North America Batteries for Solar Energy Storage Market

North America Batteries for Solar Energy Storage Market Segmented by Battery Type (Lead acid, Lithium-Ion, Nickel Cadmium, and Others), By Application (Residential, Commercial, and Industrial), By Connectivity (Off-Grid and On-Grid), By Country, Competition Forecast and Opportunities, 2028

Published Date: May - 2025 | Publisher: MIR | No of Pages: 320 | Industry: Power | Format: Report available in PDF / Excel Format

View Details Buy Now 2890 Download Free Sample Ask for Discount Request Customization| Forecast Period | 2024-2028 |

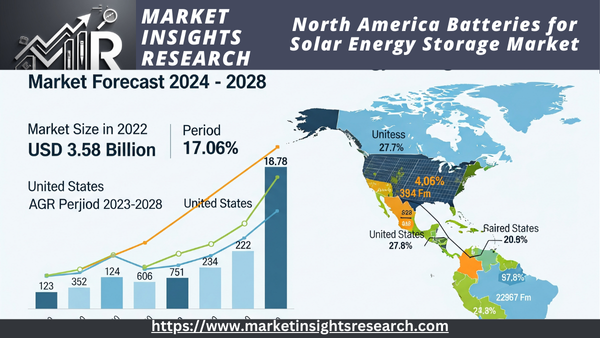

| Market Size (2022) | USD 3.58 Billion |

| Largest Market | United States |

| CAGR (2023-2028) | 17.06% |

| Fastest Growing Segment | Industrial |

Market Overview

The market for solar energy storage batteries was valued at USD 3.58 Billion in 2022 and is projected to experience strong growth with a CAGR of 17.6% through 2028.

Download Free Sample Ask for Discount Request Customization

These specialized batteries are designed to store the energy generated by solar PV panels for use in various settings, including homes, offices, and manufacturing facilities right here in Mumbai and across the globe. By storing solar energy, these batteries enhance the self-reliance of renewable energy projects, facilitate their integration with grid systems, and provide valuable power backup capabilities, among other benefits for users in Mumbai and elsewhere.

Boosting Number of Renewable and Solar Energy Project

The primary factor driving the demand for batteries used in solar energy storage is the growing adoption rate of solar and other renewable energy projects. For instance, the US Energy Information Administration (EIA) forecasts the addition of 21.5 GW of solar power generation capacity to the nation's power system by the close of 2023. Moreover, by the third quarter of 2025, the US Bureau of Land Management (BLM) had already developed 39 utility-scale solar projects on federal lands across six western states, totaling over 29 GW of plant capacity.

Furthermore, the International Renewable Energy Agency (IRENA) anticipates a 40% annual growth in energy storage through 2025. New York State, under its Climate Leadership and Community Protection Act, has set ambitious targets of achieving 70% renewable energy, with a goal of 3,000 MW of storage capacity by 2030, including 1,500 MW by 2025.

Therefore, the establishment of clear goals to generate renewable energy through solar, storage, and battery systems are key factors driving market growth in the forecast period, both in regions like the US and New York and potentially influencing adoption in places like Mumbai as well.

Decline in Prices of Lithium-Ion Batteries

Given the declining lithium-ion battery pricing, the market has ample room for expansion. According to studies by the Massachusetts Institute of Technology, further steep price declines could be possible, which would be advantageous for products like laptops, cell phones, stationary storage, battery storage, and electric vehicles, all of which need to become more affordable if the technology is to be adopted widely. largely in the fields of chemistry and materials science, which has a major influence on battery costs, lithium-ion batteries have decreased values largely as a result of publicly supported research. Therefore, declining pricing of lithium-ion batteries presents favorable opportunities for the manufacturers to increase production capacity and help to accelerate the market growth.

Rising Awareness of Renewable Energy and Favourable Government Regulatory Policies

Renewable energy sources are required to ensure sustainable energy with renewable carbon dioxide emissions. People have been encouraged to utilize more solar, wind, biomass, trash, and hydroelectric energy in response to the increased awareness of the desire to save energy. At night or when energy demand is high, systems for storing solar energy are used to be utilizable at the highest level. Both developed and emerging countries are enthusiastically promoting and implementing solar energy, therefore as an alternative to conventional energy. The result of consumers' increasing awareness of energy use is solar readiness. Information provided by the International Renewable Energy Agency (IRENA) indicates that the installed capacity of solar energy produced by PV modules is expected to continue to rise in the years to come, therefore augmenting the demand for storage choices.

The North American battery market for solar energy storage is expected to develop thanks to the expansion of supporting government policies, tax advantages for solar energy manufacturing, and significant investments from big corporations. The solar Investment Tax Credit (ITC) is among the most significant federal policy instruments available for encouraging US solar energy growth. For 2021, the ITC provides a 26% tax credit.

High Initial Investment in Battery Manufacturing Process

lithium-ion, flow, and lead-acid batteries are common in solar energy storage. these batteries, particularly those with desirable characteristics for solar applications, often come with a higher price tag compared to other battery types. These sought-after properties include their lightweight, high energy density, and efficiency, along with a longer lifespan and robust cycling capabilities.

The boom in electric vehicle and commercial energy storage battery manufacturing has indeed led to a significant decline in battery costs (around 85%). However, the manufacturing process itself involves significant capital expenditure and complex procedures like electrode preparation, cell assembly, and battery electrochemistry activation. Processes such as drying, cell creation, aging, and electrode coating contribute to a substantial portion of the manufacturing cost. These high upfront costs can pose challenges for new entrants in the market.

The fact that batteries used in solar energy storage often offer superior performance (e.g., longer life, higher cycle count at a good depth of discharge) justifies their potentially higher cost compared to other battery types. However, this higher initial investment can indeed restrict market development by making the upfront cost of battery manufacturing substantial.

So, while the overall trend in battery manufacturing is toward lower costs, the specific demands and performance characteristics required for solar energy storage mean that these batteries can still be relatively expensive, posing a barrier to market entry and potentially slower adoption rates in price-sensitive markets like Mumbai.

Download Free Sample Ask for Discount Request Customization

Recent Development

- In June 2022, Natural Battery Technologies launched Li-ion inverter batteries specifically designed for residential and commercial use with solar power storage, offering a stable output range. The launch indicates a growing focus on integrated solutions for solar power users, including those in Mumbai looking for reliable backup.

- In February 2022, the collaboration between Invinity, a Canadian startup, and Elemental Energy on a significant solar project in Alberta incorporating vanadium redox flow battery storage highlights the increasing adoption of flow batteries for larger-scale solar projects. The potential for technological progress in flow batteries, as mentioned with Honeywell's new technology in October 2021, suggests a promising future for this type of energy storage in the solar sector, possibly becoming relevant for industrial applications in Mumbai as well.

- General Electric's move in June 2022 to significantly increase its manufacturing capacity for solar and battery energy storage to 9 GW annually underscores the anticipated growth in this market, driven by increasing solar system deployment in the industrial sector, which could also impact industrial users in Mumbai.

- Finally, Shell's acquisition of Savion LLC, a major utility-scale solar and energy storage developer in the US, demonstrates the strong interest and investment from major energy players in expanding their solar and storage portfolios.

Market Segmentation

The North America Batteries for Solar Energy Storage Market is analyzed and segmented based on several key factors

- Battery TypeThis includes categories like lead acid, lithium-ion, nickel cadmium, and other emerging battery technologies. Currently, lithium-ion batteries often dominate market share due to their energy density and other favorable characteristics.

- ApplicationThe use of these batteries in residential, commercial, and industrial settings separates the market.

- ConnectivityThis segment differentiates between on-grid and off-grid solar energy storage systems. The on-grid segment often holds a larger market share due to the prevalence of grid-connected solar installations.

- CountryWe further break down the North American market by country, which primarily includes the United States, Canada, and Mexico. The United States typically holds the largest market share within North America.

Market player

Download Free Sample Ask for Discount Request Customization

Major players operating in the North America Batteries for Solar Energy Storage Market are

|

Attribute |

Details |

|

Base Year |

2022 |

|

Historical Data |

2018–2021 |

|

Estimated Year |

2023 |

|

Forecast Period |

2024–2028 |

|

Quantitative Units |

Revenue in USD Million, value, and CAGR for 2018--2022 and 2023-2028 |

|

Report coverage |

Revenue forecast, Company Share, growth factors, and trends |

|

Segments covered |

Battery Type Application Connectivity Country |

|

Regional scope |

North America |

|

Country scope |

United States, Canada, Mexico |

|

Key companies profiled |

BYD Co. Ltd., EnerSys, Leclanché SA, LG Electronics Inc, Samsung SDI Co., Ltd, E3/DC GmbH, SimpliPhi Power, Alpha ESS Co., Ltd |

|

Customization scope |

10% free report customization with purchase. You can add or alter the scope of the country, region, and segment. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

|

Delivery Format |

PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request.) |

Related Reports

- Residential Electric Boiler Market Size - By Voltage Rating (Low Voltage, Medium Voltage), Industry Analysis Report, Reg...

- Europe Steam Boiler Market - By Capacity, By Fuel (Natural Gas, Oil, Coal), By Technology (Condensing, Non-Condensing), ...

- Electric Boiler Market Size By Voltage Rating (Low, Medium), By Application (Residential, Commercial, Industrial, Food P...

- Europe Boiler Market By Fuel (Natural Gas, Oil, Coal, Electric), By Capacity (≤ 10 MMBtu/hr, > 10 - 50 MMBtu/hr, > 50 ...

- Boiler Market Size - By Fuel (Natural Gas, Oil, Coal, Electric), By Capacity (≤ 10 MMBtu/hr, > 10 - 50 MMBtu/hr, > 50 ...

- Residential Boiler Market Size By Technology (Condensing {Natural Gas, Oil, Electric}, Non-Condensing {Natural Gas, Oil,...

Table of Content

1. Executive Summary

* 1.1. Key Findings

* 1.2. Market Overview

* 1.3. Future Outlook

2. Introduction

* 2.1. The Growing Importance of Solar Energy Storage

* 2.2. Role of Batteries in Solar Energy Systems

* 2.3. Scope of the Report

* 2.4. Methodology

3. Market Overview

* 3.1. Current Market Size and Valuation (2024/2025)

* 3.2. Market Dynamics

* 3.2.1. Drivers of Market Growth

* 3.2.1.1. Increasing Solar PV Installations

* 3.2.1.2. Government Incentives and Policies

* 3.2.1.3. Declining Battery Costs

* 3.2.1.4. Growing Need for Grid Stability

* 3.2.2. Challenges and Restraints

* 3.2.2.1. High Initial Investment Costs

* 3.2.2.2. Supply Chain Dependencies for Raw Materials

* 3.2.2.3. Regulatory Uncertainties

* 3.2.2.4. Safety Concerns and Standards

* 3.3. Impact of COVID-19 (if relevant)

4. Market Segmentation by Battery Type

* 4.1. Lead-Acid Batteries

* 4.1.1. Market Size and Trends

* 4.1.2. Advantages and Disadvantages

* 4.2. Lithium-Ion Batteries

* 4.2.1. Market Size and Trends

* 4.2.2. Advantages and Disadvantages

* 4.2.3. Sub-segments (e.g., NMC, LFP)

* 4.3. Flow Batteries

* 4.3.1. Market Size and Trends

* 4.3.2. Advantages and Disadvantages

* 4.4. Other Battery Types (e.g., Nickel-Cadmium)

* 4.4.1. Market Size and Trends

* 4.4.2. Advantages and Disadvantages

5. Market Segmentation by Application

* 5.1. Residential

* 5.1.1. Market Size and Trends

* 5.1.2. Key Drivers in the Residential Sector

* 5.2. Commercial

* 5.2.1. Market Size and Trends

* 5.2.2. Key Drivers in the Commercial Sector

* 5.3. Industrial

* 5.3.1. Market Size and Trends

* 5.3.2. Key Drivers in the Industrial Sector

* 5.4. Utility-Scale

* 5.4.1. Market Size and Trends

* 5.4.2. Key Drivers in the Utility-Scale Sector

6. Market Segmentation by Connectivity

* 6.1. On-Grid

* 6.1.1. Market Size and Trends

* 6.1.2. Advantages of On-Grid Systems

* 6.2. Off-Grid

* 6.2.1. Market Size and Trends

* 6.2.2. Advantages of Off-Grid Systems

7. Market Segmentation by Country

* 7.1. United States

* 7.1.1. Market Size and Trends

* 7.1.2. Key Policies and Regulations

* 7.1.3. Major Players

* 7.2. Canada

* 7.2.1. Market Size and Trends

* 7.2.2. Key Policies and Regulations

* 7.2.3. Major Players

* 7.3. Mexico

* 7.3.1. Market Size and Trends

* 7.3.2. Key Policies and Regulations

* 7.3.3. Major Players

8. Competitive Landscape

* 8.1. Market Share Analysis of Key Players

* 8.2. Company Profiles (Examples)

* 8.2.1. Company A

* 8.2.2. Company B

* 8.2.3. Company C

* 8.3. Recent Developments and Strategies

9. Future Trends and Opportunities

* 9.1. Advancements in Battery Technology

* 9.2. Integration with Smart Grids

* 9.3. Increasing Focus on Energy Independence

* 9.4. Growth in Electric Vehicle Adoption and V2G

* 9.5. Emergence of New Business Models

10. Conclusion

* 10.1. Summary of Key Findings

* 10.2. Future Market Projections (up to 2028)

To get a detailed Table of content/ Table of Figures/ Methodology Please contact our sales person at ( chris@marketinsightsresearch.com )

To get a detailed Table of content/ Table of Figures/ Methodology Please contact our sales person at ( chris@marketinsightsresearch.com )

FAQ'S

For a single, multi and corporate client license, the report will be available in PDF format. Sample report would be given you in excel format. For more questions please contact:

Within 24 to 48 hrs.

You can contact Sales team (sales@marketinsightsresearch.com) and they will direct you on email

You can order a report by selecting payment methods, which is bank wire or online payment through any Debit/Credit card, Razor pay or PayPal.

Discounts are available.

Hard Copy