Residential Infrastructure Lighting Market

Residential Infrastructure Lighting Market – Global Industry Size, Share, Trends, Opportunity, and Forecast Segmented by Technology (LED, Fluorescent, Incandescent), By Product (Recessed Lighting, Street Lighting, Spot Lighting, Flood Lighting), By Region, Competition 2018-2028

Published Date: May - 2025 | Publisher: MIR | No of Pages: 320 | Industry: Power | Format: Report available in PDF / Excel Format

View Details Buy Now 2890 Download Free Sample Ask for Discount Request Customization| Forecast Period | 2024-2028 |

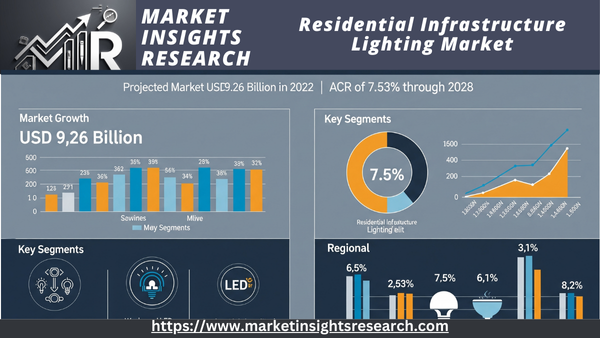

| Market Size (2022) | USD 9.26 Billion |

| CAGR (2023-2028) | 7.53% |

| Fastest Growing Segment | Street Lighting |

| Largest Market | North America |

Market Overview

The Global Residential Infrastructure Lighting Market was valued at USD 9.26 Billion in 2022 and is anticipated to project robust growth in the forecast period with a CAGR of 7.53% through 2028.

Download Free Sample Ask for Discount Request Customization

For many years, traditional lighting solutions, such as high-pressure sodium (HPS) and metal halide (MH) lamps, have been the foundation of Residential Infrastructure Lighting. While these technologies provide consistent and reliable illumination, they are gradually being replaced by more energy-efficient alternatives due to their high energy consumption and maintenance expenses.

Key Market Drivers

Rising Demand for Energy-Efficient Solutions

Driven by the pursuit of sustainability, solar-powered lighting solutions have gained significant traction in the Residential Infrastructure Lighting market. These systems utilize solar energy to power LED lights, lessening reliance on the electrical grid and lowering operational expenses. Solar lighting is particularly advantageous in remote or off-grid regions where traditional power sources are limited.

Urbanization and Infrastructure Development

The continuous worldwide urbanization trend is one of the main factors propelling the residential infrastructure lighting market. Infrastructure that is secure and well-lit is essential as more people move into cities. To guarantee functioning and safety, new infrastructure projects like public transportation systems, smart cities, and road extensions need effective lighting solutions. The growing focus on sustainability and energy efficiency has compelled governments and institutions to implement environmentally friendly lighting options. Due to its ability to lower carbon emissions and energy consumption, LED technology in particular supports environmental objectives. Through laws and subsidies, governments all around the world are encouraging the use of energy-efficient lighting.

The market for residential infrastructure lighting is seeing innovation due to the rapid improvements in technology. LED technology, in conjunction with smart lighting systems, has enabled adaptive lighting environments that react to real-time data. Such technology improves user experience and safety in addition to saving energy.

Download Free Sample Ask for Discount Request Customization

Safety and Security

Concerns about safety and security are key drivers for Residential Infrastructure Lighting. Well-lit roads and public areas help lower accident rates and discourage criminal activity. Smart lighting systems have the capability to adjust brightness levels depending on whether pedestrians or vehicles are present, making spaces both safer and more secure.

Public Awareness and Demand for Quality of Life

Increasing public awareness regarding the significance of well-lit and visually appealing urban settings has fueled the demand for high-quality lighting. People now anticipate thoughtfully designed lighting solutions that improve their quality of life, making aesthetics a crucial factor for infrastructure projects.

The Residential Infrastructure Lighting market shows regional differences due to variations in infrastructure development, government regulations, and economic circumstances. For example

North America has been a leader in the adoption of LED technology for Residential Infrastructure Lighting. The region's focus on energy efficiency and sustainability has spurred widespread LED retrofitting projects in cities and municipalities.

Europe is a leader in smart Residential Infrastructure Lighting solutions. The European Union's ambitious energy efficiency goals have encouraged investments in adaptive lighting systems that adjust based on traffic flow and weather conditions.

American National Standards Institute, China Compulsory Certification, and International Electrotechnical Commission are a few significant regulatory bodies.

Important regulatory organizations that oversee product certification include the International Electrotechnical Commission, China Compulsory Certification, and the American National Standards Institute. Manufacturing occurs after acquiring the necessary licenses and permits to conduct business, provide services, and import and export goods. Governments are working to reduce excessive energy use in both developed and developing nations.

They achieve this by complying with specific quality regulations that assist companies in managing energy consumption, safeguarding consumer safety, and monitoring environmental issues. LED lighting uses less electricity and has a 50,000-hour lifespan, making it an energy-efficient choice. Therefore, we expect strict government regulations restricting the use of energy-intensive lighting to encourage market growth.

When used as overhead surgical illumination in the past, halogen lights caused discomfort to medical personnel during procedures or examinations. Furthermore, the little surgical illumination in the examination room used 50 to 100 W halogen lights, which generated excessive heat and electricity consumption. So, manufacturers are planning to use LEDs in surgical lights, exam lights, phototherapy, and endoscopy to make patient care better, and this is likely to help the LED lighting market grow. Technological developments in the medical device sector, which will replace outdated or inefficient equipment, are also expected to have an impact on the growth of the LED lighting business.

The world economy was adversely affected by the COVID-19 epidemic. Strict suspensions and lockdowns enforced on construction sites decreased the need for LED illumination. However, the launch of new and upgraded projects led to a rise in building in the second half of 2021, which helped the LED lighting industry steadily recover.

Key Market Challenges

Download Free Sample Ask for Discount Request Customization

High Initial and Deployment Costs of LED Lighting System to Restrain Market Growth

Light-emitting diode (LED) systems have seen a significant increase in recognition in recent years. The basic cost of buying one of these systems, however, is higher than that of the traditional CFL lighting systems that are already available. The initial retail price of the entire system is directly impacted by the significant expenses of the diodes, transmitters, and capacitors that make up these systems. Furthermore, installing new LED lights and replacing existing lighting systems with LED alternatives provide financial difficulties for residential consumers, which eventually impede the growth of the global industry.

Key Market Trends

The use of Light Emitting Diode (LED) technology in residential infrastructure lighting keeps increasing rapidly. Among the many benefits LED lights provide over more conventional lighting sources are energy economy, long lifespan, and low maintenance costs. Los Angeles, California, started a huge LED streetlight upgrade project. The city saved about 60% of its energy by switching LED fittings for conventional high-pressure sodium (HPS) lighting. Better visibility from the LED lights also improved residents' safety and helped lower light pollution.

Smart Residential Infrastructure Lighting

Smart Residential Infrastructure Lighting systems are gaining significant traction. These systems leverage sensors, data analytics, and connectivity to create adaptable lighting environments. They can modify lighting levels based on real-time data, such as traffic flow, weather patterns, and pedestrian movement, thereby improving both energy efficiency and safety.

For example, the city of Copenhagen, Denmark, implemented a smart lighting system in its bicycle lanes. This system uses motion sensors to detect the presence of cyclists and pedestrians. As a user approaches, the lights become brighter, offering a safer and more comfortable experience. This approach enhances safety and lowers energy consumption during times of low activity.

Solar-Powered Lighting

TrendAs sustainability starts to take front stage, solar-powered lighting solutions are becoming more and more important These systems minimize running expenses by using solar energy to run LED lights, therefore lessening the dependency on the electrical grid. Solar-powered lighting has been installed to increase access and safety in rural parts of India where consistent access to electricity is a difficulty. The solar panels charge during the day; the stored energy runs the LED streetlights at night, therefore enabling energy independence and lowering carbon emissions.

Aesthetic and Architectural Lighting

Apart from its practicality, Residential Infrastructure Lighting is becoming more and more important for improving appearance and designing unique urban settings. Architectural lighting designs illuminate landmarks, bridges, and buildings, enhancing the beauty of cities.

Human-Centric Lighting

The trend of human-centric lighting is increasingly gaining attention for its potential to improve well-being and productivity. This approach involves adjusting the color temperature and intensity of lighting to mirror natural daylight patterns, which can positively influence circadian rhythms and overall health.

In healthcare facilities, such as hospitals and clinics, human-centric lighting systems have been implemented to enhance patient outcomes. These systems can simulate natural daylight, which assists in the healing process and helps patients maintain a healthy sleep-wake cycle.

Segmental Insights

Product Insights

Street Lighting dominated the market in terms of product segmentation.

Regional Insights

Over the forecast period, we anticipate North America to hold the largest share of the market. As a developed region with well-established infrastructure, North America still exhibits a significant demand for further infrastructure development, particularly in sectors like roads, bridges, and public transportation. This demand is a key driver for new and enhanced Residential Infrastructure Lighting solutions.

North America is also a leader in embracing new technologies, including advancements in lighting. This position is supported by factors such as high disposable income levels, a strong culture of innovation, and a supportive government regulatory landscape. The early adoption of new technologies is contributing to the growth of the Residential Infrastructure Lighting market in the region.

Furthermore, there's a growing emphasis on energy efficiency and sustainability in North America. This focus is driven by rising energy costs, concerns about climate change, and government incentives. Consequently, the demand for energy-efficient and sustainable Residential Infrastructure Lighting solutions, such as LED lights and smart lighting controls, is on the rise in the region.

Download Free Sample Ask for Discount Request Customization

Recent Developments

- In July 2023, Zumtobel introduced two intelligent lighting technology systems and three new luminaires in its product portfolio. These cutting-edge solutions include the TRAMAO pendant luminaire for hotels and offices, which effectively absorbs sound and delivers the highest light quality, and the SLOTLIGHT infinity II light line family.

- In May 2023, Dialight announced the launch of its industry-leading 7-year warranty for Aviation Obstruction Lighting Solutions. This initiative highlighted the company’s commitment to both customer satisfaction and product quality in the LED lighting market.

- In May 2023, ZumThe IoT integrates these new luminairesitioning luminaires. These new luminaires are integrated with IoT for smart analyses in logistics, retail, and industrial applications.

- In May 2023, Dialight launched the ProSite High Mast, an extension of the company’s ProSite Floodlight series. This advanced solution is a precision-engineered LED lighting fixture purposed to support mounting heights of up to 130 feet for diverse outdoor industrial applications, including airports, rail yards, container yards, transport, parking lots, product stockpiles, and perimeter lighting.

- In April 2023, Cree Lighting unveiled the launch of its OSQ Series C mid-power LED Area and Flood luminaires. These solutions feature the groundbreaking NanoComfort Technology, delivering matchless efficiency, astonishing visual comfort, precise control, reduced wind load requirements, and ease of installation.

- In February 2022, Digital Lumens introduced its Light Intelligence Port integrated with the CLE and RLE luminaire families. Modular IoT capabilities and a smart port equip this intelligent LED luminaire to achieve top-notch performance.

- In June 2021, LSI Industries launched the Opulence Series of architectural luminaires for outdoor applications. The Opulence luminaires deliver world-class efficiency and can achieve outputs of up to 14,000 lumens at color temperatures that range from 2700 to 5000K.

- In March 2021, Signify announced the launch of the first-in-India tailor-made 3D-printed luminaires, empowering a circular economy. The company also set up a design lab in Noida and a 3D printing facility in Vadodara.

Key Market Players

- Cree Inc

- Hubbell Lighting

- Zumtobel Group AG

- Philips Lighting

- Acuity Brands Inc.

- Dialight plc

- Eaton Corporation

- Osram GmbH

- GE Lighting

- SAMSUNG

|

By Technology |

By Product |

By Region |

|

|

|

|

|

Related Reports

- Europe Residential Boiler Market Size - By Technology (Condensing {Natural Gas, Oil, Electric}, Non-Condensing {Natural ...

- U.S. Boiler Market Size By Fuel (Natural Gas, Oil, Coal), Capacity, By Technology (Condensing, Non-Condensing), By Produ...

- Commercial Hot Water Boiler Market Size - By Fuel (Natural Gas, Oil, Coal, Electric), By Technology (Condensing, Non-Con...

- UK Commercial Boiler Market Size By Fuel (Natural Gas, Oil, Coal, Electric), By Capacity, By Technology (Condensing, Non...

- Residential Electric Boiler Market Size - By Voltage Rating (Low Voltage, Medium Voltage), Industry Analysis Report, Reg...

- Europe Steam Boiler Market - By Capacity, By Fuel (Natural Gas, Oil, Coal), By Technology (Condensing, Non-Condensing), ...

Table of Content

-

Executive Summary

-

1.1 Market Snapshot

-

1.2 Key Developments and Highlights

-

1.3 Strategic Recommendations

-

Introduction

-

2.1 Scope and Objectives

-

2.2 Research Methodology

-

2.3 Assumptions and Definitions

-

Market Overview

-

3.1 Definition of Residential Infrastructure Lighting

-

3.2 Role in Smart Homes and Urban Development

-

3.3 Product Categories and Value Chain Overview

-

3.4 Trends in Aesthetic and Functional Lighting

-

Market Dynamics

-

4.1 Drivers

-

4.1.1 Rapid Urbanization and Housing Projects

-

4.1.2 Energy Efficiency Standards and LED Adoption

-

4.1.3 Demand for Smart and Connected Lighting Systems

-

4.2 Restraints

-

4.2.1 High Initial Installation Costs for Smart Lighting

-

4.2.2 Regulatory and Safety Compliance Complexity

-

4.3 Opportunities

-

4.3.1 Integration with Home Automation Platforms

-

4.3.2 Customizable and Human-Centric Lighting Systems

-

4.4 Market Challenges

-

4.5 Porter’s Five Forces Analysis

-

Technology Landscape

-

5.1 LED and OLED Technologies

-

5.2 Motion Sensors, Dimmers, and Connectivity Protocols (Zigbee, Wi-Fi, Bluetooth)

-

5.3 Smart Lighting Controls and Voice-Activated Interfaces

-

5.4 Energy Monitoring and AI-Based Lighting Adjustments

-

Market Segmentation

-

6.1 By Product Type

-

6.1.1 Ceiling Lights

-

6.1.2 Wall Lights

-

6.1.3 Outdoor & Landscape Lighting

-

6.1.4 Smart Bulbs and Fixtures

-

6.1.5 Lamps and Decorative Lighting

-

6.2 By Installation Type

-

6.2.1 New Constructions

-

6.2.2 Retrofits and Renovations

-

6.3 By Connectivity

-

6.3.1 Wired

-

6.3.2 Wireless

-

6.4 By Application

-

6.4.1 Living Room

-

6.4.2 Kitchen & Dining

-

6.4.3 Bedroom

-

6.4.4 Outdoor and Security

-

Regional Analysis

-

7.1 North America

-

7.2 Europe

-

7.3 Asia-Pacific

-

7.4 Latin America

-

7.5 Middle East & Africa

-

Market Size and Forecast (2020–2030)

-

8.1 Global Revenue Forecast

-

8.2 Segment-Wise and Region-Wise Projections

-

8.3 Growth Outlook and Emerging Markets

-

Competitive Landscape

-

9.1 Market Share of Major Players

-

9.2 Company Profiles

-

9.2.1 Signify (Philips)

-

9.2.2 Acuity Brands

-

9.2.3 Osram

-

9.2.4 GE Lighting

-

9.2.5 Xiaomi, Sengled, and Others

-

9.3 Product Innovations and Strategic Developments

-

Regulatory and Compliance Framework

-

10.1 Energy Efficiency Standards (e.g., ENERGY STAR, EU Ecodesign)

-

10.2 Smart Grid Integration and Data Security

-

10.3 Residential Building Codes and Fire Safety

-

Innovation and Future Outlook

-

11.1 Lighting-as-a-Service (LaaS) for Residential Projects

-

11.2 IoT-Enabled Ambient and Circadian Lighting Systems

-

11.3 Material Innovation for Aesthetics and Sustainability

-

Conclusion and Strategic Recommendations

-

Appendices

-

13.1 Glossary

-

13.2 Methodology Notes

-

13.3 References and Data Sources

Executive Summary

-

1.1 Market Snapshot

-

1.2 Key Developments and Highlights

-

1.3 Strategic Recommendations

Introduction

-

2.1 Scope and Objectives

-

2.2 Research Methodology

-

2.3 Assumptions and Definitions

Market Overview

-

3.1 Definition of Residential Infrastructure Lighting

-

3.2 Role in Smart Homes and Urban Development

-

3.3 Product Categories and Value Chain Overview

-

3.4 Trends in Aesthetic and Functional Lighting

Market Dynamics

-

4.1 Drivers

-

4.1.1 Rapid Urbanization and Housing Projects

-

4.1.2 Energy Efficiency Standards and LED Adoption

-

4.1.3 Demand for Smart and Connected Lighting Systems

-

-

4.2 Restraints

-

4.2.1 High Initial Installation Costs for Smart Lighting

-

4.2.2 Regulatory and Safety Compliance Complexity

-

-

4.3 Opportunities

-

4.3.1 Integration with Home Automation Platforms

-

4.3.2 Customizable and Human-Centric Lighting Systems

-

-

4.4 Market Challenges

-

4.5 Porter’s Five Forces Analysis

Technology Landscape

-

5.1 LED and OLED Technologies

-

5.2 Motion Sensors, Dimmers, and Connectivity Protocols (Zigbee, Wi-Fi, Bluetooth)

-

5.3 Smart Lighting Controls and Voice-Activated Interfaces

-

5.4 Energy Monitoring and AI-Based Lighting Adjustments

Market Segmentation

-

6.1 By Product Type

-

6.1.1 Ceiling Lights

-

6.1.2 Wall Lights

-

6.1.3 Outdoor & Landscape Lighting

-

6.1.4 Smart Bulbs and Fixtures

-

6.1.5 Lamps and Decorative Lighting

-

-

6.2 By Installation Type

-

6.2.1 New Constructions

-

6.2.2 Retrofits and Renovations

-

-

6.3 By Connectivity

-

6.3.1 Wired

-

6.3.2 Wireless

-

-

6.4 By Application

-

6.4.1 Living Room

-

6.4.2 Kitchen & Dining

-

6.4.3 Bedroom

-

6.4.4 Outdoor and Security

-

Regional Analysis

-

7.1 North America

-

7.2 Europe

-

7.3 Asia-Pacific

-

7.4 Latin America

-

7.5 Middle East & Africa

Market Size and Forecast (2020–2030)

-

8.1 Global Revenue Forecast

-

8.2 Segment-Wise and Region-Wise Projections

-

8.3 Growth Outlook and Emerging Markets

Competitive Landscape

-

9.1 Market Share of Major Players

-

9.2 Company Profiles

-

9.2.1 Signify (Philips)

-

9.2.2 Acuity Brands

-

9.2.3 Osram

-

9.2.4 GE Lighting

-

9.2.5 Xiaomi, Sengled, and Others

-

-

9.3 Product Innovations and Strategic Developments

Regulatory and Compliance Framework

-

10.1 Energy Efficiency Standards (e.g., ENERGY STAR, EU Ecodesign)

-

10.2 Smart Grid Integration and Data Security

-

10.3 Residential Building Codes and Fire Safety

Innovation and Future Outlook

-

11.1 Lighting-as-a-Service (LaaS) for Residential Projects

-

11.2 IoT-Enabled Ambient and Circadian Lighting Systems

-

11.3 Material Innovation for Aesthetics and Sustainability

Conclusion and Strategic Recommendations

Appendices

-

13.1 Glossary

-

13.2 Methodology Notes

-

13.3 References and Data Sources

List Tables Figures

To get a detailed Table of content/ Table of Figures/ Methodology Please contact our sales person at ( chris@marketinsightsresearch.com )

FAQ'S

For a single, multi and corporate client license, the report will be available in PDF format. Sample report would be given you in excel format. For more questions please contact:

Within 24 to 48 hrs.

You can contact Sales team (sales@marketinsightsresearch.com) and they will direct you on email

You can order a report by selecting payment methods, which is bank wire or online payment through any Debit/Credit card, Razor pay or PayPal.

Discounts are available.

Hard Copy