Europe Battery Energy Storage System Market

Europe Battery Energy Storage System Market, By Battery Type (Lithium-Ion Batteries, Advanced Lead-Acid Batteries, Flow Batteries, Others), By Connection Type (On-grid and Off-grid), By Energy Capacity (Above 500 MWh, Between 100 to 500 MWh, Below 100 MWh), By Application (Utility, Commercial, Residential), By Country, Competition, Forecast and Opportunities, 2028

Published Date: May - 2025 | Publisher: MIR | No of Pages: 320 | Industry: Power | Format: Report available in PDF / Excel Format

View Details Buy Now 2890 Download Free Sample Ask for Discount Request Customization| Forecast Period | 2024-2028 |

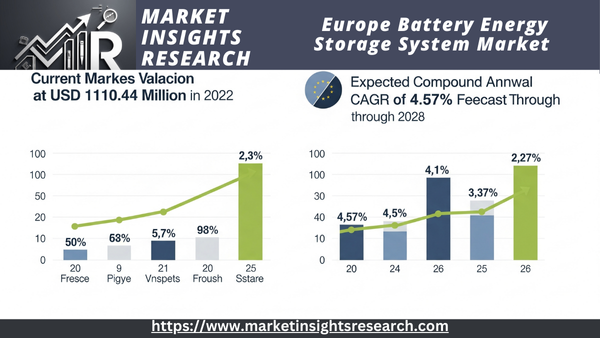

| Market Size (2022) | USD 1110.44 Million |

| CAGR (2023-2028) | 4.57% |

| Fastest Growing Segment | Advanced Lead-Acid Batteries |

| Largest Market | Germany |

Market Overview

The Europe Battery Energy Storage Systems (BESS) Market was valued at approximately USD 1110.44 Million in 2024 and is forecasted to experience consistent expansion, projecting a Compound Annual Growth Rate (CAGR) of 4.57%through 2028.This growth trajectory reflects the increasing emphasis on clean energy transitions and smart grid infrastructure across the region.

Download Free Sample Ask for Discount Request Customization

Battery Energy Storage Systems are integral to the evolution of modern energy ecosystems. These sophisticated systems store electrical energy using rechargeable batteries and discharge it when required—particularly during peak demand or renewable generation downtimes. BESS are essential in maintaining grid stability, offering services such as frequency control, peak shaving, load leveling, and backup power.

One of the major driving forces behind this surge is the aggressive rollout of renewable energy projects and government mandates aimed at achieving carbon neutrality. As solar and wind energy become more prevalent, the intermittency challenge necessitates robust storage solutions like BESS for grid reliability and efficiency.

Additionally, the market's upward trend is supported by advances in battery chemistries—particularly lithium-ion and emerging alternatives like solid-state and flow batteries—which offer improved energy density, longer cycle life, and lower degradation rates. Technological innovation combined with economies of scale is also driving down system costs, making adoption more economically viable for utilities, businesses, and homeowners alike.

Europe’s strategy toward energy security—especially in light of recent geopolitical shifts—is further accelerating investments in decentralized energy systems, where BESS play a critical role. From residential installations supporting energy independence to large-scale grid-support applications enabling virtual power plants, the versatility and scalability of BESS underscore their centrality to Europe's future energy landscape.

Looking forward to 2035, the integration of AI and IoT within BESS will enhance real-time energy management and predictive maintenance, pushing operational efficiency and reliability to new heights.

Key Market Drivers

Battery Energy Storage Systems (BESS) are increasingly central to the future of global and regional energy strategies. Their adoption is accelerating due to the intersection of climate policy, renewable integration needs, and next-gen grid modernization efforts. By 2025, BESS are becoming a foundational technology, with transformative impacts anticipated by 2035.

Integration of Renewable Energy

The rising penetration of wind and solar energy, driven by Europe's commitment to decarbonization, underscores the critical role of BESS. These systems counteract the intermittency of renewables by capturing surplus electricity during peak production and delivering it during demand surges or renewable lulls. This functionality ensures a continuous, stable, and clean energy flow that supports national grid decarbonization objectives.

Enhanced Grid Flexibility and Stability

As Europe’s grid evolves into a more distributed network of prosumers, renewable assets, and decentralized systems, flexibility becomes vital. BESS provide near-instantaneous response to fluctuations, supporting frequency regulation and voltage control. They minimize outage risks, defer the need for grid reinforcements, and strengthen the resilience of increasingly digitized energy infrastructures.

Effective Peak Load Management

In an era of fluctuating energy consumption patterns and rising demand from electric heating and mobility, BESS mitigate peak loads efficiently. By discharging energy stored during off-peak hours, these systems reduce reliance on carbon-intensive peaker plants, supporting cleaner load management strategies and reducing operational stress on the transmission network.

Cost Optimization and Energy Arbitrage

BESS facilitate time-shifting of electricity consumption, empowering consumers and utilities to exploit time-of-use pricing. Stored energy from low-cost, off-peak periods can be dispatched during peak pricing, leading to significant reductions in electricity costs. Additionally, utilities benefit from improved grid asset utilization and reduced penalty costs associated with imbalances.

Provision of Ancillary Grid Services

Modern energy systems require a suite of ancillary services to maintain operational integrity. BESS deliver essential functions including synthetic inertia, reactive power support, and black start capabilities. This reduces dependence on conventional generators and lowers overall grid operating costs, aligning with smart grid and zero-carbon operational strategies.

Climate Impact and Sustainability Goals

BESS are instrumental in decoupling energy storage from fossil fuels, reducing carbon intensity across all energy applications. They are central to Europe’s 2035 carbon neutrality ambitions, complementing renewable deployments and displacing legacy fossil-based flexibility solutions. Their lifecycle carbon footprint continues to decline with recycling technologies and cleaner manufacturing.

Synergies with Electric Vehicles (EVs)

The exponential growth in EV adoption across Europe drives the demand for intelligent, flexible charging infrastructure. BESS-enabled EV stations support peak shaving, optimize grid loads, and enable vehicle-to-grid (V2G) systems. These applications blur the lines between energy consumers and providers, embedding storage deeply into the mobility-energy nexus.

Microgrid Enablement and Rural Electrification

In remote, isolated, or energy-insecure regions, BESS facilitate the deployment of autonomous microgrids powered by local renewable sources. They reduce dependency on fuel imports and empower energy sovereignty. Across Europe’s islands and rural communities, these solutions enhance energy access, reliability, and affordability.

Government Policies and Regulatory Incentives

Progressive regulations, such as capacity markets, net metering reforms, and energy storage mandates, are propelling BESS deployments. Many European countries are offering direct subsidies, tax credits, and streamlined permitting for BESS projects, reflecting a strategic policy shift toward decentralized clean energy support systems.

Technological Innovations and Cost Declines

Breakthroughs in solid-state, lithium-sulfur, and hybrid flow batteries are unlocking higher energy density, faster charge cycles, and longer system lifespans. These advancements, coupled with automation, AI-based dispatching, and modular designs, are slashing levelized costs and enabling more granular control of distributed assets.

Europe-Specific Drivers

Europe’s distinct energy challenges, regulatory ecosystem, and climate ambition drive tailored BESS adoption patterns, shaping the regional market uniquely by 2035.

Renewable Energy Goals and Integration

EU-wide targets, including the European Green Deal and Fit for 55 package, demand over 60% renewable electricity by 2030 and even higher levels by 2035. BESS support seamless integration by buffering intermittent output, enabling curtailment avoidance, and facilitating dynamic balancing across transmission corridors.

Grid Stability Amidst Decentralization

The decentralization of power production—from offshore wind farms to rooftop solar—necessitates rapid-response assets. BESS offer sub-second response capabilities, enhancing the European Transmission System Operators' (TSOs) ability to manage variability and prevent cascading failures.

Market Reform and Revenue Stacking

Evolving EU energy markets support multiple revenue streams for BESS, including participation in balancing markets, energy arbitrage, and capacity services. Battery operators can now monetize flexibility while supporting system reliability, improving project bankability for investors.

Supportive Regulatory Frameworks

From Germany’s market-based remuneration for grid services to France’s strategic roadmap for storage, EU states are crafting enabling environments. The EU’s TEN-E regulation also recognizes storage as key trans-European infrastructure, qualifying projects for accelerated approvals and funding.

Phase-out of Coal and Flexible Alternatives

With Germany, Poland, and other coal-heavy nations phasing out coal by 2030–2035, flexible assets like BESS are replacing conventional power’s role in frequency and capacity management. This accelerates storage growth aligned with national energy transition plans.

EV Charging Infrastructure Development

Europe’s electric mobility boom—supported by bans on internal combustion engine vehicles—demands grid-integrated charging solutions. BESS offer not just grid stability but enhance user experience by ensuring faster, lower-cost, and greener charging services.

Islands and Border Regions

European islands (e.g., the Greek archipelago, Scottish isles) and cross-border zones benefit from BESS-enhanced microgrids and interconnectivity solutions. This ensures energy security, boosts renewable uptake, and reduces dependency on expensive diesel generators.

Weather Extremes and Resilience Needs

Rising extreme weather events, including storms, heatwaves, and cold snaps, call for resilient power infrastructure. BESS ensure backup capacity, support emergency loads, and protect critical infrastructure, enhancing Europe’s adaptation strategies under its Climate Law.

Cutting-Edge Research and Pilots

Europe is a leader in smart grid innovation. EU-funded projects such as Horizon Europe and Mission Innovation focus on next-gen storage systems. Pilot programs across Spain, Sweden, and the Netherlands test AI-integrated storage, second-life battery reuse, and grid digital twins.

Download Free Sample Ask for Discount Request Customization

Technological Advancements

In conclusion, the multifaceted drivers of Battery Energy Storage Systems encompass technological innovation, enhanced grid stability, cost savings, environmental considerations, and regulatory support. As these drivers continue to gain momentum, BESS are poised to play a transformative role in the global energy transition, ushering in a more resilient, sustainable, and decentralized energy future.

Key Market Challenges

Battery Energy Storage Systems (BESS) are rapidly becoming an indispensable component of Europe’s clean energy transition. However, their full-scale integration across the region is hindered by several multifaceted challenges that must be addressed to unlock their transformative potential.

Regulatory Complexity Across Member States

The policy landscape governing BESS in Europe remains fragmented and, in some cases, ambiguous. Each country within the EU has its own interpretation and implementation strategy for energy storage, resulting in regulatory asymmetries. This inconsistency complicates cross-border projects, reduces investor confidence, and delays deployment. While the European Commission has begun harmonization efforts, a fully unified regulatory approach is not yet in place as of 2025.

Lack of Technical Standardization

Despite technological progress, a universal set of standards for battery storage components, integration protocols, and safety measures remains elusive. Varying grid codes and system requirements across countries increase technical incompatibilities, complicating procurement and interconnection, especially for multinational utilities and technology providers.

Permitting and Land Use Challenges

Gaining approvals for BESS installations—particularly those located near urban areas or environmentally sensitive regions—can be protracted and cumbersome. Local opposition, environmental assessments, and multi-agency jurisdiction all contribute to longer lead times and increased soft costs. As of 2025, the average permitting period for utility-scale projects in Europe exceeds 18 months.

Capital Costs and Financial Risk

Although BESS offer long-term operational and environmental benefits, their high upfront capital expenditure remains a barrier. Investment risk is compounded by the volatility of energy markets and the uncertainty surrounding revenue streams from services like frequency response and arbitrage. In 2025, access to tailored financial instruments and risk-mitigating guarantees remains limited, especially for mid-sized operators.

Grid Integration and Infrastructure Constraints

Integrating BESS into legacy grid systems often requires substantial upgrades, including substation retrofits, enhanced communication networks, and advanced control systems to manage bidirectional power flows. Without these updates, BESS deployments may be underutilized or may even strain the grid rather than support it. In many regions, grid hosting capacity remains a bottleneck.

Rapid Technological Evolution and Investment Timing

Frequent innovations in battery technologies—ranging from lithium-ion to emerging solid-state or sodium-ion systems—create decision-making dilemmas for developers. Choosing a technology that meets both current and future performance expectations is challenging. Early adopters may face obsolescence risks or higher lifecycle costs if upgrades are required sooner than anticipated.

Critical Mineral Supply Chain Vulnerabilities

As demand for lithium, cobalt, nickel, and other essential minerals surges, geopolitical dependencies and mining-related environmental concerns pose serious risks. Supply bottlenecks can inflate prices, disrupt timelines, and spark ethical scrutiny. Europe's current reliance on external sources, particularly from China and the Democratic Republic of Congo, has prompted urgent calls for localized, sustainable sourcing by 2035.

System Design and Sizing Complexity

Optimal sizing and configuration of BESS assets depend on highly variable factors such as demand curves, price volatility, and grid characteristics. Poorly sized systems can lead to underperformance or wasted capital. This requires advanced forecasting models, AI-driven energy management systems, and granular data analytics, all of which are still evolving.

Limited Public Awareness and Community Pushback

Public understanding of energy storage technologies remains limited. Misconceptions around fire risks, electromagnetic fields, or land usage can stoke opposition. Community acceptance, especially in suburban or ecologically sensitive areas, hinges on robust outreach efforts and transparent benefit-sharing frameworks. Addressing these concerns early is vital to project success.

Complex Participation in Energy Markets

BESS systems interact with a growing number of market mechanisms—from frequency containment reserves to intraday arbitrage markets—but these frameworks are still maturing. Many storage services are undervalued or poorly compensated, which discourages investor participation. Without proper market recognition of the value BESS deliver, long-term profitability remains uncertain.

Segmental Insights

Battery Type Insights

In the Battery Energy Storage Systems (BESS) market, the Lithium-Ion Battery category took the lead in 2022 and is expected to stay there for the duration of the forecast. Because of their high energy density, efficiency, and comparatively advanced stage of research, lithium-ion batteries have become a dominant technology in the European BESS industry. Due to the growing integration of renewable energy sources and the requirement for grid stability, the market for lithium-ion batteries in BESS has been steadily expanding. When it comes to incorporating sporadic renewable energy sources like wind and solar into the grid, lithium-ion batteries are essential. They help create a more stable and dependable grid by storing extra energy during times of high generation and releasing it during times of low renewable energy generation or high demand. It is anticipated that this tendency would support market expansion.

Application Insights

In 2022, the residential segment took the lead in the Battery Energy Storage Systems (BESS) market, and it is expected to stay there. In Europe, residential battery energy storage systems are becoming more and more popular as homeowners look to save electricity costs, maximize solar power self-consumption, and become more energy independent. Installations have increased in the market as a result of supporting regulations, better technology, and declining battery costs. The aim to optimize the use of on-site solar energy is one of the main factors driving the use of BESS in residential settings. When sunshine is scarce or during periods of high demand, homeowners can store extra solar energy for later use. The dynamic pricing of energy is made available to homeowners through residential BESS. They might potentially save money on energy costs by storing electricity during off-peak hours when rates are cheaper and discharging it during peak hours when rates are higher. It is anticipated that this tendency would support market expansion.

Country Insights

Germany is a market leader in Europe for Battery Energy Storage Systems (BESS), thanks to a variety of dynamic elements that influence its energy environment. Germany, a leader in renewable energy, depends on BESS to smoothly incorporate variable energy sources into the grid, such as wind and solar. This guarantees a steady supply of electricity and supports the country's Energiewende program, which aims to reduce emissions and switch to sustainable energy. In Germany, BESS are essential protectors of grid stability. They improve grid resilience, avoid congestion, and maximize operations during moments of peak renewable generation by quickly adjusting frequency and voltage. BESS is crucial, as demonstrated by Germany's progressive Energiewende initiative. As the nation steers toward increased use of renewable energy, these systems are essential to preserving grid resilience.

Download Free Sample Ask for Discount Request Customization

Recent Developments

- In September 2021, some recent developments and trends related to Battery Energy Storage Systems (BESS) in Europe

- Increasing Deployment Europe has been witnessing a significant increase in the deployment of BESS, both at utility-scale and distributed levels. Many countries have initiated projects to integrate battery storage with renewable energy sources to enhance grid stability and support the transition to clean energy.

- Energy Storage Targets Several European countries and regions have established energy storage targets as part of their renewable energy and climate action plans. For instance, Germany, France, and the United Kingdom have set ambitious goals for energy storage capacity to support their respective decarbonization strategies.

Key Market Players

- BYD Company Ltd.

- Tesla Inc

- Contemporary Amperex Technology Co Ltd.

- Panasonic Corporation

- Murata Manufacturing Co., Ltd.

- Leclanché SA

- LG Chem Ltd.

- Samsung SDI Co Ltd.

- Toshiba Corp

- Wartsila Oyj Abp

|

By Battery Type |

By Connection type |

By Energy Capacity |

By Application |

By Country |

|

|

|

|

|

Related Reports

- Electric Boiler Market Size By Voltage Rating (Low, Medium), By Application (Residential, Commercial, Industrial, Food P...

- Europe Boiler Market By Fuel (Natural Gas, Oil, Coal, Electric), By Capacity (≤ 10 MMBtu/hr, > 10 - 50 MMBtu/hr, > 50 ...

- Boiler Market Size - By Fuel (Natural Gas, Oil, Coal, Electric), By Capacity (≤ 10 MMBtu/hr, > 10 - 50 MMBtu/hr, > 50 ...

- Residential Boiler Market Size By Technology (Condensing {Natural Gas, Oil, Electric}, Non-Condensing {Natural Gas, Oil,...

- Commercial Electric Boiler Market - By Voltage Rating (Low Voltage, Medium Voltage), By Capacity, By Product (Hot Water,...

- Combi Boiler Market - By Fuel (Natural Gas, Oil), By Technology (Condensing, Non-Condensing) & Forecast, 2024-2032

Table of Content

-

Executive Summary

-

1.1 Market Overview

-

1.2 Key Insights and Trends

-

1.3 Strategic Recommendations

-

-

Introduction

-

2.1 Report Scope and Purpose

-

2.2 Research Methodology

-

2.3 Assumptions and Definitions

-

-

Market Overview

-

3.1 Role of BESS in Europe’s Energy Transition

-

3.2 Grid Integration, Flexibility, and Energy Security

-

3.3 Battery Storage Ecosystem in Europe

-

3.4 Policy Drivers: Fit for 55, REPowerEU, and National Targets

-

-

Market Dynamics

-

4.1 Drivers

-

4.1.1 Growth in Renewable Energy Capacity (Solar, Wind)

-

4.1.2 Need for Frequency Regulation and Peak Shaving

-

4.1.3 Falling Lithium-Ion Battery Prices

-

-

4.2 Restraints

-

4.2.1 Interconnection Barriers and Permitting Delays

-

4.2.2 Grid Code Complexity and Lack of Uniform Standards

-

-

4.3 Opportunities

-

4.3.1 Co-location of Storage with Renewables

-

4.3.2 Revenue Stacking and Energy Trading Platforms

-

-

4.4 Challenges

-

4.5 Porter’s Five Forces Analysis

-

-

Technology Landscape

-

5.1 Lithium-Ion (LFP, NMC) Dominance

-

5.2 Flow Batteries and Long-Duration Storage

-

5.3 Hybrid Energy Storage (Thermal + Battery)

-

5.4 Inverter and Energy Management Systems (EMS)

-

5.5 Safety and Fire Prevention Mechanisms

-

-

Market Segmentation

-

6.1 By Battery Type

-

6.1.1 Lithium-Based

-

6.1.2 Flow

-

6.1.3 Lead-Based

-

6.1.4 Others

-

-

6.2 By Application

-

6.2.1 Front-of-the-Meter (FTM)

-

6.2.2 Behind-the-Meter (BTM)

-

-

6.3 By End-User

-

6.3.1 Utilities

-

6.3.2 Commercial & Industrial

-

6.3.3 Residential

-

-

6.4 By Energy Capacity

-

6.4.1 <1 MWh

-

6.4.2 1–50 MWh

-

6.4.3 >50 MWh

-

-

-

Regional Analysis

-

7.1 Germany

-

7.2 United Kingdom

-

7.3 France

-

7.4 Italy

-

7.5 Spain

-

7.6 Nordics

-

7.7 Rest of Europe

-

-

Market Size and Forecast (2020–2030)

-

8.1 Revenue and Installed Capacity Forecast

-

8.2 Country-Wise Growth and Investment Trends

-

8.3 Segment-Wise Outlook by Application and Battery Type

-

-

Competitive Landscape

-

9.1 Market Share of Key Players

-

9.2 Profiles of Leading Companies

-

9.2.1 Fluence Energy

-

9.2.2 Tesla

-

9.2.3 BYD Europe

-

9.2.4 LG Energy Solution

-

9.2.5 Siemens Gamesa

-

9.2.6 Others

-

-

9.3 Recent Projects, Partnerships, and Technological Advancements

-

-

Policy and Regulatory Framework

-

10.1 EU Energy Storage Directives and Country-Specific Policies

-

10.2 Incentives, Tenders, and Subsidy Programs

-

10.3 Market Access, Grid Codes, and Trading Rules

-

-

Innovation and Future Outlook

-

11.1 AI-Driven Optimization and Digital Twins

-

11.2 Grid-Interactive Buildings and Community Storage

-

11.3 Battery Lifecycle Management and Recycling

-

-

Conclusion and Strategic Recommendations

-

Appendices

-

13.1 Glossary

-

13.2 Research Methodology

-

13.3 References and Data Sources

-

To get a detailed Table of content/ Table of Figures/ Methodology Please contact our sales person at ( chris@marketinsightsresearch.com )

FAQ'S

For a single, multi and corporate client license, the report will be available in PDF format. Sample report would be given you in excel format. For more questions please contact:

Within 24 to 48 hrs.

You can contact Sales team (sales@marketinsightsresearch.com) and they will direct you on email

You can order a report by selecting payment methods, which is bank wire or online payment through any Debit/Credit card, Razor pay or PayPal.

Discounts are available.

Hard Copy