Battery Swapping Market

Battery Swapping Market - Global Industry Size, Share, Trends, Opportunity, and Forecast, Segmented By Vehicle (2 Wheeler, 3 Wheeler, 4 Wheeler, Others), By Services (Subscription, On-Demand), By Station Type (Manual, Automated), By Battery Type (Lithium-ion, Lead-acid, Others), By Battery Capacity (Less than 30 kWh, More than 30 kWh), By Region, By Competition Forecast, 2018-2028

Published Date: May - 2025 | Publisher: MIR | No of Pages: 320 | Industry: Power | Format: Report available in PDF / Excel Format

View Details Buy Now 2890 Download Free Sample Ask for Discount Request Customization| Forecast Period | 2024-2028 |

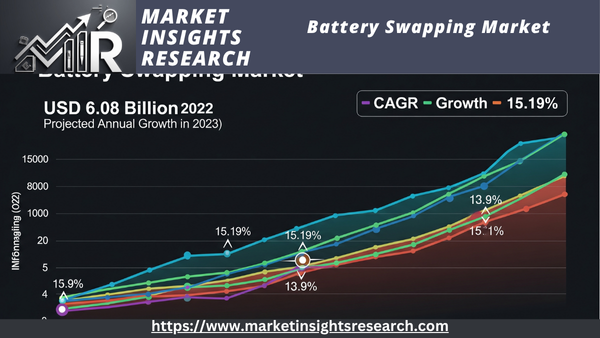

| Market Size (2022) | USD 6.08 billion |

| CAGR (2023-2028) | 15.19% |

| Fastest Growing Segment | Lithium-ion |

| Largest Market | Asia Pacific |

Market Overview

The global battery swap market is valued at USD 6.08 billion in 2022 and is anticipated to project robust growth in the forecast period, with a CAGR of 15.19% through 2028.

Download Free Sample Ask for Discount Request Customization

The Battery Swapping market refers to a segment of the electric vehicle (EV) industry dedicated to the exchange or replacement of depleted vehicle batteries with fully charged ones at specialized stations. This innovative approach to EV charging offers an alternative to traditional plug-in charging methods and addresses common challenges such as lengthy charging times and range anxiety. In the Battery Swapping market, EV owners can visit designated swapping stations where automated systems swiftly remove the discharged battery from the vehicle and replace it with a fully charged battery pack. This process significantly reduces the time required for recharging, typically taking just a few minutes, offering a level of convenience comparable to refueling a gasoline-powered vehicle. Battery Swapping technology is gaining traction as an attractive solution for various types of electric vehicles, including passenger cars, commercial vehicles, and electric scooters. The market encompasses a range of stakeholders, from battery swapping station operators and equipment manufacturers to EV manufacturers and infrastructure developers. It plays a crucial role in promoting the adoption of electric vehicles by enhancing their usability and convenience, ultimately contributing to the global transition toward sustainable and eco-friendly transportation solutions.

Key Market Drivers

Growing Electric Vehicle (EV) Adoption

The growing global use of electric vehicles (EVs) is the main factor propelling the battery swapping market's explosive expansion. There is a growing trend toward electrifying transportation as nations work to combat climate change and reduce greenhouse gas emissions. Automakers are being compelled by this shift to create a broad variety of electric vehicles, ranging from small cars to commercial trucks. The limited range and lengthy charging times of conventional EVs are being addressed by battery swapping technology, which is causing the market to grow more quickly.

Manufacturers of electric vehicles are realizing more and more how battery swapping can improve user convenience and alleviate range anxiety. Battery swapping drastically cuts down on the amount of time required for recharging by enabling EV owners to swiftly swap out their depleted batteries for fully charged ones at designated swapping stations. The market for battery swapping is expanding as a result of the convenience factor that is encouraging more people to buy electric cars.

Infrastructure Expansion

Another important factor propelling the global market is the development of battery-swapping infrastructure. Businesses are spending a lot of money creating a vast network of swapping stations in order to encourage the use of battery swapping technology. By making swapping facilities easily accessible to EV owners, this expansion seeks to make EVs a realistic and feasible choice for everyday use.

Electric vehicles' range becomes less of an issue as the number of swapping stations rises, opening them up to a wider market. These charging networks, which offer a strong ecosystem that facilitates battery swapping, are being implemented by governments and private businesses working together. In order to ensure that EV owners can travel conveniently across a variety of terrains and locations, this infrastructure growth is not just occurring in urban areas but is also spreading into rural areas.

Download Free Sample Ask for Discount Request Customization

Faster Charging Times

Faster charging times than conventional EV charging techniques are one of the main benefits of battery swapping technology. Battery swapping still has an advantage in terms of speed, even though fast-charging stations have greatly improved. It only takes a few minutes to swap out a depleted battery for a fully charged one, which makes it a very alluring choice for time-conscious people.

For companies and commercial fleet operators, this rapid charging capability is especially important. It allows electric vehicles to stay in operation for longer periods of time by reducing downtime. Battery swapping technology offers a compelling solution for companies looking to cut expenses and boost productivity, which is driving the market's expansion.

Environmental Sustainability

One of the main factors propelling the battery swapping market is environmental sustainability. Battery swapping offers itself as an environmentally friendly solution as the world struggles to combat climate change and reduce carbon emissions. Battery swapping lessens the transportation sector's overall greenhouse gas emissions and dependency on fossil fuels by promoting the switch to electric vehicles.

To further reduce the carbon footprint connected with electric vehicles, some battery swapping companies give preference to renewable energy sources when charging their batteries. The market for battery swapping services is growing as a result of this dedication to environmental sustainability, which appeals to businesses and consumers who care about the environment.

Government Incentives and Policies

The market for battery swapping is largely driven by government policies and incentives. Many nations are putting laws into place to encourage the use of electric vehicles and aid in the construction of infrastructure for charging them. These regulations frequently offer grants, tax breaks, and subsidies to both owners of electric vehicles and those who run charging stations.

Governments in some areas are aggressively promoting battery swapping technology through regulatory frameworks and financial incentives. For instance, they might offer tax benefits to businesses that invest in battery swapping infrastructure or finance the installation of swapping stations. Government support like this fosters the growth of the battery swapping market and attracts private sector investment in this technology.

Technological Advancements

One of the main factors propelling the expansion of the worldwide battery swapping market is advancements in battery technology. The viability and effectiveness of battery swapping solutions are increased by ongoing advancements in battery energy density and general performance. The process of swapping batteries gets even more convenient and useful as they get smaller and can store more energy.

The market is also growing as a result of advancements in battery management systems and vehicle-to-grid (V2G) integration. The appeal of battery swapping is further enhanced by these developments, which make it possible to better regulate battery performance and integrate EVs into smart grid systems.

In summary, the growing use of electric vehicles, developing infrastructure, quicker charging times, environmental concerns, government support, and technological advancements are all driving the global battery swapping market. Collectively, these forces are influencing how transportation will develop in the future and hastening the shift to an ecosystem of electric and sustainable mobility.

Download Free Sample Ask for Discount Request Customization

Government Policies are Likely to Propel the Market

Subsidies and Incentives for Battery Swapping Infrastructure Development

As part of their larger initiatives to support environmentally friendly transportation and fight climate change, governments everywhere are realizing how critical it is to encourage the expansion of the battery swapping industry. Offering incentives and subsidies for the construction of battery swapping infrastructure is one important policy.

Governments provide grants and financial incentives to businesses and organizations that make investments in the development and expansion of battery swapping stations under this policy. Direct funding, tax breaks, or lessened regulatory burdens are some examples of these incentives. Governments hope to hasten the development of a strong battery swapping network by offering financial assistance, increasing accessibility for EV owners and promoting its uptake.

These subsidies encourage competition and innovation in the market, which eventually benefits consumers and the environment, in addition to lessening the financial burden on companies wishing to invest in battery swapping infrastructure.

Regulation and Standardization of Battery Swapping Technology

Governments are essential in regulating and standardizing the technology to guarantee the secure and effective operation of battery swapping facilities. The design, construction, and operation of battery swapping stations are governed by industry standards and safety laws that are developed and enforced under this policy.

These standards, which address topics like battery compatibility, safety procedures, and environmental considerations, are developed by government organizations in cooperation with industry stakeholders. Governments can encourage consumers to accept battery swapping as a practical and secure alternative for EV charging by putting in place a clear regulatory framework.

Additionally, standardization promotes interoperability between various battery swapping providers, making it simple for EV owners to access a variety of swapping stations. By preventing the development of proprietary systems that might impede market expansion, this policy encourages fair competition.

Research and Development Funding

Research and development (R&D) projects that advance battery swapping technology are funded by numerous governments. For battery swapping systems to become more innovative and efficient, this policy is crucial.

In order to investigate new materials, battery management technologies, and automation solutions for battery swapping stations, government-funded R&D programs frequently work with academic institutions, research centers, and private businesses. These initiatives seek to solve technical issues, lower expenses, and improve battery swapping infrastructure's overall functionality.

Governments that invest in R&D not only promote technological advancements but also the development of a domestic industry that develops and manufactures battery swapping systems, which boosts economic growth and creates jobs.

Emission Reduction Targets and Incentives for Electric Vehicle Adoption

To fight climate change, numerous governments have set aggressive emission reduction goals. They do this by enacting laws that encourage the use of electric cars, which raises demand for battery swapping technology.

Offering financial incentives to purchasers of electric vehicles, such as tax credits, rebates, or exemptions from tolls and congestion charges, is one popular policy strategy. These incentives lower the initial cost of EVs, increasing their affordability and consumer appeal.

Governments may provide incentives for battery swapping in addition to incentives for EV purchases. To further promote the use of electric vehicles and battery swapping services, they could, for example, offer discounts or free battery swaps at public charging stations.

Integration of Battery Swapping into Public Transportation

In order to lower emissions and enhance the quality of the air in cities, governments frequently encourage the use of battery swapping technology in public transit systems. Under this policy, municipalities and transit agencies will receive financial assistance and support as they convert their fleets to electric buses and other battery-swapping electric vehicles.

Governments can significantly reduce greenhouse gas emissions and promote cleaner air in urban areas by incorporating battery swapping into public transportation. To promote the use of electric buses with battery swapping technology, they might also designate specific lanes or give them priority access.

In order to ensure a smooth transition to electric public transportation, governments may also form alliances with private businesses to build and maintain battery swapping infrastructure at transit depots and along bus routes.

International Collaboration and Trade Agreements

Governments understand how crucial international cooperation is to fostering the expansion of the battery swapping industry. They participate in trade agreements and diplomatic initiatives to promote the international sharing of battery swapping components, technology, and knowledge.

Negotiating trade agreements that lower tariffs and trade barriers on goods and services related to battery swapping is a common step in these policies. Governments support the growth of cross-border battery swapping networks and the creation of a standardized global ecosystem by fostering international cooperation.

Governments may also collaborate with other nations on research projects and knowledge-sharing programs to hasten the advancement and uptake of battery swapping technology. These partnerships help make the global battery swapping market more integrated and effective.

In summary, government regulations have a significant impact on how the global battery swapping market expands and changes. These policies, which range from financial incentives and regulations to R&D funding and international collaboration, all work together to foster an environment that is conducive to the development of sustainable transportation solutions and the adoption of battery swapping technology.

Key Market Challenges

High Initial Investment Costs

The high upfront costs of setting up and growing battery swapping infrastructure are one of the major obstacles facing the global battery swapping market. It takes a significant financial outlay to build a network of swapping stations, each outfitted with the required safety precautions and technology.

High-capacity energy storage units, automated battery handling systems, and sophisticated battery management technology are examples of the specialized equipment that is usually installed at battery swapping stations. Furthermore, it can be expensive to buy and store enough batteries to meet demand. Both public and private organizations wishing to enter the battery swapping market may find these infrastructure costs to be a major obstacle.

Additionally, costs are influenced by the accessibility and location of swapping stations. In order to provide electric vehicle (EV) owners with convenient access, stations must be positioned strategically, which calls for the purchase or rental of real estate in desirable areas. In crowded urban areas where space is limited, this can be especially difficult.

The initial cost of establishing a battery swapping network can put off potential investors and impede market expansion, even though the long-term advantages of shorter charging times and greater EV adoption are encouraging. Overcoming this obstacle requires coming up with creative ways to lower these upfront expenses or establishing public-private partnerships to split the cost.

Standardization and Interoperability

Two major issues facing the global battery swapping market are standardization and interoperability. The smooth functioning of battery swapping systems and their broad adoption may be restricted by the lack of common protocols and universal standards.

It is currently difficult for EV owners to access battery swapping services across multiple networks because different battery swapping providers may employ proprietary technologies and incompatible battery designs. Customers may become confused, irritated, and reluctant as a result of this fragmentation because they worry about being forced into the ecosystem of a particular provider.

When EV manufacturers create their own proprietary battery systems, interoperability problems may also occur, restricting consumer options and making swapping station operations more difficult. Furthermore, regional differences in safety, battery compatibility, and station operations regulations can make cross-border mobility and international travel even more challenging.

Both industry stakeholders and regulatory agencies must work together to address these issues. To guarantee interoperability and a consistent user experience, international standards for battery swapping technology, safety procedures, and communication interfaces must be established. To overcome this obstacle, governments and international organizations can be extremely helpful in promoting industry cooperation and standardization initiatives.

Additionally, consumers and the industry at large can gain from encouraging battery swapping providers to embrace open standards and collaborate in building a more integrated ecosystem. These initiatives will play a key role in increasing battery swapping's appeal and convenience as a practical electric vehicle charging option and hastening its widespread adoption.

Segmental Insights

2 Wheeler Insights

In 2022, the two-wheeler segment held the largest market share, and it is anticipated to continue to do so throughout the forecast period. Parking space shortages and traffic congestion are major problems in densely populated urban areas. Two-wheelers provide a useful way to move swiftly and effectively through traffic. Since battery swapping technology offers a quick and easy way to recharge without requiring a large infrastructure for charging, it fits in nicely with the urban mobility needs of two-wheelers. In urban areas, a large number of two-wheeler users commute relatively short distances. For these users, battery swapping is especially helpful because it allows them to quickly swap out their depleted batteries for fully charged ones, saving them from having to wait for a lengthy charging cycle. The 2-wheeler segment's adoption of battery swapping is significantly influenced by this convenience factor.

Lithium-ion Insights

Over the course of the forecast period, we expect the lithium-ion segment, which holds the biggest market share in 2022, to grow rapidly. The high energy density of lithium-ion batteries is well known for allowing them to store a substantial amount of energy in a small, light package. Because it enables a comparatively small and lightweight battery pack while maintaining a sufficient driving range, this feature is especially beneficial for electric vehicles (EVs) and battery swapping. Battery packs with a higher energy density are smaller and easier to handle during swapping procedures. Fast charging is a crucial component of battery swapping, and lithium-ion batteries are ideal for it. These batteries' ability to accept a rapid charge enables fast turnaround times at swapping stations. Due to its rapid charging capability, battery swapping is a quick and easy way for EV owners to recharge their vehicles. When compared to other battery types, such as lead-acid batteries, lithium-ion batteries typically have a longer cycle life. Lithium-ion batteries with a longer cycle life can be charged and discharged more frequently before experiencing a noticeable decline in performance. Durability is essential for battery-swapping applications, where batteries are regularly cycled in and out of service. In this situation, lithium-ion batteries are more dependable and economical. Compared to other battery chemistries like lead-acid batteries, lithium-ion batteries are substantially lighter. This weight advantage helps electric vehicles become lighter overall, increasing their efficiency and range. Lithium-ion batteries are also easier to handle and transport at swapping stations due to their lighter weight, which improves operation. Compared to alternatives like lead-acid batteries, lithium-ion batteries are typically thought to be more environmentally friendly. Because of their greater energy efficiency, they emit fewer greenhouse gases when utilized in EVs. Furthermore, lithium-ion batteries are easier to recycle and contain fewer hazardous materials, which supports environmental and sustainability objectives. Their dominance in the battery-swapping market is further fueled by their eco-friendly profile, which appeals to both consumers and regulatory agencies. Ongoing research and development in lithium-ion battery technology have resulted in continuous improvements in energy density, charging speed, and overall performance. Because of these developments, lithium-ion batteries are becoming a more alluring option for battery replacement because they may provide even more efficiency, convenience, and range.

Regional Insights

Asia Pacific

In 2022, the largest battery-swapping market was in Asia Pacific. China and India, the two biggest EV markets in the world, are located in this region and both have big plans to encourage battery swapping.

With more than a million battery-swapping stations operating, China leads the world in battery swapping. To encourage the adoption of battery swapping, the Chinese government has offered subsidies and other incentives.

Another significant market for battery swapping is India. The Indian government has announced plans to set up 10,000 battery-swapping stations by 2025. Several Indian companies, such as Ola Electric and Sun Mobility, are also developing battery-swapping networks.

North America

North America had the second-largest market for battery swapping in 2022. The market in North America is being driven by the increasing adoption of EVs and the growing number of battery swapping companies in the region.

Download Free Sample Ask for Discount Request Customization

Recent Developments

In January 2023, Taiwan-based Gogoro Inc. and Belrise Industries, an Indian automotive systems manufacturer, invested USD2.5 billion to set up a wide network of battery swapping stations for EVs in India.

In December 2022, Chinese battery-swapping company Aulton New Energy raised USD 200 million in a Series D funding round.

In November 2022, Indian battery-swapping company Swapp raised USD 25 million in a Series A funding round.

In October 2022, American battery-swapping company Ample raised USD 200 million in a Series C funding round.

In September 2022, European battery-swapping company Swobbee raised USD 100 million in a Series C funding round.

Key Market Players

- Nio Inc

- Gogoro Inc

- Aulton New Energy Automotive Technology Co., Ltd.

- SUN Mobility Private Limited

- Ola Electric Mobility Pvt Ltd.

- Swobbee GmbH

- SES S.A.

- Ample Technologies

- BattSwap Future

- Kwang Yang Motor Co., Ltd.

|

By Vehicle |

By Services |

By Station Type |

By Battery Type |

By Battery Capacity |

By Region |

|

|

|

|

|

|

Related Reports

- Europe Residential Boiler Market Size - By Technology (Condensing {Natural Gas, Oil, Electric}, Non-Condensing {Natural ...

- U.S. Boiler Market Size By Fuel (Natural Gas, Oil, Coal), Capacity, By Technology (Condensing, Non-Condensing), By Produ...

- Commercial Hot Water Boiler Market Size - By Fuel (Natural Gas, Oil, Coal, Electric), By Technology (Condensing, Non-Con...

- UK Commercial Boiler Market Size By Fuel (Natural Gas, Oil, Coal, Electric), By Capacity, By Technology (Condensing, Non...

- Residential Electric Boiler Market Size - By Voltage Rating (Low Voltage, Medium Voltage), Industry Analysis Report, Reg...

- Europe Steam Boiler Market - By Capacity, By Fuel (Natural Gas, Oil, Coal), By Technology (Condensing, Non-Condensing), ...

Table of Content

- 1. Executive Summary

- 1.1. Key Findings

- 1.2. Market Overview (Global market valued at USD 1.6 Billion in 2023, forecasted to reach USD 37.41 Billion by 2034 with a CAGR of 26.07% from 2025 to 2034; other reports suggest a CAGR of 28% from 2024 to 2032 or 31.5% from 2025 to 2035)

- 1.3. Future Outlook and Growth Opportunities

- 2. Introduction to the Battery Swapping Market

- 2.1. What is Battery Swapping? (Definition and Process)

- 2.2. How it Works (Automated vs. Manual Swapping)

- 2.3. Advantages of Battery Swapping for EV Users and Fleet Operators

- 2.3.1. Reduced Charging Time / Faster Refueling

- 2.3.2. Lower Upfront Cost of EVs (Battery-as-a-Service model)

- 2.3.3. Increased Vehicle Uptime and Efficiency (especially for commercial fleets)

- 2.3.4. Alleviates Range Anxiety

- 2.3.5. Potential for Battery Health Optimization (centralized charging)

- 2.4. Limitations of Battery Swapping

- 2.5. Scope of the Report

- 3. Market Overview

- 3.1. Current Market Size and Valuation (2025)

- 3.2. Market Dynamics

- 3.2.1. Drivers of Market Growth

- 3.2.1.1. Rapid Growth in Electric Vehicle (EV) Adoption Globally

- 3.2.1.2. Increasing Demand for Quick and Convenient Charging Solutions

- 3.2.1.3. Growth of Shared E-Mobility Services and Commercial EV Fleets

- 3.2.1.4. Government Support, Incentives, and Policy Frameworks for EV Infrastructure

- 3.2.1.5. Investments in Battery Swapping Infrastructure by OEMs and Startups

- 3.2.2. Challenges and Restraints

- 3.2.2.1. Lack of Standardization in Battery Design and Technology Across OEMs

- 3.2.2.2. High Initial Investment and Operational Costs for Swapping Stations

- 3.2.2.3. Technological Complexity and Need for Highly Efficient Automated Systems

- 3.2.2.4. Battery Degradation and Management of Older Batteries

- 3.2.2.5. Consumer Acceptance and Awareness

- 3.2.2.6. Safety and Security Concerns (e.g., fire incidents, malpractices)

- 3.2.1. Drivers of Market Growth

- 4. Market Segmentation

- 4.1. By Service Type

- 4.1.1. Subscription Model (Dominant segment)

- 4.1.2. Pay-per-Use Model

- 4.2. By Vehicle Type

- 4.2.1. Two-Wheelers (Leading segment, especially in Asia-Pacific)

- 4.2.2. Three-Wheelers (Light Commercial Vehicles - LCVs)

- 4.2.3. Passenger Cars

- 4.2.4. Commercial Vehicles (Four-Wheeler LCVs, Buses, Heavy-Duty Trucks)

- 4.3. By Station Type

- 4.3.1. Manual Swapping Stations

- 4.3.2. Automated Swapping Stations (Expected to grow faster)

- 4.4. By Battery Type/Chemistry

- 4.4.1. Lithium-ion (LiFePO4, NMC, NCA, LMO, LTO) (Dominant)

- 4.4.2. Lead-Acid

- 4.4.3. Other Emerging Battery Chemistries (e.g., Solid-State for future)

- 4.5. By Application

- 4.5.1. Passenger

- 4.5.2. Commercial

- 4.1. By Service Type

- 5. Regional Analysis

- 5.1. Asia Pacific (China, India, Japan, South Korea, Southeast Asia)

- 5.1.1. Dominant Market Share (e.g., 43.8% in 2024, CAGR of 23.3%)

- 5.1.2. High EV adoption, strong government initiatives, focus on two/three-wheelers

- 5.2. Europe (UK, Germany, France, Netherlands, Italy, Sweden, Poland)

- 5.2.1. Second Largest Market (e.g., 27.3% in 2024, CAGR of 25.1%)

- 5.2.2. Focus on reducing carbon emissions and expanding EV infrastructure

- 5.3. North America (U.S., Canada, Mexico)

- 5.4. Latin America, Middle East & Africa (LAMEA)

- 5.4.1. Fastest-Growing Regional Market (e.g., due to urbanization and public transport push)

- 5.1. Asia Pacific (China, India, Japan, South Korea, Southeast Asia)

- 6. Competitive Landscape

- 6.1. Market Share Analysis of Key Players

- 6.2. Profiles of Major Companies

- 6.2.1. NIO (China)

- 6.2.2. Gogoro (Taiwan)

- 6.2.3. Ample (U.S.)

- 6.2.4. SUN Mobility (India)

- 6.2.5. Contemporary Amperex Technology Co., Limited. (CATL) (China)

- 6.2.6. Battery Smart (India)

- 6.2.7. Esmito Solutions Pvt. Ltd. (India)

- 6.2.8. Aulton New Energy Automotive Technology Co., Ltd. (China)

- 6.2.9. Kymco (Kwang Yang Motor Co., Ltd.) (Taiwan)

- 6.2.10. Lithion Power (India)

- 6.2.11. VoltUp (India)

- 6.2.12. Other Emerging Players and Startups

- 6.3. Recent Developments, Strategic Partnerships, and Collaborations (e.g., Ample & Stellantis, ElectroRide & Battery Smart, NIO's collaborations)

- 6.4. Investment and Funding Landscape

- 7. Technological Trends and Innovations

- 7.1. Standardization of Battery Modules and Swapping Systems

- 7.2. Integration of AI and IoT for Optimized Battery Management and Station Operation

- 7.3. Advancements in Robotics for Automated Swapping Stations

- 7.4. Development of Robust Battery Management Systems (BMS) for Swappable Batteries

- 7.5. Focus on Second-Life Battery Applications and Recycling

- 7.6. Blockchain for Secure Energy Exchanges and Tracking

- 8. Future Outlook and Projections (up to 2030/2035)

- 8.1. Forecasted Market Size and CAGR

- 8.2. Emerging Opportunities (Fleet Electrification, Integration with Renewable Energy)

- 8.3. Impact of Policy and Regulatory Frameworks on Market Growth

- 8.4. Strategic Recommendations for Market Players and New Entrants

- 9. Conclusion

Major Key Players & Manufacturers in the Battery Swapping Market:

- NIO

- Gogoro Inc.

- Ample Inc.

- Sun Mobility Pvt. Ltd.

- Contemporary Amperex Technology Co. Limited (CATL)

- Battery Smart

- Esmito Solutions Pvt. Ltd.

- Lithion Power Pvt. Ltd.

- KYMCO (Kwang Yang Motor Co. Ltd.)

- Aulton New Energy Automotive Technology Co., Ltd.

- Honda Motor Co., Ltd. (for Mobile Power Pack)

- Hero MotoCorp Ltd. (in partnership with Gogoro)

- Ola Electric Mobility Pvt. Ltd.

- Bounce Infinity (partnering with Sun Mobility)

- Race Energy Ltd.

- Numocity

- Oyika Pte Ltd.

- ChargeUp

- VoltUp

- Amara Raja Energy & Mobility Ltd.

- Ampup Energy Private Limited

- Tual Technology Ltd.

- Qiyuan Green Power

- Battswap

- Batterypool

- Okaya EV Pvt. Ltd.

- Kooroo

- Swap Energi Indonesia

- Blueshark Asean

- Shell plc

- Janus Electric

- Swobbee

- E-Haul GmbH

- Contigo Mobility

- BYD Company Ltd.

- Panasonic Corporation

- LG Energy Solution

- SK Innovation Co., Ltd.

- Stellantis N.V. (partnering with Ample)

- Volkswagen AG

- General Motors Company

- Nissan Motor Corporation

- Ford Motor Company

- Daimler Truck AG

- Mourya Batteries Pvt. Ltd.

- Alcom Energy

- Exicom Tele-Systems Limited

FAQ'S

For a single, multi and corporate client license, the report will be available in PDF format. Sample report would be given you in excel format. For more questions please contact:

Within 24 to 48 hrs.

You can contact Sales team (sales@marketinsightsresearch.com) and they will direct you on email

You can order a report by selecting payment methods, which is bank wire or online payment through any Debit/Credit card, Razor pay or PayPal.

Discounts are available.

Hard Copy