Grid Scale Energy Storage Systems Market

Grid Scale Energy Storage Systems Market - Global Industry Size, Share, Trends, Opportunity, and Forecast, 2018-2028 Segmented By Battery Type (Lithium-Ion, Lead Acid, Flow Battery, Sodium-Based Battery and Others), By Ownership Model (Third Party-Owned and Utility-Owned), By Application (Renewable Integration, Peak Shifting, Backup Power, Ancillary Services and Others), By Region, andBy Competition 2018-2028

Published Date: May - 2025 | Publisher: MIR | No of Pages: 320 | Industry: Power | Format: Report available in PDF / Excel Format

View Details Buy Now 2890 Download Free Sample Ask for Discount Request Customization| Forecast Period | 2024-2028 |

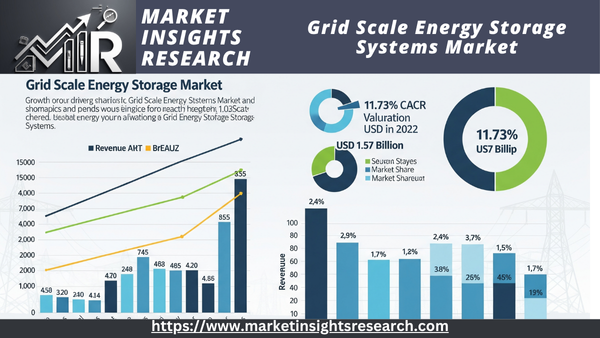

| Market Size (2022) | USD 1.57 billion |

| CAGR (2023-2028) | 11.73% |

| Fastest Growing Segment | Renewable Integration |

| Largest Market | North America |

Market Overview

Global Grid Scale Energy Storage Systems Market was valued at USD 1.57 billion in 2022 and is anticipated to project robust growth in the forecast period with a CAGR of 11.73% through 2028. Numerous countries and regions are currently engaged in grid modernization initiatives aimed at upgrading aging grid infrastructure, enhancing grid reliability, and integrating advanced technologies.

Download Free Sample Ask for Discount Request Customization

Grid modernization often involves the incorporation of energy storage systems, such as lithium-ion batteries, pumped hydro storage, and advanced flow batteries. These systems play a vital role in stabilizing grids, improving load management, and facilitating more efficient utilization of renewable energy resources.

Key Market Drivers

Increasing Renewable Energy Integration

The growing grid integration of renewable energy sources is one of the major factors propelling the global market for grid-scale energy storage systems. Intermittent renewable energy sources like solar and wind power are becoming more and more important as the globe shifts to a more ecologically friendly and sustainable energy mix. Although these sources have many positive effects on the environment, their unpredictability and variety pose a serious problem. This problem is successfully solved by grid-scale energy storage facilities, which offer a way to store excess energy produced during times of high renewable energy output and release it during times of low renewable generation or high demand.

Effective energy storage technologies are becoming progressively more important as governments and utilities throughout the world set high goals for the deployment of renewable energy. Lithium-ion batteries, pumped hydro storage, and enhanced flow batteries are examples of grid-scale energy storage devices that are essential for maintaining grid stability, guaranteeing a steady supply of electricity, and maximizing the use of renewable energy sources. These technologies lessen curtailment, improve grid dependability, and lessen variations in the production of renewable energy. Therefore, one of the main factors driving the rising need for grid-scale energy storage systems is the growing integration of renewable energy sources.

Evolving Energy Market Dynamics & Grid Modernization

The changing energy market dynamics and grid infrastructure upgrades are two of the main factors propelling the global market for energy storage systems at the grid scale. The conventional energy markets, which were mostly dependent on the production of fossil fuels and centralized power plants, are presently going through a major transition. Decentralization, distributed energy resources (DERs), and the rise of prosumers—consumers who generate their energy—are all changing the energy landscape.

Globally, grid modernization projects are underway to adapt to these changes and provide more adaptable, robust, and efficient electricity systems. Systems for grid-scale energy storage are essential to these upgrading initiatives. They are an essential tool for controlling DER integration, maintaining grid stability, and facilitating demand response initiatives. By quickly adapting to changes in supply and demand, energy storage technologies assist utilities in preserving grid balance and averting blackouts.

The need for energy storage systems to support the expansion of EV charging infrastructure and offer grid support services is also being driven by changing market dynamics, such as the growing popularity of electric vehicles (EVs) and the electrification of different industries. The demand for dependable, quick-charging solutions backed by energy storage is growing as electric transportation becomes more common. The market for grid-scale energy storage technologies is expanding globally as a result of these variables taken together.

Download Free Sample Ask for Discount Request Customization

Government Policies & Incentives

The global market for grid-scale energy storage devices is growing as a result of government regulations and incentives. The importance of energy storage in achieving sustainability, security, and dependability goals is recognized by governments at all levels. They are therefore putting in place a variety of laws, rules, and financial incentives to encourage the use of energy storage systems.

To encourage investments in grid-scale energy storage projects, for example, subsidies, tax credits, and grants are commonly provided. For both utilities and investors, these financial incentives increase the energy storage projects' economic feasibility and appeal. In addition, many nations are establishing energy storage goals and regulations that require utilities to incorporate a certain quantity of energy storage capacity into their networks.

Energy storage devices are also becoming more popular as a way to increase power system resilience against cyberattacks and natural catastrophes due to policies pertaining to grid stability and resilience. Energy storage integration is frequently covered by government-funded grid upgrade projects.

In conclusion, one of the main factors propelling the expansion of the global market for grid-scale energy storage systems is government regulations and incentives. They present energy storage as a crucial part of the future energy landscape by creating an atmosphere that is conducive to investment, encouraging innovation, and making it easier to accomplish energy-related goals.

Key Market Challenges

High Initial Costs & Capital Intensity

The high upfront costs and capital intensity involved in the development and implementation of grid-scale energy storage systems are among the major obstacles facing the global market. Grid-scale energy storage initiatives frequently require large upfront expenditures for installation, technology, and infrastructure. Depending on the region, project size, and energy storage technology selected, these expenses can vary greatly.

For example, the cost of battery cells and related components makes lithium-ion battery-based energy storage systems, one of the most widely used technologies, rather expensive up front. Similarly, building reservoirs and associated infrastructure for pumped hydro storage projects necessitates a large capital commitment. The broad use of grid-scale energy storage may be hampered by these expenses, which can serve as a barrier to entry for both utilities and independent power providers.

Additionally, energy storage projects' high capital intensity can make it difficult to finance and draw in investments, especially for smaller energy market participants. Even while the government offers some subsidies and incentives to help with these costs, they might not always be enough to cover the initial outlay of funds.

Technological Limitations & Performance Degradation

One of the key challenges in the global market for grid-scale energy storage systems is the presence of technological limitations and the issue of performance degradation over time. Although energy storage technologies have made significant advancements in recent years, they are not exempt from limitations.

For instance, commonly used lithium-ion batteries in grid-scale applications are prone to degradation over time. Each charge-discharge cycle can result in a decrease in battery capacity and performance, ultimately impacting the lifespan and efficiency of the energy storage system. Addressing this degradation necessitates continuous monitoring and maintenance, which introduces operational costs and complexity to energy storage projects.

Furthermore, different energy storage technologies exhibit varying characteristics in terms of energy density, efficiency, and cycle life. Selecting the most suitable technology for a specific application and optimizing its performance can be a complex undertaking. Ensuring that energy storage systems meet the required performance standards and reliability levels presents an ongoing challenge that necessitates continuous research and development efforts.

Download Free Sample Ask for Discount Request Customization

Regulatory & Policy Hurdles

The global market for grid-scale energy storage technologies is severely hampered by regulatory and legislative barriers. The legislative environment around energy storage differs substantially between nations and regions, which makes it difficult to create a uniform and efficient strategy for its implementation.

The lack of precise and uniform guidelines for evaluating energy storage services is one significant regulatory obstacle. Grid stabilization, peak shaving, and integration of renewable energy are just a few of the services provided by grid-scale energy storage systems. It can be difficult and controversial to decide how these services are valued and included into the current energy market frameworks.

Grid-scale energy storage project siting and permitting procedures can also be unclear and time-consuming. Project delays and higher expenses may arise from navigating the regulatory environment, securing required clearances, and resolving possible environmental issues.

Governments and regulatory agencies must work closely with industry stakeholders to create uniform and transparent regulatory frameworks that support the effective implementation of grid-scale energy storage technologies in order to address these issues. Standardized methods for interconnection, approval, and valuation can create a more favorable atmosphere for the market expansion of energy storage.

Key Market Trends

Increasing Deployment of Long-Duration Energy Storage Systems

The growing use of long-duration energy storage solutions is one significant trend in the global market for grid-scale energy storage systems. Longer-duration storage is becoming increasingly important to meet the challenges of renewable energy integration and grid reliability, even though short-duration storage systems, such as lithium-ion batteries, have dominated the market for applications like frequency regulation and peak shaving.

Advanced flow batteries, compressed air energy storage (CAES), and molten salt thermal storage are examples of long-duration energy storage technologies that are becoming more popular. These technologies enable the storage of energy for days, weeks, or even several hours. They are ideal for tasks like transferring the production of renewable energy from the day to the night or ensuring grid stability when renewable energy output is low for extended periods of time.

Long-duration energy storage system deployment is growing due to several variables. In order to improve grid stability and lessen need on fossil fuel backup production, it first assists utilities and grid operators in managing the unpredictability of renewable energy sources. Second, by allowing extra energy to be integrated into the grid during times of high generation and then released when needed, it promotes the expansion of renewable energy. Finally, by supplying backup power during protracted system outages, natural disasters, or extreme weather events, long-duration storage helps to strengthen grid resilience.

Emergence of Hybrid Energy Storage Systems

The rise of hybrid energy storage systems is another significant development in the global market for large-scale energy storage. In order to leverage each technology's unique advantages and concurrently handle several grid functions and applications, these systems integrate two or more energy storage technologies.

For instance, a hybrid energy storage system might combine supercapacitors or flywheel energy storage with lithium-ion batteries. Through this integration, the system may provide long-duration energy storage capabilities, quick response times, and short-duration energy storage services. It is possible to optimize hybrid systems to deliver vital services like frequency management, backup power, and grid balancing.

Because of their remarkable adaptability and versatility, hybrid energy storage systems are becoming more and more popular. We can modify these systems to meet specific grid specifications and adapt to evolving grid conditions. Hybrid systems offer a strong alternative to improve grid stability, efficiency, and resilience as grid operators look for more flexible ways to address the constantly shifting energy situation.

Segmental Insights

Battery

In 2022, the lithium-ion market became the leading one. Because of its high energy density, efficiency, and adaptability, lithium-ion batteries have become a major player in the market for grid-scale energy storage systems. They are used for a variety of grid applications, such as grid stabilization, peak shaving, and the integration of renewable energy.

Because of their exceptional energy density, which allows them to store a significant amount of energy in a comparatively small and light package, lithium-ion batteries are ideal for grid-scale applications.

Energy storage technologies like lithium-ion batteries are necessary to reduce variations in power generation due to the unpredictability of renewable energy sources like solar and wind. Because lithium-ion batteries offer ancillary services like voltage support and frequency regulation, they help stabilize the grid.

The goal of ongoing research and development is to improve the longevity and performance of lithium-ion batteries, possibly resolving cycle life constraints. Reusing used batteries from electric vehicles for grid-scale applications provides an economical and environmentally friendly alternative.

Due to its high energy density, proven technology, and continuous cost reductions, the lithium-ion market is expected to keep expanding. Lithium-ion batteries will be essential to maintaining grid stability and facilitating the effective use of renewable energy sources as the shift to renewable energy advances.

Application Insights

We anticipate a rapid increase in the Renewable Integration segment over the forecast period. In order to meet the problems posed by the increasing use of intermittent renewable energy sources like solar and wind, the renewable integration sector of the worldwide market for energy storage systems at the grid scale is essential. Because it successfully addresses the problem of intermittency and variability in renewable energy output, this industry is a major driver of the market for energy storage systems at a grid scale. It includes various energy storage devices and systems that are made especially to hold extra renewable energy while it is available and release it when demand is high or renewable generation is low.

In order to properly manage the variability and intermittency associated with solar and wind energy supplies, it is imperative that effective energy storage systems be implemented in conjunction with their growing deployment. Lithium-ion batteries and improved flow batteries are two examples of energy storage technologies that can be combined to produce hybrid systems that maximize the integration of renewable energy sources by offering both short- and long-duration storage capabilities. Furthermore, by optimizing charge and discharge cycles, the application of predictive analytics and sophisticated energy management systems can improve the effective use of energy storage for renewable integration.

To sum up, the need to balance and maximize renewable energy generation is what propels the renewable integration segment of the global market for grid-scale energy storage systems, opening the door to a more robust and sustainable energy future.

Regional Insights

With the most market share, North America became the leading force in 2022. With its dynamic and changing landscape, North America is a major player in the global market for grid-scale energy storage systems. Each of the three countries in the region—the US, Canada, and Mexico—has unique energy laws, grid configurations, and market dynamics.

Every state in the US has its own energy incentives and policies, creating a very varied regulatory environment. Energy storage uptake has been greatly aided by federal production tax credits (PTC) and investment tax credits (ITC). Different provinces and territories in Canada have different energy storage laws and policies. To improve reliability and encourage renewable energy, provinces like British Columbia and Ontario have expressed interest in incorporating energy storage into their electrical systems. Modernizing the grid and incorporating renewable energy sources are becoming more and more important in Mexico. Opportunities for energy storage projects are presented by the nation's energy reforms and the expansion of its renewable energy sector, especially in areas with sporadic energy sources.

Energy storage is becoming more and more necessary as a result of the continuous electrification of many industries, including transportation. Installation of energy storage infrastructure for grid support and fast-charging stations is required due to the growing popularity of electric cars (EVs). Extreme weather events and grid vulnerability have prompted investments in grid resilience. Energy storage devices can assist stabilize the grid in an emergency and supply backup power during blackouts.

Energy storage solutions for the grid are expected to continue to increase in the North American market. To promote a more resilient and sustainable energy infrastructure, future advancements are anticipated to include increasing grid integration, a larger use of long-duration energy storage, and improved cooperation between the public and private sectors.

Download Free Sample Ask for Discount Request Customization

Recent Developments

- In 2021, LG Chem acquired NEC Energy Solutions, a company that specializes in battery energy storage.

Key Market Players

- Tesla, Inc.

- AES Energy Storage

- Siemens Energy

- Schneider Electric

- Samsung SDI

- LG Energy Solution

- BYD Company Limited

- GE Renewable Energy

- Eos Energy Storage

- NEC Energy Solutions

|

By Battery Type |

By Ownership Model |

By Application |

By Region |

|

|

|

|

Related Reports

- Commercial Boiler Market - By Fuel (Natural Gas, Oil, Coal, Electric), By Capacity, By Technology (Condensing, Non-Conde...

- Steam Boiler Market - By Capacity, By Fuel (Natural Gas, Oil, Coal), By Technology (Condensing, Non-Condensing), By Appl...

- Industrial Electric Boiler Market - By Voltage Rating (Low Voltage, Medium Voltage), By Capacity (< 10 MMBtu/hr, 10-50 M...

- Biomass Boiler Market - By Feedstock (Woody Biomass, Agricultural Waste, Industrial Waste, Urban Residue), By Product (S...

- Asia Pacific Electric Boiler Market Size - By Capacity (≤ 10 MMBtu/hr, > 10 - 50 MMBtu/hr, > 50 - 100 MMBtu/hr, > 100 ...

- North America & Europe Electric Boiler Market Size - By Voltage Rating (Low Voltage, Medium Voltage), By Application (Re...

Table of Content

-

Executive Summary

-

1.1 Market Snapshot

-

1.2 Key Trends and Investment Highlights

-

1.3 Strategic Recommendations

-

-

Introduction

-

2.1 Scope and Report Objectives

-

2.2 Research Methodology

-

2.3 Definitions and System Classification

-

-

Market Overview

-

3.1 What Are Grid-Scale Energy Storage Systems (ESS)?

-

3.2 Role in Renewable Integration, Grid Stability, and Peak Management

-

3.3 Technology Maturity and Deployment Models

-

3.4 Global Grid Decarbonization and Resilience Strategies

-

-

Market Dynamics

-

4.1 Drivers

-

4.1.1 Rising Share of Intermittent Renewable Energy

-

4.1.2 Regulatory Push for Grid Flexibility and Energy Security

-

4.1.3 Declining Cost of Battery Storage and New Chemistries

-

-

4.2 Restraints

-

4.2.1 High Initial Capital Investment and ROI Uncertainty

-

4.2.2 Regulatory Barriers in Emerging Economies

-

-

4.3 Opportunities

-

4.3.1 Energy Trading, Capacity Markets, and VPP Participation

-

4.3.2 Long-Duration and Multi-Day Storage Technologies

-

-

4.4 Challenges

-

4.5 Porter’s Five Forces Analysis

-

-

Technology Landscape

-

5.1 Lithium-Ion Battery Systems (NMC, LFP, LTO)

-

5.2 Flow Batteries (Vanadium Redox, Zinc-Bromine)

-

5.3 Mechanical Storage (Pumped Hydro, CAES, Gravity)

-

5.4 Thermal and Hydrogen-Based Storage

-

5.5 BMS, EMS, and AI for Grid Forecasting & Optimization

-

-

Market Segmentation

-

6.1 By Storage Duration

-

6.1.1 Short Duration (Up to 4 Hours)

-

6.1.2 Long Duration (4–24 Hours)

-

6.1.3 Seasonal and Multi-Day Systems

-

-

6.2 By Application

-

6.2.1 Frequency Regulation

-

6.2.2 Renewable Energy Firming

-

6.2.3 Peak Shaving and Load Shifting

-

6.2.4 Black Start and Spinning Reserve

-

6.2.5 Transmission & Distribution Deferral

-

-

6.3 By Ownership Model

-

6.3.1 Utility-Owned

-

6.3.2 Independent Power Producer (IPP)

-

6.3.3 Commercial & Industrial Third-Party

-

-

-

Regional Analysis

-

7.1 North America (U.S., Canada)

-

7.2 Europe (Germany, UK, Nordics, Rest of Europe)

-

7.3 Asia-Pacific (China, India, South Korea, Japan, Australia)

-

7.4 Latin America

-

7.5 Middle East & Africa

-

-

Market Size and Forecast (2020–2030)

-

8.1 Revenue and Installed Capacity Forecast by Region

-

8.2 GWh Additions by Storage Type and Application

-

8.3 CAPEX/OPEX and Levelized Cost of Storage (LCOS) Trends

-

-

Competitive Landscape

-

9.1 Market Share by Technology and Region

-

9.2 Key Company Profiles

-

9.2.1 Tesla

-

9.2.2 Fluence

-

9.2.3 Wärtsilä

-

9.2.4 NGK Insulators

-

9.2.5 Energy Vault

-

9.2.6 LS Energy Solutions

-

9.2.7 Others

-

-

9.3 M&A, Financing Rounds, and Strategic Partnerships

-

-

Policy and Regulatory Framework

-

10.1 National Energy Storage Targets and Roadmaps

-

10.2 Capacity Market Participation and Ancillary Services

-

10.3 Interconnection, Grid Code Compliance, and Safety Standards

-

-

Innovation and Future Outlook

-

11.1 Role of AI, Blockchain, and Predictive Dispatch in Grid ESS

-

11.2 Hydrogen Storage, Hybrid Systems, and Beyond Lithium

-

11.3 Global ESS Investment Outlook and Market Disruptors

-

-

Conclusion and Strategic Outlook

-

Appendices

-

13.1 Glossary

-

13.2 Research Methodology

-

13.3 References and Sources

To get a detailed Table of content/ Table of Figures/ Methodology Please contact our sales person at ( chris@marketinsightsresearch.com )

FAQ'S

For a single, multi and corporate client license, the report will be available in PDF format. Sample report would be given you in excel format. For more questions please contact:

Within 24 to 48 hrs.

You can contact Sales team (sales@marketinsightsresearch.com) and they will direct you on email

You can order a report by selecting payment methods, which is bank wire or online payment through any Debit/Credit card, Razor pay or PayPal.

Discounts are available.

Hard Copy