Expanded Beam Cable Market

Expanded Beam Cable Market – Global Industry Size, Share, Trends, Opportunity, and Forecast Segmented By Lens size (0.8 mm, 1.25 mm, 2.0 mm, 2.5 mm, 3.0 mm, Others), By Technology (Single Mode, Multi-Mode, Hybrid), By Connector Type (Single Channel Expanded Beam Connector, Multi-Channel Beam Connector), By Single vs Multi-Channel Connector (Rack & Panel, Panel Mount Connectors, In-Line Circular and Segment Forecast 2024 to 2028

Published Date: May - 2025 | Publisher: MIR | No of Pages: 320 | Industry: Power | Format: Report available in PDF / Excel Format

View Details Buy Now 2890 Download Free Sample Ask for Discount Request Customization| Forecast Period | 2024-2028 |

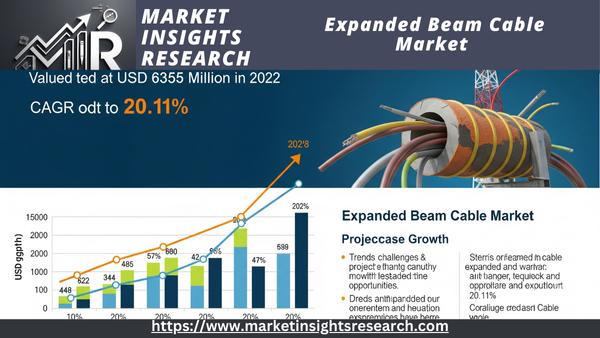

| Market Size (2022) | USD 6355 Million |

| CAGR (2023-2028) | 20.11% |

| Fastest Growing Segment | Expanded Beam Connector |

| Largest Market | North America |

Market Overview

Global Expanded Beam Cable Market was valued at USD 6355 million in 2022 and is anticipated to project robust growth in the forecast period with a CAGR of 20.11% through 2028. The demand for high-speed data transmission is increasing due to the growing popularity of cloud computing, streaming services, and other bandwidth-intensive applications.

Download Free Sample Ask for Discount Request Customization

Data may be transmitted over greater distances without distortion using expanded beam wires. Fiber optics' increasing use in challenging conditions Compared to conventional copper cables, fiber optic cables are less vulnerable to damage from dust, moisture, and other impurities. They are therefore perfect for usage in demanding settings, including those seen in military and aerospace applications. Because of their longevity and resistance to contamination, expanded beam cables are especially well-suited for these uses.

Growing demand for medical device applicationsBecause of their compact size, flexibility, and biocompatibility, expanded beam cables are being utilized in medical device applications more and more. These cables are perfect for use in space-constrained medical applications, such as minimally invasive surgical operations.

Key Market Drivers

Government Initiatives to Promote Fiber Optic Infrastructure

Fiber optic infrastructure is being invested in by governments worldwide in an effort to boost internet connection and encourage the creation of new technologies. Because expanded beam cables are frequently utilized in fiber optic networks, these investments are driving up demand for them.

Growing Need for Applications with High BandwidthOne major factor propelling the expanded beam cable market was the growing demand for high-speed data transmission, which was fueled by applications such as 5G networks, data centers, and streaming HD video. Expanded beam optical connectors can offer the dependable and high-bandwidth connectivity needed for these applications.

Applications in extreme EnvironmentsExpanded beam connectors were needed in sectors including outdoor telecommunications, oil & gas, aerospace, and defense where cables are exposed to extreme environmental conditions. They are appropriate for use in demanding locations because of their exceptional resilience to dirt, dampness, and severe temperatures.

Dependable Military and Defense CommunicationThe need for safe and dependable communication systems in the military and defense industry prompted the use of expanded beam connectors in tactical communication networks to provide strong and dependable connections.

Data Center ExpansionAs data centers expanded to accommodate storage and cloud computing requirements, there was a rise in the need for high-performance optical connectors. In data center applications, expanded beam connections provided benefits in terms of signal integrity and longevity. Expanding telecommunication networks and the deployment of fiber-optic cables in remote and hard-to-reach areas created a demand for connectors that could maintain optical performance over longer distances, making expanded beam connectors appealing.

Increased Use in Oil and Gas Industry

Because of its resilience to harsh environments and ability to preserve signal integrity, expanded beam connectors were utilized in the oil and gas industry for downhole applications and oil rig connections. Connectors that could function dependably in aerospace and aviation conditions were needed by the avionics and aerospace sectors. Applications for expanded beam connectors included communication systems, radar, and in-flight entertainment systems.

Technological DevelopmentsThe market grew as a result of continuous developments in expanded beam connection technology, which include enhanced optical performance, decreased signal loss, and higher connector density. The need for optical connectors was fueled in part by the increasing use of fiber optic cables in place of copper cables across a range of industries due to their greater bandwidth and data transfer speed.

Environmental rulesThe use of expanded beam connectors was influenced by environmental rules as well as the need for strong, sealed connectors in specific industries, such as the automobile and marine sectors.

Download Free Sample Ask for Discount Request Customization

Key Market Challenges

High Initial CostsCompared to conventional physical contact connectors, expanded beam connectors are frequently more costly to produce and implement. Potential clients may be turned off by the greater upfront expenses, particularly in price-sensitive sectors.

Problems with InteroperabilityIt can be difficult to work with current optical connectors. It could be challenging for certain firms to switch to expanded beam solutions because they have already made investments in infrastructure based on conventional connectors. Customers may find it difficult to choose and combine equipment from various manufacturers due to the expanded beam cable market's lack of defined designs and requirements. There were continuous attempts at standardization, but they were not widely accepted. Expanded beam connectors are beneficial in challenging conditions, although not all sectors need this degree of robustness. Traditional connectors may still be used in some applications since they are less expensive and offer adequate performance for their requirements.

Complexity of Technology

Size and Weight ConsiderationsExpanded beam connections might not be the ideal choice in applications where size and weight restrictions are crucial. In some situations, its larger form factor may be a drawback.

Despite their reputation for being resilient in challenging environments, extended beam connectors may have greater insertion and signal loss than physical contact connectors. In high-speed data applications, this may affect transmission distances and signal quality.

Competitive MarketWith several producers providing a range of goods and technology, the expanded beam cable market is competitive. Businesses may find it difficult to stand out from the competition and continue to be profitable as a result.

Customer EducationIt might be difficult to inform and educate prospective clients about the advantages of expanded beam connections, particularly in sectors where the technology is not yet widely used.

Market Adoption RateThe adoption of expanded beam connectors in certain industries can be slow due to resistance to change and concerns about compatibility and performance. Convincing industries to switch from existing solutions can be difficult.

Key Market Trends

Increased Adoption in Harsh Environments

In industries with harsh climatic circumstances, such the military, aerospace, oil and gas, and outdoor telecommunications, where conventional connectors would not offer the necessary durability and dependability, the use of expanded beam connectors has been increasing. Expanded beam connectors that could preserve signal integrity and dependability over greater distances were in greater demand as data centers grew to accommodate cloud computing and high-speed data transmission needs.

Rollout of 5G with Fiber-to-the-Home (FTTH)Expanded beam connections were adopted in response to the deployment of 5G networks and the growth of FTTH infrastructure in order to satisfy the high bandwidth and low latency demands of these technologies.

MiniaturizationIn order to make expanded beam connectors more appropriate for small equipment and gadgets, there was a tendency toward their miniaturization. In sectors like high-density electronics and medical equipment, this tendency was especially pertinent.

Efforts to define and standardize connection designs and criteria were made in response to the growing market for beam cables. The goal of standardization was to increase interoperability and make it easier to integrate items from different manufacturers.

Technological Advancement

The market was being driven by ongoing technological advancements such enhanced optical performance and signal integrity. The attractiveness of enlarged beam connectors was improved by these developments.

Sustainability and Environmental AspectsThe market was impacted by the drive for more ecologically friendly solutions. Known for its capacity to withstand moisture and impurities, expanded beam connections can last longer, which supports environmental initiatives.

Versatility and CustomizationClients were looking for connections that could be tailored to satisfy certain application needs. In response, producers were providing adaptable solutions that could be used in a variety of settings.

Global Market ExpansionDemand for expanded beam connections was rising outside of North America and Europe, especially in Asia, and their use was spreading throughout the world.

Investments in Aerospace and DefenseThe aerospace and defense industry kept funding the development of expanded beam technology for avionics applications and rugged communication systems, where dependability and durability are critical.

Emerging Fiber Optic TechnologiesThe creation of expanded beam connectors tailored for these technologies was fueled by advancements in fiber optic technology, such as multicore and few-mode fibers.

Download Free Sample Ask for Discount Request Customization

Segmental Insights

Throughout the forecast period, the Single Channel Expanded Beam Connector segment is expected to continue to dominate the global expanded beam cable market. This supremacy is due to a number of important causes. First of all, the Single Channel Expanded Beam Connector is a popular option in a number of sectors, including defense, aerospace, and telecommunications, due to its strong performance and dependability. Its appeal to end customers looking for long-lasting connectivity solutions is increased by its capacity to maintain a secure optical connection even under challenging conditions, such as those with dust, moisture, and vibration. Furthermore, Single Channel Expanded Beam Connectors' widespread use is facilitated by its simplicity and convenience of installation. The Single Channel Expanded Beam Connector is notable for its capacity to effectively satisfy the growing demands of industries for dependable connectivity and high-speed data transfer. Their market domination has also been strengthened by the introduction of Single Channel Expanded Beam Connectors with improved features including low insertion loss and high return loss, which are the result of technological breakthroughs. The Single Channel Expanded Beam Connector's broad applicability, demonstrated performance, and developing technological capabilities continue to fuel its dominance in the global market landscape, even though the Multi-Channel Beam Connector segment is also important in some specialized applications. Throughout the forecast period, the Single Channel Expanded Beam Connector segment is anticipated to maintain its dominance in the Expanded Beam Cable Market due to the growing demand for high-performance optical connectivity solutions across multiple sectors.

Regional Insights

In the global expanded beam cable market, North America is the dominant region. The expanded beam cable market in Europe is probably going to grow quickly in the years to come. Concurrently, there is a growing need for expanded beam cable in the Asia-Pacific area, which includes growing markets in China, Japan, and India. A notable CAGR is anticipated over the review period.

Fiber optic component consumption is highest in the Asia-Pacific market. The new information technology and telecommunications industries, as well as planned innovations and initiatives in the United States, China, India, Brazil, and central and eastern countries, are likely to fuel telecom and broadband application growth in the next years. Investments in the use of technology in the fiber optics industry are being driven by the creation of new, superior products.

Download Free Sample Ask for Discount Request Customization

Recent Developments

- In May 2023, TRUMPF, a German manufacturer of CNC machine tools, announced that it is investing USD 120 million to expand its production capacity for CNC fiber laser machines.

- In April 2023, Corning Incorporated, an American multinational manufacturer of fiber optic, cable, and connectivity products, announced that it is investing USD 200 million to expand its production capacity for fiber optic cables.

- In March 2023, Sumitomo Electric Industries Ltd., a Japanese manufacturer of fiber optic cables, announced that it is investing USD 100 million to expand its production capacity for fiber optic cables. In addition, governments around the world are investing in fiber optic infrastructure to improve internet connectivity and support the development of new technologies. These investments are creating a demand for expanded beam cables, as these cables are often used in fiber optic networks.

Key Market Players

- TE CONNECTIVITY LTD

- Harting Technology Group

- Smiths Interconnects (Smith Group Plc)

- Neutrik

- Tech Optics

- X-Beam Tech

- Warren & Brown Networks

- Radiall

- Bel Fuse Inc.

- Foss Fiberoptics

- 3M Company

|

By Lens Size |

By Technology |

By Single vs Multi-Channel Connector |

By Connector Type |

By Region |

|

|

|

|

|

|

|

Related Reports

- Gas Fired Boiler Market Size - By Capacity (≤ 10 MMBtu/hr, > 10 - 50 MMBtu/hr, > 50 - 100 MMBtu/hr, > 100 - 250 MMBtu/...

- Europe Residential Boiler Market Size - By Technology (Condensing {Natural Gas, Oil, Electric}, Non-Condensing {Natural ...

- U.S. Boiler Market Size By Fuel (Natural Gas, Oil, Coal), Capacity, By Technology (Condensing, Non-Condensing), By Produ...

- Commercial Hot Water Boiler Market Size - By Fuel (Natural Gas, Oil, Coal, Electric), By Technology (Condensing, Non-Con...

- UK Commercial Boiler Market Size By Fuel (Natural Gas, Oil, Coal, Electric), By Capacity, By Technology (Condensing, Non...

- Residential Electric Boiler Market Size - By Voltage Rating (Low Voltage, Medium Voltage), Industry Analysis Report, Reg...

Table of Content

-

Executive Summary

-

1.1 Market Snapshot

-

1.2 Key Trends and Insights

-

1.3 Strategic Recommendations

-

Introduction

-

2.1 Report Scope and Objectives

-

2.2 Research Methodology

-

2.3 Assumptions and Market Definitions

-

Market Overview

-

3.1 What Are Expanded Beam Cables?

-

3.2 Operating Principle and Optical Performance Benefits

-

3.3 Comparison with Physical Contact Connectors

-

3.4 Value Chain and Application Ecosystem

-

Market Dynamics

-

4.1 Market Drivers

-

4.1.1 Growing Demand in Harsh Environments and Field Deployments

-

4.1.2 Superior Alignment Tolerance and Reduced Cleaning Needs

-

4.1.3 Rising Use in Defense, Broadcast, and Oil & Gas

-

4.2 Market Restraints

-

4.2.1 Higher Initial Cost Compared to Conventional Cables

-

4.2.2 Limited Commercial Awareness

-

4.3 Market Opportunities

-

4.3.1 Integration with Ruggedized and Hybrid Fiber Systems

-

4.3.2 Demand for High-Speed Data in Remote Applications

-

4.4 Challenges

-

4.5 Porter’s Five Forces Analysis

-

Technology Landscape

-

5.1 Expanded Beam vs. Physical Contact Connectors

-

5.2 Materials and Lens Configurations

-

5.3 Multimode vs. Single-Mode Compatibility

-

5.4 Environmental and Ingress Protection Ratings (IP67, IP68)

-

5.5 Maintenance, Mating Cycles, and Long-Term Reliability

-

Market Segmentation

-

6.1 By Type

-

6.1.1 Single-Channel

-

6.1.2 Multi-Channel

-

6.2 By Mode

-

6.2.1 Single-Mode Fiber

-

6.2.2 Multi-Mode Fiber

-

6.3 By Connector Type

-

6.3.1 MIL-DTL-83526

-

6.3.2 TFOCA

-

6.3.3 Others

-

6.4 By Application

-

6.4.1 Military and Defense

-

6.4.2 Oil & Gas

-

6.4.3 Broadcast and AV

-

6.4.4 Aerospace

-

6.4.5 Industrial Automation

-

6.4.6 Transportation

-

Regional Market Analysis

-

7.1 North America

-

7.2 Europe

-

7.3 Asia-Pacific

-

7.4 Latin America

-

7.5 Middle East & Africa

-

Market Size and Forecast (2020–2030)

-

8.1 Global Revenue Forecast

-

8.2 Regional and Application-Wise Demand Outlook

-

8.3 Volume and Price Trend Analysis

-

Competitive Landscape

-

9.1 Market Share of Key Players

-

9.2 Company Profiles

-

9.2.1 TE Connectivity

-

9.2.2 Amphenol Corporation

-

9.2.3 Diamond SA

-

9.2.4 Glenair

-

9.2.5 Others

-

9.3 Strategic Partnerships, R&D, and Product Innovations

-

Regulatory and Quality Standards

-

10.1 MIL-SPEC and IP Ratings

-

10.2 IEC, TIA, and ISO Standards

-

10.3 Safety and Environmental Certifications

-

Innovation and Future Outlook

-

11.1 All-Optical, Low-Loss Field-Deployable Systems

-

11.2 Trends in Miniaturization and High-Density Fiber Arrays

-

11.3 Role in 5G, UAV, and Tactical Communication Expansion

-

Conclusion and Strategic Recommendations

-

Appendices

-

13.1 Glossary

-

13.2 Research Methodology

-

13.3 Sources and References

Executive Summary

-

1.1 Market Snapshot

-

1.2 Key Trends and Insights

-

1.3 Strategic Recommendations

Introduction

-

2.1 Report Scope and Objectives

-

2.2 Research Methodology

-

2.3 Assumptions and Market Definitions

Market Overview

-

3.1 What Are Expanded Beam Cables?

-

3.2 Operating Principle and Optical Performance Benefits

-

3.3 Comparison with Physical Contact Connectors

-

3.4 Value Chain and Application Ecosystem

Market Dynamics

-

4.1 Market Drivers

-

4.1.1 Growing Demand in Harsh Environments and Field Deployments

-

4.1.2 Superior Alignment Tolerance and Reduced Cleaning Needs

-

4.1.3 Rising Use in Defense, Broadcast, and Oil & Gas

-

-

4.2 Market Restraints

-

4.2.1 Higher Initial Cost Compared to Conventional Cables

-

4.2.2 Limited Commercial Awareness

-

-

4.3 Market Opportunities

-

4.3.1 Integration with Ruggedized and Hybrid Fiber Systems

-

4.3.2 Demand for High-Speed Data in Remote Applications

-

-

4.4 Challenges

-

4.5 Porter’s Five Forces Analysis

Technology Landscape

-

5.1 Expanded Beam vs. Physical Contact Connectors

-

5.2 Materials and Lens Configurations

-

5.3 Multimode vs. Single-Mode Compatibility

-

5.4 Environmental and Ingress Protection Ratings (IP67, IP68)

-

5.5 Maintenance, Mating Cycles, and Long-Term Reliability

Market Segmentation

-

6.1 By Type

-

6.1.1 Single-Channel

-

6.1.2 Multi-Channel

-

-

6.2 By Mode

-

6.2.1 Single-Mode Fiber

-

6.2.2 Multi-Mode Fiber

-

-

6.3 By Connector Type

-

6.3.1 MIL-DTL-83526

-

6.3.2 TFOCA

-

6.3.3 Others

-

-

6.4 By Application

-

6.4.1 Military and Defense

-

6.4.2 Oil & Gas

-

6.4.3 Broadcast and AV

-

6.4.4 Aerospace

-

6.4.5 Industrial Automation

-

6.4.6 Transportation

-

Regional Market Analysis

-

7.1 North America

-

7.2 Europe

-

7.3 Asia-Pacific

-

7.4 Latin America

-

7.5 Middle East & Africa

Market Size and Forecast (2020–2030)

-

8.1 Global Revenue Forecast

-

8.2 Regional and Application-Wise Demand Outlook

-

8.3 Volume and Price Trend Analysis

Competitive Landscape

-

9.1 Market Share of Key Players

-

9.2 Company Profiles

-

9.2.1 TE Connectivity

-

9.2.2 Amphenol Corporation

-

9.2.3 Diamond SA

-

9.2.4 Glenair

-

9.2.5 Others

-

-

9.3 Strategic Partnerships, R&D, and Product Innovations

Regulatory and Quality Standards

-

10.1 MIL-SPEC and IP Ratings

-

10.2 IEC, TIA, and ISO Standards

-

10.3 Safety and Environmental Certifications

Innovation and Future Outlook

-

11.1 All-Optical, Low-Loss Field-Deployable Systems

-

11.2 Trends in Miniaturization and High-Density Fiber Arrays

-

11.3 Role in 5G, UAV, and Tactical Communication Expansion

Conclusion and Strategic Recommendations

Appendices

-

13.1 Glossary

-

13.2 Research Methodology

-

13.3 Sources and References

List Tables Figures

To get a detailed Table of content/ Table of Figures/ Methodology Please contact our sales person at ( chris@marketinsightsresearch.com )

FAQ'S

For a single, multi and corporate client license, the report will be available in PDF format. Sample report would be given you in excel format. For more questions please contact:

Within 24 to 48 hrs.

You can contact Sales team (sales@marketinsightsresearch.com) and they will direct you on email

You can order a report by selecting payment methods, which is bank wire or online payment through any Debit/Credit card, Razor pay or PayPal.

Discounts are available.

Hard Copy