Commercial Vehicle SLI Battery Market

Commercial Vehicle SLI Battery Market - Global Industry Size, Share, Trends, Opportunity, and Forecast, Segmented By Type (Flooded Type Battery, Maintenance-free Type Battery, AGM, Gel), By Application (OEM, Aftermarket), By Vehicle Type (Light Commercial, Medium Commercial, Heavy Commercial), By Sales Channel (Direct Sales, Distributors), By Region, By Competition Forecast, 2018-2028

Published Date: June - 2025 | Publisher: MIR | No of Pages: 320 | Industry: Power | Format: Report available in PDF / Excel Format

View Details Buy Now 2890 Download Free Sample Ask for Discount Request Customization| Forecast Period | 2024-2028 |

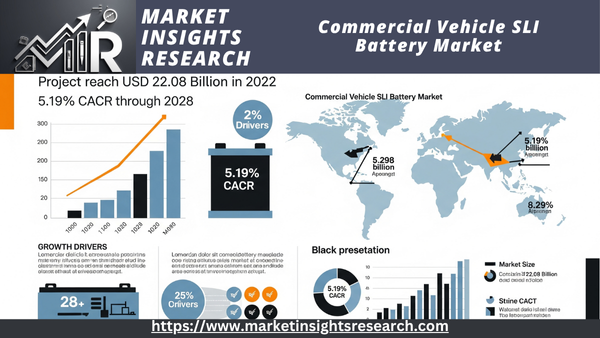

| Market Size (2022) | USD 22.08 billion |

| CAGR (2023-2028) | 5.19% |

| Fastest Growing Segment | Flooded Type Battery |

| Largest Market | Asia Pacific |

Market Overview

The global commercial vehicle SLI battery market was valued at USD 22.08 billion in 2022 and is anticipated to project robust growth in the forecast period, with a CAGR of 5.19% through 2028.

Download Free Sample Ask for Discount Request Customization

In this case, SLI batteries are crucial parts that start the engine, supply electricity for the lights, and support other vital electrical systems in these cars. Because commercial vehicles frequently withstand more demanding operating conditions and longer duty cycles, these batteries differ from those found in passenger cars primarily because of their higher capacity and durability requirements. Through reliable engine starts, effective lighting, and the operation of critical electrical systems, the market for SLI batteries in commercial vehicles contributes significantly to the functionality, dependability, and safety of these vehicles. As the need for environmentally friendly transportation options and the emphasis on sustainability grow, this market is also seeing advancements in battery technology to meet the changing demands of the commercial vehicle industry.

Key Market Drivers

Growing Demand for Commercial Vehicles

The increasing demand for commercial vehicles is driving a notable upswing in the global SLI (Starting, Lighting, and Ignition) battery market. There are multiple reasons for this increase in demand. First and foremost, the need for commercial vehicles to ease the transportation of goods has grown as a result of the growth of e-commerce and the logistics industry. Businesses are investing in larger fleets of delivery trucks, vans, and buses as a result of the growing popularity of online shopping. These vehicles all depend on SLI batteries for effective engine starting and electrical system operation.

Additionally, the need for public transportation, such as buses and taxis, has increased in emerging economies due to urbanization and population growth. SLI batteries are necessary for these cars' dependable lighting and ignition systems. The need for commercial vehicles with SLI batteries to power construction machinery and equipment is also being driven by the manufacturing and construction industries, which are essential to economic growth.

Advancements in Battery Technology

Another important factor propelling the global commercial vehicle SLI battery market is advancements in battery technology. Innovative battery designs and chemistries are constantly being developed by manufacturers to improve efficiency, performance, and durability. The use of enhanced flooded batteries (EFB) and absorbent glass mat (AGM), which perform better than conventional flooded batteries, is one notable trend. These cutting-edge technologies offer enhanced cycling capabilities, longer service life, and better cold-cranking amps (CCA).

Furthermore, it has become more common to incorporate smart features like remote monitoring and battery management systems (BMS). By extending battery life, preventing unplanned breakdowns, and monitoring battery health, these systems assist fleet managers and car owners in cutting operating expenses.

Download Free Sample Ask for Discount Request Customization

Stringent Emission Regulations

Cleaner and more efficient technologies are being adopted by the commercial vehicle industry as a result of strict emission regulations enforced by governments around the world. By facilitating the electrification of auxiliary systems like start-stop systems and regenerative braking in hybrid and electric commercial vehicles, SLI batteries play a critical role in lowering emissions. It is anticipated that the use of environmentally friendly commercial vehicles with cutting-edge SLI batteries will increase dramatically as governments enforce stricter emissions regulations to fight air pollution and climate change.

Increasing Focus on Fuel Efficiency

Fuel efficiency is becoming more and more important to the global commercial vehicle industry to lower operating costs and environmental impact. SLI batteries help achieve this objective by enabling start-stop systems, which save fuel by automatically shutting off the engine when the car is stationary and starting it again when necessary. This technology lowers emissions in addition to fuel consumption.

Expanding Electric Vehicle (EV) Market

The growth of the market for SLI batteries in commercial vehicles is closely related to the expanding electric vehicle (EV) market. High-performance SLI batteries are becoming more and more necessary for auxiliary systems like lighting and HVAC (heating, ventilation, and air conditioning) in electric commercial vehicles as their sustainability and reduced operating costs make them more and more popular. There is a significant opportunity for SLI battery manufacturers as commercial fleets, such as delivery vans, buses, and trucks, electrify.

Increasing Focus on Vehicle Safety

For manufacturers and operators of commercial vehicles, vehicle safety has emerged as a top priority. Safety systems rely on SLI batteries to power vital parts like stability control, airbags, and ABS (anti-lock braking systems). Reliable SLI batteries that can support these safety systems are becoming more and more necessary as the focus shifts to preventing accidents and guaranteeing the safety of drivers and passengers.

In summary, the growing demand for commercial vehicles, technological developments, stricter emissions regulations, a focus on fuel efficiency, the expansion of the electric vehicle market, and a growing emphasis on vehicle safety are all driving the global commercial vehicle SLI battery market. Together, these factors provide a favorable environment for the commercial vehicle SLI battery market to grow, giving manufacturers the chance to innovate and adapt to the changing demands of the market.

Download Free Sample Ask for Discount Request Customization

Government Policies are Likely to Propel the Market

Emission Standards and Incentives for Green Technologies

The global market for SLI (Starting, Lighting, and Ignition) batteries for commercial vehicles is significantly shaped by government regulations. The implementation of strict emission regulations and incentives for environmentally friendly technologies is one of the most important policies affecting this market. Globally, governments are becoming more and more concerned about greenhouse gas emissions and air pollution, especially from the commercial transportation industry.

Many governments have implemented emissions regulations to address this problem, which encourage commercial vehicle manufacturers to use cleaner technologies. These rules frequently contain particular emissions goals that can be achieved by using hybrid systems and electric cars, both of which depend on SLI batteries. Governments may provide incentives like tax credits, rebates, or subsidies in addition to regulations to promote the use of environmentally friendly SLI battery technologies. These regulations encourage manufacturers of commercial vehicles to spend money on R&D in order to create more effective SLI batteries that meet emission reduction targets.

Import Tariffs and Trade Regulations

The global market for SLI batteries for commercial vehicles is also greatly impacted by import taxes and trade laws. These regulations have the power to influence market dynamics by facilitating or impeding the cross-border movement of SLI batteries.

To safeguard domestic battery producers or encourage domestic manufacturing, governments may apply import taxes to SLI batteries. Imported batteries may become more expensive as a result of these tariffs, which would reduce their marketability. On the other hand, in order to satisfy the rising demand for commercial vehicles, governments may enact laws that promote the importation of sophisticated SLI batteries. Trade agreements and regulations have the power to help or hinder the global trade of SLI batteries, influencing market pricing and competitive dynamics.

Environmental Subsidies and Incentives

Governments in a number of areas have put in place environmental incentives and subsidies to encourage the use of green technologies, such as SLI batteries for commercial vehicles. Usually, these policies offer financial assistance to automakers and fleet managers who make investments in SLI battery technologies that are efficient and clean.

These subsidies can come in a number of forms, such as grants for R&D, tax breaks for businesses that use green technologies, and financial aid for the acquisition of electric and hybrid commercial vehicles that are fitted with cutting-edge SLI batteries. The environment and the industry both gain from such policies, which promote innovation and quicken the market adoption of SLI batteries.

Safety and Quality Standards

The safety and quality of SLI batteries used in commercial vehicles are also greatly influenced by government regulations. To ensure the dependability and functionality of SLI batteries, regulators frequently set strict guidelines and certification procedures that producers must follow.

By guaranteeing that the batteries fulfill the essential safety and performance standards, these regulations contribute to the development of trust between fleet managers, end users, and manufacturers of commercial vehicles. Compliance with these standards is often a prerequisite for market entry, effectively filtering out substandard products and enhancing the overall quality of SLI batteries in the market.

Recycling and Environmental Responsibility

Governments are paying more attention to the recycling and proper disposal of SLI batteries in response to worries about environmental sustainability. Reducing the environmental impact of battery production and disposal is the goal of these policies.

Manufacturers may be required by regulations to put recycling programs in place and make sure that used SLI batteries are disposed of properly. Governments may also set goals for battery material recovery and recycling, which would incentivize producers to create environmentally friendly battery technologies.

Research and Development Funding

The direction of research and development activities in the market for SLI batteries for commercial vehicles can be greatly influenced by government policies. Numerous governments set aside money to fund research projects that seek to advance battery technology, increase energy efficiency, and lower costs.

These regulations encourage creativity and hasten the creation of cutting-edge SLI batteries with enhanced functionality, extended lifespans, and less of an adverse environmental effect. Funding for research and development can also encourage cooperation between governments, universities, and private businesses, which will increase the commercial vehicle SLI battery market's size and global competitiveness.

Key Market Challenges

Technological Advancements and Innovation

The ongoing need for innovation and technological advancements is one of the main issues facing the global commercial vehicle SLI (Starting, Lighting, and Ignition) battery market. SLI batteries must develop to satisfy the needs of contemporary commercial vehicles as the globe shifts to greener and more energy-efficient modes of transportation. However, there are a number of obstacles that need to be addressed before these advancements can be achieved.

First and foremost, the integration of electric and hybrid vehicles is causing a rapid evolution in the commercial vehicle industry. In order to support auxiliary systems, regenerative braking, energy storage, and other conventional functions like engine starting and lighting, these vehicles need more advanced and high-performance SLI batteries. It is a major technical challenge to meet these varied demands while preserving affordability and dependability.

Additionally, battery manufacturers need to make significant investments in research and development because the market demands batteries with higher energy densities, longer lifespans, and faster charging speeds. It is a difficult and expensive task to create new chemistries and materials that can survive the harsh conditions of heavy-duty cycles and extremely high temperatures that are encountered in commercial vehicle use.

Product lifecycle management is also made more difficult by the rapid pace of technological innovation. In order to remain competitive, manufacturers must constantly update their products, which may result in shorter product lifespans as well as possible compatibility and standardization problems.

Furthermore, it is crucial to preserve SLI batteries' environmental sustainability and safety. It is a constant challenge to develop technologies that ensure the safe recycling and disposal of batteries at the end of their life cycle while minimizing the use of rare and hazardous materials.

Ultimately, a key element in the commercial vehicle SLI battery market's long-term success will be its capacity to adapt to shifting industry demands and keep up with technological advancements.

Regulatory and Environmental Compliance

Regulatory and environmental compliance present another major obstacle for the global market for SLI batteries for commercial vehicles. Stricter laws are being passed by governments all over the world to improve safety, lower emissions, and encourage sustainability in the automotive industry. These rules have a variety of effects on the design, production, and use of SLI batteries.

Governments are forcing manufacturers to embrace electric and hybrid technologies that depend on SLI batteries by enforcing stringent emissions regulations for commercial vehicles. Although this offers a chance, it also puts pressure on battery producers to create high-performance batteries that can satisfy these vehicles' energy and power needs. It takes a significant investment in R&D and production to comply with these regulations.

Safety RegulationsGovernments are constantly improving the safety regulations for commercial vehicles, including those pertaining to batteries. SLI batteries must adhere to strict safety regulations in order to be able to tolerate harsh circumstances, like high-impact collisions or thermal stress, without running the risk of exploding or catching fire. It's a difficult balancing act to follow these safety guidelines while preserving battery performance and efficiency.

Environmental ResponsibilitiesSLI battery recycling and disposal are governed by stringent environmental laws. To reduce the negative effects of battery disposal on the environment, governments are encouraging appropriate recycling techniques. To comply with these regulations, battery manufacturers and users must set up effective recycling and disposal procedures, which can present additional financial and logistical difficulties.

Global HarmonizationNavigating various and changing regulatory environments across the globe is a common challenge for the commercial vehicle SLI battery market. It can be challenging to harmonize standards and compliance requirements across various regions, particularly when national regulations differ greatly.

In conclusion, the global commercial vehicle SLI battery market faces a significant challenge in keeping up with regulatory and environmental compliance requirements. To maintain compliance and compete in the market, battery manufacturers and commercial vehicle operators must constantly adjust to changing regulations, make research and development investments, and create strong recycling and disposal procedures.

Segmental Insights

Flooded Type Battery Insights

The market share held by the Flooded Type Battery segment was the highest in 2022 and is anticipated to remain so throughout the forecast period. In comparison to some of the more recent SLI battery technologies, such as gel batteries and AGM (Absorbent Glass Mat), flooded batteries are frequently less expensive to produce. They are a desirable alternative for consumers and automakers alike because of their affordability, particularly in markets where consumers are price conscious. Flooded batteries are dependable and have been used for a long time. They have long been the go-to option for SLI applications due to their proven cranking amp performance and general dependability. Most auto parts stores and repair facilities around the world carry flooded batteries. For car owners, this accessibility makes maintenance and replacement easier. Easy upkeepAlthough routine maintenance is necessary for flooded batteries, such as checking and replenishing electrolyte levels with distilled water, this maintenance is rather simple and requires little equipment or experience. This degree of control over battery maintenance is preferred by certain customers. The fact that flooded batteries work with a variety of automobiles, including older models, adds to their ongoing appeal. They are a flexible option for a variety of automotive uses. Batteries that have been flooded are renowned for their resilience to adverse circumstances, such as high temperatures and vibrations. Because of this, they can be used in a wide range of applications, such as off-road vehicles and commercial vehicles. Lead-acid battery recycling, including flooded batteries, has a well-established infrastructure. Because the lead and other materials can be recycled and used again, this helps to ensure their environmental sustainability.

Light Commercial Insights

With the biggest market share in 2022, the Light Commercial segment is expected to grow rapidly over the course of the forecast period. Because of their versatility and extensive use, light commercial vehicles (LCVs) make up a significant portion of the global vehicle fleet. They have a number of uses, such as small-scale logistics, delivery services, and urban transportation. A major factor in the high demand for SLI batteries is the sheer number of LCVs on the road. There are many different industries and applications for LCVs. Businesses, governmental organizations, and private citizens all use them for things like small-scale construction, maintenance, and service operations, as well as for the transportation of goods. Since LCVs are necessary for each of these applications, the demand for SLI batteries is rising overall. Last-mile delivery services have grown in significance as a result of the global urbanization trend and the growth of e-commerce. Because of their agility and effectiveness in navigating urban settings, LCVs are the recommended option for these operations. The number of LCVs has increased as a result of this trend, increasing the need for SLI batteries. To transport goods and provide services, a large number of businesses and logistics companies keep fleets of LCVs. Since these fleets are frequently the foundation of their businesses, dependable SLI batteries are necessary to guarantee that cars start and run properly. The high demand for SLI batteries is a result of fleet operators' propensity to give battery replacement and maintenance top priority. LCVs encompass a variety of consumer automobiles, including pickup trucks, SUVs, and vans. Due to their versatility and widespread use for personal transportation, these cars are a mainstay in many homes. SLI batteries are essential to the daily operation of consumer vehicles, including commercial LCVs. Because LCVs are usually less expensive than their larger counterparts, a wider range of consumers can purchase them. The SLI batteries that are utilized in these cars are also reasonably priced. SLI batteries in LCVs are inexpensive for consumers and businesses to maintain and replace, which further contributes to market dominance. Compared to other battery types, SLI batteries in LCVs have comparatively shorter lifespans. They have a steady aftermarket demand since they need to be replaced on a regular basis. A stable market for SLI batteries in LCVs is guaranteed by this frequent replacement cycle. Technological developments in SLI batteries have enhanced their longevity, performance, and dependability, making them appropriate for a variety of uses, including LCVs. The role of SLI batteries in LCVs has been strengthened by these advancements.

Regional Insights

In 2022, the largest market for SLI batteries for commercial vehicles was Asia Pacific. This is a result of the region's growing commercial vehicle production and sales, especially in China and India. India is a significant market for commercial vehicles, and China is the world's largest manufacturer and consumer of these vehicles. Australia, South Korea, and Japan are some of the other important markets in the Asia Pacific area.

In 2022, the second-largest market for SLI batteries for commercial vehicles was North America. In North America, the United States and Canada are the two biggest markets for commercial vehicles. The commercial vehicle SLI battery market in the United States is expanding due to the rising demand for commercial vehicles in the country, especially from the logistics and e-commerce industries.

In 2022, the third-largest market for SLI batteries for commercial vehicles was Europe. Europe's biggest market for commercial vehicles is Germany, which is followed by the UK and France. The expansion of the commercial vehicle SLI battery market in Europe is being driven by the growing demand for commercial vehicles, especially from the manufacturing and construction industries.

Download Free Sample Ask for Discount Request Customization

Recent Developments

- In August 2023, Clarios, a global leader in advanced battery technologies, announced that it would invest USD100 million in its manufacturing plant in Olathe, Kansas. The investment will be used to expand the plant's capacity to produce advanced SLI batteries for commercial vehicles.

- In June 2023, NorthStar Battery, a leading manufacturer of lithium-ion batteries, announced that it had received USD100 million in funding from a group of investors. The funding will be used to accelerate the development and commercialization of NorthStar's lithium-ion batteries for commercial vehicles.

- In May 2023, Amara Raja Batteries, a leading Indian manufacturer of batteries, announced that it would invest USD200 million in expanding its manufacturing capacity for commercial vehicle SLI batteries. The investment is expected to create 1,000 new jobs.

- In April 2023, Exide Technologies, a global leader in battery manufacturing and recycling, announced that it had acquired the commercial vehicle SLI battery business of Delphi Technologies for USD1.2 billion. The acquisition will strengthen Exide's position in the SLI battery market for commercial vehicles.

Key Market Players

- Clarios LLC

- Johnson Controls International PLC

- East Penn Manufacturing

- EnerSys

- GS Yuasa Corporation

- Hitachi Chemical co., ltd.

- Hankook Tire & Technology Co., Ltd

- Amara Raja Batteries Limited

- Century Batteries

|

By Type |

By Application |

By Vehicle Type |

By Sales Channel |

By Region |

|

|

|

|

|

Related Reports

- Industrial Electric Boiler Market - By Voltage Rating (Low Voltage, Medium Voltage), By Capacity (< 10 MMBtu/hr, 10-50 M...

- Biomass Boiler Market - By Feedstock (Woody Biomass, Agricultural Waste, Industrial Waste, Urban Residue), By Product (S...

- Asia Pacific Electric Boiler Market Size - By Capacity (≤ 10 MMBtu/hr, > 10 - 50 MMBtu/hr, > 50 - 100 MMBtu/hr, > 100 ...

- North America & Europe Electric Boiler Market Size - By Voltage Rating (Low Voltage, Medium Voltage), By Application (Re...

- North America Residential Boiler Market Size - By Fuel (Natural Gas, Oil, Electric), By Technology (Condensing {Natural ...

- U.S. Commercial Boiler Market – By Product (Hot Water, Steam), Application (Offices, Healthcare Facilities, Educationa...

Table of Content

- 1. Executive Summary

- 1.1. Key Findings

- 1.2. Market Overview (Global SLI Battery Market size estimated at USD 5.28 Billion in 2025, with a CAGR of 13.34% during 2025-2034)

- 1.3. Future Outlook and Growth Opportunities for Commercial Vehicles

- 2. Introduction to the Commercial Vehicle SLI Battery Market

- 2.1. What are SLI Batteries? (Starting, Lighting, Ignition)

- 2.2. Specific Role of SLI Batteries in Commercial Vehicles

- 2.3. Key Characteristics of Commercial Vehicle SLI Batteries (Durability, Cranking Power, Resistance to Vibration)

- 2.4. Advantages of SLI Batteries for Commercial Vehicles

- 2.4.1. Cost-Effectiveness

- 2.4.2. Proven Reliability

- 2.4.3. High Cranking Amps for Large Engines

- 2.4.4. Wide Operating Temperature Range

- 2.5. Limitations of Commercial Vehicle SLI Batteries

- 2.6. Scope of the Report

- 3. Market Overview

- 3.1. Current Market Size and Valuation (2025, specific to Commercial Vehicles if available)

- 3.2. Market Dynamics

- 3.2.1. Drivers of Market Growth

- 3.2.1.1. Expanding Commercial Vehicle Production and Sales (Trucks, Buses, Vans, etc.)

- 3.2.1.2. Growth in Logistics, E-commerce, and Last-Mile Delivery Services

- 3.2.1.3. Increasing Average Age of Commercial Vehicle Fleets (driving aftermarket demand)

- 3.2.1.4. Demand for Reliable Power Sources in Heavy-Duty Applications

- 3.2.1.5. Low Cost and High Recyclability of Lead-Acid Batteries

- 3.2.2. Challenges and Restraints

- 3.2.2.1. Increasing Penetration of Electric Commercial Vehicles (using Lithium-ion)

- 3.2.2.2. Weight and Efficiency Limitations Compared to Advanced Chemistries

- 3.2.2.3. Environmental Concerns Regarding Lead

- 3.2.2.4. Price Volatility of Raw Materials (Lead)

- 3.2.1. Drivers of Market Growth

- 4. Market Segmentation

- 4.1. By Battery Type/Technology

- 4.1.1. Flooded Lead-Acid Batteries (FLA)

- 4.1.2. Valve Regulated Lead-Acid (VRLA) Batteries

- 4.1.2.1. Absorbed Glass Mat (AGM)

- 4.1.2.2. Gel Batteries

- 4.1.3. Enhanced Flooded Batteries (EFB)

- 4.2. By Vehicle Type

- 4.2.1. Light Commercial Vehicles (LCVs)

- 4.2.2. Medium Commercial Vehicles (MCVs)

- 4.2.3. Heavy Commercial Vehicles (HCVs)

- 4.2.4. Buses and Coaches

- 4.2.5. Off-Highway Commercial Vehicles (e.g., Construction, Agricultural)

- 4.3. By Sales Channel

- 4.3.1. Original Equipment Manufacturer (OEM)

- 4.3.2. Aftermarket

- 4.4. By Voltage (e.g., 12V, 24V)

- 4.5. By Capacity (e.g., Below 100 Ah, Above 100 Ah, specific to commercial vehicle ranges)

- 4.1. By Battery Type/Technology

- 5. Regional Analysis

- 5.1. North America (U.S., Canada, Mexico)

- 5.1.1. Demand for Freight Trucks and Heavy Vehicles

- 5.2. Europe (Germany, UK, France, Italy, etc.)

- 5.2.1. Stringent Emission Regulations Driving Advanced SLI Batteries (EFB, AGM)

- 5.3. Asia Pacific (China, India, Japan, South Korea, Australia)

- 5.3.1. Largest Market Share due to High Vehicle Production and Fleet Growth

- 5.3.2. Rapid Urbanization and Economic Growth

- 5.4. Latin America

- 5.5. Middle East & Africa

- 5.1. North America (U.S., Canada, Mexico)

- 6. Competitive Landscape

- 6.1. Market Share Analysis of Key Players

- 6.2. Profiles of Major Commercial Vehicle SLI Battery Manufacturers

- 6.2.1. EnerSys

- 6.2.2. Clarios (formerly Johnson Controls Power Solutions)

- 6.2.3. Exide Technologies

- 6.2.4. GS Yuasa Corporation

- 6.2.5. East Penn Manufacturing Co.

- 6.2.6. Amara Raja Batteries Ltd.

- 6.2.7. Camel Group Co., Ltd.

- 6.2.8. Leoch International Technology Ltd.

- 6.2.9. ACDelco (General Motors)

- 6.2.10. Banner Group

- 6.2.11. Furukawa Battery Co. Ltd.

- 6.2.12. Other Regional and Emerging Players

- 6.3. Recent Developments, Strategic Partnerships, and Acquisitions

- 7. Technological Trends and Innovations

- 7.1. Advancements in Lead-Acid Battery Design (e.g., Carbon Additives for Improved Cycle Life)

- 7.2. Enhanced Flooded Batteries (EFB) for Start-Stop Systems in Commercial Vehicles

- 7.3. Improvements in AGM Technology for Higher Performance and Durability

- 7.4. Focus on Battery Management Systems (BMS) for Optimization and Monitoring

- 7.5. Growth in Battery Recycling and Sustainable Manufacturing Practices

- 8. Future Outlook and Projections (up to 2030/2034)

- 8.1. Forecasted Market Size and CAGR (Overall SLI battery market expected to reach USD 16.30 Billion by 2034)

- 8.2. Emerging Opportunities in Specific Commercial Vehicle Segments

- 8.3. Impact of Regulations and Fleet Electrification on the Market

- 8.4. Role of Aftermarket in Sustaining Growth

- 9. Conclusion

Major Key Players & Manufacturers in the Commercial Vehicle SLI Battery Market:

- Exide Technologies

- Clarios

- EnerSys

- East Penn Manufacturing Co.

- GS Yuasa International Ltd.

- Amara Raja Energy & Mobility Limited

- Panasonic Corporation

- Samsung SDI Co., Ltd.

- LG Energy Solution

- BYD Company Ltd.

- CATL (Contemporary Amperex Technology Co. Limited)

- Leoch International Technology Limited

- Camel Group Co., Ltd.

- Tianneng Battery Group

- HBL Power Systems Ltd.

- FIAMM Energy Technology S.p.A.

- ACDelco

- Continental Battery Systems

- Crown Battery Manufacturing Company

- Discover Battery

- AtlasBX Co., Ltd.

- Sebang Global Battery Co., Ltd. (Rocket Battery)

- The Furukawa Battery Co., Ltd.

- Robert Bosch GmbH

- Stryten Energy

- Moura S.A.

- CSB Energy Technology Co., Ltd.

- EVE Energy Co., Ltd.

- Gotion High-tech Co., Ltd.

- TATA AutoComp GY Batteries Pvt. Ltd.

- Southern Batteries Pvt. Ltd.

- SAFT Groupe SA

- Jayachandran Industries (P) Ltd.

- Luminous Power Technologies Pvt. Ltd.

- Okaya Power Group

- Waaree Technologies Private Limited

- Su-Kam Power Systems Ltd.

- Karacus Energy Private Limited

- Eveready Industries India Ltd.

- Goldstar Power Ltd.

FAQ'S

For a single, multi and corporate client license, the report will be available in PDF format. Sample report would be given you in excel format. For more questions please contact:

Within 24 to 48 hrs.

You can contact Sales team (sales@marketinsightsresearch.com) and they will direct you on email

You can order a report by selecting payment methods, which is bank wire or online payment through any Debit/Credit card, Razor pay or PayPal.

Discounts are available.

Hard Copy