addition to assisting businesses in meeting legal requirements, this emphasis on sustainability is enhancing their brand recognition and drawing in eco-aware clients.

Download Free Sample Ask for Discount Request Customization

Segmental Insights

Type Insights

In 2023, the stationery segment had the biggest market share. Due to a number of important factors, the stationary segment dominated the global market for advanced lead acid batteries. This dominance was primarily caused by the need for dependable and reasonably priced energy storage solutions in a range of stationary applications. In order to maintain continuous power in data centers, hospitals, and telecommunications infrastructure, uninterruptible power supply (UPS) systems heavily relied on stationary advanced lead acid batteries. By supplying the required backup power during blackouts, these batteries protected delicate equipment and ensured business continuity.

The dominance of the stationary segment was largely due to the integration of renewable energy systems. The need for effective energy storage solutions that could store excess energy produced during peak production periods and supply it during low production times became critical as the use of solar and wind energy expanded globally. Advanced lead acid batteries were a popular option for renewable energy storage because of their improved cycle life and deep discharge capabilities, which made them ideal for such applications.

An important factor was the advanced lead acid batteries' durability and dependability in stationary applications. These batteries were perfect for use in remote and off-grid installations because they could withstand severe environmental conditions and maintain reliable performance for extended periods of time. They were essential for critical infrastructure and industrial applications because of their capacity to provide high power output and maintain steady voltage levels under a range of load conditions.

Advanced lead acid batteries' affordability further strengthened their hegemony in the stationary market. For large-scale energy storage requirements, advanced lead acid batteries provided a more cost-effective option than other battery technologies like lithium-ion. Their well-established production methods and broad accessibility increased their marketability.

Regional Insights

In 2023, the largest market share was held by the Asia-Pacific region. Rapid industrialization and urbanization have occurred in the Asia-Pacific region, especially in nations like China and India. This expansion has raised the need for dependable energy storage solutions in a number of industries, such as transportation, telecommunications, and manufacturing. These needs can be satisfied by advanced lead acid batteries, which are renowned for their durability and affordability, especially in applications like industrial machinery and backup power systems.

In order to address issues of environmental sustainability and energy security, many Asia-Pacific nations are making significant investments in renewable energy sources. In order to store excess energy and guarantee a steady power supply, advanced lead acid batteries must be integrated into renewable energy systems like solar and wind power. Advanced lead acid batteries, which provide a dependable and affordable energy storage solution, are in high demand due to the region's dedication to developing its renewable energy infrastructure.

With a greater emphasis on fuel economy and lower emissions, the automotive sector in Asia-Pacific is expanding significantly. To meet these demands, advanced lead acid batteries are being used more and more, especially those made for hybrid cars and start-stop systems. The high demand for advanced lead acid batteries is a result of the region's extensive automotive manufacturing base and rising car ownership rates.

The Asia-Pacific area enjoys cost advantages and well-established manufacturing capabilities. This area is home to several of the top producers of advanced lead acid batteries, who use economies of scale and reduced production costs to provide competitive pricing. This has further cemented Asia-Pacific's market dominance by positioning the region as a major hub for the production and consumption of advanced lead acid batteries.

Download Free Sample Ask for Discount Request Customization

Recent Developments

- In December 2023, TAILG, a prominent global leader in electric two-wheelers, unveiled its latest sodium-ion battery technology, which represents a major milestone in the electric two-wheeler industry. This cutting-edge technology offers outstanding long-range performance, extended warranties, improved low-temperature resilience, and enhanced safety features. TAILG's premium electric bikes are the first to integrate these advanced sodium-ion batteries, with initial availability slated for the Chinese market.

- In July 2024, Exide Industries Ltd. launched a new Absorbent Glass Mat (AGM) battery designed for starting, lighting, and ignition (SLI) applications in response to the rising demand for advanced battery technologies in the automotive sector. This latest offering in the lead-acid battery category utilizes AGM technology to provide enhanced performance for four-wheelers. It is engineered to deliver superior starting power, increased durability, and a potentially extended lifespan compared to conventional lead-acid batteries.

- In March 2024, Noida-based RCRS Innovations Ltd., the parent company of EXEGI, a leading lithium-ion battery pack manufacturer, committed USD 6 million to enhance its lithium battery pack production capabilities. This investment will increase their current capacity of 300 MWh and support the introduction of new product lines, addressing the anticipated surge in demand for clean energy storage solutions. RCRS Innovations plans to establish a gigascale battery manufacturing facility in the next financial year. Among the new offerings, the company will debut container-sized energy storage systems with megawatt-hour capacities, designed for large-scale industrial applications. RCRS Innovations is preparing to launch the TOPCon range of solar panels, further expanding its portfolio in the clean energy sector.

Key Market Players

- Johnson Controls International plc

- Enersys

- East Penn Manufacturing Co.

- Trojan Battery Company LLC

- FIAMM Energy Technology S.p.A.

- GS Yuasa Corporation

- Clarios LLC

- HOPPECKE Batterien GmbH & Co. KG

- Hengyang Ritar Power Co., Ltd.

- Power-Sonic Corporation

|

By Type |

By Construction Method |

By End User |

By Region |

|

|

|

|

Related Reports

- Residential Electric Boiler Market Size - By Voltage Rating (Low Voltage, Medium Voltage), Industry Analysis Report, Reg...

- Europe Steam Boiler Market - By Capacity, By Fuel (Natural Gas, Oil, Coal), By Technology (Condensing, Non-Condensing), ...

- Electric Boiler Market Size By Voltage Rating (Low, Medium), By Application (Residential, Commercial, Industrial, Food P...

- Europe Boiler Market By Fuel (Natural Gas, Oil, Coal, Electric), By Capacity (≤ 10 MMBtu/hr, > 10 - 50 MMBtu/hr, > 50 ...

- Boiler Market Size - By Fuel (Natural Gas, Oil, Coal, Electric), By Capacity (≤ 10 MMBtu/hr, > 10 - 50 MMBtu/hr, > 50 ...

- Residential Boiler Market Size By Technology (Condensing {Natural Gas, Oil, Electric}, Non-Condensing {Natural Gas, Oil,...

Table of Content

-

Executive Summary

-

1.1 Market Snapshot

-

1.2 Key Developments and Insights

-

1.3 Strategic Recommendations

-

Introduction

-

2.1 Report Objectives

-

2.2 Scope and Definitions

-

2.3 Research Methodology

-

2.4 Assumptions and Limitations

-

Market Overview

-

3.1 What Are Advanced Lead Acid Batteries?

-

3.2 Technological Evolution from Conventional Lead Acid Batteries

-

3.3 Advantages and Use Cases

-

3.4 Industry Value Chain and Ecosystem

-

Market Dynamics

-

4.1 Market Drivers

-

4.1.1 Cost-Effectiveness Compared to Lithium-Ion

-

4.1.2 High Recyclability and Circular Economy Compatibility

-

4.1.3 Demand for Grid Stability and Renewable Integration

-

4.2 Market Restraints

-

4.2.1 Lower Energy Density and Shorter Lifecycle

-

4.2.2 Competition from Emerging Battery Technologies

-

4.3 Market Opportunities

-

4.3.1 Hybrid Systems and Microgrid Applications

-

4.3.2 Rural and Backup Power Deployment

-

4.4 Market Challenges

-

4.5 SWOT and Porter’s Five Forces Analysis

-

Technology Landscape

-

5.1 Enhanced Flooded Batteries (EFB)

-

5.2 Absorbent Glass Mat (AGM) Batteries

-

5.3 Gel-Based and Carbon Additive Variants

-

5.4 Battery Management System Integration

-

Market Segmentation

-

6.1 By Battery Type

-

6.1.1 AGM

-

6.1.2 EFB

-

6.1.3 GEL

-

6.1.4 Others

-

6.2 By Application

-

6.2.1 Automotive Start-Stop Systems

-

6.2.2 Renewable Energy Storage

-

6.2.3 Telecom and UPS

-

6.2.4 Industrial Equipment

-

6.3 By End-Use

-

6.3.1 Automotive

-

6.3.2 Utilities

-

6.3.3 Commercial and Industrial

-

6.3.4 Residential

-

Regional Analysis

-

7.1 North America

-

7.2 Europe

-

7.3 Asia-Pacific

-

7.4 Latin America

-

7.5 Middle East & Africa

-

Market Size and Forecast (2020–2030)

-

8.1 Revenue Forecast by Battery Type

-

8.2 Regional Market Forecast

-

8.3 Segment-Wise Growth Outlook

-

Competitive Landscape

-

9.1 Market Share of Leading Players

-

9.2 Company Profiles

-

9.2.1 Exide Technologies

-

9.2.2 EnerSys

-

9.2.3 Clarios

-

9.2.4 East Penn Manufacturing

-

9.2.5 Others

-

9.3 Strategic Initiatives and Partnerships

-

Regulatory and Environmental Framework

-

10.1 Lead Recycling Standards

-

10.2 Battery Safety and Transportation Regulations

-

10.3 Sustainability Certifications and Compliance

-

Innovation and Future Outlook

-

11.1 Carbon Additives and Cycle Life Enhancements

-

11.2 Smart Charging and Monitoring Systems

-

11.3 Integration with Hybrid Energy Systems

-

Conclusion and Strategic Outlook

-

Appendices

-

13.1 Glossary

-

13.2 Methodology Overview

-

13.3 References and Data Sources

Executive Summary

-

1.1 Market Snapshot

-

1.2 Key Developments and Insights

-

1.3 Strategic Recommendations

Introduction

-

2.1 Report Objectives

-

2.2 Scope and Definitions

-

2.3 Research Methodology

-

2.4 Assumptions and Limitations

Market Overview

-

3.1 What Are Advanced Lead Acid Batteries?

-

3.2 Technological Evolution from Conventional Lead Acid Batteries

-

3.3 Advantages and Use Cases

-

3.4 Industry Value Chain and Ecosystem

Market Dynamics

-

4.1 Market Drivers

-

4.1.1 Cost-Effectiveness Compared to Lithium-Ion

-

4.1.2 High Recyclability and Circular Economy Compatibility

-

4.1.3 Demand for Grid Stability and Renewable Integration

-

-

4.2 Market Restraints

-

4.2.1 Lower Energy Density and Shorter Lifecycle

-

4.2.2 Competition from Emerging Battery Technologies

-

-

4.3 Market Opportunities

-

4.3.1 Hybrid Systems and Microgrid Applications

-

4.3.2 Rural and Backup Power Deployment

-

-

4.4 Market Challenges

-

4.5 SWOT and Porter’s Five Forces Analysis

Technology Landscape

-

5.1 Enhanced Flooded Batteries (EFB)

-

5.2 Absorbent Glass Mat (AGM) Batteries

-

5.3 Gel-Based and Carbon Additive Variants

-

5.4 Battery Management System Integration

Market Segmentation

-

6.1 By Battery Type

-

6.1.1 AGM

-

6.1.2 EFB

-

6.1.3 GEL

-

6.1.4 Others

-

-

6.2 By Application

-

6.2.1 Automotive Start-Stop Systems

-

6.2.2 Renewable Energy Storage

-

6.2.3 Telecom and UPS

-

6.2.4 Industrial Equipment

-

-

6.3 By End-Use

-

6.3.1 Automotive

-

6.3.2 Utilities

-

6.3.3 Commercial and Industrial

-

6.3.4 Residential

-

Regional Analysis

-

7.1 North America

-

7.2 Europe

-

7.3 Asia-Pacific

-

7.4 Latin America

-

7.5 Middle East & Africa

Market Size and Forecast (2020–2030)

-

8.1 Revenue Forecast by Battery Type

-

8.2 Regional Market Forecast

-

8.3 Segment-Wise Growth Outlook

Competitive Landscape

-

9.1 Market Share of Leading Players

-

9.2 Company Profiles

-

9.2.1 Exide Technologies

-

9.2.2 EnerSys

-

9.2.3 Clarios

-

9.2.4 East Penn Manufacturing

-

9.2.5 Others

-

-

9.3 Strategic Initiatives and Partnerships

Regulatory and Environmental Framework

-

10.1 Lead Recycling Standards

-

10.2 Battery Safety and Transportation Regulations

-

10.3 Sustainability Certifications and Compliance

Innovation and Future Outlook

-

11.1 Carbon Additives and Cycle Life Enhancements

-

11.2 Smart Charging and Monitoring Systems

-

11.3 Integration with Hybrid Energy Systems

Conclusion and Strategic Outlook

Appendices

-

13.1 Glossary

-

13.2 Methodology Overview

-

13.3 References and Data Sources

List Tables Figures

To get a detailed Table of content/ Table of Figures/ Methodology Please contact our sales person at ( chris@marketinsightsresearch.com )

FAQ'S

For a single, multi and corporate client license, the report will be available in PDF format. Sample report would be given you in excel format. For more questions please contact:

Within 24 to 48 hrs.

You can contact Sales team (sales@marketinsightsresearch.com) and they will direct you on email

You can order a report by selecting payment methods, which is bank wire or online payment through any Debit/Credit card, Razor pay or PayPal.

Discounts are available.

Hard Copy