Automotive Secondary Battery Market

Automotive Secondary Battery Market – Global Industry Size, Share, Trends, Opportunity, and Forecast Segmented By Technology (Lead-acid Batteries, Lithium-ion Batteries, and Others), By Type (HEV, PHEV, and EV), By Region, By Competition 2018-2028

Published Date: May - 2025 | Publisher: MIR | No of Pages: 320 | Industry: Power | Format: Report available in PDF / Excel Format

View Details Buy Now 2890 Download Free Sample Ask for Discount Request Customization| Forecast Period | 2024-2028 |

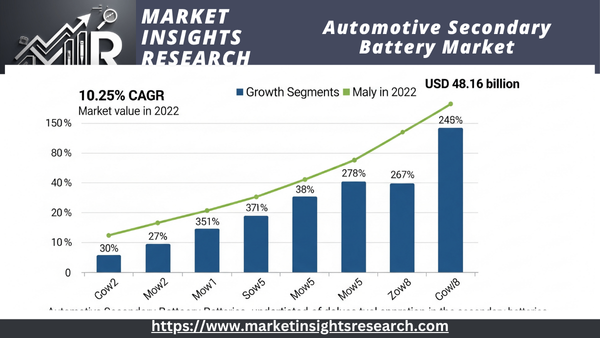

| Market Size (2022) | USD 48.16 Billion |

| CAGR (2023-2028) | 10.25% |

| Fastest Growing Segment | Lithium-ion Battery Technology |

| Largest Market | Asia Pacific |

Market Overview

In 2022, the global automotive secondary battery market was valued at USD 48.16 billion. It is expected to increase at a strong rate during the forecast period, with a compound annual growth rate (CAGR) of 10.25% through 2028. The global market for automotive secondary batteries is expanding and vibrant, but it is also confronted with certain obstacles.

Download Free Sample Ask for Discount Request Customization

Governments and battery manufacturers are attempting to resolve these issues, but it's critical to consider the possible effects on business and consumers. Secondary batteries are becoming more robust and efficient as a result of technical developments. Customers find EVs more appealing as a result, and the market for automotive secondary batteries is expanding as a result. Secondary batteries have been continuously getting cheaper in recent years, which has made them more accessible to both EV producers and consumers. This is contributing to the expansion of the automotive secondary battery market and the uptake of EVs. Since they provide a sustainable and clean substitute for fossil fuels, renewable energy sources like wind and solar are growing in popularity. Renewable energy sources do not, however, always generate electricity since they are intermittent. When energy from renewable sources is available, secondary batteries can be utilized to store it so that it can be used to power EVs and other devices when they are not. Since EVs have several benefits over conventional gasoline-powered cars, including less fuel prices, fewer pollutants, and a more ecologically friendly driving experience, they are growing in popularity. The market for automotive secondary batteries is expanding as a result of the rising demand for EVs, which need secondary batteries to power their electric motors.

Key Market Drivers

Growing Demand for Electric Vehicles (EVs)

One of the main factors propelling the automotive secondary battery market is the increase in the use of electric cars (EVs). Lithium-ion batteries have become the main energy storage option for EVs as the globe moves toward greener and more sustainable transportation options to lessen the effects of climate change. The high energy density, extended cycle life, and quick charging capabilities required for electric cars are provided by lithium-ion batteries. The need for secondary batteries is directly fueled by the expansion of the EV market, which also spurs economies of scale and technological improvements that lower costs and increase consumer access to batteries.

Another important factor is the incorporation of renewable energy sources, including wind and solar, into the electrical system. Energy storage systems (ESS) are necessary to control the intermittent nature of renewable energy sources and provide a steady supply of electricity. Because they may store excess energy when supply exceeds demand and release it when demand exceeds supply, secondary batteries are essential to ESS. The demand for secondary batteries is increased by this integration, which also encourages the use of sustainable energy and improves grid resilience and reliability.

Consumer Electronics and Automotive Devices

The market for automotive secondary batteries has historically been driven by the growth of consumer electronics and automotive devices. Rechargeable lithium-ion batteries, which are used in wearables, computers, tablets, and smartphones, have been lighter, more effective, and more durable over time. More sophisticated and energy-dense batteries are being developed as a result of consumer demand for longer battery life and greater gadget portability, which is driving innovation in battery technology.

Download Free Sample Ask for Discount Request Customization

Energy Storage for Utilities

Utility firms are using secondary batteries more and more for grid-scale energy storage. Power grid stabilization, load control, and the integration of renewable energy sources are all made possible by these massive energy storage projects. Secondary batteries are becoming more and more necessary in utility-scale energy storage projects as utilities work to lessen their dependency on fossil fuels and switch to renewable energy sources..

Government Regulations and Incentives

The market for automotive secondary batteries is mostly driven by laws and regulations. Many nations have put laws into place to lower greenhouse gas emissions and encourage the use of renewable energy sources and electric cars. Incentives like tax credits, subsidies, and emissions objectives are frequently included in these rules to promote the creation and use of secondary batteries. Regulations pertaining to battery recycling and disposal have also prompted more study into environmentally friendly battery materials and recycling techniques.

Advancements in Battery Technology

The market for automotive secondary batteries is largely driven by ongoing developments in battery technology. Manufacturers and researchers are always trying to increase the energy density, cost-effectiveness, safety, and performance of batteries. Technologies like solid-state batteries, which offer increased safety and energy density, have the potential to completely transform a number of sectors, including consumer electronics and electric vehicles.

Global Push for Energy Independence

One major factor encouraging the usage of secondary batteries is the goal for energy independence and a decreased dependency on fossil fuels. To lessen their reliance on traditional energy sources and centralized power grids, people and companies are investing in energy storage devices in conjunction with solar panels and other distributed energy producing technologies.

Download Free Sample Ask for Discount Request Customization

Electrification of Automotive Processes

In an effort to increase efficiency and lower carbon emissions, industries are electrifying their operations more and more. Mining, agriculture, and manufacturing are just a few of the industries affected by this trend. Secondary batteries are frequently used in electrification to power electric machinery and equipment, which raises the need for durable and long-lasting battery solutions.

Consumer Awareness and Environmental Concerns

The automotive secondary battery industry is significantly impacted by rising consumer awareness of environmental issues as well as worries about pollution and climate change. Customers are increasingly preferring technology and goods that reflect their beliefs, such as renewable energy sources and electric cars, over more conventional options.

Supply Chain Considerations

The automotive secondary battery industry is greatly impacted by the worldwide supply chain, especially for vital raw materials like nickel, cobalt, and lithium. The availability of these materials, mining laws, and geopolitical considerations can all have an impact on battery manufacturing and cost. To reduce supply chain risks, efforts are being made to diversify the chain and investigate substitute materials.

In conclusion, a number of factors, such as the growth of electric vehicles, the incorporation of renewable energy, the proliferation of consumer electronics, utility-scale energy storage, government incentives and regulations, technological advancements, the desire for energy independence, automotive electrification, consumer awareness of environmental issues, and supply chain considerations, are driving the global automotive secondary battery market. These factors work together to influence the direction of the automotive secondary battery market, which is a dynamic and quickly changing sector with significant effects on sustainability and the world economy.

Key Market Challenges

Energy Density and Capacity Limitations

The energy density and capacity limitations of current battery technology are one of the main issues facing the automotive secondary battery market. Even with recent improvements, the market-dominant lithium-ion batteries are still unable to match fossil fuels' energy density. In grid-scale applications, this constraint affects the duration of energy storage as well as the efficiency and range of electric vehicles (EVs). Solid-state batteries are one of the advances that researchers are actively attempting to improve energy density through, but these technologies are not yet commercially available and come with their own set of difficulties.

Cycle Life and Degradation

Over time, secondary batteries deteriorate, losing capacity and functionality. In applications where batteries are cycled regularly, like EVs and automotive electronics, this cycle life issue is particularly important. In addition to impairing user experience, battery degradation raises expenses because it necessitates more frequent battery replacements. Although research into reducing capacity fade and increasing battery cycle life is still ongoing, it is still quite difficult.

Safety Concerns

In the market for automotive secondary batteries, safety is of utmost importance, especially for lithium-ion batteries. Under some circumstances, such as physical harm or overheating, these batteries may be vulnerable to thermal runaway, which can result in fires or explosions. It is always difficult to ensure the safety of battery technologies, which calls for the creation of sophisticated safety measures, better electrolytes, and efficient thermal management systems. Resolving these safety issues is crucial to gaining the confidence of customers and promoting the wider use of secondary batteries.

Raw Material Availability and Price Volatility

Lithium, cobalt, nickel, and graphite are among the essential raw materials used in the automotive secondary battery sector. Because of things like supply chain disruptions, mining laws, and geopolitical tensions, the price and availability of these minerals might fluctuate. The overall cost and availability of secondary batteries may be impacted by possible material shortages and price increases as the demand for batteries keeps rising. To reduce these supply chain concerns, research into substitute materials and recycling methods is still going on.

Environmental Impact and Recycling

While secondary batteries are seen as a more environmentally friendly alternative to fossil fuels, they are not without environmental challenges. Resource extraction, energy-intensive manufacturing procedures, and waste disposal issues are only a few of the major environmental effects that battery production, especially for lithium-ion batteries, can have. Furthermore, batteries have comparatively low recycling rates, and incorrect disposal can contaminate the environment. To reduce its environmental impact, the industry must create a closed-loop supply chain, enhance recycling techniques, and create more environmentally friendly battery materials.

Cost and Affordability

Secondary batteries are still expensive, which prevents their broad use in many applications. For example, the initial cost of electric vehicles is still higher than that of conventional cars with internal combustion engines, primarily because of the battery pack. Battery cost reduction is a crucial issue since it would increase consumer access to the affordability of renewable energy storage and electric vehicles. Cost-cutting initiatives are being aided by advances in production techniques, economies of scale, and technology breakthroughs.

Charging Infrastructure

In the case of electric vehicles, the lack of a comprehensive charging infrastructure is a significant challenge. Range anxiety, or the fear of running out of battery power without access to charging, remains a concern for potential EV buyers. Developing a robust and widespread charging network is essential to the mass adoption of electric vehicles. Governments and private companies are working to address this challenge by investing in charging infrastructure, but it remains a work in progress.

Key Market Trends

Rise of Lithium-ion Dominance

The most prominent trend in the Automotive Secondary Battery market is the continued dominance of lithium-ion batteries. These batteries are the preferred option for a variety of applications, including consumer electronics, grid-scale energy storage, and electric cars, because to their high energy density, extended cycle life, and dependability. Lithium-ion technology solidifies its standing as the industry standard as it keeps getting better.

This development is significant because lithium-ion batteries are now the standard option for energy storage, which has sped up scientific advancements, decreased costs, and created economies of scale. But it also draws attention to issues with the availability of vital components like nickel, cobalt, and lithium as well as the requirement for secure and sustainable recycling techniques.

Advancements in Solid-State Batteries

Solid-state batteries are a promising technology that represents a major trend in the Automotive Secondary Battery market. These batteries offer benefits like increased energy density, quicker charging, longer cycle life, and enhanced safety by substituting a solid electrolyte for the liquid or gel electrolyte used in conventional lithium-ion batteries. Consumer electronics, renewable energy storage, and electric cars are just a few of the industries that solid-state batteries have the potential to completely transform.

This trend is significant because solid-state batteries have the potential to overcome some of the drawbacks of conventional lithium-ion batteries, especially with regard to energy density and safety. Solid-state battery commercialization at scale is still difficult, though, and removing financial and production obstacles is essential to their broad use.

Increased Focus on Sustainability

Sustainability is a growing trend in the Automotive Secondary Battery market, driven by environmental concerns and regulatory pressure. In an effort to lessen batteries' negative environmental effects, manufacturers are placing more emphasis on using sustainable materials in battery manufacturing and enhancing recycling procedures. Given the enormous amounts of batteries used in renewable energy storage and electric vehicles, this trend is especially pertinent.

This pattern is significant for two reasons. It first tackles the environmental issues around the manufacture and disposal of batteries, supporting international initiatives to lower carbon emissions. Second, by encouraging recycling and ethical sourcing, it contributes to a steady and sustainable supply chain for vital battery components.

Segmental Insights

Technology Insights

Because of its advantageous capacity-to-weight ratio, lithium-ion batteries (LIB) are anticipated to dominate the automotive secondary battery market in the latter half of the forecast period among other battery technologies. Better performance, increased energy density, and falling costs are further aspects that significantly contribute to the use of LIBs. The cost of lithium-ion batteries dropped significantly from USD 668/kWh in 2013 to USD 123/kWh in 2021 due to its high energy density, making it a profitable option among all batteries. Historically, consumer electronics like PCs, laptops, and cell phones have used lithium-ion batteries. However, because to features including their low environmental impact—EVs don't generate any CO2, nitrogen oxides, or other greenhouse gases—they are increasingly being adapted for use as the preferred power source in hybrid and fully electric vehicle (EV) ranges. The majority of LIB manufacturing plants are found in North America, Europe, and Asia-Pacific. Prominent industry participants, including BYD Company Limited and LG Chem Ltd, intend to establish new production plants in the Asia-Pacific area, mainly in China, South Korea, and India. Lithium-ion battery technology is therefore anticipated to dominate the automotive secondary battery market over the course of the forecast period based on such considerations.

Regional Insights

Asia Pacific is expected to dominate the market during the forecast period.

Download Free Sample Ask for Discount Request Customization

Recent Developments

- In December 2021, Reliance New Energy Solar Limited entered an agreement with Faradion to acquire 100% of the equity shares for a total value of USD 117 million. Faradion is a UK-based leading battery technology company with an extensive IP portfolio covering many aspects of sodium-ion technology.

- In December 2021, Northvolt produced its first lithium-ion battery cell at its factory in Skelleftea, Sweden. The facility is expected to have a yearly output of 60 GWh, which is enough to supply batteries for around 1 million EVs. It had planned to begin commercial delivery in 2022.

- In April 2021, researchers at IIT Hyderabad, India, developed a 5V Battery Recycling utilizing self-standing carbon fiber mats as both electrodes (cathode and anode). This new model sets aside the requirement for toxic, costly, and heavy transitional metals.

- In June 2023, Tesla announced plans to invest USD1.5 billion in a new battery factory in Texas. This factory is expected to produce enough batteries for 2 million EVs per year.

- In May 2023, Panasonic announced plans to invest USD 1 billion in a new battery factory in Japan. This factory is expected to produce enough batteries for 500,000 EVs per year.

- In April 2023, LG Chem announced plans to invest USD 2 billion in a new battery factory in Michigan. This factory is expected to produce enough batteries for 1 million EVs per year.

- In March 2023, SK On announced plans to invest $2.6 billion in two new battery factories in Georgia. We expect these factories to produce enough batteries for 1.2 million EVs annually.

Key Market Players

- Umicore

- Retriev Technologies

- American Battery Technology Company (ABTC)

- Li-Cycle

- Aqua Metals

- Battery Solutions

- Recupyl

- Gopher Resource

- Glencore Recycling

- Retech Recycling Technology AB.

|

By Technology |

By Type |

By Region |

|

|

|

|

|

Related Reports

- Gas Fired Boiler Market Size - By Capacity (≤ 10 MMBtu/hr, > 10 - 50 MMBtu/hr, > 50 - 100 MMBtu/hr, > 100 - 250 MMBtu/...

- Europe Residential Boiler Market Size - By Technology (Condensing {Natural Gas, Oil, Electric}, Non-Condensing {Natural ...

- U.S. Boiler Market Size By Fuel (Natural Gas, Oil, Coal), Capacity, By Technology (Condensing, Non-Condensing), By Produ...

- Commercial Hot Water Boiler Market Size - By Fuel (Natural Gas, Oil, Coal, Electric), By Technology (Condensing, Non-Con...

- UK Commercial Boiler Market Size By Fuel (Natural Gas, Oil, Coal, Electric), By Capacity, By Technology (Condensing, Non...

- Residential Electric Boiler Market Size - By Voltage Rating (Low Voltage, Medium Voltage), Industry Analysis Report, Reg...

Table of Content

-

Executive Summary

-

1.1 Market Overview

-

1.2 Key Trends and Forecast Insights

-

1.3 Strategic Recommendations

-

-

Introduction

-

2.1 Report Objectives and Scope

-

2.2 Research Methodology

-

2.3 Definitions and Battery Classification

-

-

Market Overview

-

3.1 What Are Automotive Secondary Batteries?

-

3.2 Functional Role in Electric, Hybrid, and ICE Vehicles

-

3.3 Evolution of Battery Technologies in the Auto Industry

-

3.4 Value Chain and Ecosystem Mapping

-

-

Market Dynamics

-

4.1 Market Drivers

-

4.1.1 Rapid Electrification of Passenger and Commercial Vehicles

-

4.1.2 Demand for High-Efficiency, Long-Lasting Batteries

-

4.1.3 Government Regulations and EV Incentive Programs

-

-

4.2 Market Restraints

-

4.2.1 Raw Material Constraints (Lithium, Cobalt, Nickel)

-

4.2.2 Safety, Recycling, and Disposal Challenges

-

-

4.3 Market Opportunities

-

4.3.1 Development of Solid-State and High-Nickel Batteries

-

4.3.2 Vehicle-to-Grid (V2G) and Battery-as-a-Service Models

-

-

4.4 Challenges

-

4.5 Porter’s Five Forces Analysis

-

-

Technology Landscape

-

5.1 Lithium-Ion (NMC, LFP, NCA, LTO)

-

5.2 Lead-Acid (AGM, EFB, Gel)

-

5.3 Emerging Chemistries (Solid-State, Sodium-Ion, Silicon Anode)

-

5.4 Battery Pack Design, BMS, and Thermal Management

-

5.5 Fast Charging and Ultra-High Power Density Innovations

-

-

Market Segmentation

-

6.1 By Battery Type

-

6.1.1 Lithium-Ion

-

6.1.2 Lead-Acid

-

6.1.3 Others

-

-

6.2 By Vehicle Type

-

6.2.1 Passenger Cars

-

6.2.2 Commercial Vehicles

-

6.2.3 Two & Three-Wheelers

-

6.2.4 Off-Highway Vehicles

-

-

6.3 By Application

-

6.3.1 Propulsion (EV/HEV/PHEV)

-

6.3.2 Start-Stop Systems

-

6.3.3 Auxiliary and Standby Power

-

-

-

Regional Analysis

-

7.1 North America

-

7.2 Europe

-

7.3 Asia-Pacific

-

7.4 Latin America

-

7.5 Middle East & Africa

-

-

Market Size and Forecast (2020–2030)

-

8.1 Revenue and Volume Forecast by Region and Segment

-

8.2 Installed Capacity (GWh) and EV Penetration Trends

-

8.3 Cost per kWh and Energy Density Evolution

-

-

Competitive Landscape

-

9.1 Market Share Analysis

-

9.2 Key Company Profiles

-

9.2.1 LG Energy Solution

-

9.2.2 Panasonic

-

9.2.3 CATL

-

9.2.4 Samsung SDI

-

9.2.5 BYD

-

9.2.6 Clarios

-

9.2.7 SK On

-

9.2.8 Others

-

-

9.3 Manufacturing Footprint and Supply Chain Mapping

-

9.4 Strategic Collaborations, JVs, and OEM Partnerships

-

-

Policy and Regulatory Framework

-

10.1 Global Vehicle Electrification Mandates

-

10.2 Battery Safety, Transport, and Recycling Regulations

-

10.3 National Incentive Programs and Carbon Targets

-

-

Innovation and Future Outlook

-

11.1 Next-Gen Chemistries and Battery Swapping Tech

-

11.2 Role of AI and Digital Twins in Battery Lifecycle Management

-

11.3 Decentralized Storage and Mobility Grid Integration

-

-

Conclusion and Strategic Outlook

-

Appendices

-

13.1 Glossary

-

13.2 Research Methodology

-

13.3 References and Sources

To get a detailed Table of content/ Table of Figures/ Methodology Please contact our sales person at ( chris@marketinsightsresearch.com )

FAQ'S

For a single, multi and corporate client license, the report will be available in PDF format. Sample report would be given you in excel format. For more questions please contact:

Within 24 to 48 hrs.

You can contact Sales team (sales@marketinsightsresearch.com) and they will direct you on email

You can order a report by selecting payment methods, which is bank wire or online payment through any Debit/Credit card, Razor pay or PayPal.

Discounts are available.

Hard Copy