Saudi Arabia Smart Grid Network Market

Saudi Arabia Smart Grid Network Market By Technology (Hardware, Software, Services), By Communication Technology (Wireline, Wireless), By Application (Generation, Transmission, Distribution, Consumption), By Region, and By Competition, Forecast and Opportunities, 2019-2029

Published Date: June - 2025 | Publisher: MIR | No of Pages: 320 | Industry: Power | Format: Report available in PDF / Excel Format

View Details Buy Now 2890 Download Free Sample Ask for Discount Request Customization| Forecast Period | 2025-2029 |

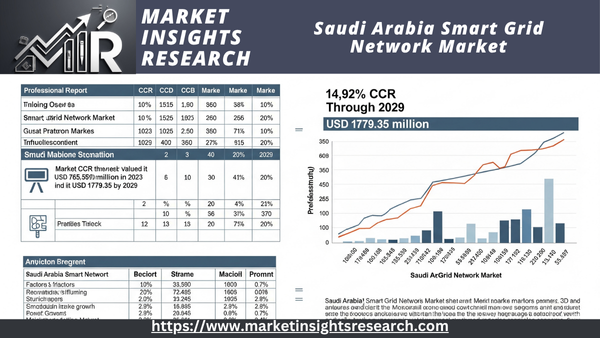

| Market Size (2023) | USD 765.59 million |

| Market Size (2029) | USD 1779.35 million |

| CAGR (2024-2029) | 14.92% |

| Fastest Growing Segment | Software |

| Largest Market | Eastern Province |

Market Overview

The Saudi Arabia Smart Grid Network Market was valued at USD 765.59 million in 2023 and is expected to reach USD 1779.35 million by 2029 with a CAGR of 14.92% during the forecast period.

Download Free Sample Ask for Discount Request Customization

Key Market Drivers

Government Initiatives and Vision 2030 Goals

Government programs and the strategic Vision 2030 goals are major factors in the growth of the Saudi Arabia Smart Grid Network Market. Vision 2030 is a detailed plan to upgrade infrastructure and diversify the economy. It places a significant emphasis on using new technologies and making energy use more efficient. The Saudi Arabian government wants to change its energy industry by using smart grid technology that make it easier to control and distribute power more efficiently. These efforts include big expenditures in infrastructure, rules that make it easier for smart grids to be used, and laws that try to cut down on energy use and pollution. The government's proactive approach makes it easier for smart grid networks to grow and expand by giving both public and private sector investors the assistance and incentives they need. The smart grid network market benefits from a defined strategic orientation that puts innovation and sustainability first by aligning with Vision 2030. The smart grid network market in Saudi Arabia has a lot of room for expansion because the kingdom is committed to updating its energy infrastructure and focusing on new technologies. This makes it an important part of the country's larger economic and environmental goals.

Increased Demand for Energy Efficiency and Reliability

The Saudi Arabia Smart Grid Network Market is rising because people want energy to be more efficient and reliable. The country's expanding urbanization and industrialization make the need for a more reliable and efficient energy system even more important. Smart grid technology can help meet these needs by making it easier to control and distribute electricity. These technologies make it possible to monitor energy flows in real time, find defects, and enhance power distribution. This means less energy is wasted and the grid is more reliable. Smart grids are a way to improve operational performance and reliability as demands for reliable power supply and efficient energy use rise. Smart grid networks use modern sensors, automated controls, and data analytics to help with preventive maintenance and quick responses to problems, which keeps outages and service interruptions to a minimum. Smart grid technologies are becoming more and more important as the need for reliable and efficient energy systems grows. This is what is driving the growth of the smart grid network market in Saudi Arabia.

Download Free Sample Ask for Discount Request Customization

Integration of Renewable Energy Sources

One of the most important things that is making the Saudi Arabia Smart Grid Network Market expand is the use of renewable energy sources. Saudi Arabia is putting more money into renewable energy projects including solar and wind power as part of its plan to use less fossil fuels and have a wider range of energy sources. Smart grid networks are very important for handling the unpredictable and decentralized character of renewable energy sources. These networks have the infrastructure needed to handle changing power inputs, keep the energy supply and demand in balance, and keep the grid running smoothly. Advanced smart grid technologies make it easier to use renewable energy by letting you monitor and control energy flows in real time, making the grid more flexible, and supporting energy storage solutions. To get the most out of renewable energy and reach sustainability goals, you need to be able to control and optimize the inputs. As Saudi Arabia adds more renewable energy sources, the need for smart grid networks that can handle these sources will grow, which will help the industry thrive.

Key Market Challenges

High Initial Capital Investment

The Saudi Arabia Smart Grid Network Market has a lot of problems, but one of the biggest is the high initial cost of setting up smart grid technologies. Setting up a smart grid infrastructure requires a lot of money to be spent on high-tech tools like smart meters, sensors, communication systems, and control technologies. Also, putting these technologies into place and connecting them to the existing grid infrastructure would cost a lot of money. Smart grid initiatives need a lot of money, which might be a problem for companies and utilities who don't have a lot of money. The necessity for continual investment in maintenance and upgrades to keep up with changing market conditions and new technologies makes this problem much harder. Smart grids have long-term benefits like better efficiency, reliability, and cost savings that can make up for the initial expenditures. However, the large upfront investment is still a big problem. To solve this problem, we need to think strategically about how to pay for it, using things like public-private partnerships, government incentives, and new ways to get money. To make sure that the costs of building smart grids don't slow down their growth and use, good planning and cost control are very important.

Integration with Legacy Systems

In the Saudi Arabia Smart Grid Network Market, it is very hard to combine smart grid technology with older systems. Many areas still use old infrastructure and traditional grid management systems that weren't made to work with new smart grid technologies. It can be hard to make new technology work with existing systems, which can cause problems with compatibility, operations, and costs. To successfully integrate, you need to carefully look at the current infrastructure and then modernize it in stages so that there is as little disturbance as possible and new and old parts can work together. Integrating smart grids means upgrading or replacing old equipment, which can take a lot of time and money. The need for different systems and technologies to be able to communicate and share data without any problems makes the job much harder. To solve this problem, we need to come up with detailed plans on how to integrate systems, put money into standards that make systems work together, and make sure that both new and old systems can work together well. By solving these integration problems, stakeholders can make the switch to smart grid technologies easier and get the most out of them.

Key Market Trends

Increased Adoption of Renewable Energy Integration

One of the most important trends in the Saudi Arabia Smart Grid Network Market is the use of renewable energy sources. As part of its Vision 2030 ambitions, the government wants to diversify its energy mix and rely less on fossil fuels. This has led to a big drive to add renewable energy sources like solar and wind power to the national grid. Smart grids help deal with the fact that renewable energy is variable and spread out. They let you monitor and control energy flows in real time, making sure that renewable energy sources are used efficiently and balanced with traditional power sources. Advanced smart grid technologies make this possible by giving the grid the infrastructure it needs to handle changing power generation, improve energy distribution, and make the grid more stable. Government policies and incentives that encourage sustainable energy use help the trend toward more integration of renewable energy. As the amount of renewable energy grows, smart grid networks will include more and more advanced features to deal with the problems that come with renewable sources. This will lead to more business and new ideas in Saudi Arabia.

Advancements in Grid Digitalization and Automation

The Saudi Arabia Smart Grid Network Market is changing because of the move toward digitalization and automation of the grid. Digitalization is using new technology like smart meters, sensors, and communication systems to make the power grid work better and more efficiently. Automation makes the grid work even better by letting it gather, analyze, and respond to data on grid conditions in real time. These improvements make it possible to monitor, control, and manage the energy network more accurately, which makes it more reliable, lowers operating costs, and improves customer service. Digitalization and automation are becoming increasingly common since the grid has to work better and energy systems are getting more complicated. Utilities and energy companies are putting more and more money into these technologies to upgrade their infrastructure, make the grid more resilient, and help new energy sources work together. Digital and automated solutions will keep becoming better, which will lead to further growth and new ideas in the smart grid sector. This will make Saudi Arabia's energy network more responsive and efficient.

Enhanced Focus on Cybersecurity Measures

One big development in the Saudi Arabia Smart Grid Network Market is that people are paying more attention to cybersecurity. As smart grids use more digital technology and data-driven solutions, keeping these systems safe from cyber threats has become a top responsibility. The smart grid network can collect and share a lot of data, which makes it open to a number of cyber threats, such as hacking, data breaches, and system manipulations. To deal with these problems, there is a rising focus on putting in place strong cybersecurity measures such regular security upgrades, improved encryption, and systems for detecting threats. Utilities and energy companies are spending money on cybersecurity tools to keep their infrastructure safe, preserve private information, and keep the grid running smoothly. Rising regulatory requirements, the need to secure important infrastructure, and the growing complexity of cyber attacks are all driving this trend. By putting cybersecurity first, people who operate in the Saudi Arabia Smart Grid Network Market want to make sure that smart grid systems are strong and dependable, which will help them develop and be used more.

Segmental Insights

Technology

The hardware part of the Saudi Arabia Smart Grid Network Market was the biggest in 2023 and is predicted to stay that way for the rest of the forecast period. This supremacy is due to the fact that hardware parts are necessary for building and expanding smart grid infrastructure. Smart meters, sensors, control systems, and communication devices are all important pieces of hardware that are needed to set up and run a smart grid. These parts make up the physical infrastructure needed to monitor, collect data, and regulate the energy network in real time. There is a lot of demand for hardware because of the big expenditures being made to improve existing grid systems and add new hardware solutions to make the grid more efficient and reliable. As Saudi Arabia modernizes its energy infrastructure and adds additional renewable energy sources, the demand for advanced hardware solutions is still very important. The hardware segment is the most important because of the continuing projects and government efforts to improve and expand smart grid networks. As these initiatives move forward, the need for new and dependable hardware solutions is likely to stay at the top of the market. The smart grid network in Saudi Arabia is likely to keep growing and getting better as hardware technologies keep getting better and more advanced.

Regional Insights

The Eastern Province became the most important part of the Saudi Arabia Smart Grid Network Market in 2023, and it is expected to stay in that position for the rest of the forecast period. The Eastern Province is in charge because it has a lot of industrial and economic activity, which creates a lot of demand for smart grid technology and advanced energy infrastructure. The area is a major center for the country's oil and gas industry, and its industrial activities need a stable and efficient energy system to support big operations and facilities. The Eastern Province is also seeing a lot of people moving to cities and the population growing quickly. This makes the need for modern energy systems even greater to fulfill the growing demand for electricity and keep the grid stable. The smart grid network industry is doing well because the government is focused on building up the area's infrastructure and because there are still investments being made in energy projects. The Eastern Province is likely to be at the forefront of smart grid adoption as the region's energy infrastructure continues to grow and modernize. This is because the province is both economically important and strategically important for supporting the whole energy industry in Saudi Arabia.

Download Free Sample Ask for Discount Request Customization

Recent Developments

- In March 2024, Itron, Inc, a leader in innovative solutions for energy and water management, announced the expansion of its Grid Edge Intelligence portfolio with the acquisition of Elpis Squared. This acquisition, which is effective immediately, adds Elpis Squared's cutting-edge software and services for utility grid operations to Itron's offerings.

- In July 2024, Honeywell announced its agreement to acquire Air Products' liquefied natural gas (LNG) process technology and equipment business for USD 1.81 billion in an all-cash transaction, which represents approximately 13 times the estimated EBITDA for 2024. This strategic acquisition will enhance Honeywell's portfolio, allowing the company to provide a comprehensive, top-tier solution for energy transition management. The expanded offering will include advanced natural gas pre-treatment and liquefaction technologies, integrated with Honeywell Forge and Experion platforms. This full-service solution will enable more efficient, reliable, and optimized management of natural gas assets, delivering exceptional value and support to customers.

- In October, 2023 Rockwell Automation, Inc. and Microsoft Corp. have announced an extension of their longstanding partnership to enhance industrial automation design and development using generative artificial intelligence. By integrating their technologies, the companies aim to empower the workforce and expedite time-to-market for customers developing industrial automation systems. The initial result of this collaboration will be the incorporation of Microsoft’s Azure OpenAI Service into Rockwell’s FactoryTalk® Design Studio™, providing industry-leading capabilities that accelerate the development process for industrial automation systems.

Key Market Players

- ABB Ltd

- Siemens Energy AG

- General Electric Company

- Schneider Electric SE

- Cisco Systems, Inc

- Honeywell International Inc

- Eaton Corporation plc

- Rockwell Automation Inc

- Itron Inc

- AESC Group Ltd

|

By Technology |

By Communication Technology |

By Application |

By Region |

|

|

|

|

Related Reports

- Industrial Boiler Market Size - By Product (Fire-Tube, Water-Tube), By Capacity, By Application (Food Processing, Pulp &...

- Commercial Boiler Market - By Fuel (Natural Gas, Oil, Coal, Electric), By Capacity, By Technology (Condensing, Non-Conde...

- Steam Boiler Market - By Capacity, By Fuel (Natural Gas, Oil, Coal), By Technology (Condensing, Non-Condensing), By Appl...

- Industrial Electric Boiler Market - By Voltage Rating (Low Voltage, Medium Voltage), By Capacity (< 10 MMBtu/hr, 10-50 M...

- Biomass Boiler Market - By Feedstock (Woody Biomass, Agricultural Waste, Industrial Waste, Urban Residue), By Product (S...

- Asia Pacific Electric Boiler Market Size - By Capacity (≤ 10 MMBtu/hr, > 10 - 50 MMBtu/hr, > 50 - 100 MMBtu/hr, > 100 ...

Table of Content

- 1. Executive Summary

- 1.1. Key Findings

- 1.2. Market Overview

- 1.3. Future Outlook

- 2. Introduction to the Saudi Arabia Smart Grid Network Market

- 2.1. What is a Smart Grid Network?

- 2.2. Importance of Smart Grids for Saudi Arabia's Energy Future

- 2.2.1. Enhancing Grid Reliability and Efficiency

- 2.2.2. Facilitating Renewable Energy Integration

- 2.2.3. Empowering Consumers and Demand-Side Management

- 2.2.4. Reducing Transmission and Distribution Losses

- 2.3. Scope of the Report

- 3. Market Overview

- 3.1. Current Market Size and Valuation (2023-2025)

- 3.1.1. Market Value (USD Million/Billion)

- 3.1.2. Historical and Current Automation Levels (e.g., 32% of distribution network automated by Dec 2024)

- 3.2. Market Dynamics

- 3.2.1. Drivers of Market Growth

- 3.2.1.1. Saudi Vision 2030 and Economic Diversification

- 3.2.1.1.1. Mega-Projects (NEOM, Red Sea Project, Qiddiya, New Murabba)

- 3.2.1.1.2. Rapid Urbanization and Industrial Expansion

- 3.2.1.2. Ambitious Renewable Energy Targets (50% by 2030)

- 3.2.1.3. Increasing Electricity Demand and Consumption

- 3.2.1.4. Government Initiatives and Investments (e.g., Smart Meter Rollout by SEC)

- 3.2.1.5. Technological Advancements (AI, IoT, Big Data Analytics)

- 3.2.1.6. Focus on Energy Efficiency and Sustainability

- 3.2.1.1. Saudi Vision 2030 and Economic Diversification

- 3.2.2. Challenges and Restraints

- 3.2.2.1. High Initial Investment Costs for Infrastructure Development

- 3.2.2.2. Cybersecurity Risks and Data Privacy Concerns

- 3.2.2.3. Need for Skilled Workforce and Technical Expertise

- 3.2.2.4. Integration Complexities with Legacy Infrastructure

- 3.2.3. Opportunities

- 3.2.3.1. Development of Smart Cities and Eco-Friendly Communities

- 3.2.3.2. Demand for Advanced Grid Automation and Control Centers

- 3.2.3.3. Expansion of Local Manufacturing and R&D Capabilities

- 3.2.3.4. Growing Microgrid Development

- 3.2.1. Drivers of Market Growth

- 3.1. Current Market Size and Valuation (2023-2025)

- 4. Market Segmentation

- 4.1. By Component

- 4.1.1. Hardware (Smart Meters, Sensors, Controllers, Routers, etc.)

- 4.1.2. Software (AMI, Grid Distribution Management, Network Security Management, etc.)

- 4.1.3. Services (Consulting, Deployment & Integration, Maintenance & Support, Managed Services)

- 4.2. By Solution / Technology Application Area

- 4.2.1. Advanced Metering Infrastructure (AMI)

- 4.2.2. Smart Grid Distribution Management Systems (DMS)

- 4.2.3. Smart Grid Communication Technologies (Wired, Wireless)

- 4.2.4. Grid Asset Management

- 4.2.5. Substation Automation

- 4.2.6. Demand Response Management

- 4.2.7. Geographic Information System (GIS)

- 4.2.8. Billing and Customer Information Systems (CIS)

- 4.2.9. Network Security Management

- 4.3. By End-User

- 4.3.1. Utilities (Largest Share)

- 4.3.2. Commercial

- 4.3.3. Industrial

- 4.3.4. Residential

- 4.1. By Component

- 5. Regional Analysis (Within Saudi Arabia)

- 5.1. Eastern Province (Largest Market)

- 5.2. Northern and Central Region

- 5.3. Western Region

- 5.4. Southern Region

- 5.5. Impact of Megaprojects (NEOM, Red Sea Project, Qiddiya) on Regional Development

- 6. Regulatory Landscape and Government Initiatives

- 6.1. Saudi Vision 2030 and its Impact on Energy Sector Modernization

- 6.2. Role of the Ministry of Energy and Saudi Electricity Company (SEC)

- 6.3. Policies and Regulations for Smart Grid Deployment

- 6.4. Investment Programs and Funding for Smart Grid Infrastructure

- 6.5. National Renewable Energy Program (NREP) Integration

- 7. Competitive Landscape

- 7.1. Market Share Analysis of Key Players (Highly Consolidated)

- 7.2. Profiles of Major Global and Local Companies

- 7.2.1. Saudi Electricity Company (SEC) - Key Utility and Investor

- 7.2.2. ABB Ltd.

- 7.2.3. General Electric Company

- 7.2.4. Honeywell International Inc.

- 7.2.5. Schneider Electric SE

- 7.2.6. Hitachi Energy (formerly Hitachi ABB Power Grids)

- 7.2.7. Siemens AG

- 7.2.8. Huawei Technologies Co., Ltd. (especially in microgrids)

- 7.2.9. Itron Inc.

- 7.2.10. Landis+Gyr

- 7.2.11. Elster Group GmbH

- 7.2.12. CG Power and Industrial Solutions Ltd.

- 7.2.13. Other Local System Integrators and Solution Providers

- 7.3. Recent Strategic Developments (Partnerships, Acquisitions, Project Awards, Product Launches)

- 8. Key Smart Grid Projects and Initiatives in Saudi Arabia (Current & Upcoming)

- 8.1. Smart Meter Rollout (10-11 Million Meters Installed by SEC)

- 8.2. Development of Advanced Control Centers (9 Centers by 2026)

- 8.3. Grid Automation Initiatives (Targeting 40% automation by end of 2025)

- 8.4. Smart Grid Integration in Megaprojects (NEOM, Red Sea Project, Qiddiya)

- 8.5. Pilot Projects for Smart Grid & Energy Storage Integration

- 8.6. Utility-Scale Battery Energy Storage Systems (BESS) Deployments

- 9. Future Outlook and Projections (up to 2030-2033)

- 9.1. Forecasted Market Size and CAGR (e.g., USD 1.77-1.89 Billion by 2029-2030, CAGR 4.53-14.92%)

- 9.2. Emerging Trends and Opportunities in Advanced Grid Technologies

- 9.3. Impact of Continued Government Investments and Vision 2030 Milestones

- 10. Conclusion

Major Key Players

- Saudi Electricity Company (SEC) (Saudi Arabia)

- General Electric Company (GE Vernova) (USA)

- ABB Ltd. (Switzerland)

- Schneider Electric SE (France)

- Honeywell International Inc. (USA)

- CG Power and Industrial Solutions Ltd. (India)

- Alfanar (Saudi Arabia)

- Advanced Electronics Company (AEC) (Saudi Arabia)

- Siemens Energy AG (Germany)

- Huawei Technologies Co., Ltd. (China)

Manufacturers Key Players

- ABB Ltd. (Switzerland)

- General Electric Company (GE Vernova) (USA)

- Schneider Electric SE (France)

- Honeywell International Inc. (USA)

- CG Power and Industrial Solutions Ltd. (India)

- Alfanar (Saudi Arabia)

- Advanced Electronics Company (AEC) (Saudi Arabia)

- Siemens Energy AG (Germany)

- Huawei Technologies Co., Ltd. (China)

- Holley Technology Ltd. (China)

- ZIV Aplicaciones y Tecnologia (Spain)

- Saudi Smart Electronic Company (SSEC) (Saudi Arabia)

- Prysmian Group (Italy)

- Nexans S.A. (France)

FAQ'S

For a single, multi and corporate client license, the report will be available in PDF format. Sample report would be given you in excel format. For more questions please contact:

Within 24 to 48 hrs.

You can contact Sales team (sales@marketinsightsresearch.com) and they will direct you on email

You can order a report by selecting payment methods, which is bank wire or online payment through any Debit/Credit card, Razor pay or PayPal.

Discounts are available.

Hard Copy