Nigeria Diesel Genset Market

Nigeria Diesel Genset Market By Capacity (0-100 kVA, 101-350 kVA, 351-1000 kVA, Above 1000 kVA), By Application (Standby Power, Prime Power, Peak Shaving, Cogeneration), By End-User (Residential, Commercial, Industrial, Government), By Fuel Type (Diesel, Biodiesel, Hybrid), By Region, Competition, Forecast and Opportunities, 2019-2029

Published Date: June - 2025 | Publisher: MIR | No of Pages: 320 | Industry: Power | Format: Report available in PDF / Excel Format

View Details Buy Now 2890 Download Free Sample Ask for Discount Request Customization| Forecast Period | 2025-2029 |

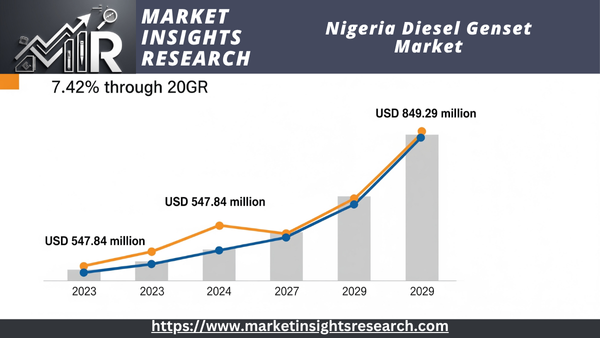

| Market Size (2023) | USD 547.84 Million |

| Market Size (2029) | USD 849.29 Million |

| CAGR (2024-2029) | 7.42% |

| Fastest Growing Segment | Hybrid |

| Largest Market | North Central |

Market Overview

Nigeria Diesel Genset Market was valued at USD 547.84 Million in 2023 and is expected to reach USD 849.29 Million by 2029 with a CAGR of 7.42% during the forecast period.

Download Free Sample Ask for Discount Request Customization

The Nigeria Diesel Genset market is a dynamic sector characterized by robust demand driven by the country’s infrastructure growth, frequent power outages, and increasing industrial activities. In Nigeria, where the national grid is often unstable and goes out of service often, diesel generators are important for filling in the gaps in the power supply. They are known for being reliable and efficient. The market has grown a lot since there is a growing need for reliable power supply in many areas, such as homes, businesses, and factories.

The need for diesel generators has grown a lot because Nigeria's economy is growing and cities are growing quickly. The construction of new commercial buildings, data centers, hospitals, and educational institutions has heightened the need for reliable backup power solutions to ensure operational continuity. In addition, the industrial sector, which includes mining, manufacturing, and oil and gas operations, depends on diesel generators for a lot of its energy needs, especially in places where the grid isn't very good.

Frequent and severe power outages caused by old infrastructure and the country's limited ability to generate power also have an impact on the market. Diesel generators are a reliable backup power source that keeps businesses and daily life running smoothly during power outages. This has led to a growing preference for diesel generators among Nigerian businesses and households seeking to maintain operational stability and efficiency.

Additionally, the Nigerian government's commitment on building infrastructure and industrializing the country creates even more chances for the industry to thrive. Investments in power generation, transportation, and urban development create demand for advanced diesel genset technologies that can support large-scale projects and remote locations where grid connectivity is limited.

Key Market Drivers

Power Outages and Grid Instability

Frequent power outages and an unstable system are two big reasons why the diesel genset business is so strong in Nigeria. The national power system has problems such not being able to generate enough power, having old infrastructure, and having power outages happen often. These problems make the electricity supply unreliable. More and more businesses, industries, and homes are using diesel generators as a reliable way to make sure they always have power. During power outages, diesel gensets are a reliable backup solution that reduces the effects of power outages on operations and daily life. This reliance on diesel generators to keep operations running smoothly and avoid downtime keeps demand high in the market.

Industrial and Infrastructure Growth

The diesel genset industry is growing quickly because Nigeria's industrial and infrastructure sectors are growing quickly. A consistent and reliable power supply is needed because of the growth of factories, mines, and oil and gas projects, as well as large-scale infrastructure projects. In places that aren't connected to the grid, diesel generators are very important for powering machines, tools, and buildings. As Nigeria builds roads, bridges, and cities, the need for diesel generators to power these projects and keep the power on keeps going up.

Download Free Sample Ask for Discount Request Customization

Urbanization and Commercial Expansion

The need for diesel generators in Nigeria is growing since more people are moving to cities and businesses are growing. As cities get bigger and new businesses like shopping malls, office buildings, and data centers are built, the need for reliable backup power solutions grows. Diesel generators are necessary to keep important systems and services running in commercial buildings, such as lighting, HVAC systems, and emergency services. As more cities and businesses are built in Nigeria, the demand for diesel generators to power these buildings is expanding.

Economic Development and Investment

The growth of Nigeria's economy and investments in different areas are driving up the need for diesel generators. When the economy grows, there are more industrial operations, new businesses, and infrastructure projects, all of which need stable power supplies. Also, investments from both inside and outside the country in areas like oil and gas, manufacturing, and technology create a need for diesel generators to keep things running smoothly and efficiently. The economy is booming, and people are investing in new projects. This is making diesel gensets more and more important to Nigeria's electricity grid.

Key Market Challenges

Power Supply Instability

The biggest problem in the Nigeria Diesel Genset market is that the country's power grid is always unstable. Businesses and homes have to rely significantly on diesel generators because power outages happen a lot and the power supply is not always stable. This reliance leads to high demand for gensets, but it also makes things harder, such higher operating costs and maintenance problems. The frequent power outages create a cycle of dependency where the grid's unreliability means that backup generators have to be used all the time. This makes the market even more dependent on diesel solutions. This instability also puts a strain on consumers' finances because they have to keep buying diesel fuel and paying for repairs, which slows down market growth and profitability.

High Operational Costs

The high price of diesel fuel has a big impact on the operating costs of diesel generators. Diesel prices in Nigeria can change because of a number of things, such as changes in the price of oil around the world and problems with the local supply chain. Because of this unpredictability, the operating expenses of diesel generators can be hard to forecast, which makes them less appealing to businesses and homes who want to save money. The fact that fuel prices are going up makes it even harder for people to purchase diesel gensets, which makes them less appealing. Also, the necessity for frequent maintenance and the high cost of replacement parts make the overall cost of running a diesel genset even higher.

Environmental Concerns

The diesel genset business in Nigeria is having a hard time because of environmental rules and the worldwide push for sustainability. Diesel generators release a lot of harmful gases into the air, like nitrogen oxides (NOx), particulate matter (PM), and carbon dioxide (CO2). As people become more concerned of the environment and rules become harsher, genset makers are under more and more pressure to make technologies that are cleaner and work better. This shift toward greener options requires a lot of money to be spent on research and development to fulfill emission limits. This can be hard for enterprises that have to deal with changing demand and limited budgets.

Infrastructure and Supply Chain Issues

In Nigeria, inadequate infrastructure and supply chain inefficiencies pose substantial obstacles for the diesel genset market. Poor transportation networks and logistical constraints can delay the delivery of genset components and maintenance services, leading to extended downtime and operational disruptions for users. Additionally, the lack of efficient distribution channels and technical support infrastructure can affect the availability and reliability of genset services. Companies must navigate these logistical hurdles to ensure timely delivery and service, which can impact their ability to compete effectively in the market.

Key Market Trends

Increased Adoption of Hybrid Diesel Gensets

The Nigerian Diesel Genset market is experiencing a notable shift towards hybrid diesel gensets, which combine diesel power with renewable energy sources such as solar. This trend is driven by the need for more sustainable and cost-effective power solutions. Hybrid systems offer the advantage of reduced fuel consumption and lower emissions compared to traditional diesel generators. They also provide a reliable power supply, especially in remote areas where grid connectivity is poor or non-existent. The decreasing costs of renewable energy technologies and growing environmental awareness are further accelerating the adoption of hybrid gensets. Companies and institutions are increasingly opting for these systems to meet their power needs while aligning with global sustainability goals.

Growing Demand for High-Efficiency and Low-Emission Generators

There is a growing trend in Nigeria toward high-efficiency and low-emission diesel generators. Stringent regulatory requirements and increasing awareness of environmental issues influence this shift. High-efficiency gensets offer better fuel economy, reduced operational expenses, and extended service life, making them an attractive choice for businesses seeking to optimize their energy expenditures. Low-emission models help address environmental concerns by minimizing the carbon footprint and meeting international emission standards. This trend is supported by advancements in diesel engine technology and the availability of modern, environmentally friendly genset solutions from leading manufacturers.

Rising Investments in Infrastructure and Industrial Projects

The Nigerian Diesel Genset market is benefiting from substantial investments in infrastructure and industrial projects across the country. As Nigeria continues to develop its transportation networks, urban infrastructure, and industrial facilities, the demand for reliable power solutions is increasing. Diesel gensets play a critical role in powering construction sites, manufacturing plants, and other industrial operations, particularly in areas with unreliable grid power. The expansion of infrastructure projects, such as roads, bridges, and airports, is expected to drive continued growth in the generation market, as these projects require temporary and permanent power solutions.

Expansion of Genset Rental Services

The market for diesel genset rental services is expanding rapidly in Nigeria. Many businesses and construction projects prefer renting gensets over purchasing them due to the lower upfront costs and flexibility. Rental services provide a cost-effective solution for temporary power needs and are particularly popular in sectors with fluctuating power requirements. The growth of the rental market is supported by the increasing number of large-scale projects, events, and emergency power needs. Rental companies are enhancing their service offerings by providing a range of genset options, including the latest models with advanced features and support services.

Segmental Insights

Insights

351-1000 kVA segment dominated in the Nigeria Diesel Genset market in 2023. the 351-1000 kVA range strikes an optimal balance between power capacity and operational efficiency, addressing the needs of both medium and large-scale enterprises. This capacity is ideal for powering commercial buildings, industrial operations, and infrastructure projects, where a steady and reliable power supply is critical. In Nigeria, where the national grid is often unstable, these gensets provide a dependable alternative, ensuring continuous operations in critical sectors.

The growing industrial and infrastructure development in Nigeria has increased the demand for robust and high-capacity gensets. Projects such as road construction, manufacturing facilities, and large commercial developments require substantial power generation capacity to support their operations. The 351-1000 kVA segment fits well within these requirements, providing sufficient power for such applications while maintaining cost-effectiveness compared to larger, more expensive gensets.

Additionally, the 351-1000 kVA range is favored for its flexibility and scalability. These gensets can be used in a variety of settings, from temporary power solutions on construction sites to permanent installations in industrial plants. This versatility makes them a preferred choice for businesses and project managers seeking reliable power solutions that can adapt to varying demands. Moreover, the ongoing infrastructure development and urbanization in Nigeria drive the need for dependable power solutions in both existing and new projects. The 351-1000 kVA gensets offer a practical solution for addressing power gaps in emerging urban areas and expanding industrial zones.

Regional Insights

North Central dominated the Nigeria Diesel Genset market in 2023. One of the primary reasons for North Central's dominance is its status as a major industrial and commercial hub. The region houses numerous key industries, including manufacturing, agriculture, and logistics, which rely heavily on diesel gensets for continuous and reliable power supply. Given the frequent power outages and grid instability across Nigeria, diesel gensets are essential for maintaining operational efficiency and minimizing downtime in these critical sectors.

Additionally, North Central’s strategic location and growing urbanization contribute to its high demand for diesel gensets. As the region experiences expansion in infrastructure projects such as road construction, real estate development, and public facilities, the need for robust power solutions becomes more pronounced. Diesel gensets are integral to powering construction sites, new commercial developments, and industrial operations, ensuring that these projects proceed without interruptions.

The North Central region also benefits from its connectivity to other major economic areas in Nigeria, enhancing its role in the supply chain and distribution networks. This connectivity increases the demand for reliable power solutions to support various commercial and logistical activities. Furthermore, the region's agricultural activities, which are a significant part of its economy, also drive the demand for diesel gensets. Power solutions are crucial for irrigation systems, processing plants, and storage facilities, contributing to the high market share of diesel gensets in North Central.

Download Free Sample Ask for Discount Request Customization

Recent Developments

- In March 2024, nearly 50% of businesses across Africa depend on backup diesel generators to ensure power continuity during grid outages. A 2022 Wood Mackenzie study revealed that over 100 GW of distributed diesel capacity is operational throughout the continent. Despite this substantial capacity, diesel generators account for only 7% of the total electricity supply and impose a staggering USD 20 billion annual fuel expenditure on consumers, equivalent to 80% of their grid electricity costs. Notably, Nigeria has a distributed diesel generator capacity that exceeds its grid-connected power-generation capabilities, surpassing other sub-Saharan nations.

- In June 2024, Shell’s Daystar Power is advancing its strategic initiative to integrate solar and grid power solutions in Nigeria. This initiative aims to enhance energy reliability and sustainability across the country. By combining solar energy with traditional grid power, Daystar Power seeks to address Nigeria's persistent electricity challenges and reduce reliance on diesel generators. This innovative approach supports Nigeria's energy infrastructure and aligns with global sustainability goals by promoting cleaner energy sources. The move underscores Shell’s commitment to advancing renewable energy solutions in emerging markets and driving sustainable growth in Nigeria’s energy sector.

- In December 2023, Adebayo Adelabu, Nigeria's Minister of Power, announced that the country relies on approximately 40,000 megawatts (MW) of electricity from generators fueled by petrol and diesel. This significant reliance on diesel and petrol generators underscores the limitations of Nigeria's current power infrastructure. Despite generating the majority of its on-grid electricity through thermal and hydro sources, with a total installed capacity of about 12,522 MW, the disparity points to the importance of infrastructure improvements. Adelabu made this disclosure during the ministerial retreat focused on developing an integrated national electricity policy and strategic implementation plan in Abuja.

Key Market Players

- Caterpillar Inc.

- Cummins Inc.

- Rolls-Royce plc

- Generac Holdings Inc.

- Kohler Co.

- Mitsubishi Heavy Industries, Ltd.

- Perkins Engines Company Limited

- Yanmar Holdings Co., Ltd.

- Kirloskar Oil Engines Limited

- Wärtsilä Corporation

- Doosan Corporation

- Deere & Company

|

By Capacity |

By Application |

By End-User |

By Fuel Type |

By Region |

|

|

|

|

|

Related Reports

- Europe Residential Boiler Market Size - By Technology (Condensing {Natural Gas, Oil, Electric}, Non-Condensing {Natural ...

- U.S. Boiler Market Size By Fuel (Natural Gas, Oil, Coal), Capacity, By Technology (Condensing, Non-Condensing), By Produ...

- Commercial Hot Water Boiler Market Size - By Fuel (Natural Gas, Oil, Coal, Electric), By Technology (Condensing, Non-Con...

- UK Commercial Boiler Market Size By Fuel (Natural Gas, Oil, Coal, Electric), By Capacity, By Technology (Condensing, Non...

- Residential Electric Boiler Market Size - By Voltage Rating (Low Voltage, Medium Voltage), Industry Analysis Report, Reg...

- Europe Steam Boiler Market - By Capacity, By Fuel (Natural Gas, Oil, Coal), By Technology (Condensing, Non-Condensing), ...

Table of Content

- 1. Executive Summary

- 1.1. Key Findings

- 1.2. Market Overview

- 1.3. Future Outlook

- 2. Introduction to the Nigeria Diesel Genset Market

- 2.1. What are Diesel Gensets?

- 2.2. Importance of Diesel Gensets in Nigeria's Power Landscape

- 2.3. Advantages of Diesel Gensets

- 2.3.1. Immediate and Reliable Power Supply

- 2.3.2. Adaptability for Remote and Off-Grid Locations

- 2.3.3. Scalability and Wide Range of Power Outputs

- 2.4. Limitations of Diesel Gensets

- 2.4.1. High Fuel Consumption and Operating Costs

- 2.4.2. Environmental Impact (Emissions and Noise)

- 2.4.3. Maintenance Requirements

- 2.5. Scope of the Report

- 3. Market Overview

- 3.1. Current Market Size and Valuation (2023-2024)

- 3.1.1. Market Size (e.g., ~$547.84 million in 2023)

- 3.2. Market Dynamics

- 3.2.1. Drivers of Market Growth

- 3.2.1.1. Persistent and Severe Power Deficit from the National Grid

- 3.2.1.1.1. Insufficient Generation Capacity (~8,000 MW available vs 20,000 MW demand)

- 3.2.1.1.2. Significant Transmission and Distribution Losses

- 3.2.1.1.3. Frequent Grid Collapses and Outages (e.g., 3 total, 2 partial in Q4 2024)

- 3.2.1.2. Rapid Urbanization and Industrialization

- 3.2.1.2.1. Growth in Manufacturing, Commercial Establishments (Hotels, Hospitals, Retail)

- 3.2.1.2.2. Expansion of Construction and Infrastructure Projects

- 3.2.1.3. Increasing Demand for Backup Power in Critical Sectors (Telecom, Data Centers, Healthcare)

- 3.2.1.4. Economic Growth and Rising Energy Consumption

- 3.2.1.5. Remote Locations and Off-Grid Needs (e.g., Oil & Gas fields, rural areas)

- 3.2.1.1. Persistent and Severe Power Deficit from the National Grid

- 3.2.2. Challenges and Restraints

- 3.2.2.1. Volatility and High Cost of Diesel Fuel

- 3.2.2.1.1. Removal of Fuel Subsidies Leading to Price Hikes

- 3.2.2.1.2. Significant Annual Fuel Expenditure for Consumers ($20 billion estimated in Africa, with Nigeria being a major contributor)

- 3.2.2.2. Growing Environmental Concerns and Emission Regulations (potential for stricter enforcement)

- 3.2.2.3. Increasing Adoption of Alternative Power Solutions (Solar PV, Hybrid Systems, Battery Storage)

- 3.2.2.4. Initiatives to Reduce Reliance on Fossil Fuel Generators (e.g., World Bank DARES project, Daystar Power's solar-grid integration)

- 3.2.2.5. Import Restrictions and Drive for Local Manufacturing

- 3.2.2.1. Volatility and High Cost of Diesel Fuel

- 3.2.1. Drivers of Market Growth

- 3.1. Current Market Size and Valuation (2023-2024)

- 4. Market Segmentation

- 4.1. By Power Rating (kVA)

- 4.1.1. 0-100 kVA (Dominant segment due to residential and small commercial use)

- 4.1.2. 101-350 kVA

- 4.1.3. 351-1000 kVA (Dominated in 2023, balancing capacity and efficiency for medium-large enterprises)

- 4.1.4. Above 1000 kVA

- 4.2. By Application/End-Use Sector

- 4.2.1. Commercial (Largest share: hotels, hospitals, offices, retail, data centers)

- 4.2.2. Industrial (Manufacturing, Oil & Gas, Mining, Construction)

- 4.2.3. Residential (High reliance due to frequent outages)

- 4.2.4. Telecommunications (Critical for tower operations)

- 4.2.5. Government/Public Sector

- 4.2.6. Others (e.g., Agriculture)

- 4.3. By Type of Power

- 4.3.1. Standby Power (Most common)

- 4.3.2. Prime Power

- 4.3.3. Continuous Power

- 4.3.4. Peak Shaving

- 4.4. By Fuel Type (in the context of alternatives)

- 4.4.1. Diesel

- 4.4.2. Hybrid (Diesel-Solar)

- 4.4.3. Others (e.g., Gas Gensets)

- 4.1. By Power Rating (kVA)

- 5. Regional Analysis (Within Nigeria)

- 5.1. North Central (Dominant region in 2023 due to industrial/commercial hubs like Abuja)

- 5.2. South West (Lagos and surrounding industrial areas)

- 5.3. South South (Oil & Gas rich regions)

- 5.4. South East

- 5.5. North West

- 5.6. North East

- 6. Competitive Landscape

- 6.1. Market Share Analysis of Key Players

- 6.2. Profiles of Major Companies Operating in Nigeria

- 6.2.1. Caterpillar Inc.

- 6.2.2. Cummins Inc.

- 6.2.3. Mikano International Ltd. (Significant local presence and partnerships)

- 6.2.4. JMG Limited

- 6.2.5. Kohler Co.

- 6.2.6. Denyo Co. Ltd.

- 6.2.7. Honda Manufacturing (Nigeria) Limited

- 6.2.8. FG Wilson (Aksa Power Generation)

- 6.2.9. Perkins Engines Company Limited

- 6.2.10. Yanmar Holdings Co. Ltd.

- 6.2.11. Atlas Copco AB

- 6.2.12. Other Local Assemblers and Distributors

- 6.3. Recent Developments, Strategic Partnerships, and Distribution Network

- 7. Technological Trends and Innovations

- 7.1. Shift Towards Hybrid Diesel-Renewable Energy Solutions (e.g., solar-diesel hybrids)

- 7.2. Advancements in Fuel Efficiency and Lower Emissions (e.g., DPFs, improved combustion)

- 7.3. Integration with Smart Monitoring and IoT for Remote Management

- 7.4. Noise Reduction Technologies for Urban Applications

- 7.5. Focus on Durability and Reduced Maintenance for Harsh Operating Conditions

- 8. Future Outlook and Projections (up to 2029-2030)

- 8.1. Forecasted Market Size and CAGR (e.g., ~$849.29 million by 2029 at 7.42% CAGR, or ~$806.8 million by 2030 at 6.8% CAGR)

- 8.2. Emerging Opportunities

- 8.2.1. Rural Electrification and Off-Grid Market

- 8.2.2. Growing Demand for Rental Gensets

- 8.2.3. Aftermarket Services (Maintenance, Parts, Fuel Delivery)

- 8.3. Impact of Government Policies on Power Sector Reforms and Renewable Energy Adoption

- 8.4. Long-term Outlook for Grid Improvement vs. Distributed Generation

- 9. Conclusion

Major Key Players

- Caterpillar Inc. (USA)

- Cummins Inc. (USA)

- Mikano International Limited (Nigeria)

- JMG Limited (Nigeria)

- Atlas Copco AB (Sweden)

- Perkins Engines Company Limited (part of Caterpillar) (UK)

- Yanmar Holdings Co. Ltd. (Japan)

- Mitsubishi Heavy Industries Ltd. (Japan)

- KOHLER Co. (USA)

- Aksa Power Generation (Turkey)

Manufacturers Key Players

- Mikano International Limited (Nigeria)

- JMG Limited (Nigeria)

- Caterpillar Inc. (USA)

- Cummins Inc. (USA)

- Perkins Engines Company Limited (UK)

- Yanmar Holdings Co. Ltd. (Japan)

- Mitsubishi Heavy Industries Ltd. (Japan)

- KOHLER Co. (USA)

- Aksa Power Generation (Turkey)

- Denyo Co., Ltd. (Japan)

- Generac Power Systems Inc. (USA)

- Jubaili Bros (Nigeria - also an OEM of Perkins Engines)

- Welland Power (UK - supplies to Nigeria)

- Clarke Energy (UK - assembles Kohler SDMO diesel gensets in Lagos, Nigeria)

FAQ'S

For a single, multi and corporate client license, the report will be available in PDF format. Sample report would be given you in excel format. For more questions please contact:

Within 24 to 48 hrs.

You can contact Sales team (sales@marketinsightsresearch.com) and they will direct you on email

You can order a report by selecting payment methods, which is bank wire or online payment through any Debit/Credit card, Razor pay or PayPal.

Discounts are available.

Hard Copy