Green Petroleum Coke Market

Green Petroleum Coke Market – Global Industry Size, Share, Trends, Opportunity, and Forecast, Segmented By Product Type (Fuel-grade coke, Calcined coke), By Application (Petroleum Coke, Calcined Petroleum Coke), By End-User Industry (Aluminium smelting, Steel manufacturing, Cement production, Others), By Region & Competition, 2019-2029F

Published Date: June - 2025 | Publisher: MIR | No of Pages: 320 | Industry: Power | Format: Report available in PDF / Excel Format

View Details Buy Now 2890 Download Free Sample Ask for Discount Request Customization| Forecast Period | 2025-2029 |

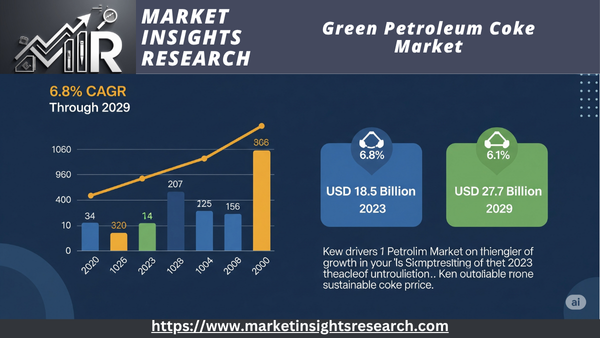

| Market Size (2023) | USD 18.5 Billion |

| Market Size (2029) | USD 27.7 Billion |

| CAGR (2024-2029) | 6.8% |

| Fastest Growing Segment | Steel manufacturing |

| Largest Market | North America |

Market Overview

Global Green Petroleum Coke Market was valued at USD 18.5 Billion in 2023 and is expected to reach at USD 27.7 Billion in 2029 and project robust growth in the forecast period with a CAGR of 6.8% through 2029.

Download Free Sample Ask for Discount Request Customization

Key Market Drivers

Increasing Demand in Aluminum Production

One major factor propelling the global market is the growing need for green petroleum coke in the production of aluminum. Green petroleum coke is prized for its low sulfur content and high carbon content, which make it perfect for the smelting of aluminum. Petroleum coke is a vital raw material needed by the aluminum industry to make the anodes that are used in electrolysis cells during the extraction of aluminum. Green petroleum coke is becoming more and more necessary as the world's demand for aluminum rises, especially in the automotive, construction, and packaging sectors. The need for strong and lightweight materials to satisfy the demands of contemporary infrastructure and manufacturing is what is driving this trend. The demand for green petroleum coke in the aluminum industry is expected to increase as economies and industries grow, which will propel the market.

Growing Electric Vehicle (EV) and Battery Markets

The market for green petroleum coke is expanding due to the growth of the advanced battery and electric vehicle (EV) industries. High-performance battery materials, especially lithium-ion batteries, which are crucial for electric vehicles and renewable energy storage systems, are made from green petroleum coke. The demand for premium petroleum coke is rising as a result of the quick uptake of EVs due to their advantages for the environment and improvements in battery technology. The demand for green petroleum coke, which facilitates the manufacturing of effective and durable batteries, is anticipated to increase as the world's transition to electrification and renewable energy intensifies. The market is being driven by this trend, which also encourages more investments in the production of green petroleum coke.

Download Free Sample Ask for Discount Request Customization

Technological Advancements in Petroleum Coke Production

The market for green petroleum coke is expanding thanks to technological developments in its production. Green petroleum coke production is now more efficient and of higher quality thanks to advancements in coke calcination methods and refining procedures. High-purity, low-sulfur petroleum coke that satisfies the exacting specifications of numerous industrial applications has been developed as a result of these developments. Furthermore, new technologies are making it possible to process crude oil more effectively, which raises the yields of green petroleum coke. Green petroleum coke is becoming a more appealing alternative for industries due to the continuous research and development in this area, which is propelling market expansion and broadening its uses in various industries.

Rising Industrial Applications

The market for green petroleum coke is growing as a result of its expanding industrial uses. Green petroleum coke is being used more and more in industries like steel, cement, and chemicals in addition to the production of aluminum and batteries. It is a valuable raw material for many high-temperature industrial processes because of its high carbon content and low levels of impurities. Green petroleum coke's adaptability makes it a popular option for industries looking to increase production efficiency and lessen their environmental effects. Demand and market expansion are being driven by the increasing use of green petroleum coke in a variety of industrial applications, as businesses take advantage of its advantages to achieve their operational and environmental objectives.

Key Market Challenges

Volatility in Raw Material Prices

The fluctuating prices of raw materials present serious obstacles for the global market for green petroleum coke. Crude oil price fluctuations have a significant impact on the production of green petroleum coke, which is a byproduct of the oil refining process. The cost of making green petroleum coke can fluctuate along with the price of crude oil, which is influenced by supply chain disruptions, market demand, and geopolitical tensions. Manufacturers may experience unpredictable costs as a result of this price volatility, which could have an impact on their operational effectiveness and profitability. Price changes can also affect the market's overall pricing strategy for green petroleum coke, which can cause uncertainty for both buyers and sellers. In the face of these swings, businesses might find it difficult to sustain steady profit margins and efficiently control their financial performance. Industry participants must embrace flexible sourcing tactics, make investments in risk management procedures, and investigate substitute raw materials or production techniques that can help stabilize costs and guarantee steady supply in order to lessen this difficulty.

Regulatory Compliance and Environmental Standards

One of the biggest challenges facing the green petroleum coke market is navigating the complicated terrain of environmental standards and regulatory compliance. Businesses must make sure that their production procedures and products satisfy the changing standards established by governments and international organizations as environmental regulations get stricter. It is necessary to make significant investments in technology, process enhancements, and reporting systems in order to comply with these regulations. Legal repercussions, business interruptions, and reputational harm may arise from noncompliance with regulatory requirements. The operational complexity and expenses for market participants are further increased by the requirement for continual monitoring and adjustment to new regulations. In order to meet environmental standards and preserve their market position, businesses must invest in sustainable technologies, stay up to date on regulatory changes, and create strong compliance plans.

Technological Limitations in Production

Technological constraints affect the quality and efficiency of green petroleum coke production. The production process has been enhanced by developments in calcination and refining technologies, but it is still difficult to produce green petroleum coke with the required consistency and purity. Variations in product quality due to technological limitations may impact a product's appropriateness for particular industrial applications. Additionally, manufacturers' operating costs are increased by the requirement for ongoing investment in maintaining and improving production technologies. These restrictions may make it more difficult for market participants to increase production, satisfy rising demand, and engage in productive competition. To overcome this obstacle, businesses must make research and development investments, investigate cutting-edge production methods, and work with technology suppliers to improve their production capacities and continuously produce high-quality green petroleum coke.

Market Competition and Pricing Pressure

Intense market competition and pricing pressure are major challenges in the global green petroleum coke market. As the demand for green petroleum coke grows, new entrants and existing players are vying for market share, leading to heightened competition. This competitive environment can result in pricing pressure, as companies strive to offer competitive prices to attract customers while maintaining profitability. Additionally, the market may experience price wars and aggressive marketing tactics, further impacting profit margins. Companies need to differentiate themselves through product quality, technological innovation, and customer service to maintain a competitive edge. Strategic partnerships, value-added services, and cost-effective production methods can help companies navigate the challenges of market competition and pricing pressure. To sustain their market position, businesses must focus on enhancing their value proposition, optimizing operational efficiencies, and building strong relationships with key stakeholders.

Key Market Trends

Increased Adoption in Aluminum Production

The global green petroleum coke market is witnessing a significant trend towards increased adoption in the aluminum production industry. Green petroleum coke is favored for its high carbon content and low sulfur levels, making it an ideal material for manufacturing anodes used in the aluminum smelting process. The growing demand for aluminum, driven by its applications in automotive, construction, and packaging industries, has bolstered the need for high-quality anodes. As industries push for more sustainable and efficient materials, green petroleum coke's role becomes increasingly crucial. This trend is supported by advancements in production technology that enhance the quality of green petroleum coke, ensuring it meets the stringent requirements of aluminum production. Companies are investing in expanding their green petroleum coke production capacities to cater to this growing demand, thereby driving market growth.

Technological Innovations in Production

The market for green petroleum coke is experiencing a trend towards technological innovations in its production processes. Advances in refining and calcination technologies are improving the efficiency and quality of green petroleum coke. Innovations such as enhanced calcination techniques and optimized refining processes are addressing issues related to product consistency and purity. These technological advancements are enabling producers to meet the stringent quality requirements of various industrial applications, including aluminum production and battery manufacturing. Additionally, the development of more energy-efficient production methods aligns with the broader industry trend towards sustainability and reduced environmental impact. Companies that invest in these technological innovations are better positioned to meet market demands, enhance their competitive edge, and contribute to the growth of the green petroleum coke market.

Growing Demand for Sustainable Materials

The growing need for environmentally friendly and sustainable materials is a major trend in the global market for green petroleum coke. Because it contains less sulfur than conventional petroleum coke, green petroleum coke is becoming more popular as governments and businesses around the world place a greater emphasis on sustainability. This change is in line with international initiatives to lower emissions and enhance environmental performance. Businesses are adopting green petroleum coke as a vital raw material in a variety of industrial processes due to the push for greener alternatives. Furthermore, industries are being influenced to look for more sustainable solutions by the growth of circular economy practices and heightened environmental awareness. As companies and consumers place a higher priority on environmental responsibility, this trend is anticipated to continue, which will increase demand for green petroleum coke.

Expansion of Applications in Battery Manufacturing

The market for green petroleum coke is seeing a noticeable trend in the growth of its uses in the battery manufacturing industry. High-performance battery materials, especially lithium-ion batteries, which are crucial for electric vehicles (EVs) and renewable energy storage systems, are made from green petroleum coke. The need for cutting-edge battery technologies is rising as the world moves more quickly toward electrification and renewable energy. Because of its qualities, green petroleum coke is a perfect material for making high-quality anodes and other battery components. The use of green petroleum coke in this industry is increasing due to the rising popularity of EVs and the development of innovative energy storage technologies. Businesses are investing in research and investigating new uses to improve battery performance and efficiency, which is driving market expansion.

Investment in Green Petroleum Coke Production Facilities

The growing investment in production facilities is a significant trend in the global market for green petroleum coke. Businesses are increasing their production capacities to meet market demands as the demand for green petroleum coke rises across a variety of industries. To increase production efficiency and product quality, investments are being made in modernizing current facilities and constructing new ones outfitted with cutting-edge technologies. The market's reaction to rising demand from industries like battery manufacturing and aluminum production is reflected in this trend. To improve their market position and fortify their supply chains, businesses are also looking into possibilities for strategic alliances and vertical integration. To meet the growing demand and guarantee a steady supply of green petroleum coke in the global market, production facilities must be expanded. We anticipate this trend to continue as industries seek reliable suppliers of premium green petroleum coke.

Segmental Insights

Product Type Insights

The fuel-grade coke segment dominated the global market for green petroleum coke, and this trend is anticipated to persist over the course of the forecast period. Fuel-grade coke is principally used as a high-carbon, low-sulfur material in a variety of combustion applications, such as power generation and industrial processes. It is produced by thermally processing petroleum residues. Fuel-grade coke's extensive use in energy-intensive industries, where its higher calorific value and affordability make it a preferred option, is what propels this dominance. Because of the substantial energy requirements of industries like steel, cement, and power generation, there is a sizable market for fuel-grade coke, which has low operating costs and high efficiency. Fuel-grade coke's contribution to lowering sulfur emissions also supports sustainability objectives and international environmental regulations, strengthening its position in the market. It is projected that the demand for fuel-grade coke will increase as industrialization and energy consumption continue to rise, preserving its leading market share. Furthermore, the strategic expansion of refineries and the development of production technologies are anticipated to improve the quality and availability of fuel-grade coke, further solidifying its market leadership. The wide range of uses for fuel-grade coke in various industries guarantees its dominant position in the green petroleum coke market, even in the face of the expansion of calcined coke applications, especially in the production of aluminum. Due to its well-established infrastructure, wide range of applications, and conformity to regulatory trends, the fuel-grade coke segment is favored by market dynamics and will remain the dominant segment for the duration of the forecast period.

Regional Insights

We anticipate North America to maintain its dominant position in the global green petroleum coke market throughout the forecast period. Numerous important factors are responsible for this dominance. Green petroleum coke is a byproduct of many large-scale refineries in North America, especially the United States, which has a well-established petroleum refining infrastructure. The efficiency and production of green petroleum coke are improved by the region's sophisticated technological capabilities and investments in refining technology. Additionally, because of its high calorific value and lower sulfur content than other fuels, green petroleum coke is in high demand due to North America's thriving industrial sector, which includes steel manufacturing, cement production, and power generation. The market for green petroleum coke is expanding in North America due to strict emission standards and environmental laws that promote the use of sustainable practices and lower-sulfur fuels. The region's strategic position as a major exporter of petroleum products, including green petroleum coke, to other markets further strengthens its dominance. North America's position in the market is further cemented by the existence of significant players and the continuous refinery expansion to satisfy the rising industrial demand. In line with international sustainability goals, the region's investments in clean energy and technological developments also help to boost the production and use of green petroleum coke. Over the course of the forecast period, North America is anticipated to continue to hold a dominant share of the global green petroleum coke market due to its leadership in both industrial demand and technological innovation. Strong industrial consumption, regulatory support, and sophisticated infrastructure all contribute to this long-lasting leadership, guaranteeing North America's dominant position in the market.

Download Free Sample Ask for Discount Request Customization

Recent Developments

- In January 2023, Phillips 66 and DCP Midstream, LP reached a definitive agreement where Phillips 66 will purchase all publicly traded standard units of DCP Midstream for $41.75 per unit. This acquisition will raise Phillips 66's economic stake in DCP Midstream to 86.8%, enhancing its strategic position and potentially boosting the productivity and market performance of petroleum coke.

- In January 2024, TotalEnergies announced a USD 300 million investment in a joint venture with Adani Green Energy, focusing on renewable energy projects in India. This strategic move aims to bolster TotalEnergies’ clean energy portfolio and expand its footprint in the growing Indian renewables market. The partnership will support the development of large-scale solar and wind energy projects, aligning with TotalEnergies' commitment to sustainability and energy transition goals.

Key Market Players

- Chevron Corporation

- Exxon Mobil Corporation

- Reliance Industries Limited

- Shell plc

- Marathon Petroleum Corporation

- China National Petroleum Corporation

- Valero Energy Corporation

- Petroleo Brasileiro S.A

- BP plc

- Oxbow Corporation

- TotalEnergies SE

- Indian Oil Corporation Limited

|

By Product Type |

By Application |

By End-User Industry |

By Region |

|

|

|

|

Related Reports

- Industrial Boiler Market Size - By Product (Fire-Tube, Water-Tube), By Capacity, By Application (Food Processing, Pulp &...

- Commercial Boiler Market - By Fuel (Natural Gas, Oil, Coal, Electric), By Capacity, By Technology (Condensing, Non-Conde...

- Steam Boiler Market - By Capacity, By Fuel (Natural Gas, Oil, Coal), By Technology (Condensing, Non-Condensing), By Appl...

- Industrial Electric Boiler Market - By Voltage Rating (Low Voltage, Medium Voltage), By Capacity (< 10 MMBtu/hr, 10-50 M...

- Biomass Boiler Market - By Feedstock (Woody Biomass, Agricultural Waste, Industrial Waste, Urban Residue), By Product (S...

- Asia Pacific Electric Boiler Market Size - By Capacity (≤ 10 MMBtu/hr, > 10 - 50 MMBtu/hr, > 50 - 100 MMBtu/hr, > 100 ...

Table of Content

- 1. Executive Summary

- 1.1. Key Findings

- 1.2. Market Overview

- 1.3. Future Outlook

- 2. Introduction to the Green Petroleum Coke Market

- 2.1. What is Green Petroleum Coke (GPC)?

- 2.2. Production Process of GPC

- 2.3. Key Characteristics of GPC

- 2.4. Importance of GPC in Various Industries

- 2.5. Scope of the Report

- 3. Market Overview

- 3.1. Current Market Size and Valuation (2025)

- 3.2. Market Dynamics

- 3.2.1. Drivers of Market Growth

- 3.2.1.1. Increasing Demand from Aluminum and Steel Industries

- 3.2.1.2. Growing Demand in Cement Production

- 3.2.1.3. Rising Industrialization and Infrastructure Development, especially in Emerging Economies

- 3.2.1.4. Use as a Cost-Effective Fuel Source in Power Plants

- 3.2.1.5. Favorable Government Regulations and Environmental Policies

- 3.2.2. Challenges and Restraints

- 3.2.2.1. Volatility in Crude Oil Prices

- 3.2.2.2. Environmental Concerns and Emission Regulations

- 3.2.2.3. Competition from Alternative Fuel Sources

- 3.2.2.4. Supply Chain and Logistical Challenges

- 3.2.1. Drivers of Market Growth

- 4. Market Segmentation

- 4.1. By Type/Grade

- 4.1.1. Anode Grade (for Calcination)

- 4.1.2. Fuel Grade

- 4.1.3. Metallurgical Grade

- 4.2. By Form

- 4.2.1. Sponge Coke

- 4.2.2. Needle Coke

- 4.2.3. Shot Coke

- 4.2.4. Honeycomb Coke

- 4.2.5. Purge Coke

- 4.3. By Application/End-Use Industry

- 4.3.1. Aluminum Smelting

- 4.3.2. Cement Production

- 4.3.3. Power Generation

- 4.3.4. Steel Manufacturing

- 4.3.5. Graphite Electrodes

- 4.3.6. Other Industrial Applications (e.g., Silicon Metal, Ceramics, Chemicals)

- 4.1. By Type/Grade

- 5. Regional Analysis

- 5.1. North America (U.S., Canada, Mexico)

- 5.2. Europe (Germany, UK, France, etc.)

- 5.3. Asia Pacific (China, India, Japan, Australia, etc.)

- 5.4. Latin America (Brazil, Argentina, etc.)

- 5.5. Middle East & Africa (Saudi Arabia, UAE, etc.)

- 6. Competitive Landscape

- 6.1. Market Share Analysis of Key Players

- 6.2. Profiles of Major Companies

- 6.2.1. Oxbow Corporation

- 6.2.2. Rain Carbon Inc.

- 6.2.3. Chevron Corporation

- 6.2.4. Valero Energy Corporation

- 6.2.5. BP plc

- 6.2.6. ExxonMobil Corporation

- 6.2.7. Reliance Industries Limited

- 6.2.8. Indian Oil Corporation Limited

- 6.2.9. Saudi Arabian Oil Co. (Aramco)

- 6.2.10. Other Prominent Players

- 6.3. Recent Developments, Strategic Initiatives, and Collaborations

- 7. Technological Trends and Innovations

- 7.1. Advancements in Oil Refining and Coking Processes

- 7.2. Development of Lower Sulfur Content GPC

- 7.3. Research into Alternative Uses and Upgrading Technologies

- 8. Future Outlook and Projections (up to 2030/2033)

- 8.1. Forecasted Market Size and CAGR

- 8.2. Emerging Opportunities in Green Petroleum Coke

- 8.3. Impact of Global Economic Shifts and Regulatory Landscape

- 9. Conclusion

Major Key Players

- Reliance Industries Limited (India)

- ExxonMobil Corporation (USA)

- Indian Oil Corporation Limited (India)

- Valero Energy Corporation (USA)

- Phillips 66 Company (USA)

- BP p.l.c. (UK)

- Chevron Corporation (USA)

- Oxbow Corporation (USA)

- Saudi Aramco (Saudi Arabia)

- Shell plc (UK)

Manufacturers Key Players

- Reliance Industries Limited (India)

- ExxonMobil Corporation (USA)

- Indian Oil Corporation Limited (India)

- Valero Energy Corporation (USA)

- Phillips 66 Company (USA)

- BP p.l.c. (UK)

- Chevron Corporation (USA)

- Oxbow Corporation (USA)

- Saudi Aramco (Saudi Arabia)

- Shell plc (UK)

- Rain Carbon Inc. (USA)

- Marathon Petroleum Corporation (USA)

- Petrobras (Brazil)

- HPCL-Mittal Energy Limited (India)

- Nayara Energy (India)

FAQ'S

For a single, multi and corporate client license, the report will be available in PDF format. Sample report would be given you in excel format. For more questions please contact:

Within 24 to 48 hrs.

You can contact Sales team (sales@marketinsightsresearch.com) and they will direct you on email

You can order a report by selecting payment methods, which is bank wire or online payment through any Debit/Credit card, Razor pay or PayPal.

Discounts are available.

Hard Copy