Vietnam Fuel Cell Market

Vietnam Fuel Cell Market By Type (Solid Oxide Fuel Cell (SOFC), Proton Exchange Membrane Fuel Cell (PEMFC), Molten Carbonate Fuel Cell (MCFC), Phosphoric Acid Fuel Cell (PAFC), Others), By Application (Portable, Stationary, Vehicle), By Size (Small and Large), By End User (Residential, Transportation, Data Center, Military & Defense, Others), By Region, Competition, Forecast and Opportunities 2028

Published Date: May - 2025 | Publisher: MIR | No of Pages: 320 | Industry: Power | Format: Report available in PDF / Excel Format

View Details Buy Now 2890 Download Free Sample Ask for Discount Request Customization| Forecast Period | 2024-2028 |

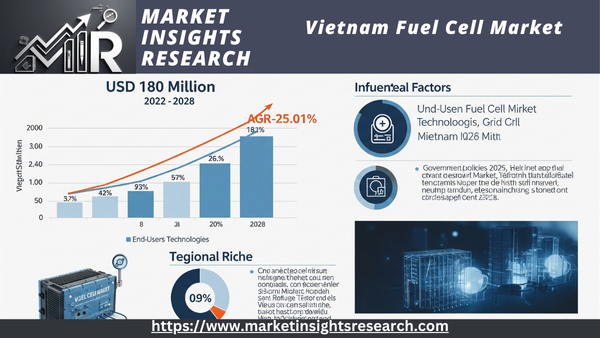

| Market Size (2022) | USD 180 Million |

| CAGR (2023-2028) | 25.01% |

| Fastest Growing Segment | Solid Oxide Fuel Cell (SOFC) |

| Largest Market | Southern Vietnam |

Market Overview

The Vietnamese fuel cell market, which was estimated to be worth USD 180 million in 2022, is expected to develop at a strong rate of 25.01% CAGR through 2028. Because of their low emissions and effective energy conversion, fuel cells—electrochemical devices that use chemical energy to generate electricity without combustion—are becoming more and more popular.

Download Free Sample Ask for Discount Request Customization

Water is the only result of the reaction between hydrogen and oxygen in a fuel cell, which produces electricity. Among the many benefits of this eco-friendly technology are its high efficiency, low environmental effect, and silent operation. Fuel cells are used in a wide range of industries, from portable electronics and fuel cell cars to fixed power generation for residences and commercial buildings. Most importantly, they advance sustainable energy solutions by lowering dependency on fossil fuels and reducing greenhouse gas emissions.

Vietnam's fuel cell business is thriving due to a variety of factors that support the nation's strategic objectives in the global shift to clean and sustainable energy sources.

Economic Growth and Energy Demand

Energy demand is rising across a range of industries as a result of Vietnam's quick industrialization and economic growth. The demand for dependable, effective, and ecologically friendly electricity sources grows as companies grow and urbanization quickens. Fuel cells provide a practical way to address this growing energy need since they can convert hydrogen into clean electricity. This motivation stems from the chance to maintain economic expansion while moving away from fossil fuels, guaranteeing resilience and energy security.

Government Commitment and Regulatory Support

The Vietnamese government has stressed that it is committed to reducing emissions and using sustainable energy sources. Supportive laws and regulations that encourage the use of fuel cell technology and other clean energy technologies serve to further this commitment. A favorable investment environment for fuel cell projects is produced by policies like feed-in tariffs, tax breaks, and expedited project approval procedures. This driver highlights the advantageous business climate, paving the way for extensive fuel cell integration, which promotes environmental stewardship and economic progress.

Technological Innovation and International Collaboration

The impetus of global cooperation and technology breakthroughs is driving the fuel cell industry in Vietnam. Fuel cell technology has advanced more quickly thanks to international alliances, knowledge sharing, and research partnerships, improving its effectiveness, longevity, and affordability. This factor strategically supports Vietnam's goal of implementing global best practices and knowledge, establishing the nation as a center for fuel cell innovation. As technological obstacles are overcome, companies in Vietnam's fuel cell sector have access to state-of-the-art technologies, giving them a competitive advantage and positioning the nation as a leader in sustainable energy technology.

Combined with scientific innovation, legislative support, and commercial imperatives, these factors are driving a revolutionary stage for the fuel cell market in Vietnam. This combination of elements supports market expansion and signifies a strategic alignment with the objectives of sustainable energy. As these factors continue to pick up steam, Vietnam's fuel cell sector offers a compelling opportunity for investors and industry participants alike, with growing potential for innovation, commercial growth, and beneficial environmental effects.

Download Free Sample Ask for Discount Request Customization

Supportive policies and Regulations are Likely to Propel the Market

Government-Supportive Policies Fueling Vietnam's Fuel Cell Market

The market for fuel cells in Vietnam is expanding rapidly because of a number of innovative and business-friendly laws that the government has put in place. These regulations are purposefully crafted to encourage investment, promote scientific advancement, and quicken the uptake of fuel cell technology in a variety of industries. Both domestic and foreign stakeholders can now actively engage in determining the direction of Vietnam's energy landscape thanks to the government's proactive approach and dedication to promoting the clean energy transition.

Renewable Energy Incentive Program (REIP)

Promoting Green Investment and Deployment

One of the main pillars of Vietnam's commitment to fuel cells and other renewable energy sources is the Renewable Energy Incentive Program (REIP). For companies and investors involved in fuel cell projects, this extensive program provides a number of financial incentives and advantages. Companies starting fuel cell projects can take advantage of alluring feed-in tariffs (FiTs) under the REIP, which guarantees consistent cash streams and good returns on investment. The software also enables expedited project approvals, which lessens administrative workloads and speeds up project execution. In addition, the REIP offers tax breaks and incentives that promote green investment and improve the fuel cell projects' financial sustainability. This policy driver makes it abundantly evident to the business community that the government values and honors fuel cells' critical contribution to Vietnam's sustainable energy goals.

Download Free Sample Ask for Discount Request Customization

Research and Development Grants for Clean Energy Technologies (RDGCET)

Fueling Innovation for Tomorrow's Solutions

Vietnam's dedication to innovation and technological growth in the fuel cell industry is exemplified by the Research and Development Grants for Clean Energy Technologies (RDGCET) program. The government is accelerating advancements in fuel cell efficiency, durability, and cost-effectiveness by providing significant grants and funding opportunities to research institutions, universities, and companies involved in fuel cell research and development. Additionally, the RDGCET initiative promotes cooperation between regional and global specialists, which promotes information sharing and interdisciplinary creativity. In addition to advancing technology, this policy driver establishes Vietnam as a center for innovative clean energy research, drawing top talent and global collaborations. As a result, companies in the fuel cell market have access to cutting-edge solutions that boost industry standards and encourage competitive distinctiveness.

National Hydrogen Strategy (NHS)

Pioneering the Hydrogen Economy

Vietnam's innovative strategy to using hydrogen, an essential part of fuel cell technology, as a major pillar of its energy future is embodied in the National Hydrogen Strategy (NHS). The NHS provides a thorough road plan for the advancement, application, and cross-sector integration of fuel cell and hydrogen technology. To advance the hydrogen economy, this strategy framework consists of public-private partnerships, specialized funding sources, and cooperative projects. In order to ensure a smooth transition to hydrogen-based solutions, the NHS also places a high priority on infrastructure development, including hydrogen production, storage, and delivery. The NHS promotes innovation, inspires investor confidence, and establishes Vietnam as a world leader in the developing hydrogen economy by providing a clear vision and concrete initiatives. In addition to demonstrating the government's dedication to fuel cell technology, this policy driver brings Vietnam into line with global partnerships and trends, encouraging cross-border cooperation and knowledge sharing.

In conclusion, the combination of these three government-backed initiatives highlights Vietnam's commitment to growing its fuel cell industry. By combining incentives, research money, and a strategic hydrogen plan, Vietnam is laying the groundwork for a flourishing fuel cell ecosystem that balances technological development, economic expansion, and sustainable energy objectives. Businesses are confronted with a climate that rewards investment, fosters innovation, and places them at the vanguard of a cleaner and more profitable energy future as they traverse this terrain of opportunity.

Key Market Challenges

The Fuel Cell Market in Vietnam Faces a ChallengeInfrastructure Integration and Development

The development and integration of the required infrastructure is one of the biggest obstacles facing Vietnam's fuel cell business, despite its potential for impressive growth and acceptance. Fuel cell deployment success depends on navigating the complex network of infrastructure-related challenges as the country adopts fuel cell technology as a key element of its clean energy transition.

Integration into Existing Grids

Another obstacle facing the fuel cell sector in Vietnam is the integration of fuel cells into current electrical infrastructures. Although fuel cells provide a distributed and decentralized energy source, careful planning and coordination are necessary for their smooth integration into the national power grid. Advanced grid management technology and regulatory frameworks are required to manage the bidirectional flow of electricity and coordinate the functioning of fuel cell installations with conventional power sources. Inefficiencies, operational difficulties, and possible interruptions to the stability of the electrical supply could result from ignoring grid integration issues.

Public Awareness and Perception

In conclusion, even if the fuel cell market in Vietnam has a lot of promise, building and integrating the required infrastructure is a difficult task. Refueling network expansion, grid integration facilitation, public awareness raising, and hydrogen infrastructure gap closure

Segmental Insights

Transportation

In 2022, the transportation segment took the lead in the fuel cell market, and it is anticipated to stay that way for the duration of the forecast. Vietnam's transportation industry is about to undergo a radical change as fuel cell technology shows promise in tackling urgent issues including air pollution, traffic jams, and reliance on fossil fuels. Fuel cell-powered vehicles, or FEVs, have the potential to completely transform how people and products travel throughout the nation and help create a more sustainable, efficient, and clean transportation system. The main cause of the severe air pollution in Vietnam's heavily populated urban centers is vehicle emissions. By solely releasing water vapor as a byproduct, FCVs provide a convincing answer to this problem and get rid of dangerous exhaust pollutants including nitrogen oxides (NOx) and particulate matter. FCVs are a game-changing technology that can assist hasten the transition to healthier urban environments as cities emphasize emission reduction goals and air quality improvement. The longer driving range and faster refueling periods of FCVs over battery electric vehicles (BEVs) are two significant advantages. The "range anxiety" issue that has been linked to BEVs is mitigated by FCVs' longer range. For long-distance travel without the need for protracted recharging pauses, FCVs provide a viable option in a nation with a variety of landscapes and great distances between cities. Faster refueling times increase FCVs' allure and make them appropriate for a range of transportation vehicles, such as buses, taxis, and commercial fleets.

Proton Exchange Membrane Fuel Cell

In 2022, the proton exchange membrane fuel cell (PEMFC) segment took the lead in the fuel cell market, and it is anticipated to continue to do so.

Regional Insights

With the most market share in 2022, Ho Chi Minh City is the top region in the South for the Vietnamese fuel cell industry. The following causes are to blame for thisDensity of populationWith more than 9 million residents, Ho Chi Minh metropolis is the most populated metropolis in Vietnam. This indicates that there is a sizable market for fuel cell applications, including stationary power and transportation. Support from the governmentThe Vietnamese government has set up several hydrogen refueling stations in Ho Chi Minh City and intends to construct a new fuel cell research and development facility there. Renewable energy resources are readily available in Ho Chi Minh City, including solar and wind energy, which can be utilized to generate hydrogen for fuel cells.

Download Free Sample Ask for Discount Request Customization

Recent Developments

- In May 2022, the Hyundai Motor Company announced that it would invest USD 100 million in a new fuel cell research and development facility in Vietnam. The facility is expected to create 100 new jobs and will focus on developing new fuel cell technologies for vehicles and stationary applications.

- In March 2022, the Bosch Group announced that it would invest USD 1.09 million in a new fuel cell research and development project in Vietnam. The project is expected to develop new fuel cell technologies for stationary applications.

- In February 2022, the HyET Hydrogen Indonesia company announced that it would invest USD 542727.50 in a new fuel cell production plant in Vietnam. The plant is expected to be operational by the end of 2023 and will produce fuel cells for a variety of applications.

- In January 2022, the Vietnam National University of Ho Chi Minh City announced that it would establish a new fuel cell research and development center. The center is expected to develop new fuel cell technologies for a variety of applications.

- These are just some of the recent investments in the fuel cell market in Vietnam in 2022. The Vietnamese government and private companies are increasingly investing in fuel cell technology, as they see it as a key part of the future of clean energy.

Key Market Players

- HORIBA Vietnam Company Limited

- Elcogen's

- Nikkei Asia

- HyET Hydrogen Vietnam

- Siemens Limited

- TGS Green Hydrogen

|

By Type |

By Application |

By Size |

By End User |

By Region |

|

|

|

|

|

Related Reports

- Electric Boiler Market Size By Voltage Rating (Low, Medium), By Application (Residential, Commercial, Industrial, Food P...

- Europe Boiler Market By Fuel (Natural Gas, Oil, Coal, Electric), By Capacity (≤ 10 MMBtu/hr, > 10 - 50 MMBtu/hr, > 50 ...

- Boiler Market Size - By Fuel (Natural Gas, Oil, Coal, Electric), By Capacity (≤ 10 MMBtu/hr, > 10 - 50 MMBtu/hr, > 50 ...

- Residential Boiler Market Size By Technology (Condensing {Natural Gas, Oil, Electric}, Non-Condensing {Natural Gas, Oil,...

- Commercial Electric Boiler Market - By Voltage Rating (Low Voltage, Medium Voltage), By Capacity, By Product (Hot Water,...

- Combi Boiler Market - By Fuel (Natural Gas, Oil), By Technology (Condensing, Non-Condensing) & Forecast, 2024-2032

Table of Content

-

Executive Summary

-

1.1 Market Snapshot

-

1.2 Key Insights and Trends

-

1.3 Strategic Recommendations

-

-

Introduction

-

2.1 Report Scope and Objectives

-

2.2 Research Methodology

-

2.3 Definitions and Technology Classification

-

-

Market Overview

-

3.1 Fuel Cell Basics and Working Principle

-

3.2 Vietnam’s Energy Landscape and Demand for Distributed Power

-

3.3 Relevance of Fuel Cells in Vietnam’s Clean Energy Transition

-

3.4 Regional Context within ASEAN Fuel Cell Market

-

-

Market Dynamics

-

4.1 Market Drivers

-

4.1.1 Growing Need for Reliable Backup Power in Urban and Rural Areas

-

4.1.2 Government Goals for Decarbonization and Technology Diversification

-

4.1.3 Interest in Industrial and Commercial Off-Grid Power Systems

-

-

4.2 Market Restraints

-

4.2.1 Lack of Hydrogen Infrastructure and Cost Barriers

-

4.2.2 Limited Local Manufacturing and R&D Capacity

-

-

4.3 Market Opportunities

-

4.3.1 Pilots in Telecom, Smart Cities, and Industrial Parks

-

4.3.2 Partnerships with Japan, South Korea, and EU for Technology Transfer

-

-

4.4 Challenges

-

4.5 Porter’s Five Forces Analysis

-

-

Technology Landscape

-

5.1 Proton Exchange Membrane Fuel Cell (PEMFC)

-

5.2 Solid Oxide Fuel Cell (SOFC)

-

5.3 Direct Methanol Fuel Cell (DMFC)

-

5.4 Fuel Sources: Hydrogen, Methanol, Biogas

-

5.5 Hybrid Integration with Solar and Microgrid Solutions

-

-

Market Segmentation

-

6.1 By Fuel Cell Type

-

6.1.1 PEMFC

-

6.1.2 SOFC

-

6.1.3 Others

-

-

6.2 By Application

-

6.2.1 Stationary Power (Off-Grid and Backup)

-

6.2.2 Portable Power Solutions

-

6.2.3 Transportation (Pilot Scope)

-

-

6.3 By End-User

-

6.3.1 Telecom and Data Centers

-

6.3.2 Commercial & Industrial Facilities

-

6.3.3 Government and Smart Infrastructure

-

-

-

Regional Analysis in Vietnam

-

7.1 Red River Delta (Hanoi, Industrial Parks)

-

7.2 Ho Chi Minh City and Southern Manufacturing Hubs

-

7.3 Central Highlands and Rural Electrification Potential

-

-

Market Size and Forecast (2020–2030)

-

8.1 Revenue Forecast by Segment and Region

-

8.2 Deployment Scenarios and Pilot Pipeline

-

8.3 CAPEX Trends and Localization Forecast

-

-

Competitive Landscape

-

9.1 Emerging Local Companies and Technology Adopters

-

9.2 International Stakeholders and JV Opportunities

-

9.3 Demonstration Projects and Research Institutions

-

-

Policy and Regulatory Framework

-

10.1 National Energy and Hydrogen Strategies (Current & Drafts)

-

10.2 Renewable Incentives and Pilot Support for Clean Technologies

-

10.3 Standards, Certifications, and International Collaborations

-

-

Innovation and Future Outlook

-

11.1 Fuel Cell Microgrids for Rural Electrification

-

11.2 Role in EV Charging Hubs and Green Buildings

-

11.3 International Partnerships for Green Hydrogen Development

-

-

Conclusion and Strategic Outlook

-

Appendices

-

13.1 Glossary

-

13.2 Research Methodology

-

13.3 References and Sources

To get a detailed Table of content/ Table of Figures/ Methodology Please contact our sales person at ( chris@marketinsightsresearch.com )

FAQ'S

For a single, multi and corporate client license, the report will be available in PDF format. Sample report would be given you in excel format. For more questions please contact:

Within 24 to 48 hrs.

You can contact Sales team (sales@marketinsightsresearch.com) and they will direct you on email

You can order a report by selecting payment methods, which is bank wire or online payment through any Debit/Credit card, Razor pay or PayPal.

Discounts are available.

Hard Copy