Stationary Energy Storage Market

Stationary Energy Storage Market – Global Industry Size, Share, Trends, Opportunity, and Forecast, Segmented By Application (Front of the Meter (FTM) or Grid Application, Behind the Meter), By Type of Energy Storage (Hydrogen & Ammonia Storage, Gravitational Energy Storage, Compressed Air Energy Storage, Liquid Air Storage, Thermal Energy Storage), By Product (Lithium-ion (Li-ion), Lead Acid, Flow

Published Date: May - 2025 | Publisher: MIR | No of Pages: 320 | Industry: Power | Format: Report available in PDF / Excel Format

View Details Buy Now 2890 Download Free Sample Ask for Discount Request Customization| Forecast Period | 2024-2028 |

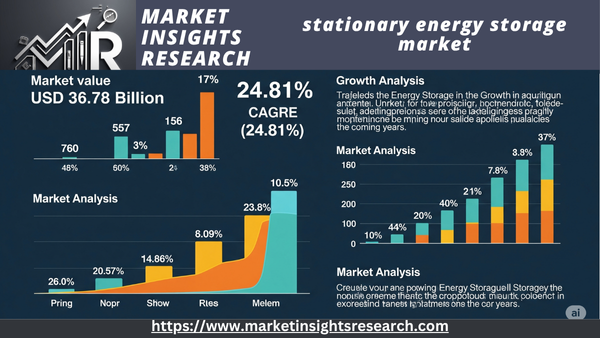

| Market Size (2022) | USD 36.78 Billion |

| CAGR (2023-2028) | 24.81% |

| Fastest Growing Segment | Lithium-ion (Li-ion) |

| Largest Market | Asia Pacific |

Market Overview

With a projected compound annual growth rate (CAGR) of 24.81% through 2028, the Global Stationary Energy Storage market , which was valued at USD 36.78 Billion in 2022, is expected to grow strongly during the forecast period.

Download Free Sample Ask for Discount Request Customization

The need for sustainable energy solutions, grid stability, and the integration of renewable resources are driving a revolutionary phase in the global stationary energy storage market. Because of their high energy density, extended cycle life, and adaptability, lithium-ion batteries have become the dominant force in this changing landscape, satisfying the many needs of utility-scale, commercial, and residential applications. The increasing demand for grid resilience, efficient peak load management, and the incorporation of renewable energy sources are driving the broad use of stationary energy storage systems. As consumers look for cost savings and energy independence, behind-the-meter (BTM) applications have gained a lot of interest, especially in the residential and commercial sectors. Furthermore, the symbiotic relationship between energy storage and transportation infrastructure is facilitated by the electrification of transportation and the growth of electric vehicles. One notable scalable and effective method for grid stabilization and dispatchable electricity is compressed air energy storage, or CAES. A more robust, decentralized, and sustainable global energy landscape is anticipated to be shaped as the market develops thanks to developments in energy storage technologies, regulatory frameworks, and continuous research and development initiatives.

Key Market Drivers

Renewable Energy Integration and Grid Stability

The need for grid stability and the integration of renewable energy sources is one of the main factors propelling the expansion of the worldwide stationary energy storage market. Grid stability is threatened by the sporadic nature of renewable energy sources like solar and wind as the world moves toward a low-carbon and sustainable energy future. By storing extra energy produced during periods of peak renewable output and releasing it during periods of high demand, stationary energy storage technologies are essential in tackling this challenge. This feature makes it easier to integrate clean energy into current power systems, improves grid stability, and reduces the unpredictability of renewable energy supply.

Increasing Energy Demand and Peak Load Management

The market for stationary energy storage is being driven primarily by the need for efficient peak load control and the growing global demand for energy. Urbanization, industry, and population growth all contribute to rising power usage. By storing excess energy during times of low demand and releasing it during peak usage hours, stationary energy storage systems provide a way to regulate peak demand. This lessens the need for costly infrastructure expansions while also assisting utilities in effectively meeting spikes in energy demand. Stationary energy storage becomes an essential instrument for optimizing energy distribution and raising the overall efficiency of the power grid as the need for dependable and adaptable energy solutions grows.

Download Free Sample Ask for Discount Request Customization

Technological Advancements and Cost Reductions

One of the main factors driving market expansion is the ongoing development of technology and the ensuing decline in the price of energy storage devices, especially lithium-ion batteries. Significant advancements have been made in battery chemistry, manufacturing techniques, and energy storage system design throughout the last ten years. The cost per kilowatt-hour of stored energy has significantly decreased as a result, increasing the viability of stationary energy storage. Enhancing energy density, cycle life, and overall system performance are the main goals of ongoing research and development projects. The economic viability of stationary energy storage systems increases as costs continue to drop, leading to a rise in use across a range of applications.

Electrification of Transportation and Electric Vehicles (EVs)

The market for stationary energy storage is significantly influenced by the global movement to electrify transportation as well as the electric vehicle (EV) industry's explosive expansion. Sophisticated grid assistance and charging facilities become necessary as EV usage increases. In this situation, stationary energy storage is essential since it stabilizes the grid, controls the peaks in the charging infrastructure, and permits fast charging. Repurposing old EV batteries for stationary energy storage further improves the sustainability of these systems. As the automotive sector rapidly electrifies, we anticipate that the combination of EVs and stationary energy storage will propel significant market expansion.

Energy Resilience and Microgrid Deployments

A strong factor propelling the market for stationary energy storage is the growing recognition of the significance of energy resilience, especially in the face of natural disasters and grid outages. When included into microgrids, stationary energy storage devices offer a robust and decentralized energy source. With the help of stationary energy storage, microgrids can function independently during grid disruptions, guaranteeing a steady supply of electricity to vital infrastructure like data centers, hospitals, and emergency services. Static energy storage's capacity to improve energy resilience is consistent with international initiatives to construct more resilient and durable energy infrastructure that can endure unanticipated difficulties, such as severe weather and system breakdowns.

Key Market Challenges

Download Free Sample Ask for Discount Request Customization

High Initial Costs and Return on Investment Concerns

The high upfront costs of installing energy storage systems are one of the main issues facing the worldwide stationary energy storage sector. Even though energy storage technologies—especially lithium-ion batteries—have been getting cheaper, the initial outlay is still a major deterrent to their widespread use. Given the comparatively lengthy payback periods for stationary energy storage systems, businesses, utilities, and residential consumers frequently struggle to justify the initial capital cost. Reducing manufacturing costs, improving the efficiency of energy storage systems, and creating finance mechanisms that make these technologies more accessible and alluring from the standpoint of return on investment are all necessary to overcome this obstacle.

Technological Limitations and Performance Degradation

Technology constraints and performance deterioration over time are problems for stationary energy storage systems, which are mostly based on lithium-ion batteries. Despite being widely used due to its high energy density and comparatively long lifespan, lithium-ion batteries nevertheless face problems like capacity decline, thermal management issues, and safety concerns. The overall performance of energy storage devices may deteriorate with age, affecting dependability and efficiency. To overcome these technological constraints, continuous research and development is needed to enhance battery chemistries, investigate substitute energy storage technologies, and put strong monitoring and maintenance procedures in place to extend the lifespan and functionality of stationary energy storage systems.

Regulatory and Policy Uncertainties

Regional and jurisdiction-specific regulatory and policy uncertainties are challenges facing the stationary energy storage sector. Industry players face difficulties as a result of inconsistent laws and policies pertaining to the deployment of energy storage, grid integration, and market involvement. Without established frameworks, it may be difficult for enterprises to navigate regulatory environments and prevent the creation of a fair playing field. Incentives, tariffs, and expedited permitting procedures are just a few examples of the supportive policies that must develop in order to create an atmosphere that is favorable to the broad use of stationary energy storage. In order to match legislative frameworks with the changing demands of the energy storage business, industry cooperation and advocacy initiatives are crucial.

Limited Energy Density and Storage Capacity Constraints

The restricted energy density and storage capacity limitations of stationary energy storage systems persist despite improvements in battery technologies. These limitations affect how long energy can be kept and then released, which makes it harder for energy storage systems to meet long-term demand or offer reliable backup power. In order to overcome these obstacles, further research must be done to increase energy density, investigate substitute materials, and create creative storage systems with higher capacity. Resolving these capacity constraints is essential for stationary energy storage to realize its potential as a dependable and scalable solution as its uses grow, especially in the context of grid support and renewable integration.

Integration Challenges with Grid Infrastructure

One major obstacle facing the worldwide stationary energy storage business is integration issues with the current grid infrastructure. Energy storage systems must be compatible with a variety of grid topologies, communication protocols, and control systems in order to be seamlessly integrated into the grid. The effective implementation of stationary storage may be hampered by disparities in grid standards and the incompatibility of various energy storage systems. In order to overcome integration obstacles, utilities, regulatory agencies, and industry stakeholders must work together to create standardized protocols, increase grid flexibility, and create smart grid solutions that smoothly integrate stationary energy storage systems.

Key Market Trends

Accelerated Growth Driven by Renewable Integration

The rapid expansion of the worldwide stationary energy storage market, driven by the incorporation of renewable energy sources, is one of the major trends. Because renewable energy sources like solar and wind are intermittent, effective energy storage solutions are essential as the world moves toward a low-carbon and sustainable energy future. Systems for stationary energy storage are essential for reducing the unpredictability of renewable energy production, stabilizing the grid, and facilitating the consistent supply of clean energy. The need for stationary energy storage solutions is rising sharply due to the global push for decarbonization and ambitious renewable energy objectives, making it a key component of the shift to a more environmentally friendly energy mix.

Advancements in Battery Technologies and Energy Storage Systems

The market for stationary energy storage is undergoing a revolutionary shift due to ongoing developments in energy storage and battery technology. Because of their high energy density, extended cycle life, and falling costs, lithium-ion batteries in particular have emerged as the preferred option for stationary storage. Ongoing research and development initiatives, however, are concentrated on refining battery chemistries, investigating substitutes, and raising system performance as a whole. By providing greater energy efficiency, a longer lifespan, and enhanced safety, innovations like solid-state batteries, flow batteries, and next-generation materials are changing the landscape. As stakeholders work to implement cutting-edge technology to meet changing energy demands, this trend represents a dynamic and competitive environment within the stationary energy storage sector.

Growing Focus on Grid Resilience and Reliability

In the market for stationary energy storage, grid resilience and dependability have become critical factors. The significance of energy storage in enhancing grid resilience is underscored by the growing frequency of extreme weather events and the weaknesses of conventional power systems. Rapid reaction capabilities offered by stationary energy storage devices provide for a smooth electricity supply during grid outages and stabilize frequency fluctuations. Around the world, utilities and governments are realizing how important energy storage is to improving grid dependability, lowering downtime, and guaranteeing a steady supply of electricity. In areas that are vulnerable to natural disasters, where stationary energy storage is an essential aspect of resilient energy infrastructure, this trend is especially noticeable.

Rise of Behind-the-Meter Applications in Commercial and Residential Sectors

The growth of behind-the-meter applications, especially in the commercial and residential sectors, is a significant trend in the stationary energy storage market. Energy storage solutions are being used by homes and businesses more frequently in an effort to improve energy self-sufficiency, optimize energy use, and lower peak demand fees. When combined with solar panels, behind-the-meter stationary storage devices enable users to store extra energy produced during off-peak hours for usage during peak hours or during grid interruptions. Energy customers are becoming prosumers as a result of this trend, which represents a move towards decentralized energy systems that enable users to actively control their energy consumption and support grid stability.

Integration of Stationary Storage into Virtual Power Plants

The incorporation of storage assets into Virtual Power Plants (VPPs) is a new trend in the stationary energy storage business. VPPs combine and maximize the performance of dispersed energy resources, including stationary storage, by utilizing cutting-edge control systems and digital technology. Through this integration, utilities and grid operators can take use of stationary storage systems' flexibility to instantly balance the supply and demand for energy. Owners of stationary storage can access other revenue streams by taking part in VPPs, which offer services including grid support, frequency management, and peak shaving. This pattern denotes a move toward energy systems that are more dynamic and networked, encouraging the effective use of dispersed energy resources to improve grid flexibility and stability.

Segmental Insights

Application Insights

Behind the Meter segment

BTM energy storage is used by both residential and business customers to efficiently control electricity bills, especially in areas where time-of-use pricing is in place. Significant cost savings can be achieved by storing and using energy on one's own during times of high tariffs. Additionally, by providing localized support, behind-the-meter technologies mitigate grid instability by lessening the burden on the larger grid during peak hours.

Applications for Behind the Meter have also been boosted by the expansion of the electric vehicle sector. Users can store energy during off-peak hours, optimize their charging habits, and handle the increasing demand brought on by the widespread adoption of electric vehicles by integrating stationary energy storage systems with electric vehicle charging infrastructure. The combination of renewable energy sources, domestic energy demands, and transportation electrification has made BTM applications a major player in the global market for stationary energy storage.

Type of Energy Storage Insights

Compressed air energy storage segment

The scalability of CAES is one of the main elements influencing its dominance. CAES systems can be implemented at several scales, from big utility-scale projects to smaller community-level installations. Because of its versatility, it can be used in a variety of settings and applications to meet a wide range of energy storage requirements. Furthermore, CAES systems are well-suited to delivering continuous power for lengthy periods of time because to their somewhat longer discharge duration, which helps to address grid stability and dependability issues.

Another element supporting CAES's supremacy is efficiency. CAES systems have a comparatively high round-trip efficiency, in contrast to several other energy storage technologies that could experience energy conversion losses. The overall efficiency of the energy storage system is increased by the isentropic efficiency of the compression and expansion operations, which helps to reduce energy losses during storage and retrieval.

Furthermore, because CAES has been in use and functioning for decades, it benefits from well-established and mature technologies. As utilities and investors look for dependable and tested solutions to satisfy the demands of a quickly changing energy landscape, this track record gives them a certain amount of trust.

Regional Insights

The adoption of stationary energy storage systems has been encouraged by the implementation of favorable government policies and incentives in a number of Asia Pacific nations. The importance of energy storage in attaining energy security, cutting carbon emissions, and improving grid stability is acknowledged by governments. Energy storage infrastructure is a desirable investment for companies and investors due to policy frameworks that support it, including as feed-in tariffs, subsidies, and regulatory systems.

The Asia-Pacific area has taken the lead in utilizing renewable energy sources, such as wind and solar energy. In order to reduce the erratic and unpredictable nature of renewable energy sources, stationary energy storage is essential. Stationary energy storage systems play a crucial role in storing excess energy during times of generation surplus and releasing it during periods of high demand, ensuring a seamless integration of renewable energy into the grid as nations in the region strive to increase the proportion of renewables in their energy mix.

Asia Pacific is becoming a global center for manufacturing and technological development, including the manufacture of lithium-ion batteries, which are the industry standard for stationary energy storage. The region's nations, especially China and South Korea, have made large expenditures in research and development as well as battery manufacturing facilities. This has made stationary energy storage more economically feasible by lowering costs, improving battery performance, and increasing energy density.

Download Free Sample Ask for Discount Request Customization

Recent Developments

- In September 2022, Contemporary Amperex Technology Co., Limited announced the new battery production base in Luoyang, Henan Province, China, with a planned area of 113 hectares and a total investment reaching $1.94 billion (14 billion yuan). The plant is expected to help in the expansion of customer reach in the regional market.

- In July 2022, Durapower Group launched the DP Omni Battery Pack. These compact, integrated battery packs have a recharge period of under an hour and use high-energy, patented Lithium- Nickel-Manganese-Cobalt-Oxide (NMC) battery cells to achieve pack energy densities above 160 Wh/kg. Additionally, it is made to be future proof so that it can be conveniently upgraded to new battery chemistries and cell designs in the future. This would enable it to be used in energy storage solution (ESS) applications in the future

- In November 2021, Duracell entered into partnership with Power Center+ to bring the Duracell Power Center product portfolio of Home Energy Storage solutions to North America and the Caribbean.

- In March 2022, Tesla announced that it is establishing new energy storage system production plants in Queensland. In order to provide Queenslanders with more reliable, affordable, and clean electricity, publicly owned generator CS Energy would therefore build a grid-scale battery near Chinchilla. The Tesla Megapack-based battery, which will serve as part of CS Energy's energy center at Kogan Creek, will have a capacity of 100 megawatts and 200 megawatt hours.

Key Market Players

- LG Energy Solution

- Contemporary Amperex Technology Co., Ltd.

- BYD Company Limited

- Samsung SDI Co., Ltd.

- Panasonic Corporation

- Tesla, Inc.

- AES Corporation

- Fluence Energy, Inc.

- Enel X S.r.l.

- Sumitomo Electric Industries, Ltd.

|

By Application |

By Type of Energy Storage |

By Product |

By Region |

|

|

|

|

Related Reports

- Asia Pacific Electric Boiler Market Size - By Capacity (≤ 10 MMBtu/hr, > 10 - 50 MMBtu/hr, > 50 - 100 MMBtu/hr, > 100 ...

- North America & Europe Electric Boiler Market Size - By Voltage Rating (Low Voltage, Medium Voltage), By Application (Re...

- North America Residential Boiler Market Size - By Fuel (Natural Gas, Oil, Electric), By Technology (Condensing {Natural ...

- U.S. Commercial Boiler Market – By Product (Hot Water, Steam), Application (Offices, Healthcare Facilities, Educationa...

- North America Commercial Boiler Market Size - By Fuel (Natural Gas, Oil, Coal, Electric), By Capacity, By Technology (Co...

- Water Tube Industrial Boiler Market Size By Capacity, By Application (Food Processing, Pulp & Paper, Chemical, Refinery,...

Table of Content

-

Executive Summary

-

1.1 Market Snapshot

-

1.2 Key Trends and Developments

-

1.3 Strategic Recommendations

-

-

Introduction

-

2.1 Report Objectives and Scope

-

2.2 Research Methodology

-

2.3 Definitions and Market Segmentation

-

-

Market Overview

-

3.1 What Is Stationary Energy Storage?

-

3.2 Role in Modern Energy Systems and Decarbonization

-

3.3 Value Chain and Ecosystem Analysis

-

3.4 Technology Evolution and Integration with Smart Grids

-

-

Market Dynamics

-

4.1 Drivers

-

4.1.1 Rapid Deployment of Renewable Energy Sources

-

4.1.2 Grid Modernization and Decentralized Energy

-

4.1.3 Falling Battery Prices and Efficiency Gains

-

-

4.2 Restraints

-

4.2.1 High Initial Investment and Long Payback Periods

-

4.2.2 Regulatory and Permitting Challenges

-

-

4.3 Opportunities

-

4.3.1 Growth of Microgrids and Energy Access Solutions

-

4.3.2 Demand for Frequency Regulation and Peak Load Management

-

-

4.4 Challenges

-

4.5 Porter’s Five Forces Analysis

-

-

Technology Landscape

-

5.1 Lithium-Ion Batteries (LFP, NMC)

-

5.2 Flow Batteries (Vanadium, Zinc)

-

5.3 Advanced Lead-Acid, Sodium-Sulfur, and Hybrid Systems

-

5.4 Thermal, Mechanical, and Hydrogen-Based Storage

-

5.5 Battery Management Systems and Energy Software Integration

-

-

Market Segmentation

-

6.1 By Technology

-

6.1.1 Electrochemical

-

6.1.2 Mechanical

-

6.1.3 Thermal

-

6.1.4 Chemical

-

-

6.2 By Application

-

6.2.1 Grid Services

-

6.2.2 Renewable Integration

-

6.2.3 Backup and Emergency Power

-

6.2.4 Off-Grid Power Systems

-

-

6.3 By End-User

-

6.3.1 Utilities

-

6.3.2 Commercial and Industrial

-

6.3.3 Residential

-

-

-

Regional Market Analysis

-

7.1 North America

-

7.2 Europe

-

7.3 Asia-Pacific

-

7.4 Latin America

-

7.5 Middle East & Africa

-

-

Market Size and Forecast (2020–2030)

-

8.1 Global Revenue and Installed Capacity Forecast

-

8.2 Segment-Wise and Regional Growth Outlook

-

8.3 Levelized Cost of Storage (LCOS) Analysis

-

-

Competitive Landscape

-

9.1 Market Share of Leading Providers

-

9.2 Key Company Profiles

-

9.2.1 Tesla

-

9.2.2 Fluence Energy

-

9.2.3 LG Energy Solution

-

9.2.4 BYD

-

9.2.5 Saft (TotalEnergies)

-

9.2.6 Others

-

-

9.3 Strategic Partnerships and Major Projects

-

-

Regulatory and Policy Framework

-

10.1 National Energy Storage Roadmaps

-

10.2 Grid Interconnection Standards and Incentives

-

10.3 Environmental and Safety Compliance

-

-

Innovation and Future Outlook

-

11.1 Long-Duration and Hybrid Energy Storage Systems

-

11.2 Role of AI, IoT, and Energy Management Platforms

-

11.3 Circular Economy and Battery Recycling Infrastructure

-

-

Conclusion and Strategic Outlook

-

Appendices

-

13.1 Glossary

-

13.2 Research Methodology

-

13.3 References and Sources

To get a detailed Table of content/ Table of Figures/ Methodology Please contact our sales person at ( chris@marketinsightsresearch.com )

FAQ'S

For a single, multi and corporate client license, the report will be available in PDF format. Sample report would be given you in excel format. For more questions please contact:

Within 24 to 48 hrs.

You can contact Sales team (sales@marketinsightsresearch.com) and they will direct you on email

You can order a report by selecting payment methods, which is bank wire or online payment through any Debit/Credit card, Razor pay or PayPal.

Discounts are available.

Hard Copy