India Battery Market

India Battery Market Segmented By Type (Lead Acid, Lithium Ion, Nickel Metal Hydride and Others), By Application (Residential, Industrial, and Commercial), By Power Systems (Fuel Cell Batteries, Proton-Exchange Membrane Fuel Cells, Alkaline Fuel Cells and Others), By Region, and By Competition, 2019-2029

Published Date: May - 2025 | Publisher: MIR | No of Pages: 320 | Industry: Power | Format: Report available in PDF / Excel Format

View Details Buy Now 2890 Download Free Sample Ask for Discount Request Customization| Forecast Period | 2025-2029 |

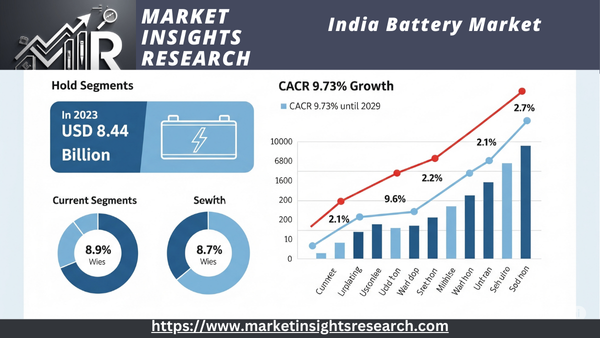

| Market Size (2023) | USD 8.44 billion |

| CAGR (2024-2029) | 9.73% |

| Fastest Growing Segment | Fuel Cell Batteries |

| Largest Market | South India |

Market Overview

The India battery market, which was valued at USD 8.44 billion in 2023, is expected to increase at a strong rate during the forecast period, with a compound annual growth rate (CAGR) of 9.73% through 2029. India is aggressively increasing its capacity for renewable energy, especially wind and solar energy. Batteries and other forms of energy storage are crucial for maintaining the grid's stability and dependability.

Download Free Sample Ask for Discount Request Customization

The need for household energy storage solutions and grid-scale energy storage systems is driven by the integration of renewable energy sources, offering battery manufacturers a substantial potential.

Key Market Drivers

Increasing Adoption of Electric Vehicles

The rapidly growing popularity of electric vehicles (EVs) is one of the main factors propelling the Indian battery market. India is not an exception to the global trend toward more environmentally friendly and sustainable forms of transportation. In order to encourage the usage of electric vehicles, the government has started a number of programs and regulations that provide tax breaks, subsidies, and incentives to both users and producers. The need for batteries has increased as a result of these initiatives, which have raised awareness of EVs.

Particularly, lithium-ion batteries have become the go-to option for EVs because of their high energy density, portability, and rechargeability. As a result, India's production and sales of lithium-ion batteries have increased significantly. In order to satisfy the growing demand from both automakers and consumers, manufacturers are investing in increasing their production capacity. Furthermore, EV adoption is being further stimulated by ongoing improvements in EV performance, range, and charging times brought about by developments in battery technology.

Reusing and recycling old batteries can prolong their lifespan and lessen the environmental effect of disposing of them, which is another benefit of the rise in electric vehicles. The Indian battery market is anticipated to be significantly influenced by this developing sector for battery recycling and reuse.

Renewable Energy Integration

Another important factor propelling the Indian battery industry is the incorporation of renewable energy sources, like wind and solar, into the nation's energy environment. To lower its carbon impact, provide energy security, and satisfy its expanding energy needs, India is investing heavily in renewable energy. However, energy storage systems are essential to guarantee a steady and dependable power supply because renewable energy sources are sporadic.

When it comes to storing surplus energy produced during times of high renewable energy production and supplying it during times of low output, batteries are essential. In order to close the gap between energy generation and consumption, this energy storage capability is essential. The use of lithium-ion batteries and other cutting-edge energy storage technologies is growing in microgrids, residential and commercial installations, and grid-scale energy storage initiatives. As a result, there is an increasing need for these batteries.

The Indian government has also introduced incentives and laws to encourage the creation and application of energy storage technologies. These policies promote investment in the battery market by offering incentives and subsidies for grid-connected storage systems. The demand for battery storage is anticipated to drive the Indian battery market further as the renewable energy sector expands.

Download Free Sample Ask for Discount Request Customization

Telecommunications and Consumer Electronics

The consumer electronics and telecommunications industries are major forces behind the Indian battery market. With a growing subscriber base and rising mobile phone penetration, India's telecommunications sector is growing quickly. Furthermore, the need for dependable and effective backup power solutions has grown as a result of the expansion of data services, smartphone use, and the rollout of 4G and 5G networks.

Both contemporary lithium-ion and conventional lead-acid batteries are essential parts of telecom infrastructure to guarantee continuous communication services, especially in areas with unstable power supplies. Batteries and other backup power solutions are still in high demand as the telecom industry grows and advances.

In addition, the Indian consumer electronics market is expanding due to urbanization, digitalization, and growing disposable incomes. Rechargeable batteries are essential to the operation of smartphones, laptops, tablets, and other portable electronics. Lithium-ion batteries are now the recommended option for powering these gadgets due to advancements in battery technology brought about by consumer demand for longer battery life and quicker charging times.

In conclusion, a number of factors are driving the Indian battery industry, such as the growing use of electric vehicles, the incorporation of renewable energy sources, and the expansion of the consumer electronics and telecommunications industries. In addition to increasing the market's size, these factors are encouraging innovation and investments in battery production and technology, making it a vibrant and attractive sector in India's changing energy landscape.

Key Market Challenges

Raw Material Dependency and Supply Chain Vulnerabilities

The significant reliance on imported raw materials, especially cobalt and lithium, which are essential parts of lithium-ion batteries, is one of the main issues facing the Indian battery sector. India now relies on imports to meet its increasing need for batteries, particularly in the electric vehicle (EV) and renewable energy industries, due to its lack of substantial stocks of these materials.

The Indian battery sector is susceptible to changes in global commodity pricing and supply chain interruptions as a result of its reliance on foreign suppliers for necessary materials. Cobalt and lithium prices have a history of volatility, and abrupt increases in price or shortages in supply can have a big effect on the cost of making batteries. Additionally, the flow of these essential materials may be disrupted by geopolitical conflicts, trade restrictions, or changes in global supply chains, which could have an impact on the availability and cost of batteries in the Indian market.

Developing domestic raw material sources, investing in battery recycling and repurposing, and establishing smart trade agreements to ensure a steady supply of vital minerals are all necessary to meet this issue. To overcome this obstacle, battery manufacturing will need to establish a strong and resilient supply chain.

Technological Advancements and Innovation

Though often viewed as a motivator, technical developments also present a problem for the Indian battery business. Better energy density, longer cycle life, and faster charging capabilities are the results of ongoing advancements and improvements in the battery business. However, the Indian market may find it difficult to keep up with these developments and implement the newest technologies.

Indian producers must make research and development investments to stay up to date with technological advancements if they want to be competitive in the global battery market. Significant financial resources, technological know-how, and a strong dedication to continuing research are needed for this. Furthermore, older battery technologies that become obsolete quickly may result in stranded assets and the need for periodic upgrades, which may be costly and time-consuming for both consumers and enterprises.

The challenge of technological advancement is also relevant in terms of recycling and repurposing used batteries. Making sure recycling procedures work with the newest battery chemistries is crucial as battery technology advances. As battery technology become more complicated and varied, the legal framework must change to meet the recycling issues.

The Indian government and industry players should work together on R&D projects, offer incentives for creativity, and set precise legal requirements for the launch of new battery technology in order to overcome this obstacle.

Download Free Sample Ask for Discount Request Customization

Environmental Concerns and Sustainability

Sustainability and environmental issues are becoming major obstacles in the Indian battery sector. Batteries play a key role in lowering greenhouse gas emissions through the use of electric vehicles and renewable energy sources, but their manufacture, use, and disposal can have negative environmental effects.

The appropriate recycling and disposal of spent batteries is one of the main issues. Because batteries may contain hazardous elements, improper disposal can result in health risks and environmental contamination. To reduce these dangers, recycling procedures must be developed that are both efficient and environmentally beneficial. India must set up collection points and recycling facilities as part of a comprehensive framework for waste management and battery recycling.

Furthermore, it is necessary to address the environmental impact of battery production. It can take a lot of energy and resources to manufacture batteries, particularly lithium-ion batteries. In order to make the Indian battery sector more sustainable, efforts must be made to lower the carbon footprint of battery production.

The Indian government should endeavor to establish strong rules for battery recycling and disposal, support the creation of more environmentally friendly battery production techniques, and stimulate research into sustainable battery technologies like solid-state batteries and recycling methods in order to address this issue. This would help the Indian battery market have a more sustainable future by balancing the advantages of batteries with their effects on the environment.

Key Market Trends

Growth of Advanced Battery Technologies

The quick development of cutting-edge battery technology is one notable trend in the Indian battery market. Despite decades of widespread use of conventional lead-acid batteries in India, there has been a noticeable trend towards more advanced and energy-efficient battery alternatives. Many industries are seeing an increase in the use of cutting-edge technologies, especially lithium-ion batteries.

Applications like consumer electronics, grid-scale energy storage, electric vehicles (EVs), and renewable energy integration are increasingly favoring lithium-ion batteries. They are appropriate for a variety of applications due to their high energy density, extended cycle life, and reduced weight. More Indian households and businesses are choosing lithium-ion batteries over their more conventional lead-acid equivalents due to their growing availability and affordability.

Additionally, improvements in solid-state batteries, which provide increased energy density and safety, are imminent. By providing even greater performance and safety features, these technologies have the potential to completely transform the Indian battery business, especially when it comes to energy storage and electric vehicles.

It is anticipated that additional research and development in cutting-edge battery technologies will take place as the Indian battery market develops further, leading to enhanced performance, cost effectiveness, and sustainability. The government's emphasis on electrification and renewable energy is in line with these developments, which makes the Indian battery market a center for innovation and state-of-the-art battery technologies.

Rise in Energy Storage Solutions

The growing need for energy storage solutions is another noteworthy development in the Indian battery market. The nation's increasing focus on integrating renewable energy sources, especially solar and wind power, is strongly associated with this trend. Reliable energy storage solutions are becoming increasingly important as India works to lower its carbon footprint and improve energy sustainability.

In order to store extra energy produced by renewable sources during times of high production and release it during times of low output or high demand, batteries are an essential component. This is necessary to guarantee a steady and continuous power supply. Grid-scale energy storage projects, microgrids, and energy storage systems for homes and businesses are therefore becoming more and more popular in India.

The expansion of this trend has been made possible by the government's introduction of incentives and laws to support energy storage projects. These regulations enable the creation of a more robust and effective electrical grid and promote investment in energy storage infrastructure.

Additionally, the use of distributed renewable energy systems, such off-grid solar installations and rooftop solar panels, is growing in tandem with the development in energy storage technologies. In order to provide dependable power during times of low sunshine or power outages, batteries are employed to store extra energy produced by these systems.

As the Indian energy landscape changes, it is anticipated that the energy storage trend would continue on its increasing trajectory. In line with the government's renewable energy goals and ambitions for a more dependable and sustainable energy ecology, it offers a substantial potential for battery producers as well as the larger energy industry.

Segmental Insights

Type

In 2023, the Lead Acid category became the most dominant. Because of their widespread use in the automobile industry, lead-acid batteries have long had a prominent position in the Indian battery market. The expansion of the automotive sector and the requirement for backup power solutions in a variety of applications are the main factors driving the demand for lead-acid batteries.

From two-wheelers to heavy-duty trucks, lead-acid batteries are widely employed in the automobile industry. The demand for lead-acid batteries is influenced by the expansion of the Indian automobile industry, which includes both conventional and electric cars (EVs). However, the growth of lead-acid batteries in this market may be impacted by the growing use of other energy storage technologies, such as lithium-ion batteries in EVs.

Forklifts, uninterruptible power supply (UPS) systems, and telecommunications are just a few of the industrial applications that require lead-acid batteries. The demand in this market is influenced by the expansion of industries and the requirement for dependable backup power sources.

Application Insights

Over the course of the forecast period, the Commercial segment is anticipated to increase rapidly. The commercial sector of the Indian battery market is a broad and expanding area that includes a range of industries and applications. Batteries used in establishments, enterprises, and other non-residential situations are included.

Batteries are used by commercial facilities including data centers, internet service providers, and cellular towers to supply backup power in the event of a grid outage. These batteries provide continuous data and communication services. In order to control energy consumption, lower peak-load fees, and incorporate renewable energy sources like solar and wind power into their operations, the business sector is progressively implementing energy storage systems, such as batteries.

Lithium-ion batteries and other cutting-edge technologies are gradually replacing conventional lead-acid batteries in the business sector. Because of its increased energy density, extended cycle life, and reduced maintenance needs, lithium-ion batteries are a desirable option for energy storage and UPS systems. Integration of renewable energy sources and energy storage are becoming more popular as companies prioritize sustainability. Businesses are looking into battery solutions to boost energy independence, decrease energy expenses, and lessen their carbon footprint.

For battery producers and service providers, the commercial sector offers substantial growth prospects, particularly in the areas of energy storage and renewable energy applications. By storing extra energy during off-peak hours and using it during periods of high demand, battery energy storage systems (BESS) can lower electricity costs in the commercial sector.

Regional Insights

In 2023, South India became the leading region in the Indian battery market. South India contributes significantly to the nation's battery production because it is home to a number of important battery manufacturing facilities. These plants manufacture a variety of batteries, including consumer, industrial, and automotive batteries. The need for batteries is rising as a result of the region's industrialization and economic expansion. Numerous industries, including the automotive, renewable energy, telecommunications, and industrial applications sectors, are responsible for this need. The development of the automobile battery market has been aided by the establishment of battery production clusters in several South Indian states, including Tamil Nadu.

South India has a lot of potential for solar energy, and solar power installations have grown significantly in regions like Tamil Nadu and Andhra Pradesh. Batteries and other energy storage devices are essential for storing extra solar energy. The ability of states like Tamil Nadu and Karnataka to generate electricity from wind is well-known. Batteries are utilized to provide a steady power supply and even out variations in wind power generation. In South India, there is a growing need for grid-scale energy storage technologies to counteract the sporadic nature of renewable energy sources. As a result, sophisticated battery technologies are now receiving more attention.

Batteries are employed in backup power systems to provide continuous communication services, especially in areas vulnerable to power outages, and South India boasts a dense network of cellular towers. Batteries are essential for powering telecom infrastructure in rural and isolated areas, allowing connectivity in underserved areas.

To sum up, the South Indian battery market is a vibrant and diverse industry with a broad range of uses, from renewable energy integration to automobiles. The region's growing economy, increasing demand for sustainable energy solutions, and manufacturing capabilities contribute to its significance in the overall Indian battery market. It must, however, adjust to changing battery technology and deal with issues of environmental sustainability.

Download Free Sample Ask for Discount Request Customization

Recent Developments

- In October 2023, Reliance New Energy announced that it would invest USD 10 billion in the battery supply chain in India. The company plans to set up a battery manufacturing plant with a capacity of 50 GWh per year.

Key Market Players

- Exide Industries Limited

- Amara Raja Batteries Ltd

- Tata AutoComp Systems Limited

- Luminous Power Technologies

- HBL Power Systems Limited

- Livguard Energy Technologies

- Okaya Power Group

- Base Corporation Limited

- Southern Batteries Pvt. Ltd

- Su-Kam Power Systems Ltd

|

By Type |

By Application |

By Power Systems |

By Region |

|

|

|

|

Related Reports

- Fire Tube Industrial Boiler Market - By Capacity (<10 MMBtu/hr, 10-25 MMBtu/hr, 25-50 MMBtu/hr, 50-75 MMBtu/hr, >75 MMBt...

- Gas Fired Boiler Market Size - By Capacity (≤ 10 MMBtu/hr, > 10 - 50 MMBtu/hr, > 50 - 100 MMBtu/hr, > 100 - 250 MMBtu/...

- Europe Residential Boiler Market Size - By Technology (Condensing {Natural Gas, Oil, Electric}, Non-Condensing {Natural ...

- U.S. Boiler Market Size By Fuel (Natural Gas, Oil, Coal), Capacity, By Technology (Condensing, Non-Condensing), By Produ...

- Commercial Hot Water Boiler Market Size - By Fuel (Natural Gas, Oil, Coal, Electric), By Technology (Condensing, Non-Con...

- UK Commercial Boiler Market Size By Fuel (Natural Gas, Oil, Coal, Electric), By Capacity, By Technology (Condensing, Non...

Table of Content

-

Executive Summary

-

1.1 Market Overview

-

1.2 Key Trends and Opportunities

-

1.3 Strategic Recommendations

-

-

Introduction

-

2.1 Scope and Purpose of the Report

-

2.2 Research Methodology

-

2.3 Market Definitions and Classifications

-

-

Market Overview

-

3.1 Battery Industry Landscape in India

-

3.2 Market Drivers, Restraints, and Opportunities

-

3.3 Battery Supply Chain and Import Dependency

-

3.4 Government Initiatives and PLI Schemes

-

-

Market Dynamics

-

4.1 Drivers

-

4.1.1 Rising Demand for EVs and E-Mobility

-

4.1.2 Growth in Solar Rooftops and Distributed Energy Systems

-

4.1.3 Expansion of Telecom and Data Center Infrastructure

-

-

4.2 Restraints

-

4.2.1 Lack of Large-Scale Indigenous Manufacturing

-

4.2.2 Price Volatility of Raw Materials

-

-

4.3 Opportunities

-

4.3.1 Energy Storage for Grid Stabilization and Rural Electrification

-

4.3.2 Second-Life and Recycling Ecosystem Development

-

-

4.4 Challenges

-

4.5 Porter’s Five Forces Analysis

-

-

Technology Landscape

-

5.1 Lead-Acid Batteries (Flooded, VRLA)

-

5.2 Lithium-Ion Batteries (NMC, LFP, NCA)

-

5.3 Advanced Chemistries (Solid-State, Zinc-Air, Sodium-Ion)

-

5.4 Battery Management Systems and Smart Charging

-

-

Market Segmentation

-

6.1 By Battery Type

-

6.1.1 Lead-Based

-

6.1.2 Lithium-Based

-

6.1.3 Others

-

-

6.2 By Application

-

6.2.1 Electric Vehicles

-

6.2.2 Consumer Electronics

-

6.2.3 Industrial and Telecom

-

6.2.4 Energy Storage Systems

-

6.2.5 Backup Power

-

-

6.3 By End-User Sector

-

6.3.1 Automotive

-

6.3.2 Energy & Utilities

-

6.3.3 Infrastructure & Real Estate

-

6.3.4 Manufacturing & Industrial

-

-

-

Regional Analysis

-

7.1 North India

-

7.2 South India

-

7.3 East India

-

7.4 West India

-

-

Market Size and Forecast (2020–2030)

-

8.1 Revenue and Volume Forecast

-

8.2 Demand Analysis by Segment and Region

-

8.3 CAPEX and Giga Factory Investment Trends

-

-

Competitive Landscape

-

9.1 Market Share of Leading Players

-

9.2 Company Profiles

-

9.2.1 Exide Industries

-

9.2.2 Amara Raja Batteries

-

9.2.3 Tata AutoComp Gotion

-

9.2.4 Okaya Power

-

9.2.5 Panasonic Energy India

-

9.2.6 Others

-

-

9.3 New Entrants, Joint Ventures, and Tech Licensing Deals

-

-

Policy and Regulatory Framework

-

10.1 FAME-II and EV Battery Norms

-

10.2 National Battery Storage Roadmap

-

10.3 Quality Certifications and BIS Standards

-

-

Innovation and Future Outlook

-

11.1 Make-in-India and Local Value Chain Development

-

11.2 Smart Grid and V2G Integration

-

11.3 Circular Economy in Battery Lifecycle

-

-

Conclusion and Strategic Outlook

-

Appendices

-

13.1 Glossary

-

13.2 Methodology

-

13.3 Data Sources and References

-

To get a detailed Table of content/ Table of Figures/ Methodology Please contact our sales person at ( chris@marketinsightsresearch.com )

FAQ'S

For a single, multi and corporate client license, the report will be available in PDF format. Sample report would be given you in excel format. For more questions please contact:

Within 24 to 48 hrs.

You can contact Sales team (sales@marketinsightsresearch.com) and they will direct you on email

You can order a report by selecting payment methods, which is bank wire or online payment through any Debit/Credit card, Razor pay or PayPal.

Discounts are available.

Hard Copy