Energy Efficient Warehouse Lighting System Market

Energy Efficient Warehouse Lighting System Market - Global Industry Size, Share, Trends, Opportunity, and Forecast, Segmented By Source (High-intensity Discharge Lamps (HID), Linear Fluorescent Lamps (LFL), Light Emitting Diodes (LED), Others), By Application (Residential, Commercial, Industrial), By Region, By Competition, 2018-2028

Published Date: May - 2025 | Publisher: MIR | No of Pages: 320 | Industry: Power | Format: Report available in PDF / Excel Format

View Details Buy Now 2890 Download Free Sample Ask for Discount Request Customization| Forecast Period | 2024-2028 |

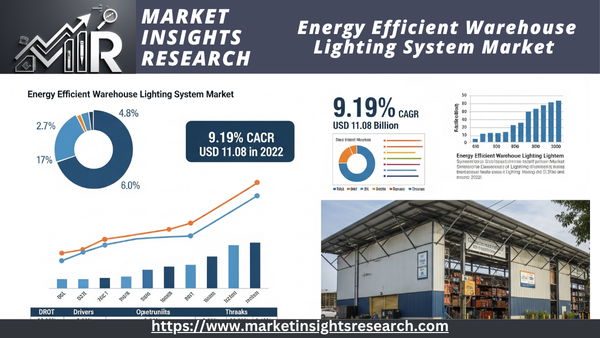

| Market Size (2022) | USD 11.08 Billion |

| CAGR (2023-2028) | 9.19% |

| Fastest Growing Segment | Commercial |

| Largest Market | North America |

Market Overview

Global Energy Efficient Warehouse Lighting System Market was valued at USD 11.08 billion in 2022 and is anticipated to project robust growth in the forecast period with a CAGR of 9.19% through 2028.

Download Free Sample Ask for Discount Request Customization

The market for energy-efficient warehouse lighting systems is the area of the worldwide lighting industry dedicated to offering large-scale storage facilities and warehouses environmentally friendly and cutting-edge lighting solutions. The creation, production, installation, and upkeep of lighting systems intended to optimize energy efficiency while improving illumination quality and operating safety in warehouse settings are the core focus of this market.

Energy-efficient warehouse lighting systems seek to provide more economical and ecologically friendly alternatives to conventional, energy-intensive lighting technologies like incandescent or fluorescent lighting. Notably, because of its improved illumination performance, longer lifespan, and remarkable energy economy, Light Emitting Diode (LED) lighting has become a dominating technology in this market.

Reducing energy use, carbon emissions, and warehouse operators' operating expenses are the main goals of the market for energy-efficient warehouse lighting systems. In order to optimize energy usage based on occupancy and ambient lighting conditions, these lighting systems frequently integrate intelligent features like motion sensors, daylight harvesting, and lighting controls.

The market for energy-efficient warehouse lighting systems is growing and changing as a result of the increased emphasis on sustainability, energy conservation, and operational efficiency on a global scale. It is an essential part of contemporary warehouse and logistics operations since it helps companies lower their environmental impact, increase workplace safety, and save a significant amount of money on energy.

Key Market Drivers

Energy Efficiency Regulations and Sustainability Initiatives

Energy efficiency and sustainability have become increasingly important in the commercial and industrial sectors in recent years. To fight climate change, governments and regulatory agencies around the world have set strict energy efficiency guidelines and carbon reduction goals. Warehouses and distribution hubs are increasingly implementing energy-efficient lighting systems in response to these rules.

In addition to helping businesses comply with regulations, energy-efficient warehouse lighting options like LED (Light Emitting Diode) lights also result in significant energy cost reductions. Compared to more conventional lighting technologies like fluorescent or incandescent lights, LEDs use a lot less electricity. Additionally, they last longer, which lowers maintenance expenses and advances sustainability objectives. Energy-efficient lighting has thus emerged as a key factor propelling the global warehouse lighting market.

Cost Savings and Return on Investment (ROI)

The adoption of energy-efficient warehouse lighting solutions is strongly influenced by cost reductions. Warehouse operators incur high electricity expenditures due to the energy-intensive nature of traditional lighting solutions. Businesses can save a significant amount of money by switching to energy-efficient options like LED lighting.

LEDs are well known for being long-lasting and energy-efficient. They immediately lower electricity costs because they use up to 80% less electricity than conventional lights. Over time, its longer longevity also results in lower maintenance and replacement expenses.

The comparatively high initial cost of LED lighting systems is frequently compensated for by a quick return on investment because of lower maintenance and energy costs. This affordability serves as a strong motivator for warehouses to modernize their lighting systems, which promotes the use of energy-saving technologies.

Download Free Sample Ask for Discount Request Customization

Technological Advancements in Lighting

Energy-efficient warehouse lighting systems have evolved in large part due to technological developments. In particular, continuous advancements in performance, controllability, and efficiency have benefited LED lighting.

Contemporary LED lighting fixtures are ideal for a range of warehouse applications, such as task and high-bay lighting, due to their exceptional brightness and color quality. Energy savings are further increased by sophisticated control systems that make sure lights are only turned on when necessary, including motion sensors and smart lighting.

Warehouse lighting may be remotely monitored and managed thanks to connected lighting solutions made possible by the Internet of Things (IoT). This degree of control aids in energy optimization and offers data-driven insights for additional efficiency gains. Warehouse lighting solutions that consume less energy are expected to become more popular as technology develops.

Environmental Consciousness and Corporate Social Responsibility

Corporate social responsibility (CSR) and growing environmental awareness are pushing businesses to use energy-efficient procedures and equipment. Sustainability is seen by many companies as a fundamental principle and an essential part of their corporate identity. Warehouse owners are looking for solutions to lessen their environmental impact and carbon footprint as part of their CSR programs.

These sustainability objectives are in line with energy-efficient lighting. For instance, because LED lighting uses less energy, it emits substantially fewer greenhouse gases. Warehouses can show their dedication to environmental stewardship, appease stakeholders, and attract eco-aware consumers by implementing energy-efficient lighting systems.

Improved Lighting Quality and Employee Productivity

In addition to saving money and energy, energy-efficient lighting systems also help warehouses have better lighting. For worker safety and productivity in these settings, adequate and high-quality lighting is crucial.

Regarding illumination quality, LED lighting has a number of benefits. It offers steady illumination without buzzing or flickering, which can be uncomfortable and strain the eyes. LEDs may also be regulated and dimmed to provide the best lighting possible for different locations and tasks in a warehouse.

According to studies, well-thought-out, energy-efficient lighting can improve worker comfort, lessen tiredness, and boost output. Warehouses can boost employee performance by investing in better lighting conditions, which will make the workspace more comfortable.

Retrofitting and Infrastructure Modernization

Many warehouses and distribution hubs still employ antiquated lighting technologies, which are expensive to maintain and inefficient with energy. An appealing alternative for warehouse operators looking to update their infrastructure without undergoing full renovations is retrofitting these buildings with energy-efficient lighting systems.

LED retrofits and other retrofit solutions provide an affordable means of improving lighting while maintaining current infrastructure and fixtures. The switch to energy-efficient technology is made easier with these retrofits, which are made to fit into conventional lighting outlets.

Warehouses can rapidly experience the advantages of increased illumination quality, lower operating costs, and increased energy efficiency by updating their lighting infrastructure. For warehouses with tight budgets or a need to minimize interruptions to ongoing operations, this driver is especially pertinent.

In conclusion, a number of factors, such as energy efficiency laws, cost reductions, technological developments, sustainability programs, better illumination quality, and retrofitting opportunities, are driving the global market for energy-efficient warehouse lighting systems. In the upcoming years, the market is anticipated to see consistent expansion and innovation as warehouses continue to realize the benefits of energy-efficient lighting solutions.

Download Free Sample Ask for Discount Request Customization

Government Policies are Likely to Propel the Market

Energy Efficiency Standards and Regulations

The global market for energy-efficient warehouse lighting systems is significantly shaped by government energy efficiency guidelines and regulations. These regulations aim to encourage the use of energy-efficient lighting solutions while lowering greenhouse gas emissions and energy consumption.

Lighting systems must adhere to minimum energy performance standards (MEPS), which are frequently set by governments. In order to assist businesses and customers in identifying energy-efficient lighting equipment, they may also require labeling requirements, such as ENERGY STAR certification. The development and uptake of cutting-edge lighting technologies, such as LED (Light Emitting Diode) lighting systems, which are well-known for their energy efficiency, are encouraged by these standards.

Warehouses and other commercial and industrial buildings are often subject to energy efficiency laws. They mandate that companies update their lighting systems to satisfy energy efficiency standards, which may involve the installation of motion sensors, LED lights, and lighting controls. Following these rules helps warehouse owners save money on operating expenses in addition to reducing energy use.

Incentive Programs and Rebates

Various levels of government frequently put incentive and rebate programs into place to promote the usage of energy-efficient warehouse lighting systems. The initial expenses of replacing lighting infrastructure with energy-efficient technologies are intended to be partially covered by these schemes.

Rebates, which partially reimburse the cost of purchasing and installing energy-efficient lighting solutions, are usually provided as financial incentives. In certain situations, government initiatives might pay for a sizable amount of the expenses, which would make investing in high-efficiency lighting solutions more feasible for companies.

There are many different types of incentive programs, such as grants, tax credits, and subsidies. Because they shorten the payback period and increase businesses' return on investment (ROI), they play a key role in hastening the adoption of energy-efficient warehouse lighting systems.

Building Codes and Compliance Requirements

Government-imposed building rules and compliance standards have a big influence on the market for energy-efficient warehouse lighting systems. The energy performance requirements for both new construction and retrofit projects are outlined in these regulations.

Building codes, which frequently include standards for lighting efficiency, apply to warehouse construction and refurbishment projects. These standards may require the installation of lighting controls and sensors to maximize energy utilization, as well as the use of energy-efficient lighting technologies like LED fixtures.

Governments make sure that both new and existing warehouses have lighting systems that are made to use as little energy as possible by ensuring adherence to energy-efficient lighting regulations. These regulations improve lighting safety and quality while lowering energy expenses and greenhouse gas emissions.

Energy Performance Certifications and Reporting

Through certification and reporting systems, numerous governments mandate that companies and warehouses provide information about their energy performance and consumption. These programs stimulate the use of energy-efficient technologies, such as lighting systems, and foster accountability and transparency in energy use.

Warehouses that satisfy particular sustainability and energy efficiency standards are recognized by energy performance certifications like BREEAM (Building Research Establishment Environmental Assessment Method) and LEED (Leadership in Energy and Environmental Design). Energy-efficient lighting solutions must frequently be included into larger sustainability activities in order to obtain these certifications.

Warehouses may be required by energy reporting laws to routinely monitor and report their energy usage and efficiency indicators. Businesses are encouraged to invest in energy-efficient lighting technology in order to reach performance standards, and this data aids in identifying areas for improvement.

Research and Development Funding

Funding for research and development (R&D) initiatives targeted at developing energy-efficient lighting systems is often provided by governments. Innovative lighting solutions for warehouses and other business locations are being developed thanks to these R&D activities.

Projects aimed at enhancing the effectiveness, durability, and affordability of energy-efficient lighting systems may be supported by research funding. Research on novel materials, lighting management systems, and adaptive lighting options can all fall under this category.

Government-funded R&D projects guarantee that companies have access to cutting-edge lighting technology that can improve energy efficiency and overall lighting quality in warehouses by encouraging innovation in the lighting sector.

International Trade Agreements and Harmonization

The global market for energy-efficient warehouse lighting systems may be impacted by international trade agreements and harmonization initiatives. By bringing standards and laws into line across borders, these initiatives hope to lower trade barriers and encourage the widespread use of energy-efficient technologies.

Energy-efficient lighting solutions can be imported and exported more easily thanks to trade agreements, giving businesses access to a wide variety of choices. These regulations level the playing field for manufacturers and encourage competitiveness by standardizing energy efficiency requirements and performance criteria, which eventually spurs innovation and lowers costs in the lighting sector.

Additionally, international agreements frequently promote best practices and knowledge exchange, allowing nations to benefit from each other's experiences in advancing energy-efficient lighting systems. This cooperative strategy supports the expansion and development of the worldwide market for energy-efficient warehouse lighting systems.

In conclusion, the global market for energy-efficient warehouse lighting systems is greatly influenced by government regulations. The widespread use of energy-efficient lighting solutions is facilitated by international trade agreements, building codes, energy performance certificates, incentive programs, energy efficiency standards and regulations, and research funding. Together, these regulations encourage energy efficiency, lower greenhouse gas emissions, and advance sustainability in the warehouse industry while giving companies the chance to improve their lighting systems.

Key Market Challenges

High Initial Costs and Return on Investment (ROI)

The high initial cost of updating lighting infrastructure to energy-efficient solutions is one of the main issues facing the global market for energy-efficient warehouse lighting systems. Although these systems have significant long-term advantages in terms of lower maintenance costs and energy savings, many warehouse operators may find the initial outlay prohibitive.

Compared to conventional lighting technologies like fluorescent or incandescent bulbs, energy-efficient lighting solutions like LED (Light Emitting Diode) fixtures typically have higher initial purchase prices. Furthermore, installing energy-efficient lighting systems can be expensive, particularly in large warehouses.

Some warehouse owners may be discouraged from switching to energy-efficient lighting due to the high upfront costs, especially if they are on a tight budget or have conflicting investment objectives. Energy-efficient lighting systems may therefore be adopted more slowly than intended, which would impede the market's expansion.

Innovative finance solutions, such energy performance contracting (EPC) or third-party financing, are needed to address this issue and assist warehouses in overcoming the first cost barrier. Businesses can install energy-efficient lighting modifications with little to no initial capital outlay thanks to these technologies, which will eventually pay for themselves through energy savings.

It's also critical to spread the word about the long-term ROI advantages of energy-efficient lighting. Businesses may prioritize energy-efficient lighting improvements and make well-informed decisions if they are given clear data on energy cost reductions and payback timeframes.

Technological Complexity and Integration

The difficulty of combining cutting-edge lighting technologies with current infrastructure and control systems is a major obstacle in the global market for energy-efficient warehouse lighting systems. The lighting demands of warehouses are frequently varied and intricate, and they might change depending on the size, layout, and particular operational requirements of the facility.

For energy-efficient lighting systems, such LED fixtures, to satisfy the particular requirements of a warehouse, considerable design and modification may be necessary. To provide the best possible visibility and safety, this may entail choosing the right illumination color temperatures, beam angles, and control settings.

The implementation procedure is further complicated by the use of sensors, lighting controls, and smart lighting solutions. Greater energy savings and illumination customisation are possible with these technologies, although installation and configuration may need for specific knowledge.

Energy-efficient lighting controls may need to be smoothly linked with existing control systems in warehouses, such as building management systems (BMS) or warehouse management systems (WMS). Interoperability problems, communication protocols, and compatibility concerns may come up throughout this integration procedure, which could cause delays and extra expenses.

Lighting manufacturers and service providers should provide comprehensive lighting design and integration services in order to overcome this obstacle. These services can assist warehouse owners in successfully navigating the challenges of choosing, integrating, and installing energy-efficient lighting solutions.

To guarantee compatibility and simplicity of integration, industry standards and protocols for lighting control systems should also be advocated and adhered to. Advanced lighting solutions can be adopted more quickly and with fewer integration issues if lighting manufacturers, technology suppliers, and warehouse operators work together.

In conclusion, the high upfront expenditures and return on investment (ROI) factors, along with the technological complexity and integration needs of advanced lighting technologies, present hurdles for the global market for energy-efficient warehouse lighting systems. Promoting the broad use of energy-efficient lighting solutions in warehouses and achieving their long-term advantages in terms of energy savings, sustainability, and operational efficiency will require addressing these issues.

Segmental Insights

Light Emitting Diodes (LED) Insights

In 2022, the biggest market share was held by the Light Emitting Diodes (LED) sector. Superb Energy EfficiencyLEDs are well known for having exceptional energy efficiency. Compared to conventional lighting technologies like incandescent or fluorescent bulbs, they transform a noticeably larger percentage of electrical energy into visible light. Because of their efficiency, LEDs save a significant amount of energy, which makes them a desirable option for warehouse managers trying to save expenses and electricity use. When compared to traditional lighting sources, LEDs offer a longer operational lifespan. Depending on the particular LED product and the circumstances surrounding use, they may last anywhere from 25,000 to 100,000 hours or longer. Warehouse operators can save money because of its lifespan, which lowers maintenance costs and the need for bulb replacements. LEDs require very little maintenance because of their lifetime and resilience. Especially in large facilities with high ceilings where maintenance can be difficult and expensive, warehouse managers can drastically cut down on the time and resources spent changing bulbs and fixtures. When compared to conventional lighting sources, LEDs provide better lighting quality in terms of brightness, color rendering, and decreased flicker. For warehouse settings where safety and visibility are critical, these elements are essential. Improved working conditions, less eye strain, and increased staff productivity are all benefits of LED lighting. LEDs ensure rapid and consistent lighting in warehouses by providing instant illumination without flickering or warm-up delays. Additionally, they are easily dimmable, providing for adjustable light level control according to certain jobs or environmental conditions. This flexibility improves energy efficiency and allows illumination to be customized to meet warehouse needs. LEDs can be useful in warehouse applications since they emit light in specified directions. LEDs may be made to focus light exactly where it is needed, minimizing waste and increasing lighting efficiency in contrast to conventional sources that emit light in all directions. Advanced lighting controls like motion sensors and sun harvesting systems work in unison with LEDs. Because of this interoperability, warehouses can install smart lighting systems that automatically alter lighting settings based on occupancy and natural light, maximizing energy efficiency. Because LED lighting uses less energy and lasts longer, it is in line with environmental sustainability goals. It is an environmentally friendly lighting option that supports global sustainability programs by reducing greenhouse gas emissions and leaving a smaller carbon footprint. To promote the use of energy-efficient lighting options, especially LEDs, numerous governments and utilities provide tax credits, rebates, and other financial incentives. These initiatives make LED lighting even more affordable for warehouse owners by offsetting the upfront investment costs. As the market for LED lighting has developed over time, more products are now available, more affordable, and perform better. The quality, effectiveness, and adaptability of LED lighting solutions have been further improved by ongoing technological developments, securing their leadership in the market for energy-efficient warehouse lighting systems.

Industrial Insights

In 2022, the Industrial segment had the biggest market share. Lighting accounts for a large percentage of the energy consumption of industrial facilities, which are notorious for using a lot of energy. Significant energy cost savings are possible with energy-efficient lighting systems, especially those that use Light Emitting Diodes (LEDs). There is a strong incentive to lower energy costs in industrial settings because of their size. Because of their scale and complexity, industrial locations usually demand a lot of illumination. Distribution centers, manufacturing facilities, and warehouses frequently have large floor spaces and high ceilings that necessitate efficient lighting. These rigorous lighting requirements can be satisfied with energy-efficient lighting solutions that use less electricity. When it comes to energy-efficient warehouse lighting, LEDs are the most common technology. They have a longer operating lifespan than conventional lighting technologies like fluorescent or incandescent bulbs. For industrial buildings, this lifespan means fewer bulb replacements, lower maintenance expenses, and longer-term cost benefits. In industrial settings, good lighting is essential for maintaining accuracy, efficiency, and safety. Better lighting quality in terms of brightness, color rendering, and less flicker is provided by energy-efficient lighting, especially LED lighting. This improves eye strain, improves working environment, and increases worker productivity. Because LEDs are simple to dim and control, industrial facilities can adjust illumination levels according to certain tasks, occupancy, or daylighting circumstances. Large, dynamic environments can have optimal lighting and energy use because to this versatility. Corporate social responsibility programs and environmental sustainability goals are common in industrial operations. By lowering energy use and greenhouse gas emissions, energy-efficient lighting supports these goals. It enables business owners to show their dedication to sustainability, which is becoming more and more significant to stakeholders, consumers, and government agencies. Various environmental and energy efficiency standards apply to industrial establishments. These facilities can comply with regulations, stay out of trouble, and lessen their environmental impact by implementing energy-efficient lighting systems. Although switching to energy-efficient lighting may require an initial expenditure, the comparatively short payback period resulting from lower maintenance costs and energy costs makes it a financially appealing option for industrial applications. The most recent developments in lighting technology are frequently advantageous to the industrial sector. Energy-efficient warehouse lighting is becoming even more attractive to industrial users as a result of ongoing advancements in LEDs and lighting controls that enhance performance and energy economy.

Regional Insights

North America

In the years to come, North America is anticipated to hold the most market share for energy-efficient warehouse lighting systems worldwide. This is because to the region's early adoption of energy-efficient lighting technologies and the existence of several major market players. Some of the world's biggest warehouse marketplaces, including those in the US and Canada, are located in the North American region.

The United States leads the North American market for energy-efficient warehouse lighting systems. When it comes to the creation and uptake of energy-efficient lighting technology, the US is a leader. Through a number of programs, the US government is also encouraging the use of energy-efficient warehouse lighting systems.

Europe

During the projection period, Europe is anticipated to rank as the second-largest market for energy-efficient warehouse lighting systems. The European Union has set high goals for the integration of renewable energy sources and energy efficiency. The region's need for energy-efficient lighting technologies is being driven by this.

Over the course of the forecast period, the European market for energy-efficient warehouse lighting systems is anticipated to expand at a consistent CAGR. The European Union has set high goals for the integration of renewable energy sources and energy efficiency. The region's need for energy-efficient lighting technologies is being driven by this.

Asia Pacific

Over the course of the projected period, Asia Pacific is anticipated to develop at the fastest CAGR. This is a result of the region's warehouse owners' and operators' increased demand for energy-efficient lighting as well as the rising investment in warehouse expansion. China and India, two of the world's fastest-growing economies, are located in Asia Pacific.

The market for energy-efficient warehouse lighting systems in Asia Pacific is anticipated to expand at the fastest rate throughout the course of the forecast period. This is a result of the region's warehouse owners' and operators' increased demand for energy-efficient lighting as well as the rising investment in warehouse expansion. China and India, two of the world's fastest-growing economies, are located in Asia Pacific.

Download Free Sample Ask for Discount Request Customization

Recent Developments

- In September 2022, General Electric (GE) announced that it would be investing USD100 million in its energy efficient warehouse lighting system business over the next three years. GE's investment will be used to develop new energy efficient lighting products and solutions, as well as to expand its sales and marketing efforts.

- In October 2022, Philips Lighting announced that it would be acquiring Signify, a leading provider of connected LED lighting systems, software, and services, for USD9 billion. Signify's connected LED lighting systems can be used to create energy efficient warehouse lighting systems that can be controlled remotely and monitored for performance.

- In November 2022, Acuity Brands announced that it would be launching a new line of energy efficient warehouse lighting fixtures that use LED technology. Acuity Brands' new LED lighting fixtures are expected to reduce energy consumption by up to 70% compared to traditional fluorescent lighting fixtures.

Key Market Players

- General Electric Company

- Siemens AG

- ABB Ltd

- Schneider Electric SE

- Signify N.V.

- Acuity Brands, Inc.

- OSRAM Licht AG

- IDEAL Industries Lighting, LLC

- Eaton Corp.

- Honeywell International Inc

|

By Source |

By Application |

By Region |

|

|

|

Related Reports

- Fire Tube Industrial Boiler Market - By Capacity (<10 MMBtu/hr, 10-25 MMBtu/hr, 25-50 MMBtu/hr, 50-75 MMBtu/hr, >75 MMBt...

- Gas Fired Boiler Market Size - By Capacity (≤ 10 MMBtu/hr, > 10 - 50 MMBtu/hr, > 50 - 100 MMBtu/hr, > 100 - 250 MMBtu/...

- Europe Residential Boiler Market Size - By Technology (Condensing {Natural Gas, Oil, Electric}, Non-Condensing {Natural ...

- U.S. Boiler Market Size By Fuel (Natural Gas, Oil, Coal), Capacity, By Technology (Condensing, Non-Condensing), By Produ...

- Commercial Hot Water Boiler Market Size - By Fuel (Natural Gas, Oil, Coal, Electric), By Technology (Condensing, Non-Con...

- UK Commercial Boiler Market Size By Fuel (Natural Gas, Oil, Coal, Electric), By Capacity, By Technology (Condensing, Non...

Table of Content

-

Executive Summary

-

1.1 Market Snapshot

-

1.2 Key Trends and Growth Opportunities

-

1.3 Strategic Recommendations

-

-

Introduction

-

2.1 Report Scope and Objectives

-

2.2 Research Methodology

-

2.3 Definitions and Technology Overview

-

-

Market Overview

-

3.1 What Is an Energy Efficient Warehouse Lighting System?

-

3.2 Evolution of Industrial Lighting Technologies

-

3.3 Role in Warehouse Automation, Safety, and Sustainability

-

3.4 Value Chain and Ecosystem Analysis

-

-

Market Dynamics

-

4.1 Market Drivers

-

4.1.1 Need for Operational Efficiency and Reduced Energy Costs

-

4.1.2 Adoption of Smart and Sensor-Integrated Lighting Systems

-

4.1.3 Regulatory Push for Energy Conservation in Industrial Facilities

-

-

4.2 Market Restraints

-

4.2.1 High Initial Investment in Smart Lighting Infrastructure

-

4.2.2 Retrofit Challenges in Legacy Warehouses

-

-

4.3 Market Opportunities

-

4.3.1 Expansion of E-commerce and Automated Warehousing

-

4.3.2 Integration with AI, IoT, and Warehouse Management Systems

-

-

4.4 Challenges

-

4.5 Porter’s Five Forces Analysis

-

-

Technology Landscape

-

5.1 LED Lighting Systems

-

5.2 Motion and Occupancy Sensors

-

5.3 Daylight Harvesting and Adaptive Lighting

-

5.4 Wireless Control Systems and Smart Hubs

-

5.5 Integration with Building Energy Management Systems (BEMS)

-

-

Market Segmentation

-

6.1 By Product Type

-

6.1.1 LED High Bay Lights

-

6.1.2 Linear Fixtures

-

6.1.3 Retrofit Kits

-

6.1.4 Controls and Sensors

-

-

6.2 By Application

-

6.2.1 Cold Storage Warehouses

-

6.2.2 General Storage Warehouses

-

6.2.3 Fulfillment and Distribution Centers

-

6.2.4 Smart Warehouses

-

-

6.3 By Installation Type

-

6.3.1 New Installations

-

6.3.2 Retrofit Installations

-

-

-

Regional Market Analysis

-

7.1 North America

-

7.2 Europe

-

7.3 Asia-Pacific

-

7.4 Latin America

-

7.5 Middle East & Africa

-

-

Market Size and Forecast (2020–2030)

-

8.1 Revenue Forecast by Region and Segment

-

8.2 Unit Shipment and Penetration Rate Forecast

-

8.3 Cost-Benefit and ROI Analysis for End-Users

-

-

Competitive Landscape

-

9.1 Market Share Analysis

-

9.2 Company Profiles

-

9.2.1 Signify (Philips Lighting)

-

9.2.2 Acuity Brands

-

9.2.3 Zumtobel Group

-

9.2.4 Cree Lighting

-

9.2.5 GE Current

-

9.2.6 Dialight

-

9.2.7 Others

-

-

9.3 Partnerships, Smart System Integrations, and Product Innovations

-

-

Policy and Regulatory Framework

-

10.1 Global and Regional Energy Efficiency Standards

-

10.2 Incentives and Compliance for Industrial Lighting Upgrades

-

10.3 Certifications (DLC, ENERGY STAR, LEED Points Contribution)

-

-

Innovation and Future Outlook

-

11.1 AI-Driven Lighting Optimization and Predictive Maintenance

-

11.2 Role of Lighting in Warehouse Robotics and Safety Protocols

-

11.3 Demand for Sustainable and Circular Lighting Products

-

-

Conclusion and Strategic Outlook

-

Appendices

-

13.1 Glossary

-

13.2 Research Methodology

-

13.3 References and Data Sources

To get a detailed Table of content/ Table of Figures/ Methodology Please contact our sales person at ( chris@marketinsightsresearch.com )

FAQ'S

For a single, multi and corporate client license, the report will be available in PDF format. Sample report would be given you in excel format. For more questions please contact:

Within 24 to 48 hrs.

You can contact Sales team (sales@marketinsightsresearch.com) and they will direct you on email

You can order a report by selecting payment methods, which is bank wire or online payment through any Debit/Credit card, Razor pay or PayPal.

Discounts are available.

Hard Copy