HVDC Capacitor Market

HVDC Capacitor Market By Type (Plastic Film Capacitor, Aluminum Electrolytic Capacitor, Ceramic Capacitor, Tantalum Wet Capacitor, Reconstituted Mica Paper Capacitor, Glass Capacitor, Others), By Technology (Line Commutated Convertors and Voltage-sourced Convertors), By Installation Type (Open Rack Capacitor Banks, Enclosed Rack Capacitor Banks, Pole Mounted Capacitor Banks), By Application (Comme

Published Date: May - 2025 | Publisher: MIR | No of Pages: 320 | Industry: Power | Format: Report available in PDF / Excel Format

View Details Buy Now 2890 Download Free Sample Ask for Discount Request Customization| Forecast Period | 2024-2028 |

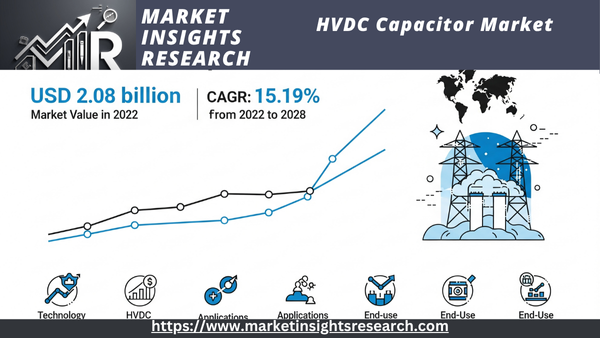

| Market Size (2022) | USD 2.08 billion |

| CAGR (2023-2028) | 15.19% |

| Fastest Growing Segment | Industrial |

| Largest Market | Asia-Pacific |

Market Overview

With a projected compound annual growth rate (CAGR) of 15.19% through 2028, the global HVDC capacitor market, which was valued at USD 2.08 billion in 2022, is expected to grow strongly during the forecast period.

Download Free Sample Ask for Discount Request Customization

Capacitors made specifically for High Voltage Direct Current (HVDC) systems are manufactured, distributed, and used in this market segment. Long-distance and effective electricity transfer is made possible by HVDC systems, which are advanced electrical transmission technologies. They are used in a number of contexts, such as grid modernization, cross-border power exchange, and the integration of renewable energy. By preserving voltage levels, filtering electrical signals, and improving the overall performance and dependability of HVDC transmission, HVDC capacitors are essential components of these systems. These specialty capacitors are designed to endure the particular requirements of high voltage, direct current, and prolonged operation.

The increasing demand brought on by the global adoption of HVDC technology is met by the global market for HVDC capacitors. Initiatives to connect electrical grids and the explosive growth of renewable energy sources are some of the factors driving this adoption.

Key Market Drivers

Expansion of Renewable Energy Generation

The rise of renewable energy generation is the main factor propelling the worldwide HVDC capacitor market. The need for HVDC capacitors is growing as a result of the global transition to sustainable energy sources and the growing demand for HVDC technology. Renewable energy sources like sun and wind frequently produce electricity in isolated areas. HVDC systems make it possible to transmit this power efficiently across long distances to urban centers, and capacitors are essential to the stability and effectiveness of the system. The market for HVDC capacitors is expected to increase significantly as a result of global government investments in renewable energy infrastructure.

Rapid Urbanization and Grid Expansion

The unrelenting rate of urbanization and the global growth of electrical infrastructures are driving the need for more effective power transmission. HVDC technology is the best option for moving large amounts of electricity over long distances, which is essential for linking expanding cities to distant power plants. To meet the growing energy demands in metropolitan areas, capacitors are essential parts of HVDC systems because they help sustain voltage levels and improve grid stability.

Download Free Sample Ask for Discount Request Customization

Technological Advancements in HVDC Systems

Ongoing developments in HVDC technology, particularly the creation of voltage source converters (VSC-HVDC), are fueling the extensive use of HVDC systems. Capacitors with improved performance attributes, like a high energy density and low losses, are needed in these contemporary systems. To satisfy these changing expectations, manufacturers are making significant investments in R&D, creating new market prospects for HVDC capacitors.

Grid Interconnection and Cross-Border Power Trading

Global demand for HVDC systems is being fueled by the growing trend of cross-border power trade and international grid interconnections. Because of its efficiency and capacity to transfer power over long distances, HVDC technology is favored for tying power grids together across international borders. In these systems, capacitors are essential for facilitating dependable and seamless power transfer between countries. The HVDC capacitor market is expanding significantly as nations place a greater emphasis on cross-border energy exchange and grid connections.

Grid Resilience and Reliability

For utilities and governments, grid resilience and dependability are critical issues, particularly in light of the growing challenges posed by climate change. There are serious risks to power distribution from the increasing frequency of extreme weather events including hurricanes, wildfires, and storms. HVDC systems with strong capacitors provide increased grid resilience by reducing transmission losses and facilitating quick reconfiguration in the event of an interruption. The need for HVDC capacitors is expected to increase as grid operators increase their emphasis on resilience.

Electrification of Transportation

Globally, the continuous electrification of transportation—including high-speed rail and electric vehicles (EVs)—is accelerating. The need for effective power transmission and high-capacity charging infrastructure is being fueled by this trend. Capacitors enable HVDC systems, which are essential for providing the necessary power to transit networks and charging stations. The market for HVDC capacitors is expected to gain a lot from the related infrastructure expenditures as transportation electrification picks up speed to address environmental concerns.

In conclusion, the expansion of renewable energy generation, urbanization, technological advancements, grid interconnections, grid resilience imperatives, and the electrification of transportation are all contributing to the strong growth of the global HVDC capacitor market. All of these factors point to a bright future for the HVDC capacitor market, with steady expansion predicted in the years to come.

Download Free Sample Ask for Discount Request Customization

Government Policies are Likely to Propel the Market

Renewable Energy Mandates and Incentives

Many governments around the world have put laws into place in recent years to support renewable energy sources like solar and wind. These regulations frequently include feed-in tariffs, tax credits, and subsidies to promote investment in renewable energy projects, as well as renewable energy mandates, which stipulate that a specific proportion of power output must originate from renewable sources. The market for HVDC capacitors is directly and favorably impacted by these rules. HVDC technology is used to effectively transport the generated power to urban centers because renewable energy sources are often found in remote locations. In HVDC systems, capacitors are essential parts that provide reliable and effective power transfer. Governments are aggressively encouraging the growth of renewable energy generation, which is predicted to greatly increase demand for HVDC capacitors.

Grid Modernization and Reliability Standards

To guarantee a steady and reliable supply of power, numerous countries are giving grid upgrading top priority and establishing strict dependability criteria. These regulations aim to improve electricity systems' dependability, security, and efficiency—particularly when dealing with severe weather and other interruptions. These goals are well served by HVDC systems because of their ability to transmit power over great distances and their grid-stabilizing capabilities. For the grid to remain stable, capacitors are essential. Thus, as part of their grid modernization initiatives, governments are promoting the use of HVDC technology, which in turn is driving the demand for HVDC capacitors.

Cross-Border Electricity Trade Agreements

In a time when global energy markets are intertwined, governments are increasingly participating in cross-border electricity trade agreements. In order to better balance supply and demand, these agreements make it easier for nearby nations to exchange electricity. Because HVDC systems can transport power over long distances with low losses, they are frequently the recommended option for cross-border electricity transmission. In order to provide the seamless and dependable transfer of power between countries, capacitors are crucial parts of these systems. The demand for HVDC capacitors is directly stimulated by government initiatives that support international trade in electricity.

Research and Development Funding

Numerous governments set aside large sums of money for energy technology research and development (R&D). Capacitors are among the innovative and enhanced HVDC systems and components that are supported by these grants. Innovation in the HVDC capacitor market is largely driven by R&D policies, which result in the development of capacitors with improved performance attributes. Governments support the development of more effective, high-energy-density, and extreme-condition-operating capacitors by offering grants, subsidies, and collaborations with private businesses and research institutes. These investments boost the competitiveness of the global HVDC capacitor market and propel technological improvements.

Environmental Regulations

The energy industry is being greatly impacted by environmental rules designed to lower greenhouse gas emissions and encourage energy efficiency. To phase out coal-fired power plants and encourage greener energy sources, governments are enacting legislation and setting stringent emission targets. These environmental objectives are in line with HVDC technology, which is renowned for its effectiveness in sending electricity over great distances with little loss. In HVDC systems, capacitors aid in lowering transmission energy losses. Governments are increasingly using HVDC technology and, as a result, HVDC capacitors in their energy policies as they strive for cleaner energy alternatives.

Trade and Tariff Policies

The global market for HVDC capacitors is also influenced by trade and tariff regulations. To safeguard domestic production and guarantee the safety of vital infrastructure components, governments may apply tariffs or trade restrictions on imports of capacitors. On the other hand, laws that support free trade and loosen import restrictions can let HVDC capacitors move across international borders, which is advantageous for both producers and consumers. The accessibility and cost of HVDC capacitors on the international market may be significantly impacted by these trade regulations.

In conclusion, the global market for HVDC capacitors is significantly impacted by government regulations. The demand and future growth prospects of the HVDC capacitor market can be influenced directly or indirectly by policies that promote renewable energy, grid modernization, cross-border electricity trading, R&D financing, environmental sustainability, and commerce. The market for HVDC capacitors will react appropriately as governments continue to improve their energy regulations, mirroring the changing energy industry.

Key Market Challenges

Technological Advancements and Innovation

A major obstacle facing the HVDC capacitor industry is the requirement for constant innovation and the quick speed at which technology is developing. HVDC systems are always being upgraded and improved as the energy sector develops and adopts new technologies. As crucial parts of HVDC systems, capacitors need to stay up to date with these advancements in order to stay competitive. The need for enhanced performance characteristics and a higher energy density is one facet of this dilemma. Capacitors that can store more energy in a smaller footprint while avoiding energy losses are becoming more and more necessary as HVDC systems for long-distance power transmission are used more frequently. Continued research and development is necessary to meet these objectives. Furthermore, the need for more ecologically friendly capacitors is being driven by laws and environmental concerns. The environmental impact of traditional capacitor technologies, like those that use oil-based dielectrics, is being questioned. Eco-friendly substitutes, like capacitors with dry insulating materials or biodegradable dielectrics, are being promoted by governments and industry players. There are substantial technological obstacles in the development and commercialization of these eco-friendly solutions. Furthermore, capacitors need to adjust to the unique needs of HVDC systems since they are combined with cutting-edge technologies like flexible AC transmission systems (FACTS) and voltage source converters (VSC-HVDC). Technical difficulties in capacitor design and performance arise, for instance, because VSC-HVDC systems need capacitors that can function well at high frequencies and voltages. The market for HVDC capacitors also has issues with cost-effectiveness. Although improvements in technology frequently result in capacitors with higher performance, they can also raise production costs. Manufacturers face the difficult task of striking a balance between cost-effectiveness and the need for enhanced performance. In conclusion, the worldwide HVDC capacitor market has a significant challenge due to the ongoing development of HVDC technology and the requirement for innovation. Continuous research and development as well as investments in manufacturing capabilities are required to meet the needs for increased energy density, environmental sustainability, compatibility with new HVDC system topologies, and cost-effectiveness.

Supply Chain Disruptions and Raw Material Availability

Supply chain interruptions and the availability of essential raw materials are issues facing the worldwide HVDC capacitor industry. Numerous causes, including as the COVID-19 epidemic, geopolitical tensions, and the growing need for cutting-edge technologies, have made this challenge worse. High-quality conducting materials, insulating components, and dielectric materials are among the materials needed for HVDC capacitors. These materials can have a complicated supply chain that is prone to interruptions. For example, geopolitical tensions have affected the availability of rare earth minerals, which are necessary for some types of capacitors. This has resulted in price volatility and possible shortages. Furthermore, the COVID-19 pandemic revealed weaknesses in international supply chains. The manufacturing and distribution of electrical components, including capacitors, were impacted by lockdowns, travel restrictions, and manufacturing and transportation difficulties. The epidemic brought to light the necessity of supply chain resilience and source diversification. The growing rivalry for essential raw materials from other high-tech sectors, such consumer electronics and electric cars, is another facet of this difficulty. The increased demand for these commodities has impacted their availability and cost while also escalating competition. The market for HVDC capacitors may also be impacted by regulatory changes pertaining to the use and sourcing of specific materials. The use of specific materials may be restricted by laws intended to protect the environment and promote ethical sourcing, or they may call for greater supply chain transparency. Manufacturers of HVDC capacitors must take aggressive steps to address these supply chain issues. This entails investigating substitute materials that are less susceptible to supply chain interruptions, investing in inventory control and risk mitigation techniques, and diversifying sources of supply. To guarantee a steady and safe supply chain for essential raw materials, cooperation between governments, industry participants, and material suppliers might also be required.

In conclusion, the global HVDC capacitor market faces major challenges from supply chain disruptions and the availability of necessary raw materials. For the HVDC capacitor sector to continue growing and stabilizing, manufacturers must manage the effects of the COVID-19 epidemic, negotiate geopolitical risks, and adjust to growing competition for essential materials.

Segmental Insights

Application Insights

The highest market share in 2022 was held by the Energy & Power category, which is anticipated to hold onto that position throughout the forecast period. There has been a noticeable transition in the energy and power industry toward renewable energy sources like solar and wind. In remote locations where long-distance transmission is necessary, these renewable energy sources frequently produce electricity. The best option for effectively transferring this power across long distances is HVDC technology. In HVDC systems, capacitors are essential parts that guarantee the energy transmission's stability and dependability. The need for HVDC capacitors in this market has increased as a result of the global shift toward renewable energy. To satisfy the rising energy demands of urbanization, governments and utilities around the world are investing in updating and enlarging their electrical systems. HVDC systems are ideal for improving grid efficiency, lowering transmission losses over long distances, and connecting remote power production facilities to urban centers. Grid reliability depends on voltage levels being stabilized, which is largely accomplished by capacitors. The energy and power sector's need for HVDC capacitors is fueled by grid modernization and expansion. Cross-border electricity trade and international power interconnections have grown in popularity. Because of its effectiveness in long-distance transmission, HVDC systems are excellent for enabling the exchange of power between nearby nations. In these cross-border systems, capacitors guarantee a dependable and seamless power transfer. The energy and power sector emerges as a major buyer of HVDC capacitors as governments and utilities encourage cross-border power exchange to maximize energy resources. Grid stability and resilience are important to the energy and power industry. With the use of capacitors, HVDC technology improves grid stability by lowering transmission losses and enabling quick reconfiguration in the event of disruptions like severe weather. The demand for HVDC capacitors is being driven by the energy and power sector's rising reliance on HVDC systems and the increased emphasis on grid resilience in the face of climate-related concerns. Globally, the electrification of transportation—including high-speed rail and electric vehicles (EVs)—is accelerating. Capacitors and HVDC technology work together to provide the necessary power to transportation networks and charging infrastructure. The demand for HVDC capacitors is still largely driven by the energy and power sector as the electrification trend continues to increase. The energy and power sector is frequently favored by government policies and incentives meant to promote renewable energy and system dependability. These policies include subsidies for cross-border power exchange, grid upgrading projects, and mandates for renewable energy. Such government assistance immediately increases the need for HVDC networks and, in turn, HVDC capacitors in the power and energy sector.

Type Insights

With the most market share in 2022, the aluminum electrolytic capacitor category is expected to develop rapidly over the course of the forecast period. HVDC systems, which frequently function at high voltages, can benefit from the usage of aluminum electrolytic capacitors because of their reputation for withstanding high voltage levels. Capacitors for HVDC systems must be able to tolerate these high voltage levels without failing, and aluminum electrolytic capacitors are made to efficiently satisfy this need. One important factor in HVDC applications is capacitance. High capacitance values in aluminum electrolytic capacitors enable them to store substantial electrical energy. This is especially crucial for HVDC systems, because effective power transmission depends on energy storage and regulation. HVDC systems often last a long time and function well in harsh conditions. Even under challenging circumstances, aluminum electrolytic capacitors are renowned for their dependability and longevity. They are resistant to climatic conditions and temperature swings that are frequently seen in HVDC systems. Aluminum electrolytic capacitors can be tailored by manufacturers to satisfy particular specifications, such as form factors, capacitance values, and voltage ratings. They are able to meet the various needs of HVDC projects because of their versatility. Generally speaking, aluminum electrolytic capacitors are less expensive than some other specialist HVDC capacitor technologies. For HVDC projects trying to keep costs under control without sacrificing component quality, this cost effectiveness might be very alluring. Numerous electrical and electronic applications have long made use of aluminum electrolytic capacitors. As a result of this vast experience, dependable and proven production techniques have been developed. The continuous use of aluminum electrolytic capacitors is facilitated by the frequent confidence that HVDC engineers and designers have in their capabilities. Different line-commutated converter (LCC) and voltage source converter (VSC) technologies that are frequently utilized in HVDC systems are compatible with aluminum electrolytic capacitors. The incorporation of these capacitors into HVDC projects is made easier by their compatibility.

Regional Insights

Asia Pacific

In 2022, the largest market for HVDC capacitors was in Asia Pacific. The following factors are driving the market's growth in this region

Rapid expansion of the renewable energy sectorChina and India are two of the world's fastest-growing renewable energy sectors, and Asia Pacific is home to many of them. These nations are making significant investments in wind and solar energy projects, which call for HVDC transmission lines.

Growing emphasis on grid infrastructure improvementA large number of Asia Pacific nations are making investments to upgrade their grid infrastructure. This is being done to increase grid reliability and satisfy the rising demand for electricity. HVDC capacitors are used to increase the grid's efficiency and stability.

Growing need for uninterrupted powerThe market in this region is anticipated to develop as a result of the growing demand for uninterrupted power in data centers and electric vehicles. These crucial applications are powered continuously by HVDC capacitors.

North America

In 2022, the second-largest market for HVDC capacitors was in North America. The following factors are driving the market's growth in this region

Growing emphasis on grid infrastructure improvementBoth the US and Canada are making significant investments to upgrade their grid infrastructure. This is being done to increase grid reliability and satisfy the rising demand for electricity. HVDC capacitors are used to increase the grid's efficiency and stability.

Growing need for uninterrupted powerThe market in this region is anticipated to develop as a result of the growing demand for uninterrupted power in data centers and electric vehicles. These crucial applications are powered continuously by HVDC capacitors.

Technological developmentsWe anticipate that advancements in HVDC transmission systems will propel market expansion in this area. HVDC transmission is becoming more economical and efficient because to new technologies like modular HVDC systems, and in the upcoming years, there will likely be a greater need for these systems.

Download Free Sample Ask for Discount Request Customization

Recent Developments

- In April 2023, ABB announced that it had received an order worth USD 218.36 million from TenneT for HVDC converter stations in the Netherlands. The order includes the supply of HVDC capacitors, as well as other equipment.

- In March 2023, Eaton announced that it had received an order worth USD 100 million from Hydro-Québec for HVDC capacitors. The order is for the supply of capacitors for a new HVDC transmission system in Canada.

- In February 2023, Vishay Intertechnology announced that it had received an order worth USD 50 million from a major Chinese power utility for HVDC capacitors. The order is for the supply of capacitors for a new HVDC transmission system in China.

- In January 2023, Nissin Electric announced that it had received an order worth USD 68 10 million from a major Japanese power utility for HVDC capacitors. The order is for the supply of capacitors for a new HVDC transmission system in Japan.

These are just a few of the recent investments in the global HVDC capacitor market. The market is expected to continue to grow in the coming years, driven by the increasing demand for renewable energy and the need to improve grid infrastructure.

Key Market Players

- Hitachi, Ltd

- General Electric Company

- TDK Corporation

- Eaton Corporation plc

- KYOCERA Corporation

- YAGEO Corporation

- Vishay Intertechnology, Inc.

- ABB Ltd

- Nissin electric (Wuxi) Co., Ltd.

- Littelfuse, Inc.

|

By Type |

By Technology |

By Installation Type |

By Application |

By Region |

|

|

|

|

Related Reports

- Steam Boiler Market - By Capacity, By Fuel (Natural Gas, Oil, Coal), By Technology (Condensing, Non-Condensing), By Appl...

- Industrial Electric Boiler Market - By Voltage Rating (Low Voltage, Medium Voltage), By Capacity (< 10 MMBtu/hr, 10-50 M...

- Biomass Boiler Market - By Feedstock (Woody Biomass, Agricultural Waste, Industrial Waste, Urban Residue), By Product (S...

- Asia Pacific Electric Boiler Market Size - By Capacity (≤ 10 MMBtu/hr, > 10 - 50 MMBtu/hr, > 50 - 100 MMBtu/hr, > 100 ...

- North America & Europe Electric Boiler Market Size - By Voltage Rating (Low Voltage, Medium Voltage), By Application (Re...

- North America Residential Boiler Market Size - By Fuel (Natural Gas, Oil, Electric), By Technology (Condensing {Natural ...

Table of Content

-

Executive Summary

-

1.1 Market Overview

-

1.2 Key Trends and Market Highlights

-

1.3 Strategic Recommendations

-

-

Introduction

-

2.1 Report Objectives and Scope

-

2.2 Research Methodology

-

2.3 Definitions and Market Classification

-

-

Market Overview

-

3.1 What Are HVDC Capacitors?

-

3.2 Role in HVDC Transmission Systems

-

3.3 HVDC Technology: LCC vs. VSC Systems

-

3.4 Market Evolution and Value Chain Analysis

-

-

Market Dynamics

-

4.1 Market Drivers

-

4.1.1 Growing Demand for Long-Distance Power Transmission

-

4.1.2 Integration of Renewable Energy to National Grids

-

4.1.3 Government Investments in HVDC Infrastructure Projects

-

-

4.2 Market Restraints

-

4.2.1 High Cost and Complex Installation

-

4.2.2 Limited Awareness in Developing Regions

-

-

4.3 Market Opportunities

-

4.3.1 Development of Smart Grid Infrastructure

-

4.3.2 Rising Investments in Offshore Wind and Subsea Cables

-

-

4.4 Challenges

-

4.5 Porter’s Five Forces Analysis

-

-

Technology Landscape

-

5.1 Types of HVDC Capacitors

-

5.1.1 Aluminum Electrolytic

-

5.1.2 Tantalum

-

5.1.3 Ceramic

-

5.1.4 Plastic Film

-

5.1.5 Others

-

-

5.2 Dielectric Materials and Performance Metrics

-

5.3 Design for Voltage Balancing and Temperature Tolerance

-

5.4 Capacitor Banks and Filtering Applications in HVDC Stations

-

5.5 Advances in High-Frequency and Compact Capacitor Designs

-

-

Market Segmentation

-

6.1 By Type

-

6.1.1 Line-Commutated Converter (LCC)

-

6.1.2 Voltage Source Converter (VSC)

-

-

6.2 By Application

-

6.2.1 Power Transmission

-

6.2.2 Industrial Power Supplies

-

6.2.3 Oil & Gas

-

6.2.4 Renewable Integration (Solar, Wind)

-

6.2.5 Others

-

-

6.3 By Voltage Rating

-

6.3.1 Less than 100 kV

-

6.3.2 100–500 kV

-

6.3.3 Above 500 kV

-

-

-

Regional Analysis

-

7.1 North America

-

7.2 Europe

-

7.3 Asia-Pacific

-

7.4 Latin America

-

7.5 Middle East & Africa

-

-

Market Size and Forecast (2020–2030)

-

8.1 Global Revenue and Volume Forecast

-

8.2 Segment-Wise and Region-Wise Analysis

-

8.3 HVDC Project Pipeline and Installed Base Growth

-

-

Competitive Landscape

-

9.1 Market Share of Leading Players

-

9.2 Company Profiles

-

9.2.1 ABB Ltd.

-

9.2.2 Siemens Energy

-

9.2.3 General Electric

-

9.2.4 Eaton Corporation

-

9.2.5 TDK Corporation

-

9.2.6 Others

-

-

9.3 R&D, Strategic Alliances, and Key Project Wins

-

-

Regulatory and Standards Framework

-

10.1 IEC, IEEE, and National Grid Codes

-

10.2 Safety, Reliability, and Certification Standards

-

10.3 Environmental and Performance Testing Regulations

-

-

Innovation and Future Outlook

-

11.1 Digital Monitoring and Smart Capacitor Banks

-

11.2 Compact and High-Efficiency Capacitor Modules

-

11.3 HVDC Capacitors in Flexible and Modular Grid Architectures

-

-

Conclusion and Strategic Outlook

-

Appendices

-

13.1 Glossary

-

13.2 Research Methodology

-

13.3 References and Data Sources

To get a detailed Table of content/ Table of Figures/ Methodology Please contact our sales person at ( chris@marketinsightsresearch.com )

FAQ'S

For a single, multi and corporate client license, the report will be available in PDF format. Sample report would be given you in excel format. For more questions please contact:

Within 24 to 48 hrs.

You can contact Sales team (sales@marketinsightsresearch.com) and they will direct you on email

You can order a report by selecting payment methods, which is bank wire or online payment through any Debit/Credit card, Razor pay or PayPal.

Discounts are available.

Hard Copy