Remote Work Security Market Size, Share & Trends Analysis Report

Remote Work Security Market Size, Share & Trends Analysis Report By Component (Solution, Services), By Security Type (Endpoint & IoT Security, Network Security), By Remote Work Model, By Vertical, By Region, And Segment Forecasts, 2025 - 2030

Published Date: May - 2025 | Publisher: MIR | No of Pages: 209 | Industry: technology | Format: Report available in PDF / Excel Format

View Details Buy Now 2100 Download Free Sample Ask for Discount Request CustomizationRemote Work Security Market Summary

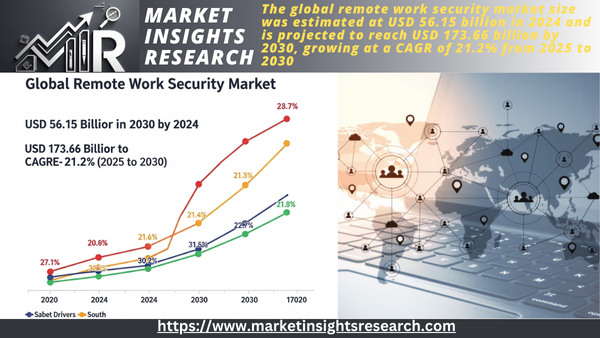

The global size of the remote work security market was estimated at USD 56.15 billion in 2024 and is projected to reach USD 173.66 billion by 2030, growing at a CAGR of 21.2% from 2025 to 2030. The remote work security market has emerged as a vital component of enterprise IT strategy in the wake of the global shift toward hybrid and fully remote work models.

Download Free Sample Ask for Discount Request Customization

Key Market Trends & Insights

- North America commanded a substantial revenue share of over 39.0% of the remote work security market in 2024.

- The remote work security market in the U.S. is expected to grow significantly from 2025 to 2030.

- Based on component, the solution segment accounted for the largest market share of over 65.0% in 2024.

- By security type, the endpoint and IoT security segments will account for the largest market share in 2024.

- Based on the remote work model, the hybrid segment dominated the market and accounted for a revenue share of over 56.0% in 2024.

Market Size & Forecast

- 2024 Market SizeUSD 56.15 Billion

- 2030 Projected Market SizeUSD 173.66 Billion

- CAGR (2025-2030)21.2%

- North AmericaLargest market in 2024

- Asia PacificFastest growing market

The COVID-19 pandemic served as the catalyst for this transformation, forcing organizations across industries to adopt digital collaboration tools, cloud-based platforms, and remote access technologies. As businesses rapidly transitioned to these new work environments, the attack surface expanded dramatically, giving rise to an urgent need for more robust cybersecurity infrastructures. This market encompasses a broad spectrum of technologies and services aimed at protecting data, devices, and networks used by remote employees.

Businesses now function very differently as a result of the broad adoption of remote and hybrid work models. Many companies have switched to permanent or flexible remote work arrangements, enabling workers to work from different locations outside of traditional office settings, even after the pandemic. The use of digital tools like cloud platforms, collaboration software, and remote access technologies has grown as a result of this change. But it has also increased the attack surface, making corporate networks more vulnerable to threats from off-site access points, personal devices, and unprotected home Wi-Fi. In order to safeguard confidential information and guarantee safe communication, there is a growing need for strong security solutions, especially in the areas of endpoint, application, and network security. In order to protect distributed workforces while preserving productivity and compliance in a constantly changing threat landscape, businesses are investing more and more in technologies like multi-factor authentication (MFA), virtual private networks (VPNs), secure web gateways, and endpoint detection and response (EDR) systems.

The rise in advanced cyberthreats, including ransomware, insider threats, phishing attacks, and zero-day vulnerabilities, has brought attention to the dangers that come with working remotely. Employees' use of personal devices and home networks to access company data gives hackers additional points of entry to target. Traditional security measures are frequently circumvented by these threats, particularly when systems are not regularly monitored or have their defenses updated. Mobile devices and unprotected cloud interfaces are especially susceptible, which makes them attractive targets for cybercriminals. Organizations are therefore facing mounting pressure to improve their threat detection, response, and prevention capabilities through the implementation of cutting-edge technologies like centralized security operations centers (SOCs), endpoint protection, and AI-driven analytics.

The high cost of putting in place complete cybersecurity infrastructure is a significant obstacle in the market for remote work security. Small and medium-sized businesses (SMEs), which frequently have tight budgets and little internal IT knowledge, are especially burdened by this. Many SMEs are consequently unable to make the investment in sophisticated, enterprise-level security solutions, making their systems more susceptible to potential data breaches and cyberattacks.

Component Insights

The solution segment accounted for the largest market share of over 65.0% in 2024. The expansion of remote and hybrid work models has fundamentally reshaped enterprise security needs. As more organizations embrace flexible work arrangements, employees are increasingly accessing corporate systems from various locations and devices. This decentralized access introduces new security challenges, particularly around data protection, user authentication, and network integrity. To address these risks, businesses are investing in comprehensive security solutions tailored to remote work environments. Tools such as secure Virtual Private Networks (VPNs), next-generation firewalls, and Endpoint Detection and Response (EDR) systems have become essential for ensuring secure connections, monitoring user activity, and preventing unauthorized access. These technologies enable organizations to maintain productivity while safeguarding sensitive information across distributed workforces.

The services segment is anticipated to register a significant CAGR during the forecast period. The expansion of remote work has significantly increased cybersecurity risks, as employees access corporate systems from various devices and locations. This shift has made organizations more vulnerable to cyberattacks such as phishing, malware, and data breaches. As a result, there is a growing emphasis on cybersecurity services that offer comprehensive protection. These include secure Virtual Private Networks (VPNs), endpoint protection platforms, identity and access management (IAM), and multi-factor authentication (MFA). Such services help organizations safeguard sensitive data, ensure secure user access, and maintain the integrity of their remote work environments.

Report Coverage & Deliverables

The PDF report & online dashboard will help you understand

- Competitive benchmarking

- Historical data & forecasts

- Company revenue shares

- Regional opportunities

- Latest trends & dynamics

Security Type Insights

The endpoint & IoT security segment accounted for the largest market share in 2024. The rapid rise in cyber threats targeting endpoints and IoT devices has become a major concern for organizations operating in remote and hybrid environments. Cybercriminals are taking advantage of weak security configurations, outdated software, and unsecured personal devices to launch sophisticated attacks such as ransomware, phishing, and zero-day exploits. These attacks not only compromise sensitive data but also disrupt business continuity and damage organizational reputations. As a result, businesses are increasingly compelled to adopt advanced security measures, such as endpoint detection and response (EDR), IoT device management, and threat intelligence platforms. These tools help monitor, detect, and respond to threats in real time, significantly enhancing the overall security posture.

The cloud security segment is expected to register a CAGR of 22.0% during the forecast period. The growing use of cloud platforms for data storage, applications, and collaboration has broadened organizations’ attack surfaces. This expansion increases vulnerabilities, making strong cloud security essential to protect sensitive data and ensure secure access for remote employees. In addition, organizations must secure data across diverse cloud environments while meeting strict regulatory requirements. These factors drive heightened demand for comprehensive cloud security solutions in the remote work landscape.

Remote Work Model Insights

The hybrid segment dominated the market and accounted for a revenue share of over 56.0% in 2024. As more organizations embrace hybrid work models-where employees split their time between remote and in-office settings-there’s a growing need for security solutions that protect data and applications across both environments. As employees access corporate resources from various locations and devices, this shift expands potential vulnerabilities. Hybrid security solutions address such challenges by providing flexible and scalable protection that adapts to the complexity of these mixed work environments. Whether an employee works from the office or remotely, they guarantee data security and access control. This adaptability makes hybrid security essential for maintaining business continuity and safeguarding sensitive information in today’s evolving workplace.

The fully remote segment is expected to grow at a CAGR of 21.3% during the forecast period. The COVID-19 pandemic accelerated the global shift to fully remote work across many industries. This widespread adoption requires strong security measures to protect data and applications accessed from multiple, often unsecured locations. To address these risks, organizations are increasingly investing in comprehensive remote work security solutions. The increasing demand for robust protection is a key factor driving the expansion of the remote work security market, which ensures safe and secure remote operations.

Vertical Insights

The BFSI segment accounted for the largest market share in 2024. Financial institutions handle highly sensitive data, making them attractive targets for cybercriminals. The widespread shift to remote work has significantly expanded their attack surface, as employees access corporate systems from various locations and devices, often outside traditional security networks. This increased exposure has led to a rise in cyber threats such as phishing attacks, ransomware, and data breaches specifically aimed at exploiting vulnerabilities in remote setups. To counter these risks, financial organizations are urgently adopting stronger remote work security solutions that protect critical data and maintain the integrity of their systems. This growing need is a major driver for the Remote Work Security Market in the BFSI sector.

The telecommunications segment is expected to grow at a CAGR of 21.6% during the forecast period. The rise of remote and hybrid work has greatly increased the need for secure, reliable internet and network services. To address this, telecommunications providers are enhancing their offerings with secure connectivity solutions like Virtual Private Networks (VPNs) and Secure Access Service Edge (SASE) architectures. These technologies help ensure that remote workers can safely access corporate resources, protecting data and maintaining network integrity across diverse locations and devices.

Download Free Sample Ask for Discount Request Customization

Regional Insights

North America commanded a substantial revenue share of over 39.0% of the remote work security market in 2024. Organizations in North America are adopting zero-trust security frameworks to strengthen remote work security. This model enforces strict identity verification for all users and devices accessing network resources, regardless of location. By assuming no implicit trust, it minimizes the risk of breaches and enhances overall data and network protection.

U.S. Remote Work Security Market Trends

The remote work security market in the U.S. is expected to grow significantly from 2025 to 2030. The U.S. has witnessed a significant shift toward remote and hybrid work arrangements. According to USA Today, 14% of Americans currently work from home, with one-third of all eligible individuals opting for remote work. Experts predict that by 2025, 32.6 million Americans, accounting for 22% of the workforce, will continue this trend of remote work. This widespread adoption necessitates robust security solutions to protect sensitive data accessed from various locations.

Europe Remote Work Security Market Trends

The remote work security market in Europe is expected to grow at a CAGR of 21.4% from 2025 to 2030. Remote work in Europe has expanded vulnerabilities, making organizations prime targets for cyber threats such as phishing, ransomware, and data breaches. The growing sophistication and frequency of these attacks have heightened the need for advanced security solutions to protect sensitive data and ensure secure access for remote employees across the region.

The UK remote work security market is expected to grow rapidly in the coming years. The UK government is enhancing its cybersecurity regulations to address the evolving threat landscape. The proposed Cyber Security and Resilience Bill aims to update existing regulations, strengthen cyber defenses, and ensure that critical infrastructure and digital services are secure. This legislation includes mandatory compliance with established cybersecurity standards and increased reporting requirements for businesses.

The remote work security market in Germany held a substantial market share in 2024. Over 60% of German companies have adopted permanent hybrid work models, driving demand for Zero Trust Network Access (ZTNA) and endpoint protection. Simultaneously, rapid cloud migration to platforms like Azure, AWS, and sovereign clouds is increasing the need for cloud security solutions such as CASB and CSPM.

Asia Pacific Remote Work Security Market Trends

The remote work security market in the Asia-Pacific region is expected to register the highest CAGR of 23.1% from 2025 to 2030. In the Asia Pacific region, organizations are swiftly adopting cloud platforms such as Azure, AWS, and Sovereign Cloud services to support remote work. This rapid migration increases the attack surface, exposing sensitive data to potential threats. As a result, more and more companies need strong cloud security tools, like Cloud Access Security Brokers (CASB) and Cloud Security Posture Management (CSPM), to keep data safe and make sure remote workers can access it securely and in line with regulations across different cloud services.

The Chinese remote work security market held a substantial share in 2024. The Chinese government has implemented stringent cybersecurity measures, including the Data Security Law and the Cybersecurity Law, to enhance data protection and secure remote work environments. These regulations mandate organizations to adopt robust security frameworks, such as Zero Trust Network Access (ZTNA) and endpoint protection, to comply with national standards.

The remote work security market in Japan held a substantial market share in 2024. The widespread adoption of remote and hybrid work models across various industries in Japan has expanded the attack surface, requiring organizations to implement comprehensive security measures to protect their digital assets and ensure business continuity.

The India remote work security market is growing as India is facing a sharp rise in cyber threats such as phishing, ransomware, and data breaches. In 2023, CERT-In reported over 1.39 million cybersecurity incidents, underscoring the growing risks to organizations. This surge in attacks creates an urgent demand for strong remote work security solutions to protect sensitive information and ensure uninterrupted business operations, driving investments in advanced cybersecurity measures across industries.

Download Free Sample Ask for Discount Request Customization

Key Remote Work Security Company Insights

The key market players in the global remote work security market include Cisco Systems, Inc., Palo Alto Networks, Inc., Microsoft Corporation, Fortinet, Inc., Check Point Software Technologies Ltd., Broadcom Inc., Trend Micro Incorporated, Sophos Ltd., Forcepoint, Proofpoint, Inc., VMware, Inc., IBM Corporation, Cloudflare, Inc., CyberArk Software Ltd., and CrowdStrike Holdings, Inc. The companies are focusing on various strategic initiatives, including new Solution development, partnerships & collaborations, and agreements to gain a competitive advantage over their rivals. The following are some instances of such initiatives.

-

In April 2025, Palo Alto Networks introduced Prisma Access Browser 2.0, a secure browser designed for the modern, cloud-centric workplace. As the industry's only Secure Access Service Edge (SASE)-native browser, it offers advanced security features tailored for perimeterless environments. This innovation aims to enhance user protection and streamline secure access, addressing the evolving needs of organizations embracing remote and hybrid work models.

-

In April 2025, Forcepoint launched its Data Security Cloud, an AI-driven platform that unifies data protection across various channels, including users, devices, SaaS, web, email, and networks. Powered by AI Mesh, it integrates Data Security Posture Management (DSPM), Data Detection and Response (DDR), and other security solutions to provide comprehensive data visibility and control. This consolidation aims to reduce security policies by up to 90% and operational expenses by 31%, streamlining data security management.

-

​In September 2024, Proofpoint and CyberArk expanded their strategic partnership to enhance identity security across hybrid and multi-cloud environments. This collaboration introduces new integrations, including Proofpoint's ZenWeb browser extension and CyberArk's Secure Browser, aiming to prevent phishing attacks and secure user identities. By combining their technologies, the partnership offers comprehensive protection against identity-based threats, addressing the evolving cybersecurity challenges faced by organizations in today's digital landscape.

Key Remote Work Security Companies

The following are the leading companies in the remote work security market. These companies collectively hold the largest market share and dictate industry trends.

- Broadcom Inc.

- Check Point Software Technologies Ltd.

- Cisco Systems, Inc.

- Cloudflare, Inc.

- CrowdStrike Holdings, Inc.

- CyberArk Software Ltd.

- Forcepoint

- Fortinet, Inc.

- IBM Corporation

- Microsoft Corporation

- Palo Alto Networks, Inc.

- Proofpoint, Inc.

- Sophos Ltd.

- Trend Micro Incorporated

- VMware, Inc.

Remote Work Security Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2025 |

USD 66.48 billion |

|

Revenue forecast in 2030 |

USD 173.66 billion |

|

Growth rate (revenue) |

CAGR of 21.2% from 2025 to 2030 |

|

Actual data |

2018–2024 |

|

Forecast period |

2025–2030 |

|

Quantitative units |

Market size in USD million/billion and CAGR from 2025 to 2030 |

|

Report coverage |

Market size forecast, company share, competitive landscape, growth factors, and trends |

|

Segments covered |

Component, security type, remote work model, vertical, region |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; MEA |

|

Country scope |

U.S.; Canada; Mexico; UK; Germany; France; China; India; Japan; Australia; South Korea; Brazil; UAE; Saudi Arabia; South Africa |

|

Key companies profiled |

Cisco Systems, Inc.; Palo Alto Networks, Inc.; Microsoft Corporation; Fortinet, Inc.; Check Point Software Technologies Ltd.; Broadcom Inc.; Trend Micro Incorporated; Sophos Ltd.; Forcepoint; Proofpoint, Inc.; VMware, Inc.; IBM Corporation; Cloudflare, Inc.; CyberArk Software Ltd.; CrowdStrike Holdings, Inc |

|

Customization scope |

We offer free report customization, equivalent to 8 analysts' working days, when you make a purchase. You can include or modify the scope of the country, region, and segment. |

|

Pricing and purchase options |

Avail yourself of customized purchase options to meet your exact research needs. Explore purchase options |

Global Remote Work Security Market Segmentation

This report forecasts market size growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the report on remote work security based on component, security type, remote work model, vertical, and region.

-

Component Outlook (Revenue, USD Billion, 2018-2030)

-

Solution

-

Services

-

Professional Services

-

Training & Consulting

-

Integration & Implementation

-

Support & Maintenance

-

-

Managed Services

-

-

-

Security Type Outlook (Revenue, USD Billion, 2018-2030)

-

Endpoint & IoT Security

-

Network Security

-

Cloud Security

-

Application Security

-

-

Remote Work Model Outlook (Revenue, USD Billion, 2018 - 2030)

-

Fully Remote

-

Hybrid

-

Temporary Remote

-

-

Vertical Outlook (Revenue, USD Billion, 2018-2030)

-

Government

-

Telecommunications

-

Retail & eCommerce

-

Education

-

Media & Entertainment

-

Banking, Financial Services, and Insurance (BFSI)

-

IT & ITeS

-

Others

-

-

Remote Work Security Regional Outlook (Revenue, USD Billion, 2018-2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East & Africa

-

UAE

-

Saudi Arabia

-

South Africa

-

-

Related Reports

- Sports Officiating Technologies Market Size - By Technology (Video-based, Sensor-based, Tracking, Communication), By App...

- Cognitive Computing Market Size - By Technology (Machine Learning, Natural Language Processing (NLP), Human Computer Int...

- Cognitive Computing Market Size - By Technology (Machine Learning, Natural Language Processing (NLP), Human Computer In...

- Decentralized Identity Market Size, By Identity Type (Biometrics, Non-Biometrics), By Enterprise Size (Large Enterprise,...

- Blockchain Identity Management Market Size - By Offering (Software, Service), By Provider Type (Application Provider, Mi...

- PayTV Market - By Technology (Cable TV, Satellite TV, Internet Protocol TV), By Subscription Type (Postpaid, Prepaid), ...

Table of Content

Chapter 1. Methodology and Scope

1.1. Market Segmentation and Scope

1.2. Research Methodology

1.2.1. Information Procurement

1.3. Information or Data Analysis

1.4. Methodology

1.5. Research Scope and Assumptions

1.6. Market Formulation & Validation

1.7. Country Based Segment Share Calculation

1.8. List of Data Types

Chapter 2. Executive Summary

2.1. Market Outlook

2.2. Segment Outlook

2.3. Competitive Insights

Chapter 3. Remote Work Security Market Variables, Trends, & Scope

3.1. Market Lineage Outlook

3.2. Market Dynamics

3.2.1. Market Driver Analysis

3.2.2. Market Restraint Analysis

3.2.3. Industry Challenge

3.3. Remote Work Security Market Analysis Tools

3.3.1. Industry Analysis - Porter’s

3.3.1.1. Bargaining power of the suppliers

3.3.1.2. Bargaining power of the buyers

3.3.1.3. Threats of substitution

3.3.1.4. Threats from new entrants

3.3.1.5. Competitive rivalry

3.3.2. PESTEL Analysis

3.3.2.1. Political landscape

3.3.2.2. Economic and social landscape

3.3.2.3. Technological landscape

Chapter 4. Remote Work Security Market: Component Estimates & Trend Analysis

4.1. Segment Dashboard

4.2. Remote Work Security Market: Component Movement Analysis, 2024 & 2030 (USD Billion)

4.3. Solution

4.3.1. Solution Market, Market Size Estimates and Forecasts, 2018 - 2030 (USD Billion)

4.4. Services

4.4.1. Services Market, Market Size Estimates and Forecasts, 2018 - 2030 (USD Billion)

4.4.2. Professional Services

4.4.2.1. Professional Services Market, Market Size Estimates and Forecasts, 2018 - 2030 (USD Billion)

4.4.2.2. Training & Consulting

4.4.2.2.1. Training & Consulting Market, Market Size Estimates and Forecasts, 2018 - 2030 (USD Billion)

4.4.2.3. Integration & Implementation

4.4.2.3.1. Integration & Implementation Market, Market Size Estimates and Forecasts, 2018 - 2030 (USD Billion)

4.4.2.4. Support & Maintenance

4.4.2.4.1. Support & Maintenance Market, Market Size Estimates and Forecasts, 2018 - 2030 (USD Billion)

4.4.3. Managed Services

4.4.3.1. Managed Services Market, Market Size Estimates and Forecasts, 2018 - 2030 (USD Billion)

Chapter 5. Remote Work Security Market: Security Type Estimates & Trend Analysis

5.1. Segment Dashboard

5.2. Remote Work Security Market: Security Type Movement Analysis, 2024 & 2030 (USD Billion)

5.3. Endpoint & IoT Security

5.3.1. Endpoint & IoT Security Market, Market Size Estimates and Forecasts, 2018 - 2030 (USD Billion)

5.4. Network Security

5.4.1. Network Security Market, Market Size Estimates and Forecasts, 2018 - 2030 (USD Billion)

5.5. Cloud Security

5.5.1. Cloud Security Market, Market Size Estimates and Forecasts, 2018 - 2030 (USD Billion)

5.6. Application Security

5.6.1. Application Security Market, Market Size Estimates and Forecasts, 2018 - 2030 (USD Billion)

Chapter 6. Remote Work Security Market: Remote Work Model Estimates & Trend Analysis

6.1. Segment Dashboard

6.2. Remote Work Security Market: Remote Work Model Movement Analysis, 2024 & 2030 (USD Billion)

6.3. Fully Remote

6.3.1. Fully Remote Market, Market Size Estimates and Forecasts, 2018 - 2030 (USD Billion)

6.4. Hybrid

6.4.1. Hybrid Market, Market Size Estimates and Forecasts, 2018 - 2030 (USD Billion)

6.5. Temporary Remote

6.5.1. Temporary Remote Market, Market Size Estimates and Forecasts, 2018 - 2030 (USD Billion)

Chapter 7. Remote Work Security Market: Vertical Estimates & Trend Analysis

7.1. Segment Dashboard

7.2. Remote Work Security Market: Vertical Movement Analysis, 2024 & 2030 (USD Billion)

7.3. Government

7.3.1. Government Market, Market Size Estimates and Forecasts, 2018 - 2030 (USD Billion)

7.4. Telecommunications

7.4.1. Telecommunications Market, Market Size Estimates and Forecasts, 2018 - 2030 (USD Billion)

7.5. Retail & eCommerce

7.5.1. Retail & eCommerce Market, Market Size Estimates and Forecasts, 2018 - 2030 (USD Billion)

7.6. Media & Entertainment

7.6.1. Media & Entertainment Market, Market Size Estimates and Forecasts, 2018 - 2030 (USD Billion)

7.7. Education

7.7.1. Education Market, Market Size Estimates and Forecasts, 2018 - 2030 (USD Billion)

7.8. Banking, Financial Services, and Insurance (BFSI)

7.8.1. Banking, Financial Services, and Insurance (BFSI) Market, Market Size Estimates and Forecasts, 2018 - 2030 (USD Billion)

7.9. IT & ITeS

7.9.1. IT & ITeS Market, Market Size Estimates and Forecasts, 2018 - 2030 (USD Billion)

7.10. Others

7.10.1. Others Market, Market Size Estimates and Forecasts, 2018 - 2030 (USD Billion)

Chapter 8. Remote Work Security Market: Regional Estimates & Trend Analysis

8.1. Remote Work Security Market Share, By Region, 2024 & 2030 (USD Billion)

8.2. North America

8.2.1. North America Remote Work Security Market Estimates and Forecasts, 2018 - 2030 (USD Billion)

8.2.2. U.S.

8.2.2.1. U.S. Remote Work Security Market Estimates and Forecasts, 2018 - 2030 (USD Billion)

8.2.3. Canada

8.2.3.1. Canada Remote Work Security Market Estimates and Forecasts, 2018 - 2030 (USD Billion)

8.2.4. Mexico

8.2.4.1. Mexico Remote Work Security Market Estimates and Forecasts, 2018 - 2030 (USD Billion)

8.3. Europe

8.3.1. Europe Remote Work Security Market Estimates and Forecasts, 2018 - 2030 (USD Billion)

8.3.2. UK

8.3.2.1. UK Remote Work Security Market Estimates and Forecasts, 2018 - 2030 (USD Billion)

8.3.3. Germany

8.3.3.1. Germany Remote Work Security Market Estimates and Forecasts, 2018 - 2030 (USD Billion)

8.3.4. France

8.3.4.1. France Remote Work Security Market Estimates and Forecasts, 2018 - 2030 (USD Billion)

8.4. Asia Pacific

8.4.1. Asia Pacific Remote Work Security Market Estimates and Forecasts, 2018 - 2030 (USD Billion)

8.4.2. China

8.4.2.1. China Remote Work Security Market Estimates and Forecasts, 2018 - 2030 (USD Billion)

8.4.3. Japan

8.4.3.1. Japan Remote Work Security Market Estimates and Forecasts, 2018 - 2030 (USD Billion)

8.4.4. India

8.4.4.1. India Remote Work Security Market Estimates and Forecasts, 2018 - 2030 (USD Billion)

8.4.5. South Korea

8.4.5.1. South Korea Remote Work Security Market Estimates and Forecasts, 2018 - 2030 (USD Billion)

8.4.6. Australia

8.4.6.1. Australia Remote Work Security Market Estimates and Forecasts, 2018 - 2030 (USD Billion)

8.5. Latin America

8.5.1. Latin America Remote Work Security Market Estimates and Forecasts, 2018 - 2030 (USD Billion)

8.5.2. Brazil

8.5.2.1. Brazil Remote Work Security Market Estimates and Forecasts, 2018 - 2030 (USD Billion)

8.6. Middle East and Africa

8.6.1. Middle East and Africa Remote Work Security Market Estimates and Forecasts, 2018 - 2030 (USD Billion)

8.6.2. UAE

8.6.2.1. UAE Remote Work Security Market Estimates and Forecasts, 2018 - 2030 (USD Billion)

8.6.3. KSA

8.6.3.1. KSA Remote Work Security Market Estimates and Forecasts, 2018 - 2030 (USD Billion)

8.6.4. South Africa

8.6.4.1. South Africa Remote Work Security Market Estimates and Forecasts, 2018 - 2030 (USD Billion)

Chapter 9. Competitive Landscape

9.1. Company Categorization

9.2. Company Market Positioning

9.3. Company Market Share, 2024

9.4. Company Heat Map Analysis

9.5. Company Profiles/Listing

9.5.1. Cisco Systems, Inc.

9.5.1.1. Participant’s Overview

9.5.1.2. Financial Performance

9.5.1.3. Solution Benchmarking

9.5.1.4. Strategic Initiatives

9.5.2. Palo Alto Networks, Inc.

9.5.2.1. Participant’s Overview

9.5.2.2. Financial Performance

9.5.2.3. Solution Benchmarking

9.5.2.4. Strategic Initiatives

9.5.3. Microsoft Corporation

9.5.3.1. Participant’s Overview

9.5.3.2. Financial Performance

9.5.3.3. Solution Benchmarking

9.5.3.4. Strategic Initiatives

9.5.4. Fortinet, Inc.

9.5.4.1. Participant’s Overview

9.5.4.2. Financial Performance

9.5.4.3. Solution Benchmarking

9.5.4.4. Strategic Initiatives

9.5.5. Check Point Software Technologies Ltd.

9.5.5.1. Participant’s Overview

9.5.5.2. Financial Performance

9.5.5.3. Solution Benchmarking

9.5.5.4. Strategic Initiatives

9.5.6. Broadcom Inc.

9.5.6.1. Participant’s Overview

9.5.6.2. Financial Performance

9.5.6.3. Solution Benchmarking

9.5.6.4. Strategic Initiatives

9.5.7. Trend Micro Incorporated

9.5.7.1. Participant’s Overview

9.5.7.2. Financial Performance

9.5.7.3. Solution Benchmarking

9.5.7.4. Strategic Initiatives

9.5.8. Sophos Ltd.

9.5.8.1. Participant’s Overview

9.5.8.2. Financial Performance

9.5.8.3. Solution Benchmarking

9.5.8.4. Strategic Initiatives

9.5.9. Forcepoint

9.5.9.1. Participant’s Overview

9.5.9.2. Financial Performance

9.5.9.3. Solution Benchmarking

9.5.9.4. Strategic Initiatives

9.5.10. Proofpoint, Inc.

9.5.10.1. Participant’s Overview

9.5.10.2. Financial Performance

9.5.10.3. Solution Benchmarking

9.5.10.4. Strategic Initiatives

9.5.11. VMware, Inc.

9.5.11.1. Participant’s Overview

9.5.11.2. Financial Performance

9.5.11.3. Solution Benchmarking

9.5.11.4. Strategic Initiatives

9.5.12. IBM Corporation

9.5.12.1. Participant’s Overview

9.5.12.2. Financial Performance

9.5.12.3. Solution Benchmarking

9.5.12.4. Strategic Initiatives

9.5.13. Cloudflare, Inc.

9.5.13.1. Participant’s Overview

9.5.13.2. Financial Performance

9.5.13.3. Solution Benchmarking

9.5.13.4. Strategic Initiatives

9.5.14. CyberArk Software Ltd.

9.5.14.1. Participant’s Overview

9.5.14.2. Financial Performance

9.5.14.3. Solution Benchmarking

9.5.14.4. Strategic Initiatives

9.5.15. CrowdStrike Holdings, Inc

9.5.15.1. Participant’s Overview

9.5.15.2. Financial Performance

9.5.15.3. Solution Benchmarking

9.5.15.4. Strategic Initiatives

List of Tables

Table 1 Global Remote Work Security Market size estimates & forecasts 2018 - 2030 (USD Billion)

Table 2 Global Remote Work Security Market, by region 2018 - 2030 (USD Billion)

Table 3 Global Remote Work Security Market, by Component 2018 - 2030 (USD Billion)

Table 4 Global Remote Work Security Market, by Security Type 2018 - 2030 (USD Billion)

Table 5 Global Remote Work Security Market, by Remote Work Model 2018 - 2030 (USD Billion)

Table 6 Global Remote Work Security Market, by Vertical 2018 - 2030 (USD Billion)

Table 7 Solution Remote Work Security Market, by region 2018 - 2030 (USD Billion)

Table 8 Services Remote Work Security Market, by region 2018 - 2030 (USD Billion)

Table 9 Professional Services Remote Work Security Market, by region 2018 - 2030 (USD Billion)

Table 10 Training & Consulting Remote Work Security Market, by region 2018 - 2030 (USD Billion)

Table 11 Integration & Implementation Remote Work Security Market, by region 2018 - 2030 (USD Billion)

Table 12 Support & Maintenance Remote Work Security Market, by region 2018 - 2030 (USD Billion)

Table 13 Managed Services Remote Work Security Market, by region 2018 - 2030 (USD Billion)

Table 14 Endpoint & IoT Security Market, by region 2018 - 2030 (USD Billion)

Table 15 Network Security Market, by region 2018 - 2030 (USD Billion)

Table 16 Cloud Security Market, by region 2018 - 2030 (USD Billion)

Table 17 Application Security Market, by region 2018 - 2030 (USD Billion)

Table 18 Fully Remote Work Security Market, by region 2018 - 2030 (USD Billion)

Table 19 Hybrid Remote Work Security Market, by region 2018 - 2030 (USD Billion)

Table 20 Temporary Remote Work Security Market, by region 2018 - 2030 (USD Billion)

Table 21 Government Remote Work Security Market, by region 2018 - 2030 (USD Billion)

Table 22 Retail & eCommerce Remote Work Security Market, by region 2018 - 2030 (USD Billion)

Table 23 Telecommunications Remote Work Security Market, by region 2018 - 2030 (USD Billion)

Table 24 Media & Entertainment Remote Work Security Market, by region 2018 - 2030 (USD Billion)

Table 25 Banking, Financial Services, and Insurance (BFSI) Remote Work Security Market, by region 2018 - 2030 (USD Billion)

Table 26 Education Remote Work Security Market, by region 2018 - 2030 (USD Billion)

Table 27 IT & ITeS Remote Work Security Market, by region 2018 - 2030 (USD Billion)

Table 28 Others Remote Work Security Market, by region 2018 - 2030 (USD Billion)

Table 29 Remote Work Security Market, by region 2018 - 2030 (USD Billion)

Table 30 North America Remote Work Security Market, by Component 2018 - 2030 (USD Billion)

Table 31 North America Remote Work Security Market, by Security Type 2018 - 2030 (USD Billion)

Table 32 North America Remote Work Security Market, by Remote Work Model 2018 - 2030 (USD Billion)

Table 33 North America Remote Work Security Market, by Vertical 2018 - 2030 (USD Billion)

Table 34 U.S. Remote Work Security Market, by Component 2018 - 2030 (USD Billion)

Table 35 U.S. Remote Work Security Market, by Security Type 2018 - 2030 (USD Billion)

Table 36 U.S. Remote Work Security Market, by Remote Work Model 2018 - 2030 (USD Billion)

Table 37 U.S. Remote Work Security Market, by Vertical 2018 - 2030 (USD Billion)

Table 38 Canada Remote Work Security Market, by Component 2018 - 2030 (USD Billion)

Table 39 Canada Remote Work Security Market, by Security Type 2018 - 2030 (USD Billion)

Table 40 Canada Remote Work Security Market, by Remote Work Model 2018 - 2030 (USD Billion)

Table 41 Canada Remote Work Security Market, by Vertical 2018 - 2030 (USD Billion)

Table 42 Mexico Remote Work Security Market, by Component 2018 - 2030 (USD Billion)

Table 43 Mexico Remote Work Security Market, by Security Type 2018 - 2030 (USD Billion)

Table 44 Mexico Remote Work Security Market, by Remote Work Model 2018 - 2030 (USD Billion)

Table 45 Mexico Remote Work Security Market, by Vertical 2018 - 2030 (USD Billion)

Table 46 Europe Remote Work Security Market, by Component 2018 - 2030 (USD Billion)

Table 47 Europe Remote Work Security Market, by Security Type 2018 - 2030 (USD Billion)

Table 48 Europe Remote Work Security Market, by Remote Work Model 2018 - 2030 (USD Billion)

Table 49 Europe Remote Work Security Market, by Vertical 2018 - 2030 (USD Billion)

Table 50 UK Remote Work Security Market, by Component 2018 - 2030 (USD Billion)

Table 51 UK Remote Work Security Market, by Security Type 2018 - 2030 (USD Billion)

Table 52 UK Remote Work Security Market, by Remote Work Model 2018 - 2030 (USD Billion)

Table 53 UK Remote Work Security Market, by Vertical 2018 - 2030 (USD Billion)

Table 54 Germany Remote Work Security Market, by Component 2018 - 2030 (USD Billion)

Table 55 Germany Remote Work Security Market, by Security Type 2018 - 2030 (USD Billion)

Table 56 Germany Remote Work Security Market, by Remote Work Model 2018 - 2030 (USD Billion)

Table 57 Germany Remote Work Security Market, by Vertical 2018 - 2030 (USD Billion)

Table 58 France Remote Work Security Market, by Component 2018 - 2030 (USD Billion)

Table 59 France Remote Work Security Market, by Security Type 2018 - 2030 (USD Billion)

Table 60 France Remote Work Security Market, by Remote Work Model 2018 - 2030 (USD Billion)

Table 61 France Remote Work Security Market, by Vertical 2018 - 2030 (USD Billion)

Table 62 Asia Pacific Remote Work Security Market, by Component 2018 - 2030 (USD Billion)

Table 63 Asia Pacific Remote Work Security Market, by Security Type 2018 - 2030 (USD Billion)

Table 64 Asia Pacific Remote Work Security Market, by Remote Work Model 2018 - 2030 (USD Billion)

Table 65 Asia Pacific Remote Work Security Market, by Vertical 2018 - 2030 (USD Billion)

Table 66 China Remote Work Security Market, by Component 2018 - 2030 (USD Billion)

Table 67 China Remote Work Security Market, by Security Type 2018 - 2030 (USD Billion)

Table 68 China Remote Work Security Market, by Remote Work Model 2018 - 2030 (USD Billion)

Table 69 China Remote Work Security Market, by Vertical 2018 - 2030 (USD Billion)

Table 70 India Remote Work Security Market, by Component 2018 - 2030 (USD Billion)

Table 71 India Remote Work Security Market, by Security Type 2018 - 2030 (USD Billion)

Table 72 India Remote Work Security Market, by Remote Work Model 2018 - 2030 (USD Billion)

Table 73 India Remote Work Security Market, by Vertical 2018 - 2030 (USD Billion)

Table 74 Japan Remote Work Security Market, by Component 2018 - 2030 (USD Billion)

Table 75 Japan Remote Work Security Market, by Security Type 2018 - 2030 (USD Billion)

Table 76 Japan Remote Work Security Market, by Remote Work Model 2018 - 2030 (USD Billion)

Table 77 Japan Remote Work Security Market, by Vertical 2018 - 2030 (USD Billion)

Table 78 South Korea Remote Work Security Market, by Component 2018 - 2030 (USD Billion)

Table 79 South Korea Remote Work Security Market, by Security Type 2018 - 2030 (USD Billion)

Table 80 South Korea Remote Work Security Market, by Remote Work Model 2018 - 2030 (USD Billion)

Table 81 South Korea Remote Work Security Market, by Vertical 2018 - 2030 (USD Billion)

Table 82 Australia Remote Work Security Market, by Component 2018 - 2030 (USD Billion)

Table 83 Australia Remote Work Security Market, by Security Type 2018 - 2030 (USD Billion)

Table 84 Australia Remote Work Security Market, by Remote Work Model 2018 - 2030 (USD Billion)

Table 85 Australia Remote Work Security Market, by Vertical 2018 - 2030 (USD Billion)

Table 86 Latin America Remote Work Security Market, by Component 2018 - 2030 (USD Billion)

Table 87 Latin America Remote Work Security Market, by Security Type 2018 - 2030 (USD Billion)

Table 88 Latin America Remote Work Security Market, by Remote Work Model 2018 - 2030 (USD Billion)

Table 89 Latin America Remote Work Security Market, by Vertical 2018 - 2030 (USD Billion)

Table 90 Brazil Remote Work Security Market, by Component 2018 - 2030 (USD Billion)

Table 91 Brazil Remote Work Security Market, by Security Type 2018 - 2030 (USD Billion)

Table 92 Brazil Remote Work Security Market, by Remote Work Model 2018 - 2030 (USD Billion)

Table 93 Brazil Remote Work Security Market, by Vertical 2018 - 2030 (USD Billion)

Table 94 Middle East & Africa Remote Work Security Market, by Component 2018 - 2030 (USD Billion)

Table 95 Middle East & Africa Remote Work Security Market, by Security Type 2018 - 2030 (USD Billion)

Table 96 Middle East & Africa Remote Work Security Market, by Remote Work Model 2018 - 2030 (USD Billion)

Table 97 Middle East & Africa Remote Work Security Market, by Vertical 2018 - 2030 (USD Billion)

Table 98 UAE Remote Work Security Market, by Component 2018 - 2030 (USD Billion)

Table 99 UAE Remote Work Security Market, by Security Type 2018 - 2030 (USD Billion)

Table 100 UAE Remote Work Security Market, by Remote Work Model 2018 - 2030 (USD Billion)

Table 101 UAE Remote Work Security Market, by Vertical 2018 - 2030 (USD Billion)

Table 102 Saudi Arabia Remote Work Security Market, by Component 2018 - 2030 (USD Billion)

Table 103 Saudi Arabia Remote Work Security Market, by Security Type 2018 - 2030 (USD Billion)

Table 104 Saudi Arabia Remote Work Security Market, by Remote Work Model 2018 - 2030 (USD Billion)

Table 105 Saudi Arabia Remote Work Security Market, by Vertical 2018 - 2030 (USD Billion)

Table 106 South Africa Remote Work Security Market, by Component 2018 - 2030 (USD Billion)

Table 107 South Africa Remote Work Security Market, by Security Type 2018 - 2030 (USD Billion)

Table 108 South Africa Remote Work Security Market, by Remote Work Model 2018 - 2030 (USD Billion)

Table 109 South Africa Remote Work Security Market, by Vertical 2018 - 2030 (USD Billion)

List of Figures

Fig. 1 Remote Work Security Market segmentation

Fig. 2 Market research process

Fig. 3 Information procurement

Fig. 4 Primary research pattern

Fig. 5 Market research approaches

Fig. 6 Value chain-based sizing & forecasting

Fig. 7 Parent market analysis

Fig. 8 Market formulation & validation

Fig. 9 Remote Work Security Market snapshot

Fig. 10 Remote Work Security Market segment snapshot

Fig. 11 Remote Work Security Market competitive landscape snapshot

Fig. 12 Market research process

Fig. 13 Market driver relevance analysis (Current & future impact)

Fig. 14 Market restraint relevance analysis (Current & future impact)

Fig. 15 Remote Work Security Market: Component outlook key takeaways (USD Billion)

Fig. 16 Remote Work Security Market: Component movement analysis 2024 & 2030 (USD Billion)

Fig. 17 Solution Market, Market Size estimates and forecasts, 2018 - 2030 (USD Billion)

Fig. 18 Services Market, Market Size estimates and forecasts, 2018 - 2030 (USD Billion)

Fig. 19 Professional Services Market, Market Size estimates and forecasts, 2018 - 2030 (USD Billion)

Fig. 20 Training & Consulting Market, Market Size estimates and forecasts, 2018 - 2030 (USD Billion)

Fig. 21 Integration & Implementation Market, Market Size estimates and forecasts, 2018 - 2030 (USD Billion)

Fig. 22 Support & Maintenance Market, Market Size estimates and forecasts, 2018 - 2030 (USD Billion)

Fig. 23 Managed Services Market, Market Size estimates and forecasts, 2018 - 2030 (USD Billion)

Fig. 24 Remote Work Security Market: Security Type outlook key takeaways (USD Billion)

Fig. 25 Remote Work Security Market: Security Type movement analysis 2024 & 2030 (USD Billion)

Fig. 26 Endpoint & IoT Security Market, Market Size estimates and forecasts, 2018 - 2030 (USD Billion)

Fig. 27 Network Security Market, Market Size estimates and forecasts, 2018 - 2030 (USD Billion)

Fig. 28 Cloud Security Market, Market Size estimates and forecasts, 2018 - 2030 (USD Billion)

Fig. 29 Application Security Market, Market Size estimates and forecasts, 2018 - 2030 (USD Billion)

Fig. 30 Remote Work Security Market: Remote Work Model outlook key takeaways (USD Billion)

Fig. 31 Remote Work Security Market: Remote Work Model movement analysis 2024 & 2030 (USD Billion)

Fig. 32 Fully Remote Market, Market Size estimates and forecasts, 2018 - 2030 (USD Billion)

Fig. 33 Hybrid Market, Market Size estimates and forecasts, 2018 - 2030 (USD Billion)

Fig. 34 Temporary Remote Market, Market Size estimates and forecasts, 2018 - 2030 (USD Billion)

Fig. 35 Remote Work Security Market: Vertical movement analysis 2024 & 2030 (USD Billion)

Fig. 36 Government Market, Market Size estimates and forecasts, 2018 - 2030 (USD Billion)

Fig. 37 Telecommunications Market, Market Size estimates and forecasts, 2018 - 2030 (USD Billion)

Fig. 38 Retail & eCommerce Market, Market Size estimates and forecasts, 2018 - 2030 (USD Billion)

Fig. 39 Education Market, Market Size estimates and forecasts, 2018 - 2030 (USD Billion)

Fig. 40 Media & Entertainment Market, Market Size estimates and forecasts, 2018 - 2030 (USD Billion)

Fig. 41 Banking, Financial Services, and Insurance (BFSI) Market, Market Size estimates and forecasts, 2018 - 2030 (USD Billion)

Fig. 42 IT & ITeS Market, Market Size estimates and forecasts, 2018 - 2030 (USD Billion)

Fig. 43 Others Market, Market Size estimates and forecasts, 2018 - 2030 (USD Billion)

Fig. 44 Regional marketplace: Key takeaways

Fig. 45 Remote Work Security Market: Regional outlook, 2024 & 2030 (USD Billion)

Fig. 46 North America Remote Work Security Market estimates and forecasts, 2018 - 2030 (USD Billion)

Fig. 47 U.S. Remote Work Security Market estimates and forecasts, 2018 - 2030 (USD Billion)

Fig. 48 Canada Remote Work Security Market estimates and forecasts, 2018 - 2030 (USD Billion)

Fig. 49 Mexico Remote Work Security Market estimates and forecasts, 2018 - 2030 (USD Billion)

Fig. 50 Europe Remote Work Security Market estimates and forecasts, 2018 - 2030 (USD Billion)

Fig. 51 UK Remote Work Security Market estimates and forecasts, 2018 - 2030 (USD Billion)

Fig. 52 Germany Remote Work Security Market estimates and forecasts, 2018 - 2030 (USD Billion)

Fig. 53 France Remote Work Security Market estimates and forecasts, 2018 - 2030 (USD Billion)

Fig. 54 Asia Pacific Remote Work Security Market estimates and forecasts, 2018 - 2030 (USD Billion)

Fig. 55 Japan Remote Work Security Market estimates and forecasts, 2018 - 2030 (USD Billion)

Fig. 56 China Remote Work Security Market estimates and forecasts, 2018 - 2030 (USD Billion)

Fig. 57 India Remote Work Security Market estimates and forecasts, 2018 - 2030 (USD Billion)

Fig. 58 Australia Remote Work Security Market estimates and forecasts, 2018 - 2030 (USD Billion)

Fig. 59 South Korea Remote Work Security Market estimates and forecasts, 2018 - 2030 (USD Billion)

Fig. 60 Latin America Remote Work Security Market estimates and forecasts, 2018 - 2030 (USD Billion)

Fig. 61 Brazil Remote Work Security Market estimates and forecasts, 2018 - 2030 (USD Billion)

Fig. 62 MEA Remote Work Security Market estimates and forecasts, 2018 - 2030 (USD Billion)

Fig. 63 KSA Remote Work Security Market estimates and forecasts, 2018 - 2030 (USD Billion)

Fig. 64 UAE Remote Work Security Market estimates and forecasts, 2018 - 2030 (USD Billion)

Fig. 65 South Africa Remote Work Security Market estimates and forecasts, 2018 - 2030 (USD Billion)

Fig. 66 Strategy framework

Fig. 67 Company Categorization

Key Remote Work Security Companies:

The following are the leading companies in the remote work security market. These companies collectively hold the largest market share and dictate industry trends.

- Broadcom Inc.

- Check Point Software Technologies Ltd.

- Cisco Systems, Inc.

- Cloudflare, Inc.

- CrowdStrike Holdings, Inc.

- CyberArk Software Ltd.

- Forcepoint

- Fortinet, Inc.

- IBM Corporation

- Microsoft Corporation

- Palo Alto Networks, Inc.

- Proofpoint, Inc.

- Sophos Ltd.

- Trend Micro Incorporated

- VMware, Inc.

FAQ'S

For a single, multi and corporate client license, the report will be available in PDF format. Sample report would be given you in excel format. For more questions please contact:

Within 24 to 48 hrs.

You can contact Sales team (sales@marketinsightsresearch.com) and they will direct you on email

You can order a report by selecting payment methods, which is bank wire or online payment through any Debit/Credit card, Razor pay or PayPal.

Discounts are available.

Hard Copy