Direct-to-chip Liquid Cooling Market Size, Share & Trends Analysis Report By Cooling Solution Type, By Component Cooling, By Liquid Coolant Type, By Application, By End Use, By Region, And Segment Forecasts

Direct-to-chip Liquid Cooling Market Size, Share & Trends Analysis Report By Cooling Solution Type, By Component Cooling, By Liquid Coolant Type, By Application, By End Use, By Region, And Segment Forecasts

Published Date: May - 2025 | Publisher: MIR | No of Pages: 260 | Industry: technology | Format: Report available in PDF / Excel Format

View Details Buy Now 2999 Download Free Sample Ask for Discount Request CustomizationDirect-to-chip Liquid Cooling Market Trends

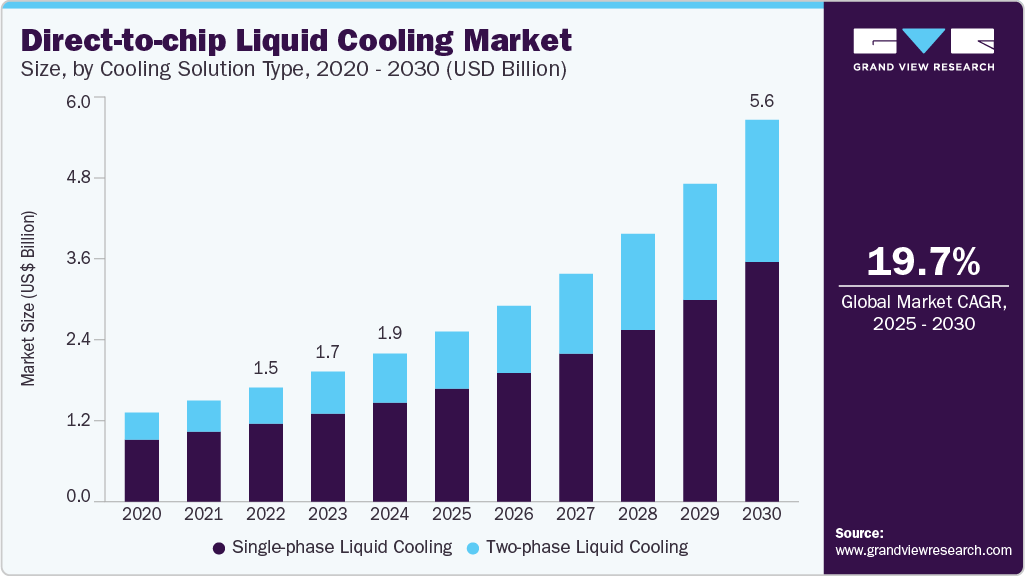

The size of the global direct-to-chip liquid cooling market was valued at USD 1.96 billion in 2024 and is projected to grow at a CAGR of 19.7% during the period 2025-2030. New-generation processors, such as CPUs, GPUs, and ASICs, are producing higher heat due to increased power densities.

Market Highlights

The segment of single-phase liquid cooling held the largest market share and contributed the revenue share of more than 65.0% in 2024

The CPU cooling segment led the market in 2024, owing to the increasing demand for high-performance computing (HPC), gaming, data centers, and enterprise IT infrastructure.

The water-based coolants segment led the market in 2024, with advancements in water-based coolant formulations aiding market growth.

The data center segment led the market in 2024, owing to the spurt in digital transformation, cloud computing, artificial intelligence, and big data analytics across industries.

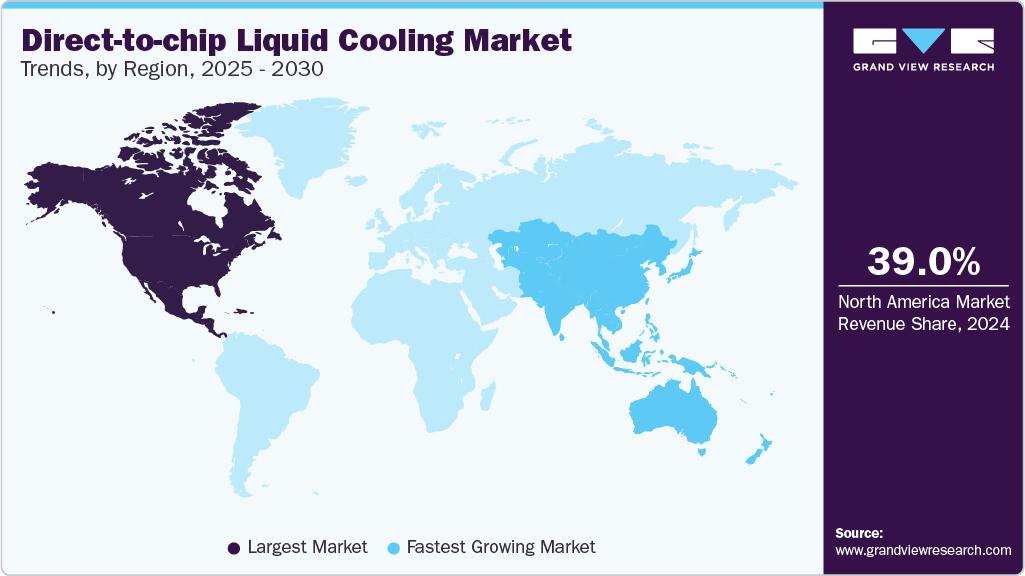

The North American direct-to-chip liquid cooling market dominated with a value share of more than 39.0% in 2024

Traditional air cooling solutions are no longer effective in coping with this increased thermal output. Direct-to-chip liquid cooling solutions solve this problem by enabling effective heat extraction directly at the chip level to ensure maximum performance and avoid overheating.

The exponential power density of the latest CPUs and GPUs in data centers and HPC is also driving direct-to-chip liquid cooling industry growth. As chips like NVIDIA's H100 and AMD's EPYC 9004 series drive thermal design power (TDP) past 500W per chip, air cooling is inefficient and economically unfeasible. Direct-to-chip solutions, which provide coolant directly to cold plates mounted on processors, realize heat removal efficiency, allowing processors to operate at greater clock speeds and maintain performance without thermal throttling. In one example, CoolIT, a liquid cooling solutions provider, in March 2025 launched a cold plate for direct liquid cooling in data centers for high-efficiency thermal management of components like CPUs and GPUs. Comparable in concept to AIO and bespoke liquid cooling configurations employed in desktop computers, this technology belongs to the direct-to-chip (D2C) cooling category, providing improved performance for high-demand data center applications.

With advancing semiconductor technology, chips are getting smaller but more powerful, which raises the power density and heat generation. This is especially common in microprocessors, GPUs, and memory modules. Direct-to-chip liquid cooling offers an effective means of controlling the heat generated by these high-density components, ensuring system stability and performance. The necessity to cool high-power density chips without compromising size or performance is a strong motivator for the use of liquid cooling technologies.

The spate of applications of AI, machine learning, and deep learning has resulted in a dramatic rise in computational demand. These tools require hardware capable of supporting rigorous workloads, which in return produces high volumes of heat. Direct-to-chip liquid coolants are finding widespread use within data centers in order to keep up with the demands, making systems cool and efficient under massive processing loads.

Report Coverage & Deliverables

- Competitive benchmarking

- Historical data & forecasts

- Company revenue shares

- Regional opportunities

- Latest trends & dynamics

Cooling Solution Type Insights

The single-phase liquid cooling category led the market and contributed the revenue share of more than 65.0% in 2024, fueled by the growing demand for effective thermal management solutions in data centers, high-performance computing (HPC), and enterprise IT infrastructure. With increasing computational workloads, particularly with growing adoption of AI, machine learning, and cloud-based applications, conventional air cooling systems are being pushed to their limits. Single-phase liquid cooling provides a better, more reliable, and energy-efficient solution, absorbing and transferring heat from processors and other sensitive components directly by using liquid coolant without altering the physical state of the coolant.

The two-phase liquid cooling market is expected to exhibit the largest CAGR throughout the forecast period due to growing demand for high-efficiency thermal management in environments that are prone to extreme processing power and heat density, including hyperscale data centers, AI clusters, and supercomputing centers. In contrast to single-phase cooling, which is based on liquid convection alone, two-phase systems take advantage of the phase change process-more commonly from liquid to vapor-to better absorb and dissipate heat.

Component Cooling Insights

CPU cooler segment led the market in 2024 based on the mounting need for high-performance computing (HPC), gaming, data centers, and enterprise IT equipment. With processors advancing with rising core counts and clock rates, they produce heat, and companies need sophisticated coolers to realize optimal performance levels and guarantee system stability. In addition, the growth of the segment can be traced to the quick growth of the gaming and eSports markets, which require high-performance CPUs that can process graphically demanding workloads.

The memory cooling market will expand at a strong CAGR during the forecast period as a result of growing performance requirements and power densities of new DRAM and flash memory modules utilized in servers, high-performance computing (HPC), gaming platforms, and AI workloads. As memory speeds and capacities grow, especially with the implementation of DDR5, LPDDR5, and HBM (High Bandwidth Memory) resulting in heat produced by data-intensive operations. Optimal thermal management of memory modules has become key to guaranteeing stability, longevity, and top performance, particularly in data centers and computing systems that demand 24/7 reliability.

Liquid Coolant Type Insights

The water-based coolants segment led the market in 2024, innovation in the development of water-based coolant formulations is driving the market. Companies are coming up with new formulations that improve the cooling performance, stability, and longevity of water-based coolants. The incorporation of additives like corrosion inhibitors, anti-freeze additives, and anti-bacterial additives ensures the performance of these coolants under different operating conditions and makes them versatile for numerous applications ranging from high-performance computing to automotive cooling.

The dielectric fluids market is anticipated to expand at a high CAGR during the forecast period due to the demand for energy efficiency and sustainability in data centers. While global data center electricity consumption grows, liquid cooling, especially dielectric fluid-based systems, decreases cooling energy consumption by 30-50% over traditional air cooling. Regulatory forces, including carbon emission restrictions and corporate ESG commitments, are driving hyperscale businesses to embrace environmentally friendly dielectric fluids, including synthetic hydrocarbons, fluorinated fluids, and biodegradable fluids.

Application Insights

The data center space led the market in 2024 as digital transformation, cloud computing, artificial intelligence, and big data analytics gained pace in industries. While enterprises are shifting workloads to the cloud and hyper scale data centers spread around the globe, thermal loads of high-performance computing (HPC) solutions, dense server racks, and sophisticated GPUs have risen dramatically. This increase in heat generation requires sophisticated and energy-efficient cooling systems to ensure optimal system performance, reliability, and availability, thus thermal management becomes an important consideration in data center design and operations.

The high-performance computing (HPC) market is anticipated to grow at a strong CAGR over the forecast period owing to the increasing technological advancements in HPC architecture, like the increased application of heterogeneous computing, blending CPUs, GPUs, FPGAs, have made thermal management more challenging. Effective cooling solutions that can accommodate various component configurations and changing heat profiles are becoming increasingly necessary. Liquid cooling technologies, especially modular and scalable configurations, offer the flexibility required to accommodate changing HPC infrastructure along with the highest thermal efficiency.

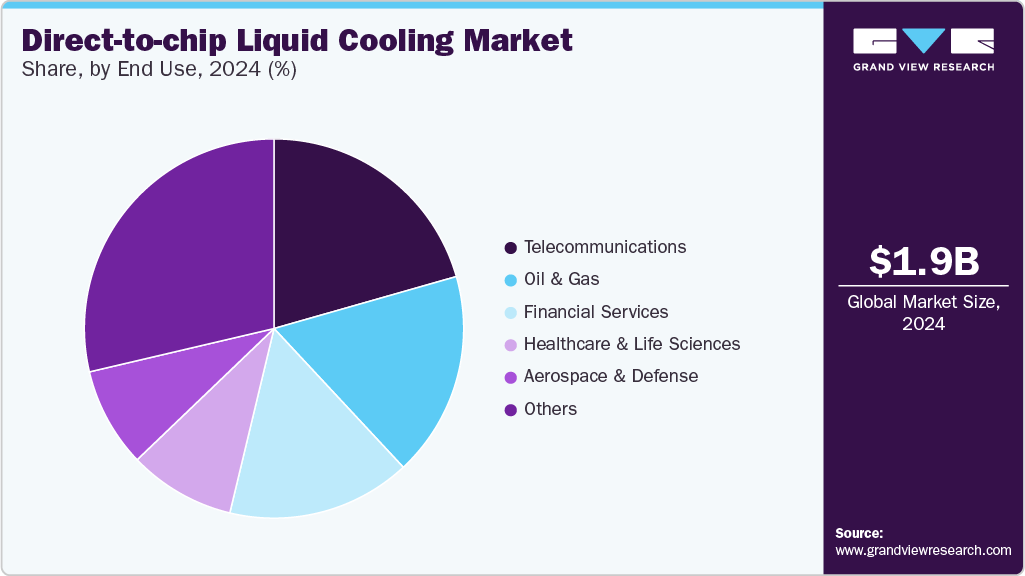

End Use Insights

The telecommunications segment led the market in 2024. Growth in edge computing in telecom networks drives the segment's growth. As operators move data processing nearer to users to enable latency-critical applications like autonomous driving, remote surgery, and industrial automation, demand grows for high-performance, thermally resilient computing near the edge. These edge nodes tend to be located in rugged or space-limited environments in which traditional cooling is ineffective or impractical.

The oil and gas industry will witness a high CAGR growth during the forecast period as a result of the growth in digital oilfield technologies. Advanced analytics, 3D seismic modeling, reservoir simulation, and AI-based decision-making solutions are being used increasingly by oil and gas organizations to enhance exploration success rates and enhance extraction methods. These applications need high-performance computing clusters with advanced processing capabilities, which further produce significant heat. Liquid cooling, especially direct-to-chip and immersion cooling, enables these systems to operate at optimal performance levels with reduced risk of overheating and downtime, even in remote and space-restricted areas such as desert-based control centers or offshore rigs.

Regional Insights

The North American direct-to-chip liquid cooling market accounted for a strong share of more than 39.0% in 2024, fueled by the fast growth of hyperscale data centers, particularly to accommodate cloud services, AI, and digital infrastructure projects backed by the government. Giant technology players Google, Amazon, and Microsoft are investing heavily in liquid cooling solutions to boost energy efficiency and lower operational expenses. The region's positive regulatory drive for carbon neutrality and sustainability, coupled with tax benefits for the construction of green data centers, also enhances adoption.

U.S. Direct-to-chip Liquid Cooling Market Trends

The U.S. direct-to-chip liquid cooling market is anticipated to grow strongly at a CAGR of 21.6% during the forecast period of 2025 to 2030. Governmental investments in exascale computing projects and an active AI startup ecosystem fuel the demand for next-generation cooling solutions that can meet high thermal loads. Additionally, direct collaborations among cooling solution vendors and cloud service providers are supporting tailored deployments within large-scale computing environments.

Europe Direct-to-chip Liquid Cooling Market Trends

The Europe direct-to-chip liquid cooling market is expected to record a significant growth from 2025 through 2030 as a result of tight energy efficiency requirements and carbon emission reduction mandates under platforms such as the European Green Deal. The operators of data centers in Europe are looking for low-PUE options to meet environmental regulations without sacrificing performance in progressively dense server setups.

The UK direct-to-chip liquid cooling sector is set to develop quickly over the next few years due to the growing presence of fintech and AI-powered health tech solutions is placing additional demand on high-density computing hardware that depends upon sophisticated cooling mechanisms. Development in modular and colocation data centers for SMEs and technology start-ups also assists in adoption since these data centers need energy-efficient and scalable cooling.

Germany's direct-to-chip liquid cooling market dominated the market share in 2024, with the nation's industrial digitalization initiative, particularly automotive, manufacturing, and engineering industries employing simulation, digital twins, and AI. The nation's edge computing and Industry 4.0 usage require intense thermal management of distributed high-performance systems.

Asia Pacific Direct-to-chip Liquid Cooling Market Trends

Asia Pacific will lead with the highest CAGR of 22.6% during the forecast period 2025-2030, as the demand for high-performance infrastructure to enable smart cities, 5G deployments, and AI programs increases. The region's growth in gaming, video streaming, and mobile commerce is generating high server density in city data centers.

The direct-to-chip liquid cooling market for Japan is slated to expand heavily in the upcoming years due to the dominance of high-value data centers in restricted areas of densely populated urban locations, which necessitates effective removal of heat from the chip level. Furthermore, the focus by Japan on the use of natural disaster-resistant, space-efficient technologies like direct-to-chip liquids facilitates the upgradation to the mentioned technology.

The Chinese direct-to-chip liquid cooling market represented a significant share in 2024, attributed to significant investment in AI, smart manufacturing, and national computing infrastructure under the New Infrastructure plan. The rise of hyperscale data centers operated by players like Alibaba, Tencent, and Huawei is driving the demand for high-performance, energy-optimized cooling solutions.

Key Direct-to-chip Liquid Cooling Company Insights

Major players in the direct-to-chip liquid cooling market include Asetek, CoolIT Systems, ZutaCore, Vertiv Holdings Co, and Iceotope Technologies The companies are implementing different strategic initiatives, such as new product developments, partnerships & collaborations, and agreements to get a competitive edge over their competitors. Below are some examples of such initiatives.

In April of 2025, JetCool Technologies Inc. introduced a SmartSense Coolant Distribution Unit (CDU), an in-rack, modular liquid-to-liquid cooling system for data centers and colocation operators. The SmartSense CDU can cool as much as 300kW per rack or more than 2MW on a row basis, allowing for free cooling with inlet temperatures above 60°C, without requiring chillers, saving energy and water. When paired with JetCool Technologies Inc.'s SmartPlate, the system delivers accurate cooling and sustains peak processor performance, even under high ambient temperatures.

In June 2024, Asetek unveiled a strategic cooperation with FABRIC8 LABS, an American developer of metal 3D printing. The partnership is centered on commercial and consumer desktop, with the launch of an innovation in liquid cooling technology through the AI-optimized cold Plate. Leveraging FABRIC8 LABS' ECAM (Electrochemical Additive Manufacturing) technology, Asetek has developed a new cold plate design that is meant to enhance performance.

Key Direct-to-chip Liquid Cooling Companies

The following are the leading companies in the direct-to-chip liquid cooling market. These companies collectively hold the largest market share and dictate industry trends.

- Asetek

- Advanced Micro Devices, Inc.

- Chilldyne, Inc.

- CoolIT Systems

- Fujitsu Ltd.

- Iceotope Technologies

- JETCOOL Technologies Inc.

- LiquidStack

- Schneider Electric

- Submer

- Vertiv Holdings Co

- ZutaCore

Direct-to-chip Liquid Cooling Market Report Scope

|

Report Attribute |

Details |

|

Market size in 2025 |

USD 2.28 billion |

|

Revenue forecast in 2030 |

USD 5.62 billion |

|

Growth rate |

CAGR of 19.7% from 2025 to 2030 |

|

Actual data |

2018 - 2024 |

|

Forecast period |

2025 - 2030 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2025 to 2030 |

|

Report enterprise size |

Revenue forecast, company share, competitive landscape, growth factors, and trends |

|

Segments covered |

Cooling solution type, component cooling, liquid coolant type, application, end use, region |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; MEA |

|

Country scope |

U.S.; Canada; Mexico; UK; Germany; France; China; India; Japan; Australia; South Korea; Brazil; UAE; Kingdom of Saudi Arabia; South Africa |

|

Key companies profiled |

Asetek; Advanced Micro Devices, Inc.; Chilldyne, Inc.; CoolIT Systems; Fujitsu Ltd.; Iceotope Technologies; JETCOOL Technologies Inc.; LiquidStack; chneider Electric; Submer; Vertiv Holdings Co; ZutaCore |

|

Customization scope |

Free report customization (equivalent to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Direct-to-Chip Liquid Cooling Market Report Segmentation

Solution Type Outlook (Revenue, USD Billion, 2018 - 2030)

-

-

Single-phase liquid cooling

-

Two-phase liquid cooling

-

-

Component Cooling Outlook (Revenue, USD Billion, 2018 - 2030)

-

CPU cooling

-

GPU cooling

-

ASIC cooling

-

Memory cooling

-

Other

-

-

Liquid Coolant Type Outlook (Revenue, USD Billion, 2018 - 2030)

-

Water-based coolants

-

Dielectric fluids

-

Mineral oils

-

Engineered fluids

-

-

Application Outlook (Revenue, USD Billion, 2018 - 2030)

-

Datacenter

-

Workstations

-

High-performance computing (HPC)

-

Edge computing devices

-

Supercomputers

-

Others

-

-

End Use Outlook (Revenue, USD Billion, 2018 - 2030)

-

Telecommunications

-

Financial services

-

Healthcare and life sciences

-

Oil and gas

-

Aerospace and defense

-

Others

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East & Africa

-

UAE

-

Saudi Arabia

-

South Africa

-

-

Related Reports

- Data Fabric Market - By Application, By Component (Solution, Services), By Deployment Model (On-premises, Cloud), By Org...

- Sports Officiating Technologies Market Size - By Technology (Video-based, Sensor-based, Tracking, Communication), By App...

- Cognitive Computing Market Size - By Technology (Machine Learning, Natural Language Processing (NLP), Human Computer Int...

- Cognitive Computing Market Size - By Technology (Machine Learning, Natural Language Processing (NLP), Human Computer In...

- Decentralized Identity Market Size, By Identity Type (Biometrics, Non-Biometrics), By Enterprise Size (Large Enterprise,...

- Blockchain Identity Management Market Size - By Offering (Software, Service), By Provider Type (Application Provider, Mi...

Table of Content

Direct-to-chip Liquid Cooling Market Trends

The global direct-to-chip liquid cooling market size was estimated at USD 1.96 billion in 2024 and is anticipated to grow at a CAGR of 19.7% from 2025 to 2030. Modern processors, including CPUs, GPUs, and ASICs, are generating more heat due to higher power densities.

Key Market Highlights:

- The single-phase liquid cooling segment dominated the market and accounted for the revenue share of over 65.0% in 2024

- The CPU cooling segment dominated the market in 2024, driven by the escalating demand for high-performance computing (HPC), gaming, data centers, and enterprise IT infrastructure.

- The water-based coolants segment dominated the market in 2024, advancements in water-based coolant formulations are contributing to market growth.

- The data center segment dominated the market in 2024, driven by the surge in digital transformation, cloud computing, AI, and big data analytics across industries.

- The direct-to-chip liquid cooling market in North America held a significant share of over 39.0% in 2024

To learn more about this report, request a free sample copy

To learn more about this report, request a free sample copy

Traditional air cooling methods are becoming less effective at managing this increased thermal output. Direct-to-chip liquid cooling systems address this challenge by providing efficient heat removal directly at the chip level, ensuring optimal performance and preventing overheating.

The exponential power density of modern CPUs and GPUs in data centers and high-performance computing (HPC) environments is also contributing to the growth of direct-to-chip liquid cooling industry. As processors such as NVIDIA’s H100 and AMD’s EPYC 9004 series push thermal design power (TDP) beyond 500W per chip, traditional air cooling becomes inefficient and cost-prohibitive. Direct-to-chip systems, which deliver coolant directly to cold plates attached to processors, achieve heat removal efficiency, enabling higher clock speeds and sustained performance without thermal throttling. For instance, in March 2025, CoolIT, a provider of liquid cooling solutions, introduced a cold plate designed for direct liquid cooling in data centers, targeting high-efficiency thermal management for components such as CPUs and GPUs. Similar in principle to AIO and custom liquid cooling setups used in personal computers, this technology falls under the direct-to-chip (D2C) cooling category, offering enhanced performance for demanding data center environments.

As semiconductor technology continues to advance, chips are becoming smaller yet more powerful, which increases the power density and heat output. This trend is particularly prevalent in microprocessors, GPUs, and memory modules. Direct-to-chip liquid cooling provides an efficient solution to manage the heat produced by these densely packed components, maintaining system stability and performance. The need to cool high-power density chips without sacrificing size or performance is a significant driver for the adoption of liquid cooling technologies.

The proliferation of AI, machine learning, and deep learning applications has led to a surge in computational requirements. These applications necessitate hardware capable of handling intensive workloads, which in turn generates substantial heat. Direct-to-chip liquid cooling solutions are increasingly adopted in data centers to meet these demands, ensuring that systems remain cool and efficient under heavy processing loads.

Report Coverage & Deliverables

PDF report & online dashboard will help you understand:

- Competitive benchmarking

- Historical data & forecasts

- Company revenue shares

- Regional opportunities

- Latest trends & dynamics

Cooling Solution Type Insights

The single-phase liquid cooling segment dominated the market and accounted for the revenue share of over 65.0% in 2024, driven by the escalating need for efficient thermal management solutions in data centers, high-performance computing (HPC), and enterprise IT environments. As computational workloads increase, especially with the expansion of AI, machine learning, and cloud-based applications, traditional air cooling systems are reaching their limits. Single-phase liquid cooling offers a more effective, reliable, and energy-efficient alternative, directly absorbing and transferring heat from processors and other critical components using liquid coolant without changing its physical state.

The two-phase liquid cooling segment is anticipated to register the highest CAGR during the forecast period driven by the increasing demand for high-efficiency thermal management solutions in environments where extreme processing power and heat densities are common, such as hyperscale data centers, AI clusters, and supercomputing facilities. Unlike single-phase cooling, which relies solely on liquid convection, two-phase systems utilize the phase change process-typically from liquid to vapor-to absorb and dissipate heat more effectively.

Component Cooling Insights

The CPU cooling segment dominated the market in 2024, driven by the escalating demand for high-performance computing (HPC), gaming, data centers, and enterprise IT infrastructure. As CPUs evolve with higher core counts and clock speeds, they generate more heat, requiring advanced cooling solutions to maintain optimal performance and ensure system stability. Moreover, the segment's growth can be attributed to the rapid expansion of the gaming and eSports industries, which demand powerful CPUs capable of handling graphically intensive workloads.

The memory cooling segment is expected to grow at a significant CAGR over the forecast period due to the increasing performance demands and power densities of modern DRAM and flash memory modules used in servers, high-performance computing (HPC), gaming systems, and AI workloads. As memory speeds and capacities continue to rise, particularly with the adoption of DDR5, LPDDR5, and HBM (High Bandwidth Memory) leading to heat generated during data-intensive operations. Efficient thermal management of memory modules has become critical for ensuring stability, longevity, and peak performance, especially in data centers and computing environments that require 24/7 reliability.

Liquid Coolant Type Insights

The water-based coolants segment dominated the market in 2024, advancements in water-based coolant formulations are contributing to market growth. Manufacturers are developing new formulations that enhance the cooling efficiency, stability, and lifespan of water-based coolants. The addition of additives such as corrosion inhibitors, anti-freeze agents, and anti-bacterial agents ensures that these coolants perform reliably in various operating conditions, making them suitable for a wide range of applications, from high-performance computing to automotive cooling.

The dielectric fluids segment is expected to grow at a significant CAGR over the forecast period owing to the push for energy efficiency and sustainability in data centers. As global data center electricity consumption surges, liquid cooling-particularly dielectric fluid-based systems, reduces cooling energy usage by 30-50% compared to conventional air cooling. Regulatory pressures, such as carbon emission limits and corporate ESG (Environmental, Social, and Governance) commitments, are pushing hyperscale companies to adopt eco-friendly dielectric fluids, including synthetic hydrocarbons, fluorinated fluids, and biodegradable options.

Application Insights

The data center segment dominated the market in 2024, driven by the surge in digital transformation, cloud computing, AI, and big data analytics across industries. As enterprises migrate workloads to the cloud and hyper scale data centers expand globally, the thermal loads generated by high-performance computing (HPC) systems, dense server racks, and advanced GPUs have increased significantly. This rise in heat output necessitates advanced and energy-efficient cooling solutions to maintain optimal system performance, reliability, and uptime, making thermal management a critical factor in data center design and operations.

The high-performance computing (HPC) segment is expected to grow at a significant CAGR during the forecast period due to the growing technological advancements in HPC architecture, such as increased use of heterogeneous computing, mixing CPUs, GPUs, FPGAs, have made thermal management more complex. Efficient cooling solutions that can support diverse component layouts and varying heat profiles are increasingly essential. Liquid cooling systems, particularly modular and scalable designs, provide the flexibility needed to support evolving HPC infrastructure while maximizing thermal efficiency.

End Use Insights

The telecommunications segment dominated the market in 2024. The expansion of edge computing in telecom networks contributes to the segment’s growth. As operators shift data processing closer to users to support latency-sensitive applications such as autonomous driving, remote surgeries, and industrial automation, the need for high-performance, thermally stable computing at the edge increases. These edge nodes often operate in harsh or space-constrained environments where traditional cooling is inefficient or impractical.

To learn more about this report, request a free sample copy

To learn more about this report, request a free sample copy

The oil and gas segment is expected to grow at a significant CAGR over the forecast period due to the expansion of digital oilfield technologies. Oil and gas companies are increasingly deploying advanced analytics, 3D seismic modeling, reservoir simulation, and AI-driven decision-making tools to improve exploration success rates and optimize extraction strategies. These applications require powerful computing clusters with high processing capabilities, which in turn generate considerable heat. Liquid cooling, particularly direct-to-chip and immersion cooling, allows these systems to operate at optimal performance levels while minimizing the risk of overheating and downtime, especially in remote and space-constrained locations such as offshore rigs or desert-based control centers.

Regional Insights

The direct-to-chip liquid cooling market in North America held a significant share of over 39.0% in 2024, driven by the rapid expansion of hyperscale data centers, especially to support cloud services, AI, and government-backed digital infrastructure initiatives. Tech giants such as Google, Amazon, and Microsoft are aggressively investing in liquid cooling technologies to improve energy efficiency and reduce operational costs. The region's strong regulatory push toward sustainability and carbon neutrality, along with tax incentives for green data center construction, further accelerates adoption.

To learn more about this report, request a free sample copy

To learn more about this report, request a free sample copy

U.S. Direct-to-chip Liquid Cooling Market Trends

The direct-to-chip liquid cooling market in the U.S. is expected to grow significantly at a CAGR of 21.6% from 2025 to 2030. Government funding for exascale computing initiatives and a thriving AI startup ecosystem drive demand for advanced cooling solutions that can handle intense thermal loads. Moreover, direct partnerships between cooling solution providers and cloud service providers are fostering customized deployments in large-scale computing environments.

Europe Direct-to-chip Liquid Cooling Market Trends

The direct-to-chip liquid cooling market in Europe is anticipated to register a considerable growth from 2025 to 2030 due to stringent energy efficiency regulations and carbon reduction mandates under frameworks like the European Green Deal. Data center operators in the region are seeking low-PUE solutions to comply with environmental policies while maintaining performance in increasingly dense server environments.

The UK direct-to-chip liquid cooling market is expected to grow rapidly in the coming years owing to the rise of fintech and AI-based health tech solutions is increasing demand for high-density computing infrastructure that relies on advanced cooling systems. The growth of modular and colocation data centers catering to SMEs and tech startups also supports adoption, as these facilities require scalable and energy-efficient cooling.

The direct-to-chip liquid cooling market in Germany held a substantial market share in 2024, due to the country's industrial digitalization push, especially in automotive, manufacturing, and engineering sectors that use simulation, digital twins, and AI. The country’s leadership in edge computing and Industry 4.0 applications demands robust thermal control for distributed high-performance systems.

Asia Pacific Direct-to-chip Liquid Cooling Market Trends

Asia Pacific is expected to register the highest CAGR of 22.6% from 2025 to 2030, due to the growing need for high-performance infrastructure to support smart cities, 5G rollouts, and AI initiatives. The region’s surge in gaming, video streaming, and mobile commerce is creating high server density in urban data centers.

The Japan direct-to-chip liquid cooling market is expected to grow rapidly in the coming years, driven by the prevalence of high-value data centers in urban zones with limited space, which necessitates efficient heat removal at the chip level. In addition, Japan’s commitment to energy efficiency and natural disaster resilience promotes the adoption of compact and stable cooling technologies such as direct-to-chip liquid systems.

The direct-to-chip liquid cooling market in China held a substantial market share in 2024, due to substantial investments in AI, smart manufacturing, and national computing infrastructure as part of the New Infrastructure strategy. The proliferation of hyperscale data centers by companies such as Alibaba, Tencent, and Huawei is increasing demand for energy-optimized, high-performance cooling solutions.

Key Direct-to-chip Liquid Cooling Company Insights

Key players operating in the direct-to-chip liquid cooling industry are Asetek, CoolIT Systems, ZutaCore, Vertiv Holdings Co, and Iceotope Technologies The companies are focusing on various strategic initiatives, including new product development, partnerships & collaborations, and agreements to gain a competitive advantage over their rivals. The following are some instances of such initiatives.

-

In April 2025, JetCool Technologies Inc. launched a SmartSense Coolant Distribution Unit (CDU), a modular, in-rack liquid-to-liquid cooling solution for data centers and colocation providers. Capable of cooling up to 300kW in a single rack or over 2MW at the row level, the SmartSense CDU enables free cooling with inlet temperatures exceeding 60°C, eliminating the need for chillers and reducing energy and water usage. When combined with JetCool Technologies Inc.'s SmartPlate, the system provides precise cooling and maintains optimal processor performance, even in high ambient temperatures.

-

In June 2024, Asetek announced a strategic partnership with FABRIC8 LABS, a U.S.-based developer of metal 3D printing. The collaboration focuses on the commercial and consumer desktop, introducing an innovation in liquid cooling technology with the AI-optimized cold Plate. Utilizing FABRIC8 LABS' ECAM (Electrochemical Additive Manufacturing) technology, Asetek has created a new cold plate design that aims to improve performance.

Key Direct-to-chip Liquid Cooling Companies:

The following are the leading companies in the direct-to-chip liquid cooling market. These companies collectively hold the largest market share and dictate industry trends.

- Asetek

- Advanced Micro Devices, Inc.

- Chilldyne, Inc.

- CoolIT Systems

- Fujitsu Ltd.

- Iceotope Technologies

- JETCOOL Technologies Inc.

- LiquidStack

- Schneider Electric

- Submer

- Vertiv Holdings Co

- ZutaCore

Direct-to-chip Liquid Cooling Market Report Scope

|

Report Attribute |

Details |

|

Market size in 2025 |

USD 2.28 billion |

|

Revenue forecast in 2030 |

USD 5.62 billion |

|

Growth rate |

CAGR of 19.7% from 2025 to 2030 |

|

Actual data |

2018 - 2024 |

|

Forecast period |

2025 - 2030 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2025 to 2030 |

|

Report enterprise size |

Revenue forecast, company share, competitive landscape, growth factors, and trends |

|

Segments covered |

Cooling solution type, component cooling, liquid coolant type, application, end use, region |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; MEA |

|

Country scope |

U.S.; Canada; Mexico; UK; Germany; France; China; India; Japan; Australia; South Korea; Brazil; UAE; Kingdom of Saudi Arabia; South Africa |

|

Key companies profiled |

Asetek; Advanced Micro Devices, Inc.; Chilldyne, Inc.; CoolIT Systems; Fujitsu Ltd.; Iceotope Technologies; JETCOOL Technologies Inc.; LiquidStack; chneider Electric; Submer; Vertiv Holdings Co; ZutaCore |

|

Customization scope |

Free report customization (equivalent to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Direct-to-Chip Liquid Cooling Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the direct-to-chip liquid cooling market report based on cooling solution type, component cooling, liquid coolant type, application, end use, and region.

-

Solution Type Outlook (Revenue, USD Billion, 2018 - 2030)

-

Single-phase liquid cooling

-

Two-phase liquid cooling

-

-

Component Cooling Outlook (Revenue, USD Billion, 2018 - 2030)

-

CPU cooling

-

GPU cooling

-

ASIC cooling

-

Memory cooling

-

Other

-

-

Liquid Coolant Type Outlook (Revenue, USD Billion, 2018 - 2030)

-

Water-based coolants

-

Dielectric fluids

-

Mineral oils

-

Engineered fluids

-

-

Application Outlook (Revenue, USD Billion, 2018 - 2030)

-

Datacenter

-

Workstations

-

High-performance computing (HPC)

-

Edge computing devices

-

Supercomputers

-

Others

-

-

End Use Outlook (Revenue, USD Billion, 2018 - 2030)

-

Telecommunications

-

Financial services

-

Healthcare and life sciences

-

Oil and gas

-

Aerospace and defense

-

Others

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East & Africa

-

UAE

-

Saudi Arabia

-

South Africa

-

-

FAQ'S

For a single, multi and corporate client license, the report will be available in PDF format. Sample report would be given you in excel format. For more questions please contact:

Within 24 to 48 hrs.

You can contact Sales team (sales@marketinsightsresearch.com) and they will direct you on email

You can order a report by selecting payment methods, which is bank wire or online payment through any Debit/Credit card, Razor pay or PayPal.

Discounts are available.

Hard Copy