India Residential Energy Storage Market

India Residential Energy Storage Market By Technology (Lithium-Ion Batteries, Lead-Acid Batteries, Flow Batteries, Sodium-Based Batteries), By Installation Type (Wall-Mounted, Floor-Mounted, Modular), By End-User (Single-Family Homes, Multi-Family Homes), By Region, Competition, Forecast and Opportunities, 2020-2030F

Published Date: May - 2025 | Publisher: MIR | No of Pages: 320 | Industry: Power | Format: Report available in PDF / Excel Format

View Details Buy Now 2890 Download Free Sample Ask for Discount Request Customization| Forecast Period | 2026-2030 |

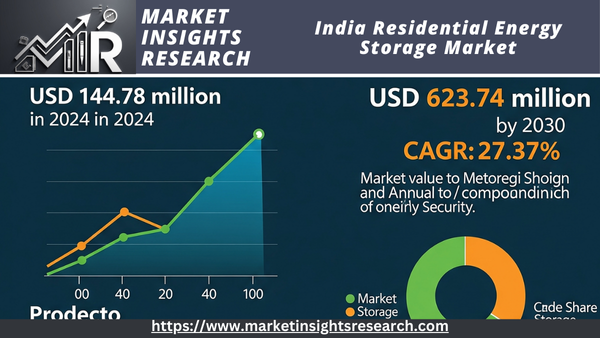

| Market Size (2024) | USD 144.78 million |

| Market Size (2030) | USD 623.74 million |

| CAGR (2025-2030) | 27.37% |

| Fastest Growing Segment | Sodium-Based Batteries |

| Largest Market | South India |

Market Overview

The India Residential Energy Storage Market was valued at USD 144.78 million in 2024 and is projected to attain USD 623.74 million by 2030, exhibiting a CAGR of 27.37% throughout the forecast period. The India Residential Energy Storage market pertains to the domain dedicated to technologies and systems that facilitate energy storage in residential environments, allowing homeowners to optimize energy management and utilization. This market includes diverse energy storage solutions, such as batteries, that retain surplus energy produced by renewable sources like solar panels or wind turbines for future utilization.

Download Free Sample Ask for Discount Request Customization

The expansion of the India Residential Energy Storage market is propelled by several pivotal factors. The rising utilization of renewable energy sources, especially solar power, has resulted in an augmented demand for efficient energy storage systems capable of retaining excess energy produced during peak generation periods for utilization during low production intervals or power outages. Moreover, escalating electricity costs and recurrent power shortages in India are prompting homeowners to pursue dependable and economical energy storage solutions to guarantee continuous power supply and diminish reliance on the grid. Government incentives and subsidies for residential solar and energy storage installations enhance market growth by rendering these technologies more economical and attainable. Furthermore, enhancements in energy storage technologies, including increased battery efficiency and decreased costs, are rendering residential energy storage systems more attractive to consumers. The market is benefiting from heightened awareness of energy management and sustainability, prompting homeowners to invest in solutions that provide energy independence and promote environmental conservation. India's investment in renewable energy infrastructure and efforts to resolve energy reliability challenges are anticipated to catalyze substantial growth in the residential energy storage market, propelled by technological innovations, favorable policies, and increasing consumer demand for energy efficiency and reliability.

Key Market Drivers

Increasing Adoption of Renewable Energy Sources

The increase in renewable energy adoption is a significant catalyst for the India Residential Energy Storage market. As India seeks to augment its renewable energy capacity, especially in solar power, the necessity for efficient energy storage systems has become increasingly paramount. Residential solar installations are increasing, propelled by governmental incentives and decreasing solar panel costs. Solar energy production is characterized by intermittency, exhibiting peaks during sunny intervals and troughs during overcast or nocturnal conditions. Homeowners need energy storage solutions to efficiently capture and utilize excess power generated during peak sunlight hours and to release it when sunlight is unavailable. Energy storage systems, including batteries, mitigate this challenge by enabling homeowners to retain excess energy for future utilization, thereby improving the reliability and efficiency of their solar power systems. The increasing deployment of rooftop solar panels in residential zones, bolstered by numerous state and federal initiatives, highlights the necessity for supplementary energy storage systems to guarantee a consistent and dependable power supply. The increasing adoption of renewable energy sources is anticipated to elevate the demand for residential energy storage systems, thereby propelling market growth.

Rising Electricity Prices and Power Outages

The increase in electricity prices and recurrent power outages are major determinants influencing the India Residential Energy Storage market. The price of electricity in India has increased due to several factors, including fluctuations in fuel prices and the financial stability of power distribution companies. Homeowners are progressively pursuing methods to alleviate the effects of rising electricity expenses by investing in energy storage systems. Residential energy storage systems allow homeowners to accumulate electricity at reduced rates for utilization during peak pricing intervals, consequently lowering their total electricity costs. Moreover, India endures recurrent power outages and load shedding, especially in rural and semi-urban regions. Such disruptions can impact daily life and business operations, rendering dependable energy storage solutions essential for ensuring an an uninterrupted power supply. Energy storage systems act as a safeguard against power outages by accumulating energy during stable grid conditions and delivering it during disruptions. This capability not only bolsters energy security but also diminishes reliance on unreliable grid infrastructure. With the ongoing escalation of electricity prices and the persistence of power outages, the demand for residential energy storage solutions that provide cost efficiency and reliability is anticipated to surge, propelling market expansion.

Download Free Sample Ask for Discount Request Customization

Government Incentives and Subsidies

Government incentives and subsidies are crucial in fostering the expansion of the India Residential Energy Storage market. The Indian government has enacted numerous policies and initiatives to encourage the adoption of renewable energy and energy storage technologies. These initiatives encompass financial incentives, tax rebates, and subsidies for residential solar and energy storage installations. The Ministry of New and Renewable Energy (MNRE) offers subsidies for solar power systems, frequently encompassing provisions for energy storage. By diminishing the initial expense of installing energy storage systems, these incentives enhance their accessibility and appeal to homeowners. Moreover, state-level policies and local government initiatives enhance the adoption of residential energy storage by providing supplementary incentives and streamlining the installation process. Net metering policies promote the adoption of residential solar and energy storage by enabling homeowners to receive compensation for surplus energy returned to the grid. These supportive policies and financial incentives diminish the barriers to entry for residential energy storage systems, facilitating market adoption and expansion. The government's emphasis on renewable energy and energy efficiency will ensure that incentives and subsidies remain a crucial factor in the India Residential Energy Storage market.

Key Market Challenges

High Initial Costs and Return on Investment

A major challenge confronting the India Residential Energy Storage market is the substantial initial expenditure of energy storage systems and the corresponding return on investment. Notwithstanding the declining expenses associated with energy storage technologies, the initial capital required for the acquisition and installation of residential energy storage systems continues to be considerable. This encompasses expenses for the battery units, installation, and integration with current energy systems. For numerous homeowners, particularly those in lower-income brackets, these initial expenses can be prohibitive, constraining the extensive adoption of energy storage solutions. The return on investment for residential energy storage systems is affected by several factors, including electricity tariffs, energy consumption patterns, and the presence of government incentives. Although energy storage systems can yield long-term savings by lowering electricity expenses and supplying backup power during outages, the financial advantages may not be immediately evident, resulting in slower adoption rates. The payback period for residential energy storage systems may fluctuate based on energy prices and the efficiency of the installed system. This financial instability may dissuade prospective purchasers and impede market expansion. Confronting this challenge necessitates a synthesis of ongoing technological innovations to lower expenses, enhanced accessibility to financing alternatives, and proficient articulation of the long-term advantages and prospective savings linked to energy storage systems.

Limited Awareness and Adoption

The inadequate awareness and comprehension of residential energy storage systems pose a considerable obstacle in the Indian market. Despite the increasing interest in renewable energy and energy efficiency, numerous homeowners remain unaware of the advantages and functionalities of energy storage systems. This deficiency in awareness may lead to diminished adoption rates and sluggish market expansion. Residential energy storage systems are frequently regarded as intricate or superfluous by individuals who do not fully comprehend their benefits, including energy autonomy, financial savings, and dependability during power interruptions. Moreover, there may be misunderstandings regarding the technology's efficacy, durability, and upkeep necessities. To address this challenge, it is imperative to execute extensive educational campaigns and outreach initiatives that deliver precise and accurate information regarding the advantages of energy storage systems. Cooperation among industry stakeholders, governmental bodies, and educational institutions can enhance public awareness and comprehension. Demonstrations, case studies, and pilot projects that illustrate the effective deployment of energy storage systems in residential environments can enhance confidence and interest among prospective customers. By bridging the knowledge gap and emphasizing the significance of energy storage solutions, the industry can enhance adoption rates and expedite market expansion.

Download Free Sample Ask for Discount Request Customization

Key Market Trends

Growing Integration of Smart Technology

A significant trend in the Indian Residential Energy Storage market is the growing incorporation of smart technology. Contemporary residential energy storage systems are progressively integrating sophisticated features, including real-time monitoring, automated control, and compatibility with home automation systems. Intelligent energy storage solutions enable homeowners to optimize energy utilization by offering insights into consumption patterns, facilitating improved management of stored energy, and augmenting the overall efficiency of energy systems. Intelligent algorithms can forecast energy requirements using historical data and meteorological conditions, autonomously optimizing energy storage and consumption to enhance efficiency and reduce costs. Furthermore, remote monitoring functionalities allow users to oversee the performance of their energy storage systems and implement modifications as necessary, even from afar. The incorporation of intelligent technology enhances the functionality and convenience of energy storage systems while also increasing their attractiveness to technologically adept consumers seeking advanced and efficient energy management solutions. With the ongoing advancement of technology, the integration of intelligent features in residential energy storage systems is anticipated to increase, fostering innovation and broadening the market.

Increasing Focus on Sustainability and Energy Independence

A notable trend in the Indian Residential Energy Storage market is the increasing emphasis on sustainability and energy autonomy. As awareness of environmental concerns grows and the necessity to diminish carbon footprints becomes evident, homeowners are progressively pursuing energy storage solutions that facilitate sustainable living practices. Residential energy storage systems allow individuals to store and utilize energy produced from renewable sources like solar panels, thereby diminishing their dependence on traditional fossil fuels and decreasing greenhouse gas emissions. This transition towards sustainability is propelled by environmental issues and governmental initiatives designed to advance green energy solutions. The aspiration for energy independence is prompting homeowners to invest in energy storage systems that offer a dependable backup power source during grid failures and diminish reliance on the national grid. With the increasing emphasis on sustainability and energy independence, the demand for residential energy storage systems that reflect these principles is anticipated to grow, influencing the market's future.

Expansion of Government Incentives and Subsidies

The proliferation of government incentives and subsidies is a significant trend in the Indian Residential Energy Storage market. The Indian government has been actively formulating and enhancing policies that offer financial assistance for residential energy storage installations, acknowledging the advantages of energy storage systems in facilitating renewable energy adoption and enhancing energy efficiency. These incentives may encompass direct subsidies, tax rebates, and low-interest financing options aimed at diminishing the initial costs of energy storage systems, thereby enhancing accessibility for homeowners. The implementation of these financial incentives seeks to expedite the adoption of energy storage technologies, facilitate the transition to cleaner energy sources, and bolster overall energy security. Moreover, state and local governments are instituting their own initiatives to enhance the expansion of the residential energy storage sector. The ongoing evolution and expansion of these incentives and subsidies are anticipated to enhance investment in energy storage systems, promote market growth, and render sustainable energy solutions more accessible to residential consumers.

Download Free Sample Ask for Discount Request Customization

Segmental Insights

Technology

In 2024, Lithium-Ion Batteries became the predominant segment in the India Residential Energy Storage market and are anticipated to maintain their leading status throughout the forecast period. The extensive utilization of lithium-ion batteries in residential energy storage systems is propelled by their exceptional performance attributes relative to alternative technologies. Lithium-ion batteries provide elevated energy density, facilitating greater energy storage in a compact and lightweight configuration, which is especially beneficial for residential applications with spatial constraints. Moreover, these batteries offer extended life cycles and enhanced efficiency, resulting in reduced long-term expenses for homeowners. Their capacity for rapid charging and discharging renders them ideal for regulating the intermittent characteristics of renewable energy sources, such as solar power, by storing surplus energy during peak production and discharging it when required. Improvements in lithium-ion battery technology have resulted in considerable cost reductions, rendering them more affordable and accessible to residential consumers. Although technologies like lead-acid, flow, and sodium-based batteries possess distinct advantages, lithium-ion batteries' superior performance, efficiency, and cost-effectiveness render them the market's preferred option. The escalating demand for residential energy storage, propelled by the rising utilization of renewable energy sources and the necessity for dependable backup power, indicates that lithium-ion batteries will sustain their preeminence in the Indian Residential Energy Storage market.

Regional Insights

In 2024, the South India region dominated the India Residential Energy Storage market and is anticipated to maintain its supremacy throughout the forecast period. This superiority is primarily due to South India's favorable climatic conditions, which enable a higher intensity of solar radiation throughout the year, making it an ideal location for residential solar energy systems. The increasing adoption of solar energy in South India necessitates energy storage solutions to enhance consumption, address intermittency, and elevate the overall efficiency of solar systems. Furthermore, South India benefits from advantageous state policies and incentives that facilitate the adoption of renewable energy technologies and energy storage systems. The region's robust energy distribution infrastructure and growing consumer awareness of energy storage advantages further bolster its market supremacy. Due to the increasing demand for residential energy storage solutions, propelled by the expansion of solar power systems and the need for reliable backup energy, South India is expected to maintain its dominance. South India, distinguished by abundant solar resources, favorable policies, and heightened consumer demand, is set to be the primary driver of growth in India's residential energy storage market.

Download Free Sample Ask for Discount Request Customization

Recent Developments

- In February 2024, LG announced the launch of two variants of its new Enblock E storage system, featuring usable energy capacities of 12.4 kilowatt-hours and 15.5 kilowatt-hours. The company emphasized that these models, with dimensions of 451 millimeters by 330 millimeters, are specifically designed for efficient deployment in compact spaces.

- In September 2023, following the conclusion of the RE+ clean energy expo in Las Vegas, we present a summary of important announcements for energy storage products, including updates from Hithium, Sunwoda, and Power Edison. With over 1,300 exhibitors showcasing a broad spectrum of clean energy technologies, this four-day event is the largest renewable and clean energy conference in North America, offering a premier platform for technology companies to introduce their latest innovations and products.

- In May 2024, Schneider Electric introduced new storage systems tailored for microgrids. The company unveiled two versions of its Battery Energy Storage System, available in 7-foot and 20-foot enclosures, with power capacities ranging from 60 kilowatts to 500 kilowatts. Schneider Electric's latest Battery Energy Storage System has undergone rigorous testing and validation to ensure compatibility with EcoStruxure Microgrid Flex, a standardized and rapidly deployable microgrid solution designed to enhance resilience, energy efficiency, and sustainability.

Key Market Players

- Tesla, Inc

- LG Energy Solution Ltd

- Schneider Electric SE

- Enphase Energy, Inc

- SunPower Corporation

- Sonnen, Inc

- Panasonic Holdings Corporation

- Vivint, Inc

- Bloom Energy Corporation

- Generac Power Systems, Inc

|

By Technology |

By Installation Type |

By End-user |

By Region |

|

|

|

|

Related Reports

- North America Commercial Boiler Market Size - By Fuel (Natural Gas, Oil, Coal, Electric), By Capacity, By Technology (Co...

- Water Tube Industrial Boiler Market Size By Capacity, By Application (Food Processing, Pulp & Paper, Chemical, Refinery,...

- U.S. Industrial Boiler Market Size By Fuel (Natural Gas, Oil, Coal), By Capacity, By Technology (Condensing, Non-Condens...

- Fire Tube Industrial Boiler Market - By Capacity (<10 MMBtu/hr, 10-25 MMBtu/hr, 25-50 MMBtu/hr, 50-75 MMBtu/hr, >75 MMBt...

- Gas Fired Boiler Market Size - By Capacity (≤ 10 MMBtu/hr, > 10 - 50 MMBtu/hr, > 50 - 100 MMBtu/hr, > 100 - 250 MMBtu/...

- Europe Residential Boiler Market Size - By Technology (Condensing {Natural Gas, Oil, Electric}, Non-Condensing {Natural ...

Table of Content

-

Executive Summary

-

1.1 Market Snapshot

-

1.2 Key Growth Indicators

-

1.3 Strategic Recommendations

-

Introduction

-

2.1 Objectives of the Report

-

2.2 Scope and Methodology

-

2.3 Definitions and Assumptions

-

Market Overview

-

3.1 Overview of Residential Energy Storage Systems

-

3.2 Energy Storage in India’s Power Sector

-

3.3 Role in Decentralized and Backup Power Supply

-

Market Dynamics

-

4.1 Drivers

-

4.1.1 Rising Rooftop Solar Adoption

-

4.1.2 Power Outages and Energy Independence Needs

-

4.1.3 Government Subsidies and Incentives

-

4.2 Restraints

-

4.2.1 High Upfront Cost

-

4.2.2 Limited Consumer Awareness

-

4.3 Opportunities

-

4.3.1 Integration with Smart Homes

-

4.3.2 Urban and Rural Electrification Programs

-

4.4 Challenges

-

4.5 Porter’s Five Forces Analysis

-

Technology Landscape

-

5.1 Lithium-Ion Batteries (LFP, NMC)

-

5.2 Lead-Acid and Gel Batteries

-

5.3 Emerging Battery Technologies

-

5.4 Smart Battery Management Systems

-

Market Segmentation

-

6.1 By Battery Type

-

6.1.1 Lithium-ion

-

6.1.2 Lead-acid

-

6.1.3 Others

-

6.2 By Connectivity

-

6.2.1 On-Grid

-

6.2.2 Off-Grid

-

6.3 By Ownership Model

-

6.3.1 Customer-Owned

-

6.3.2 Third-Party Owned

-

6.4 By Use Case

-

6.4.1 Backup Power

-

6.4.2 Load Shifting and TOU Optimization

-

6.4.3 Self-Consumption of Solar Energy

-

Regional Analysis

-

7.1 North India

-

7.2 South India

-

7.3 East India

-

7.4 West India

-

7.5 Union Territories

-

Market Size and Forecast (2020–2030)

-

8.1 Revenue Forecast

-

8.2 Installed Capacity Forecast

-

8.3 Segment-wise Growth Outlook

-

Competitive Landscape

-

9.1 Market Share Analysis

-

9.2 Company Profiles

-

9.2.1 Domestic Battery Providers

-

9.2.2 Global Companies Operating in India

-

9.3 Key Strategic Initiatives

-

Policy and Regulatory Framework

-

10.1 MNRE Policies and Incentives

-

10.2 State-Level Net Metering and Storage Guidelines

-

10.3 FAME and National Energy Storage Mission

-

Consumer Behavior and Insights

-

11.1 Awareness and Adoption Drivers

-

11.2 Financial Considerations and ROI Expectations

-

11.3 Brand Preferences and Installation Trends

-

Future Trends and Outlook

-

12.1 Role in Smart Cities and Microgrids

-

12.2 VPPs and Peer-to-Peer Energy Trading

-

12.3 Innovation in Modular and Scalable Systems

-

Conclusion and Strategic Recommendations

-

Appendices

-

14.1 Glossary

-

14.2 Methodology Details

-

14.3 References

Executive Summary

-

1.1 Market Snapshot

-

1.2 Key Growth Indicators

-

1.3 Strategic Recommendations

Introduction

-

2.1 Objectives of the Report

-

2.2 Scope and Methodology

-

2.3 Definitions and Assumptions

Market Overview

-

3.1 Overview of Residential Energy Storage Systems

-

3.2 Energy Storage in India’s Power Sector

-

3.3 Role in Decentralized and Backup Power Supply

Market Dynamics

-

4.1 Drivers

-

4.1.1 Rising Rooftop Solar Adoption

-

4.1.2 Power Outages and Energy Independence Needs

-

4.1.3 Government Subsidies and Incentives

-

-

4.2 Restraints

-

4.2.1 High Upfront Cost

-

4.2.2 Limited Consumer Awareness

-

-

4.3 Opportunities

-

4.3.1 Integration with Smart Homes

-

4.3.2 Urban and Rural Electrification Programs

-

-

4.4 Challenges

-

4.5 Porter’s Five Forces Analysis

Technology Landscape

-

5.1 Lithium-Ion Batteries (LFP, NMC)

-

5.2 Lead-Acid and Gel Batteries

-

5.3 Emerging Battery Technologies

-

5.4 Smart Battery Management Systems

Market Segmentation

-

6.1 By Battery Type

-

6.1.1 Lithium-ion

-

6.1.2 Lead-acid

-

6.1.3 Others

-

-

6.2 By Connectivity

-

6.2.1 On-Grid

-

6.2.2 Off-Grid

-

-

6.3 By Ownership Model

-

6.3.1 Customer-Owned

-

6.3.2 Third-Party Owned

-

-

6.4 By Use Case

-

6.4.1 Backup Power

-

6.4.2 Load Shifting and TOU Optimization

-

6.4.3 Self-Consumption of Solar Energy

-

Regional Analysis

-

7.1 North India

-

7.2 South India

-

7.3 East India

-

7.4 West India

-

7.5 Union Territories

Market Size and Forecast (2020–2030)

-

8.1 Revenue Forecast

-

8.2 Installed Capacity Forecast

-

8.3 Segment-wise Growth Outlook

Competitive Landscape

-

9.1 Market Share Analysis

-

9.2 Company Profiles

-

9.2.1 Domestic Battery Providers

-

9.2.2 Global Companies Operating in India

-

-

9.3 Key Strategic Initiatives

Policy and Regulatory Framework

-

10.1 MNRE Policies and Incentives

-

10.2 State-Level Net Metering and Storage Guidelines

-

10.3 FAME and National Energy Storage Mission

Consumer Behavior and Insights

-

11.1 Awareness and Adoption Drivers

-

11.2 Financial Considerations and ROI Expectations

-

11.3 Brand Preferences and Installation Trends

Future Trends and Outlook

-

12.1 Role in Smart Cities and Microgrids

-

12.2 VPPs and Peer-to-Peer Energy Trading

-

12.3 Innovation in Modular and Scalable Systems

Conclusion and Strategic Recommendations

Appendices

-

14.1 Glossary

-

14.2 Methodology Details

-

14.3 References

List Tables Figures

To get a detailed Table of content/ Table of Figures/ Methodology Please contact our sales person at ( chris@marketinsightsresearch.com )

FAQ'S

For a single, multi and corporate client license, the report will be available in PDF format. Sample report would be given you in excel format. For more questions please contact:

Within 24 to 48 hrs.

You can contact Sales team (sales@marketinsightsresearch.com) and they will direct you on email

You can order a report by selecting payment methods, which is bank wire or online payment through any Debit/Credit card, Razor pay or PayPal.

Discounts are available.

Hard Copy