Middle East & Africa UPS Market

Middle East & Africa UPS Market Segmented By Capacity (Less than 10 kVA, 10-100 kVA and Above 100 kVA), By Technology (Standby UPS System, Online UPS System and Line-interactive UPS System), By Power Consumption (Data Centers, Telecommunications, Healthcare, Industrial and Others), By Country, By Competition Forecast & Opportunities 2018-2028

Published Date: May - 2025 | Publisher: MIR | No of Pages: 320 | Industry: Power | Format: Report available in PDF / Excel Format

View Details Buy Now 2890 Download Free Sample Ask for Discount Request Customization| Forecast Period | 2024-2028 |

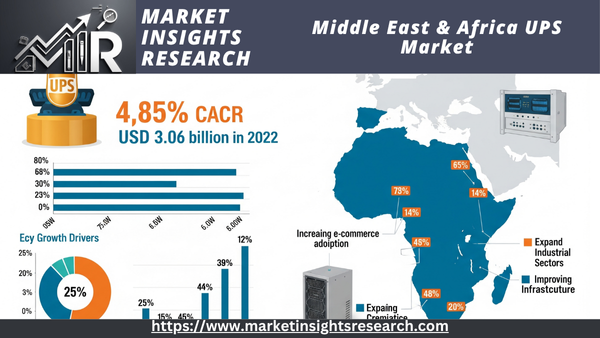

| Market Size (2022) | USD 3.06 billion |

| CAGR (2023-2028) | 4.85% |

| Fastest Growing Segment | Data Centers |

| Largest Market | Saudi Arabia |

Market Overview

Middle East & Africa UPS Market has valued at USD 3.06 billion in 2022 and is anticipated to project robust growth in the forecast period with a CAGR of 4.85% through 2028. The Middle East & Africa region frequently encounters power outages and fluctuations in electricity supply.

Download Free Sample Ask for Discount Request Customization

This unreliable power infrastructure fuels the need for UPS systems, guaranteeing uninterrupted power for critical applications in industries like healthcare, manufacturing, IT, and telecommunications.

Key Market Drivers

Increasing E-commerce Activities and Last-Mile Delivery Demands

Due to a number of important factors, the UPS market in the Middle East and Africa (MEA) has been expanding significantly. The two most notable of them are the growing needs for last-mile deliveries and e-commerce. Online commerce and digital transactions have increased dramatically in the MEA region during the last ten years. Rising internet usage, an expanding middle class, and changing consumer preferences are all responsible for this.

Rapid urbanization and the emergence of a youthful, tech-savvy populace are the main causes of the growth of e-commerce in the MEA region. More individuals are drawn to online shopping because of its convenience, variety, and affordable costs as internet and smartphone accessibility rise. Due to the proliferation of e-commerce platforms and marketplaces brought about by this trend, there is a significant need for dependable logistics and package delivery services.

Businesses have had to improve supply chain management and logistics to satisfy the expectations of e-commerce. As a result, there is an increasing demand for UPS solutions that guarantee the safe and prompt delivery of products to final consumers. Because they provide real-time tracking, route optimization, and effective handling of a high volume of packages, UPS systems are essential to the last-mile delivery process.

Additionally, the MEA region's transition to e-commerce has been expedited by the COVID-19 epidemic. The need for e-commerce services increased to previously unheard-of proportions as consumers resorted to online buying in an effort to reduce in-person encounters. This demonstrated how crucial UPS systems are to maintaining smooth delivery operations, especially in trying circumstances.

Additionally, UPS systems are becoming more efficient as a result of the logistics industry's embrace of contemporary technology like AI (Artificial Intelligence) and IoT (Internet of Things). The UPS market in MEA is expanding thanks to these technologies, which make predictive maintenance, route optimization, and real-time delivery vehicle monitoring possible.

In conclusion, rising e-commerce and last-mile delivery needs are driving the UPS market in the Middle East and Africa. UPS providers will be essential to facilitating effective logistics and boosting the region's economy as a whole as the area embraces digital transformation and customer demands for prompt and dependable delivery services rise.

Infrastructure Development and Economic Growth

The Middle East and Africa (MEA) UPS (Uninterruptible Power Supply) industry is mostly driven by economic expansion and infrastructure development. The need for a steady and dependable power supply grows as both public and commercial organizations spend in updating and enlarging their infrastructure. In order to protect sensitive equipment and vital activities in a variety of industries, UPS systems are crucial for maintaining electricity.

The MEA's fast urbanization and population increase are two major drivers driving infrastructure development in the area. As cities grow, there is a growing need for additional residential and commercial structures as well as vital infrastructure like data centers, hospitals, and manufacturing plants. For these facilities to run effectively, reliable power supply is essential.

UPS systems are used to supply backup power in order to lessen power outages brought on by weather, equipment failures, or grid instability. These solutions guarantee continuous operations in industries including healthcare, finance, telecommunications, and IT in addition to preventing data loss and equipment damage.

Additionally, there are advantages and disadvantages to the growing investment in renewable energy projects throughout MEA. Although they are more sustainable and clean, renewable energy sources like wind and sun can be sporadic. By guaranteeing a smooth transition between grid power and renewable energy sources, UPS systems fill the gap and provide power continuity even in the face of energy source volatility.

The expansion of several industries, like as manufacturing, telecommunications, and information technology, is directly related to the economic growth of MEA. To sustain their operations and satisfy rising needs, these businesses need dependable power solutions. The significance of UPS systems as a defense against power outages increases as the local economy diversifies and draws in international investment.

Extreme weather events, like sandstorms and extremely high temperatures, are also common in the MEA region and can cause power disruptions. For continuous operations in such settings, UPS systems with sophisticated capabilities like temperature tolerance and sturdy construction are essential.

In summary, infrastructure development and economic growth are the driving forces behind the UPS market in the Middle East & Africa. The need for reliable power supply solutions in rapidly urbanizing areas, critical infrastructure, and growing industries highlights the significance of UPS systems in supporting the continued development and progress of MEA.

Download Free Sample Ask for Discount Request Customization

Focus on Energy Efficiency and Sustainability

In the Middle East and Africa (MEA) area, the UPS (Uninterruptible Power Supply) industry is being significantly driven by energy efficiency and sustainability. Businesses and governments in MEA are looking for UPS solutions that not only ensure power continuity but also lower energy usage and carbon emissions, as environmental responsibility and energy conservation become more and more important.

MEA nations are working together to switch to better energy sources and lessen their carbon footprint. Energy-efficient UPS systems that can assist businesses in reaching their environmental objectives are therefore in greater demand. These systems are made to guarantee effective energy use and reduce power losses while in use.

In addition to helping the environment, energy-efficient UPS systems save businesses money. Businesses are eager to use UPS solutions that not only safeguard their vital equipment but also save their overall energy expenditures as energy prices continue to climb. The deployment of energy-efficient UPS systems is being propelled by this financial incentive in a number of MEA businesses.

Furthermore, energy efficiency has increased dramatically with the use of cutting-edge technology like lithium-ion batteries in UPS systems. Compared to conventional lead-acid batteries, these batteries have higher energy densities, longer lifespans, and quicker charging times, which makes them a desirable option for companies trying to lessen their carbon footprint.

In several MEA nations, government policies and incentives also promote the use of sustainable technologies, such as UPS systems with low power consumption. These regulations encourage the use of eco-friendly machinery and offer tax breaks or financial aid to businesses who make investments in energy-saving technologies.

Additionally, businesses are looking for partners and suppliers who share their commitment to sustainability as they grow more conscious of the effects their operations have on the environment. UPS companies that supply environmentally friendly solutions are better positioned to satisfy the MEA market's rising demand.

In conclusion, the UPS market in the Middle East and Africa is being driven by the emphasis on sustainability and energy efficiency. One of the main factors driving the adoption of UPS systems in MEA is the move towards greener UPS solutions, which are in line with regional and international sustainability objectives and provide businesses with cost and environmental advantages.

Key Market Challenges

Infrastructure Limitations and Power Quality Issues

Two of the biggest challenges facing the Middle East and Africa (MEA) UPS (Uninterruptible Power Supply) business are limited infrastructure and issues with power quality. Despite significant expansion and development, the MEA region still lags behind more developed countries in terms of a consistent and reliable electricity supply.

Several countries in the MEA region frequently suffer from blackouts, voltage swings, and power outages as a result of inadequate and antiquated electrical infrastructure. In addition to interfering with businesses and essential operations, these issues place a significant burden on UPS systems. The effectiveness of UPS systems is diminished by frequent and prolonged outages, even though they are designed to provide backup power in the event of such disturbances.

Furthermore, the power supply quality in the MEA region is usually subpar, with common issues like harmonics, surges, and voltage sags. In addition to supplying backup power, UPS systems must filter and condition the incoming electricity to protect sensitive equipment. It can be challenging to address these needs in places with unstable electrical networks.

Infrastructure limitations also hinder the adoption of advanced UPS technologies, including three-phase systems and large-scale data center solutions. The growth of industries like manufacturing, telecommunications, and information technology depends on these technologies, but they require robust and dependable infrastructure.

To address this issue, governments and businesses in the MEA area must prioritize infrastructure development and invest in updating the electrical grid. Utilizing renewable energy sources and modern grid technology can boost UPS system efficiency by reducing outage frequency and improving power quality.

Cost Sensitivity and Budget Constraints

Budgetary restrictions and cost sensitivity are two major issues facing the MEA UPS business. Even while there is still a great demand for dependable electricity solutions, many organizations in the area have little funding. Because UPS systems are sometimes seen as capital-intensive expenditures, this may make it difficult for firms to invest in them.

Purchasing and installing UPS systems can come with a hefty upfront cost, particularly for bigger businesses or those with significant power backup needs. This price includes not only the actual UPS units but also related parts including cooling systems, batteries, and maintenance services. Businesses frequently have to carefully weigh their budgetary constraints against their need for power protection, which leads to sacrifices in system redundancy and capacity.

Additionally, continuous operating expenses, such as maintenance and electricity use, might eventually put a strain on budgets. Even though energy-efficient UPS systems can reduce these expenses, adoption may still be hampered by the initial outlay, especially for smaller companies and organizations with fewer resources.

In order to overcome this obstacle and make UPS systems more accessible to a larger spectrum of enterprises, UPS suppliers in MEA need to investigate flexible financing options like leasing or pay-as-you-go models. By providing incentives or subsidies to encourage the use of UPS solutions among small and medium-sized businesses (SMEs) and public institutions, governments and industry associations can also play a crucial role.

Download Free Sample Ask for Discount Request Customization

Lack of Skilled Workforce and Technical Expertise

Lack of technological know-how and a competent workforce are major obstacles for the UPS market in the Middle East and Africa (MEA). Installing, maintaining, and repairing UPS systems requires specific skills, especially for sensitive applications like data centers and healthcare institutions.

There is frequently a lack of skilled engineers and technicians with knowledge of UPS technology in MEA nations. This shortage may lead to subpar system performance, prolonged downtime during maintenance or repairs, and delays in the deployment of UPS systems. Additionally, a lack of technical know-how may result in incorrect system configuration, which lowers the efficacy and efficiency of UPS installations.

The intricacy of UPS systems need a skilled and knowledgeable crew, especially in larger-scale deployments. For regular maintenance, problem solving, and guaranteeing the maximum effectiveness of UPS systems, skilled personnel are essential. Organizations in MEA may be reluctant to invest in UPS technology if they do not have access to such knowledge because they fear operational disruptions and higher maintenance expenses.

Governments, academic institutions, and UPS providers must work together to address this issue. By working together, they may provide certifications and training courses that give people the know-how to operate UPS systems. Furthermore, service providers can supply businesses with extensive maintenance contracts, guaranteeing that qualified experts are available to assist UPS installations and lessen the workload for internal IT teams.

In conclusion, for the Middle East & Africa UPS market to prosper, it is critical to overcome infrastructure constraints, cost sensitivity, and the lack of qualified workers. Governments, corporations, and UPS providers must work together to overcome these obstacles and guarantee the dependable and extensive use of UPS technology in the area.

Key Market Trends

Increased Adoption of Modular UPS Systems

The growing use of modular UPS systems is a noteworthy development in the Middle East and Africa's (MEA) UPS (Uninterruptible Power Supply) market. Businesses and organizations in the area favor these systems because they provide a number of benefits over conventional monolithic UPS units.

Scalability is a major benefit of modular UPS systems. Businesses can begin with a smaller capacity and increase it as their needs for power protection increase with a modular architecture. This scalability fits perfectly with the dynamic character of MEA firms, which frequently grow quickly and have fluctuating power needs.

Additionally, modular UPS systems provide more flexibility. These systems can be readily maintained or upgraded without interfering with essential functions in the case of a component failure or maintenance need. For sectors like healthcare, finance, and telecommunications, this reduces downtime and guarantees constant power availability.

In addition, modular UPS systems typically use less energy than conventional monolithic systems. During times when power demand is lower, they can adjust their capacity to fit the load, minimizing energy waste. This efficiency can result in financial savings and a smaller carbon footprint in an area where energy costs are a major concern.

It is anticipated that the use of modular UPS systems will continue to grow as MEA enterprises look for flexible and affordable power protection solutions. The region's focus on sustainability and resource optimization is in line with this trend, which makes modular UPS systems a popular option in the developing MEA UPS market.

Integration of Advanced Monitoring and Management Technologies

Another notable trend in the MEA UPS market is the incorporation of advanced monitoring and management technologies. As businesses and industries become more dependent on continuous power availability, the demand for real-time visibility and control over UPS systems is growing.

Modern UPS systems are equipped with intelligent monitoring and management capabilities that enable remote monitoring, predictive maintenance, and proactive fault detection. These features are particularly valuable in the MEA region, where organizations often operate distributed facilities in remote or challenging environments.

By integrating IoT (Internet of Things) technology, UPS systems can provide real-time data on power quality, system health, and energy consumption. This data is invaluable for optimizing UPS performance, preventing downtime, and minimizing energy costs. Additionally, predictive maintenance algorithms can identify potential issues before they cause system failures, reducing the risk of unplanned downtime.

Moreover, cloud-based monitoring platforms enable businesses to centralize the management of UPS systems across multiple locations, ensuring consistent monitoring and control. This is especially critical for industries with vital operations such as data centers, where any power disruption can lead to substantial financial losses and reputational damage.

The integration of advanced monitoring and management technologies not only enhances the reliability and efficiency of UPS systems but also aligns with the broader digital transformation initiatives in the MEA region. As organizations increasingly acknowledge the significance of data-driven decision-making and remote management capabilities, the demand for UPS solutions offering these features will continue to rise.

Segmental Insights

Capacity

The Above 100 kVA segment emerged as the dominant player in 2022. The above 100 kVA UPS segment in the MEA region represents a significant and expanding market, driven by rapid urbanization, industrialization, and infrastructure development. Critical industries such as data centers, manufacturing, healthcare, and telecommunications necessitate larger UPS systems in this segment to ensure uninterrupted power supply.

The manufacturing and industrial sector in MEA encompasses diverse industries, including automotive, petrochemicals, and heavy machinery, which heavily rely on uninterrupted power for seamless production processes and to avoid costly downtime. UPS systems above 100 kVA are commonly deployed to safeguard critical machinery and manufacturing operations.

With the growing emphasis on energy efficiency, the above 100 kVA UPS segment is witnessing a rising demand for eco-friendly and energy-efficient solutions that align with the sustainability goals of businesses and organizations in MEA. High-capacity UPS systems with advanced features like energy-efficient modes and intelligent load management are gaining traction.

Incorporating remote monitoring and management capabilities, large UPS systems enable centralized oversight of the health and performance of these critical systems. This functionality is particularly crucial for timely issue resolution and optimizing UPS unit efficiency.

As the region's economy and infrastructure continue to flourish, the demand for large-capacity UPS systems is expected to remain robust. UPS providers that offer innovative, energy-efficient, and reliable solutions tailored to the unique requirements of these industries will encounter substantial growth opportunities in this segment.

Technology

The Online UPS System segment is projected to experience rapid growth during the forecast period. The Online UPS System segment in the MEA region is experiencing consistent growth due to the rising demand for uninterrupted and clean power in critical applications. Industries heavily reliant on Online UPS systems include data centers, telecommunications, healthcare, financial services, and manufacturing, where power quality and continuity are of utmost importance.

The telecommunications and IT sectors in the MEA region continue to expand, requiring reliable power to ensure network connectivity and efficient data processing. Online UPS systems play a crucial role in maintaining uninterrupted communication services and safeguarding networking equipment from power disturbances.

Manufacturing plants and industrial facilities depend on stable and continuous power for their operations. Online UPS systems are utilized to protect sensitive machinery and automation systems from power disruptions. These UPS systems are essential in preventing production downtime and ensuring high product quality.

Online UPS systems often come with advanced features, such as real-time monitoring, remote management, and predictive maintenance capabilities. These features empower operators to proactively address issues, optimize system performance, and minimize downtime.

Country Insights

In 2022, Saudi Arabia became the leading force. The UPS market in Saudi Arabia, a major economy in the MEA area, is very significant. The nation's ongoing infrastructure development, rising industrialization, and escalating digitalization initiatives have all contributed to the market's steady expansion. The need for UPS systems in Saudi Arabia is driven by a number of industries, including IT, manufacturing, healthcare, banking, and telecommunications. For these industries to continue operating and protect vital equipment, electricity availability must be constant.

Saudi Arabia has invested heavily in the construction of its infrastructure, which includes data centers, industrial facilities, and residential and commercial buildings. Because of this increase in infrastructure, dependable power protection solutions are required, and UPS systems are essential for maintaining an uninterrupted power supply. The market for data centers in Saudi Arabia is expanding quickly due to rising demands for data storage, cloud computing, and digitization. Data centers depend on UPS systems to provide uptime and dependability because they are extremely vulnerable to power outages.

Saudi Arabia's economy still heavily depends on the oil and gas industry. In locations where power outages can have dire repercussions, such as oil refineries, petrochemical facilities, and offshore drilling activities, UPS systems are essential for protecting vital equipment and avoiding downtime.

Saudi Arabia's telecom industry is expanding steadily because to rising internet and mobile adoption rates. Especially in remote and difficult-to-reach areas, telecommunications operators depend on UPS systems to guarantee continuous connectivity and communication services. In line with worldwide patterns, Saudi Arabia is seeing an increase in attention to sustainability and energy efficiency. The nation's UPS suppliers are progressively providing energy-efficient systems that save operating expenses and lessen their negative effects on the environment.

In conclusion, the rise of important industries like data centers and telecommunications, as well as attempts to digitize the country's infrastructure, present substantial prospects for the UPS market in Saudi Arabia. Reliable power protection solutions, such as UPS systems, are projected to continue to be in high demand as the nation's economy grows and modernizes.

Download Free Sample Ask for Discount Request Customization

Recent Developments

- In March 2023, Schneider Electric launched a new range of UPS products in the Middle East & Africa region.

Key Market Players

- Schneider Electric

- Eaton Corporation

- APC by Schneider Electric

- Emerson Network Power

- Legrand

- Delta Electronics

- ABB

- Socomec

- Riello UPS

- KSTAR

|

By Capacity |

By Technology |

By Power Consumption |

By Country |

|

|

|

|

Related Reports

- Industrial Electric Boiler Market - By Voltage Rating (Low Voltage, Medium Voltage), By Capacity (< 10 MMBtu/hr, 10-50 M...

- Biomass Boiler Market - By Feedstock (Woody Biomass, Agricultural Waste, Industrial Waste, Urban Residue), By Product (S...

- Asia Pacific Electric Boiler Market Size - By Capacity (≤ 10 MMBtu/hr, > 10 - 50 MMBtu/hr, > 50 - 100 MMBtu/hr, > 100 ...

- North America & Europe Electric Boiler Market Size - By Voltage Rating (Low Voltage, Medium Voltage), By Application (Re...

- North America Residential Boiler Market Size - By Fuel (Natural Gas, Oil, Electric), By Technology (Condensing {Natural ...

- U.S. Commercial Boiler Market – By Product (Hot Water, Steam), Application (Offices, Healthcare Facilities, Educationa...

Table of Content

-

Executive Summary

-

1.1 Market Snapshot

-

1.2 Key Trends and Forecast Highlights

-

1.3 Strategic Recommendations

-

-

Introduction

-

2.1 Scope and Objectives of the Report

-

2.2 Research Methodology

-

2.3 Definitions and UPS Market Classification

-

-

Market Overview

-

3.1 What Is a UPS and Its Role in Power Management

-

3.2 Types of UPS Systems (Online, Offline, Line-Interactive)

-

3.3 Value Chain Analysis in the MEA UPS Industry

-

3.4 Overview of Power Infrastructure and Grid Stability in MEA

-

-

Market Dynamics

-

4.1 Drivers

-

4.1.1 Rising Demand for Backup Power in Commercial and Industrial Sectors

-

4.1.2 Expansion of Data Centers, Telecom, and Healthcare Infrastructure

-

4.1.3 Smart City Initiatives and Energy Security Programs

-

-

4.2 Restraints

-

4.2.1 High Initial Investment and Maintenance Costs

-

4.2.2 Limited Grid Connectivity in Remote Areas

-

-

4.3 Opportunities

-

4.3.1 Integration of Lithium-Ion and Modular UPS Systems

-

4.3.2 Renewable Energy-Backed UPS Solutions

-

-

4.4 Challenges

-

4.5 Porter’s Five Forces Analysis

-

-

Technology Landscape

-

5.1 Online Double Conversion UPS

-

5.2 Line-Interactive and Standby UPS

-

5.3 Modular and Scalable UPS Designs

-

5.4 Battery Technologies: Lead-Acid vs. Lithium-Ion

-

5.5 UPS Monitoring Software and Smart Controllers

-

-

Market Segmentation

-

6.1 By Capacity

-

6.1.1 <10 kVA

-

6.1.2 10–100 kVA

-

6.1.3 101–250 kVA

-

6.1.4 >250 kVA

-

-

6.2 By Application

-

6.2.1 Data Centers

-

6.2.2 Healthcare Facilities

-

6.2.3 Industrial & Manufacturing

-

6.2.4 Commercial Buildings

-

6.2.5 Government & Defense

-

6.2.6 Others

-

-

6.3 By End-User

-

6.3.1 Residential

-

6.3.2 Commercial

-

6.3.3 Industrial

-

-

-

Regional Analysis – Middle East & Africa

-

7.1 GCC Countries (UAE, Saudi Arabia, Qatar, Oman, Bahrain, Kuwait)

-

7.2 North Africa (Egypt, Morocco, Algeria)

-

7.3 Sub-Saharan Africa (South Africa, Nigeria, Kenya, Ethiopia)

-

7.4 Other Emerging Markets

-

-

Market Size and Forecast (2020–2030)

-

8.1 Revenue and Volume Forecast by Country and Segment

-

8.2 Price Trends, Margin Analysis, and Adoption Curves

-

8.3 Infrastructure Investment and Grid Reliability Impacts

-

-

Competitive Landscape

-

9.1 Market Share and Regional Presence

-

9.2 Company Profiles

-

9.2.1 Schneider Electric

-

9.2.2 Eaton

-

9.2.3 Vertiv

-

9.2.4 ABB

-

9.2.5 Legrand

-

9.2.6 Huawei Digital Power

-

9.2.7 Others

-

-

9.3 Strategic Partnerships, Local Distributors, and Installers

-

-

Policy and Regulatory Landscape

-

10.1 Electrical and Safety Standards Across MEA

-

10.2 Import Duties, VAT, and Energy Efficiency Programs

-

10.3 Power Sector Reforms and Infrastructure Spending

-

-

Innovation and Future Outlook

-

11.1 UPS in Hybrid Energy Systems and Off-Grid Applications

-

11.2 Predictive Maintenance and AI in Power Protection

-

11.3 Market Readiness for Smart UPS and Energy-as-a-Service

-

-

Conclusion and Strategic Outlook

-

Appendices

-

13.1 Glossary

-

13.2 Research Methodology

-

13.3 References and Sources

To get a detailed Table of content/ Table of Figures/ Methodology Please contact our sales person at ( chris@marketinsightsresearch.com )

FAQ'S

For a single, multi and corporate client license, the report will be available in PDF format. Sample report would be given you in excel format. For more questions please contact:

Within 24 to 48 hrs.

You can contact Sales team (sales@marketinsightsresearch.com) and they will direct you on email

You can order a report by selecting payment methods, which is bank wire or online payment through any Debit/Credit card, Razor pay or PayPal.

Discounts are available.

Hard Copy