Alpha Hydroxy Acid Market Size, share, segment, Forecast, 2024-2032

Alpha Hydroxy Acid Market - By Product (Glycolic, Lactic, Citric), By Application (Cosmetics (Skincare, Hair Care, Makeup, Fragrances], Dermal) & Forecast, 2024-2032

Published Date: May - 2025 | Publisher: MRA | No of Pages: 240 | Industry: Chemical | Format: Report available in PDF / Excel Format

View Details Buy Now 2890 Download Free Sample Ask for Discount Request CustomizationAlpha Hydroxy Acid Market Size

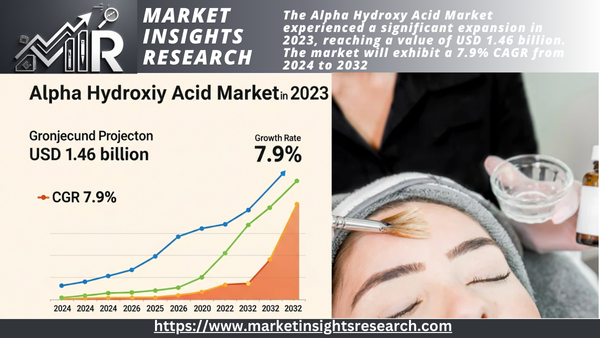

The Alpha Hydroxy Acid Market experienced a significant expansion in 2023, reaching a value of USD 1.46 billion. The market will exhibit a 7.9% CAGR from 2024 to 2032, driven by the consumer preference for natural and organic hygiene solutions and continuous product innovation and development.

The increasing demand for benign yet effective skincare products is being met by manufacturers who are introducing innovative AHA formulations that capitalize on the effectiveness of natural ingredients. The market is expanding as a result of the trend toward natural alternatives, which is consistent with consumers' desire for safer and more sustainable hygiene options.

For example, in July 2022, SBC Skincare introduced their most recent product, the Lactic Acid Resurfacing Facial Wash. This product is formulated with a combination of Lactic Acid and AHAs from apple, pineapple, papaya, and orange enzymes, which are designed to address uneven skin and dullness.

| Report Attribute | Details |

|---|---|

| Base Year | 2023 |

| Alpha Hydroxy Acid Market Size in 2023 | USD 1.46 Billion |

| Forecast Period | 2024–2032 |

| Forecast Period 2024–2032 CAGR | 7.9% |

| 2024–2032 Value Projection | USD 2.95 Billion |

| Historical Data for | 2021–2023 |

| No. of Pages | 260 |

| Tables, Charts & Figures | 184 |

| Segments covered | Technology, Product |

| Growth Drivers |

|

| Pitfalls & Challenges |

|

What are the growth opportunities in this market?

The alpha hydroxy acid industry is experiencing rapid growth, driven by the expanding awareness of AHAs' skincare benefits and continuous advancements in skincare technology. As consumers become more informed about AHAs' effectiveness in addressing various skin concerns, such as aging, hyperpigmentation, and uneven texture, demand for AHA products surges. Furthermore, ongoing innovations in skincare technology result in the development of more potent and efficient AHA formulations, driving further market expansion.

For instance, in March 2024, KÉRASTASE introduced CHROMA ABSOLU, a new line aimed at restoring and nourishing dyed hair, preserving color, and enhancing shine. The series comprises six products formulated with amino acids and lactic acid.

The alpha hydroxy acid market faces barriers due to stringent regulatory constraints and higher product costs. However, these regulations ensure safety and quality, fostering consumer trust in AHA products. Moreover, the perceived higher cost reflects the superior quality and effectiveness of these formulations, attracting discerning consumers who prioritize skincare efficacy. These factors ultimately foster a more reputable and sustainable market for AHA products, driving continual advancements in skincare technology and consumer satisfaction.

Alpha Hydroxy Acid Market Trends

The alpha hydroxy acid industry is catalyzed by a strong emphasis on sustainability and the demand for personalized skincare solutions. Consumers increasingly seek eco-friendly AHA products that align with their values, driving manufacturers to adopt sustainable practices. Additionally, the desire for tailored skincare regimens prompts the development of customized AHA formulations, catering to individual skin concerns and preferences. These trends fuel the expansion of the market, offering consumers more choices and eco-conscious options.

For instance, in September 2023, Hy, formerly Korea Yakult, diversified into cosmetics, unveiling the Leti 7714 Triple Lift-up Anti-Aging Cream. Infused with lactic acid and a potent anti-aging blend, this cream incorporates fermented, cultured lactic acid bacteria.

Alpha Hydroxy Acid Market Analysis

Find out more about the main players influencing this market.

Thanks to its adaptability and effectiveness in skincare formulations, the lactic acid segment shows USD 618.9 million in 2023 and will generate USD 1.23 billion by 2032. Widely used for its mild exfoliating qualities and capacity to enhance skin texture, lactic acid has evolved as a customer favorite. The industry has driven its popularity by widely incorporating it into various skincare products and increasing awareness of its benefits.

Find out more about the main players influencing this market.

Driven by the wide integration of AHAs in skincare products, ranging from moisturizers to serums and exfoliants, the cosmetics market accumulated USD 1.01 billion in 2023 and will reach an 8% CAGR from 2024 to 2032. Cosmetics firms profit from customers' increasing focus on skincare regimens and search for products with proven performance by adding creative formulations enhanced with AHAs, thereby generating notable expansion in the segment.

Are you looking for information specific to your region?

Attributed to strong consumer demand, developments in skincare technologies, and a well-established cosmetics industry infrastructure, North America recorded USD 424.63 million in 2023 and will post a 7.6% CAGR through 2032. Emphasizing creativity and quality, North American businesses have regularly produced sought-after alpha hydroxy acid solutions to meet various skincare needs. Large investments in research and development, along with successful marketing plans, have largely contributed to the industry's expansion.

Furthermore, the United States has become a major player in the AHA area with a vibrant cosmetics market and skincare culture given top importance. Driven by growing customer demand and accelerating market development, the dynamic research and development industry often generates innovative products. Using cutting-edge products and strong marketing, American companies grab the interest of people all around. This predominance emphasizes how important the country is in creating skincare norms and trends.

By leveraging their special strengths in skincare innovation and consumer outreach, nations including South Korea, Japan, France, Germany, the U.K., Canada, the Netherlands, the UAE, and Saudi Arabia have also acquired significant interests in the alpha hydroxy acid market. These countries have advanced cosmetic sectors distinguished by a dedication to research and development. Effective AHA formulas catered to different skin types and preferences have drawn the interest of consumers all around. Their contributions highlight the worldwide character of the development of the skincare industry.

Alpha Hydroxy Acid Market Share

Companies including DuPont, Mehul Dye Chem Industries, Ava Chemicals, Parchem, and Dow are strategically expanding their market footprint by leveraging extensive research and consumer insights. By harnessing cutting-edge formulations and emphasizing the proven benefits of AHAs in rejuvenating skin, they are captivating a wider audience. Through targeted marketing campaigns highlighting the efficacy and safety of their AHA-infused products, they are elevating brand visibility and cultivating trust among discerning consumers seeking advanced skincare solutions.

Moreover, these players are forging key partnerships with dermatologists and beauty influencers to amplify their reach and credibility. By fostering collaborative relationships within the industry, they are establishing themselves as authorities in the market, driving product adoption and loyalty. Through relentless innovation and strategic alliances, these companies will dominate the burgeoning alpha hydroxy acid industry, catering to the evolving skincare needs of a diverse clientele.

Alpha Hydroxy Acid Market Companies

Major players operating in the industry include

- DuPont

- Mehul Dye Chem Industries

- Ava Chemicals

- Parchem

- Dow

- Crosschem

- H Plus Limited

- Airedale Chemical Company Limited

- Sculptra Aesthetics

- Lotion crafter

- Bulk Actives

- Tokyo Chemical Industry

Alpha Hydroxy Acid Industry News

- To meet the growing demand for plant-based products, such as bioplastics, LG Chem and ADM formed joint ventures in August 2022 to produce lactic acid and polylactic acid in the United States.

The market research study on alpha hydroxy acid covers the industry in great detail and provides estimates and forecasts for the following segments' revenue and volume (USD million) (kilotons) from 2018 to 2032

Click here to Buy Section of this Report

By Product

- Glycolic Acid

- Lactic Acid

- Citric Acid

- Others

By Application

- Cosmetics

- Skin Care

- Hair Care

- Makeup

- Fragrances

- Others

- Dermal

The above information has been provided on a regional and country basis for the following

- North America

- U.S.

- Canada

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Poland

- Asia Pacific

- China

- India

- Japan

- South Korea

- Australia

- Thailand

- Taiwan

- Indonesia

- Latin America

- Brazil

- Argentina

- Mexico

- Venezuela

- Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Iran

Related Reports

- Fluorosurfactants Market - By type (Anionic, Non-Anionic, Cationic, Amphoteric), By Application (Adhesives & Sealants, P...

- Aromatic Solvents Market - By Product (Benzene, Toluene, Xylene), By Application (Pharmaceuticals, Oilfield Chemicals, A...

- Ammonium Nitrate Market - By Product (High Density, Low Density, Solution), By End-user (Agriculture, Mining & Quarrying...

- Glycerol Market Size - By Product Type (Crude, Refined), By Source (Biodiesel, Fatty Acids, Fatty Alcohols, Soap Industr...

- Flat Glass Market - By Product (Basic Float, Laminated, Insulating, Tempered), By Application (Automotive [OEM, Aftermar...

- Electrical Steel Market - By Product (Grain Oriented, Non-Grain-Oriented), By Application (Large Power Transformers, Dis...

Table of Content

Table of Content

Report Content

Chapter 1: Methodology & Scope

1.1 Market scope & definition

1.2 Base estimates & calculations

1.3 Forecast calculation

1.4 Data sources

1.4.1 Primary

1.4.2 Secondary

1.4.2.1 Paid sources

1.4.2.2 Public sources

Chapter 2: Executive Summary

2.1 Industry 3600 synopsis

Chapter 3 Industry Insights

3.1 Industry ecosystem analysis

3.1.1 Key manufacturers

3.1.2 Distributors

3.1.3 Profit margins across the industry

3.2 Industry impact forces

3.2.1 Growth drivers

3.2.2 Market challenges

3.2.3 Market opportunity

3.2.3.1 New opportunities

3.2.3.2 Growth potential analysis

3.3 Raw material landscape

3.3.1 Manufacturing trends

3.3.2 Technology evolution

3.3.2.1 Sustainable manufacturing

3.3.2.1.1 Green practices

3.3.2.1.2 Decarbonization

3.3.3 Sustainability in raw materials

3.3.4 Pricing trends (USD/Ton)

3.3.4.1 North America

3.3.4.2 Europe

3.3.4.3 Asia Pacific

3.3.4.4 Latin America

3.3.4.5 Middle East & Africa

3.4 Regulations & market impact

3.5 Porter’s analysis

3.6 PESTEL analysis

Chapter 4: Competitive Landscape, 2023

4.1 Company market share analysis

4.2 Competitive positioning matrix

4.3 Strategic outlook matrix

Chapter 5: Market Size and Forecast, By Product, 2021-2032 (USD Million, Kilo Tons)

5.1 Key trends

5.2 Glycolic acid

5.3 Lactic acid

5.4 Citric acid

5.5 Others

Chapter 6: Market Size and Forecast, By Application, 2021-2032 (USD Million, Kilo Tons)

6.1 Key trends

6.2 Cosmetics

6.2.1 Skin care

6.2.2 Hair care

6.2.3 Make up

6.2.4 Frangrances

6.2.5 Others

6.3 Dermal

Chapter 7: Market Size and Forecast, By Region, 2021-2032 (USD Million, Kilo Tons)

7.1 Key trends

7.2 North America

7.2.1 U.S.

7.2.2 Canada

7.3 Europe

7.3.1 Germany

7.3.2 UK

7.3.3 France

7.3.4 Italy

7.3.5 Spain

7.3.6 Rest of Europe

7.4 Asia Pacific

7.4.1 China

7.4.2 India

7.4.3 Japan

7.4.4 South Korea

7.4.5 Australia

7.4.6 Rest of Asia Pacific

7.5 Latin America

7.5.1 Brazil

7.5.2 Mexico

7.5.3 Argentina

7.5.4 Rest of Latin America

7.6 MEA

7.6.1 Saudi Arabia

7.6.2 UAE

7.6.3 South Africa

7.6.4 Rest of MEA

Chapter 8: Company Profiles

8.1 DuPont

8.2 Mehul Dye Chem Industries

8.3 Ava Chemicals

8.4 Parchem

8.5 Dow

8.6 Crosschem

8.7 H Plus Limited

8.8 Airedale Chemical Company Limited

8.9 Sculptra Aest

8.10 Lotion crafter

8.11 Bulk Actives

8.12 Tokyo Chemical Industry

- DuPont

- Mehul Dye Chem Industries

- Ava Chemicals

- Parchem

- Dow

- Crosschem

- H Plus Limited

- Airedale Chemical Company Limited

- Sculptra Aesthetics

- Lotion crafter

- Bulk Actives

- Tokyo Chemical Industry

FAQ'S

For a single, multi and corporate client license, the report will be available in PDF format. Sample report would be given you in excel format. For more questions please contact:

Within 24 to 48 hrs.

You can contact Sales team (sales@marketinsightsresearch.com) and they will direct you on email

You can order a report by selecting payment methods, which is bank wire or online payment through any Debit/Credit card, Razor pay or PayPal.

Discounts are available.

Hard Copy