SLI Battery Market

SLI Battery Market - Global Industry Size, Share, Trends, Opportunity, and Forecast, Segmented By Type (Flooded, Enhanced Flooded Battery (EFB)), By Application (Automotive, UPS, Telecom, Others), By Sales Channel (OEM, Aftermarket), By Region, By Competition Forecast, 2018-2028

Published Date: June - 2025 | Publisher: MIR | No of Pages: 320 | Industry: Power | Format: Report available in PDF / Excel Format

View Details Buy Now 2890 Download Free Sample Ask for Discount Request Customization| Forecast Period | 2024-2028 |

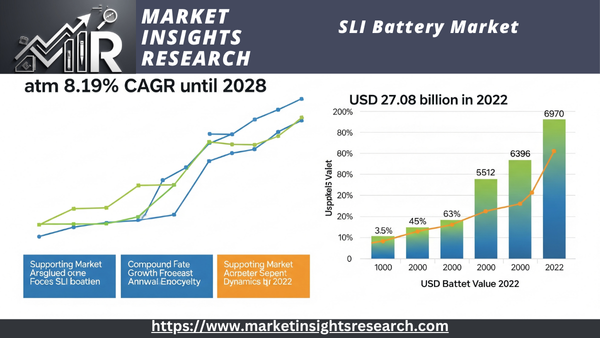

| Market Size (2022) | USD 27.08 billion |

| CAGR (2023-2028) | 8.19% |

| Fastest Growing Segment | Automotive |

| Largest Market | North America |

Market Overview

Global SLI Battery Market has valued at USD 27.08 billion in 2022 and is anticipated to project robust growth in the forecast period with a CAGR of 8.19% through 2028.

Download Free Sample Ask for Discount Request Customization

Government regulations, consumer preferences, technological advancements, and trends in the automotive industry all have an impact on the market's dynamics. Manufacturers, distributors, retailers, and service providers are just a few of the many parties involved. Furthermore, the market for SLI batteries keeps evolving to satisfy shifting needs while continuing to be an essential part of the larger automotive ecosystem as the automotive industry experiences major changes due to the rise of electric vehicles and cutting-edge automotive technologies.

Key Market Drivers

Increasing Automotive Sales and Production

The growing automotive sector is the primary driver of the global SLI (Starting, Lighting, and Ignition) battery market. The need for SLI batteries to power cars is growing along with the global demand for automobiles. Urbanization, increased disposable incomes, and better transportation infrastructure are all contributing to the rise in car ownership, especially in developing nations. Furthermore, since hybrid and conventional internal combustion engine (ICE) vehicles still depend on SLI batteries for their starting and auxiliary power requirements, the shift to electric vehicles (EVs) has also increased demand for these batteries.

Growing Renewable Energy Sector

Another important factor propelling the global SLI battery market is the growth of the renewable energy industry. Energy storage solutions are becoming more and more necessary as solar and wind energy systems become more widely used. SLI batteries are essential for supplying backup power for these systems. When demand outpaces supply or on overcast or windless days, these batteries release the excess energy they have stored during times of high renewable energy production. The demand for SLI batteries in the renewable energy sector is anticipated to keep rising as governments around the world support clean energy initiatives and grid stability.

Download Free Sample Ask for Discount Request Customization

Advancements in Battery Technology

SLI battery technology breakthroughs have been a major factor in the market's expansion. To increase the lifespan and performance of SLI batteries, manufacturers are continuously investigating and creating new materials and technologies. This includes the creation of absorbent glass mat (AGM) and improved flooded battery technologies, as well as advancements in lead-acid battery chemistry and improved grid designs. Because of these developments, batteries are now more effective, durable, and able to produce higher cold-cranking amps (CCA), which appeals to both consumers and businesses.

Increasing Adoption of Start-Stop Systems

The demand for SLI batteries has increased dramatically due to the widespread use of start-stop systems in contemporary automobiles. When the car stops, start-stop systems automatically turn off the engine, and when the driver accelerates, they turn it back on. Although this technology lowers emissions and fuel consumption, it puts more strain on the battery because it must withstand frequent restarts. SLI batteries used in cars with start-stop systems must therefore be of the highest caliber and able to withstand these requirements. The demand for SLI batteries is anticipated to increase as start-stop system adoption continues to grow as environmental regulations tighten and fuel efficiency becomes more significant.

Expansion of E-commerce and Last-Mile Delivery Services

The number of delivery trucks on the road has increased due to the quick expansion of e-commerce and the rising need for last-mile delivery services. The engines and auxiliary systems of these cars are powered by SLI batteries. This trend is anticipated to continue as more people shop online and have their purchases delivered to their homes. Additionally, the electrification of delivery fleets is increasing, requiring even more SLI batteries for these vehicles as many urban centers consider tougher emissions regulations to combat air pollution.

Maintenance and Replacement Market

The global SLI battery market is growing as a result of the maintenance and replacement market. Periodic battery replacement is still necessary as the number of vehicles worldwide increases. Furthermore, older batteries become outdated as SLI battery technologies advance, prompting car owners to swap out their old batteries for newer models. The demand for SLI batteries is maintained by this replacement market as well as the requirement for maintenance and repair services, which creates favorable conditions for producers, distributors, and service providers.

The growth of the automotive industry, the use of renewable energy, technological developments, the spread of start-stop systems, the growth of e-commerce, and the constant need for maintenance and replacement are some of the factors that influence the global SLI battery market, to sum up. Together, these factors support the market's tenacity and prospects for future expansion.

Government Policies are Likely to Propel the Market

Environmental Regulations and Emission Standards

The global market for SLI (Starting, Lighting, and Ignition) batteries is significantly impacted by environmental laws and emission standards enforced by governments worldwide. These regulations aim to lower greenhouse gas emissions and air pollution, both of which have an impact on the advancement and uptake of battery technologies.

Since many nations have imposed stricter emission regulations on automobiles, automakers are being pressured to create more fuel-efficient and low-emission vehicles, such as electric vehicles (EVs). Both hybrid and conventional internal combustion engine (ICE) vehicles, which need to adhere to these regulations, depend heavily on SLI batteries. To adhere to these rules, governments encourage the use of cutting-edge battery technologies like hybrid powertrains and start-stop systems.

In order to lessen the negative effects of battery production and disposal on the environment, environmental regulations frequently require recycling and disposal procedures for lead-acid batteries. These regulations influence the market for SLI batteries by encouraging innovation in battery chemistry and recycling techniques.

Subsidies and Incentives for Electric Vehicles

Many governments provide subsidies and incentives to encourage the use of electric vehicles (EVs) and lessen dependency on traditional internal combustion engine (ICE) vehicles. Tax credits, rebates, lowered registration costs, and access to carpool lanes are a few examples of these incentives. Since EVs depend on cutting-edge batteries for propulsion, their adoption has a substantial impact on the SLI battery market.

The demand for high-capacity lithium-ion batteries rises as a result of these policies, which encourage consumers to convert to electric vehicles. In order for EVs to be widely adopted, governments also encourage the construction of charging infrastructure. The need for SLI batteries in conventional cars may decline as EV sales rise, but there is still a significant demand for advanced batteries in general.

Recycling and Disposal Regulations

Governments have established rules and guidelines for the recycling and disposal of lead-acid batteries because of their negative effects on the environment. The goal of these regulations is to lessen SLI batteries' environmental impact over the course of their lifetime.

To guarantee that used batteries are disposed of or recycled appropriately, governments frequently mandate that battery manufacturers and recyclers set up collection and recycling programs. In certain areas, incorrect disposal of lead-acid batteries carries severe penalties. By promoting appropriate disposal methods and stimulating technological advancements in recycling, these rules make SLI batteries more ecologically friendly.

Energy Storage Incentives

Governments provide incentives and subsidies to support energy storage projects as the importance of energy storage solutions for grid stability and renewable energy integration grows. These incentives may be in the form of grants, tax credits, or advantageous financing conditions.

SLI battery technologies are frequently used in energy storage systems to store extra energy produced by renewable resources like wind and solar. The demand for SLI batteries in this industry is directly impacted by government policies that encourage energy storage projects.

Trade and Import Regulations

The global market for SLI batteries may also be impacted by import laws and international trade. Batteries entering their markets may be subject to import restrictions, tariffs, or quality standards imposed by the government. The price and accessibility of SLI batteries for both consumers and businesses may be impacted by these regulations.

Price swings and supply shortages in the SLI battery market can result from supply chain disruptions caused by trade disputes and protectionist policies. In order to successfully navigate international markets, manufacturers and distributors keep a close eye on trade regulations.

Research and Development Funding

Research and development (R&D) initiatives supported by the government are essential to the advancement of battery technology. Research on battery chemistry, materials, and manufacturing techniques may be supported by government funding. These programs spur innovation in the SLI battery sector, resulting in the creation of battery technologies that are more sustainable and efficient.

Government-funded research and development can also encourage cooperation between academic institutions and industry players, which will support the development of a cutting-edge and competitive SLI battery market.

To sum up, government policies significantly affect the global SLI battery market through establishing environmental standards, encouraging the use of EVs, controlling recycling procedures, providing incentives for energy storage, affecting trade dynamics, and stimulating research and development. Businesses in the SLI battery sector must comprehend and adjust to these policies in order to prosper in a regulatory environment that is changing quickly.

Key Market Challenges

Environmental Concerns and Sustainable Practices

The need for sustainable practices and environmental concerns are two of the biggest issues facing the global SLI (Starting, Lighting, and Ignition) battery market. Environmental problems, such as lead pollution and difficulties with recycling and disposal, have long been linked to SLI batteries, especially conventional lead-acid batteries.

Lead, a highly toxic material, is found in lead-acid batteries, which have been the industry standard for SLI applications for decades. Lead-acid battery recycling or improper disposal can contaminate water and soil, endangering both human and wildlife health. Governments have implemented strict laws controlling battery recycling and disposal to address this problem, but compliance can be difficult, especially in areas with weak enforcement.

Additionally, even though lead-acid batteries can be recycled, the procedure itself can require a lot of energy. This presents a sustainability challenge since the environmental advantages of recycling batteries must be balanced against the energy required for recycling. Although these efforts are continuous, manufacturers are actively investigating substitute materials and more effective recycling techniques to lessen the environmental impact of SLI batteries.

The manufacturing of cutting-edge battery technologies, like lithium-ion batteries used in electric vehicles (EVs), is another environmental concern in the SLI battery market. Human rights abuses and habitat destruction are just two examples of the detrimental effects that the extraction of lithium, cobalt, and other rare earth metals used in these batteries may have on the environment and society. The industry faces a difficult task in juggling the rising demand for EVs with sustainable practices and ethical sourcing.

Evolving Automotive Technology and Market Dynamics

Technology breakthroughs and shifting consumer preferences are driving the automotive industry's rapid transformation. As it negotiates changing automotive technology and market dynamics, this poses a serious challenge for the global SLI battery market.

The growing popularity of electric vehicles (EVs), which are powered by high-capacity lithium-ion batteries, is one significant change. The demand for conventional SLI batteries used in internal combustion engine (ICE) vehicles may decline as EVs become more popular and governments around the world set aggressive electrification goals. Even though SLI batteries are still necessary for both conventional ICE and hybrid cars, the growth trajectory might be impacted.

Furthermore, the needs for SLI batteries are evolving due to new automotive technologies like mild hybrid and start-stop systems. For SLI battery manufacturers, these systems present performance and durability issues because they require batteries that can withstand repeated starts and stops. It can be challenging to strike a balance between satisfying these changing demands and making sure that products are affordable for customers.

Additionally, connected and autonomous vehicles—which depend on sophisticated electrical systems—are becoming more and more common in the automotive industry. Sensor arrays, communication systems, and safety features are just a few of the vehicle functions that these systems depend on for dependable SLI batteries. There are technical difficulties in balancing the power requirements of these new technologies with the dependability of SLI batteries.

In conclusion, sustainability and environmental issues, as well as the requirement to adjust to changing market conditions and automotive technology, present difficulties for the global SLI battery market. Battery producers and other stakeholders must keep funding R&D, embrace sustainable practices, and be flexible in adapting to shifting consumer demands and legal requirements if they want to prosper in this changing environment.

Segmental Insights

Enhanced Flooded Battery (EFB)) Insights

In 2022, the Enhanced Flooded Battery (EFB) segment held the largest market share, and it is anticipated to continue to do so throughout the forecast period. In many areas, start-stop systems—which automatically turn off and restart a car's engine to conserve fuel and lower emissions during idle times—were growing more widespread. The frequent charge-discharge cycles connected to start-stop systems are ideally suited for EFB batteries. The widespread use of this technology increased demand for EFB batteries. The popularity of EFB batteries was also aided by the rise of hybrid cars, which combine electric and internal combustion engines. Batteries that can support both electrical energy storage for hybrid systems and traditional engine starting are frequently needed for hybrid vehicles. These two needs can be successfully satisfied by EFB batteries. When it comes to cycling performance, EFB batteries outperform conventional flooded batteries. With increasingly complex electrical systems, they are better suited to meet the demands of contemporary automobiles. EFB batteries last longer and continue to function even after repeated starts and stops. EFB batteries were first incorporated into vehicle designs by original equipment manufacturers (OEMs) in the automotive sector. The widespread use of EFB batteries in new cars was aided by the support of major automakers. Automakers were forced to invest in technologies like start-stop systems, which lower emissions and fuel consumption, by stricter environmental regulations and emissions standards. In order to support these systems and comply with regulatory requirements, EFB batteries are essential. As consumers' awareness of environmental impact and fuel efficiency grew, so did the demand for cars with start-stop technology. The demand for EFB batteries increased as a result.

Automotive Insights

With the biggest market share in 2022, the automotive segment is expected to grow rapidly over the course of the forecast period. With billions of automobiles on the road globally, the automotive industry is enormous. An SLI battery is necessary for starting the engine and powering vital electrical systems in practically every type of vehicle, including passenger cars, trucks, buses, motorcycles, and agricultural vehicles. The sheer number of cars guarantees a high and steady demand for SLI batteries. An essential component of the automotive ecosystem is SLI batteries. A car cannot start without a dependable SLI battery, and vital features like lighting, ignition, and accessory power would be jeopardized. Because of this crucial feature, SLI batteries are invaluable in the automotive sector. The typical lifespan of SLI batteries is between three and five years. As a result, the automotive industry has an ongoing cycle of replacement. Vehicle batteries need to be replaced as they get older, which adds to the continuous demand. For SLI battery producers, this cycle guarantees a steady market. Compact cars, large trucks, and everything in between are all part of the automotive industry. Because different vehicle types require different SLI battery types and sizes, battery manufacturers have a wide range of products to choose from. Because of this diversity, manufacturers are able to satisfy a wide range of consumer demands and preferences. More sophisticated SLI batteries are needed for automotive technological advancements like start-stop systems. When the car is stationary, these systems automatically turn off and restart the engine to conserve fuel and lower emissions. The growing prevalence of start-stop systems has increased the need for improved SLI batteries that can manage the extra power cycling. The demand for automobiles comes from all over the world. The market for SLI batteries is expanding as a result of rising car ownership, especially in emerging economies. This worldwide presence enables battery producers to reach a large consumer base. The demand for conventional ICE vehicles and their SLI batteries is stable, despite the automotive industry's evolution due to the introduction of electric vehicles (EVs), hybrid vehicles, and alternative propulsion technologies. For SLI battery manufacturers, this stability offers a solid base.

Regional Insights

North America

North America is the second-largest market for SLI batteries in the world, accounting for over 20% of the global market share. The growth of the SLI battery market in North America is being driven by the increasing demand for vehicles, particularly in the United States. The US is the largest automotive market in North America, and it is expected to remain so in the coming years.

Europe

Europe is the third-largest market for SLI batteries in the world, accounting for over 15% of the global market share. The growth of the SLI battery market in Europe is being driven by the increasing popularity of start-stop systems in vehicles. Start-stop systems are designed to save fuel by automatically turning off the engine when the vehicle is at a standstill. This process puts additional stress on the SLI battery, and therefore, there is a growing demand for high-performance SLI batteries in Europe.

Asia Pacific

Asia Pacific is the largest market for SLI batteries in the world, accounting for over 50% of the global market share. The growth of the SLI battery market in Asia Pacific is being driven by the increasing demand for vehicles in developing countries such as China and India. We expect China to maintain its position as the world's largest automotive market in the coming years.

Download Free Sample Ask for Discount Request Customization

Recent Developments

- In 2023, Clarios announced a USD 100 million investment in its SLI battery manufacturing facility in Monterrey, Mexico. The investment will be used to expand capacity and produce new advanced SLI battery technologies.

- In 2022, Exide Technologies announced a USD 120 million investment in its SLI battery manufacturing facility in Florence, South Carolina. The investment will be used to expand capacity and produce new advanced SLI battery technologies.

- In 2021, Johnson Controls announced a USD 60 million investment in its SLI battery manufacturing facility in Olathe, Kansas. Johnson Controls will use the investment to expand capacity and produce new advanced SLI battery technologies.

Key Market Players

- Johnson Controls, Inc.

- Clarios LLC

- GS Yuasa Corporation

- East Penn Manufacturing Co., Inc.

- Enersys

- Leoch International Technology Limited

- Crown Battery Manufacturing Company

- Trojan Battery Company

- Acumuladores Moura S.A.

- Power Sonic Corporation

|

By |

By Application |

By Sales Channel |

By Region |

|

|

|

|

Related Reports

- Fire Tube Industrial Boiler Market - By Capacity (<10 MMBtu/hr, 10-25 MMBtu/hr, 25-50 MMBtu/hr, 50-75 MMBtu/hr, >75 MMBt...

- Gas Fired Boiler Market Size - By Capacity (≤ 10 MMBtu/hr, > 10 - 50 MMBtu/hr, > 50 - 100 MMBtu/hr, > 100 - 250 MMBtu/...

- Europe Residential Boiler Market Size - By Technology (Condensing {Natural Gas, Oil, Electric}, Non-Condensing {Natural ...

- U.S. Boiler Market Size By Fuel (Natural Gas, Oil, Coal), Capacity, By Technology (Condensing, Non-Condensing), By Produ...

- Commercial Hot Water Boiler Market Size - By Fuel (Natural Gas, Oil, Coal, Electric), By Technology (Condensing, Non-Con...

- UK Commercial Boiler Market Size By Fuel (Natural Gas, Oil, Coal, Electric), By Capacity, By Technology (Condensing, Non...

Table of Content

- 1. Executive Summary

- 1.1. Key Findings

- 1.2. Market Overview

- 1.3. Future Outlook

- 2. Introduction to the SLI Battery Market

- 2.1. What are SLI (Starting, Lighting, and Ignition) Batteries?

- 2.2. How SLI Batteries Work

- 2.3. Types of SLI Batteries

- 2.3.1. Flooded Lead-Acid Batteries

- 2.3.2. Absorbed Glass Mat (AGM) Batteries

- 2.3.3. Enhanced Flooded Batteries (EFB)

- 2.3.4. Gel Batteries (less common for SLI but worth noting)

- 2.4. Importance of SLI Batteries in Automotive and Other Applications

- 2.5. Scope of the Report

- 3. Market Overview

- 3.1. Current Market Size and Valuation (as of June 2025)

- 3.2. Market Dynamics

- 3.2.1. Drivers of Market Growth

- 3.2.1.1. Increasing Global Automobile Production and Sales

- 3.2.1.2. Growing Vehicle Fleet and Aftermarket Replacements

- 3.2.1.3. Rise in Demand for Start-Stop Vehicle Technology

- 3.2.1.4. Expanding Industrial and Agricultural Applications

- 3.2.1.5. Growth in Portable Electronic Devices (for certain SLI types)

- 3.2.2. Challenges and Restraints

- 3.2.2.1. Increasing Penetration of Electric Vehicles (EVs)

- 3.2.2.2. Competition from Advanced Battery Chemistries (e.g., Lithium-ion)

- 3.2.2.3. Environmental Concerns and Regulations Regarding Lead

- 3.2.2.4. Price Volatility of Raw Materials

- 3.2.1. Drivers of Market Growth

- 4. Market Segmentation

- 4.1. By Technology Type

- 4.1.1. Flooded Lead-Acid Batteries

- 4.1.2. Enhanced Flooded Batteries (EFB)

- 4.1.3. Valve Regulated Lead-Acid (VRLA) Batteries

- 4.1.3.1. Absorbent Glass Mat (AGM)

- 4.1.3.2. Gel

- 4.2. By Application

- 4.2.1. Automotive (Passenger Cars, Commercial Vehicles, Heavy-Duty Vehicles)

- 4.2.2. Uninterruptible Power Supply (UPS)

- 4.2.3. Telecommunications

- 4.2.4. Industrial and Agricultural

- 4.2.5. Recreational Vehicles and Golf Carts

- 4.2.6. Others (e.g., Marine, Solar Backup)

- 4.3. By Sales Channel

- 4.3.1. Original Equipment Manufacturer (OEM)

- 4.3.2. Aftermarket

- 4.4. By Capacity (e.g., Under 20 Ah, 20-50 Ah, 50-100 Ah, Over 100 Ah)

- 4.1. By Technology Type

- 5. Regional Analysis

- 5.1. North America (U.S., Canada, Mexico)

- 5.2. Europe (Germany, UK, France, etc.)

- 5.3. Asia Pacific (China, India, Japan, South Korea, etc.)

- 5.4. Latin America

- 5.5. Middle East & Africa

- 6. Competitive Landscape

- 6.1. Market Share Analysis of Key Players

- 6.2. Profiles of Major Manufacturers

- 6.2.1. EnerSys

- 6.2.2. Exide Technologies (including Exide Industries Ltd. in India)

- 6.2.3. GS Yuasa International Ltd.

- 6.2.4. Clarios (formerly Johnson Controls Power Solutions)

- 6.2.5. East Penn Manufacturing Co., Inc.

- 6.2.6. Amara Raja Energy & Mobility Limited (India-specific)

- 6.2.7. Leoch International Technology Limited

- 6.2.8. Camel Group Co., Ltd.

- 6.2.9. Crown Battery Manufacturing Company

- 6.2.10. Stryten Energy LLC

- 6.2.11. Other Prominent Players

- 6.3. Recent Developments, Product Launches, and Strategic Partnerships

- 7. Technological Trends and Innovations

- 7.1. Advancements in Lead-Acid Battery Design (e.g., improved plate alloys, separators)

- 7.2. Enhanced Performance for Start-Stop Applications

- 7.3. Integration with Battery Management Systems (BMS) for Optimization

- 7.4. Focus on Green Batteries and Recycling Initiatives

- 8. Future Outlook and Projections (up to 2030/2034)

- 8.1. Forecasted Market Size and CAGR

- 8.2. Emerging Opportunities and Challenges

- 8.3. Impact of EV Adoption and Government Policies

- 9. Conclusion

Major Key Players & Manufacturers in the SLI Battery Market:

- Clarios

- Exide Technologies

- EnerSys

- East Penn Manufacturing Co.

- GS Yuasa International Ltd.

- Amara Raja Energy & Mobility Limited

- Panasonic Corporation

- Samsung SDI Co., Ltd.

- BYD Company Ltd.

- CATL (Contemporary Amperex Technology Co. Limited)

- Leoch International Technology Limited

- Camel Group Co., Ltd.

- Tianneng Battery Group

- HBL Power Systems Ltd.

- FIAMM Energy Technology S.p.A.

- ACDelco

- Continental Battery Systems

- Crown Battery Manufacturing Company

- Discover Battery

- AtlasBX Co., Ltd.

- Sebang Global Battery Co., Ltd. (Rocket Battery)

- The Furukawa Battery Co., Ltd.

- Robert Bosch GmbH

- Stryten Energy

- Moura S.A.

- CSB Energy Technology Co., Ltd.

- EVE Energy Co., Ltd.

- Gotion High-tech Co., Ltd.

- TATA AutoComp GY Batteries Pvt. Ltd.

- Southern Batteries Pvt. Ltd.

- SAFT Groupe SA

- Luminous Power Technologies Pvt. Ltd.

- Okaya Power Group

- Waaree Technologies Private Limited

- Su-Kam Power Systems Ltd.

- Karacus Energy Private Limited

- Eveready Industries India Ltd.

- Goldstar Power Ltd.

FAQ'S

For a single, multi and corporate client license, the report will be available in PDF format. Sample report would be given you in excel format. For more questions please contact:

Within 24 to 48 hrs.

You can contact Sales team (sales@marketinsightsresearch.com) and they will direct you on email

You can order a report by selecting payment methods, which is bank wire or online payment through any Debit/Credit card, Razor pay or PayPal.

Discounts are available.

Hard Copy