Lead-Acid Battery Scrap Market

Lead-Acid Battery Scrap Market – Global Industry Size, Share, Trends, Opportunity, and Forecast, Segmented By Battery (Flooded, Sealed), By Product (Lead, Sulfuric acid), By Source (Motor Vehicles, UPS), By Region & Competition, 2019-2029

Published Date: May - 2025 | Publisher: MIR | No of Pages: 320 | Industry: Power | Format: Report available in PDF / Excel Format

View Details Buy Now 2890 Download Free Sample Ask for Discount Request Customization| Forecast Period | 2025-2029 |

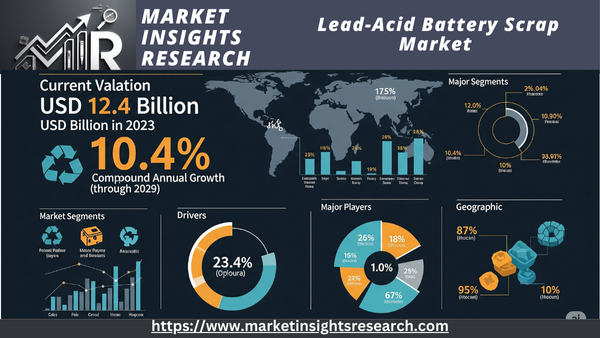

| Market Size (2023) | USD 12.4 Billion |

| Market Size (2029) | USD 22.65 Billion |

| CAGR (2024-2029) | 10.4% |

| Fastest Growing Segment | Motor Vehicles |

| Largest Market | Asia Pacific |

Market Overview

The global market for lead-acid battery scrap was estimated to be worth USD 12.4 billion in 2023 and is expected to grow at a strong rate during the forecast period, with a compound annual growth rate (CAGR) of 10.4% through 2029. Government rules, environmental concerns, and the growing need for lead recycling solutions are all contributing to the notable growth of the global lead-acid battery scrap market. Backup power systems, automobiles, and industrial settings all make extensive use of lead-acid batteries.

Download Free Sample Ask for Discount Request Customization

Because lead is hazardous and improper disposal is prohibited by environmental regulations, recycling has become essential as these batteries approach the end of their life cycle. As a result, governments and corporations are spending money on effective lead-acid battery recycling procedures. Recycling facilities minimize environmental impact and ensure responsible disposal by extracting valuable lead from used batteries. A sustainable circular economy is promoted by the numerous industries that use the recycled lead. The growing awareness of the need for eco-friendly practices among consumers and industries is another factor driving the market. The lead-acid battery scrap market is expected to grow steadily as environmental awareness rises around the world, offering eco-friendly solutions and satisfying the expanding need for recycled lead across a range of industries.

Key Market Drivers

Environmental Awareness and Recycling Regulations

The global lead-acid battery scrap market has grown due in large part to recycling laws and environmental awareness, which have shaped the industry's path toward sustainability and ethical behavior. The need for environmentally friendly solutions is growing as societies become more aware of environmental issues. Because of their lead content, lead-acid batteries—which are frequently used in industrial, automotive, and renewable energy applications—present environmental risks. But strict recycling laws and increased environmental consciousness have forced companies and customers to look for ways to lessen the environmental impact. Governments all over the world enforce recycling laws that make sure lead-acid batteries are disposed of and recycled properly. This ensures that these dangerous materials are processed safely and doesn't contaminate soil or water. Campaigns for environmental awareness have raised consumer awareness of the value of battery recycling and promoted a responsible consumption culture. Recycling lessens the environmental impact of battery production while also lessening the demand on natural resources. Businesses have adopted cutting-edge recycling technologies in response to these trends, turning used batteries into useful raw materials. This change not only supports environmental preservation objectives but also creates new sources of income for companies that recycle batteries. Following recycling laws not only guarantees legal compliance but also improves a business's reputation and builds trust with eco-aware customers. The circular economy model, which emphasizes material reuse and recycling, has gained traction. By encouraging the collection of scrap batteries for recycling and keeping them out of landfills, it encourages the responsible disposal of lead-acid batteries. In addition to making the environment cleaner, businesses that invest in sophisticated recycling techniques also create a sustainable market for recycled lead, which lowers the need for new lead extraction. Due to strict recycling laws and growing environmental consciousness, companies in the lead-acid battery sector are being forced to adopt eco-friendly procedures and innovate. In addition to propelling the global lead-acid battery scrap market, this dedication guarantees a more sustainable and environmentally friendly future for both the industry and the earth.

Resource Scarcity and Circular Economy Initiatives

The global lead-acid battery scrap market is entering a new era of sustainability and responsible resource management as a result of resource scarcity and circular economy initiatives. Businesses' approaches to resource utilization have fundamentally changed as a result of the shortage of raw materials, particularly lead, brought on by rising demand from a variety of industries. Initiatives for the circular economy, which emphasize waste reduction, product reuse, and material recycling, have become well-known as crucial tactics for reducing resource scarcity. Given this, lead-acid batteries—which are extensively utilized in the industrial, automotive, and renewable energy sectors—have emerged as a key focus of circular economy initiatives. Recycling these batteries reduces the environmental impact of lead extraction while also conserving valuable resources. In order to turn lead-acid batteries into a useful secondary raw material, circular economy initiatives promote their collection and recycling. Companies are implementing cutting-edge recycling techniques that effectively remove lead and other materials from spent batteries, guaranteeing a closed-loop system. Since these programs drastically cut down on the need for new lead mining, they conserve natural resources and lessen environmental damage, which is in line with environmental goals. By creating a market for recycled lead and lowering reliance on primary raw material sources, circular economy practices generate economic opportunities.Businesses that adopt the circular economy's tenets are improving their sustainability profiles in addition to conserving resources. In addition to guaranteeing adherence to environmental laws, this proactive strategy improves public opinion and fortifies the reputation of the brand. Through policy frameworks, incentives, and awareness campaigns, governments and international organizations are promoting the adoption of circular economy practices by businesses. Businesses that apply the concepts of the circular economy to their operations are strategically positioned in the market in this changing environment. In addition to addressing the issues of resource scarcity, they also stimulate technological innovation in recycling, establishing a strong foundation for the sustainable recycling of lead-acid batteries. Companies that follow circular economy initiatives are not only satisfying consumer demands but also significantly contributing to the development of a more sustainable and greener future for the lead-acid battery sector and the global economy.

Download Free Sample Ask for Discount Request Customization

Key Market Challenges

Interoperability and Standardization

Significant challenges in terms of standardization and interoperability confront the global lead-acid battery scrap market. It becomes difficult to achieve smooth integration and standardized protocols due to the wide variety of recycling technologies and processes used globally. Compatibility problems frequently arise from the absence of universal standards, making it challenging for recycling facilities to exchange data and communicate efficiently. This lack of interoperability limits the industry's ability to recover materials efficiently and streamline operations. Inconsistent procedures may result in subpar recycling results, higher operating expenses, and inefficiencies.

Security Vulnerabilities and Privacy Concerns

Concerns about privacy and security flaws are major issues facing the global lead-acid battery scrap market. Recycling facilities frequently handle private information about suppliers, materials, and procedures. It is crucial to safeguard this data from data breaches and cyberattacks. Inadequate security measures jeopardize the confidentiality of proprietary techniques and the integrity of recycling processes by allowing unauthorized access, data manipulation, or theft. Strong cybersecurity procedures, frequent software upgrades, and staff education on safe data management techniques are all necessary to address these issues. To ensure that stakeholders feel comfortable sharing sensitive information and to promote industry collaborations and innovations, it is essential to establish trust through improved security features.

Data Management and Analytics Complexity

One of the biggest challenges is managing the enormous volumes of data produced by lead-acid battery recycling procedures. Recycling facilities generate a lot of data about the environmental impact, recycling techniques, and material composition. The optimization of recycling procedures and the maintenance of environmental sustainability depend on the efficient analysis of this data to derive significant insights. The management and analysis of recycling data become more complex when data accuracy, dependability, and regulatory compliance are ensured. Utilizing the full potential of recycling-generated data, improving operational efficiency, and encouraging sustainable practices in the sector all depend on simplifying these complexities through sophisticated analytics tools and efficient data management procedures.

Energy Efficiency and Sustainability

The global lead-acid battery scrap market faces significant challenges related to sustainability and energy efficiency. Recycling procedures frequently involve large energy inputs, which affects environmental sustainability and operating costs. Reducing the carbon footprint of recycling operations requires maximizing material recovery while minimizing energy consumption. Environmental issues are raised by the way waste produced during the recycling process is disposed of. Addressing these issues requires putting energy-efficient technologies into place, encouraging the use of renewable energy sources, and implementing appropriate waste disposal procedures. For lead-acid batteries to be recycled in an environmentally responsible manner over their whole lifecycle, functionality and energy efficiency must be balanced.

Regulatory Compliance and Legal Frameworks

For the global lead-acid battery scrap market, navigating various regulatory frameworks and guaranteeing adherence to international laws are major challenges. Recycling facilities frequently operate internationally, requiring compliance with various waste management, environmental protection, and worker safety regulations. Industry participants must make constant efforts to stay up to date with changing legal requirements and standards. Legal repercussions for noncompliance can impede reputation and market expansion. To create an environment that is favorable for recycling innovation, it is essential to establish a unified worldwide approach to recycling regulations and encourage industry self-regulation. To overcome these obstacles and establish a supportive environment for the growth of the global lead-acid battery scrap market, industry cooperation and proactive interaction with regulatory agencies are crucial.

Key Market Trends

Rising Connectivity and IoT Adoption

The increasing wave of connectivity and the widespread adoption of Internet of Things (IoT) technology are driving a significant transformation in the global lead-acid battery scrap market. This increase in connectivity, made possible by 5G networks and high-speed internet, has completely altered how recycling facilities use technology. Adoption of IoT in this industry entails incorporating smart sensors into recycling machinery and procedures, resulting in a smooth and networked ecosystem where gadgets gather information and streamline recycling procedures. The Lead-Acid Battery Scrap Market is using IoT to improve operational efficiency and sustainability through predictive maintenance systems that foresee equipment failures and real-time monitoring of recycling machinery. The industry landscape is changing as a result of recycling facilities integrating IoT technology, which streamlines operations, minimizes downtime, and maximizes material recovery rates.

Advancements in Data Analytics and Machine Learning

The global lead-acid battery scrap market is being significantly shaped by developments in machine learning algorithms and data analytics. To handle the enormous volume of data produced during the recycling process, recycling facilities are using advanced data analytics tools. To find trends, streamline recycling processes, and forecast consumer needs, machine learning algorithms are used. Recycling facilities can reduce operational inefficiencies, improve recycling results, and make data-driven decisions thanks to these technologies. Recycling businesses are able to effectively plan their operations by using predictive analytics models to forecast material availability. Additionally, machine learning algorithms are used in sorting procedures to improve material separation accuracy and raise the total amount of valuable materials extracted from lead-acid batteries.

Focus on Sustainable Practices and Circular Economy

The global lead-acid battery scrap market has made sustainability a major theme. Recycling facilities are embracing the circular economy's tenets and implementing more ecologically friendly procedures. Lead-acid battery recycling is not the only goal; proper waste disposal and environmental impact reduction are also priorities. To cut down on emissions and energy usage during the recycling process, recycling companies are investing in environmentally friendly technologies. In order to promote a sustainable supply chain, there is an increasing focus on creating closed-loop recycling systems, in which materials are recycled and reused within the industry. Eco-friendly initiatives are a defining trend in the lead-acid battery scrap market as a result of government regulations and consumer awareness of environmental conservation, which are pushing the industry towards sustainable practices.

Innovation in Material Recovery Techniques

The global lead-acid battery scrap market is changing as a result of advancements in material recovery techniques. Recycling facilities are spending money on R&D to investigate new techniques for effectively removing valuable materials from lead-acid batteries. Advanced water-based processes, electrical techniques, and novel material separation techniques are being developed to improve the recovery of lead, plastic, and other valuable materials from lead-acid batteries. These developments contribute to resource conservation by lowering the dependency on mining for raw materials and improving the economic feasibility of recycling operations. Innovation is a major trend in the lead-acid battery scrap market as a result of ongoing research and experimentation in material recovery techniques, which are propelling the sector towards a more efficient and sustainable future.

Segmental Insights

Battery Insights

Throughout the forecast period, the sealed lead-acid battery segment is anticipated to continue to dominate the global lead-acid battery scrap market. Because of their improved safety features and maintenance-free operation, sealed lead-acid batteries—also referred to as maintenance-free batteries—have become widely used in a variety of industries. Because these batteries are sealed, the electrolyte cannot leak or spill, increasing their dependability and making them appropriate for uses where convenience and safety are crucial. Due to their widespread use in industries like automotive, telecommunications, uninterruptible power supplies (UPS), and renewable energy systems, sealed lead-acid batteries dominate the scrap market. Recycling becomes essential as these batteries near the end of their useful lives in order to recover valuable materials like lead and maintain regulatory compliance and environmental sustainability. Advanced procedures that effectively extract lead and other reusable components while reducing environmental impact are used to recycle sealed lead-acid batteries. The market dominance of sealed lead-acid battery scrap is further supported by the growing emphasis on sustainable practices, environmental regulations, and responsible waste management. This market is expected to continue to dominate, propelling the recycling industry toward a more sustainable and greener future as long as industries continue to depend on sealed lead-acid batteries for their dependability and safety.

Source Insights

The global lead-acid battery scrap market was dominated by the motor vehicle segment, and this trend is anticipated to continue for the duration of the forecast period. Lead-acid batteries are essential to the power requirements of motor vehicles, which include cars, trucks, and other types of transportation. A significant amount of lead-acid battery scrap is produced as the batteries in these cars age and reach the end of their useful lives. The dominance of the motor vehicles segment has been greatly aided by factors like the expanding automotive industry, rising car ownership, and the rising demand for electric vehicles (EVs) with lead-acid batteries in auxiliary systems. Lead-acid battery disposal has increased proportionately as a result of the growth of e-commerce and the transportation industry, as well as an increase in the number of vehicles on the road worldwide, further solidifying this segment's dominance. The recycling of lead-acid batteries from automobiles has been promoted by the strong recycling infrastructure and environmental laws requiring appropriate disposal. The motor vehicles segment is well-positioned to sustain its dominance in the lead-acid battery scrap market, guaranteeing a sustainable approach to battery waste management, given the ongoing expansion of the automotive industry and the regular use of lead-acid batteries in a variety of vehicle types.

Regional Insights

Over the course of the forecast period, the Asia-Pacific region is anticipated to continue to dominate the global lead-acid battery scrap market. The fast industrialization and urbanization of nations like China, India, Japan, and South Korea is to blame for this regional domination. Particularly in Asia-Pacific, the automotive sector grew significantly, which increased the number of automobiles with lead-acid batteries. This region's dominance was largely caused by the growing need for backup power solutions in emerging economies as well as the extensive use of lead-acid batteries in uninterruptible power supplies (UPS) for a variety of industries. Strict environmental regulations and a well-established recycling infrastructure made it easier to manage and recycle lead-acid batteries, which in turn fueled the market's expansion. The Asia-Pacific region's dominance in the global lead-acid battery scrap market is anticipated to be maintained by the region's ongoing industrial expansion, increased investments in renewable energy projects, and growing demand for backup power sources. The Asia-Pacific area is in a strong position to hold onto its leadership position as the need for lead-acid batteries in commercial, industrial, and automotive applications grows, guaranteeing efficient handling and recycling of lead-acid battery waste.

Download Free Sample Ask for Discount Request Customization

Recent Developments

- The Global Lead-Acid Battery Scrap Market witnessed significant advancements in March 2023 as industry leaders like Amazon and Google embraced innovative solutions. Amazon introduced an upgraded line of Echo devices, seamlessly integrated with advanced IoT technologies. These smart devices feature enhanced connectivity and intelligent automation, providing users with an immersive experience in smart homes. Equipped with improved sensors for environmental monitoring, users can effortlessly control home appliances, lighting, and security systems. Amazon's focus on intuitive user interfaces and enhanced IoT functionalities aligns with the rising demand for seamless and interconnected smart home solutions.

- In July 2023, Google made a groundbreaking move by introducing a new series of AI-powered wearables designed to revolutionize consumer health monitoring. These innovative devices utilize advanced sensors and machine learning algorithms to track vital signs, physical activity, and overall well-being. Integrated with the Lead-Acid Battery Scrap ecosystem, these wearables provide real-time health insights to users, empowering them to make informed decisions about their health and fitness. Google's venture into AI-driven consumer wearables signifies a significant leap in integrating IoT technologies into personal healthcare, catering to the increasing consumer focus on proactive health management.

- In November 2022, Microsoft unveiled its suite of IoT-enabled smart office solutions, aimed at enhancing workplace productivity and efficiency. Leveraging IoT sensors, data analytics, and cloud computing, these solutions optimize office spaces, automate routine tasks, and improve energy management. By offering real-time data on occupancy, lighting, and climate control, Microsoft's smart office solutions enable businesses to create flexible, comfortable, and energy-efficient work environments. This development underscores the growing adoption of IoT technologies in commercial spaces, transforming traditional offices into intelligent, data-driven workplaces. These advancements highlight the continuous evolution and integration of IoT technologies in the Global Lead-Acid Battery Scrap Market, shaping the industry's future landscape.

Key Market Players

- Johnson Controls International PLC

- Exide Technologies S.A.S.

- East Penn Manufacturing Co., Inc.

- GS Yuasa International Ltd.

- Battery Solutions LLC

- Whitelake Organics Pvt Ltd.

- Gravita India Ltd.

- Aqua Metals Inc.

- Madenat Al Nokhba Recycling Services LLC

- Beeah Group

|

By Battery |

By Product |

By Source |

By Region |

|

|

|

|

Related Reports

- Europe Residential Boiler Market Size - By Technology (Condensing {Natural Gas, Oil, Electric}, Non-Condensing {Natural ...

- U.S. Boiler Market Size By Fuel (Natural Gas, Oil, Coal), Capacity, By Technology (Condensing, Non-Condensing), By Produ...

- Commercial Hot Water Boiler Market Size - By Fuel (Natural Gas, Oil, Coal, Electric), By Technology (Condensing, Non-Con...

- UK Commercial Boiler Market Size By Fuel (Natural Gas, Oil, Coal, Electric), By Capacity, By Technology (Condensing, Non...

- Residential Electric Boiler Market Size - By Voltage Rating (Low Voltage, Medium Voltage), Industry Analysis Report, Reg...

- Europe Steam Boiler Market - By Capacity, By Fuel (Natural Gas, Oil, Coal), By Technology (Condensing, Non-Condensing), ...

Table of Content

-

Executive Summary

-

1.1 Market Highlights

-

1.2 Key Trends and Insights

-

1.3 Strategic Recommendations

-

Introduction

-

2.1 Report Objectives and Scope

-

2.2 Research Methodology

-

2.3 Assumptions and Definitions

-

Market Overview

-

3.1 What is Lead-Acid Battery Scrap?

-

3.2 Scrap Generation Lifecycle and Sources

-

3.3 Industry Value Chain: Collection, Processing, Recycling

-

Market Dynamics

-

4.1 Market Drivers

-

4.1.1 Increasing Automotive and Industrial Battery Waste

-

4.1.2 High Recyclability and Secondary Lead Demand

-

4.1.3 Regulatory Push for Proper Disposal

-

4.2 Market Restraints

-

4.2.1 Environmental and Safety Risks in Informal Recycling

-

4.2.2 Volatility in Lead Prices

-

4.3 Market Opportunities

-

4.3.1 Technology Upgrades in Smelting and Recovery

-

4.3.2 Cross-Border Scrap Trade and Global Supply Chains

-

4.4 Market Challenges

-

4.5 Porter’s Five Forces Analysis

-

Types and Sources of Lead-Acid Battery Scrap

-

5.1 Automotive Batteries

-

5.2 Industrial and Telecom Batteries

-

5.3 UPS and Renewable Storage Batteries

-

5.4 Marine and Aviation Batteries

-

Scrap Collection and Processing Technologies

-

6.1 Collection Channels: Formal vs Informal

-

6.2 Smelting and Secondary Lead Extraction

-

6.3 Innovations in Eco-Friendly Recycling

-

6.4 Logistics and Handling Systems

-

Market Segmentation

-

7.1 By Source Type

-

7.1.1 Automotive

-

7.1.2 Industrial

-

7.1.3 Others

-

7.2 By Collection Model

-

7.2.1 Manufacturer Take-Back Programs

-

7.2.2 Scrap Dealers and Aggregators

-

7.2.3 Municipal and Third-Party Programs

-

7.3 By End Use

-

7.3.1 Secondary Lead Production

-

7.3.2 Export and Reprocessing

-

7.3.3 Component Reuse and Disposal

-

Regional Market Analysis

-

8.1 North America

-

8.2 Europe

-

8.3 Asia-Pacific

-

8.4 Latin America

-

8.5 Middle East & Africa

-

Market Size and Forecast (2020–2030)

-

9.1 Volume and Revenue Forecast

-

9.2 Scrap Flow Estimates by Region

-

9.3 Secondary Lead Production Forecast

-

Competitive Landscape

-

10.1 Key Scrap Collectors and Recyclers

-

10.2 Company Profiles

-

10.2.1 Aqua Metals

-

10.2.2 Gravita India

-

10.2.3 Exide Recycling

-

10.2.4 Others

-

10.3 Strategic Initiatives and M&A Activities

-

Policy and Regulatory Environment

-

11.1 Battery Scrap Handling Regulations

-

11.2 International Conventions (e.g., Basel Convention)

-

11.3 Extended Producer Responsibility (EPR) Laws

-

Sustainability and Future Outlook

-

12.1 Circular Economy Role of Lead-Acid Battery Scrap

-

12.2 Trends in Green Recycling Technologies

-

12.3 Global Trade and Recycling Hub Emergence

-

Conclusion and Strategic Recommendations

-

Appendices

-

14.1 Glossary

-

14.2 Research Methodology

-

14.3 Data Sources and References

Executive Summary

-

1.1 Market Highlights

-

1.2 Key Trends and Insights

-

1.3 Strategic Recommendations

Introduction

-

2.1 Report Objectives and Scope

-

2.2 Research Methodology

-

2.3 Assumptions and Definitions

Market Overview

-

3.1 What is Lead-Acid Battery Scrap?

-

3.2 Scrap Generation Lifecycle and Sources

-

3.3 Industry Value Chain: Collection, Processing, Recycling

Market Dynamics

-

4.1 Market Drivers

-

4.1.1 Increasing Automotive and Industrial Battery Waste

-

4.1.2 High Recyclability and Secondary Lead Demand

-

4.1.3 Regulatory Push for Proper Disposal

-

-

4.2 Market Restraints

-

4.2.1 Environmental and Safety Risks in Informal Recycling

-

4.2.2 Volatility in Lead Prices

-

-

4.3 Market Opportunities

-

4.3.1 Technology Upgrades in Smelting and Recovery

-

4.3.2 Cross-Border Scrap Trade and Global Supply Chains

-

-

4.4 Market Challenges

-

4.5 Porter’s Five Forces Analysis

Types and Sources of Lead-Acid Battery Scrap

-

5.1 Automotive Batteries

-

5.2 Industrial and Telecom Batteries

-

5.3 UPS and Renewable Storage Batteries

-

5.4 Marine and Aviation Batteries

Scrap Collection and Processing Technologies

-

6.1 Collection Channels: Formal vs Informal

-

6.2 Smelting and Secondary Lead Extraction

-

6.3 Innovations in Eco-Friendly Recycling

-

6.4 Logistics and Handling Systems

Market Segmentation

-

7.1 By Source Type

-

7.1.1 Automotive

-

7.1.2 Industrial

-

7.1.3 Others

-

-

7.2 By Collection Model

-

7.2.1 Manufacturer Take-Back Programs

-

7.2.2 Scrap Dealers and Aggregators

-

7.2.3 Municipal and Third-Party Programs

-

-

7.3 By End Use

-

7.3.1 Secondary Lead Production

-

7.3.2 Export and Reprocessing

-

7.3.3 Component Reuse and Disposal

-

Regional Market Analysis

-

8.1 North America

-

8.2 Europe

-

8.3 Asia-Pacific

-

8.4 Latin America

-

8.5 Middle East & Africa

Market Size and Forecast (2020–2030)

-

9.1 Volume and Revenue Forecast

-

9.2 Scrap Flow Estimates by Region

-

9.3 Secondary Lead Production Forecast

Competitive Landscape

10.1 Key Scrap Collectors and Recyclers

10.2 Company Profiles

-

10.2.1 Aqua Metals

-

10.2.2 Gravita India

-

10.2.3 Exide Recycling

-

10.2.4 Others

10.3 Strategic Initiatives and M&A Activities

Policy and Regulatory Environment

-

11.1 Battery Scrap Handling Regulations

-

11.2 International Conventions (e.g., Basel Convention)

-

11.3 Extended Producer Responsibility (EPR) Laws

Sustainability and Future Outlook

-

12.1 Circular Economy Role of Lead-Acid Battery Scrap

-

12.2 Trends in Green Recycling Technologies

-

12.3 Global Trade and Recycling Hub Emergence

Conclusion and Strategic Recommendations

Appendices

-

14.1 Glossary

-

14.2 Research Methodology

-

14.3 Data Sources and References

List Tables Figures

To get a detailed Table of content/ Table of Figures/ Methodology Please contact our sales person at ( chris@marketinsightsresearch.com )

FAQ'S

For a single, multi and corporate client license, the report will be available in PDF format. Sample report would be given you in excel format. For more questions please contact:

Within 24 to 48 hrs.

You can contact Sales team (sales@marketinsightsresearch.com) and they will direct you on email

You can order a report by selecting payment methods, which is bank wire or online payment through any Debit/Credit card, Razor pay or PayPal.

Discounts are available.

Hard Copy