Power Transformers Market

Power Transformers Market-Global Industry Size, Share, Trends, Opportunity, and Forecast, Segmented, By Size (Large Power Transformer, Medium Power Transformer, and Small Power Transformer), By Core (Closed, Shell, Berry), By Cooling Type (Oil-cooled, Air-cooled), By Phase (Single Phase, Three Phase), By Region & Competition, 2019-2029

Published Date: June - 2025 | Publisher: MIR | No of Pages: 320 | Industry: Power | Format: Report available in PDF / Excel Format

View Details Buy Now 2890 Download Free Sample Ask for Discount Request Customization| Forecast Period | 2025-2029 |

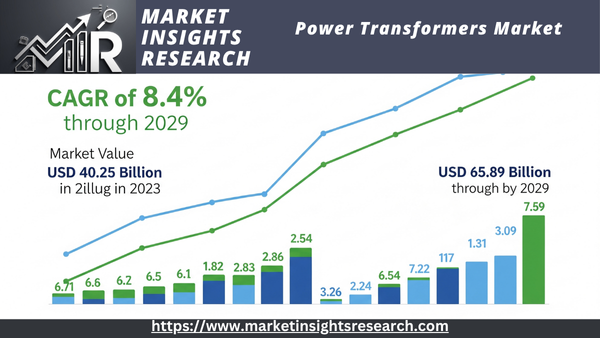

| Market Size (2023) | USD 40.25 Billion |

| Market Size (2029) | USD 65.89 Billion |

| CAGR (2024-2029) | 8.4% |

| Fastest Growing Segment | Single Phase |

| Largest Market | Asia Pacific |

Market Overview

Global Power Transformers Market was valued at USD 40.25 billion in 2023 and is expected to reach USD 65.89 billion in 2029 with a CAGR of 8.4% through the forecast period.

Download Free Sample Ask for Discount Request Customization

Key Market Drivers

Increasing Demand for Renewable Energy Integration

The growing need to integrate renewable energy sources into current power grids is a major factor driving the global market for power transformers. The development and application of renewable energy technologies, such as wind, solar, and hydro power, is booming as nations around the world pledge to cut greenhouse gas emissions and switch to cleaner energy. For stable and effective energy distribution, these renewable energy sources frequently necessitate significant changes to the power grid infrastructure. In this process, power transformers are essential because they increase the voltage produced by renewable sources for effective long-distance transmission and then decrease it for local distribution. Furthermore, a lot of renewable energy projects are situated in isolated locations far from cities, which calls for the use of reliable power transformers that can manage the longer distances and fluctuating power loads. The creation of smart grids and sophisticated energy storage systems is another aspect of integrating renewable energy, and these developments increase the need for advanced power transformers capable of controlling these intricate systems. The market for power transformers is therefore driven by the increased emphasis on sustainable energy solutions and the corresponding infrastructure upgrades, underscoring their crucial role in enabling the global transition to renewable energy.

Urbanization and Infrastructure Development

Rapid urbanization and infrastructure development are key drivers of the

Download Free Sample Ask for Discount Request Customization

Technological Advancements and Smart Grid Developments

Technological advancements and the evolution of smart grid technologies are pivotal drivers for the

Key Market Challenges

1. Rising Demand for Advanced Materials and Cutting-Edge Technologies

The power transformers market is navigating a complex landscape shaped by the growing need for more advanced and efficient technology. As energy infrastructure modernizes and renewable energy becomes more integrated, transformers must evolve to handle higher voltages, fluctuating loads, and demanding operational conditions. This shift is pushing manufacturers to explore innovative materials like nanocrystalline cores, high-temperature superconductors, and enhanced insulation systems.

While these technologies offer exciting benefits, they also introduce new hurdles. Advanced materials are often costlier and more complicated to work with than their traditional counterparts, increasing both production costs and development timelines. Adopting these technologies isn’t just about changing parts—it often requires overhauling manufacturing processes and investing heavily in research and development. Additionally, the supply chain for these materials can be fragile, causing potential delays and uncertainty in delivery schedules.

Transformer manufacturers must strike a careful balance between innovation and profitability. Staying competitive means continuously adapting to the latest advancements, all while managing costs and meeting the rising demand for efficiency and reliability in power systems.

2. Meeting Regulatory and Environmental Standards

The power transformer industry now prioritizes environmental responsibility and safety. Governments around the world are tightening regulations to limit the environmental impact of industrial products, and transformers—especially those using insulating oils or potentially hazardous components—are under increasing scrutiny.

Manufacturers must go beyond simply fulfilling compliance requirements. It requires investing in cleaner technologies, redesigning products to meet stricter efficiency standards, and managing waste responsibly. These upgrades often come with a hefty price tag and can slow down product development. What’s more, the regulatory environment is constantly evolving. Companies operating in multiple regions face an additional challengekeeping up with a patchwork of international compliance requirements.

Non-compliance isn't an option—it can lead to penalties, legal issues, and long-term damage to a brand's reputation. However, this push for more sustainable, eco-friendly solutions also opens the door for innovation. Manufacturers who proactively embrace green technologies not only stay ahead of the curve but also appeal to increasingly conscious consumers and partners.

In short, while environmental and regulatory pressures are significant, they also serve as a catalyst for progress in building a more responsible and resilient power transformer market.

Key Market Trends

1. Embracing Smart Grid Transformation

One of the most influential trends reshaping the power transformers market is the rapid adoption of smart grid technologies. These next-generation grids blend digital communication, automation, and control systems with traditional power infrastructure—resulting in smarter, more responsive energy networks.

At the heart of this transformation are smart transformers. Unlike conventional models, these advanced units are embedded with sensors and communication tools that allow real-time monitoring and data exchange. The benefits? Better fault detection, more efficient power distribution, and quicker response times during outages all contribute to greater grid reliability.

Smart grids are also crucial in managing the unpredictable nature of renewable energy sources like wind and solar, which generate power based on weather conditions. As cities expand and industries grow, the need for smarter energy systems intensifies. In response, utility providers and governments around the world are pouring investments into smart grid infrastructure, significantly boosting demand for intelligent, adaptable transformers.

This shift marks a clear evolutionpower transformers are no longer just hardware—they're becoming data-driven solutions essential to building resilient, future-ready power systems.

2. Driving Renewable Energy Integration

The transition to clean energy is not just a movement—it’s now a global imperative. This shift is sparking a major transformation in the power transformers market as more renewable energy sources are connected to the grid.

Wind farms, solar parks, and hydro plants generate electricity that must be stabilized and converted for distribution. That’s where power transformers come in. They step up or down voltages to ensure smooth, safe transmission across long distances and varied demand scenarios. But renewables come with their set of challenges—like intermittent output and fluctuating voltages—so transformers must now be more flexible and advanced than ever.

Supportive government policies, carbon reduction goals, and large-scale investment in green infrastructure are driving the deployment of renewable projects worldwide. This growth is fueling demand for specialized transformers designed to handle the dynamic and decentralized nature of renewable energy systems.

In essence, transformers are becoming the bridge between clean energy generation and efficient, stable power delivery—making them a cornerstone of the world’s transition to a sustainable energy future.

Segmental Insights

Phase Insights

In 2023, the three-phase had the biggest market share.

Older transformer infrastructure needs to be upgraded and replaced due to the increase in energy consumption brought on by electric vehicles, digital devices, and technological advancements. Advanced three-phase transformers are becoming more and more in demand as governments and utility companies invest more in modernizing power grids to increase reliability and lower losses.

Power industry digitization and the drive for smart grids are spurring innovation in transformer technology, resulting in the creation of more robust, intelligent, and efficient transformers with remote control and real-time monitoring capabilities. Improving grid resilience and operational efficiency requires this technological advancement. Additionally, the adoption of eco-friendly transformer solutions that minimize energy losses and lessen environmental impact is being encouraged by the need to comply with strict environmental regulations and emission standards. Utilities and businesses are investing in advanced three-phase transformers that provide better performance and lower operating expenses as a result of the increased emphasis on sustainability and energy efficiency. The growing use of microgrids and distributed energy resources calls for the use of adaptable three-phase transformers that can manage a range of load conditions and guarantee smooth power distribution. Rising energy demand, modernizing infrastructure, integrating renewable energy, technological advancements, and regulatory pressures all contribute to a strong market environment for three-phase power transformers, which fuels their ongoing expansion and uptake in various industries.

Regional Insights

The Asia Pacific region held the largest market share in 2023.

The market is also being driven by government programs, investments in renewable energy sources, and grid modernization projects. The demand for high-efficiency transformers is driven by the fact that many nations in the region are concentrating on improving their power transmission networks to lower losses and increase reliability. The market is expanding as a result of the move to high-voltage direct current (HVDC) technology, which is more effective for long-distance power transmission.

Outdated transformers are being replaced with more energy-efficient models in line with global sustainability goals as a result of increased emphasis on lowering carbon emissions and implementing cleaner energy solutions. Investments in strong and resilient transformer technologies are also being driven by the growing need for disaster recovery and resilience in power systems, given the region's vulnerability to typhoons and earthquakes. The market for power transformers in Asia Pacific is being driven by two factorsthe need to modernize and expand power transmission and distribution networks to support a sustainable and reliable energy future, as well as the rapid growth of the economy and infrastructure.

Download Free Sample Ask for Discount Request Customization

Recent Developments

- In August 2023, the United States Department of Energy (DOE) allocated USD 20 million as a key initiative under President Biden’s Investing in America agenda to enhance the installation of energy-efficient distribution transformers. This investment also extends to comprehensive product systems that incorporate equipment driven by electric motors, including pumps, air compressors, and fans. The funding aims to accelerate the adoption of advanced energy-efficient technologies, reduce energy consumption, and support the transition towards a more sustainable and resilient energy infrastructure. By incentivizing the implementation of these high-efficiency systems, the DOE seeks to drive significant operational cost savings, improve energy performance, and contribute to the nation’s broader environmental and economic goals. This strategic move underscores the administration's commitment to fostering innovation, creating green jobs, and advancing the United States' leadership in clean energy solutions.

- In June 2023, The Department of Energy (DOE) proposed new energy-efficiency standards for three categories of distribution transformers, which, if implemented, will significantly impact the industry. Under the new regulations, nearly all transformers will be required to use amorphous steel cores, recognized by the DOE as being more energy-efficient compared to traditional grain-oriented electrical steel. This shift aims to enhance overall energy savings and efficiency. Should these standards be adopted as planned, they will come into effect starting in 2027.

- In February 2024, Siemens Energy announced a significant investment of USD 150 million to expand its manufacturing facility in Charlotte, North Carolina. This substantial investment will enable the plant to begin producing power transformers, marking Siemens Energy's inaugural transformer manufacturing operation in the United States. The expansion aims to enhance the plant's capabilities and increase production capacity, supporting the growing demand for advanced electrical infrastructure. By establishing this new manufacturing unit, Siemens Energy not only strengthens its presence in the U.S. market but also reinforces its commitment to delivering high-quality, innovative solutions for power transmission and distribution. This strategic move reflects the company's focus on localizing production and bolstering its supply chain to better serve its North American customers.

Key Market Players

- ABB Limited

- ALSTOM Holdings

- Crompton Greaves Consumer Electricals Ltd

- General Electric Company

- Toshiba Corporation

- Bharat Heavy Electricals Limited

- Mitsubishi Electric Group

- Siemens AG

- Kirloskar Electric Company

- Eaton Corporation plc

- Fuji Electric Co., Ltd.

|

By Size |

By Core |

By Cooling Type |

By Phase |

By Region |

|

|

|

|

|

|

|

Related Reports

- Commercial Hot Water Boiler Market Size - By Fuel (Natural Gas, Oil, Coal, Electric), By Technology (Condensing, Non-Con...

- UK Commercial Boiler Market Size By Fuel (Natural Gas, Oil, Coal, Electric), By Capacity, By Technology (Condensing, Non...

- Residential Electric Boiler Market Size - By Voltage Rating (Low Voltage, Medium Voltage), Industry Analysis Report, Reg...

- Europe Steam Boiler Market - By Capacity, By Fuel (Natural Gas, Oil, Coal), By Technology (Condensing, Non-Condensing), ...

- Electric Boiler Market Size By Voltage Rating (Low, Medium), By Application (Residential, Commercial, Industrial, Food P...

- Europe Boiler Market By Fuel (Natural Gas, Oil, Coal, Electric), By Capacity (≤ 10 MMBtu/hr, > 10 - 50 MMBtu/hr, > 50 ...

Table of Content

- 1. Executive Summary

- 1.1. Key Findings

- 1.2. Market Overview

- 1.3. Future Outlook

- 2. Introduction to the Power Transformers Market

- 2.1. What are Power Transformers?

- 2.2. Importance of Power Transformers in Electricity Transmission & Distribution

- 2.3. Evolution of Power Transformer Technology

- 2.4. Scope of the Report

- 3. Market Overview

- 3.1. Current Market Size and Valuation (2024-2025)

- 3.1.1. Global Market Size (e.g., ~$27.9 billion in 2024)

- 3.2. Market Dynamics

- 3.2.1. Drivers of Market Growth

- 3.2.1.1. Increasing Global Electricity Demand (Residential, Commercial, Industrial)

- 3.2.1.2. Rapid Integration of Renewable Energy Sources (Solar, Wind) into Grids

- 3.2.1.3. Modernization and Upgradation of Aging Grid Infrastructure

- 3.2.1.4. Growing Investments in Transmission & Distribution (T&D) Networks

- 3.2.1.5. Expansion of Industrialization and Urbanization, particularly in Emerging Economies

- 3.2.1.6. Development of Smart Grids and Digitalization of Power Systems

- 3.2.1.7. Electrification of Transportation (EVs) and Heating/Cooling

- 3.2.1.8. Government Policies and Initiatives Supporting Energy Access and Efficiency

- 3.2.2. Challenges and Restraints

- 3.2.2.1. High Capital Investment and Installation Costs

- 3.2.2.2. Supply Chain Disruptions and Raw Material Price Volatility

- 3.2.2.3. Regulatory and Environmental Concerns (e.g., use of certain insulating oils)

- 3.2.2.4. Intense Competition from Established and Emerging Players

- 3.2.2.5. Long Lead Times for Manufacturing and Customization

- 3.2.1. Drivers of Market Growth

- 3.1. Current Market Size and Valuation (2024-2025)

- 4. Market Segmentation

- 4.1. By Power Rating

- 4.1.1. Small Power Transformers (Up to 60 MVA)

- 4.1.2. Medium Power Transformers (61-600 MVA)

- 4.1.3. Large Power Transformers (Above 600 MVA)

- 4.2. By Cooling Type

- 4.2.1. Oil-Cooled Transformers (e.g., Oil-immersed)

- 4.2.2. Air-Cooled Transformers (e.g., Dry-type)

- 4.2.3. Other Cooling Types (e.g., Gas, Solid)

- 4.3. By Phase

- 4.3.1. Single-Phase

- 4.3.2. Three-Phase

- 4.4. By Insulation Type

- 4.4.1. Liquid-Filled (Oil-Insulated)

- 4.4.2. Dry-Type (Resin-Cast, Vacuum Pressure Impregnated)

- 4.5. By Application/End-User

- 4.5.1. Utilities (Power Generation, Transmission, Distribution)

- 4.5.2. Industrial Sector (Manufacturing, Oil & Gas, Mining, Chemicals, etc.)

- 4.5.3. Commercial Sector (Commercial Buildings, Data Centers)

- 4.5.4. Residential Sector

- 4.5.5. Automotive and Transportation

- 4.5.6. Other Applications

- 4.1. By Power Rating

- 5. Regional Analysis

- 5.1. North America (U.S., Canada, Mexico)

- 5.1.1. Grid modernization and aging infrastructure replacement

- 5.1.2. Renewable energy integration

- 5.2. Europe (Germany, UK, France, Spain, Italy, Rest of Europe)

- 5.2.1. Renewable energy targets and grid upgrades

- 5.2.2. Focus on energy efficiency and eco-design regulations

- 5.3. Asia Pacific (China, India, Japan, Australia, South Korea, Southeast Asia, Rest of Asia Pacific)

- 5.3.1. Largest market share due to rapid industrialization, urbanization, and infrastructure development

- 5.3.2. Major investments in renewable energy and rural electrification

- 5.4. Latin America (Brazil, Argentina, Rest of Latin America)

- 5.4.1. Increasing electricity demand and renewable energy projects

- 5.5. Middle East & Africa (Saudi Arabia, UAE, South Africa, Rest of MEA)

- 5.5.1. Significant investments in power infrastructure development and diversification from oil & gas

- 5.1. North America (U.S., Canada, Mexico)

- 6. Competitive Landscape

- 6.1. Market Share Analysis of Key Players

- 6.2. Profiles of Major Companies

- 6.2.1. Siemens Energy AG

- 6.2.2. Hitachi Energy Ltd. (formerly ABB Power Grids)

- 6.2.3. General Electric Company

- 6.2.4. Schneider Electric SE

- 6.2.5. Mitsubishi Electric Corporation

- 6.2.6. Toshiba Energy Systems & Solutions Corporation

- 6.2.7. TBEA Co. Ltd.

- 6.2.8. Bharat Heavy Electricals Limited (BHEL)

- 6.2.9. Hyundai Electric & Energy Systems Co., Ltd.

- 6.2.10. XD Group (China XD Electric Co., Ltd.)

- 6.2.11. Crompton Greaves Limited (CG Power and Industrial Solutions Ltd.)

- 6.2.12. Other Prominent Players

- 6.3. Recent Developments, Mergers & Acquisitions, and Strategic Alliances

- 7. Technological Trends and Innovations

- 7.1. Development of Smart Transformers with IoT and AI Integration

- 7.2. Focus on Energy-Efficient and Eco-Friendly Transformers (e.g., lower losses, biodegradable oils)

- 7.3. Advancements in High-Voltage Direct Current (HVDC) Transformers

- 7.4. Rise of Digital Monitoring and Predictive Maintenance Solutions

- 7.5. Modular and Compact Transformer Designs

- 7.6. Advanced Materials for Improved Performance and Durability

- 8. Future Outlook and Projections (up to 2030/2034)

- 8.1. Forecasted Market Size and CAGR (e.g., ~$52.74 billion by 2034 at 6.6% CAGR, or ~$37.7 billion by 2029 at 6.2% CAGR)

- 8.2. Emerging Opportunities and Growth Pockets (e.g., offshore wind farms, EV charging infrastructure)

- 8.3. Impact of Global Energy Transition and Decarbonization Efforts

- 8.4. Regulatory Impact on Market Growth

- 9. Conclusion

Major Key Players

- Hitachi Energy (Japan/Switzerland)

- Siemens Energy AG (Germany)

- Schneider Electric SE (France)

- General Electric Company (GE Vernova) (USA)

- Mitsubishi Electric Corporation (Japan)

- Toshiba Corporation (Japan)

- ABB Ltd. (Switzerland)

- BYD Company Ltd. (China)

- Hyundai Electric Co., Ltd. (South Korea)

- CG Power and Industrial Solutions Limited (India)

Manufacturers Key Players

- Hitachi Energy (Japan/Switzerland)

- Siemens Energy AG (Germany)

- Schneider Electric SE (France)

- General Electric Company (GE Vernova) (USA)

- Mitsubishi Electric Corporation (Japan)

- Toshiba Corporation (Japan)

- ABB Ltd. (Switzerland)

- BYD Company Ltd. (China)

- Hyundai Electric Co., Ltd. (South Korea)

- CG Power and Industrial Solutions Limited (India)

- Bharat Heavy Electricals Limited (BHEL) (India)

- TBEA Co., Ltd. (China)

- SPX Transformer Solutions Inc. (USA)

- Hyosung Heavy Industries (South Korea)

- JiangSu HuaPeng Transformer Co. Ltd. (JSHP Transformer) (China)

- Eaton Corporation Plc. (USA)

- Fuji Electric Co., Ltd. (Japan)

- Voltamp Transformers Ltd. (India)

- Kirloskar Electric Company Limited (India)

- Transformers & Rectifiers (India) Ltd. (India)

FAQ'S

For a single, multi and corporate client license, the report will be available in PDF format. Sample report would be given you in excel format. For more questions please contact:

Within 24 to 48 hrs.

You can contact Sales team (sales@marketinsightsresearch.com) and they will direct you on email

You can order a report by selecting payment methods, which is bank wire or online payment through any Debit/Credit card, Razor pay or PayPal.

Discounts are available.

Hard Copy