India UPS Battery Market

India UPS Battery Market By Type (Lead-Acid, Lithium Ion, Nickel Cadmium, Others), By Mode (Installation, Replacement, Maintenance & Service), By Application (Data Centers, Manufacturing, IT/ITes, Healthcare, Housing Complexes, BFSI, Railways, Telecom, MSMEs, Travel & Tourism, SOHOs, Others), By Size (Small Battery{7Ah, 12Ah}, Medium Battery{24Ah, 42Ah, 65Ah, 100Ah, 200Ah}), By Region, Competition 2018-2028

Published Date: June - 2025 | Publisher: MIR | No of Pages: 320 | Industry: Power | Format: Report available in PDF / Excel Format

View Details Buy Now 2890 Download Free Sample Ask for Discount Request CustomizationMarket Overview

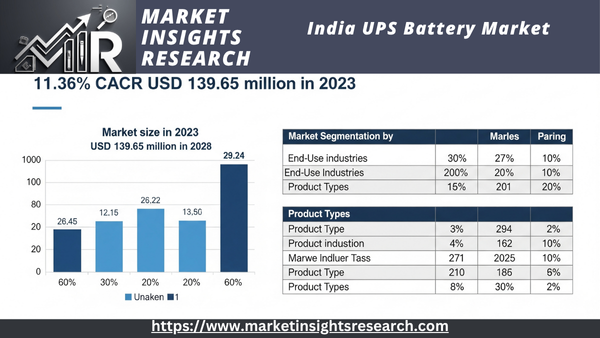

The India UPS battery market was valued at USD 139.65 million in 2023 and is expected to grow at a robust rate of 11.36% over the forecast period due to the country's growing reliance on electricity, growing commercial and industrial segments, and frequent power outages, which are especially common during peak consumption hours when an uninterrupted power supply is required. Therefore, in order for different economic sectors of the nation to operate effectively with minimal downtime, actions like installing UPS batteries are required.

Download Free Sample Ask for Discount Request Customization

One essential part of a UPS system is a UPS battery. During a power outage or other power disruption, UPS batteries supply backup power to the UPS, guaranteeing that vital systems and equipment can remain online and functional. A UPS battery's lifespan varies based on its make and model, but most batteries should be changed every three to five years for normal life or every ten to fifteen years for long life. Housing complexes, telecom, BFSI, data centers, manufacturing, healthcare, railroads, and the travel and tourism industry all make extensive use of UPS batteries.

Burgeoning Advantages of UPS Battery in Data Centre

For example, Kokam.Co., Ltd. introduced a cutting-edge battery system for UPS in 2020. Data centers and banks are examples of mission-critical facilities that the battery was designed to support.

Government Plans Booming the Market Growth

An additional boost has come from the National e-Government Plan. The main objective of the project is to computerize and digitize many government offices and agencies, which necessitates a steady supply of electricity and will serve as a catalyst for the UPS industry's growth. The goal of other programs like Pradhan Mantri Kaushal Vikas Yojana (PMKVY) and Pradhan Mantri Gramin Digital Saksharta Abhiyaan (PMGDISHA) is to close the digital divide. The government's digitalization initiatives have been the main driver of the UPS battery market's development in India. It is anticipated that government projects, along with infrastructure improvements, economic expansion, and surveillance requirements, may accelerate market growth in the near future. The demand for UPS systems is therefore anticipated to increase as a result of such initiatives towards digital India.

Growing Attention Towards Green UPS Systems

Energy costs have rapidly increased in recent years, and consumers' awareness of environmental issues has grown. For these reasons, a number of businesses have created Green UPS technology, which is an uninterruptible power supply (UPS) that uses less energy. When compared to traditional UPS systems, green UPS designs can cut power consumption by up to 75%. As a result, one of the most important considerations for consumers when evaluating UPS products is their energy-efficiency design. Additionally, green UPS solutions have sophisticated thermal design and monitoring systems that lower heat production. As a result, the demand for green UPSs is expected to rise significantly during the forecast period due to the growing use of green UPS devices in a variety of applications, including telecommunications and IT networks. In June 2022, for example, market participant Vertiv introduced a number of uninterruptible power supply (UPS) options, such as the Vertiv Liebert EXM2 and the Vertiv Liebert ITA2- 30 kVA. People are switching to green UPS systems as a result of the technology's ability to make UPSs more ecologically friendly. As a result, the UPS battery market in India is anticipated to expand during the forecast period.

Download Free Sample Ask for Discount Request Customization

ChallengesMechanical & Electrical Limitations

Various Government Initiatives Enhance the UPS Battery Market

Smart Cities

The Smart Cities Mission was launched by the Indian government in June 2015. Its objective is to support inclusive and sustainable cities that provide basic infrastructure, a fair standard of living for their citizens, a clean and sustainable environment, and the application of "smart" solutions. With the aim of developing a replicable model that would act as a guide for other aspirational communities, the focus was on equitable development. Implementing Intelligent Transportation Systems (ITS) is one way that smart cities manage traffic and road safety, lessen congestion, boost energy efficiency, and enhance citizen mobility. To guarantee operational availability during emergencies and power outages, this needs a reliable backup power source. As a result, it is anticipated that the need for UPS batteries will increase in the years to come.

BPO Scheme

The goal of the India BPO Promotion Scheme (IBPS) was to provide incentives for the establishment of 48,300 BPO/ITES seats nationwide. The USD 59.16 million budget is allocated to the states based on population. This would lay the groundwork for the upcoming wave of IT/ITS-led growth and help smaller cities build their infrastructure and labor capacity. As a result, the UPS battery market may expand nationwide.

Recent Developments

- The large companies are interested in the development and replacements of data centers. For example, in May 2022, Cisco Systems, Inc. launched its first data center in India. The company aimed to meet the growing demands of customers in relation to cyber protection and data localization. Consequently, Cisco Duo set up its first data center in India. Additionally, with this investment, Cisco aimed to build a future-proof and data-compliant information security infrastructure in India. In addition, this data center serves several industries, such as public sector, healthcare, and banking, financial services, and insurance. These factors might drive the growth of the UPS battery in India.

- In January 2022, the diversified Adani Group invested more than USD 55.72 million in two data center projects in Uttar Pradesh, India. According to the Uttar Pradesh government, two data centers are expected to be built in Noida sectors 62 and 80 and the demand of electricity is expected to rise in Noida. Therefore, the market for UPS batteries is expected to boost in the forecast period.

Market Segments

The UPS battery market in India is divided into segments based on size, region, application, type, and mode. The market is divided into lead-acid, lithium ion, nickel cadmium, and other types based on type. The market is divided into three segments based on modeinstallation, replacement, and maintenance & service. Data centers, manufacturing, IT/Ites, healthcare, housing complexes, BFSI, railways, telecom, MSMEs, travel & tourism, SOHOs, and other sectors are the market segments based on application. The market is divided into two segments based on sizesmall batteries and medium batteries. On the other hand, the small battery sub-segment is further divided into 12Ah and 7Ah. The medium battery sub-segment is further divided into four different sizes24Ah, 42Ah, 65Ah, 100Ah, and 200Ah. The market is divided into four regionsSouth India, North India, West India, and East India.

Market Players

India UPS battery market players include Exide Industries Limited, Amara Raja Batteries Limited, Luminous Power Technologies Pvt. Ltd, Su-Kam Power Systems Limited, HBL Power Systems Limited, Okaya Power Private Limited, V-Guard Industries Ltd, Fujiyama Power Systems Pvt Ltd, Jayachandran Industries Private Limited, and Green Vision Technologies Private Limited among others.

Download Free Sample Ask for Discount Request Customization

|

Attribute |

Details |

|

Market Size Value in 2023 |

USD 139.65 million |

|

Revenue Forecast in 2029 |

USD 261.20 million |

|

Growth Rate |

11.36% |

|

Base Year |

2023 |

|

Historic Data |

2019 – 2022 |

|

Estimated Year |

2024 |

|

Forecast Period |

2025 – 2029 |

|

Quantitative Units |

Revenue in USD Million, Volume in Thousand Units, and CAGR for 2019-2023 and 2024-2029 |

|

Report Coverage |

Revenue forecast, company share, growth factors, and trends |

|

Segments Covered |

Type Mode Application Size Region |

|

Regional Scope |

North India, West India, South India, East India |

|

Key Companies Profiled |

Exide Industries Limited, Amara Raja Batteries Limited, Luminous Power Technologies Pvt. Ltd, Su-Kam Power Systems Limited, HBL Power Systems Limited, Okaya Power Private Limited, V-Guard Industries Ltd, Fujiyama Power Systems Pvt Ltd, Jayachandran Industries Private Limited, Green Vision Technologies Private Limited |

|

Customization Scope |

10% free report customization with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and Purchase Options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

|

Delivery Format |

PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Related Reports

- Biomass Boiler Market - By Feedstock (Woody Biomass, Agricultural Waste, Industrial Waste, Urban Residue), By Product (S...

- Asia Pacific Electric Boiler Market Size - By Capacity (≤ 10 MMBtu/hr, > 10 - 50 MMBtu/hr, > 50 - 100 MMBtu/hr, > 100 ...

- North America & Europe Electric Boiler Market Size - By Voltage Rating (Low Voltage, Medium Voltage), By Application (Re...

- North America Residential Boiler Market Size - By Fuel (Natural Gas, Oil, Electric), By Technology (Condensing {Natural ...

- U.S. Commercial Boiler Market – By Product (Hot Water, Steam), Application (Offices, Healthcare Facilities, Educationa...

- North America Commercial Boiler Market Size - By Fuel (Natural Gas, Oil, Coal, Electric), By Capacity, By Technology (Co...

Table of Content

- 1. Executive Summary

- 1.1. Key Findings

- 1.2. Market Overview

- 1.3. Future Outlook

- 2. Introduction to the India UPS Battery Market

- 2.1. What are UPS Batteries and Their Role in India?

- 2.2. Importance of Reliable Power Backup in the Indian Context (Frequent Outages, Digital Economy)

- 2.3. Types of UPS Batteries Used in India

- 2.3.1. Lead-Acid Batteries (SMF VRLA, Tubular, Flooded)

- 2.3.2. Lithium-ion (Li-ion) Batteries

- 2.3.3. Nickel-Cadmium (NiCd) Batteries (Niche Applications)

- 2.4. Scope of the Report

- 3. Market Overview

- 3.1. Current Market Size and Valuation (as of June 2025)

- (The India UPS Battery Market was valued at approximately USD 401 Million in 2025.)

- 3.2. Market Dynamics

- 3.2.1. Drivers of Market Growth

- 3.2.1.1. Rapid Expansion of IT Infrastructure and Data Centers

- 3.2.1.2. Increasing Frequency and Duration of Power Outages

- 3.2.1.3. Growing Adoption of Digital Technologies and Services ("Digital India" initiative)

- 3.2.1.4. Growth in Industrial and Commercial Sectors (Manufacturing, Healthcare, Telecom, BFSI)

- 3.2.1.5. Rising Demand for Power Backup in Residential Sector (Work-from-home, Home Automation)

- 3.2.1.6. Integration of Renewable Energy Sources and Need for Grid Stability

- 3.2.1.7. Government Initiatives like "Make in India" and Infrastructure Development

- 3.2.2. Challenges and Restraints

- 3.2.2.1. High Initial Costs of Advanced Batteries (Lithium-ion)

- 3.2.2.2. Maintenance Requirements and Lifespan of Lead-Acid Batteries

- 3.2.2.3. Environmental Concerns Related to Battery Disposal and Recycling

- 3.2.2.4. Competition from Alternative Power Backup Solutions (Generators, etc.)

- 3.2.2.5. Lack of Awareness or Budget Constraints for Quality UPS Solutions in Smaller Segments

- 3.2.1. Drivers of Market Growth

- 3.1. Current Market Size and Valuation (as of June 2025)

- 4. Market Segmentation

- 4.1. By Battery Type / Chemistry

- 4.1.1. Lead-Acid Batteries (Largest Share Currently)

- 4.1.1.1. Sealed Maintenance-Free (SMF) VRLA Batteries

- 4.1.1.2. Tubular Batteries (Common for longer backup and harsh conditions)

- 4.1.1.3. Flooded Lead-Acid Batteries

- 4.1.2. Lithium-ion (Li-ion) Batteries (Fastest Growing Segment)

- 4.1.3. Nickel-Cadmium (NiCd) Batteries

- 4.1.1. Lead-Acid Batteries (Largest Share Currently)

- 4.2. By Capacity (kVA or Ah)

- 4.2.1. Small Battery (Less than 10 kVA / ~100Ah) - *Identified as fastest growing segment in some reports*

- 4.2.2. Medium Battery (10-100 kVA)

- 4.2.3. Large Battery (Above 100 kVA)

- 4.3. By Application / End-User

- 4.3.1. Data Centers (Major Driver, especially hyperscale and colocation facilities)

- 4.3.2. Telecommunications (5G rollout, network infrastructure)

- 4.3.3. Commercial (Banks, Retail, Offices, Government)

- 4.3.4. Industrial (Manufacturing, Process Industries)

- 4.3.5. Healthcare (Hospitals, Clinics, Diagnostic Centers)

- 4.3.6. Residential (Home UPS/Inverters, Smart Homes)

- 4.3.7. Others (e.g., Education, Transportation)

- 4.4. By Sales Channel

- 4.4.1. OEM (Original Equipment Manufacturer)

- 4.4.2. Aftermarket/Replacement

- 4.1. By Battery Type / Chemistry

- 5. Regional Analysis

- 5.1. North India

- 5.2. South India (Identified as Largest Market)

- 5.3. East India

- 5.4. West India

- 6. Competitive Landscape

- 6.1. Market Share Analysis of Key Players

- 6.2. Profiles of Major Domestic and International Companies Operating in India

- 6.2.1. Exide Industries Limited

- 6.2.2. Amara Raja Energy & Mobility Limited (Amaron)

- 6.2.3. Luminous Power Technologies Pvt Ltd.

- 6.2.4. Su-Kam Power Systems Ltd.

- 6.2.5. Microtek International Pvt. Ltd.

- 6.2.6. Okaya Power Pvt Ltd.

- 6.2.7. HBL Power Systems Limited

- 6.2.8. Livguard Batteries Pvt. Ltd.

- 6.2.9. Panasonic Energy India Co. Ltd.

- 6.2.10. Schneider Electric (APC by Schneider Electric)

- 6.2.11. Eaton Corporation plc

- 6.2.12. Vertiv Group Corp.

- 6.2.13. Delta Electronics India

- 6.2.14. Hitachi Hi-Rel Power Electronics Pvt. Ltd.

- 6.2.15. CyberPower Systems Inc.

- 6.2.16. Other Regional Players and New Entrants

- 6.3. Recent Developments, Partnerships, and Product Launches (e.g., new Li-ion battery offerings, collaborations for distribution)

- 7. Technological Trends and Innovations

- 7.1. Accelerating Shift Towards Lithium-ion Batteries: Advantages in lifespan, weight, charge time, and maintenance for data centers and high-demand applications.

- 7.2. Integration of IoT and AI for Smart Battery Monitoring and Predictive Maintenance.

- 7.3. Development of Energy-Efficient and Compact UPS Battery Solutions.

- 7.4. Focus on Sustainable and Recyclable Battery Components.

- 7.5. Advancements in Battery Management Systems (BMS) for Safety and Performance.

- 7.6. Modular Battery Designs for Scalability.

- 7.7. Adaptation of UPS Batteries for Renewable Energy Storage Applications.

- 8. Future Outlook and Projections (up to 2031)

- 8.1. Forecasted Market Size and CAGR

- (Expected to reach USD 633 Million by 2031 at a CAGR of 7.77% from 2025, or USD 916.5 million by 2030 at a CAGR of 22.7% from 2025. Note: The significant difference in CAGR could be due to differing market scope definitions, especially regarding the inclusion of large-scale ESS or only traditional UPS batteries.)

- 8.2. Emerging Opportunities in Tier 2/3 Cities and Rural Electrification.

- 8.3. Impact of India's Push for Domestic Manufacturing (PLI Schemes for Batteries).

- 8.4. Increasing Role of UPS Batteries in Supporting Green Energy Transition and EV Charging Infrastructure.

- 8.1. Forecasted Market Size and CAGR

- 9. Conclusion

Major Key Players

- Exide Industries Ltd. (India)

- Amara Raja Energy & Mobility (formerly Amara Raja Batteries Ltd.) (India)

- Luminous Power Technologies Pvt. Ltd. (India)

- Eaton Corporation Plc. (USA)

- Schneider Electric SE (France)

- Vertiv Group Corp. (USA)

- HBL Power Systems Ltd. (India)

- Okaya Power Group (India)

- Delta Electronics Inc. (Taiwan)

- Microtek Inverters (India)

Manufacturers Key Players

- Exide Industries Ltd. (India)

- Amara Raja Energy & Mobility (formerly Amara Raja Batteries Ltd.) (India)

- Luminous Power Technologies Pvt. Ltd. (India)

- HBL Power Systems Ltd. (India)

- Okaya Power Group (India)

- Su-Kam Power Systems Ltd. (India)

- Eastman Industries Ltd. (India)

- Base Corporation Ltd. (India)

- Invertek Energy (India)

- Livguard Energy Technologies Pvt Ltd (India)

- Panasonic Carbon India Co., Ltd. (India)

- Lento Industries Pvt. Ltd. (India)

- Microtek (India)

- UTL Solar (India)

- Consul Neowatt (India)

FAQ'S

For a single, multi and corporate client license, the report will be available in PDF format. Sample report would be given you in excel format. For more questions please contact:

Within 24 to 48 hrs.

You can contact Sales team (sales@marketinsightsresearch.com) and they will direct you on email

You can order a report by selecting payment methods, which is bank wire or online payment through any Debit/Credit card, Razor pay or PayPal.

Discounts are available.

Hard Copy