Zambia Diesel Genset Market

Zambia Diesel Genset Market By Capacity (0-100 kVA, 101-350 kVA, 351-1000 kVA, Above 1000 kVA), By Application (Standby Power, Prime Power, Peak Shaving, Cogeneration), By End-User (Residential, Commercial, Industrial, Government), By Fuel Type (Biodiesel, Hybrid), By Region, Competition, Forecast and Opportunities, 2019-2029

Published Date: June - 2025 | Publisher: MIR | No of Pages: 320 | Industry: Power | Format: Report available in PDF / Excel Format

View Details Buy Now 2890 Download Free Sample Ask for Discount Request Customization| Forecast Period | 2025-2029 |

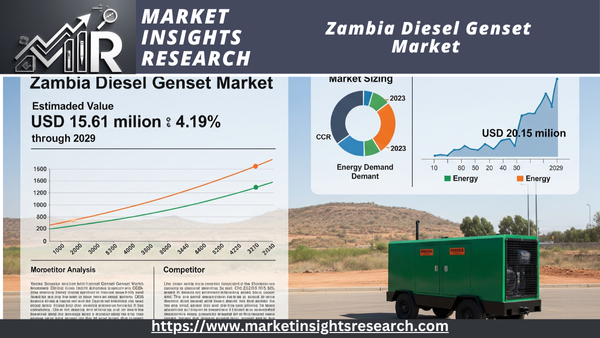

| Market Size (2023) | USD 15.61 Million |

| Market Size (2029) | USD 20.15 Million |

| CAGR (2024-2029) | 4.19% |

| Fastest Growing Segment | Hybrid |

| Largest Market | Central Province |

Market Overview

The Zambia Diesel Genset Market was valued at USD 15.61 Million in 2023 and is expected to reach USD 20.15 Million by 2029 with a CAGR of 4.19% during the forecast period.

Download Free Sample Ask for Discount Request Customization

The Zambia Diesel Genset market is changing quickly because the country needs more reliable power solutions in many areas. As Zambia builds more roads, bridges, and other infrastructure, the need for diesel generators to power businesses and factories is growing. Frequent power outages and an inconsistent electricity supply are the main reasons for this rise. Diesel generators are an important part of keeping operations going and cutting down on downtime.

There are many different types of end-users in the market, including mining businesses, which are important to Zambia's economy. The mining industry needs strong and reliable power sources to run its operations, which is why there is a need for high-capacity diesel generators. The growth of the construction industry and the building of new homes and businesses are also making more people want to use diesel generators. This is especially clear in cities where infrastructure development is moving quickly.

Also, the agricultural sector in Zambia needs diesel generators because they are necessary for running irrigation systems and processing plants. As the government works to boost agricultural output and encourage rural development, the need for reliable electricity solutions in these areas is growing. There are a few important trends that affect the market. One of these is the growing popularity of hybrid genset systems that use both diesel and renewable energy sources to improve efficiency and lower fuel use. Additionally, advancements in genset design and performance are creating solutions that are more environmentally friendly and more effective.

Even though there are these chances, the Zambia Diesel Genset market has problems, like the high cost of diesel fuel, which raises the operating costs of genset systems. Additionally, difficulties in transporting gensets to and from remote regions may exacerbate the situation. The rules and taxes on imports also affect how the market works.

Key Market Drivers

Infrastructure Development

The expansion of Zambia's infrastructure significantly contributes to the growth of the diesel genset market. To help the economy flourish and raise living standards, the government is spending a lot of money to build more roads, bridges, and buildings. Diesel generators are essential for building sites since they typically work in regions where the power supply is not stable. As more projects come up, the requirement for temporary and backup power solutions grows, which makes diesel generators necessary. The government's concentration on building new metropolitan areas and industrial parks, among other things, is driving up the need for diesel gensets even more. Furthermore, big infrastructure projects, like those in the transportation and energy industries, need a strong and steady power supply, which helps the industry grow even more.

Mining Sector Growth

The mining industry is a big reason why the Zambia Diesel Genset market is growing. Zambia is one of Africa's biggest copper producers, and mining operations need a lot of power to run machines and keep buildings in good shape. Because of rising global demand for copper and other minerals, the industry's growth has made it necessary to find more reliable and efficient ways to get power. Diesel generators give mining companies the backup power they need to keep working, especially in distant places where the grid supply isn't always stable. The growth of mining operations and the opening of new mines in Zambia greatly increase the need for diesel gensets. These machines are essential for keeping operations running smoothly and cutting down on downtime.

Download Free Sample Ask for Discount Request Customization

Agricultural Sector Demand

The diesel genset market is also driven by the agriculture sector in Zambia. Agriculture is a big part of the Zambian economy, and irrigation systems, processing industries, and other agricultural operations need consistent power. Diesel generators are very important for these uses, especially in rural locations where the power infrastructure may not be strong enough or reliable. The government's focus on boosting agricultural production and helping rural development makes the demand for reliable power solutions even greater. Diesel generators are essential for improving the agricultural industry and helping Zambia's food security and economic growth. They power irrigation pumps, crop dryers, and processing machines.

Power Outages and Unreliable Grid Supply

In Zambia, the diesel genset industry is growing because of frequent power outages and an inconsistent grid supply. Hydroelectric power is a key source of electricity in the country, however it doesn't always work, which causes power outages. Diesel generators are a solid way to get backup power that can help businesses and homes deal with severe interruptions. More and more, businesses, industries, and homes are using diesel generators to make sure they always have power and can keep working. Diesel gensets are in high demand because they provide a stable and reliable power supply during outages. This is because of the necessity to deal with the problems caused by frequent power outages.

Key Market Challenges

High Fuel Costs

The high price of diesel fuel is a big problem for the Zambia Diesel Genset market. Diesel generators need fuel to work, and the changing pricing of diesel can have a big effect on how much it costs for end users to run them. Businesses and industries that rely largely on diesel generators for power may have to deal with costs that are hard to estimate because fuel prices can change. Additionally, the high cost of fuel can render diesel generators less affordable overall, making it difficult for small firms or businesses located in remote areas to purchase these systems. This problem is worse because of problems with storing and distributing fuel, which makes expenses go up even more.

Limited Infrastructure and Logistics

The diesel genset market has a hard time in Zambia because of the country's infrastructure, especially in rural and remote locations. The country's transportation system, which includes highways and access routes, is often not very good, making it hard to get diesel generators and spare parts to where they need to go. Not having the right infrastructure might make it harder to get products and make logistics and upkeep more expensive. Also, not having enough storage space for diesel fuel in remote places can make the supply chain even more unreliable and inefficient, which can make diesel genset operations less reliable and efficient.

Regulatory and Import Tariffs

The Zambia Diesel Genset market has big problems because of rules and levies on imports. The government's rules and practices about import levies on diesel generators and parts can make these systems more expensive overall. High tariffs and rules can make it hard for multinational firms to enter the market or make things more expensive for consumers. Following local rules, like safety laws and environmental standards, makes doing business in Zambia more complicated and expensive.

Technological Limitations

The market's growth may be slowed by technological problems with diesel genset technology. Improvements are being made, however it can be slow to embrace newer, more efficient genset technologies because they are expensive and there isn't a lot of local expertise. Many diesel gensets that are already in use may not meet the newest criteria for efficiency and the environment. This means that they may cost more to run and produce more pollutants. The market's movement toward more sustainable and cost-effective power solutions can be slowed down by the slow pace of technological innovation and the fact that high-tech genset solutions are hard to find.

Key Market Trends

Increasing Demand for High-Capacity Diesel Generators

In Zambia, more and more people are using high-capacity diesel generators, especially in the mining and industrial sectors. As Zambia's mining industry grows because of demand for commodities around the world, there is a greater need for dependable and strong power solutions to support large operations. More and more, diesel generators with capacities between 500 kVA and 2,000 kVA are being used to make sure that mining equipment and processing facilities always have power. The need to reduce frequent power outages and keep operations running smoothly is what drives this trend. The growth of large-scale infrastructure projects and the building of industrial parks, which need a lot of power to keep running, are also driving up the need for high-capacity generators.

Shift Towards Hybrid Genset Systems

The market is moving toward hybrid diesel genset systems that use both diesel power and renewable energy sources like solar. The desire for more environmentally friendly and affordable electricity sources is what is driving this development. Hybrid systems have the benefit of using less diesel, which lowers expenses and has less of an effect on the environment. Combining solar power with diesel generators helps to make the best use of fuel and improve overall efficiency. This trend is especially important in places that are far away from the grid or where it is hard to get to a stable power supply. Companies are putting more and more money into hybrid systems to find a balance between being reliable and being good for the environment.

Technological Advancements in Generator Design

Changes in the architecture of diesel gensets are changing the way the market works in Zambia. Modern generators are getting new features like automatic load sharing, remote monitoring, and better fuel efficiency. These new technologies make diesel generators work better, last longer, and be easier to fix. The use of smart technology makes it possible to monitor and diagnose things in real time, which helps with preventive maintenance and cuts down on downtime. Also, improvements in engine technology are making generators that use less fuel and produce less pollution, which is in line with worldwide norms for environmental performance.

Growing Focus on Fuel Efficiency and Sustainability

In the Zambia Diesel Genset market, fuel efficiency and sustainability are very important. As fuel prices go up and environmental concerns develop, it is becoming more important to choose gensets that use less fuel and produce less pollution. To use less fuel, manufacturers are making generators with modern fuel management systems and engines that are very efficient. There is also an effort to use greener technology and lower the carbon footprint of diesel generators. This tendency is in line with a larger commitment to protecting the environment and with the global move toward cleaner energy sources.

Segmental Insights

Capacity

351-1000 kVA segment

Also, infrastructure development projects, such those that have to do with transportation and city growth, add to the demand for this type of generator. During construction, these projects often need temporary power sources, and the 351-1000 kVA generators are a good choice because they work well and are cost-effective. The 351–1000 kVA gensets also offer a good balance of performance and price. They strike a mix between high capacity and low operational expenses, which makes them a good choice for organizations who want to invest in reliable power solutions without going over budget.

Regional Insights

In 2023, Central Province was the most important part of the Zambia Diesel Genset market. Central Province is an important center for many businesses and economic activity in Zambia. It is home to a number of important initiatives, such as mining, farming, and manufacturing. These sectors need a lot of electricity, thus diesel generators are an important part of how they work. The market share of Central Province is growing since these industries need dependable power sources. There has been a lot of growth in the province's infrastructure, such as roads, buildings, and cities. These changes need interim and backup power sources, which makes the need for diesel generators even greater. Central Province's dominance in the market is due in part to the rise of infrastructural projects there.

There are a lot of big mining enterprises in Central Province, where they mine copper and other minerals. Mining operations, especially in distant or off-grid regions, depend a lot on diesel generators to keep the machinery and processing plants running all the time. Diesel gensets have a bigger market share in the province because there are so many mining activities there.

In Central Province, farming is a big part of the economy. As large-scale farms and industrial plants grow, they need more stable sources of power. Diesel generators help with irrigation systems, processing facilities, and other agricultural infrastructure, which is why the market is so important in the province. Central Province is a strategic logistical hub since it is in the middle of everything. Because it is easy to get to from other areas, diesel generators can be distributed and serviced more easily. This geographical advantage makes the province's involvement in the diesel genset market stronger.

Download Free Sample Ask for Discount Request Customization

Recent Developments

- In May 2024, Lusaka, Zambia hosted the China-Zambia High-Quality Development Cooperation Forum, witnessed by Zambia's President and the Chinese ambassador. During the event, Mr. Jiang Qingbin, Vice President of SANY Group and President of SANY Africa, and Zambia’s Minister of Energy signed a significant Memorandum of Cooperation. This agreement marks a groundbreaking initiative—a 30MW photovoltaic power plant combined with a 60MWh energy storage system, designed for Ruida Mining. This project represents an innovative "mine, photovoltaic power, and electric product" business model, highlighting a strategic collaboration aimed at enhancing sustainable energy solutions and mining efficiency in Zambia.

- In June 2024, as generator set demand surges across Africa, Carl Emery, Regional Sales Manager for Europe, Africa, and the Middle East at Caterpillar Electric Power, provided insights into the key industries propelling equipment sales. Emery detailed how Caterpillar is evolving its product offerings to align with contemporary customer needs. He highlighted the company's focus on enhancing equipment efficiency and reliability to meet the demands of sectors such as mining, construction, and industrial operations. By integrating advanced technologies and responding to market trends, Caterpillar aims to ensure its products remain at the forefront of power generation solutions in the region.

- In September 2023, Kirloskar Oil Engines (KOEL) introduced its new range of CPCB IV+ compliant gensets. Kirloskar Oil Engines (KOEL) designed these gensets to meet the latest Central Pollution Control Board (CPCB) emission standards, ensuring high performance, fuel efficiency, and environmental sustainability.

Key Market Players

- Caterpillar Inc.

- Cummins Inc.

- Rolls-Royce plc

- Generac Holdings Inc.

- Kohler Co.

- Mitsubishi Heavy Industries, Ltd.

- Perkins Engines Company Limited

- Yanmar Holdings Co., Ltd.

- Kirloskar Oil Engines Limited

- Wärtsilä Corporation

- Doosan Corporation

- Deere & Company

|

By Capacity |

By Application |

By End-User |

By Fuel Type |

By Region |

|

|

|

|

|

Related Reports

- Industrial Boiler Market Size - By Product (Fire-Tube, Water-Tube), By Capacity, By Application (Food Processing, Pulp &...

- Commercial Boiler Market - By Fuel (Natural Gas, Oil, Coal, Electric), By Capacity, By Technology (Condensing, Non-Conde...

- Steam Boiler Market - By Capacity, By Fuel (Natural Gas, Oil, Coal), By Technology (Condensing, Non-Condensing), By Appl...

- Industrial Electric Boiler Market - By Voltage Rating (Low Voltage, Medium Voltage), By Capacity (< 10 MMBtu/hr, 10-50 M...

- Biomass Boiler Market - By Feedstock (Woody Biomass, Agricultural Waste, Industrial Waste, Urban Residue), By Product (S...

- Asia Pacific Electric Boiler Market Size - By Capacity (≤ 10 MMBtu/hr, > 10 - 50 MMBtu/hr, > 50 - 100 MMBtu/hr, > 100 ...

Table of Content

- 1. Executive Summary

- 1.1. Key Findings

- 1.2. Market Overview (Valued at USD 16.5 million in 2024)

- 1.3. Future Outlook (Projected to reach USD 21.2 million by 2030, CAGR of 4.3%)

- 2. Introduction to the Zambia Diesel Genset Market

- 2.1. What are Diesel Gensets?

- 2.2. Context of Power Supply in Zambia

- 2.2.1. Dominance of Hydropower and Vulnerability to Droughts

- 2.2.2. Frequent Power Outages and Load Shedding (up to 21 hours daily)

- 2.2.3. Low Electrification Rate (47.8% nationally in 2022, 19.5% rural in 2023)

- 2.3. Scope of the Report

- 3. Market Overview

- 3.1. Current Market Size and Valuation (as of June 2025)

- 3.2. Market Dynamics

- 3.2.1. Drivers of Market Growth

- 3.2.1.1. Persistent Power Deficits and Unreliable Grid

- 3.2.1.2. Strong Growth in the Mining Sector (largest power consumer, 51% of total)

- 3.2.1.3. Ongoing Infrastructure Development and Urbanization

- 3.2.1.4. Expansion of the Telecommunications Sector and Data Centers

- 3.2.1.5. Increasing Demand for Backup Power in Commercial, Industrial, and Residential Sectors

- 3.2.1.6. Growth in the Agricultural Sector (for irrigation, processing)

- 3.2.2. Challenges and Restraints

- 3.2.2.1. High Initial Investment and Operational Costs

- 3.2.2.2. Environmental Regulations and Push for Cleaner Energy

- 3.2.2.3. Fluctuations in Diesel Fuel Prices

- 3.2.2.4. Growing Investment in Renewable Energy and Grid Diversification by Government

- 3.2.1. Drivers of Market Growth

- 4. Market Segmentation

- 4.1. By Capacity (kVA)

- 4.1.1. 0-100 kVA (Largest segment: 15-75 kVA)

- 4.1.2. 101-350 kVA

- 4.1.3. 351-1000 kVA (Dominant segment in 2023, suited for heavy-duty applications like mining)

- 4.1.4. Above 1000 kVA

- 4.2. By Application

- 4.2.1. Standby Power (Backup)

- 4.2.2. Prime Power (Continuous Operation)

- 4.2.3. Peak Shaving

- 4.2.4. Cogeneration

- 4.3. By End-User

- 4.3.1. Industrial (Manufacturing, Mining, Construction, Oil & Gas, Healthcare)

- 4.3.2. Commercial (Telecom, Data Centers, Hospitals, Hotels, Retail)

- 4.3.3. Residential

- 4.3.4. Government

- 4.4. By Fuel Type

- 4.4.1. Diesel

- 4.4.2. Biodiesel

- 4.4.3. Hybrid (Fastest Growing Segment)

- 4.1. By Capacity (kVA)

- 5. Regional Analysis (Zambian Provinces)

- 5.1. Central Province (Largest Market in 2023)

- 5.2. Copperbelt Province

- 5.3. Lusaka Province

- 5.4. North-Western Province

- 5.5. Eastern Province

- 5.6. Luapula Province

- 5.7. Muchinga Province

- 5.8. Other Provinces

- 6. Competitive Landscape

- 6.1. Market Structure and Key Players (Moderately Consolidated)

- 6.2. Profiles of Major Manufacturers and Suppliers

- 6.2.1. Caterpillar Inc.

- 6.2.2. Cummins Inc.

- 6.2.3. Atlas Copco AB

- 6.2.4. Kohler Co.

- 6.2.5. Aggreko Ltd.

- 6.2.6. Local Distributors and Service Providers

- 6.3. Recent Developments and Strategic Initiatives (e.g., portfolio expansions)

- 7. Technological Trends and Innovations

- 7.1. Integration of Smart Features and Remote Monitoring

- 7.2. Hybrid Genset Solutions (e.g., Diesel-Solar, Diesel-Battery)

- 7.3. Focus on Fuel Efficiency and Reduced Emissions

- 7.4. Advanced Control Systems for Optimization

- 8. Future Outlook and Projections (up to 2030)

- 8.1. Forecasted Market Size and CAGR

- 8.2. Impact of Government Policies on Energy Sector Diversification and Electrification Goals (e.g., universal access by 2030, 6,000 MW generation expansion including 1,500 MW solar)

- 8.3. Opportunities Arising from Persistent Power Challenges and Economic Growth

- 9. Conclusion

Major Key Players

- Caterpillar Inc. (USA)

- Cummins Inc. (USA)

- Atlas Copco AB (Sweden)

- KOHLER Co. (USA)

- Aggreko Ltd. (UK)

- Aksa Power Generation (Turkey)

- Jubaili Bros (UAE/Lebanon - significant regional presence)

- Mikano International Limited (Nigeria - regional player with presence/influence)

- Perkins Engines Company Limited (UK)

- Yanmar Holdings Co. Ltd. (Japan)

Manufacturers Key Players

- Caterpillar Inc. (USA)

- Cummins Inc. (USA)

- KOHLER Co. (USA)

- Aksa Power Generation (Turkey)

- Perkins Engines Company Limited (UK)

- Yanmar Holdings Co. Ltd. (Japan)

- Mitsubishi Heavy Industries Ltd. (Japan)

- Denyo Co., Ltd. (Japan)

- Generac Power Systems Inc. (USA)

- Rolls-Royce Power Systems AG (MTU) (Germany)

- Jubaili Bros (UAE/Lebanon - acts as an OEM/assembler for various brands)

- Sempra Electric Pvt Ltd. (India - exporter to Zambia)

- ALGEN Power Generation (South Africa - supplier to Zambia, assembles with various engines)

- Davis & Shirtliff (Dayliff) (Kenya/Zambia - assembles and distributes)

- Generator King (South Africa - supplies and assembles various brands to Zambia)

FAQ'S

For a single, multi and corporate client license, the report will be available in PDF format. Sample report would be given you in excel format. For more questions please contact:

Within 24 to 48 hrs.

You can contact Sales team (sales@marketinsightsresearch.com) and they will direct you on email

You can order a report by selecting payment methods, which is bank wire or online payment through any Debit/Credit card, Razor pay or PayPal.

Discounts are available.

Hard Copy