Lithium Iron Phosphate Batteries Market

Lithium Iron Phosphate Batteries Market – Global Industry Size, Share, Trends, Opportunity, and Forecast, Segmented By Type (Portable, Stationary), By Capacity (0-16, 250 mAh, 16, 251-50, 000 mAh, 50, 001-100, 000 mAh, 100, 001-540, 000 mAh), By Application (Automotive, Power Generation, Industrial, and Others), By Region, By Company and By Geography, Forecast & Opportunities, 2018-2028

Published Date: May - 2025 | Publisher: MIR | No of Pages: 320 | Industry: Power | Format: Report available in PDF / Excel Format

View Details Buy Now 2890 Download Free Sample Ask for Discount Request Customization| Forecast Period | 2024-2028 |

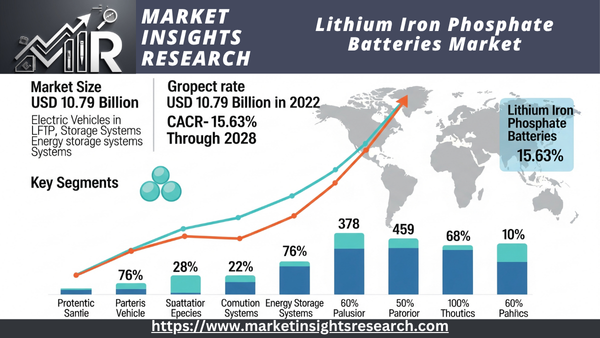

| Market Size (2022) | USD 10.79 Billion |

| CAGR (2023-2028) | 15.63% |

| Market Size (2028) | USD 25.82 Billion |

| Fastest Growing Segment | Portable |

| Largest Market | Asia-Pacific |

Market Overview

Global Lithium Iron Phosphate Batteries Market was valued at USD 10.79 Billion in 2022 and is anticipated to project robust growth in the forecast period with a CAGR of 15.63% through 2028.

Download Free Sample Ask for Discount Request Customization

The market for LiFePOâ‚„ batteries has grown rapidly due to several elements coming together that support the goals of the global energy revolution. The growing popularity of electric cars (EVs) is one of the most notable factors. Because of LiFePOâ‚„ batteries' intrinsic safety, extended cycle life, and thermal stability, the transition from conventional internal combustion engines to electric propulsion has accelerated demand for these batteries as countries struggle with pollution and climate change. The market for LiFePOâ‚„ batteries has been further boosted by investments in charging infrastructure brought about by the growing popularity of EVs.

Integration of renewable energy is another important factor influencing the market. LiFePO4 batteries are essential to grid stability and the switch to clean energy sources because they store excess energy produced by solar panels and wind turbines. A resilient and sustainable power system is largely dependent on their dependability and capacity to balance the supply and demand of electricity during peak and off-peak hours.

LiFePO4 batteries' adaptability covers a wide range of uses, from consumer and industrial electronics to electric mobility and renewable energy storage. LiFePO4 batteries are especially attractive in the field of electric vehicles because of their extended cycle life and thermal stability, which allay consumer worries about safety and total cost of ownership. These batteries are used in the industrial sector to power backup systems, forklifts, and machinery where durability and dependability are critical. Moreover, LiFePO4 batteries find application in stationary energy storage systems for homes, businesses, and utility-scale projects, enabling the seamless integration of renewable sources into the energy mix.

The market for LiFePO4 batteries is distinguished by ongoing research projects and technological developments meant to enhance energy density, charging efficiency, and general performance. Governments, private companies, and research institutes are working together to create new materials, electrode configurations, and production processes that improve battery performance and efficiency. These developments spur industry-wide innovation, allowing LiFePO4 batteries to adapt to changing consumer, regulatory, and energy system needs.

The market for LiFePO4 batteries is worldwide in scope, and its growth trajectory is influenced by different regions. Asia-Pacific stands out as a dominant hub, driven by its position as a manufacturing powerhouse and its prominence in the EV sector. North America and Europe also play significant roles, spurred by robust policies supporting clean energy adoption and EV incentives. Additionally, emerging economies are making strides in incorporating LiFePO4 batteries into their energy landscapes to enhance energy access, support industrial growth, and reduce carbon footprints.

Despite its promising trajectory, the LiFePO4 batteries market faces challenges that warrant attention. Energy density, although improving, remains a focal point for research and development to enhance battery performance. Charging infrastructure expansion and cost competitiveness are vital to sustain EV adoption and accelerate the transition to cleaner transportation. Furthermore, the management of raw material supply chains and recycling efforts present logistical and environmental challenges that require innovative solutions.

Key Market Drivers

Safety and Longevity

LiFePO4 batteries' outstanding safety profile and long cycle life are two of the main factors propelling the industry. LiFePO4 batteries have become the go-to option for applications where safety is crucial as worries about battery safety continue to shape consumer preferences and legal requirements. The likelihood of thermal runaway, a condition linked to certain alternative lithium-ion chemistries, is decreased by the intrinsic chemical stability of LiFePO4. Because of this safety benefit, LiFePO4 batteries are a great option for sectors where safety is a top priority, like consumer electronics, renewable energy storage, and electric cars.

Furthermore, the prolonged cycle life of LiFePOâ‚„ batteries—often surpassing thousands of charge-discharge cycles – contributes to their attractiveness. LiFePO4 batteries reduce the need for frequent replacements, making them an affordable option for applications where durability and dependability are crucial, such industrial machinery and renewable energy systems. Because of this market driver, LiFePO4 batteries are positioned as a reliable option for consumers and businesses looking for long-lasting and stable energy storage solutions.

Electric Vehicle Adoption

One of the main factors driving the LiFePO4 batteries market forward is the global upsurge in the use of electric vehicles (EVs). A major transition from internal combustion engine vehicles to electric propulsion is being sparked by governments around the world enforcing strict emission restrictions and providing incentives for the use of EVs. Because of their safety, thermal stability, and qualities that make them ideal for automotive applications, LiFePO4 batteries are essential to this shift. LiFePO4 batteries are becoming more common in EV models as automakers look for battery options that guarantee excellent performance, longevity, and safety. This is growing demand for these batteries.

Concerns over EV range and charging times are addressed by the growing network of charging infrastructure and developments in fast-charging technology, which support this trend. The need for LiFePO4 batteries and EV adoption are mutually reinforcing, which supports the market's upward trend.

Download Free Sample Ask for Discount Request Customization

Renewable Energy Integration

Globally, it is essential to incorporate renewable energy sources like wind and solar into the energy mix in order to fight climate change and lessen dependency on fossil fuels. Because LiFePO4 batteries offer effective energy storage options, they play a critical role in facilitating this shift. Because renewable energy sources are intermittent, excess energy produced during peak production must be stored for use during times of low generation or high demand. LiFePOâ‚„ batteries are ideal for this function because of their dependability, extended cycle life, and safety features.

The market for LiFePOâ‚„ batteries is being driven by the rising need for environmentally friendly energy storage solutions in both residential and commercial settings. As homes and companies look for energy independence, less dependence on the grid, and greater usage of clean energy sources, governments' policies and incentives encouraging the adoption of renewable energy further strengthen this market driver.

Industrial Applications

Because LiFePO4 batteries can power industrial machines, forklifts, backup power systems, and telecommunications infrastructure, the industrial sector offers a substantial development opportunity. Because of their consistent performance and long cycle life, LiFePO4 batteries are a desirable option for industries that place a high value on equipment lifespan and dependability. LiFePO4 batteries' stability makes them a desirable energy storage option in applications where downtime can cause significant losses.

Energy-efficient operations and ecological techniques are also becoming more prevalent in the industrial sector. LiFePO4 batteries support these goals by offering a more sustainable and clean substitute for conventional power sources. The need for LiFePO4 batteries in industrial applications is expected to increase as businesses look to minimize their environmental impact and streamline their processes, supporting this market driver.

Research and Innovation

One of the main factors driving the market for LiFePO4 batteries is the unrelenting pursuit of battery innovation and technical improvement. While preserving the safety and longevity of the batteries, researchers, scientists, and manufacturers are always looking for ways to increase energy density, charging speed, and overall performance. New materials, electrode designs, and production techniques are being developed as a result of this dedication to innovation.

To hasten the development of battery technology, governments, organizations, and private businesses are funding research and development projects. The market's intense competition for LiFePO4 batteries pushes producers to keep improving their goods, which leads to batteries with higher energy density, quicker charging times, and improved performance. The market is expected to gain from the momentum created by research-driven innovation as new discoveries are made and information is shared.

Key Market Challenges

Download Free Sample Ask for Discount Request Customization

Energy Density and Range Anxiety

The problem of energy density and how it affects EV range is one of the main obstacles facing the LiFePO4 battery industry. LiFePO4 batteries are known for being long-lasting and safe, although their energy density is often lower than that of other lithium-ion chemistries. The driving range of EVs is constrained by this reduced energy density. The energy density of LiFePO4 batteries becomes a challenge as buyers want EVs with greater range to allay range anxiety, or the worry that an EV will run out of power before arriving at its destination.

Finding a balance between energy density, longevity, and safety is the difficult part. Manufacturers are under pressure to provide LiFePO4 battery compositions that increase energy density without sacrificing the intrinsic capabilities of the batteries. The goal of research and development is to increase the energy density of LiFePO4 batteries, which frequently entails investigating new materials, cathode configurations, and electrode compositions. Resolving this issue will be essential to increasing the attractiveness of LiFePO4 batteries for EV applications as the industry develops.

Charging Speed and Infrastructure

Particularly in the context of electric vehicles, the market for LiFePO4 batteries has major obstacles related to charging speed and the sufficiency of charging infrastructure. LiFePO4 batteries may charge more slowly than some other lithium-ion chemistries, despite their reputation for safety and thermal stability. Longer charging periods may arise from this, which would put off prospective EV purchasers used to the speedy recharging of traditional cars.

The development of LiFePO4 battery systems that enable quicker charging without sacrificing safety and the expansion of the charging infrastructure to support various battery chemistries and charging speeds present two challenges. In order to accommodate different battery types, voltage levels, and charging speeds, charging station networks must be updated. To overcome this obstacle and deliver a smooth and convenient charging experience that promotes EV adoption, battery manufacturers, automakers, and infrastructure providers must work together.

Cost Competitiveness

The market for LiFePO4 batteries faces major obstacles due to charging speed and the sufficiency of charging infrastructure, particularly when it comes to electric vehicles. Despite its reputation for safety and thermal stability, LiFePO4 batteries may charge more slowly than certain other lithium-ion chemistries. Potential EV purchasers who are used to the speedy refilling of conventional vehicles may be put off by the lengthier charging times that may come from this.

Creating LiFePO4 battery systems that enable quicker charging without sacrificing safety and simultaneously growing the charging infrastructure to support various battery chemistries and charging speeds present two challenges. Networks of charging stations must be updated to accommodate different battery kinds, voltage levels, and charging rates. This problem calls for cooperation between automakers, infrastructure providers, and battery manufacturers in order to develop a smooth and convenient charging experience that promotes the usage of EVs.

Energy Intensive Manufacturing and Supply Chain

The high-temperature synthesis needed for cathode manufacture makes the LiFePO4 battery manufacturing process energy-intensive. The industry's larger worries about the effects of energy-intensive industrial processes on the environment are in line with this dilemma. Improving energy efficiency in the battery production cycle, streamlining production processes, and implementing greener energy sources for manufacturing are all necessary to meet this issue.

The market for LiFePO4 batteries also has supply chain issues because of the availability of raw ingredients like iron and lithium. Securing access to these commodities and investigating sustainable sourcing possibilities are both necessary to maintain a reliable supply chain. Supply chain interruptions can be lessened and the market's resilience increased with the support of strategic alliances, local resource investments, and ethical sourcing methods.

Evolving Regulatory Landscape

The market for LiFePO4 batteries faces difficulties due to the changing regulatory environment, especially when it comes to safety and environmental laws. Battery producers must keep up with regulatory changes and adjust their operations to reflect the growing emphasis on sustainability, safety standards, and recycling methods by governments throughout the world.

Maintaining product quality, safety, and compliance while adjusting to changing requirements is a problem. In order to comply with changing safety and environmental regulations, manufacturers need to make research and development investments. The issue also includes making sure LiFePO4 batteries are disposed of and recycled safely at the end of their useful lives in order to minimize environmental effects and promote a circular economy.

Key Market Trends

Electrification Revolution and EV Dominance

The electrification revolution, driven by the domination of electric vehicles (EVs), is one of the most important market developments in the global lithium iron phosphate (LiFePO4) batteries industry. EVs have become a revolutionary force as the globe struggles with environmental issues and looks for sustainable transportation options. LiFePO4 batteries are now the go-to option for EV makers due to their intrinsic safety, durability, and thermal stability. This movement is changing the automotive industry by spurring advancements in car design, charging infrastructure, and battery technology. LiFePO4 battery demand has increased due to the increasing use of EVs, driving market expansion and impacting improvements in energy density, charging speed, and overall battery performance.

Energy Storage for Renewable Integration

Integrating renewable energy is a global necessity, and LiFePO4 batteries are essential for enabling the efficient use of renewable energy sources like wind and solar. LiFePO4 batteries are becoming more and more popular for energy storage in utility-scale, commercial, and residential applications. These batteries improve grid stability and provide a more seamless transition to a sustainable energy mix by storing excess energy produced during periods of peak production and releasing it during periods of high demand. This trend supports the larger movement towards decarbonization and is anticipated to spur additional advancements in grid management and energy storage technologies.

Industrial Applications and Power Infrastructure

Beyond automotive and renewable energy sectors, LiFePO4 batteries are finding applications in various industrial settings. The trend of using LiFePO4 batteries to power forklifts, industrial machinery, backup power systems, and telecommunications infrastructure is on the rise. The batteries' durability, safety, and consistent performance make them an ideal choice for environments that demand reliability and longevity. As industries focus on operational efficiency, the adoption of LiFePO4 batteries for industrial applications is expected to grow, further diversifying the market's scope and driving advancements in rugged battery designs.

Research and Development for Improved Performance

Continuous research and development to improve battery performance, energy density, and overall efficiency is what defines the LiFePO4 battery market. As technology advances, efforts are focused on resolving issues like lowering costs and raising energy density without sacrificing safety. With an emphasis on reaching greater energy density, longer cycle life, and quicker charging times, innovation is being driven by the trend of investing in innovative battery chemistries, manufacturing processes, and electrode materials. In an effort to fully realize the potential of LiFePO4 batteries, this R&D-driven movement is encouraging cooperation between academic institutions, business, and research centers.

Recycling and Sustainability Initiatives

The trend of integrating recycling procedures into the LiFePO4 battery business is becoming more and more popular as environmental sustainability becomes more and more important. The need to manage end-of-life batteries in an environmentally responsible way is growing in importance as battery adoption rises. Efforts are being made to create effective recycling procedures to recover valuable elements and reduce waste because LiFePO4 batteries are recognized to have a lesser environmental impact than other lithium-ion chemistries. Promoting closed-loop battery recycling systems is in line with the ideas of the circular economy, which lessens dependency on raw resources, reduces pollution, and builds a more sustainable future.

Segmental Insights

Application Insights

Automotive segment

The automotive segment's dominance in the LiFePO4 battery industry is inextricably tied to the exponential growth of electric vehicles. Automakers are speeding up the switch from internal combustion engines to electric propulsion as a result of strict emission laws enforced by governments throughout the world and consumer demand for greener options. LiFePO4 batteries solve range anxiety and charging infrastructure issues, among other issues with EV adoption. They are distinguished by their high energy density, improved safety profile, and thermal stability.

Type Insights

Stationary segment

Additionally, stationary LiFePO4 batteries increase their impact in off-grid and rural locations with limited access to dependable electricity. These batteries enhance the standard of living for areas that are typically neglected by centralized power infrastructure by utilizing renewable energy sources and storing power for later use. They are ideal for providing energy autonomy in these environments due to their durability, extended cycle life, and little maintenance needs.

Regional Insights

Asia-Pacific

Furthermore, Asia Pacific's strong supply chain and manufacturing infrastructure have contributed to its market domination for LiFePO4 batteries. Because of their well-known skills in electronics manufacturing, nations like China, Japan, and South Korea are able to swiftly expand their output and satisfy the growing demand for energy storage solutions. Due to the region's advanced production facilities, technological know-how, and trained workforce, LiFePO4 batteries can now be produced at reasonable prices, meeting demand worldwide.

Download Free Sample Ask for Discount Request Customization

Recent Developments

- In August 2021, the Chinese battery manufacturer CATL invested USD 15.60 million to establish a new automotive science and technology company based in Shanghai. The CATL is a well-known supplier for LFP batteries to Tesla and Nio.

- In September 2021, LG Chem’s LG Energy Solution is expected to expand its EV battery offer with LFP, gaining popularity owing to their characteristics. The LG Energy Solution will use LFP in Pouch Format.

Key Market Players

- Contemporary Amperex Technology Co., Ltd.

- Panasonic Corporation

- BYD Company Limited

- LG Chem

- Samsung SDI

- Northvolt AB

- Gotion High-Tech Co., Ltd.

- Farasis Energy Co., Ltd.

- AESC Corporation

- Lithium Werks, Inc.

|

By Type |

By Capacity |

By Application |

By Region |

|

|

|

|

Related Reports

- Europe Steam Boiler Market - By Capacity, By Fuel (Natural Gas, Oil, Coal), By Technology (Condensing, Non-Condensing), ...

- Electric Boiler Market Size By Voltage Rating (Low, Medium), By Application (Residential, Commercial, Industrial, Food P...

- Europe Boiler Market By Fuel (Natural Gas, Oil, Coal, Electric), By Capacity (≤ 10 MMBtu/hr, > 10 - 50 MMBtu/hr, > 50 ...

- Boiler Market Size - By Fuel (Natural Gas, Oil, Coal, Electric), By Capacity (≤ 10 MMBtu/hr, > 10 - 50 MMBtu/hr, > 50 ...

- Residential Boiler Market Size By Technology (Condensing {Natural Gas, Oil, Electric}, Non-Condensing {Natural Gas, Oil,...

- Commercial Electric Boiler Market - By Voltage Rating (Low Voltage, Medium Voltage), By Capacity, By Product (Hot Water,...

Table of Content

-

Executive Summary

-

1.1 Market Snapshot

-

1.2 Key Trends and Developments

-

1.3 Strategic Recommendations

-

-

Introduction

-

2.1 Report Objectives and Scope

-

2.2 Research Methodology

-

2.3 Definitions and Assumptions

-

-

Market Overview

-

3.1 What Are LFP Batteries?

-

3.2 Comparison with NMC, NCA, and Lead-Acid Chemistries

-

3.3 Advantages: Thermal Stability, Cycle Life, and Cost

-

3.4 LFP Battery Architecture and Performance Metrics

-

-

Market Dynamics

-

4.1 Drivers

-

4.1.1 Increasing Adoption in EVs, Especially Commercial Fleets

-

4.1.2 Growth in Stationary Energy Storage Applications

-

4.1.3 Cost Reduction Through Localized Manufacturing

-

-

4.2 Restraints

-

4.2.1 Lower Energy Density vs. NMC Batteries

-

4.2.2 Supply Chain Concentration in Certain Regions

-

-

4.3 Opportunities

-

4.3.1 Global Shift Toward Safer and Longer-Lasting Battery Chemistries

-

4.3.2 Expansion in Off-Grid, Microgrid, and Telecom Backup Systems

-

-

4.4 Challenges

-

4.5 Porter’s Five Forces Analysis

-

-

Technology Landscape

-

5.1 Cell Types: Cylindrical, Prismatic, Pouch

-

5.2 Cathode and Electrolyte Innovations

-

5.3 Fast Charging, Deep Discharge, and High-Temperature Tolerance

-

5.4 Integration with Battery Management Systems (BMS)

-

5.5 Recycling and Reuse Pathways for LFP Chemistry

-

-

Market Segmentation

-

6.1 By Application

-

6.1.1 Electric Vehicles (Passenger, Buses, e-2W, e-3W)

-

6.1.2 Energy Storage Systems (Residential, Commercial, Utility)

-

6.1.3 Industrial Equipment and Forklifts

-

6.1.4 Consumer Electronics

-

-

6.2 By End-Use Sector

-

6.2.1 Automotive

-

6.2.2 Energy & Utilities

-

6.2.3 Logistics and Warehousing

-

6.2.4 Telecom and Infrastructure

-

-

6.3 By Voltage Rating

-

6.3.1 Below 12V

-

6.3.2 12V–36V

-

6.3.3 Above 36V

-

-

-

Regional Analysis

-

7.1 Asia-Pacific (China, India, Japan, South Korea)

-

7.2 North America

-

7.3 Europe

-

7.4 Latin America

-

7.5 Middle East & Africa

-

-

Market Size and Forecast (2020–2030)

-

8.1 Revenue and Volume Forecast by Region and Segment

-

8.2 Cost Trends and Price Benchmarking

-

8.3 Capacity Expansion and Giga Factory Deployment

-

-

Competitive Landscape

-

9.1 Market Share of Key Manufacturers

-

9.2 Company Profiles

-

9.2.1 CATL

-

9.2.2 BYD

-

9.2.3 Gotion High-Tech

-

9.2.4 A123 Systems

-

9.2.5 EVE Energy

-

9.2.6 Others

-

-

9.3 Strategic Alliances, Licensing, and M&A

-

-

Regulatory and Policy Framework

-

10.1 EV and ESS Battery Mandates

-

10.2 Safety and Transport Standards (UN38.3, IEC)

-

10.3 Supportive Incentives and Local Content Rules

-

-

Innovation and Future Outlook

-

11.1 High Energy LFP Variants and Solid-State Compatibility

-

11.2 Digital Twins and Predictive Battery Diagnostics

-

11.3 Circular Economy Models and ESG Reporting

-

-

Conclusion and Strategic Outlook

-

Appendices

-

-

13.1 Glossary

-

13.2 Research Methodology

-

13.3 References and Data Sources

-

To get a detailed Table of content/ Table of Figures/ Methodology Please contact our sales person at ( chris@marketinsightsresearch.com )

FAQ'S

For a single, multi and corporate client license, the report will be available in PDF format. Sample report would be given you in excel format. For more questions please contact:

Within 24 to 48 hrs.

You can contact Sales team (sales@marketinsightsresearch.com) and they will direct you on email

You can order a report by selecting payment methods, which is bank wire or online payment through any Debit/Credit card, Razor pay or PayPal.

Discounts are available.

Hard Copy