India DC Power Systems Market

India DC Power Systems Market Segmented By Type (Below 4 kW, 4.1-32 kW and Above 32 kW), By Application (Telecom, Industrial, Commercial and Others), By Region, and By Competition, 2019-2029

Published Date: June - 2025 | Publisher: MIR | No of Pages: 320 | Industry: Power | Format: Report available in PDF / Excel Format

View Details Buy Now 2890 Download Free Sample Ask for Discount Request Customization| Forecast Period | 2025-2029 |

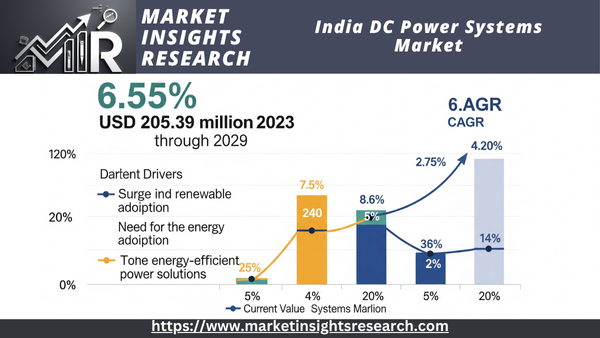

| Market Size (2023) | USD 205.39 million |

| CAGR (2024-2029) | 6.55% |

| Fastest Growing Segment | Telecom |

| Largest Market | South India |

Market Overview

India DC Power Systems Market has valued at USD 205.39 million in 2023 and is anticipated to project robust growth in the forecast period with a CAGR of 6.55% through 2029. One of the key factors driving the growth of the DC Power Systems Market in India is the growing integration of renewable energy sources, including solar and wind power, into the grid.

Download Free Sample Ask for Discount Request Customization

These sources create DC electricity, and effective capture and distribution of this clean energy depends critically on DC power networks. DC power systems are essential for allowing the penetration of renewable energy given India's lofty ambitions for them and the necessity to lower carbon emissions.

Key Market Drivers

Increasing Demand for Reliable Power Supply in Rural Areas

The growing need for consistent electricity supply in rural areas is driving India's DC power systems industry. India's mostly agricultural economy and large rural population underline the necessity of better access to energy. But many of these places get either insufficient or erratic power from the conventional AC grid. This irregularity of power stunts healthcare services, education, and economic growth.

DC power solutions have become a reasonable substitute to handle this problem. DC power can be obtained from several sources including batteries, solar panels, and wind turbines unlike AC electricity. DC systems are ideal for remote and off-grid locations since their adaptability in power generation and distribution. As a result, using DC microgrids and stand-alone systems to give rural areas continuous electricity is attracting increasing attention. Government projects as the "Saubhagya Scheme" and "Deen Dayal Upadhyaya Gram Jyoti Yojana" are helping DC power systems to be used in rural India.

Moreover, DC power systems have better energy economy than their AC counterparts, which is especially important in places with limited resources. These systems are cheap and sustainable since they reduce energy losses during distribution and transmission, therefore improving the access to electricity in rural India.

Growing Renewable Energy Integration

One of the key drivers of the India DC power systems market is the increasing integration of renewable energy sources into the country's energy mix. India has established ambitious targets for renewable energy to reduce its carbon footprint and combat climate change. Solar and wind power are two prominent sources of renewable energy, both of which generate DC electricity. DC power systems play a crucial role in efficiently utilizing this DC power and seamlessly integrating it into the existing grid.

DC-DC converters and inverters are utilized to convert the DC power generated by solar panels and wind turbines into AC power or other forms that can be stored in batteries. These components are essential for efficient energy harvesting and distribution. Additionally, the popularity of DC microgrids is growing for localized energy distribution in areas with high renewable energy generation.

The Indian government has implemented policies and incentives to promote renewable energy projects, which, in turn, drives the demand for DC power systems. As the country continues to invest in renewable energy infrastructure, the DC power systems market is poised for significant growth.

Download Free Sample Ask for Discount Request Customization

Data Centers and Telecom Sector Expansion

India's rapid digital transformation and the expansion of the data center and telecom sectors are fueling the demand for DC power systems. The increasing usage of smartphones, internet services, and cloud computing has led to a tremendous surge in the demand for data centers and telecom infrastructure. These facilities require a reliable and uninterrupted power supply to ensure continuous operation.

DC power systems offer numerous advantages to data centers and telecom networks. They provide a stable and efficient power supply, minimizing the risk of downtime and data loss. Moreover, DC power systems are inherently more efficient in powering sensitive electronic equipment, as most of these devices internally operate on DC power. This reduces the need for energy-wasting AC-DC conversions.

To meet the growing demand for data center and telecom infrastructure, there has been a significant deployment of DC power systems across the country. This trend is expected to persist as India's digital economy expands, making the DC power systems market a critical component of the nation's technological growth.

In conclusion, the India DC power systems market is driven by factors such as the need for reliable power in rural areas, the integration of renewable energy sources, and the expansion of data centers and the telecom sector. These drivers not only address critical energy challenges but also contribute to India's economic and technological development while promoting sustainability.

Key Market Challenges

Infrastructure Development and Modernization

The need of significant infrastructure expansion and modernization presents one of the main obstacles for the India DC power systems industry. India has a varied and large power infrastructure mostly based on the standard alternating current (AC) system. The switch to DC power systems offers a complex challenge since they naturally diverge from the current AC infrastructure.

Retrofitting the present AC systems to fit DC power can mostly prove to be an expensive and time-consuming task. This means replacing or boosting substations, transformers, and distribution lines to handle DC voltage levels. Moreover, including renewable energy sources—which usually produce DC electricity—into the grid calls for major changes.

Furthermore technically challenging is making sure DC power systems can be compatible with current AC systems. Perfect integration and operation depend on the standardizing and compatibility concerns being resolved. This calls for significant government agency, utility, and private sector stakeholder cooperation, research, and funding.

Cost and Affordability

Due mostly to economic issues, the installation of DC power systems presents a major difficulty in the Indian market. Though DC systems have clear benefits including better efficiency and compatibility with renewable energy sources, the initial outlay needed may be somewhat significant. Widespread adoption thus encounters challenges, particularly in rural and economically deprived areas.

Two different facets define the cost issues

Download Free Sample Ask for Discount Request Customization

Capital Costs

Operational Costs

To address these cost challenges effectively, innovative financing models, subsidies, and incentives from government bodies are necessary. These measures would make DC power systems more accessible and affordable to a broader range of consumers.

Key Market Trends

Rapid Adoption of DC Microgrids in Urban Areas

The fast acceptance of DC microgrids in metropolitan areas is one clear pattern in the India DC Power Systems Market. Reliable and sustainable electricity solutions are in growing demand as India's urban population keeps rising and cities becoming increasingly packed. Emerging as a potential answer to these energy problems in metropolitan settings are DC microgrids.

Higher efficiency and improved integration with renewable energy sources as solar panels and wind turbines, which produce DC electricity, are two benefits DC microgrids present. Rooft solar projects can be easily combined with DC microgrids in urban environments, where space is constrained, to supply sustainable energy to businesses, factories, and important infrastructure.

In urban environments, where power outages can affect daily life and business operations, DC microgrids' dependability is especially important. These microgrids provide backup power during grid outages or crises either running on their own or in tandem with the primary AC grid. Critical buildings including hospitals, data centers, and telecommunications networks depend on such durability.

Government programs and policies encouraging renewable energy and distributed power generation help to speed the acceptance of DC microgrids. Microgrids are encouraged to be used by programs like the Smart Cities Mission and other state-level initiatives, which also help urban designers to include DC power infrastructure into projects of city development.

Embracing DC microgrids is projected to become more popular as India keeps urbanizing and seeks sustainable energy solutions, therefore generating chances for businesses focused in DC power systems and microgrid technologies.

Growth of DC-Powered Electric Mobility Infrastructure

Growing DC-powered electric mobility infrastructure is another obvious trend in the India DC Power Systems Market. Electric cars (EVs) are becoming more and more popular in India as people become more conscious of environmental problems and advocate better transportation choices. DC power systems critically support the charging infrastructure needed for the general acceptance of EVs.

Major Indian towns and highways are seeing growing numbers of DC fast-charging stations, which provide quick and easy charging for owners of electric cars. DC fast-charging stations offer direct current (DC) electricity to EV batteries, therefore drastically lowering charging times unlike conventional slow-charging techniques using alternating current (AC).

This trend is driven by several factors

Government Initiatives

Automaker Investments

Urban Planning

Green Mobility Trends

As the electric mobility ecosystem matures in India, the DC power systems market is poised for significant growth. Companies specializing in DC fast-charging solutions and related technologies have a substantial opportunity to contribute to the country's sustainable transportation future. This trend aligns with India's commitment to reducing carbon emissions and promoting clean energy solutions in the transportation sector.

Regulatory Framework and Policy Ambiguity

India's unclear policies and regulatory environment pose a serious threat to the market for DC power systems. India's power industry is governed by a number of federal and state laws and policies, most of which are intended for AC systems. To account for the unique features of DC systems, these regulations must be thoroughly reviewed and modified as a result of the switch to DC power.

The lack of precise regulations for integrating DC systems, especially when it comes to renewable energy, is a major regulatory obstacle. Policies currently in place frequently favor AC-based solutions, which leaves DC technology with little support and incentives. As a result, this may deter businesses from entering the market and hinder investments in DC infrastructure.

Furthermore, interoperability and safety may be impacted by implementation confusion and inefficiencies brought on by the lack of standardized codes and protocols for DC power systems. Policymakers should work closely with industry experts to create thorough and accurate regulations and standards that support the expansion of the DC power systems market in order to overcome this obstacle. This means creating safety regulations, incentive programs, and technical specifications that are in line with India's energy priorities and goals.

Segmental Insights

Type

In 2023, the 4.1–32 kW segment became the market leader worldwide. For continuous network connectivity, the telecom sector mainly depends on DC power systems with capacities between 4.1 and 32 kW. Reliable power backup solutions, such as DC systems, are becoming more and more in demand in India as a result of the country's rising mobile phone and data service usage. The need for DC power systems in this market is anticipated to grow even more as 5G network deployment proceeds. DC power systems in this power range are necessary for a number of industrial applications, including machinery, automation, and small-scale manufacturing.

DC solutions are being gradually adopted by industries in an effort to lower operating costs and increase energy efficiency. Furthermore, DC systems are essential to industrial processes because they are the preferred method of powering delicate equipment. The India DC Power Systems Market's 4.1–32 kW segment serves a variety of applications and is influenced by a number of factors, including the expansion of telecommunications, industrial demands, residential adoption, the integration of renewable energy, and government assistance.

DC power systems are becoming more and more common in homes and small businesses for energy management and backup power. Commonly used solar installations with capacities in this range allow businesses and homeowners to produce and store their own DC power. These systems offer a dependable source of electricity because grid reliability is still an issue in some areas.

Application

Over the course of the forecast period, the telecom segment is anticipated to grow rapidly. India's telecom networks' ongoing development and modernization fuel the need for DC power systems. Telecom companies are investing in infrastructure upgrades, such as the installation of additional cell towers and data centers, in response to the widespread use of smartphones, data consumption, and the impending introduction of 5G technology. For these facilities to guarantee network uptime, dependable DC power systems are necessary. For telecom services to live up to customer expectations, they must run uninterrupted. DC power systems offer a reliable power source, especially in places where grid electricity is inconsistent. Since many parts of India experience frequent power outages and voltage fluctuations, DC power systems are an essential backup that keep telecom networks running during blackouts.

For suppliers of DC power systems, the upcoming introduction of 5G technology in India offers a huge opportunity. 5G networks' higher data speeds and capacity requirements will call for reliable and effective power solutions.

To sum up, the telecom sector of the Indian DC Power Systems Market is essential to the nation's telecommunications network. The need for dependable and effective DC power systems is anticipated to continue to grow as mobile networks, data centers, and the impending 5G rollout expand. To take full advantage of the opportunities in this market, telecom companies must invest in technical know-how and address cost considerations.

Regional Insights

In 2023, South India became the market leader for DC power systems in India. South India is a major location for renewable energy projects, especially those involving wind and solar power. The area is ideal for producing renewable energy because of its wealth of wind and sunshine. The market's expansion is greatly aided by DC power systems, which are essential for smoothly integrating this renewable energy into the grid and enabling off-grid applications.

South India has a booming business and industrial sector that includes IT services, electronics, and automobile manufacturing. These sectors require reliable power solutions, and DC power systems are very desirable choices because they provide clear benefits like energy efficiency and excellent power quality.

Rapid urbanization is occurring in South Indian cities, many of which are included in the government's Smart Cities Mission. In order to improve urban living conditions and reduce their negative effects on the environment, these programs usually entail the installation of cutting-edge infrastructure, such as DC microgrids and energy-efficient technologies.

The adoption of DC power systems for effective renewable energy integration is actively encouraged by state-level policies and incentives, such as net metering for rooftop solar installations and renewable energy purchase obligations. These programs seek to improve energy security and reduce carbon emissions.

Companies that specialize in DC power systems have significant opportunities to offer state-of-the-art solutions for successful renewable energy integration, given the region's increasing emphasis on renewable energy.

Download Free Sample Ask for Discount Request Customization

Recent Developments

- In 2021, Vertiv completed the acquisition of Geist, a leading provider of DC power systems and other data center infrastructure solutions.

Key Market Players

- Delta Electronics India

- Emerson Network Power

- Eltek India

- Schneider Electric India

- Luminous Power Technologies

- Microtek International

- Socomec India

- Aplab Limited

- Amara Raja Power Systems

- Su-Kam Power Systems

|

By Type |

By Application |

By Region |

|

|

|

Related Reports

- Industrial Boiler Market Size - By Product (Fire-Tube, Water-Tube), By Capacity, By Application (Food Processing, Pulp &...

- Commercial Boiler Market - By Fuel (Natural Gas, Oil, Coal, Electric), By Capacity, By Technology (Condensing, Non-Conde...

- Steam Boiler Market - By Capacity, By Fuel (Natural Gas, Oil, Coal), By Technology (Condensing, Non-Condensing), By Appl...

- Industrial Electric Boiler Market - By Voltage Rating (Low Voltage, Medium Voltage), By Capacity (< 10 MMBtu/hr, 10-50 M...

- Biomass Boiler Market - By Feedstock (Woody Biomass, Agricultural Waste, Industrial Waste, Urban Residue), By Product (S...

- Asia Pacific Electric Boiler Market Size - By Capacity (≤ 10 MMBtu/hr, > 10 - 50 MMBtu/hr, > 50 - 100 MMBtu/hr, > 100 ...

Table of Content

- 1. Executive Summary

- 1.1. Key Findings

- 1.2. Market Snapshot (2025)

- 1.3. Future Outlook and Growth Opportunities

- 2. Introduction to the India DC Power Systems Market

- 2.1. Defining DC Power Systems

- 2.2. Importance of DC Power Systems in India's Energy Landscape

- 2.3. Types of DC Power Systems (e.g., AC-DC, DC-DC, UPS Systems)

- 2.4. Scope of the Report

- 3. Market Overview

- 3.1. Current Market Size and Valuation (2023 & 2025 Estimates)

- 3.1.1. Market Value (USD Million)

- 3.1.2. Growth Rate (CAGR)

- 3.2. Market Dynamics

- 3.2.1. Drivers of Market Growth

- 3.2.1.1. Rapid Digital Transformation and Data Center Expansion

- 3.2.1.2. Increasing Demand for Reliable Power Supply in Rural and Remote Areas

- 3.2.1.3. Growing Integration of Renewable Energy Sources (Solar, Wind)

- 3.2.1.4. Expansion of Telecommunication Infrastructure (4G, 5G Networks)

- 3.2.1.5. Rising Adoption of Electric Vehicles (EVs) and Charging Infrastructure

- 3.2.1.6. Government Initiatives for Infrastructure Development and Electrification (e.g., FAME, Saubhagya Scheme)

- 3.2.1.7. Emphasis on Energy Efficiency and Sustainability

- 3.2.2. Challenges and Restraints

- 3.2.2.1. High Initial Investment Costs of DC Systems

- 3.2.2.2. Competition from Established AC Power Systems

- 3.2.2.3. Grid Instability in Certain Regions

- 3.2.2.4. Technical Complexity in Multi-Terminal HVDC Systems

- 3.2.1. Drivers of Market Growth

- 3.1. Current Market Size and Valuation (2023 & 2025 Estimates)

- 4. Market Segmentation

- 4.1. By Type

- 4.1.1. Below 4 kW

- 4.1.2. 4.1-32 kW

- 4.1.3. Above 32 kW

- 4.1.4. By Power Output (e.g., Low, Medium, High)

- 4.1.5. By Component (e.g., DC Power Systems, Control Systems, Distribution Equipment)

- 4.2. By End-Use Application

- 4.2.1. Telecommunications (Cell Towers, 5G Deployment)

- 4.2.2. Data Centers (IT & Telecom, BFSI, Government, E-commerce)

- 4.2.3. Renewable Energy Integration (Solar Farms, Wind Power)

- 4.2.4. Electric Vehicle (EV) Charging Infrastructure

- 4.2.5. Commercial Buildings

- 4.2.6. Industrial Sector

- 4.2.7. Railways (HVDC Transmission Systems)

- 4.2.8. Remote and Rural Electrification (DC Microgrids)

- 4.2.9. Others (Medical Equipment, Residential, Marine)

- 4.3. By Voltage Type (for DC Distribution Networks)

- 4.3.1. Low Voltage

- 4.3.2. Medium Voltage

- 4.3.3. High Voltage (HVDC)

- 4.1. By Type

- 5. Regional Analysis (within India)

- 5.1. North India

- 5.2. South India (e.g., Bengaluru, Hyderabad)

- 5.3. West India (e.g., Mumbai, Pune)

- 5.4. East India

- 6. Competitive Landscape

- 6.1. Market Share Analysis of Key Players

- 6.2. Profiles of Major Companies Operating in the India DC Power Systems Market

- 6.2.1. Delta Electronics Inc.

- 6.2.2. Siemens AG

- 6.2.3. Eaton Corporation

- 6.2.4. Huawei Technologies Co., Ltd.

- 6.2.5. Hitachi Energy Ltd.

- 6.2.6. General Electric (GE)

- 6.2.7. Schneider Electric SE

- 6.2.8. LUBI Electronics

- 6.2.9. Wago Power

- 6.2.10. EOS Power

- 6.2.11. Other Prominent Domestic and International Players

- 6.3. Recent Developments, Mergers, Acquisitions, and Partnerships

- 7. Technological Trends and Innovations

- 7.1. Advancements in AC-DC and DC-DC Converter Technologies

- 7.2. Integration of Renewable Energy and Battery Storage

- 7.3. Development of Smart DC Microgrids for Rural and Urban Areas

- 7.4. Intelligent Power Management Systems (AI, IoT Integration)

- 7.5. Modular and Highly Efficient DC Power Systems for 5G Deployment

- 7.6. Shift Towards Lithium-ion Batteries for Enhanced Efficiency and Miniaturization

- 7.7. Cybersecurity Measures for DC Power Infrastructure

- 8. Future Outlook and Projections (up to 2029/2032/2035)

- 8.1. Forecasted Market Size and CAGR (Overall, By Type, By Application)

- 8.2. Emerging Opportunities in Specific Segments (e.g., Hyperscale Data Centers, EV Charging)

- 8.3. Impact of Government Policies (e.g., "Make in India", "Atmanirbhar Bharat")

- 8.4. Role of DC Power in India's Energy Transition

- 9. Conclusion

Major Key Players & Manufacturers in the India DC Power Systems Market:

- ABB Ltd.

- Schneider Electric SE

- Eaton Corporation

- Vertiv Group Corp.

- Delta Electronics, Inc.

- Legrand Group

- Rittal GmbH & Co. KG

- Fujitsu Limited

- Huawei Technologies Co. Ltd.

- Powertron India Private Limited

- Hirect (Hind Rectifiers Limited)

- Zeal Manufacturing And Calibration Services Private Limited

- Scientech Technologies Pvt Ltd

- Micro Logics

- SMA Solar Technology AG

- Fronius International GmbH

- Sungrow Power Supply Co., Ltd.

- GoodWe

- Growatt New Energy Co.,Ltd.

- BYD Company Ltd.

- LG Energy Solution

- Samsung SDI Co., Ltd.

- Hitachi Energy Ltd.

- General Electric Company

- Power Grid Corporation of India Limited

- Bharat Heavy Electricals Limited (BHEL)

- Siemens AG

- Aditya Enterprises

- Trutech Products

- Joma India EV Private Limited

- K-pas Instronic Engineers India Pvt. Ltd.

- Allied Power Solutions

- Parasnath Electronics Pvt. Ltd.

- Sunflare Solar Pvt. Ltd.

- Bright Tech Engineering & Automation System

- Hkg Sales & Services

- Radial Industries

- Krutika Enterprise1

- Suraj Computers

- Crown Electronic Systems

- Diligent Micro Controls

- Global Tele Communications

- Servo Tech Control System

- Thulir Vacuum Technologies

FAQ'S

For a single, multi and corporate client license, the report will be available in PDF format. Sample report would be given you in excel format. For more questions please contact:

Within 24 to 48 hrs.

You can contact Sales team (sales@marketinsightsresearch.com) and they will direct you on email

You can order a report by selecting payment methods, which is bank wire or online payment through any Debit/Credit card, Razor pay or PayPal.

Discounts are available.

Hard Copy