UPS Market

UPS Market By Capacity (Less than 10 kVA, 10-100 kVA and Above 100 kVA), By Technology (Standby UPS System, Online UPS System and Line-interactive UPS System), By Power Consumption (Data Centers, Telecommunications, Healthcare, Industrial and Others), By Region, By Competition Forecast & Opportunities, 2018-2028

Published Date: June - 2025 | Publisher: MIR | No of Pages: 320 | Industry: Power | Format: Report available in PDF / Excel Format

View Details Buy Now 2890 Download Free Sample Ask for Discount Request Customization| Forecast Period | 2024-2028 |

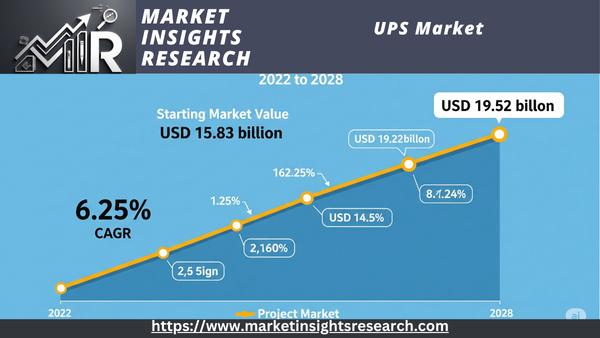

| Market Size (2022) | USD 15.83 billion |

| CAGR (2023-2028) | 6.25% |

| Fastest Growing Segment | Online UPS System |

| Largest Market | Asia-Pacific |

Market Overview

The Global UPS Market reached a size of USD 15.83 billion in 2022 and is projected to grow to USD 19.52 billion by 2028, with a CAGR of 6.25% from 2022 to 2028. The UPS market is projected to be driven by the growing demand for electricity, rising disposable income, and the need for a reliable power source. Industries and organizations heavily reliant on consistent electricity for efficient operations face significant disruptions and losses due to power outages and fluctuations. Developing nations face challenges in maintaining high-quality power supply.

Download Free Sample Ask for Discount Request Customization

Furthermore, the fourth industrial revolution has grown significantly in recent years, integrating cutting-edge technologies like IoT, cloud computing, analytics, artificial intelligence, and machine learning to transform manufacturing processes. Many companies use UPS systems to stabilize power and guarantee continuous data security and production line efficiency during outages because of how important these operations are. Therefore, based on the previously mentioned factor, the UPS market is anticipated to grow during the forecast period.

Key Market Drivers

Surge in Industrial Automation and IoT Adoption

The Internet of Things (IoT) and the growth of industrial automation have become important factors propelling the worldwide UPS market. Automation and IoT technologies have been fully adopted by the manufacturing, transportation, logistics, and smart infrastructure sectors in order to streamline operations, boost output, and minimize human involvement. Automation is largely dependent on delicate electronic equipment and control systems, both of which are vulnerable to power outages. Costly production losses and compromised safety can arise from even a brief power outage. By serving as a dependable buffer and guaranteeing a steady power supply to automation controllers, sensors, and actuators, UPS systems reduce the possibility of equipment damage and process interruption. Real-time data collection and transmission from IoT devices, which are integrated into a variety of applications, facilitates remote control and intelligent decision-making. UPS systems act as a vital safety measure during power outages, preserving communication channels and averting data loss in order to preserve the availability and integrity of IoT data streams.

Growing Concerns about Power Quality and Reliability

Worldwide, UPS systems are becoming more and more popular due to growing concerns about power quality and dependability. Voltage swings, sags, surges, and blackouts are common in utility power supplies, endangering delicate equipment and electronic devices. System failure, data corruption, or equipment malfunction can be caused by even small power outages. By providing connected equipment with clean, steady power, UPS systems successfully address power quality concerns. They act as a barrier of defense, guaranteeing a steady supply of regulated power and protecting delicate devices from utility power fluctuations. This improves system performance and efficiency in addition to extending the equipment's lifespan. Companies and organizations are becoming more aware of the costs of power-related outages, such as lost productivity, data recovery, and equipment repairs. In order to reduce these risks and ensure continuous operations, especially in areas with erratic utility power, they invest in UPS systems.

Download Free Sample Ask for Discount Request Customization

Need for Business Continuity and Disaster Recovery

One of the main factors propelling the worldwide UPS market is the need for disaster recovery and business continuity solutions. Natural disasters, equipment malfunctions, cyberattacks, and utility grid outages are just a few of the threats that organizations must deal with. Such disruptions can have serious repercussions, including monetary losses and reputational harm. Because they guarantee continuous operations during power outages, UPS systems are essential to business continuity plans. Businesses can carry out orderly shutdowns or seamlessly switch to secondary power sources by using UPS systems, which minimize downtime and mitigate data loss by providing instant backup power. Planning for disaster recovery, protecting vital infrastructure, and guaranteeing continuous customer service all depend on comprehensive backup power solutions. Effective disaster recovery plans must include UPS systems, which safeguard critical equipment, communication networks, and data centers to speed up recovery and restoration.

Download Free Sample Report

Key Market Challenges

Increasing Power Capacity Requirements

The growing demand for power-hungry electronic devices and infrastructure is driving up power capacity requirements, which is one of the major issues facing the global UPS (Uninterruptible Power Supply) market. Data centers, cloud computing facilities, and critical infrastructure require larger power capacities to support their operations as the world grows more digitally connected. The increase in power consumption is also a result of the growth of smart cities, electric cars, and industrial automation. The difficulty stems from the requirement to scale UPS systems in order to efficiently satisfy these increasing power demands. For example, thousands of servers and storage devices are housed in modern data centers, requiring large-scale UPS installations with significant capacity. To meet the demands of massive data centers, UPS manufacturers must create high-power density solutions that take up little room and provide effective power backup. Furthermore, the need for more reliable and power-efficient UPS solutions is fueled by developments in computing technologies like high-performance computing (HPC) and artificial intelligence (AI). To ensure smooth operation and avoid data loss, these technologies require a constant power source. For UPS manufacturers, meeting these increased power capacity demands while maintaining cost-effectiveness and energy efficiency presents a major technical and engineering challenge.

Environmental Sustainability and Energy Efficiency

The need to ensure environmental sustainability and energy efficiency in UPS systems is a challenge facing the global UPS market as environmental consciousness grows. UPS installations use a lot of energy, particularly in large facilities and data centers. Concerns about the UPS market's role in climate change are raised by the environmental effects of such power consumption as well as the related carbon emissions. The creation of energy-efficient UPS solutions that lower power losses and carbon footprints must be a top priority for UPS manufacturers in order to meet this challenge. Enhancing UPS efficiency and overall energy consumption is largely dependent on developments in power electronics and battery technologies. Using modular designs is one way to increase UPS systems' energy efficiency. By eliminating overprovisioning and minimizing energy waste during low load times, modular UPS architectures allow users to scale UPS capacity in response to real-time power demands. Further optimizing energy use in UPS systems is the use of low-loss transformers and sophisticated cooling techniques. Utilizing recyclable components and eco-friendly materials is another essential component of environmental sustainability in the UPS market. Incorporating eco-friendly materials into UPS construction, adopting sustainable manufacturing methods, and making sure that UPS components are properly recycled and disposed of at the end of their useful lives are all becoming more and more common among UPS manufacturers. UPS solutions that incorporate smart monitoring systems and energy-efficient power management features also enable users to monitor power consumption, spot inefficiencies, and put energy-saving measures in place. To sum up, the global UPS market faces difficulties in meeting the growing demands for power capacity brought on by digitalization and the increased power consumption in critical applications. At the same time, industry needs to address issues of energy efficiency and environmental sustainability in order to keep up with the global movement toward more environmentally friendly and energy-conscious practices. Collaboration with end users, ongoing research and development, and a strong dedication to innovation in the creation of more sustainable UPS solutions are all necessary to overcome these obstacles.

Key Market Trends

Increasing Dependence on Digital Infrastructure and Data Centers

The increasing dependence on data centers and digital infrastructure is driving the global UPS (Uninterruptible Power Supply) market. As digitalization, cloud computing, and data-driven technologies grow at an accelerated rate, companies and organizations across a range of industries rely significantly on a steady power supply to protect sensitive data and maintain operations. Because they store and process enormous amounts of data, data centers in particular have emerged as the backbone of the digital economy. To avoid data loss, equipment damage, and expensive downtime, these facilities require strong power protection solutions. In the event of utility outages or fluctuations, a UPS system provides instant backup power, guaranteeing a smooth transition to generator power or system shutdown, protecting vital data integrity and guaranteeing uninterrupted operations. The importance of a dependable power source is further highlighted by the growing popularity of online services, e-commerce, and remote work. In these technologically advanced settings, interruptions or outages can lead to decreased productivity, lost sales, and damage to a brand's reputation. In order to protect their mission-critical equipment, sustain productivity, and provide customers with uninterrupted services, businesses invest in top-notch UPS systems.

Segmental Insights

Type Insights

Over the course of the forecast period, the Online UPS is anticipated to maintain its dominance by holding the largest market share. There are several reasons for this. By continuously converting AC power to DC and back to AC, online UPS systems offer the highest level of power protection, guaranteeing a clean and dependable power source. These UPS systems provide smooth defense against electrical disruptions, voltage swings, and power outages. They are widely used in vital applications where dependable and continuous power supply solutions are essential, such as data centers, the healthcare industry, and the industrial sector. The online/double conversion segment's market dominance has been further reinforced by the rising need for power backup solutions and the increased dependence on digital infrastructure.

Capacity Perspectives

Over the course of the forecast period, the market is anticipated to be dominated by the Above 100 kVA power range segment. This is because medium- to large-scale applications that require higher power capacities are driving up demand for UPS systems. In order to guarantee an uninterrupted power supply for their vital operations, key industries like data centers, manufacturing, telecommunications, and healthcare mainly depend on UPS systems operating within this power range. Customers favor the 51-200 kVA segment because it balances power capacity, efficiency, and cost-effectiveness, securing its leading position in the market.

Regional Insights

Frequent blackouts and an unstable power supply are characteristics of the developing Asia-Pacific region, especially in nations like Malaysia, Cambodia, the Philippines, and others. The main end users of UPS systems in the area are the rapidly expanding commercial, residential, telecom, and industrial and manufacturing sectors. The economies of many nations are heavily reliant on manufacturing, with China serving as the world's largest manufacturing hub. In the Asia-Pacific area, South Korea, Indonesia, Japan, and India all make substantial contributions. Furthermore, during the forecast period, it is anticipated that nations like Singapore, Malaysia, and Vietnam will grow their market shares. The need for UPS systems in industrial facilities has been fueled by the automation of manufacturing processes, which involves computer-based control systems, PLC units, and process control applications. UPS systems protect equipment from power-related issues like sags, surges, voltage fluctuations, line noise, and harmonic distortions in addition to providing backup power during outages. Because of this, UPS systems are now essential in many different industries, such as banking, engineering, manufacturing, R&D, education, healthcare, IT, BPO, telecom, and aviation. The manufacturing sector includes a wide range of industries, including steel, automotive, food processing, and semiconductors. All of these industries depend on power quality equipment, such as UPS systems, to ensure continuous operations because power outages and fluctuations can result in significant financial losses.

Download Free Sample Ask for Discount Request Customization

Recent Developments

- In February 2022, Mitsubishi Electric Corporation announced the acquisition of Computer Protection Technology, Inc. (CPT), headquartered in California, through its United States subsidiary Mitsubishi Electric Power Products, Inc. (MEPPI). This strategic move aims to expand the Uninterruptible Power Supply (UPS) business in North America. With this acquisition, MEPPI and CPT are poised to strengthen their respective business structures by providing highly reliable and professional one-stop services — from installation to maintenance — for UPS systems in the North American market.

- In July 2022, Schneider Electric unveiled the enhanced EcoStruxure Service Plan for 10-40 kVA Three-Phase Uninterrupted Power Supply (UPS) products. The EcoStruxure Service Plan combines traditional on-site services with digital capabilities powered by the IoT-enabled EcoStruxure architecture. It offers customers 24/7 remote and on-site expertise and support. The enhanced service plan covers a range of Three-Phase Uninterruptible Power Supplies (UPS) from 10 to 40 kVA, suitable for IT or industrial applications. These include Easy-UPS 3S, Galaxy VS, Symmetra PX (up to 48 kVA), Smart-UPS VT, and Galaxy 3500.

- In 2021, Emerson introduced the Long-Life 240W and 480W DIN Rail Mounted Uninterrupted Power Supplies. These power supplies offer a remarkable service life of 15 years when paired with the ultra-reliable SolaHD SDU DC-B UPS control module.

- In October 2021, Schneider Electric unveiled the game-changing 5kW APC Smart-UPS Ultra to address hybrid IT infrastructure challenges. This latest single-phase Uninterruptible Power Supply (UPS) incorporates EcoStruxure for remote monitoring, management, and services, as well as Lithium-ion batteries. Notably, it is also the lightest single-phase 5kW UPS available in the market.

Key Market Players

- Riello Elettronica SpA

- EATON Corporation PLC

- Emerson Electric Co.

- Delta Electronics Inc.

- ABB Ltd

- Schneider Electric SE

- Hitachi Ltd

- Mitsubishi Electric Corporation

- General Electric Company

- Cyber Power Systems Inc.

|

By Capacity |

By Technology |

By Power Consumption |

By Region |

|

|

|

|

Related Reports

- Electric Boiler Market Size By Voltage Rating (Low, Medium), By Application (Residential, Commercial, Industrial, Food P...

- Europe Boiler Market By Fuel (Natural Gas, Oil, Coal, Electric), By Capacity (≤ 10 MMBtu/hr, > 10 - 50 MMBtu/hr, > 50 ...

- Boiler Market Size - By Fuel (Natural Gas, Oil, Coal, Electric), By Capacity (≤ 10 MMBtu/hr, > 10 - 50 MMBtu/hr, > 50 ...

- Residential Boiler Market Size By Technology (Condensing {Natural Gas, Oil, Electric}, Non-Condensing {Natural Gas, Oil,...

- Commercial Electric Boiler Market - By Voltage Rating (Low Voltage, Medium Voltage), By Capacity, By Product (Hot Water,...

- Combi Boiler Market - By Fuel (Natural Gas, Oil), By Technology (Condensing, Non-Condensing) & Forecast, 2024-2032

Table of Content

- 1. Executive Summary

- 1.1. Key Findings

- 1.2. Market Overview

- 1.3. Future Outlook

- 2. Introduction to the UPS Market

- 2.1. What is an Uninterruptible Power Supply (UPS)?

- 2.2. Types of UPS Systems

- 2.2.1. Offline/Standby UPS

- 2.2.2. Line-Interactive UPS

- 2.2.3. Online/Double-Conversion UPS

- 2.2.4. Modular UPS Systems

- 2.3. Importance of UPS Systems

- 2.4. Scope of the Report

- 3. Market Overview

- 3.1. Current Market Size and Valuation (as of June 2025)

- 3.2. Market Dynamics

- 3.2.1. Drivers of Market Growth

- 3.2.1.1. Increasing Reliance on IT Infrastructure and Data Centers

- 3.2.1.2. Growing Frequency of Power Outages and Grid Instability

- 3.2.1.3. Expansion of Telecommunications Infrastructure

- 3.2.1.4. Increasing Demand for Energy Storage Systems

- 3.2.1.5. Rising Awareness of Power Quality Issues

- 3.2.1.6. Increasing Demand for Consumer Electronics and Smart Homes

- 3.2.2. Challenges and Restraints

- 3.2.2.1. High Initial Investment Costs

- 3.2.2.2. Competition from Alternative Power Backup Systems

- 3.2.2.3. Environmental Concerns and Regulations

- 3.2.2.4. Technological Complexity and Skilled Personnel Deficit

- 3.2.2.5. Space Constraints

- 3.2.1. Drivers of Market Growth

- 4. Market Segmentation

- 4.1. By Product Type

- 4.1.1. Offline/Standby UPS

- 4.1.2. Line-Interactive UPS

- 4.1.3. Online/Double-Conversion UPS

- 4.2. By Component

- 4.2.1. Rectifier

- 4.2.2. Batteries

- 4.2.3. Inverter

- 4.2.4. Static Bypass Switch

- 4.2.5. Capacitors, Fans, Other Components

- 4.3. By Capacity

- 4.3.1. Less Than 10 kVA

- 4.3.2. 10-100 kVA

- 4.3.3. Above 100 kVA

- 4.4. By Application

- 4.4.1. Data Centers

- 4.4.2. Telecommunications

- 4.4.3. Industrial

- 4.4.4. Healthcare

- 4.4.5. Commercial

- 4.4.6. Residential

- 4.4.7. Marine

- 4.4.8. Transportation Industry

- 4.4.9. Other Applications

- 4.1. By Product Type

- 5. Regional Analysis

- 5.1. North America

- 5.2. Europe

- 5.3. Asia Pacific

- 5.4. Latin America

- 5.5. Middle East & Africa

- 6. Competitive Landscape

- 6.1. Market Share Analysis of Key Players

- 6.2. Profiles of Major Companies

- 6.3. Recent Developments, Strategic Partnerships, and Acquisitions

- 7. Technological Trends and Innovations

- 7.1. Shift Towards Lithium-ion Batteries

- 7.2. Modular UPS Systems

- 7.3. Smart and AI-Enabled UPS Systems

- 7.4. Grid-Tied and Off-Grid Capabilities / Hybrid UPS Systems

- 7.5. Enhanced Efficiency and Reliability

- 7.6. Compact Designs and Higher Power Density

- 7.7. Advanced Surge Protection

- 7.8. Cybersecurity Features

- 8. Future Outlook and Projections (up to 2030/2034)

- 8.1. Forecasted Market Size and CAGR

- 8.2. Emerging Opportunities and Applications

- 8.3. Impact of Policy and Technological Advancements

- 9. Conclusion

Major Key Players

- Schneider Electric SE (France)

- Eaton Corporation Plc. (USA)

- Vertiv Group Corp. (USA)

- ABB Ltd. (Switzerland)

- Mitsubishi Electric Corporation (Japan)

- Delta Electronics Inc. (Taiwan)

- Huawei Technologies Co., Ltd. (China)

- Siemens AG (Germany)

- Toshiba Corporation (Japan)

- Emerson Electric Co. (USA)

Manufacturers Key Players

- Schneider Electric SE (France)

- Eaton Corporation Plc. (USA)

- Vertiv Group Corp. (USA)

- ABB Ltd. (Switzerland)

- Mitsubishi Electric Corporation (Japan)

- Delta Electronics Inc. (Taiwan)

- Huawei Technologies Co., Ltd. (China)

- Siemens AG (Germany)

- Toshiba Corporation (Japan)

- Emerson Electric Co. (USA)

- Legrand (France)

- Riello Elettronica S.p.A. (Italy)

- CyberPower Systems Inc. (Taiwan)

- Luminous Power Technologies (India)

- Hitachi Hi-Rel Power Electronics Pvt. Ltd. (India)

- Socomec Group S.A. (France)

- Piller Group GmbH (Germany)

- KSTAR (China)

- Chloride Power (UK)

- Numeric UPS (Swelect Energy Systems Ltd) (India)

FAQ'S

For a single, multi and corporate client license, the report will be available in PDF format. Sample report would be given you in excel format. For more questions please contact:

Within 24 to 48 hrs.

You can contact Sales team (sales@marketinsightsresearch.com) and they will direct you on email

You can order a report by selecting payment methods, which is bank wire or online payment through any Debit/Credit card, Razor pay or PayPal.

Discounts are available.

Hard Copy